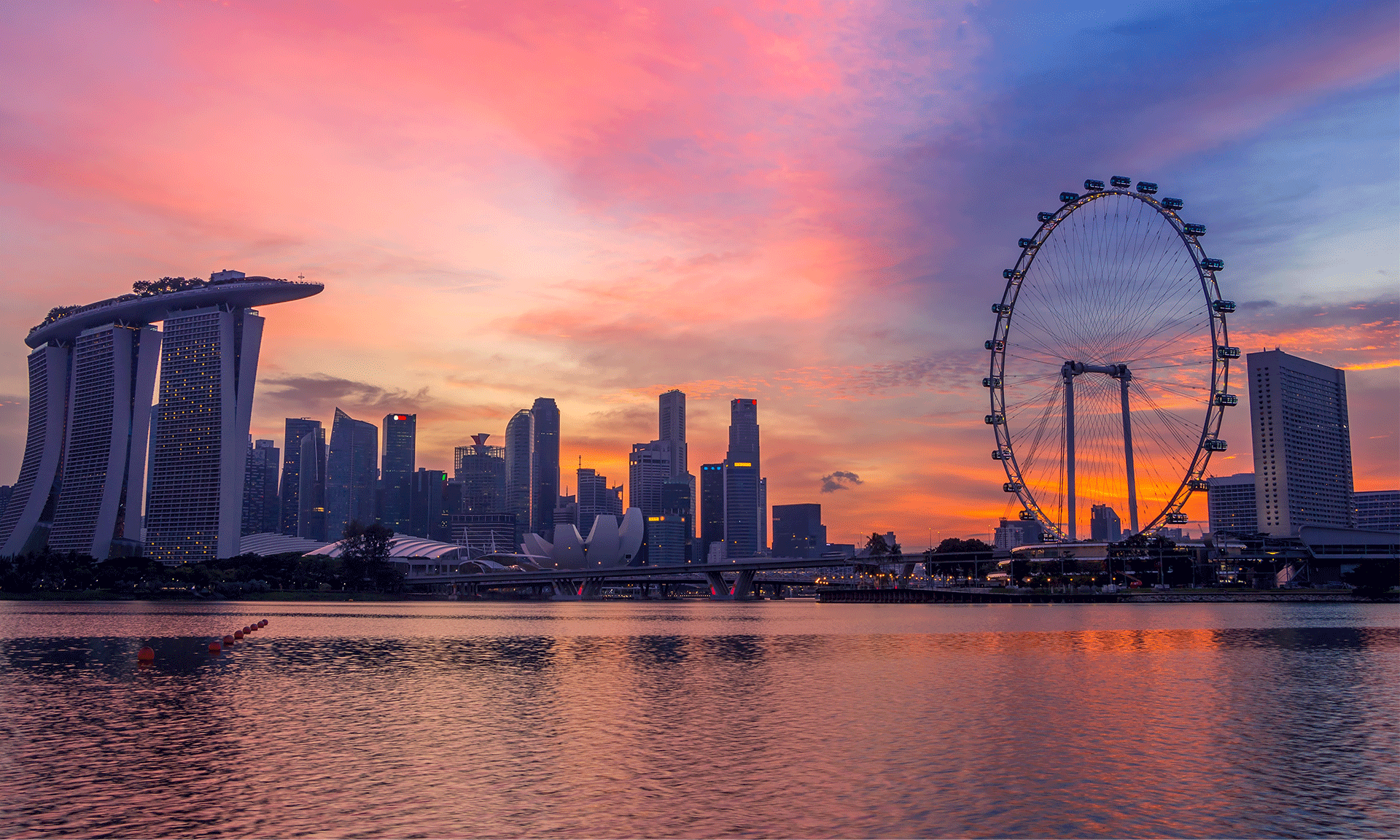

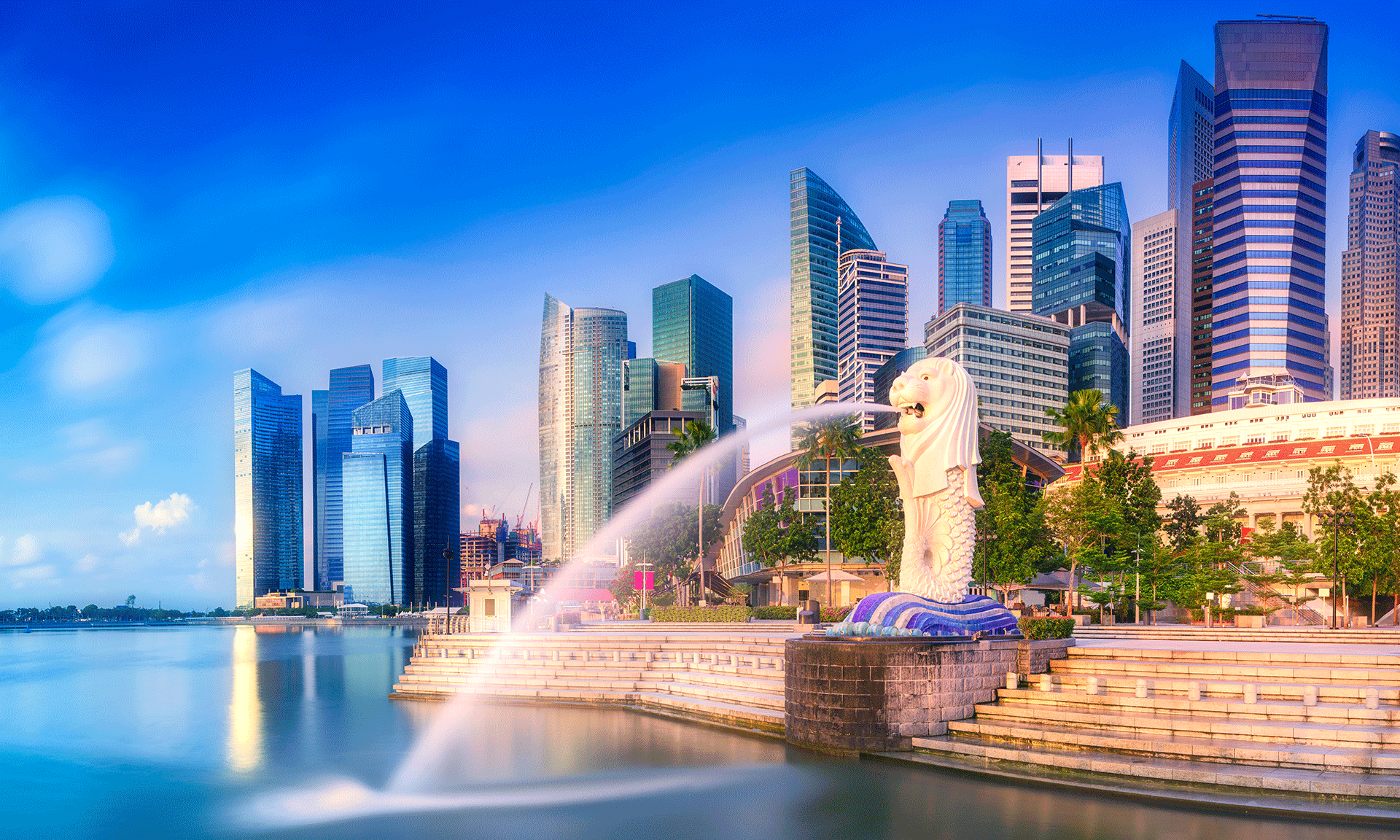

Singapore can decisively contribute to global recovery amid the coronavirus pandemic through continued investment and global collaboration, noted Deputy Prime Minister, Coordinating Minister for Economic Policies and Minister for Finance Heng Swee Keat on Monday, 7th December 2020 in his inaugural address during Singapore FinTech Festival x Singapore Week of Innovation & Technology (SFF X SWITCH).

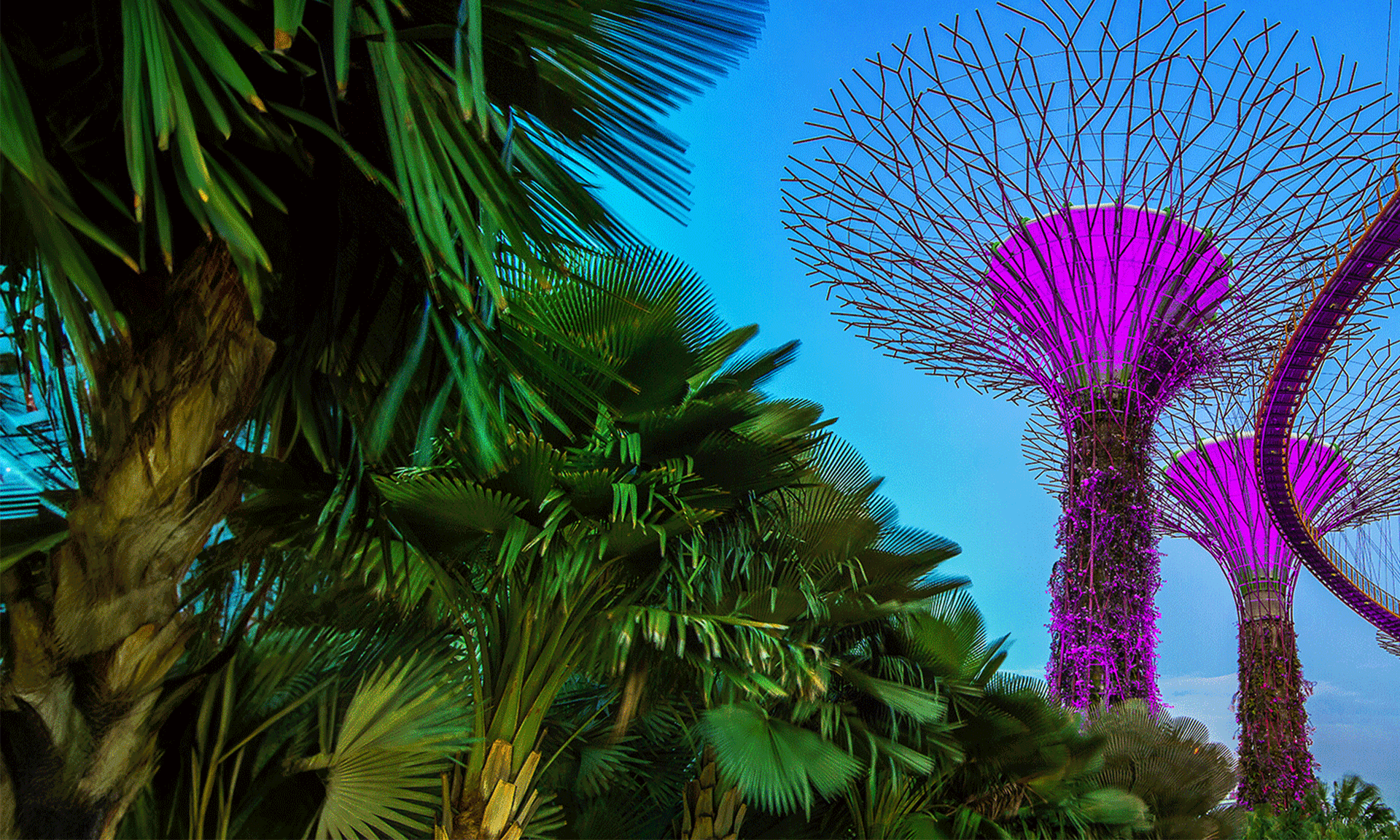

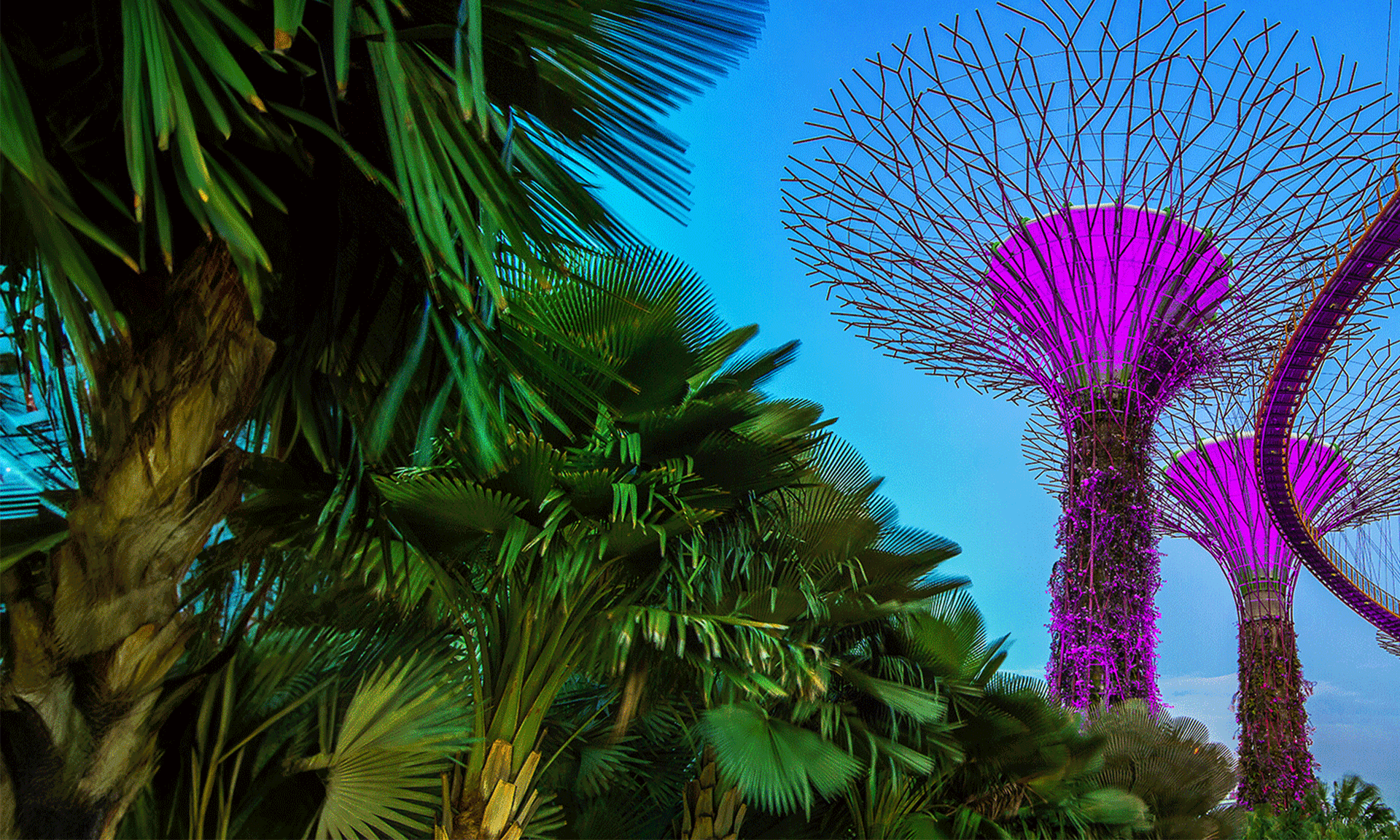

As new frontiers are opening through technology and innovation across the world with a unity of purpose, Singapore is also joining the league to ensure inclusive and sustainable growth for its companies and workforce, he added.

Describing the meet at extraordinary circumstances when Covid 19 has taken more than a million lives and disrupted the global economy, Mr Heng highlighted how the Covid-19 crisis has unearthed inequalities in many societies and the need for the world to take a more inclusive approach in global recovery plans.

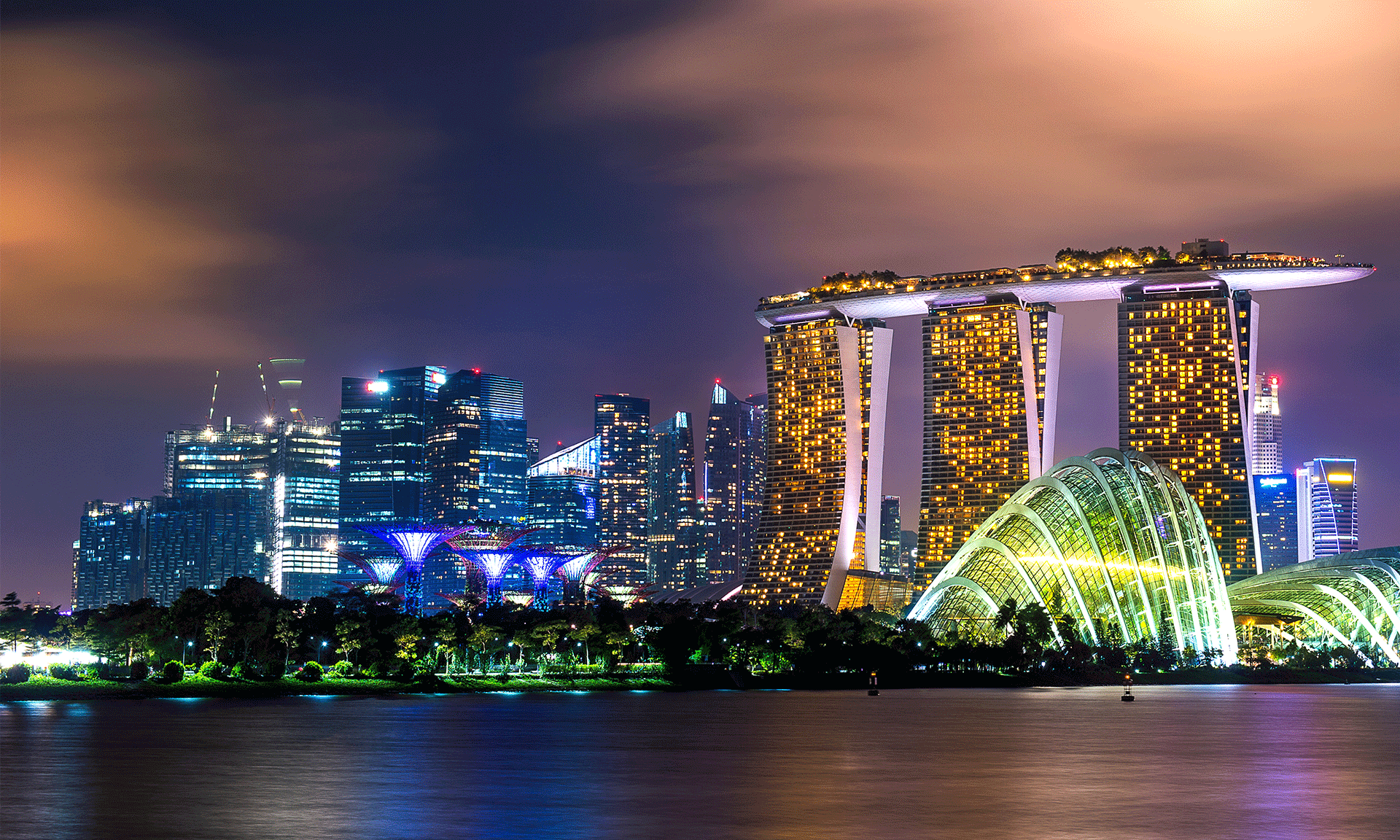

The five-day event, which ended on Friday, 11th December 2020 witnessed more than 60,000 participants from 130 countries.

Mr Heng, reiterating on Singapore’s commitment to investing in innovation remarked that the Singapore Government is making an investment of approximate 1 per cent of the country’s gross domestic product in research and development each year and finalizing plans for the next five years.

Singapore continues to deepen its capabilities to keep the tech ecosystem vibrant and develop as a global financial hub, he emphasized. “Our commitment to innovation and work together will be key to driving economic recovery and growth.”

During this festival, Mr Heng announced the launching of The Asian Institute of Digital Finance, hosted by the National University of Singapore and backed by the Monetary Authority of Singapore and the National Research Foundation on Monday, 7th December 2020.

One of the institute’s first projects is to build a data-sharing platform that can train models to improve credit assessments enabling lenders make better decisions and offer better rates, Mr Heng said, which will improve the financing of small businesses and enable a stronger post-pandemic recovery.

The institute will also play a strong role to nurture global fintech talent for Asia and will take in its first batch of post-graduate students in 2021.

To deepen its capabilities in Blockchain technology and enable transactions even in a zero-trust environment, Singapore is also launching “Singapore Blockchain Innovation programme” as the first major Blockchain research and translation programme to ward off limitations associated with the energy efficiency of processing blockchains and the ability to connect different blockchain systems, he said.

“The programme will expand blockchain research to the needs of the industry, and will also look into scalability and interoperability of blockchain solutions,” Mr Heng added.

Mr Heng also emphasized saying, “Our commitment to innovation and to work together will be key to driving economic recovery and growth. As we do so, the question before all of us is this – How do we use innovation and tech in a way that will build better lives for all our peoples? How do we build a future that is inclusive and sustainable?”

“To avoid widening inequality, we must recover from this crisis in a manner that is inclusive. We must speed up the time that it takes for the last company and worker to access and benefit from technology. Small and medium enterprises account for 90% of businesses worldwide and 50% of global employment. Many SMEs are not making use of digital technologies, much less training their workers for the digital world. It is imperative that we bring them on board the digital economy.” he said

He also highlighted how Singapore is levelling up the capabilities of its small and medium-sized enterprises (SMEs) by helping them adopt digital solutions and scale beyond Singapore’s shores and promoting new company–registration–in–Singapore.

He also talked about “Business sans Borders” initiative, or BSB, to digitally connect SMEs around the world for expanding their markets and helping foreign-companies–relocate–to–Singapore. BSB is a ‘meta hub’ helping SMEs access a much larger eco-system of suppliers and buyers and also connecting businesses to logistics and financial services providers. “Using AI, BSB enables SMEs to discover prices and sales opportunities in a much larger global marketplace”, he commented.

He pointed out with an example of a furniture maker who has used Singapore-based platform Source-Sage to connect to other digital marketplaces, discovering more buyers and recently acquiring a new buyer on the India business-to-business platform. This platform also offers a tremendous advantage to other businesses such as electronics, one of the top–10–business-options–for–foreigners–in–Singapore.

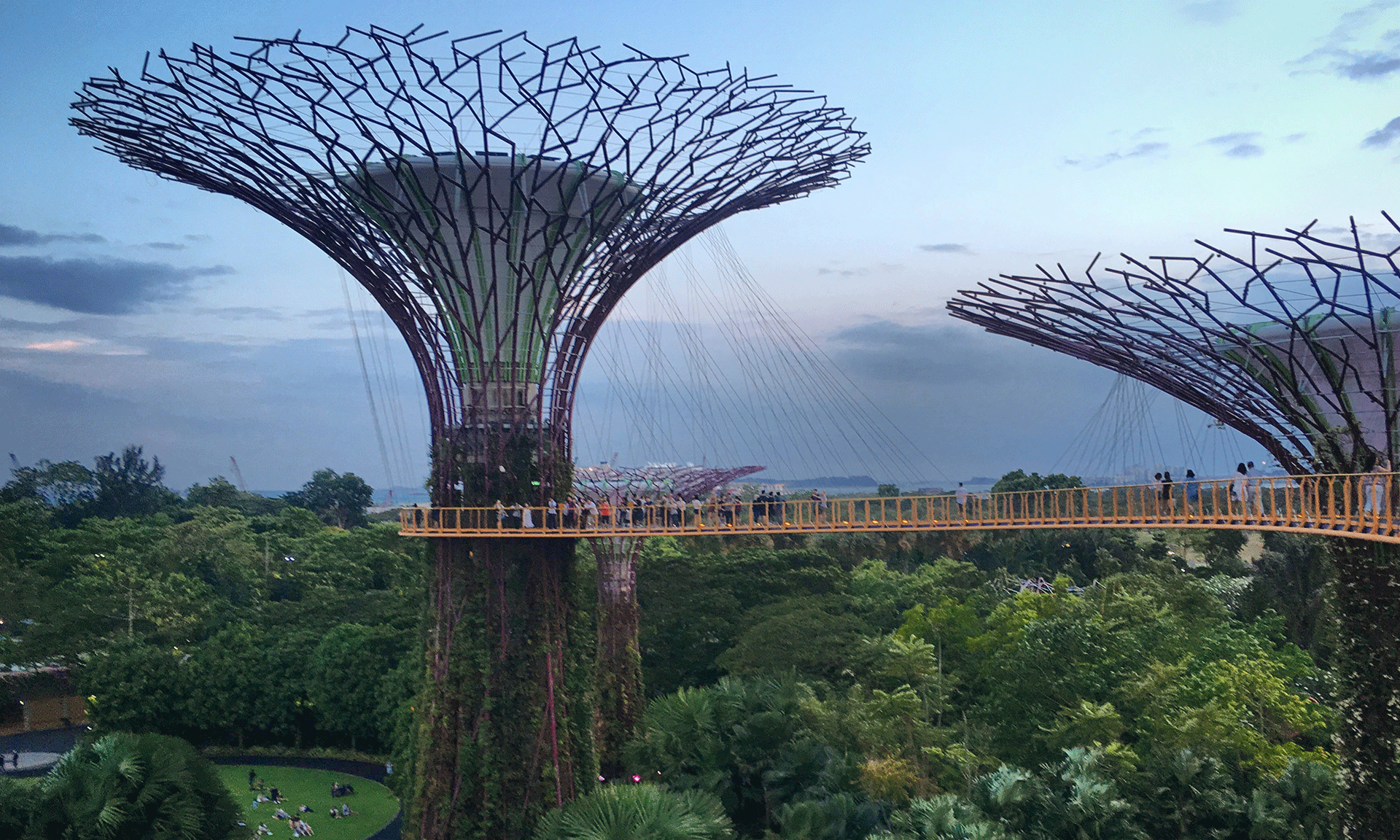

Describing Covid 19 as a wake-up call for the world with a reminder to be better prepared for big problems like climate change, Mr Heng reinforced Singapore’s commitment for addressing climate change issues through innovation citing how Singapore is deploying at least 2 gigawatts of solar power by 2030 that would accelerate the deployment of electric vehicles as well as explore smart charging technologies and promised to phase out all IC Engine vehicles by 2040 in Singapore.

“We believe that putting sustainability at the core of what we do can create economic growth opportunities,” he pointed out and reaffirmed Singapore’s ability to contribute to a green recovery in Asia.

In his address, Mr Heng emphasised that the foundation for a more inclusive and sustainable post-Covid-19 future lies in the creation of a more resilient global commons.

“One key element of a resilient global commons is stronger governance on the use of technology. Fair and ethical rules that are generally accepted will allow more people to trust and use technology,” he said.

He pointed out how Singapore’s Model AI Governance Framework released in 2019 is providing guidelines to address ethical and governance issues when deploying AI solutions with best practices captured and adopted by companies including Google, Microsoft and DBS Bank.

On the same day, Mr Heng announced the launching of Singapore Financial Data Exchange, World’s first public digital infrastructure which will allow Singaporeans to view their consolidated financial information through financial institutions’ financial planning services or the Singapore Government’s MyMoneySense app.

“Such an approach to trusted data sharing – involving both innovation and conducive regulations – can potentially be applied in other areas and other jurisdictions,” he remarked.

SFF x Switch was jointly organised by the Monetary Authority of Singapore and Enterprise Singapore and had week-long hybrid physical and digital events taking place round the clock.

1,400 speakers were invited including New Zealand Prime Minister Jacinda Ardern; Mr Sundar Pichai, chief executive of Google’s parent company Alphabet; and Microsoft co-founder Bill Gates.