In preparation for the Dubai FinTech Summit scheduled for May 8th and 9th this year, under the patronage of His Highness Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum, Deputy Ruler of Dubai, Deputy Prime Minister, Minister of Finance of the UAE, and President of the Dubai International Financial Centre, Dubai is further strengthening its global standing as a centre for FinTech and innovation.

The FinTech and innovation sector in the Middle East, Africa, and South Asia (MEASA) region is growing rapidly, and it is expected to double in market value from USD 135.9 billion in 2021 to USD 266.9 billion by 2027, according to the 2022 FinTech Report by DIFC FinTech Hive. In 2022, the investment in Dubai International Financial Center (DIFC) FC’s FinTech and innovation community surpassed USD 615 million. The number of active firms in the sector increased by 36 per cent, reaching 686. The Dubai FinTech Summit will be an ideal platform for start-ups, investors, and industry leaders to connect and tap into this opportunity as they move forward in the region and beyond.

The Summit, hosted by DIFC, the foremost international financial hub in the MEASA region, will convene 5,000 FinTech and technology experts from around the world to explore advancements and obstacles in the industry. It will also showcase all aspects affecting the future of finance, including Web 3.0, Metaverse, Blockchain, decentralised finance, regulation and policymaking, and the urgent requirement for more significant financial inclusivity. Attendees can also engage with over 100 FinTech exhibitors and participate in various panels and fireside chats.

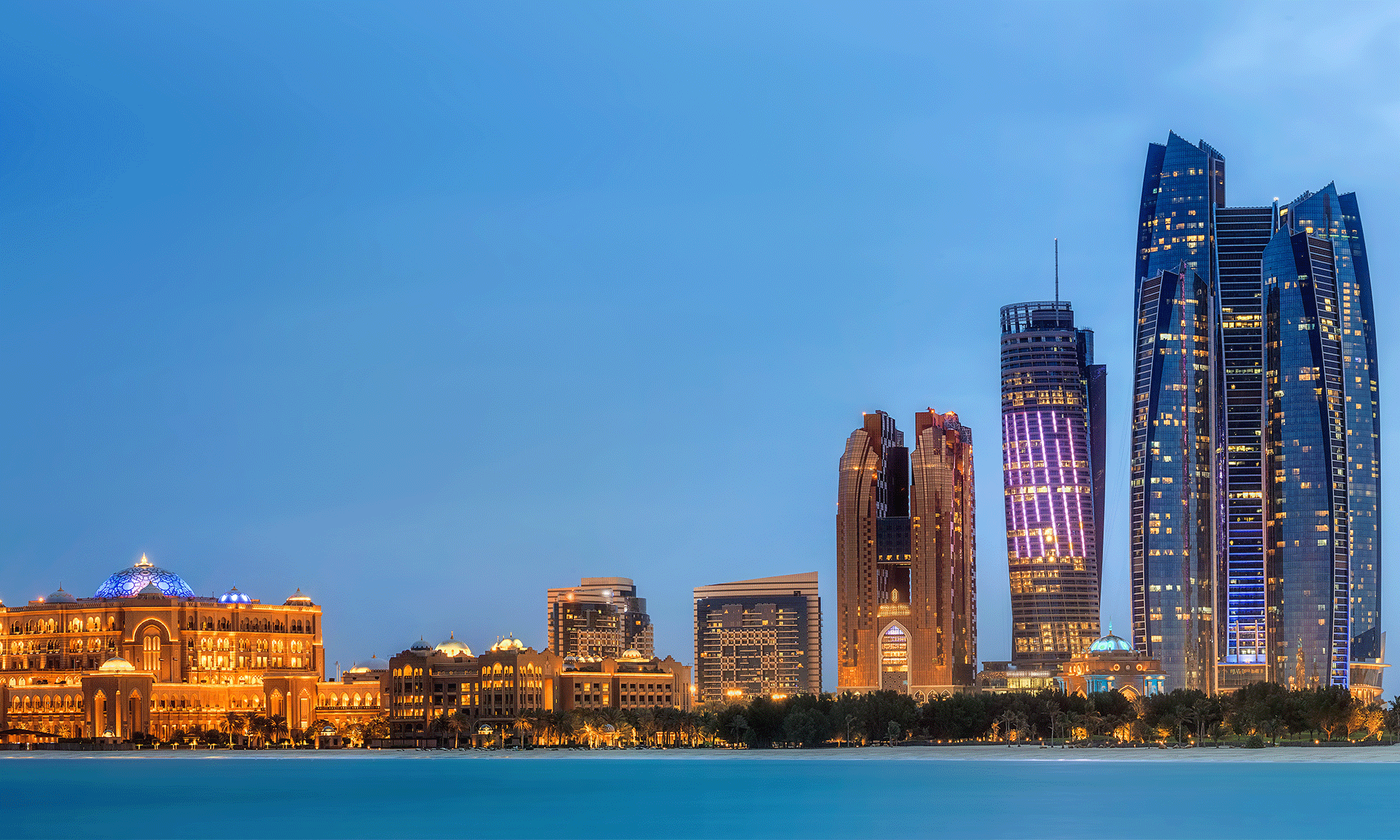

Madinat Jumeirah in Dubai is the venue for the Dubai FinTech Summit, featuring distinguished local figures such as the UAE Minister of Economy, H.E. Abdullah Bin Touq Al Marri and H.E. Essa Kazim, Governor of DIFC. The summit’s line up of speakers comprises several notable personalities, including Bill Winters, Group Chief Executive of Standard Chartered PLC; Brad Garlinghouse, CEO of Ripple; Melissa Guzy, Co-Founder and Managing, among others; Michael Shaulov, CEO of Fireblocks, and partner at Arbor Ventures.

Dubai and DIFC are now considered global centers for innovation, recognised for their unique ecosystem and comprehensive approach to business, driving not only the future of finance but also the future economy. Currently, they are home to 60% of all FinTech companies based in the GCC. In 2021, the MENA region’s FinTech startups experienced a year-over-year funding growth of 183%, as reported by MAGNITT.

Mohammad Alblooshi, Head of DIFC Innovation Hub and FinTech Hive, highlighted the increasing impact of the FinTech sector in the region. He stated that the demand for FinTech services had grown significantly in recent years, fuelled by digital technologies and innovation across various sectors. He further emphasised that DIFC has solidified its position as the finance and innovation hub in the MEASA region by providing the most comprehensive FinTech and venture capital environments. DIFC’s vision to drive the future of finance has created attractive opportunities for start-ups, global players, and unicorns to establish a base in Dubai.

His statement continued with confidence, “The Dubai FinTech Summit, organised by DIFC, is poised to become the leading platform that captures the industry’s attention and realises our vision of positioning Dubai as the new hub for the future of FinTech and finance.”

According to Michael Shaulov, CEO of Fireblocks, a secure digital asset infrastructure company, Dubai’s accomplishments in the digital asset field in recent years have been impressive. The government’s collaborative strategy with the industry has attracted some of the most innovative and dynamic firms in the digital asset industry to the region, solidifying its position as a leading FinTech center and securing its economic future. Fireblocks is enthusiastic about participating in the Dubai FinTech Summit and discovering some of the world’s top FinTech solutions.

Luis Valdich, Managing Director at Citi Ventures, expressed his excitement about FinTech, stating that it is one of the most exciting industries in both tech and banking. The industry is being disrupted by various trends, such as digitisation, open banking, embedded finance, financial inclusion, the democratisation of investing, modernisation of the core banking stack, and the emergence of the creator and shared economies are driving economic progress globally. He looks forward to exploring these innovations further as part of the upcoming summit.