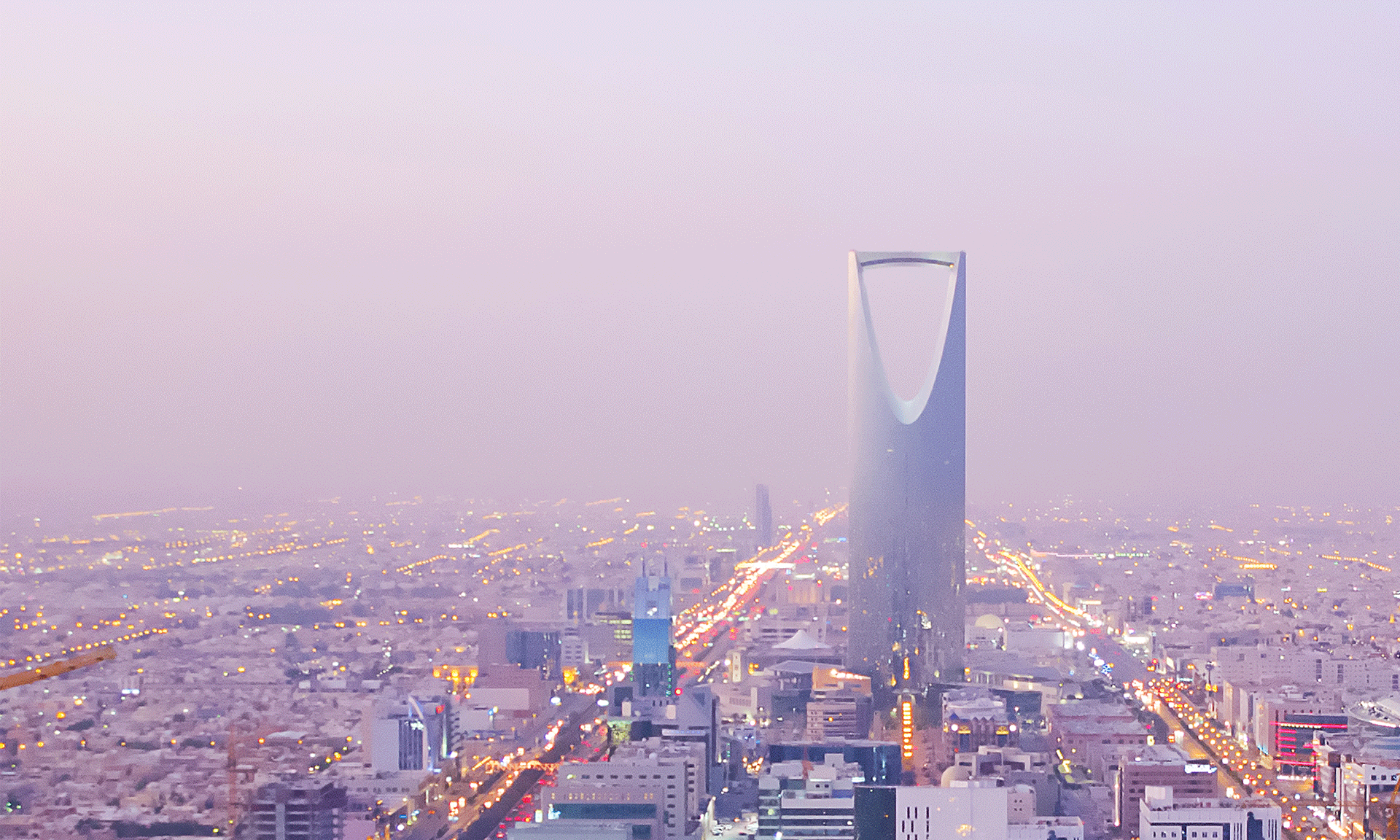

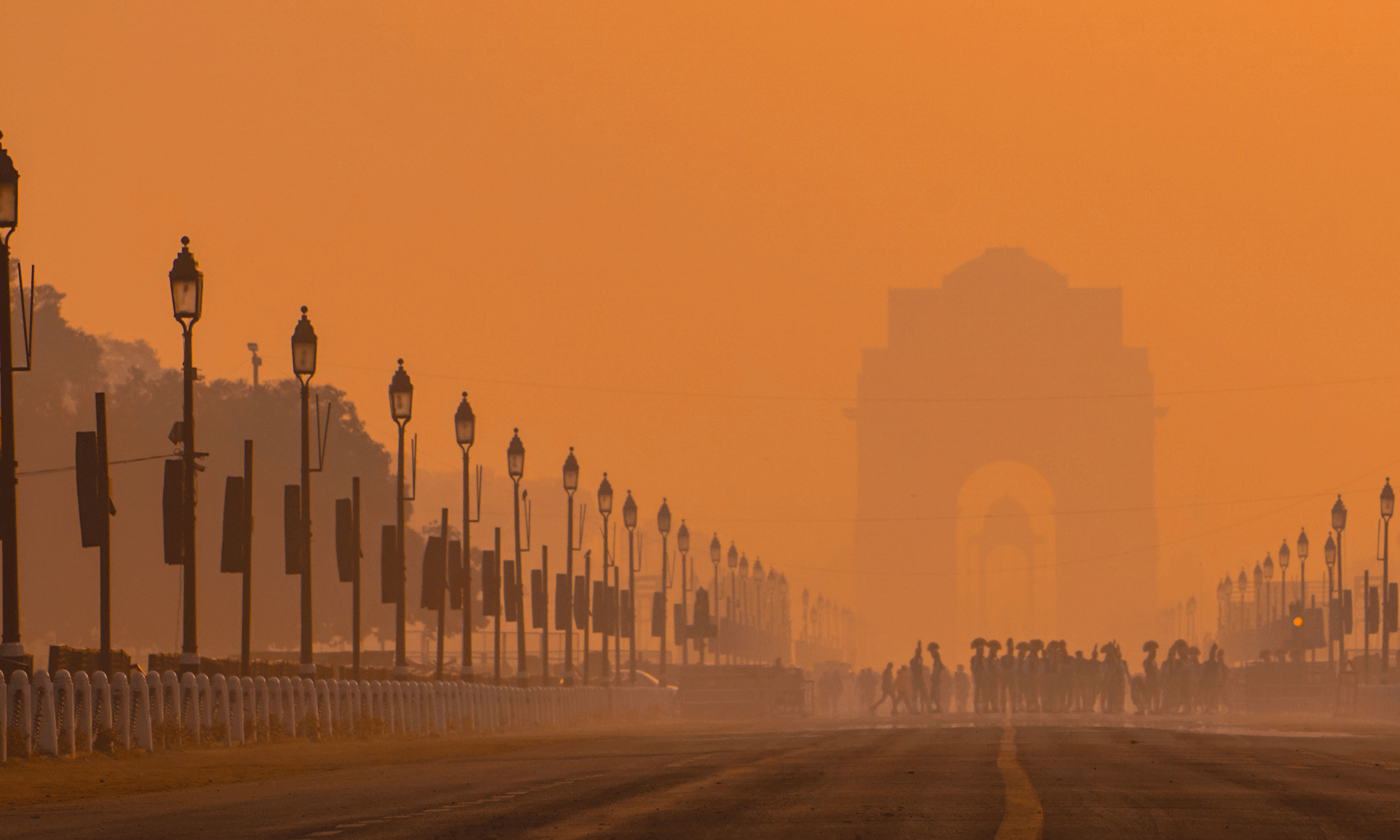

External Affairs Minister Dr S Jaishankar visited Hyderabad House in New Delhi on Sunday, the 19th of September 2021 to receive and meet the Foreign Minister of Saudi Arabia, on his three-day visit to New Delhi. It was the first Ministerial visit from Saudi Arabia since the time of the covid pandemic outbreak.

The two Ministers discussed the status and progress of implementation of the Strategic Partnership Council Agreement including measures for strengthening the partnership between the two countries in healthcare, trade, investment, energy, defence and security.

Indian Prime Minister Narendra Modi met Saudi Arabia’s Foreign Minister on Monday, the 20th and Tweeted saying, “Pleased to receive Foreign Minister of Saudi Arabia, Prince Faisal bin Farhan Al Saud. Exchanged views on ongoing bilateral cooperation initiatives and regional situations. Conveyed my regards to His Majesty the King and His Highness the Crown Prince”

The Prime Minister reiterated the willingness of India to witness larger investment from Saudi Arabia in the country’s industrial sectors including energy, IT and defence manufacturing in an in-person meeting with Saudi Arabia’s Foreign Minister Prince Faisal bin Farhan Al Saud in New Delhi on Monday.

The two countries’ views and perspectives on regional developments were discussed in the meeting like the situation in Afghanistan, an official press release noted. Several bilateral cooperation initiatives that have been recently undertaken by India and Saudi Arabia were also discussed and reviewed in this meeting.

The historic visit of His Royal Highness Crown Prince to India in February 2019 along with the country’s Deputy Prime Minister and the Minister of Defence was instrumental in Saudi-India bilateral ties and paved the way for a promising relationship between the two countries. The Crown Prince announced a Strategic Partnership Council between the two countries, led by Himself and Prime Minister of India and supported by the ministerial representation from the two countries and encompassing the entire range of strategic relationships.

The Indian Prime Minister visited Saudi Arabia on 29 October 2019 and the two sides set up the Strategic Partnership Council as announced by His Royal Highness Crown Prince earlier. The Strategic Partnership Council formed by the two countries is to explore increased cooperation in trade and investment in several industry sectors, defence and counter-terrorism.

Saudi Arabia’s Ambassador to New Delhi, Dr Mohammed Al Sati previously highlighted that his country values India as a close ally and strategic business partner. Bilateral cooperation in areas of training, knowledge sharing and the fight against terrorism was emphasized in his speech. Dr Al Sati also praised India in its handling of the covid pandemic including the economic relief package provided by the Indian government.

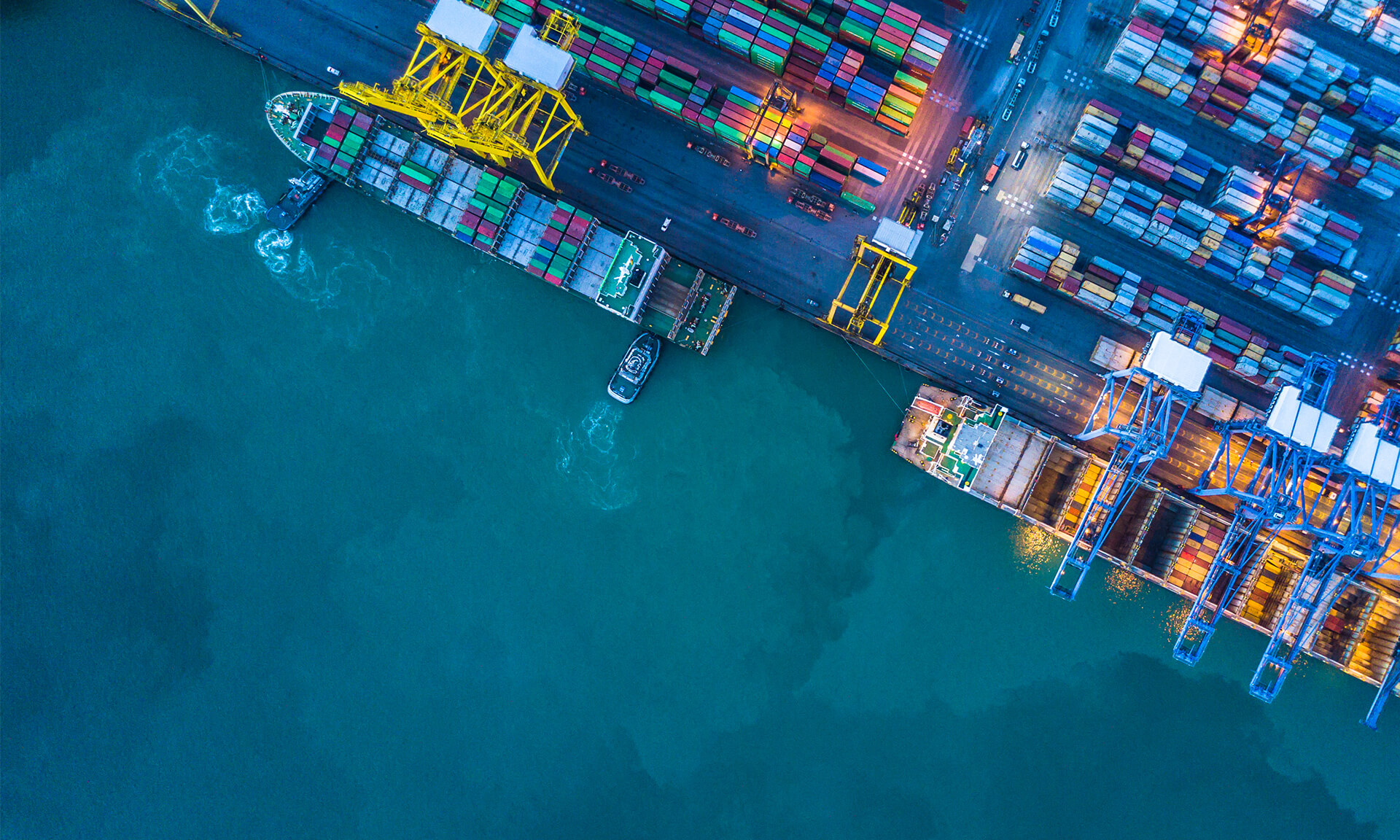

The world’s largest oil exporter earlier confirmed saying that Saudi Arabia’s investment plans in India are on track and more than 100 billion USD investment in Indian petrochemical, infrastructure, refining, mining, and manufacturing, agriculture and several other sectors would be made as announced by Crown Prince Mohammed bin Salman in 2020. Saudi Public Investment Fund (PIF) already planned for an investment of approximately USD 1.3 billion in Reliance Retail and USD 1.5 billion in Reliance’s Jio platform.

The Reliance Saudi Aramco deal is also on the verge of finalization as Saudi Arabia commits a steady supply of crude oil for Reliance refineries and makes an investment in India’s energy sector by purchasing a stake in Reliance Industries for an estimated 20 to 25 billion USD. An investment in the West Coast refinery petrochemical project is also on the cards as per a report. A complete guide on doing business in India is helping Saudi entrepreneurs and investors in planning and launching their Indian business operations.

The Indian Prime Minister in the recently held meeting with the Saudi Foreign Minister sought greater investments from Saudi Arabia and urged that Saudi entrepreneurs come for new company formation in India in energy, IT and defence manufacturing as these sectors can offer huge growth opportunities to benefit from. Saudi Arabia’s efforts in ensuring the safety and health of Indian ex-pats and workers during the Covid-19 pandemic was also appreciated by the Prime Minister.

The recent political crisis in Afghanistan was also discussed between the Saudi Foreign Minister and Indian External Affairs Minister. India has taken a ‘wait and Watch’ stance and also started discussions with other gulf countries e.g., UAE, Qatar, and Bahrain, Jaishankar remarked. Indian Prime Minister, Narendra Modi had earlier said that the matter regarding recognition of the new set-up in Afghanistan should be a collective decision of the global community.