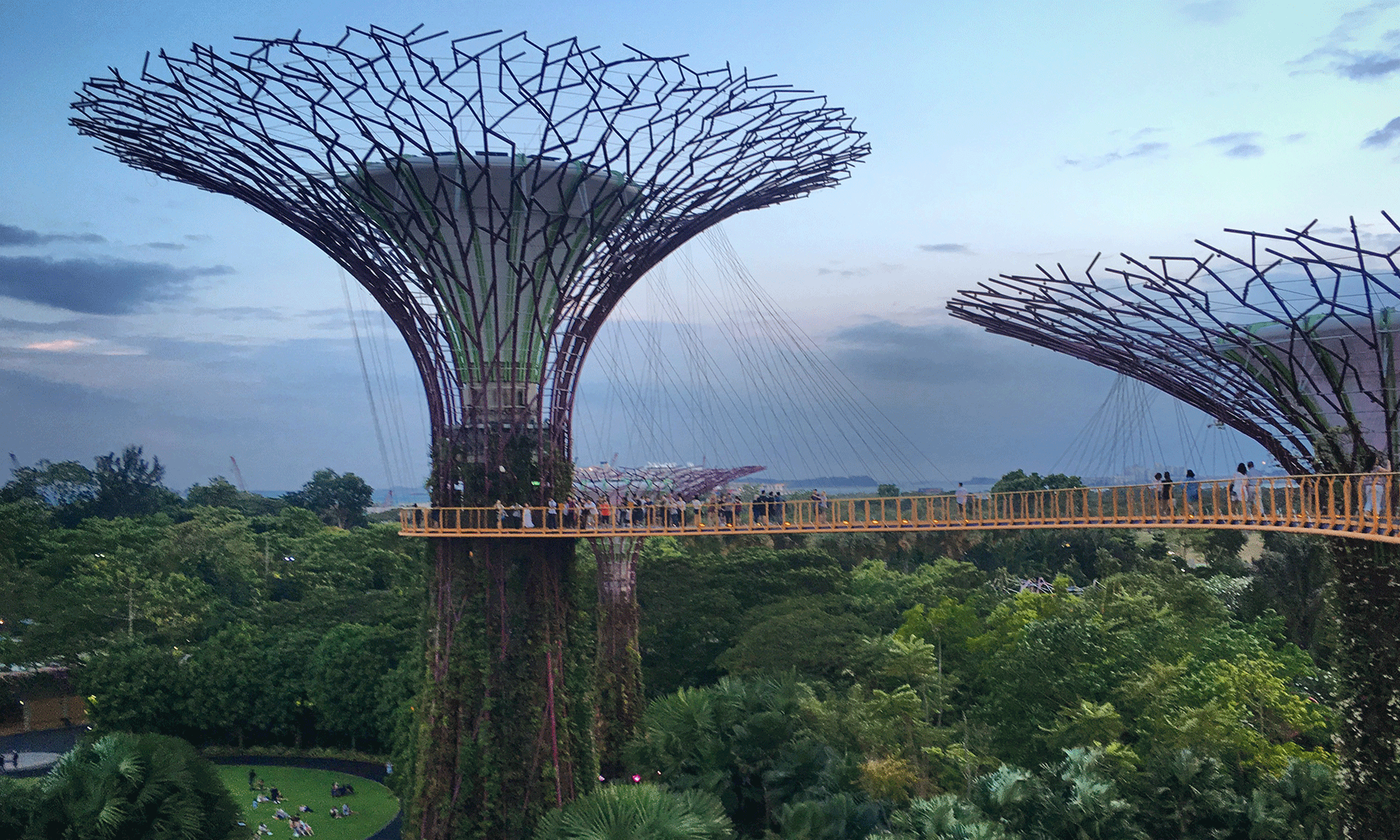

Singapore’s ease of doing business, transparent business and legal system, favourable business environment, advanced infrastructure and stable political environment have contributed to making this island nation a favourable destination for foreign investors to set-up their business. In order to maintain its dynamic business environment, the Singapore government requires all the Singapore company incorporations to abide by its audit and compliance regulations.

As per the Companies Act, it is mandatory for all the companies in Singapore to comply with the annual filing requirements of the Inland Revenue of Singapore (IRAS) and Accounting and Corporate Regulatory Agency (ACRA). If you are a foreign investor incorporating a new company in Singapore, this guide can help you understand the audit and compliance requirements with regard to Singapore company formation.

Audit Requirement

According to the Companies Act, it is mandatory for all the private limited companies to get their financial records audited by a qualified public accountant on an annual basis if the company is not qualified for Audit Exemption. Apart from this, they are also required to comply with the below-mentioned requirements.

Holding Annual General Meeting

It is obligatory for Singapore companies to hold an annual general meeting (AGM):

– The Company must hold an AGM within six months after your company’s financial year end and file the annual return within seven months after company’s financial year end.

During such AGMs, the shareholders are entitled to discuss the following Ordinary Business:

– Dividend declaration

– Auditor’s reappointment

– Director’s re-election

– Remuneration for senior executives and directors

– Adoption of the audit report

– Transact any other business

Auditor’s Appointment

It is the duty of the directors to appoint the auditor within 3 months of the incorporation of a company in Singapore. However, the appointment of auditor and audit of financial statements is exempt if

A company qualifies as a small company if:

(a) it is a private company in the financial year in question; and

(b) it meets at least 2 of 3 following criteria for immediate past two consecutive financial years:

The company audit can be carried out only by a public accountant who is registered with The Accounting and Corporate Regulatory Authority (ACRA). The duty of the auditor is to report if the company’s financial statements represent a true and fair view. Besides, they also have to report if they comply with the singapore financial reporting standards and give an objective analysis of the company’s financial performance.

Audit Exemptions

As per the small company concept introduced by the ACRA in 2015, the companies that qualify as ‘small’ are exempted from the requirement of appointing an auditor and conducting the audit. To qualify as a small company, a company must fulfil

Annual Filing Requirements

Companies are required to submit their financial accounts on an annual basis. It should include balance sheet, cash flow statement, comprehensive income statement and statement of changes in equity. Non-compliance to hold an AGM and late or non-filing of financial statements can attract penalties in the form of fines, summons or arrest warrants. If need be, you can outsource accounting services in Singapore.

Conclusion

In order to comply with the above regulations for company formation in Singapore, it is advisable for foreign investors to use the services of professional advisors like IMC Group who can help you stay compliant with these rules and regulations.