A gateway to ASEAN, Singapore has one of the lowest corporate tax rates and also boasts of various business-friendly regulations that make it easy for organizations to set up their business and offices in this South-east Asia country.

Data shows that companies are looking for regions that have higher growth potential so that they can meet the demands of their stakeholders. Especially fast-growing Asian economies like China and the South-east Asian countries are a choice of many entrepreneurs because of their large and lucrative markets.

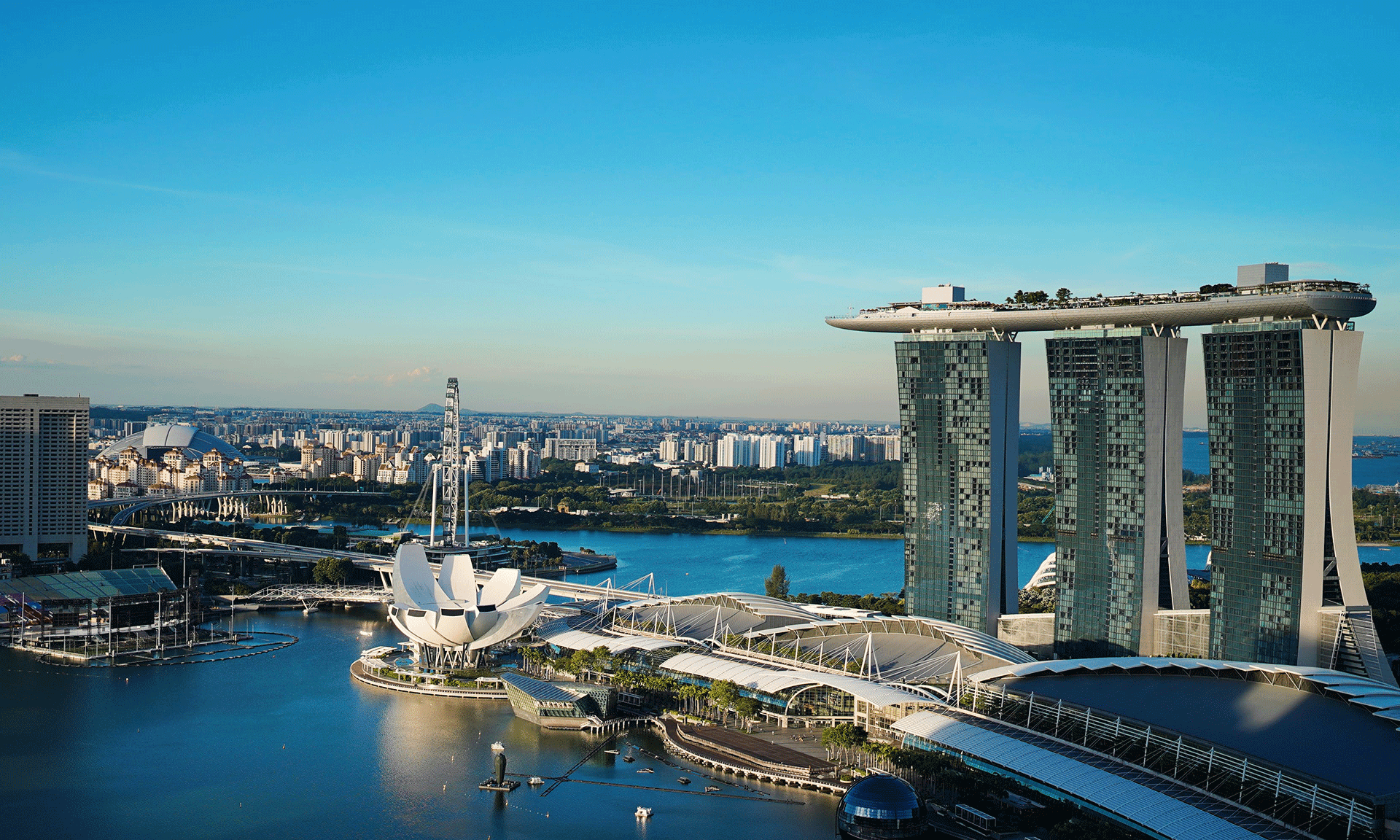

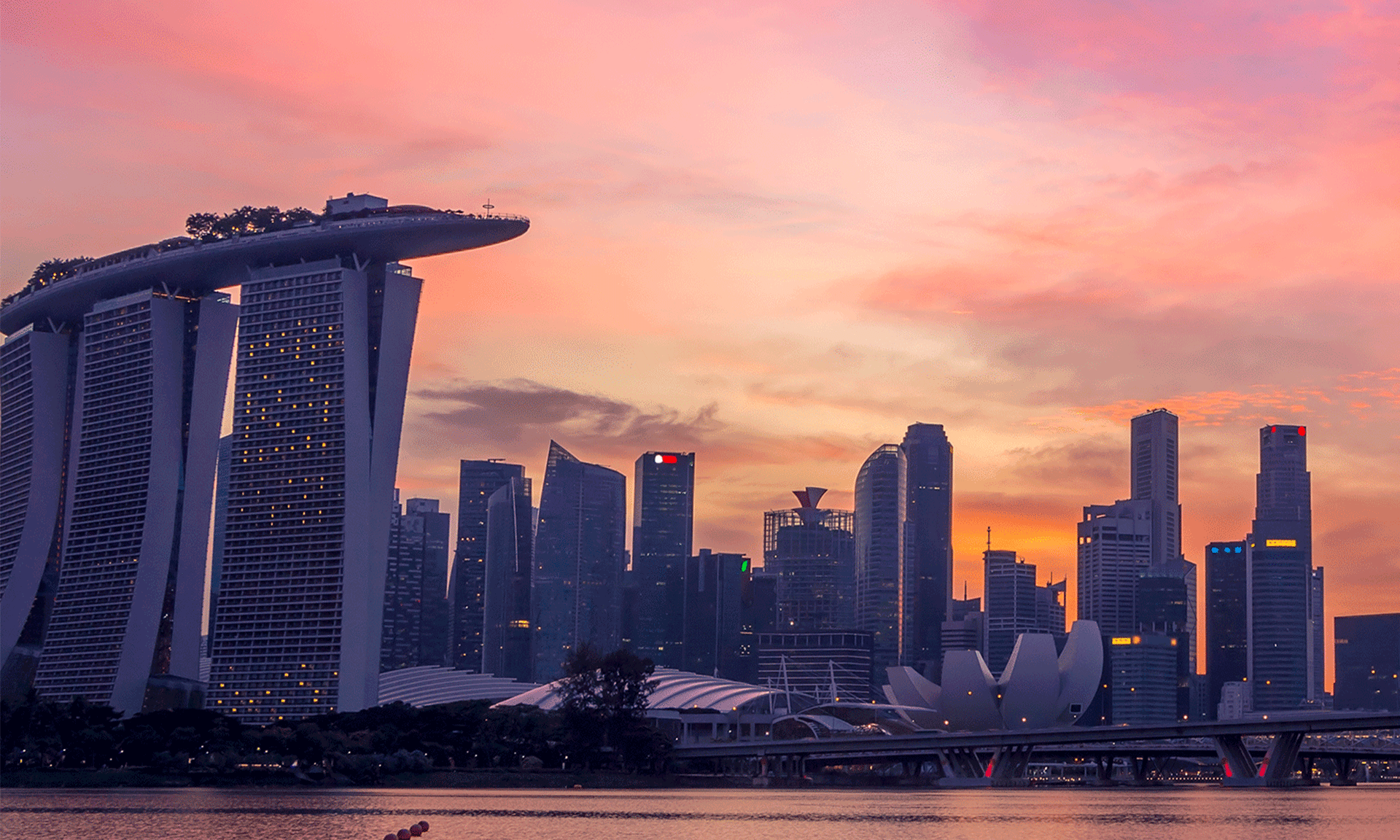

Singapore – A Gateway to ASEAN

So where does Singapore figure in all this? Gaining the fifth rank amongst the top 20 host economies in FDI inflows, Singapore has made its mark as the gateway to ASEAN and is a preferred destination for enterprises of all sectors and sizes to base their office or operations in Asia. Here in this article, we will talk about some of the major driving factor contributing to Singapore’s success in bringing in foreign companies to its shores.

Network of double tax treaties

Singapore is known for its extensive network of double tax treaties or tax agreements (DTAs) with over 80 nations across the globe. The main advantages of a DTA are that double taxes are avoided, there are lower withholding taxes, and there is a preferential tax regime. This enables in minimizing the burden of taxation for a company. Other than this, there is no capital gains and dividends tax, which further makes Singapore a lucrative choice for business investments by company formation in Singapore.

Appealing tax regime

The simple and investor-friendly tax regime is another big advantage. In Singapore, the maximum corporate tax rate on any taxable income is just 17%. There is no tax on capital gains and on dividend income and no withholding tax on post-tax dividends that are paid from Singapore. What’s more? All foreign-sourced income is completely tax exempt if that income has been taxed in a country having a headline tax rate of at least 15%. Then there are no restrictions on foreign ownership and no controls whatsoever on foreign exchange.

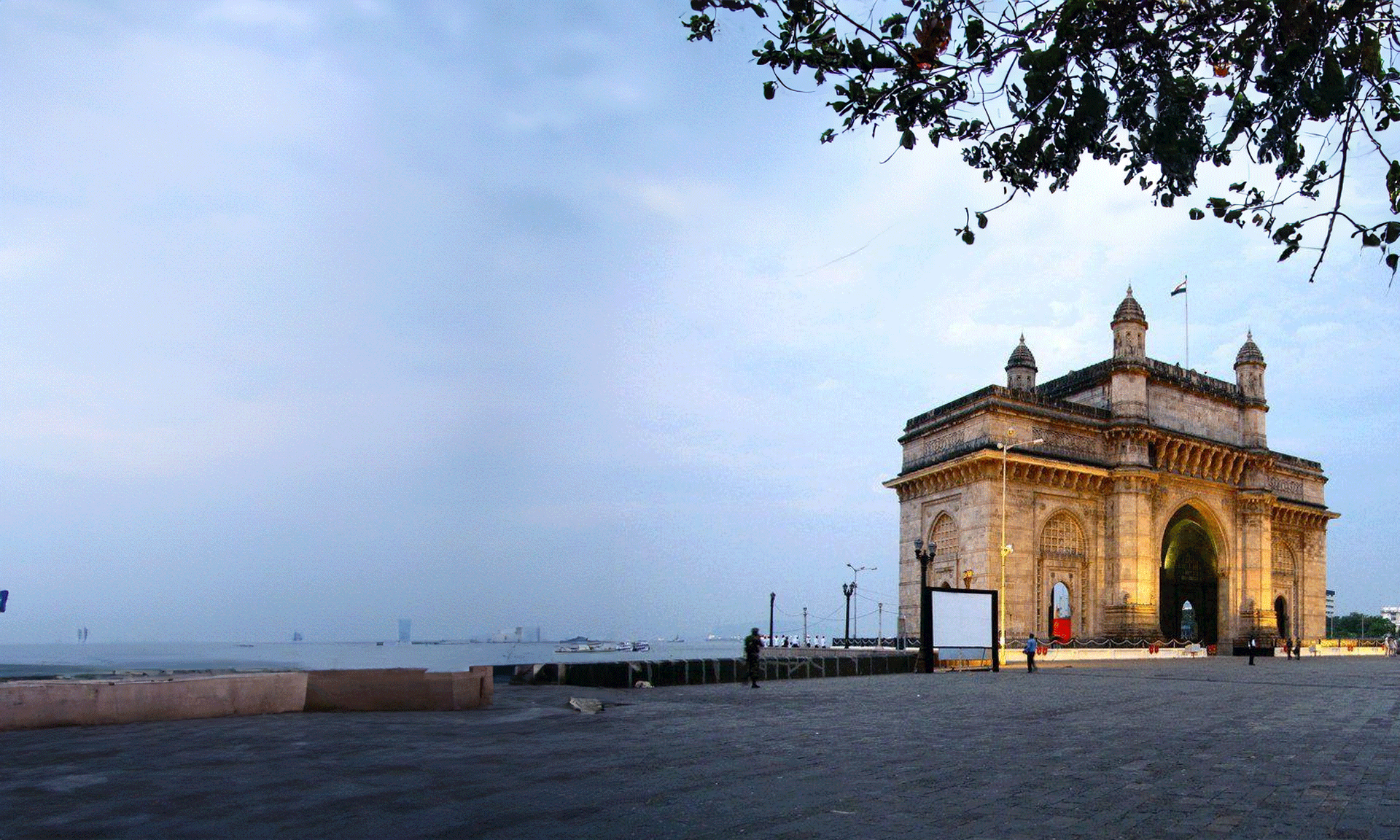

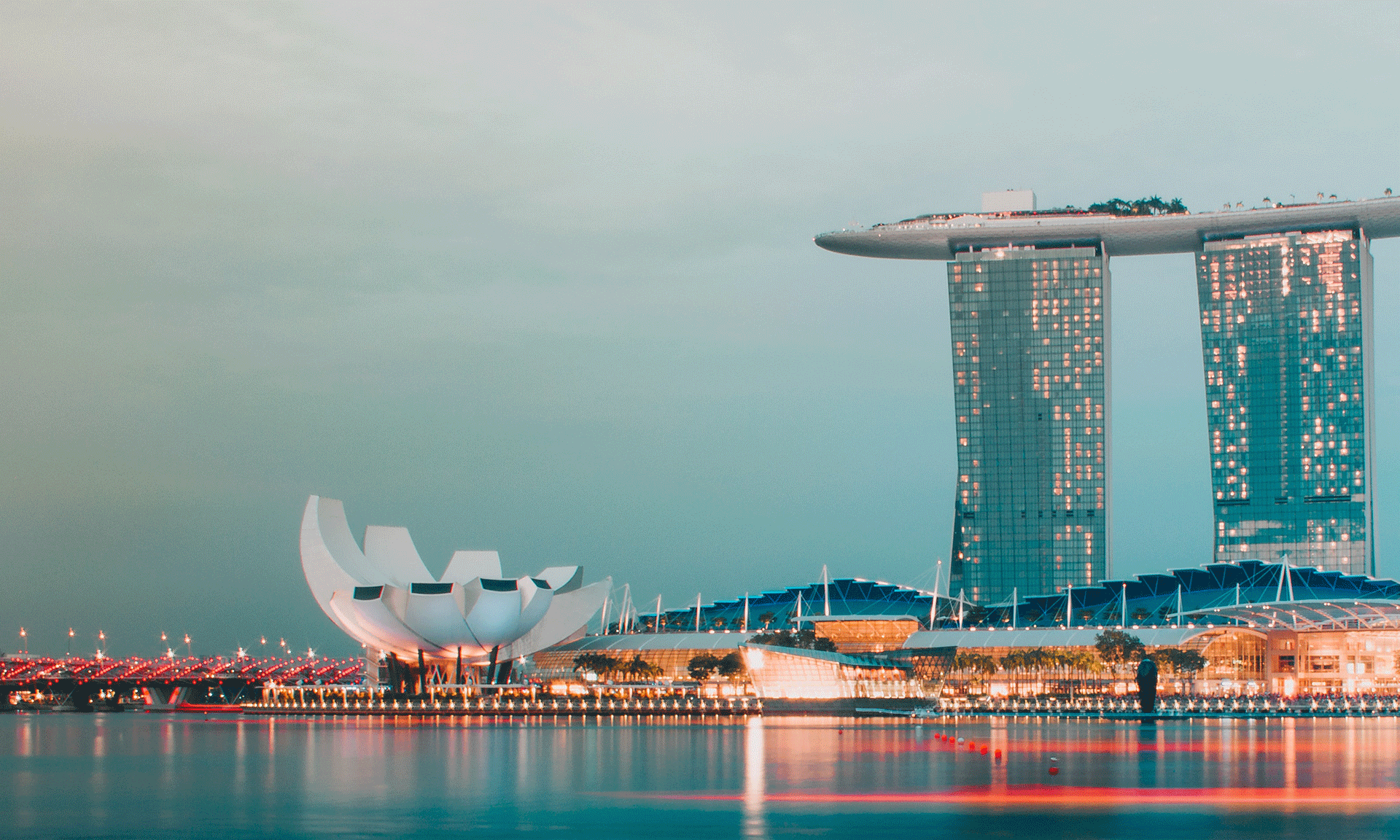

Strategic location with superb connectivity

Singapore has is very strategically located at the intersection of the main trade and all the shipping routes of the world, for example, the major sea route connecting India and China. Known as a transportation hub, Singapore is proud to have the award-winning Changi Airport and also boasts of a world-class port infrastructure, which has been awarded the ‘Best Seaport in Asia’ many times. With its telecommunications infrastructure also at a world-class level, this nation has been ranked as one of the top in leveraging information and also communications technologies to improve its country competitiveness by the World Economic Forum. Today, Singapore stands as one of the two Asian countries ranking in the top 10 amongst 139 countries worldwide.

Skilled and multilingual resources

The business environment in this country is very attractive to skilled and multilingual workers who come from across the globe. The fast-moving innovative work environment, along with a pool of local Singapore talent, reinforces Singapore’s reputation as the most productive, flexible and motivated workforce in the region, which has also been proven by the data and rankings in the IMD World Competitiveness Yearbook.

Smart immigration policies

Singapore offers many types of Visa schemes for talented and qualified professionals and entrepreneurs. The government is constantly making efforts to pull in foreign investments and enhance the level of its local workforce by adding top talent from across the globe.

State-of-art infrastructure

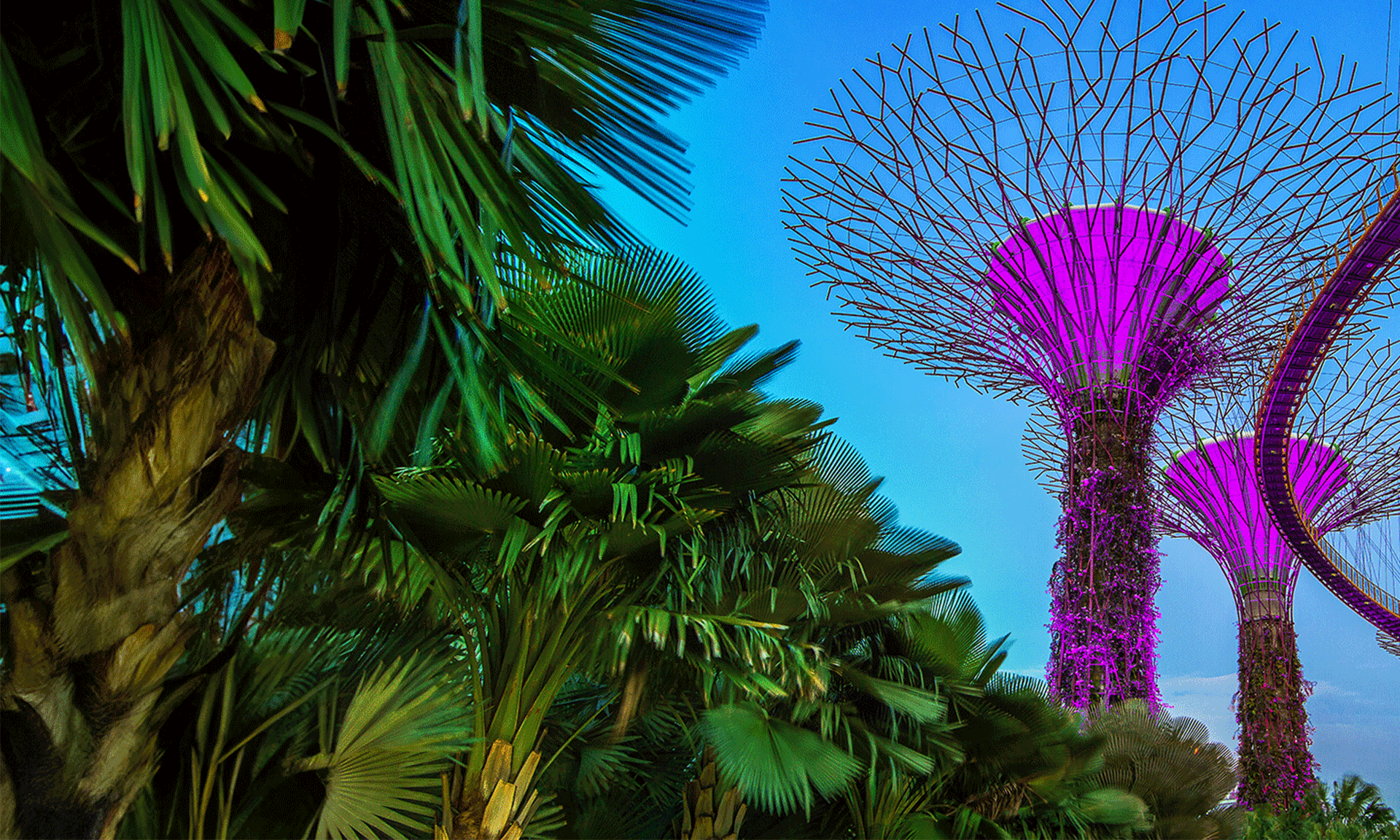

One of the most stable and prosperous countries in Asia, Singapore’s stability in terms of politicals, an array of available facilities, public services conveniences, and the cosmopolitan environment makes it an attractive destination for people globally. With its multitude of dining, entertainment, tourist options, best-in-class infrastructure, and many internationally-recognized educational institutions and universities, Singapore offers a high standard of living yet having its friendliness and warmth.

Excellent IP protection regime

A hearty intellectual property (IP) rights regime and most trusted legal system further adds to the Singapore’s list of advantages. The IP policy of the government, which aims at encouraging innovation and growth of business and commerce in Singapore has been recognized by the World Economic Forum’s Global Information Technology Report 2017-2018 as the top Asian regime for the protection of IP. Despite the high international rankings, additional initiatives by the government are underway to improve the country’s IP landscape further and build it as Asia’s IP hub.

Efficient and effective legal system

Singapore’s legal system is well-developed and has successfully maintained its relevance in the existing cultural, commercial and social environment, by taking in the common law and other best practices from evolved legal systems. The country’s legal system has won accolades globally because of its efficiency, integrity, and for being the least bureaucratic in Asia. Companies are not stuck in red tapism or slow operations because of bribery or other issues. Singapore’s commercial legal structure is also known for its fair and impartial ways.

To conclude, Singapore remains an attractive destination for offering various opportunities for business and investment in the Southeast Asian region. So if you require any assistance or professional advice on company formation in Singapore, Visa services in Singapore or Accounting services in Singapore, do get in touch with us and we would be happy to help.