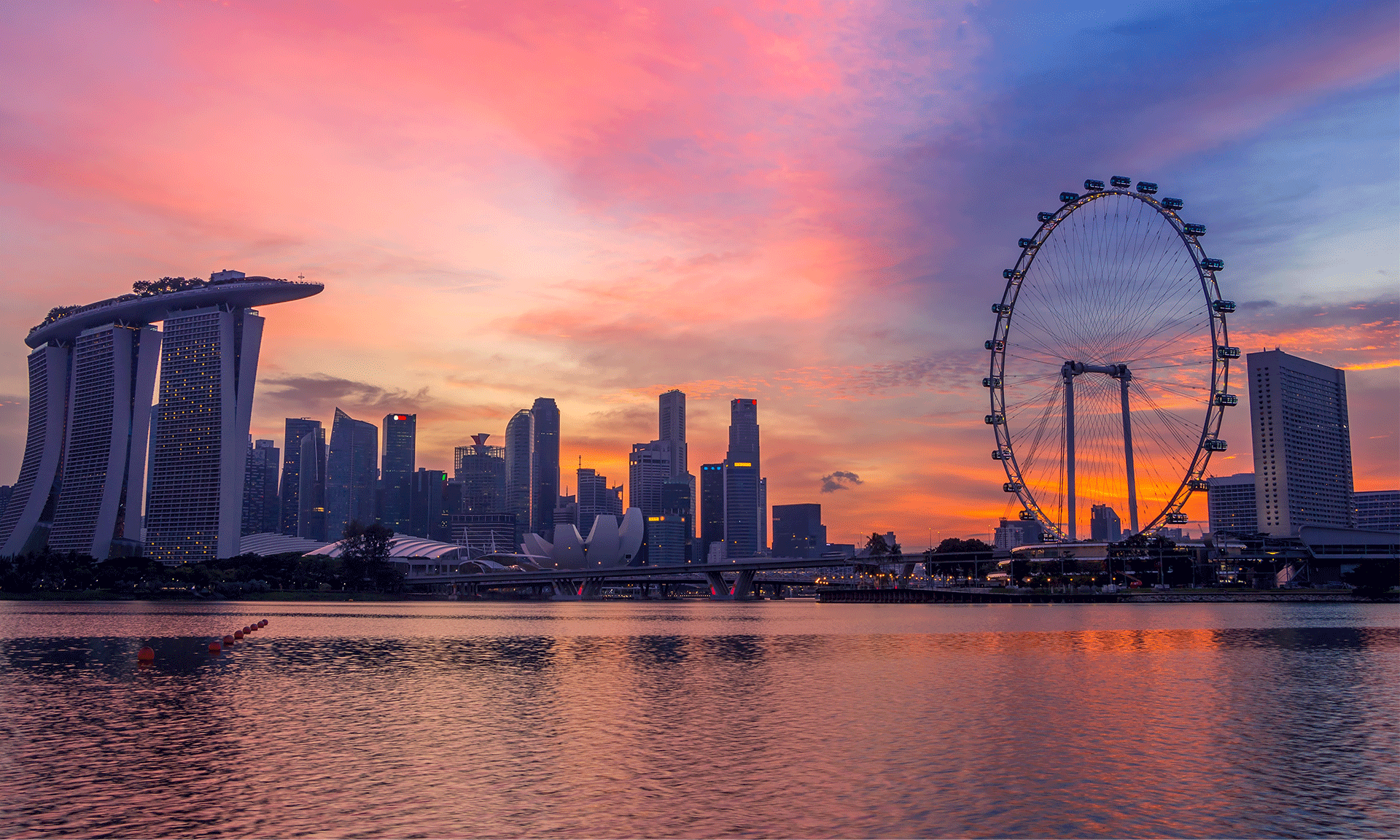

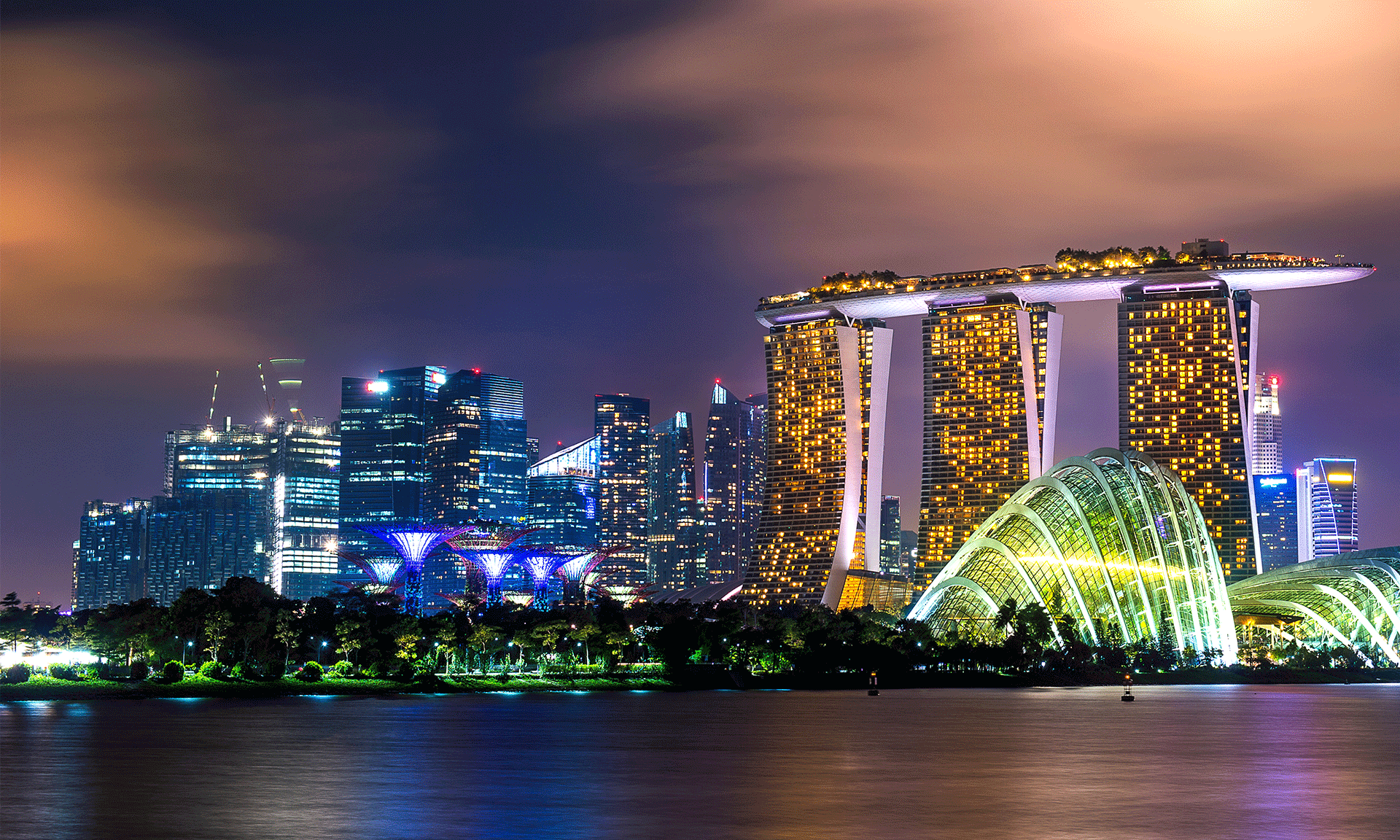

Singapore is one of the leading nations in the World Digital Competitiveness Ranking in 2020 only being second to the USA. Even in 2019, it remained the second most digitally competitive country in the world. This international ranking is based on the ability of any nation to use digital technologies for promoting economic transformation in business, government and other social domains. There is a sizable increase in Foreign Direct Investment in South- East Asia with Singapore attracting the highest investment.

“The Post-Covid world will be characterised by a K-shaped recovery, with two types of economies: those that will recover quickly and those that will recover more slowly,” says Professor Arturo Bris, Director of the IMD World Competitiveness Centre. As per him,”

Recovery is driven by many factors, such as the health of public finances. But also, fundamentally, by the digital competitiveness of those economies”

Germany, on the other hand, has been the biggest contributor to technology and science over centuries; be it in physics, chemistry, cars and consumer products and given birth to most of the Nobel Laureates in Science in the world. Many EU funded projects are controlled and coordinated by German companies and research institutes today and highlight its science and technology innovation in diverse fields including Information and Communication Technologies.

Several initiatives recently announced by Singapore and German authorities will now provide multiple opportunities to the companies from both countries to work together and spearhead their digital transformation of various business processes.

A Memorandum of Understanding (MOU) jointly signed by Enterprise Singapore (ESG) and the Asia Pacific Committee of German Business (APA) on 15th of October, 2020 announced a series of initiatives to be undertaken jointly to support enterprise development through a transformation in sectors of common interest for the two countries.

The joint initiatives are launched to strengthen business ties and exchange technological know-how between Singapore and Germany. The Germany Singapore Business Forum (GSBF) organized twice over the last four years has also been a part of the initiatives. GSBF helped influence Singapore companies to take interest and explore potential business opportunities in Germany.

As part of agreements, ESG and APA will support enterprise development through industrial and digital transformation in sectors of mutual interest including advanced manufacturing, digitalization and innovation, medical technology and healthcare, and future of mobility.

The enterprise development will be realized through increased collaboration in open innovation and by jointly accessing market opportunities in Southeast Asia and Europe.

Under the MOU, a refreshed version of GSBF newly named as GSBF Connect will be jointly organized by ESG and APA to facilitate sector-specific and more frequent collaborations between the two countries.

GSBF Connect will now be sector-specific and will be held throughout the year with the first edition dedicated to the manufacturing sector and planned to run virtually. The second edition is scheduled to take place in December during the Singapore week of innovation and technology.

More than 400 companies from both countries have used this forum over the last four years. The Germany Business missions also increased from 13 to 22 between 2018 and 2019. Over 150 companies have been benefited in 2019 from different sectors such as advanced manufacturing, medical technology and healthcare, the future of mobility and e-sports.

Peter Ong, Chairman of ESG addressed, ” In this changing business environment, our enterprises need to connect with one another in more and better ways. Germany and Singapore are trusted partners who place a high emphasis on delivering quality and innovative products and services.”

“Singapore is attractive to German companies in several ways as a long term partner with whom new technologies and innovative business models can be developed, but also as an experienced bridge builder into the emerging Asian region.”, highlighted Professor Axel Stepken, co-chairman of GSBF connect and TUV SUD AG management board chairman.

Prof Stepken also said,” Singapore has a strong record as a leading Research and Development Hub and digital trendsetter, while German companies are known for their ability to manufacture state-of-the-art machinery and products. I still see many fields and sectors in which we can bring our specific strengths together.”

Singapore and Germany collaboration also include SME funding programme facilitating Partnerships e.g. Singapore firm Move on Technologies and German company Vanguard Automation.

A new four-way partnership was agreed on October 14th between Singapore Polytechnic, German testing, inspection and certification company TUV SUD, Delta Electronics and Singapore’s Smart Transformation Alliance (STA).

Partnering with Germany will inevitably lead to lower integration cost and fewer challenges in the deployment of more advanced automation systems for the Singapore’s local companies embracing industry 4 solutions and more number of foreign companies are expected to pour in for Singapore company incorporation.