Expo 2020 Dubai is slated to contribute a whopping AED122.6 billion of gross value added (GVA) to the UAE’s economy between the time period of 2013–31. It is also expected to aid up to 905,200 full-time equivalent (FTE) job-years in the United Aran Emirates in 2013–31, which is equivalent to almost 49,700 FTE jobs every year in the UAE over this period.

Najeeb Mohammed Al-Ali, who is the Executive Director of the Dubai Expo 2020 Bureau, said that Expo 2020 Dubai is a very important long-term investment for the future of the Kingdom, which is going to contribute over 120 billion dirhams into the economy between the period of 2013 and 2031.

This is going to hearten millions around the globe to visit the UAE in the year 2020, while encouraging travel and tourism and aid economic diversification for times to come after the Expo. It will also leave behind a sustainable financial legacy that would help in ensuring that the UAE continues to be a leading hub for business, investment and also leisure.

This expo is projected to draw almost 25 million visitors and participants from over 190 countries from the time-period of October 2020 to April 2021. In this duration, it is estimated that the World Expo would contribute about 1.5% of the UAE’s yearly forecasted gross domestic product (GDP).

Besides that, the small and medium-sized enterprises (SMEs) are predicted to get almost AED 4.7 billion as investments in the pre-Expo phase, aiding about 12,600 job-years, and also helping to fulfil the Expo 2020’s goal to promote innovation and encourage small businesses.

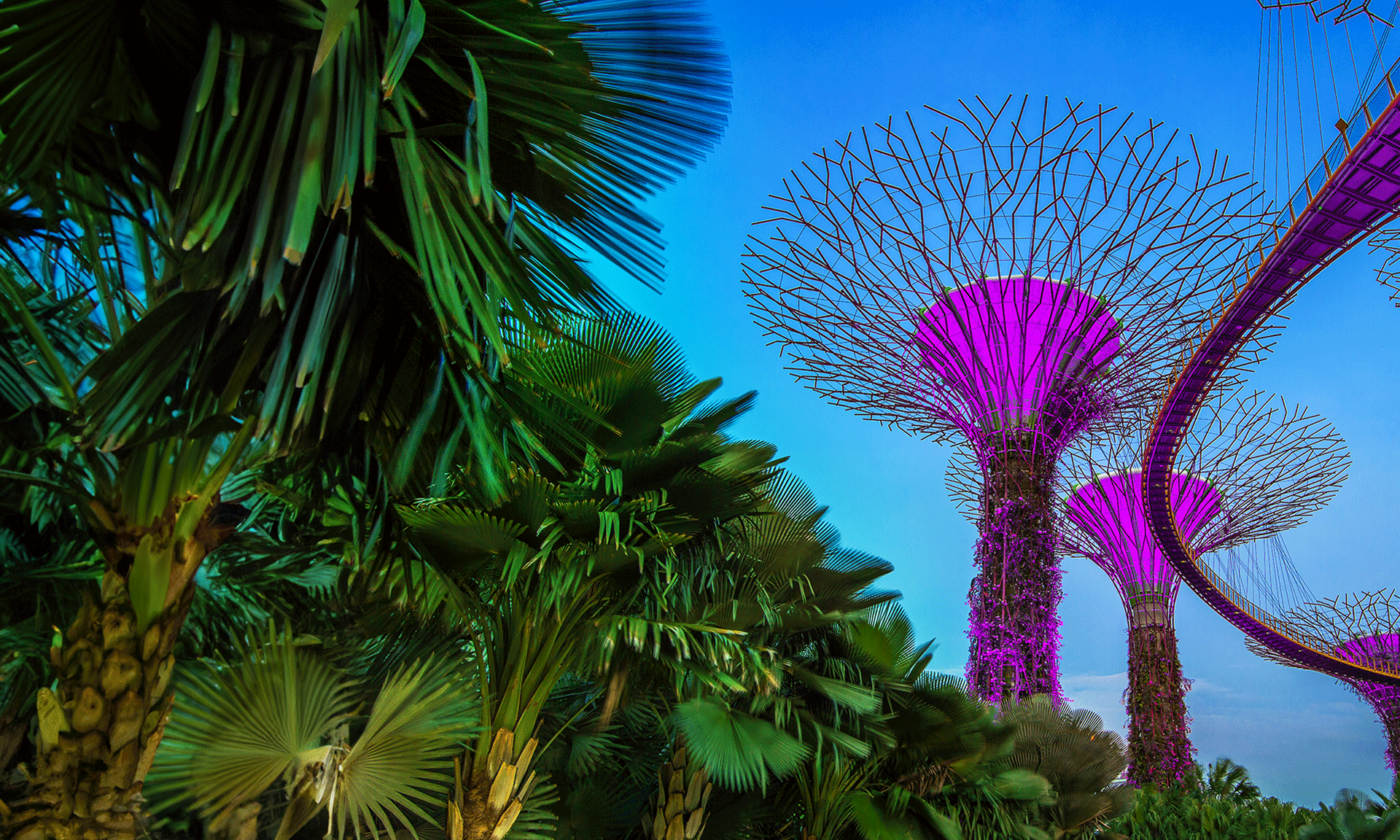

During the Legacy period, that is between the month of May 2021 to December 2031, the Expo site would be redeveloped to District 2020, which is going to comprise tenant firms and an expanded Dubai Exhibition Centre (DEC).

District 2020 is strategically planned to promote the UAE’s future vision by aiding sustainable financial development, thus, going a step closer to an innovation-driven economy and nurturing a business environment to assist major growth industries like logistics and transport, construction and real estate, travel and tourism, and education.

More than 80 percent of the Expo built environment is intended to be preserved for District 2020, and ultimately expanded into a city that covers over four million square meters. District 2020 businesses would be focused on innovation and new technology, comprising a blend of corporations and SMEs. The DEC is also going to be a major facility in the site.

The financial effect of the Legacy period is majorly anticipated to be driven by the expansion activity and operations of District 2020 along with the incremental outcomes of DEC’s expansion.

To conclude, there is going to be a ‘direct’ rise in economic activity, while there would be ‘indirect’ advantages of enhanced supply chain demand and ‘induced’ profits from amplified spending by employees of companies involved in Expo 2020.

Expo 2020 Dubai will be the first World Expo that will take place in the Middle East, Africa and South Asia (MEASA) region in the 168 years of history of the event. Close to over 200 participants, which will include of nations, corporations, firms, educational institutions and multinational organizations, would gather in Dubai between the month of October 2020 to April 2021 to discover the Expo 2020’s theme of ‘Connecting Minds, Creating the Future’.