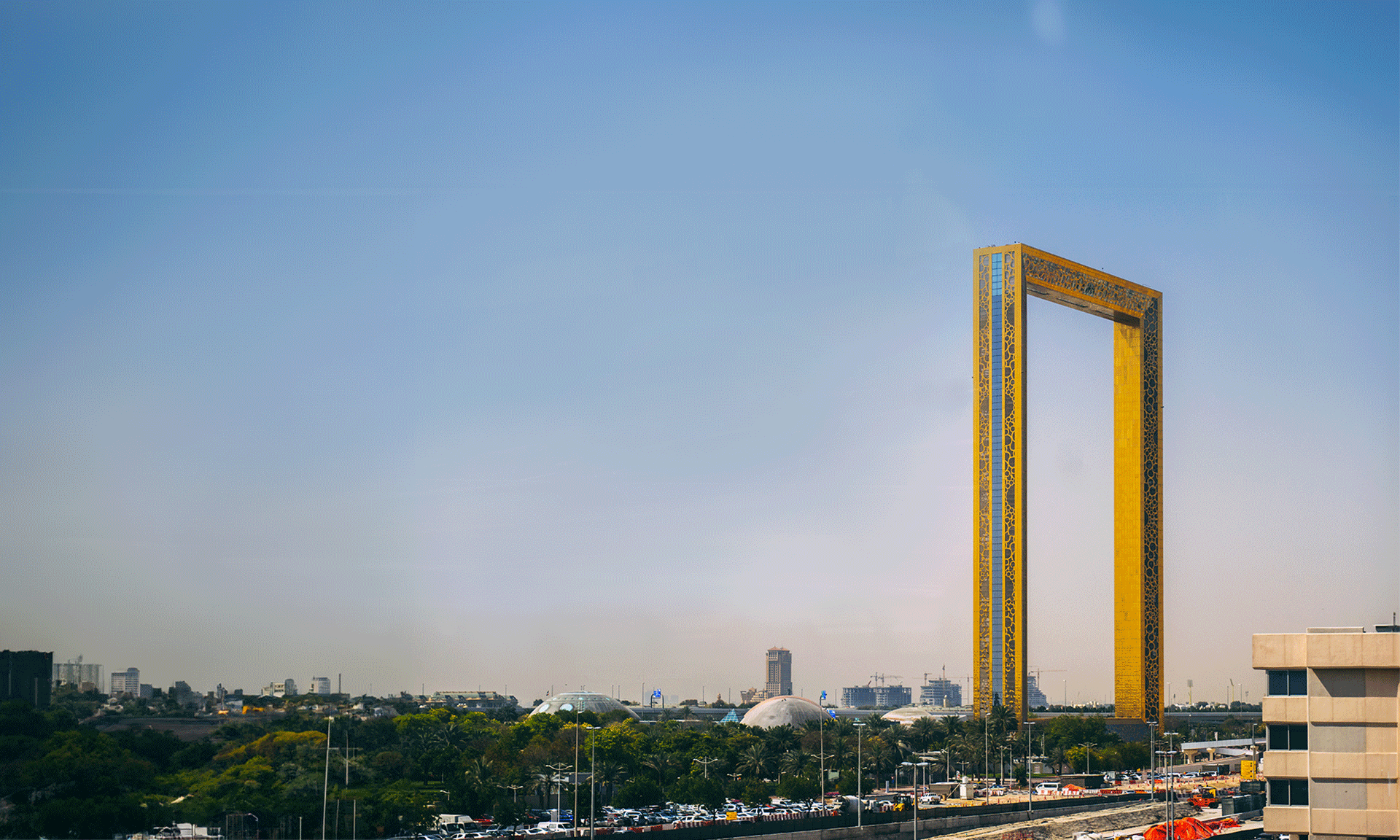

Tel Aviv-based venture fund Liquid Capital and Dubai-based Vault Investments jointly announced agreeing and launch a joint Venture Debt Investment fund with more than $100 million based in Dubai. It shall deploy debt financing aiming for technology financing across the Middle East, North Africa, and Europe and benefitting from already used and available technologies by Liquidity Capital for its newly formed offices in Dubai.

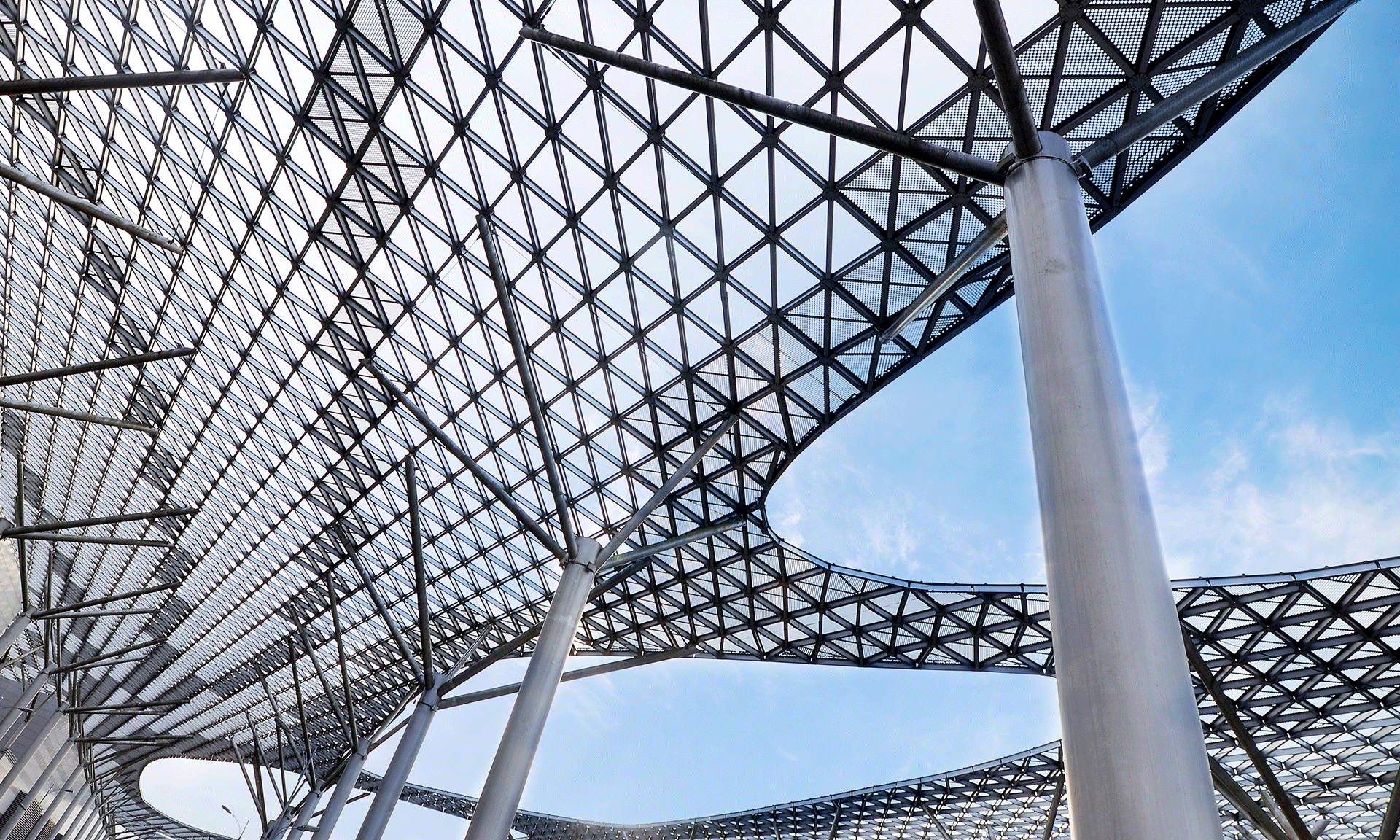

This joint venture stands as the living testimony of recent diplomatic ties between the two countries as a result of the Abraham Accords easing and normalizing bilateral relations between Israel and the UAE. The two firms will benefit by using the existing technologies in the Middle East and explore opportunities for Middle Eastern startups and companies with growth potential and help them become competitive globally.

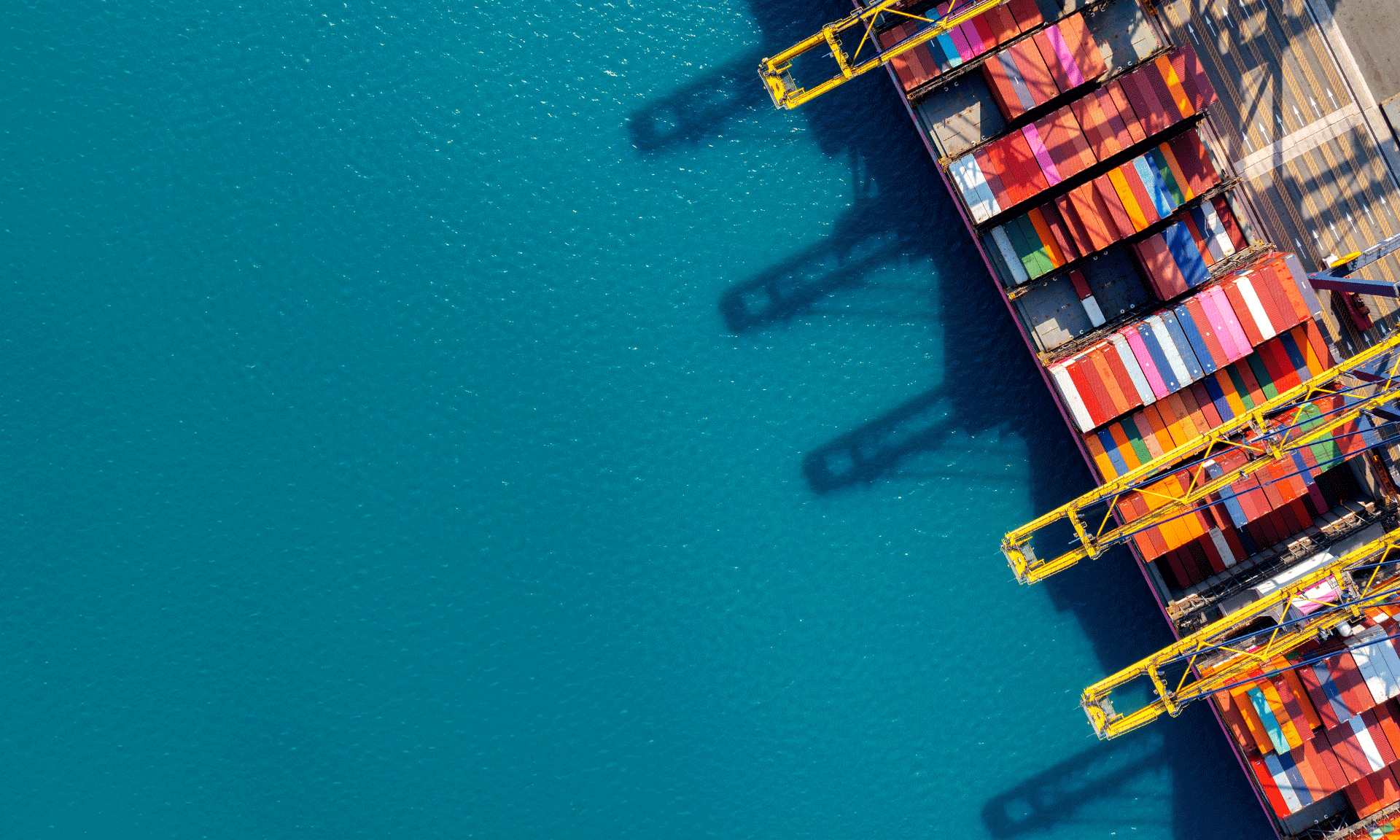

Debt financing as opposed to equity financing will fuel technology financing in the Middle East, North Africa and Europe, and will deploy technology already in use by Liquidity in its company’s Asia-Pacific and US investments. As part of the partnership, Liquidity Capital and Vault investment will engage in DMCC company formation, to more strategically locate investments in the region.

The joint venture stands as a significant step forward in the speedy diplomatic and economic relationships between Israel and the United Arab Emirates and at the backdrop of the recent peace agreements between those countries. Coming together, Liquidity Capital and Vault Investments will better explore and capitalize on the region’s growing and sound technological know-how including adequate available capital to unlock opportunities for business set up in Dubai for Middle Eastern startups and growth companies.

“The United Arab Emirates, the Gulf Cooperation Council countries and the Middle East as a whole are overflowing with technology,” remarked Sultan Ali Lootah of Vault Investments. “The partnership between Vault Investments and Liquidity Capital will create new growth in the region, and the facilities and services we provide will be a positive anchor for entrepreneurs. We believe that our partnership will provide success in the future through our combined leadership in Dubai,” he also added.

Ron Daniel, CEO and Founder of Liquidity Capital said, “Beyond the personal excitement by this first of its kind fund, and the wonderful relationship with Sultan Lootah of Vault Investments and his team, I strongly believe the new fund is a game-changer in both the availability of non-dilutive growth capital in the region and for the fast distribution of tech products from the Middle East and globally. The new climate in the region brings a lot of potentials to capture. Non-dilutive debt is an asset class now transforming successful companies into unicorns and Liquidity Capital is at the forefront of this by marrying technology and credit know-how.”

Avner Stepak, Controlling Shareholder at Meitav Dash and Chairman at Liquidity Capital noted “We are thrilled to cooperate with one of the most significant business groups of Dubai and incorporate an innovative fund that will help technology companies, mainly from our region, finance rapid growth, based on Liquidity’s great online underwriting technology. Sultan Lootah and his team will become great partners of ours and I strongly believe that this is just the beginning of several future joint businesses.”

Navas Ebin Muhammed, Partner at Vault Investments added, “We are very excited about this partnership with Liquidity Capital. Non-dilutive growth capital is the need of the hour and together we can play a significant role in helping companies that will redefine the collective future of humanity.”

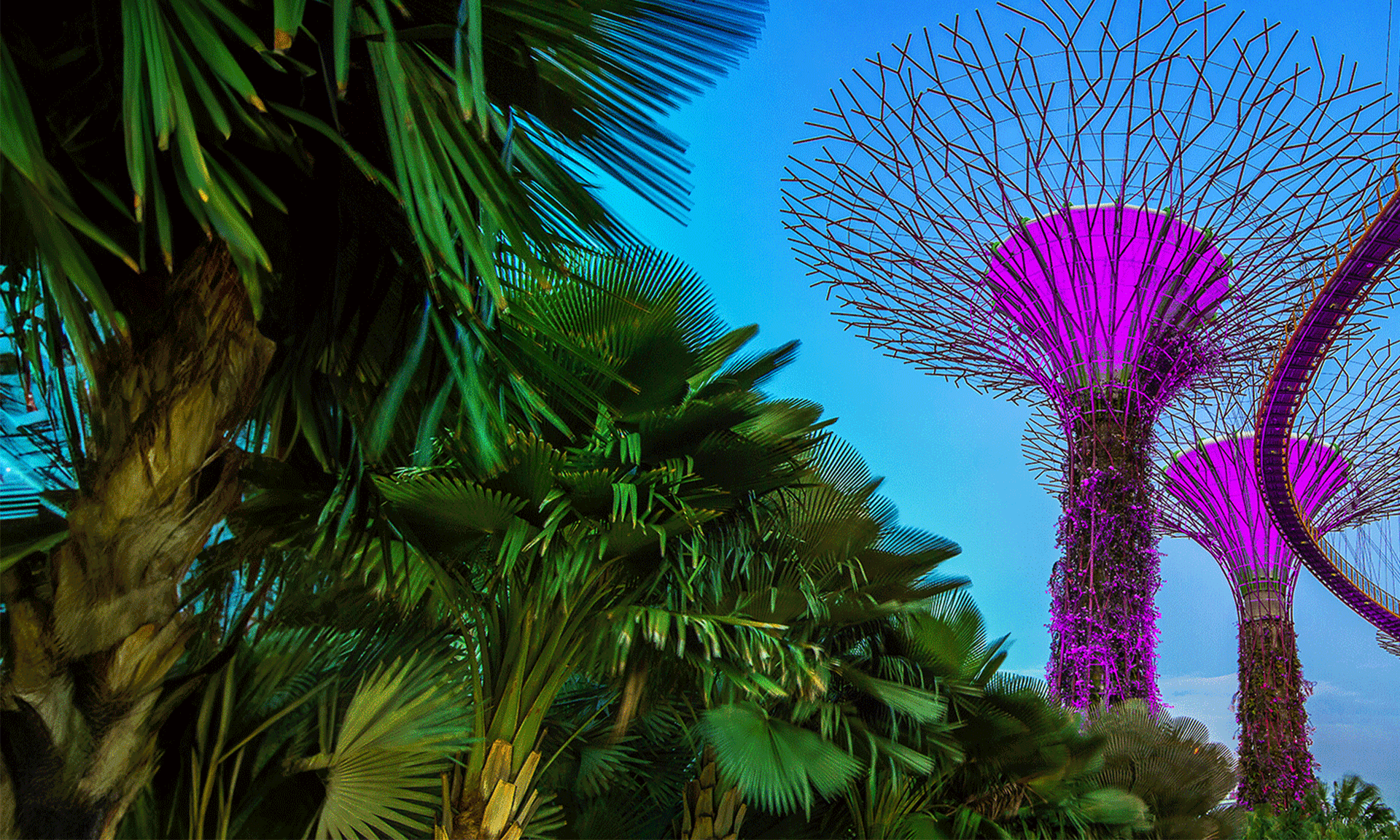

Established in 2017, Liquidity Capital is a global fund manager providing growth capital through funds focused on the US, Asia and the Middle East. Mars Growth Capital, the Singapore based subsidiary of Liquidity Capital and its partner MUFG manage and administer the company’s South East Asia program. Liquidity’s newly-released proprietary platform, Liquidity Dynamics, is one of the most advanced, real-time predictive modelling SAAS platforms for investment professionals from Vault and many other companies.

Vault Investments was founded in 2012 and is considered to be one of Dubai’s most prominent investment companies engaged in investing in many companies besides offering investment advisory services to both private organizations and governments. A dynamic, diversified, innovative and cross-border approach towards investment helped Vault investments to exploit both innovation and technical and financial expertise of its team to evaluate potential opportunities.