Global Entity Management

Solutions in Denmark

Ensure accurate filings, governance, and compliance across Denmark and global operations.

We manage entity setup, reporting, and regulatory tasks for smooth cross-border control.

Our Clients

How Global Entity Management Supports Compliance and Growth in Denmark

Comprehensive Global Entity Management Services for Businesses Operating in Denmark

Entity Formation

Regulatory Compliance

Corporate Services

Accounting, Payroll and

tax compliance

Struggling to manage entities across borders?

Partnering with Trusted Global Entity Advisors for Denmark

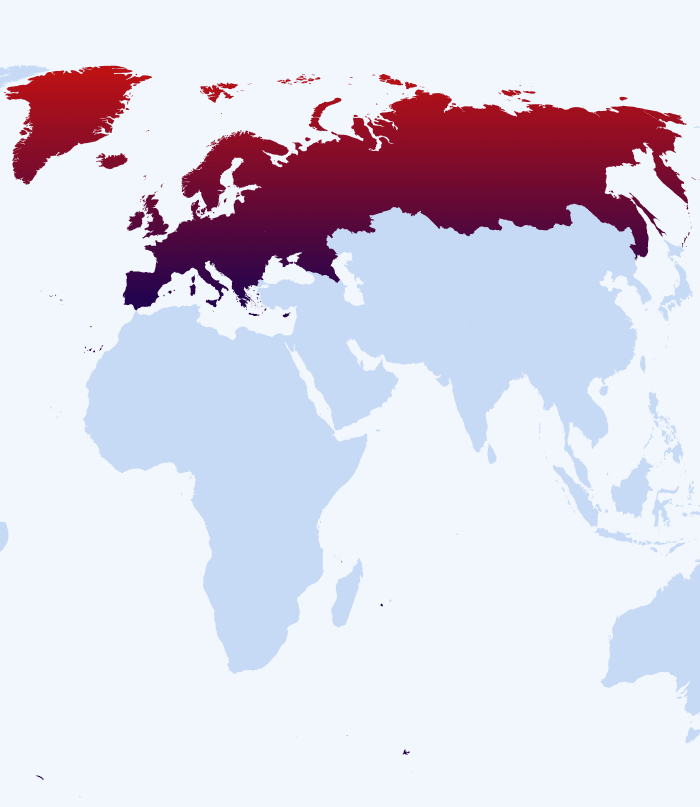

Entity Management

Across Continents

Explore our locations across Asia - Pacific region to help us on our mission to provide comprehincy entity management services across the region.

Explore our locations across MEA region to help us on our mission to provide comprehincy entity management services across the region.

Explore our locations across Americas region to help us on our mission to provide comprehincy entity management services across the region.

Explore our locations across Europe regionto help us on our mission to provide comprehincy entity management services across the region.

Global Entity Management

Your Partner in Simplifying Compliance and Managing Global Entities

FAQs

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

Need Assistance?

Get In Touch

We appreciate your interest in IMC and are eager to address your needs.

To ensure we address your needs accurately and promptly, please fill out this form. This will help us in identifying and connecting you with the appropriate team of experts in our organization.

We take pride in our responsiveness and aim to get back to you within a span of 1-2 business days. Your journey towards solutions starts here.

Companies we have worked with

IMC Group

IMC Group