Singapore and UK have signed three agreements in London recently that would encourage more collaborations in financial services.

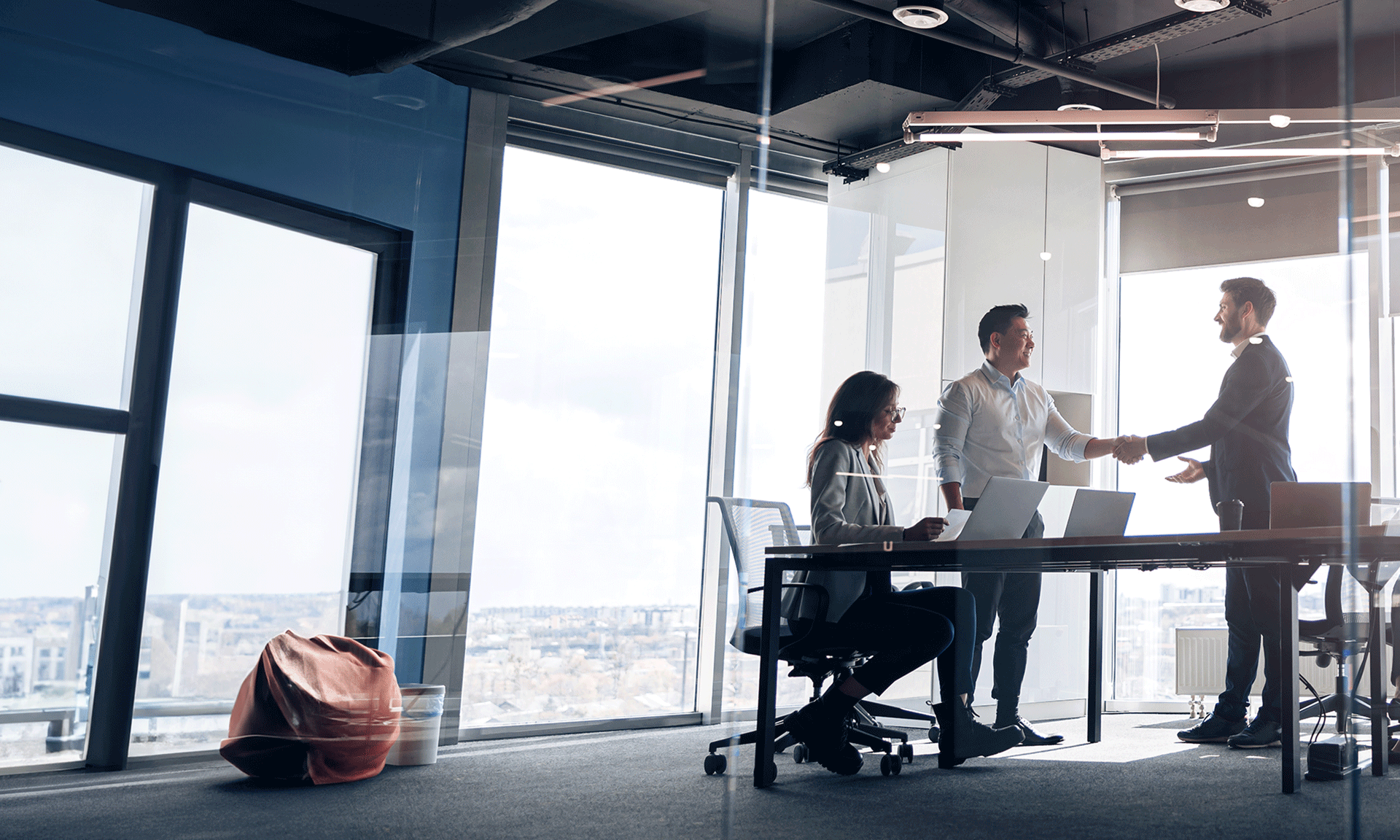

A memorandum of understanding (MOU) was signed between the Monetary Authority of Singapore (MAS) and the City of London Corporation which will boost cooperation in facilitating data flows, improving cross-border know-your-customer processes, thus developing new skills and fostering green finance.

This MOU was signed by Tharman Shanmugaratnam who is a Senior Minister and City of London Lord Mayor Peter Estlin.

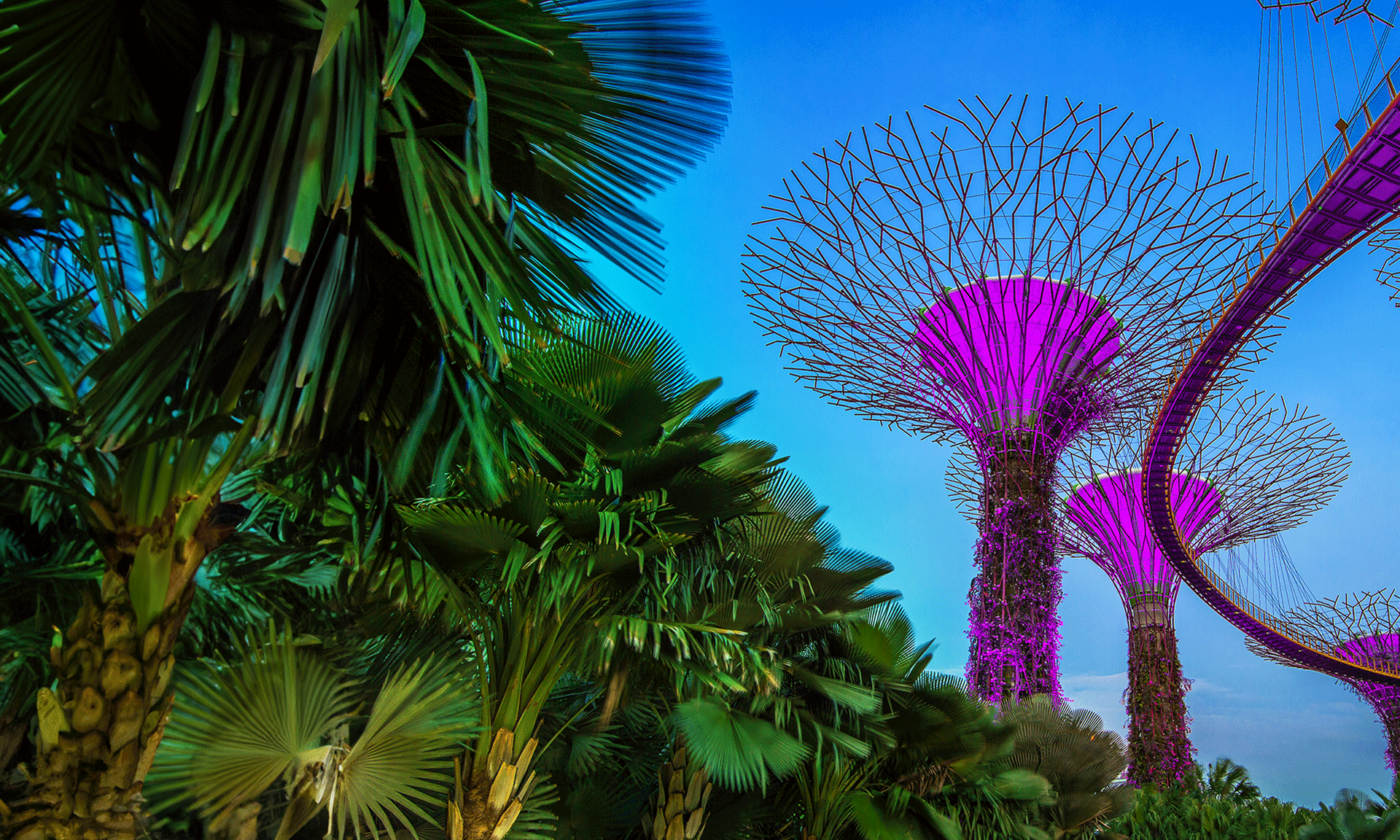

The MAS and the City of London have also recently inked a partnership arrangement regarding Britain’s Green Finance Initiative, which will encourage green and sustainable finance.

Then the third agreement, which was a declaration of intent, was done between the Institute of Banking and the Finance Singapore and Britain’s Chartered Body Alliance to partner more in fostering skills of the finance and insurance professionals.

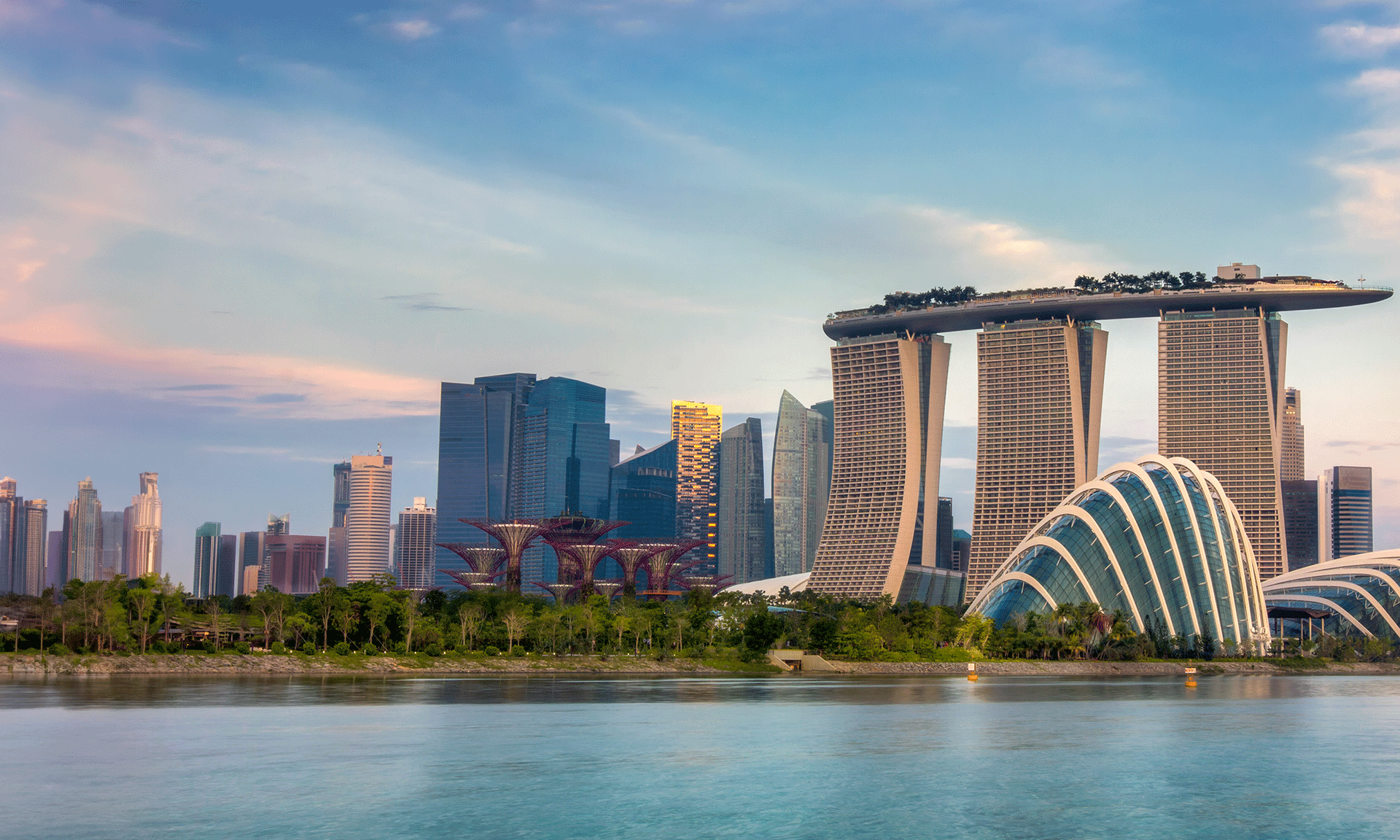

The signing ceremonies were held during the UK-Singapore Business Summit at the Guildhall in London which commemorated Singapore’s bicentennial.

The Education Minister Ong Ye Kung also attended the summit.

The MAS and the Bank of England also collaborated to enhance cooperation in improving cyber security particularly for the financial services industry.

Mr Tharman was of the view that “The initiatives we are working on – data flows and governance, cyber security, skills development, and green finance – will enable continued dynamism and stability in Singapore’s and London’s financial centres.”

These agreements show the commitment of both these countries to make “free markets and multilateralism” which are the key characteristics that Mr Tharman mentioned in the summit’s opening address, stating that they are “especially important in our future relationship and collaboration”.

Both Mr Ong and Mr Tharman stressed on the deep ties among Singapore and Britain, their shared history, and their strong friendship and collaboration across various sectors.

Mr Tharman said that “Singapore and Britain are close friends with intertwined histories and a shared orientation towards the world. It is a strong base for our future partnership.”

Mr Ong pointed out the areas where collaboration could happen, for example, innovation, financial cooperation, and data and people-to-people exchanges and said that “This relationship will live on in the generations to come. It will simply be made more efficient and effective by the digital technologies that have made many things possible. Together, we will forge ahead in our cooperation for the new era.”

There were two panel discussions on topics like green finance, various opportunities available for partnership, and the interaction between innovation and regulation.

The panellists included the Senior Parliamentary Secretary Tan Wu Meng, Institute of Banking and Finance chief executive Ng Nam Sin, and Singapore Exchange chief executive Loh Boon Chye.

In addition, the Intellectual Property Office of Singapore, Lloyd’s Asia and Antares Underwriting Asia issued a new initiative to aid innovative businesses as they enter international markets.

The goal is to provide enterprises with insurance coverage especially for legal expenses that might be incurred in IP infringement proceedings worldwide.

Mr Tharman was also conferred with the Freedom of the City of London award to recognise his efforts to enhance ties between Singapore and London and for his noteworthy contribution to global financial governance.

Some previous recipients were Singapore’s founding Prime Minister, Mr Lee Kuan Yew, in the year 1982, and the Prime Minister Lee Hsien Loong in the year 2014.