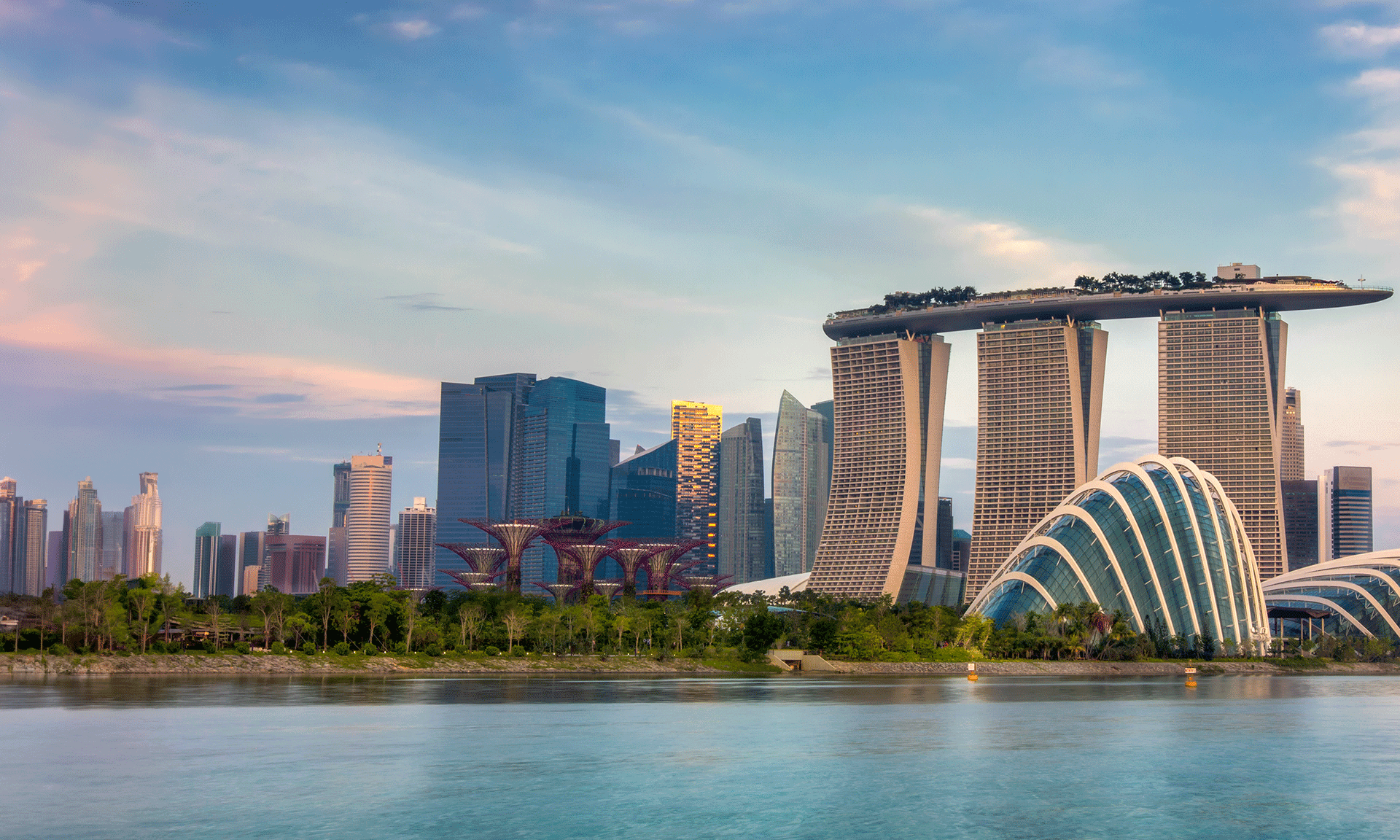

What is S Pass?

The S Pass is a work visa designed for mid-skilled foreign professionals, including journalists, accountants, and technicians, who are interested in working in Singapore. Managed by the Singapore Ministry of Manpower (MOM), the S Pass provides qualified candidates with access to a range of career opportunities in the city-state.

The S Pass allows eligible candidates to stay in Singapore for up to two years initially. The visa can be renewed for an additional three years, providing a maximum total stay of five years.

Singapore offers foreign workers various forms of work passes depending on their background. These work passes are issued and handled directly by Singapore’s Ministry of Manpower (MOM). There are four types of schemes for foreign individuals wishing to be employed in Singapore.

- S Pass

- Personalized Employment Pass (PEP)

- The Employment Pass (EP)

- Entrepreneur Pass (Entre Pass)

- The S Pass has strict regulations.

Document Required for S Pass in Singapore

The S Pass is designed for mid-skilled company workers. Technicians, accountants, programmers, typically apply for the S Pass in Singapore. The employer shall apply for your S Pass online through company’s EPOL account with MOM. The number of S Pass holders a company can employ is capped according to its industry’s Dependency Ratio Ceiling (DRC). The documents you need to provide when you apply for an S Pass include

- The S Pass Application Form – filled and notarized

- A formal letter of declaration (justifying your identity and request)

- A copy of your passport’s ‘personal details’ page

- Marriage certificate (if any)

- The business profile of the company you plan to work for

- Copies of all educational certifications, transcripts, mark sheets, etc.

- Proof of professional experience

- Letter of support from a Singaporean professional association or accreditation agency. For instance, a doctor will need to provide an official letter from the Singapore Medical Council, and lawyers will need an official letter from Singapore’s Legal Services Regulatory Authority

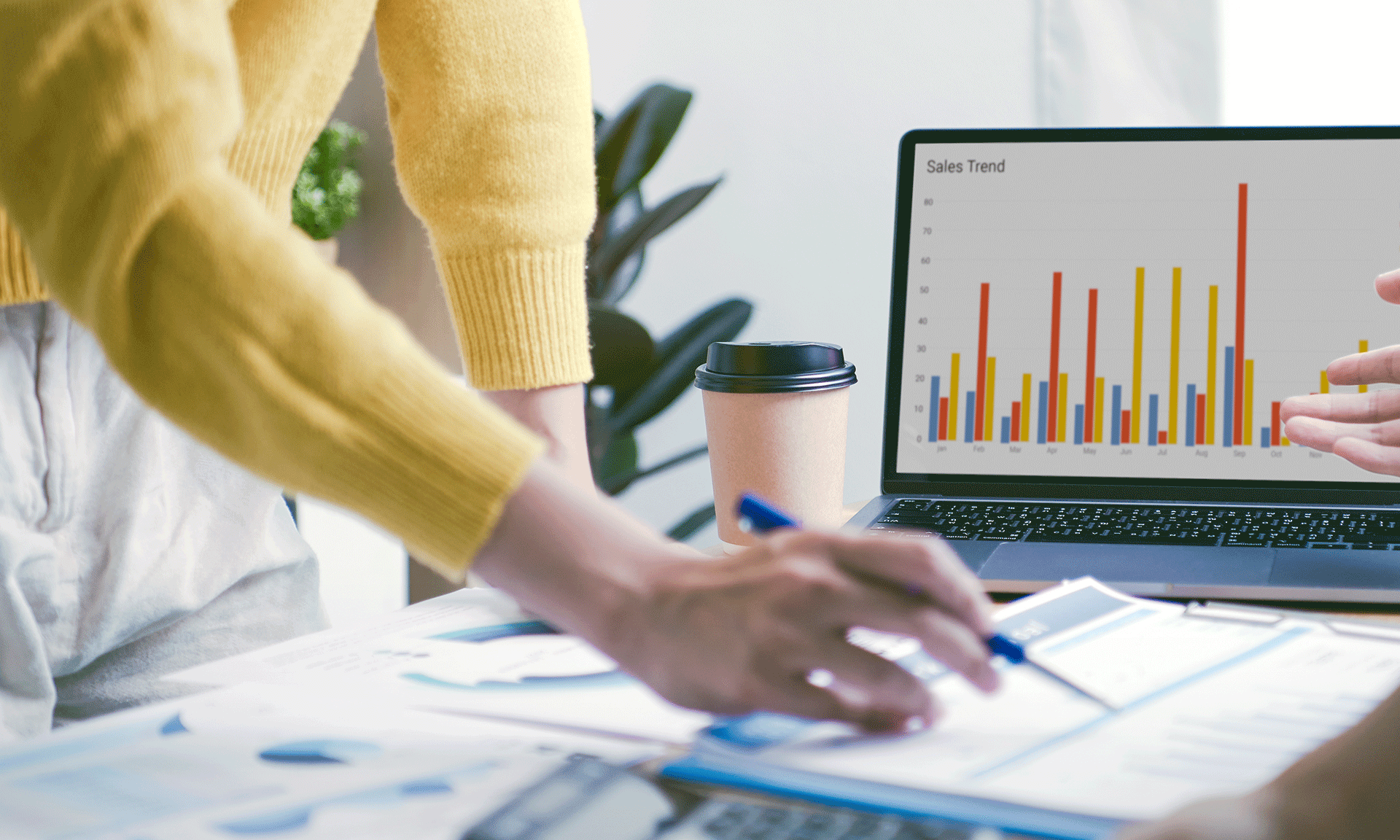

Eligibility for the S Pass in Singapore

The S Pass is a type of work visa designed for mid-level skilled workers employed by companies operating in Singapore. An application is assessed based on a point system with consideration for each of the following factors: salary, education qualifications, skills, job type and work experience. Here are the eligibility criteria for S Pass applicants

- There are no nationality-based restrictions

- Work experience in their respective field

- Have a degree, diploma, or technical certificate from accredited institutions

- Guarantee a fixed once-a-month salary of no less than $2,400. Older, more skilled applicants have to cross higher monthly salary brackets

- Family members can only apply if their pass holder earns at least $6,000 per month. They will apply for a Dependent’s Pass for their spouse and children

Here is The Process to apply for Permanent Residency (PR) in Singapore

Application for S Pass

Procedure for application of S Pass Singapore

Here are the steps for applying for an S Pass

- Provide a letter of consent to your employer/third-party member to apply for the pass. The letter should state your employment agreement

- Your employer/agency fills out the S Pass Application Form online

- Attach all the required documents (find a list of required documents on your S Pass Application Form)

- Pay the initial processing fee of $75

- Receive the In-Principle Approval (IPA) letter. Have this letter delivered to you by the employer/third-party

- Enter Singapore on a single-entry visa with the IPA

- Follow the medical documentation guidelines mentioned in the IPA

- Carry documents you’ll need to get your pass issued