- Article

- September 27, 2018

[vc_row][vc_column][vc_single_image image=”30315″ img_size=”full”][/vc_column][/vc_row]

- Article

- September 24, 2018

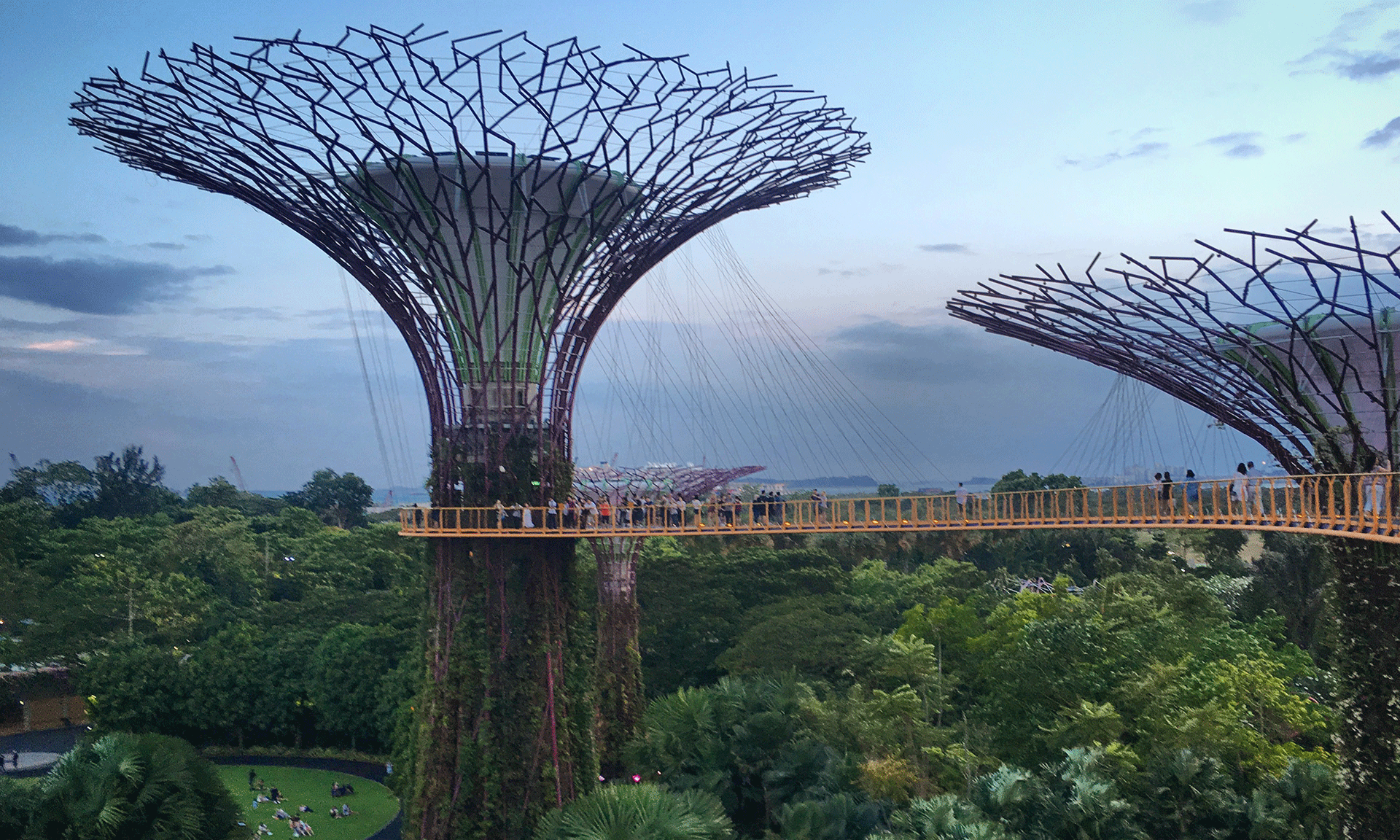

The Prime Minister of Singapore, Lee Hsien Loong has given the message of remaking the country for the future generation on 9th August 2018 on the occasion of the 53rd National Day. The summary of the message is as follows.

On the auspicious occasion, he urged the people of Singapore to stay united and contribute towards the progress of the nation. He highlighted that people in Singapore live a better life than people from many other countries. With the steady growth of the economy at 3 to 3.5% in recent years, the productivity and income of the country have risen considerably.

He also mentioned that, in spite of this growth, there are some challenges which Singapore might face. There is growing trade tension among the various economies of the world. Singapore will also get affected by such tension resulting in lower international trade, lesser investments and lower business confidence. The trade wars will also trigger a war of trust among the major economies of the world. Hence, the international and regional security are at risk.

He said that Singapore has successfully hosted a meeting between US President Donald Trump and DPRK (Democratic People’s Republic of Korea) chairman Kim Jong Un. Since then the tension in the Korean Peninsula has decreased. But still, there are many challenges that the world is facing and one of them is denuclearisation of the Korean Peninsula. Singapore aims to have a stronger partnership with its ASEAN partners (Association of Southeast Asian Nations), particularly its neighbours Malaysia and Indonesia.

He also spoke about the focus of the government in the coming years. The major focus of the government in the last few years has been to review the healthcare, education and housing policies. It aims to improve the life of people of the country, strengthen the social safety nets and build a stronger nation. Without caring about the external circumstances, the government will do the best for the country.

He said that today I am addressing the people from Kampung Admiralty, a housing estate developed especially for the senior citizens. The non-slip tiles, grip bars, and many other features make it an ideal place for senior citizens to live safely and comfortably. Apart from this, there are many amenities located here like medical centres, gardens, a childcare center, supermarket, etc.

Kampung Admiralty is the prime example of how the government is trying to change the education, housing, and healthcare system to improve the lives of the Singaporeans. We want to ensure to the people of Singapore that we are trying to bring down their cost of living. We want to make the quality of life affordable for all people, rich or poor. We would provide a helping hand to those who are in need.

He said that the job of building Singapore is not complete yet. For the next 50 years, we need to plan boldly and creatively for our future generations. It will be a long and massive project. To sustain this project, we need to have an ever growing economy and sound government finances. To realise our vision we need unity, political stability, and good governance in future years.

Today, Singapore is the land of opportunities. Each generation of the country has worked hard and built a better home than the one who came before. In this country, everyone has the right to pursue their passion, excel in their respective fields and build a better future for the country.

He concluded the speech with these lines;

As a National Day song puts it, “There’s a jewel on the ocean, a gem upon the sea

Where the future is an open book

A land of destiny.”

My fellow citizens, Singapore’s best days are yet to come. Happy National Day!

- Article

- September 24, 2018

In today’s digital age, the world is moving towards the cashless economy and digital transactions. In regard to this, PayNow Corporate in Singapore has taken a big leap forward by launching cashless services that will allow businesses and government agencies to receive or pay Singapore dollar instantly. From 13th August 2018 onwards, PayNow services will be live to everyone in Singapore. With the help of these services, the customers will be able to make payments to the entities having establishment unique number for any purchase made by them just by scanning the QR code.

Benefits of PayNow Services

The PayNow services will bring incredible cost benefits to merchants and consumers apart from the convenience. The users who are already using PayNow to pay individuals can also use it to pay for the good and services they purchase from retail stores. In addition, the PayNow Corporate also allows paying and receiving money to and from the Government.

PayNow will reduce the dependence of people on cash and cheques. Now the businesses can use the PayNow Corporate and scan the QR code to make a payment right from their bank account. It will save time and cost as the cheques take around 2 days to clear and Giro takes up to 3 days. Moreover, this facility of instant fund transfer will be available 24*7.

Response of Businesses and Government Agencies towards PayNow Services

The earlier e-payment services were more focussed on the consumers. But with PayNow service, the focus is shifting towards businesses too and their participation in the movement is incredible. According to the reports from banks, the response of the businesses towards the PayNow Corporate service is overwhelming. More and more businesses are signing up for the PayNow Corporate service.

According to DBS Bank report, around 50,000 small and medium-sized enterprises are waiting to enroll for the PayNow Corporate service by the end of the next year. While many firms are optimistic about the advantages of the new service, there are many other firms which are waiting for the actual rollout to see how the system pans out.

Apart from the business enterprises, Government agencies have also shown interest in adopting PayNow Corporate to provide convenience for customers while conducting over the counter transactions. In addition, General Insurer AIG shall also introduce this service to the travel insurance customers for a better experience.

There are seven participating banks that will give this new service, they are Citibank, Standard Chartered Bank, Maybank, OCBC, DBS/POSB, HSBC and United Overseas Bank (UOB).

PayNow Corporate is a great step considering Singapore’s ambition to become cheque-free by 2025 and reduce the number of ATM transaction significantly by the year 2020.

- Article

- September 24, 2018

Alibaba’s creator and founder Jack Ma announced his verdict on his retirement recently at the age of 54. He handed over the torch to Daniel Zhang or Zhang Yong and named him his descendant.

There sure must have been some strong reason that backed his choice; however, here in this article, we want to talk about the differentiating factor, which is his mindset with which he operates. So, what do you think is his USP (Unique selling point) or what is it makes him think and act differently? The differentiating factor, of course, is his attitude or approach. Daniel Zhang caught various eyeballs with the way he handled a Q&A session at a recent conference. You could catch that video on YouTube.

This was a Signal conference organised by P&G in the US back in 2016. So, what was so special about this Q&A session was Daniel’s response to a question asked about the lessons he had learnt from the failures he had gone through.

Do you know what Zhang responded? He told her about an example which happened in the recent years. It was about WeChat, which is very widely used in China. It was about three years ago that they decided to have their own WeChat or a social-chatting app. For this, they invested in a big way and to further mobilise it, they got many talented people on board to launch it. However, they realized soon after that top-down innovation is not a good idea in all situations and does not work.

But wait; the more interesting part of the story is yet to come. That social-chatting app couldn’t pick up and didn’t catch any eyeballs. But the good thing was that some people from the team deployed on this project didn’t give up. They tried to grasp the lessons they had learnt from this experience, which was incredible.

“They started a new application, today called ‘Ding talk’ this one is also a social chatting app but, it’s social chatting for work. It’s a chatting app with colleagues. And the amazing thing is that people who send the message can see the status of the message, whether it is read or not. This is very good for work for managers or bosses, right? You assign a task to a team, and you can see how quickly your team responds. For emails, a lot of people just read, and they don’t respond quickly, but with this app, people have no way to hide.”

So, what’s the point here? It’s important to understand that not each innovation will be always successful. More importantly, failing does not mean that we give up. One should learn to do some root cause analysis and find what happened and what are the lessons one could from it. The best part is that the younger generation today doesn’t give up so soon. They dig down till things make sense and are not scared of trying again even if they have failed the first time. The point here is that if we see globally, we will get many examples which prove that failures actually spur successes – a recent example of this is Ding Talk. We simply need to change our lens or outlook, which we use to view failure. Change your outlook or angle and see – the idea that leads to success would be just there.

- Newsletter

- September 19, 2018

The U.S. Department of Commerce has an agency called U.S. Bureau of Economic Analysis (BEA) that tracks the international commerce and publishes leading indicators of the economy like GDP. The economic statistics prepared by BEA help in gauging the performance of the U.S. economy and the role of the U.S. in the global economy. In relation to this, the agency collects the data of inbound and outbound U.S. investments. In order to collect the data, the BEA conducts 7 mandatory surveys on a quarterly, annually or five-yearly period.

Who Must Report?

For the mandatory reporting obligations, BEA collects data from;

- Any person or business of U.S. origin holding a 10% or greater interest in a foreign business.

- Any person or business of foreign origin holding a 10% or greater interest in a U.S. business.

- U.S. subsidiaries of foreign businesses.

- Foreign subsidiaries of U.S. businesses.

- U.S. or foreign-owned businesses that have transactions with the U.S. service sector.

Cross-border investment whether it is direct or indirect with ownership interests requires reporting under BEA obligations. Any failure to comply with any of the BEA norms attracts both civil and criminal penalties.

The BEA has made is mandatory for all foreign people who are making investments in the U.S. to give transactional reporting. The reporting has to be made within 45 days of acquisitions, expansions and business formation.

Reporting Obligations and Timeframe

- If the company makes a U.S. direct investment abroad then the compliance includes quarterly, annual and quinquennial i.e. 5 years reporting obligations.

- If the company makes a foreign direct investment in the US then the compliance includes quarterly, annual, quinquennial i.e. 5 years and transactional reporting obligations.

Reporting Obligations for Non-U.S. Person or Business Owing Business in the U.S.

The reporting obligation for a non US person or business owning a business in the U.S. can be divided into four parts; Transactional Survey, Quarterly Survey, Annual Survey and 5 Year Benchmark Survey.

- Transactional Survey

Transactional survey of the foreign direct investment in the U.S. is compulsory for every acquisition, formation and expansion of U.S. business. It must be filed within 45 days of the transaction. However, there is an exemption for filing if the transaction is below the threshold limit of $3 million.

- Quarterly Survey

Quarterly survey of the foreign direct investment in the U.S. is mandatory for every foreign person owning 10% or more of a U.S. business enterprise. The reporting must be done upon request from BEA, 30 days after each quarter or 45 days after year-end.

- Annual Survey

Annual survey of the foreign direct investment in the U.S. is mandatory for every foreign person owning 10% or more of a U.S. business enterprise. The reporting must be done upon request from BEA or 150 days after year-end.

- 5 Year Benchmark Survey

5 year benchmark survey of the foreign direct investment in the U.S. is required of all parties where a foreign person owns 10% or more of a U.S. business enterprise. The reporting has to be done within 150 days after year-end.

Reporting Obligations for a U.S. Person or Businesses having Ownership Interest in a Foreign Business

The reporting obligation for a US person or business owning a business in the U.S. can be divided into three parts; Quarterly Survey, Annual Survey and 5 Year Benchmark Survey.

- Quarterly Survey

Quarterly survey of the U.S. direct investment in abroad is for U.S. persons who owns 10% or more of a foreign business enterprise. The reports must be filed upon request from BEA or 30 days after each quarter or 45 days after year-end.

- Annual Survey

Quarterly survey of the U.S. direct investment in abroad is for U.S. persons who owns 10% or more of a foreign business enterprise. The reports must be filed upon request from BEA or 150 days after year-end.

- 5 Year Benchmark Survey

5 Year Benchmark Survey of the U.S. direct investment in abroad is for U.S. persons who owns 10% or more of a foreign business enterprise. It is the most comprehensive survey required by all the parties. The parties must file report within 150 days after the year-end.

Reporting Obligations for a U.S. Service Sector Business Transacting with Non-U.S. Parties

Reporting obligations for a U.S. service sector business are compulsory regardless of the fact that the ownership belongs to the U.S. or foreign ownership. The BEA services surveys track the foreign trade in services by U.S. companies. The BEA surveys apply to U.S. service sector companies regardless of the ownership.

The BEA surveys can be divided into three parts; quarterly survey, annual survey and benchmark survey.

- Quarterly Surveys

Quarterly surveys are for financial services, insurance services, U.S. ocean carriers, U.S. and foreign airline operators, selected services and intellectual property.

- Annual Surveys

Annual surveys are for foreign ocean carriers.

- Benchmark Surveys

Benchmark surveys are for financial services, intellectual property trade, insurance service and services like consulting, advertising, etc.

Bureau of Economic Analysis Compliance for Sample Organization Structures, Parent/ Subsidiary Relationships and Business Ownership Interests

- A U.S. business ownership abroad requires BEA reporting if it holds 10% or more ownership stake in such company. For example, U.S. Company holding 10% or more stake in a South African company requires BEA reporting.

A Foreign company having 10% or more stake in a U.S. business requires BEA reporting. For example, the South African company holding a 10% stake in a U.S. company is eligible for BEA reporting.

Reporting Obligations for Indirect Cross-Border Investment and Business Ownership

Any U.S. business that holds indirect business interest due to cross-border investment or business ownership requires BEA reporting.

About us

IMC Group is one of the leading firms that provide global compliance services. With our consulting services, we ensure that our clients from varied industry sectors comply with the complex BEA requirements in full and in a timely manner. Our experienced and expert team fulfils the burdensome mandatory reporting obligations of BEA in a smooth and simplified manner so that you can focus on running your business without any stress.

We guide you in implementing the best practices for collecting and retaining data, reporting processes and procedures as well as guide you on the response practices.

Our BEA Compliance Services

Few of our services include;

- BEA compliance assessment.

- Identifying when the business requires BEA reporting obligation.

- Effective and efficient maintenance of routine procedures, monitoring, collection of data, etc. to the BEA.

- Analysing complex BEA data requests and keeping a track of them.

- Gathering, retaining and reporting information in the prescribed manner.

- Completion and filing of BEA report.

To utilise our services you can reach us via email or phone.

- Newsletter

- September 17, 2018

Non-resident Indian (NRI) offshore fund managers seek Securities and Exchange Board of India (SEBI) to permit them to own a minimum of 5 percent in their fund.

There was an announcement on April 10, in which the market regulator said that the NRIs are not allowed to invest as foreign portfolio investors (FPIs).

It was also said that FPIs that were supported by NRIs discussed this with the SEBI officials on Thursday. The regulator will be finalizing and taking a decision on this matter within the coming week.

This decision is important as many India-dedicated funds are presently functioning while violating the circular from SEBI. If a solution to this issue is not found by December, they would be obligated to wrap up these funds.

The estimates and statistics suggest that about one-third of the total FPI assets are managed by Indian companies or are promoted by NRIs or PIOs (person of Indian origin).

However, as per the guidelines by SEBI, an NRI or PIO cannot be a “beneficial owner” of a foreign fund. He or she is not entitled to invest as an FPI.

Getting seed capital for the fund is a common practice when we start any pooled fund. This process is termed as ‘skin in the game’ and helps to build confidence. In fact, doing this is a statutory obligation in many countries for starting a fund.

For example, in Singapore, the founding members or the fund managers have to necessarily invest a mandatory seed capital of about $240,000 or more while starting the fund.

The main reasons for SEBI taking a tough stance regarding NRI investments coming through FPIs are the concerns regarding money laundering and regulatory arbitrage.

The FPI guidelines were framed so as to pull in additional foreign investments into the country. Therefore, these funds are granted with various incentives, which include a simple and easy process for registration, flexibility in case of taxation and also in compliance. Indian officials have a doubt that permitting NRIs to make investments via the FPI route could end up in round-tripping. Also, there could be loose ends in the form of opportunities for arbitrage as it would support domestic money to be channelled via the FPI route to shun taxes.

- Newsletter

- September 17, 2018

The Council of Ministers of Oman has decided to execute a national insurance policy in 2017

Oman is ready to make it obligatory for organizations and businesses to provide health insurance to their staff beginning from January.

Waleed Al Zadjali, the head of Oman Medical Association said while confirming this news:

Oman’s Capital Market officials said that they were dealing with the relevant institutions regarding the strategy and the future plans were still in the “drafting stage” after the Council of Ministers took a decision last year.

Nasr Al Salhi, who is the authority’s director of valuation and risks surveillance department said that the work was still “in progress” and the first step was to link the insurance companies with various hospitals and develop an electronic system which could take care of medicines and treatments, thus outing a check on manipulating practices like price increases etc.

The execution will be done in phases like in the neighbouring United Arab Emirates.

Oman’s Chamber of Commerce and Industry had earlier said that a fair health insurance cover should ideally be given to all the private sector employees by 2018.

But there are some companies which have got affected by difficult market conditions and the strict government measures and do not give importance to providing insurance to employees.

Dubai’s health insurance law has made it compulsory for the employers and sponsors in various brackets to provide coverage in a phased manner starting from 2014 to March 31, 2017.

The execution of that structure enhanced the profits made by the UAE’s health insurers in the year of 2016 in spite of difficult market environment linked to the lower oil price.

Saudi’s Council of Cooperative Health Insurance has also started with the concluding phase of a unified health insurance structure in April 2017.

- Newsletter

- September 17, 2018

The Japanese and Singapore start-ups and other enterprises are now looking forward to new initiatives, actions and exchanges of important information under the recent agreement they have got into.

Singapore and Japan got into a new partnership recently on August 29, 2018 which is meant to bolster the support that all the start-ups and other entrepreneurs and enterprises get from both the countries.

The memorandum of understanding (MOU) was signed by two parties – Singapore’s Economic Development Board (EDB) and Enterprise Singapore, and the Japan External Trade Organisation (JETRO).

The agreement was signed on the occasion of the 50th ASEAN Economic Ministers’ Meeting at the Shangri-La Hotel. This MOU aimed to reinforce the ties between Japan and Singapore so that their innovation ecosystems could collaborate. This will enable the three agencies to make the access easier and generate more opportunities by taking new initiatives, organizing events and exchanging information for all start-ups and other businesses.

Through this MOU, Japan has been included in the Singapore’s Global Innovation Alliance (GIA) initiative.

A major proposal in the Committee on the Future Economy report, the GIA was launched last year with a goal to fortify Singapore’s association with all the foremost innovation hubs and important markets globally.

This partnership is also touted to provide precious access and new opportunities for both Singapore and Japanese businesses so that they can collaborate, get into fresh partnerships and also co-create best-in-class solutions. Therefore, company formation in Singapore will be even easier and beneficial.

As a result, this will augment the ecosystems affecting start-ups and innovations in both happening in both these countries.

- Newsletter

- September 17, 2018

The UK is aiming to pump up about £8 billion of investment in both public and private sectors in Africa to create more opportunities and jobs so as to advance development in the coming four years.

- The UK’s Development Finance Institution or the CDC Group plans to put in about £3.5 billion in Africa to support thousands of new opportunities and jobs.

- The UK also aims to pump up additional private investment of £4 billion only for African nations, especially from the City of London.

The UK is coming up with many steps to improve the investment in various enterprises and infrastructure all across Africa. This includes raising an additional £4 billion investment from the private sector by collaborating closely with the City of London.

The Prime Minister also has set a new target for the UK to be known as one of the biggest G7 foreign direct investor in Africa by the year 2020.

As per statistics, Africa will see its population doubling by 2050 and to cater to that, approximately 18 million additional jobs every year would be required. It is of utmost importance that the private and public investments give rise to improved opportunities in this country to avoid the future generation to face poverty, instability or mass migration, which could impact Britain in a huge manner.

This development also implies that the level of this opportunity across Africa is humungous. As per IMF data, Africa’s GDP is going to touch $3.2 trillion in the coming five years and this is also the right time for company formation in Africa.

International Development Secretary, Penny Mordaunt was of the view that Africa’s promising markets pose as a huge and unexploited potential to the UK. There is a huge scarcity of investment, required infrastructure and also jobs in here and the City of London is well-positioned to assist in filling this gap and also reaping benefits for the economy of UK.

Some mutually-beneficial collaborations are being built, which will help in enhancing long-term revolutionary growth and also create more and more superior jobs, while also enabling the investors in UK to reap benefits of this opportunity.

In addition to the announcement of a huge investment coming through CDC and PIDG, the UK is also aiming to pump up another £4 billion of private investments, especially from the City of London. So, it would sum up to about £8 billion (around $10 billion) of investment aiming to assist the African countries from the year 2018 till 2021.

This collaboration aims to mobilise more capital out of pension funds, other investors, and insurance companies so as to help the City to take on a bigger role as Africa’s partner of choice in terms of financial services as the UK leaves the EU.

This will also generate the prospect to advance the returns out of investments for the UK’s pension pot, while boosting the important long-term investment for all African businesses, thus transforming the poorest nations of the world into the UK’s trading partners.

- Newsletter

- September 17, 2018

The Dubai Financial Services Authority or popularly known as DFSA and the Monetary Authority of Singapore, MAS, jointly got into a Fin-Tech agreement, which would help to provide a better framework for collaboration and referrals done between the teams involved in innovation at both the ends.

The agreement is done to make both the authorities commit to create an environment supporting the steadfast development of various financial services while using latest technology.

The DFSA’s Chief Executive Ian Johnston said, “We are pleased to formalise an agreement with MAS to support the growth of innovation in financial services. Co-operation between MAS and the DFSA will help create synergies and greater understanding between our two markets and will enable FinTech firms to extend their reach globally.” The agreement is based on a referral system that aims to help the authorities in referring various innovator enterprises between their respective innovation and development functions. It also outlines a clear process-map which outlines how to share and utilize information available on innovation in each relevant market.

In addition, the agreement talks about the vision and goals of both the authorities to jointly work on new innovation projects while applying major technologies like digital or mobile payments, flexible platforms (API), distributed ledgers, blockchain, big data, and other latest technologies. MAS and DFSA are also the members of the newly-established Global Financial Innovation Network, GFIN. This network consists of a total of 12 financial regulators and other global organisations. The GFIN wants to carry out joint projects and then share their experiences of various financial advancements to enhance economic stability, reliability, and customer outcomes and inclusion.

There are various regulators from countries like United Kingdom, Australia and Hong Kong as members of GFIN. The GFIN also further builds upon the mutual relationships between each regulator. An example of this is that the DFSA has mutual Fin-Tech co-operation agreements with Investment Commission and Australian Securities, the Hong Kong Monetary Authority, the Hong Kong Securities and Futures Commission, the Hong Kong Insurance Authority, and the Malaysian Securities Commission.

These agreements enlarge the on-going association between the MAS and DFSA who have signed an MoU since 2008, which gives administrative co-operation in the banking, insurance and other capital markets. It also helps in a give and take of information for various purposes.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group