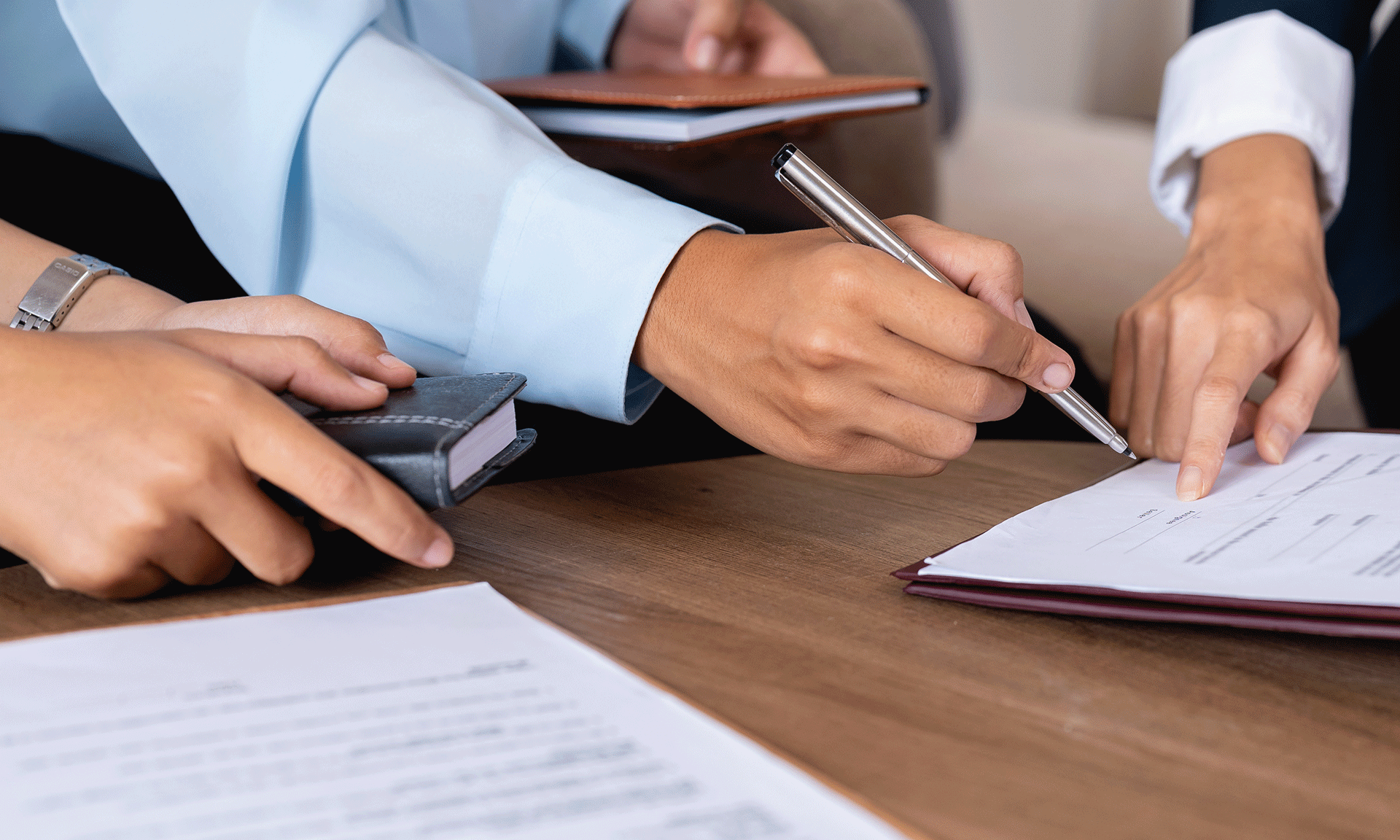

The recent amendment in Oman’s labor laws can be seen as a Government effort to reduce the rights gap between expatriates and locals and this amendment of Foreigners’ Residence Law now enables expatriate workers to transfer jobs without seeking prior approval from their employer; reported a local daily Times of Oman in its press briefing.

The amendment abolished the “No Objection Certificate” (NOC) requirement which, as per the Oman Human Rights Commission, will increase competitiveness between Omani and expatriate workers. This amendment at the same time will also offer protection to low-income families.

The requirement for expatriate workers to obtain a NOC from their current employers to join another company was in force since 2014 under the law of residence for foreigners in Oman. The law required that if a foreigner didn’t secure the NOC from the current employer, the employee was banned from working for any other employee for two years.

The new decision will now enable the foreign employees to switch over to new jobs depending entirely on the lapse of existing work contracts.

The commission added that the decision was also expected to reduce the number of foreign workers leaving the country, who do so because they fail to get NOCs. “The decision will also contribute to reducing the cases of non-Omani labor absconding, especially those who are denied a NOC, thus forcing the worker to stay outside the country after the expiry of his contract,” the commission said in its annual report.

As highlighted by the Times of Oman, the recent amendment is also expected to reduce the gap in wages between local and foreign workers.

“All these legislative and legal amendments, which came in response to the current circumstances, will undoubtedly have a more positive impact on protecting the rights of citizens and residents,” the Oman Human Rights Commission reported.

The policy on Labor Reform was also initiated by Saudi Arabia in November last year mentioning the exceptional situations under which foreign workers were allowed to move to a new job without the prior consent of their present employer.

The scrapping of NOC requirements in Oman can be considered as a significant development in labor laws as this will have a profound impact on the Omani labor market providing much-needed flexibility in changing jobs within the country and foreign workers will find Oman to be more attractive in absence of restrictions.

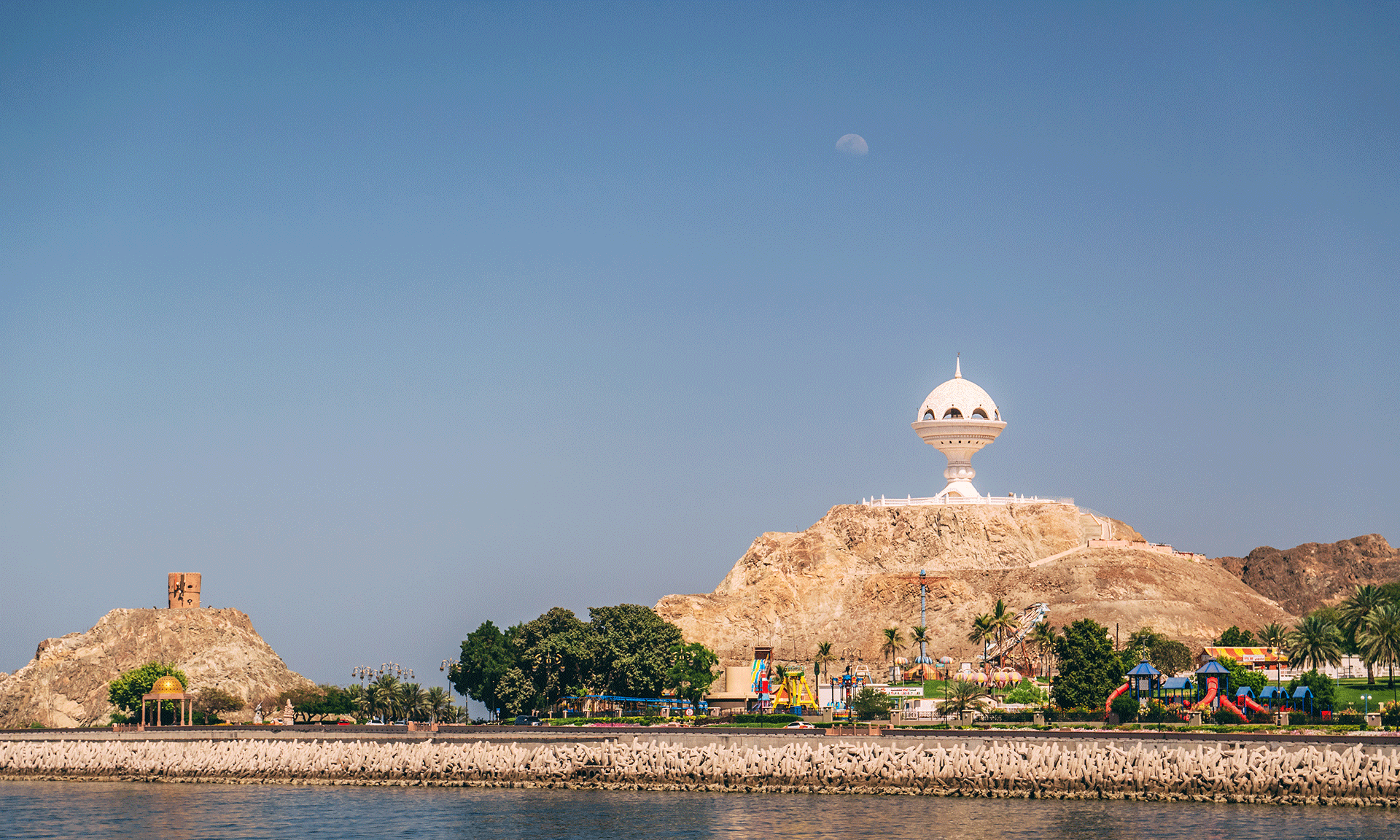

As Oman continues to attract more foreign talents, many foreign investors are likely to be lured for investments and new company formation in Oman.

Besides labor reforms, digital transformation is also fast happening in Oman and across several ministries and Oman’s fiscal plan announced in November last year also included a number of reforms signalling that business setup in Oman will continue to be easier in post-pandemic time.