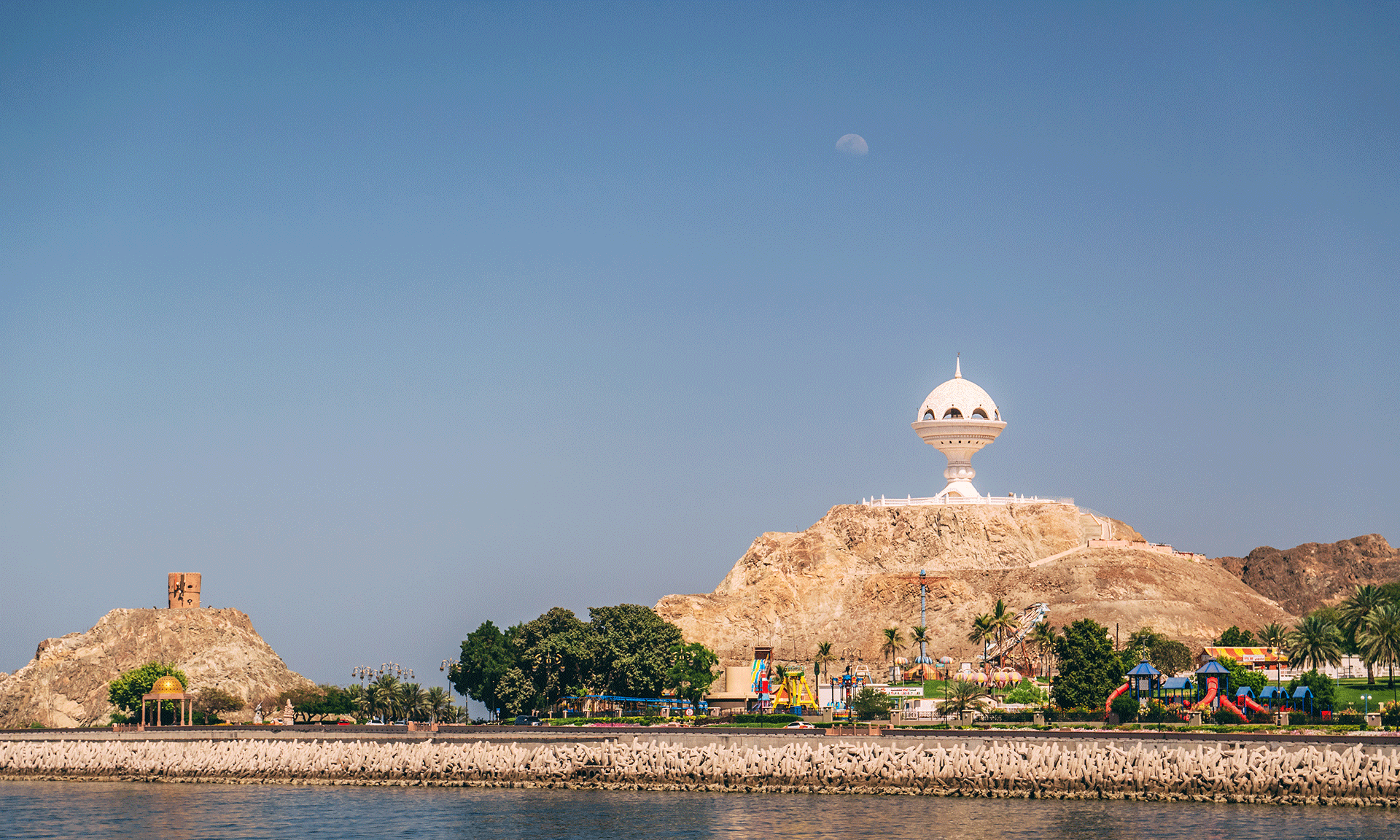

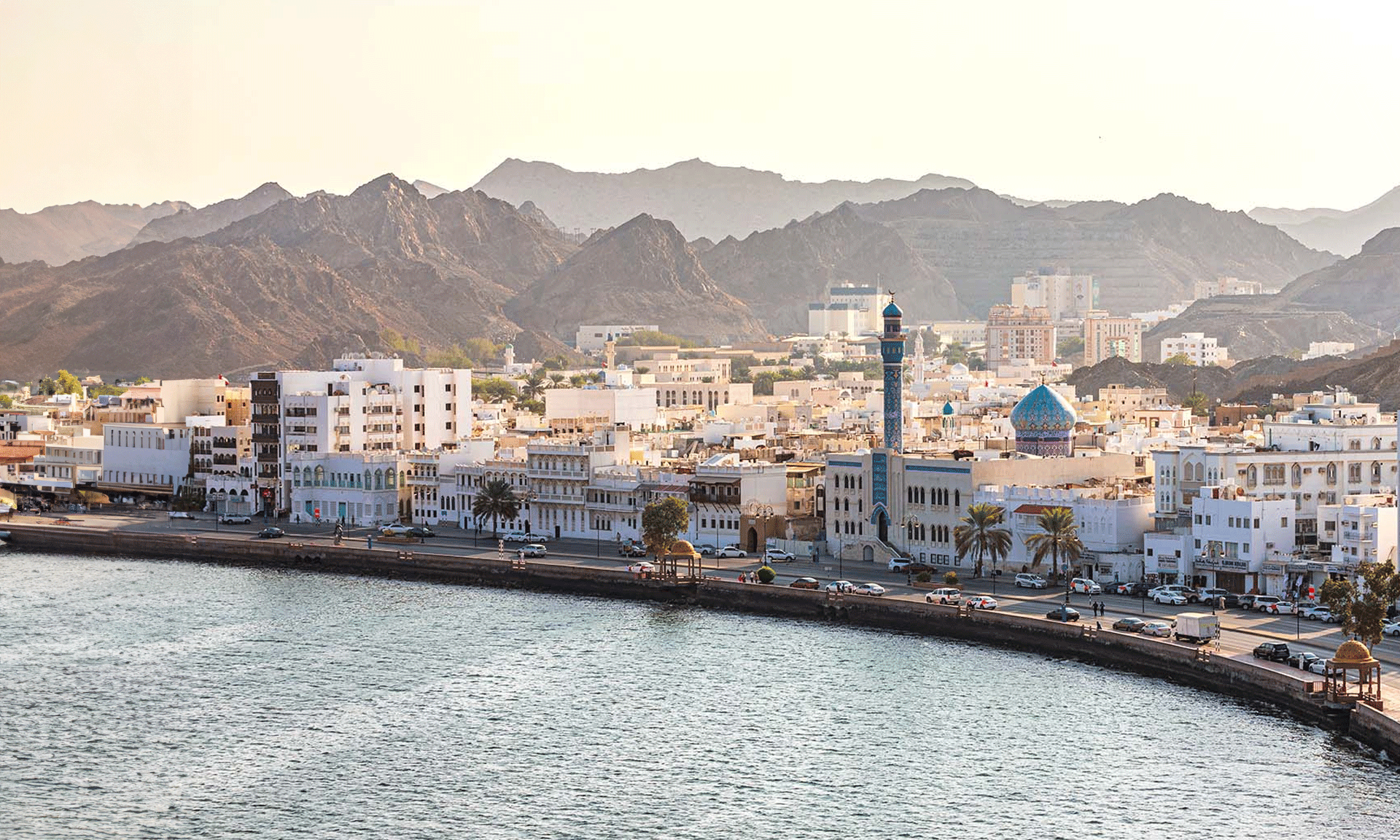

Overview

Oman is the third-largest country in the Arabian peninsula having entrepreneurship and overseas trading long been existing in Oman for many centuries and its maritime trade used to touch the shores of Africa, Europe and China.

Before the discovery of oil and gas, Oman was predominantly a rural and agrarian economy based on fisheries and agriculture. Once the oil was discovered in commercial quantities during 1964, Oman gradually moved from agrarian to an oil-based economy and production, and export of oil started dominating the government exchequer in Oman.

Sultan Qaboos Bin Said took the reign of Oman in 1970 and ruled the country till his death in 2020. Under his visionary leadership, Oman has undergone a rapid socio-economic development while upholding its cultural heritage and was a constant source of motivation to foreign investors for doing business in Oman.

Though oil and gas, reserves have rapidly boosted Oman’s economy, led by Sultan Qaboos the country actively implemented a forward-looking economic development plan focused on diversification and industrialization to reduce its dependence on oil and gas and invite foreign players for company formation in Oman.

Benefits of Company Formation in Oman

Oman has many untapped investments and business potential in many industries such as tourism, mining, fisheries, logistics and manufacturing and the government always encourages foreign direct investment and offers various incentives and free zones to promote a business-friendly economic environment and lure foreign entrepreneurs for doing business in Oman.

Oman offers many opportunities for foreign investors to become a long term business and investment partner and invest in company formation in Oman.

Friendly Taxation Policy

Nil income tax on personal income, lower income tax on companies, tax relief on effective double taxation treaties Oman enjoys with more than 35 countries.

Import Exemptions

No import duty levied on Raw materials. plant and machinery for five years from the start of manufacturing activities.

Capital & Profit Repatriation

No restriction on profit and capital repatriation and dividend transfers.

Foreign Ownership

Oman allows 100% Foreign ownership in Free Zones and 70% in other regions.

Strategic Location

Oman is the gateway to North American, European, African and Asian markets offering access to a large customer base.

Political & Economic Stability

Oman has a long reputation for political stability with controlled inflation and stable exchange rate, trade surplus and foreign currency reserves.

Diversification

Oman is well-diversified industrially which facilitates business activities through a robust supply chain.

Infrastructure

Oman has good infrastructure facilities like good roads, airports, ports with good communication networks.

Transparent Legal System

Oman has a transparent and friendly legal system offering a conducive business environment.

International Presence

Oman has ties with world economic bodies such as membership with WTO, GAFTA, GCC with free trade agreements with USA, Iceland, Singapore, Norway, Switzerland and many other countries.

Natural Resources

Oman has good reserves of Petroleum, Gas, Asbestos, Copper, Chromium and Gypsum.

Land Availability

Government leases the land with good amenities at discount.

Language

English is widely used in business and commerce.

Business Climate in Oman

Barring a few numbers of trades and services, no restrictions are imposed on company formation in Oman and doing business on its soil. 100% foreign ownership of Omani companies would now be allowed under the new Foreign Capital Investment Law (FCIL) RD 50/2019 proposed in January 2020.

A few of the 37 commercial activities not allowed for 100% Foreign ownership are mentioned as under.

- Translation and Photocopying

- Tailoring

- Vehicle and Automotive Repairs

- Sale of Drinking water

- Hairdressing and Salon Services

- Fishing

- Rehabilitation Centres

- Taxi Services

The restricted services, however, contribute to a small portion of Oman Economy and the new law would open up promising new sectors for 100% foreign investment and enthuse overseas companies for doing business in Oman.

The Ministry of Commerce and Industry ( MOCI) has embraced significant modernizing initiatives under the new FCIL regulation to facilitate and promote investor-friendly regimes in the Sultanate of Oman.

The new FCIL law doesn’t also stipulate the minimum share capital requirement which can transform the foreign investment landscape in Oman. The existing practice requiring a company with one or more foreign shareholders to have a minimum starting share capital of OMR 150,000 which is approximately $390,000 has now been relaxed by MOCI. However, being a new regulation it needs reconfirmation from MOCI on a case to case basis.

The new FCIL law is a revolutionary step towards globalization and modernization of Oman and will invariably bring a plethora of opportunities to the foreign business communities.

Types of Companies in Oman And Applicable Requirements

There are two most common ways of doing business in Oman and can further be classified based on company type and regulatory requirements

Business setup with a Local company

A locally incorporated company can take several forms

- Proprietorship Company

- Limited Liability Company

- Free Zone Company

- Joint Stock Company

- Holding Company

- Limited Partnership Company

- General Partnership Company

- Joint Ventures

Business setup with a foreign entity

There are three ways one can do business with a foreign entity

- Branch office

- Commercial Agencies

- Representative office

Most of the Omani Companies are LLCs or limited liability companies that foreigners are willing to invest and do business with. The number of founding members should be minimum two and maximum forty.

A foreign company is permitted to own a maximum of 70% of shares of an Omani company. If there is a free trade agreement with the country of foreign national, a higher %age of shares can be allowed.

The current minimum share capital requirement for a foreign-owned LLC is OMR 150,000 unless wholly owned by Oman citizens or GCC or FTA nationals for whom the initial capital investment requirement is OMR 20,000.

For joint stock and holding companies, the initial minimum capital requirement is OMR 500,000 and OMR 2 million respectively. Initial capital requirements are usually much higher for banks, financial services and insurance companies.

Partnership Companies

The features of Omani Partnership companies are

- Formed by two or more stakeholders

- Needs registration within a month of execution of partnership agreement in the Commercial Register

- Needs approval of all partners before transferring the individual interest

- Name of the partnership must spell that it is a partnership

- Any mishaps with one partner dissolve the partnership unless all other partners agree to continue

Proprietorship

Usually, only the Oman citizens are allowed for single Proprietorship companies, GCC nationals can start a Proprietorship company under certain conditions and for specific activities.

Foreign Company Branches

Foreign entities are allowed to open representative offices however, with limited scope. A foreign company is only recommended to operate a branch that has secured a Government project contract and is only valid during the tenure of the contract.

Proprietorship

A joint venture is formed through a joint venture agreement and by two or more entities performing a particular project. A JV has no legal status and is not registered. The Omani partner must own a minimum of 51% share.

Process of Registèring a Company in Oman

The process of company registration in Oman is relatively simple and straightforward and the main process steps once the initial capital is paid, are as follows

1. Reserving a Company Name

An application needs to be submitted to the Ministry of Commerce and Industry (MOCI) with a uniquely chosen name for your company highlighting and branding your products or services as you feel appropriate.

2. Submitting Incorporation documents

On approval of company name, shareholders documents and company constitution along with the bank certificate and authorized signatory form needs to be submitted to MOCI for company registration in Oman.

3. Registering with Oman Chamber of Commerce and Industries (OCCI)

Once MOCI registration is completed, you need to get your company registered with OCCI for complying with the commercial rules and regulations required for your company.

4. Designing a Company Seal

A company seal needs to be designed and issued from the registered authorized signatory of the LLC.

5. Obtaining approvals from Government Authorities

Based on company type, size and nature of business; you need to obtain a set of approvals from the appropriate authorities for company registration in Oman and include

- Tax Registration

- Oman police registration

- Registration with the Ministry of Manpower

- Industrial, environmental and other permits and licenses

- Municipality License

- Registration with Oman Police

- Import Export License as appropriate

- Registration with Public Authority of Social Insurance

6. Post Registration Process

Once the company registration is over, all documents mentioned against point 4 needs to be obtained

Documents Required for Registration of Company in Oman

Company registration in Oman requires the following essential documents

- Memorandum and Articles of Association

- Tax Registration Certificate

- Shareholders’ Visas and Passports

- Chamber of Commerce and Industry affiliation certificate

- Certificate of Initial Deposit

- Identity Cards of Shareholders

- Filled Company Registration Form

Tax Laws in Oman

Various aspects of Taxation in Oman are

- Registration with the Secretariat General of the Ministry of Finance is mandatory for all taxable entities

- A provisional return of income tax must be filed within 3 months of the applicable accounting period

- A uniform 12% tax rate is applicable for all companies irrespective of nationality and size, and profit up to OMR 30,000 is exempt from tax

- The final tax return must be filed within 6 months of the applicable accounting period

Tax Exemptions

The following are exempt from income tax in Oman

- Dividends received from an Omani company

- Gains on the disposal of Securities listed in Muscat Stock market

- Omani marine companies

- Foreign Airlines

- Investment funds

- Foreign companies engaged in the exploration of gas and oil

- Foreign companies working for government projects

Withholding Tax

Cross border payments subjected to withholding tax and at a flat rate of 10% on the gross payment in Oman are

- Royalties

- Management Fees

- Provision of Services

- Consideration for R&D

- Consideration for Computer Software

Indirect Tax

- Oman doesn’t impose any VAT or Sales Tax or Property tax; plans to implement VAT from April 2021 at a rate of 5%

- Stamp duty of 3% is levied in real estate transactions

- 5% Import duty as in other GCC countries on goods entering Oman

Personal Tax

- No personal income tax in Oman

Free Zones in Oman

There are three free zones and two special economic zones for attracting foreign investment in the country. Each zone has it’s own sets of incentives including Tax Holidays, Import Duty exemptions, Waiver on initial capital requirements and 100% foreign ownership.

Free Zones

- Salalah free zone

- Shohar free zone

- Al Mazunah free zone

Besides, there are eight Industrial Estates such as Rusayl, Sohar, Raysut, Sur, Nizwa Al Buraimi, Sumail, Al Muzanah offering highly attractive land rents, tax holidays, exemptions on machinery and equipment.

Special Economic Zones (SEZ)

- Duqm SEZ

- Knowledge Oasis Muscat

Accounting and Tax

| Type | Limited Liability Company (WLL) |

| Under Oman law, foreigners can own | 70% |

| Share Capital | OMR 20,000 |

| Memorandum & Articles of Association | Yes |

| Shareholders | Minimum Two |

| Can the entity hire expatriate staff in Oman | Yes |

| Tax Registration Certificate Required | Yes |

| Saudi Resident Secretary Required | Yes |

Timeframe for Incorporation3 weeks

| Type | Limited Liability Company (WLL) |

| Statutory Audit Required | Yes |

| How Long to open corporate Bank Account? | 3 weeks |

| Annual Return | Must be Filed |

| Annual Tax | Must be Filed |

| Access to Oman double tax treaties | Yes |

IMC Group

IMC Group