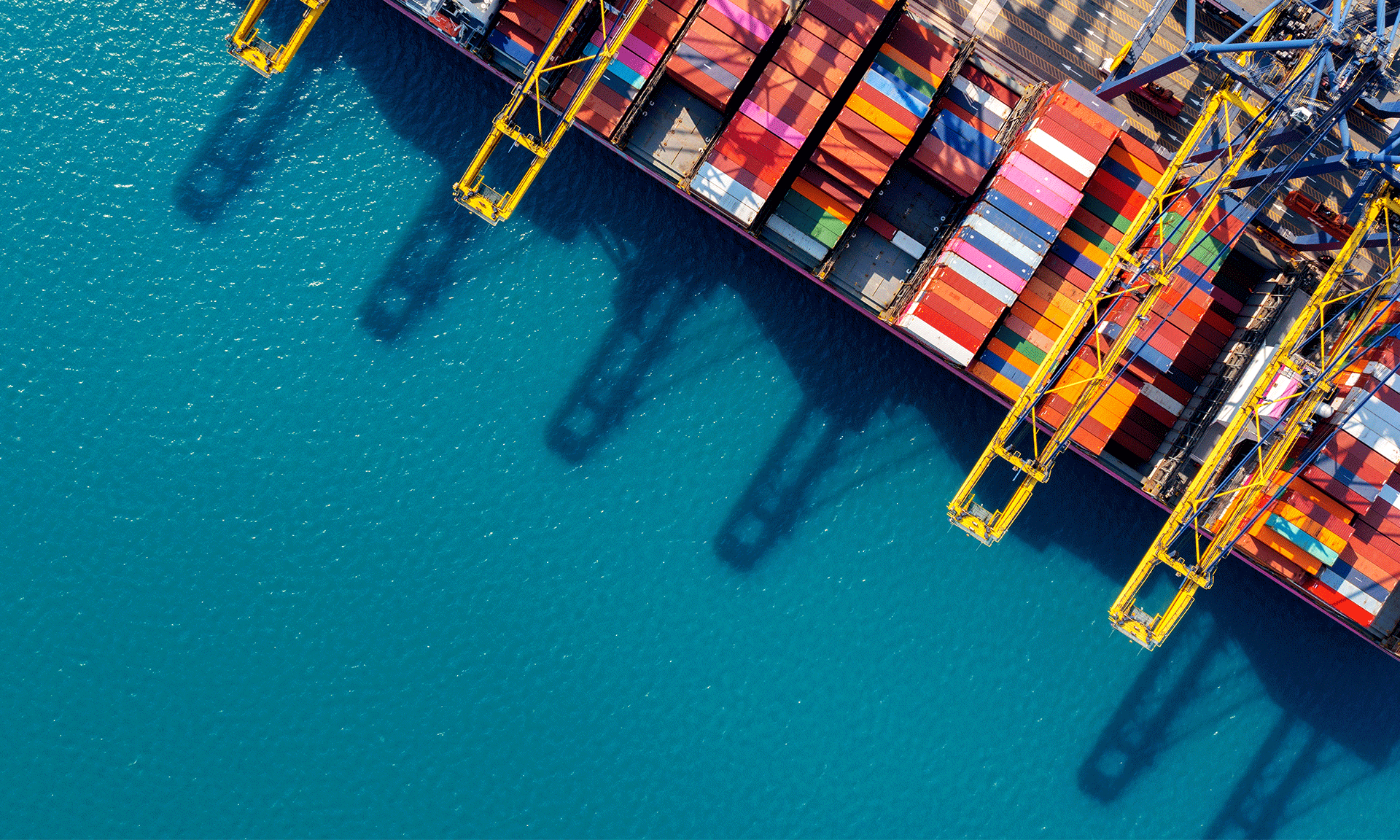

Situated on Oman’s northern coast, Sohar is a beautiful city reminiscent of a colorful past. This ancient city is steeped in history and is the largest in the northern areas of the nation. Having the fifth highest population in Oman, this town has always acted as a port for the country because of its strategic location. It also serves as a gateway between the east and west and currently, it is home to a deep sea port, allowing it to accommodate some of the largest ships, and thus becoming one of the rapidly growing free zones in the whole world.

Sohar free trade zone is one of the four operational free zones in Oman. Located in the Sultanate of Oman, situated 220 km away from Muscat – its capital, Sohar free Port and the free zone is mainly operating into areas such as Trade and Logistics, Steel Manufacturing and Processing, Petrochemicals, Oil and Gas, Minerals, Aggregate Industry, Ceramics, and Food logistics and processing. Oman’s Sohar free zone also has a one-stop-shop which acts as a window for all the customers to get whatever they need to establish and run their business seamlessly and efficiently.

Benefits of setting up a business or company in Sohar

- 100% foreign ownership but there should be a minimum of two shareholders;

- Exemption from the applicable corporate tax for at least 10 years. This period could be extended to up to 25 years or the duration of the lease in case the company meets specific Omanization targets;

- Availability of a ‘one-stop-shop’, which enables to easily get licenses, approvals or, permits they need for their business from a single place rather than running around to various government bodies;

- Very low capital requirements and encouragement to business start-ups;

- Omanization works as following regarding the corporate tax exemptions. The escalation system is as follows:

- The minimum level of Omanization is 15%;

- 25% Omanization after 10 years;

- 35% Omanization after 15 years; and

- 50% Omanization after 20 years and this is up till the final potential tax-free year (year 25);

The port was established in 2002, whereas the free zone came up in 2010.

Various possibilities in Sohar Port and Free Zone

The free zone is situated in Liwa and is on the coast. The location being close to many significant places, the free zone is within an easy reach of about 3 hours of Muscat. It is very near and well-connected to the UAE and Dubai. In addition, there are direct connections to highway which lead to Saudi Arabia, which is another significant economy in the region.

There are various types of licenses that can be obtained in this free zone. The types available are:

- Industrial License

- Light Manufacturing and Assembly License

- General Trade License

- Logistics License

- Service Provider License

These licenses permit doing these business activities and should be renewed annually. Third-party service providers must obtain a Service Provider license, although the services that are permitted to provide are specified. There’s another big advantage that the registration process for these service providers is not charged or is absolutely free of charge.

Also, there are some other permits which can be obtained, and the process is transparent and very simple. The permits are as follows:

- Plot Work Permit: This permit allows the Working Company to carry out the civil works within their plot. All the pertinent regulations on plot development and the required application process to get the Plot Work permit are in the Development Control Regulations;

- Common Area Work Permit: This permit allows the Working Company to carry out the works outside of the plot, but inside some of the common areas such as laying a pipeline or cable;

- Special Transport Permit: All businesses or companies would need an Environmental Permit. Which type of permit that would require depends on the type, scale of the work, and the complexity of the projects they intent to undertake. The permits are as follows:

- No environmental impact– In case there is going to be no environmental impact, there would be no application filling required and approval must be obtained within three working days.

- Limited environmental impact– In this case, the business needs to submit an environmental review form and the approval could take up to 30 days.

- Environmental Impact– In this case, the business should submit environmental impact assessment and the required approval could take up to 90 days.

The level of environmental impact is provided to the business or company during the assessment period so that the entities are prepared to give the needed review or assessment to make sure that the process is smooth and seamless.

The free zone does have its own rules and regulations known as the Sohar Free Zone Rules and Regulations, which are clearly distinguishable from the mainland laws.

Sohar Port and Free Zone is a very well-developed free zone, which is rapidly developing and growing and has large amounts of fixed investments flowing in. With so many advantages of a world-class deep sea port, proximity to various world-renowned business centers like Saudi Arabia and the UAE and the easy to use free zone facilities such as the one stop shop etc, Sohar Port and free zone offer very unique and promising opportunities for various businesses to set up themselves either on a regional or even on a global scale.

If you want to consider this promising prospect, do get in touch with the team of our professionals who will help you with new company formation in Oman or with foreign company registration in Oman.