Why set up a Company in Saudi Arabia

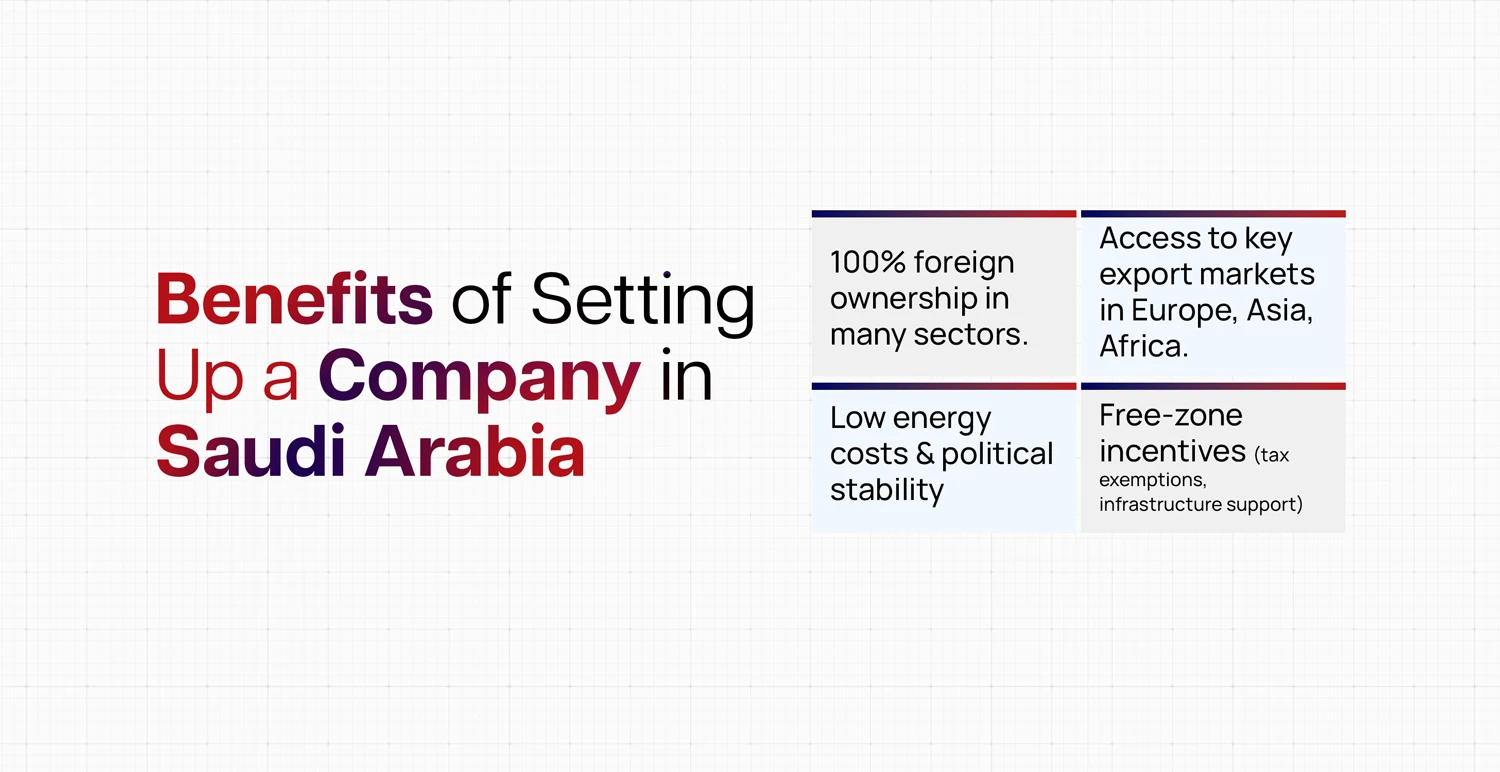

Best known for its huge oil industry, Saudi Arabia is the largest free-market economy in the Middle East and North Africa (MENA) with an approximate 28% share of total Arab GDP. The geographic location provides easy access to many export markets including Europe, Asia and Africa. Domestic consumption driven by a young and wealthy community is increasing steadily and continuously expanding local demand and accelerating the rate of company formation in Saudi Arabia.

KSA with the highest level of safe and secure business climate and political stability offers low energy cost and 100% foreign ownership in retail and wholesale sectors as a large privatization programme.

World Bank Regional Director of the Gulf Cooperation Council (GCC) and MENA, Issam Abousleiman said, “Saudi Arabia’s impressive reforms in doing business this year show its commitment to fulfilling the main pillar of its National Vision 2030: a thriving economy.” He also highlighted, ” Easing the business climate for local entrepreneurs to thrive as well as foreign investors to work in the Kingdom shows a forward path to creating more jobs for Saudi youth and women, and creating sustainable, inclusive growth.”

Major reforms attracting more foreign investments and doing business in Saudi Arabia are

- A one-stop system simplifying and easing business startups

- Protection of minority investors

- Simple and easier Enforcement of contracts

- Easier availability of credits through new insolvency law and secured transactions law

- Online platform for construction permits

- Cross border trading and investments

- Easy resolution of insolvency and financial restructuring

- Streamlining availability of power

- Why set up a Company in Saudi Arabia

- Which sectors are promising for new business set up in Saudi Arabia

- How many types of companies in Saudi Arabia

- How to form a Company in Saudi Arabia

- How free zones helped diversify Saudi Arabian Economy

- What legal requirements to be considered before Company Formation in Saudi Arabia

- Accounting and Tax

- Corporate tax rate for unlisted Company is 35%

Which sectors are promising for new business set up in Saudi Arabia

High standards of living and a young society are boosting the domestic demand and various business sectors are offering immense success and growth possibilities in the KSA now. Following are some lucrative sectors for doing business in Saudi Arabia.

- Tourism and Hospitality

- Steel Manufacturing

- Engineering and Technology

- Real Estate

- Lubricants, Glass and Plastics

- Education

- Healthcare and Pharmaceutical

- Financial services

- Media and Entertainment

How many types of companies in Saudi Arabia

Saudi Arabia, one of the largest emerging economies in the MENA and the MEASA regions offer many different corporate vehicles to its prospective business owners and investors. An understanding of the right corporate entity is important before an investment decision is made.

Company formation in Saudi Arabia and operations of the corporate entities come under the New Companies Regulations (NCR) act came into existence on 2nd May 2016.

The five forms of companies available for both local and foreign businesses in Saudi Arabia are

- Limited Liability Company (LLC) It is the most commonly formed company in Saudi Arabia. It allows minimum liability for owner’s against company debt. An LLC company is not permitted more than 50 shareholders.

- Joint Stock Company (JSC) It consists of capital that is divided into shares of equal value.

- Single Member Limited Liability Company (SMLLC) It is a limited liability company and can have a sole owner who owns all the shares of the company. There are many benefits of owning an SMLLC and one can’t own more than one such company.

- Limited Partnership Company (LLP) It is a partnership company in which some or all partners have limited liability with elements of partnerships and corporations.

Besides, special business forms are available to foreign companies for doing business in Saudi Arabia.

- Joint Ventures

- Branch Office

- Representative Office

How to form a Company in Saudi Arabia

1. Pre-incorporation Process- Planning and Strategy

During this process, due diligence is done on the optimum business type, paid-up capital and license requirement. Following are list items to be considered during this phase

- The name of Business/ Company

- The Type of Business Entity; LLC, JSC, Branch Offices or other types

- Organizing Documents such as Business License, Certificate of Incorporation, Board Resolution, Power of Attorneys etc.

2. Incorporation Process

Once everything has been planned and reviewed, the company registration in Saudi Arabia can be started with simultaneously working on different steps to optimize the time duration. The steps involved are

- Application for Investment License

All non-GCC foreign investors need to apply to the Saudi Arabian General Investment Authority (SAGIA). Nature and size of the investment activity with key financial information on the company’s operation should be clearly stated and the SAGIA application form to be filled in. The SAGIA will then issue a pre-approved certificate confirming the company’s registration with 100% foreign ownership, as appropriate. - Articles of Association

This will need to be submitted to the Ministry of Commerce and Investment and once approved, the document needs to be notarized to register for Commercial Registration certification and Tax Number, and subsequent publication of Articles of Association with a company name in the newspaper. - Registration of Company Name

The name for company registration in Saudi Arabia must be reserved with the Unified Centre and get approved before submitting incorporation forms, articles of association and the deed of establishment. - SAGIA Foreign Business Investment License

On successful submission of all documents such as the CR, Tax Registration, Municipality License and Bank’s Share Capital deposit letter and approval, SAGIA issues foreign business investment license and allows the company to sign contracts, issue invoices and hire employees. - MERAS Registration

It is a government program mainly for foreign company registration in Saudi Arabia and managed by Saudi Business Centre for facilitating procedures and providing services for business operations to speed up the business setup process. Companies can register with a municipality under MERAS and a physical office will be required for registration. The complete registration has to be submitted to the Saudi Arabia Ministry of Commerce and Industry (MOCI)

The Certificate of Registration (CR) is normally issued in 6 weeks and the company does tax registration. Under MERAS, companies can notarize the Articles of Association online, register with the Ministry of Labor and Social Development (MLSD) the General Organization for Social Insurance (GOSI) and the General Authority of Zakat & Tax (GAZT) including registration with Wasel. - Creating Company Seal

Company seal needed for contractual agreements, shareholders and management resolutions, Government documents, Official letters and notices must bear the CR number and Company name. - Registration at Chamber of Commerce

Within 30 days of registration of CR, all business entities seeking company registration in Saudi Arabia need to submit the certificate of membership obtained from the Chamber of Commerce and Industries (CCI). - Bank Account Opening

A local bank account required to be opened within 90 days of issuance of Commercial Certificate.

3. Post-incorporation Process and Staying Compliant

Once the company is incorporated, the following activities need to be initiated for completion of the entire process of company formation in Saudi Arabia.

- Saudi Employment Visas

- Conversion of Bank Account to a corporate bank account

How free zones helped diversify Saudi Arabian Economy

Saudi Arabia has implemented two types of free zones to attract foreign investments in economic and industrial activities. While industrial free zones are dedicated mostly for manufacturing industries, the economic free zones were launched for basic economic activities such as Agriculture, Healthcare, Education, Logistics, Science and Research etc.

The industrial cities were built during the 1980s and subsequently transformed into great economic hubs. Economic cities were established at the start of this century and are still being developed. Both the industrial and economic free zones allow 100% foreign ownership besides offering tax exemptions and low tax rates.

Free zones development plan mainly emphasized the need to diversify the country’s economy and reduce its reliance on oil and gas through the utilization of non-oil resources.

Presently, Saudi Arabia, has 28 industrial cities administered and maintained by Saudi Industrial Property Authority and offering custom duty exemption on raw material and equipment, easy availability of loans up to 75% of the capital, extended repayment period of loans up to 20 years and low land lease. Two most famous industrial cities are Yanbu and Jubail and major petrochemicals, fertilizers, steel, iron and chemical manufacturing facilities are located here.

Tax incentives are yet to be implemented in the economic cities which would include custom duty exemptions on raw materials and machinery, lower tax on training and salary cost and overall tax exemptions on some specific business units. Famous economic cities are Jazan economic city, Knowledge economic city and Prince Abdulaziz Bin Mousaed Economic city.

What legal requirements to be considered before Company Formation in Saudi Arabia

Tax Structure in Saudi Arabia

No personal income tax is levied on employees earnings however, companies are taxed based on the company type and business set up.

All registered companies come under the jurisdiction of corporate tax including companies and branches owned by foreign investors. The applicable tax rate is 20% for non-listed companies.

Tax is imposed based on net profits. Incomes earned through interest are also taxed for non- Saudi and non-GCC nationals. The Saudi and GCC nationals, however, need to pay a 2.5% religious tax called Zakat tax.

Withholding taxes are levied on entities who make payments to foreigners e.g rent and management fees. Withholding tax rates are imposed at different tax rates and 20% for management fees, 15% for royalties, and 5% for rent, airline tickets & freight and international telecommunications services.

Activities Prohibited for Foreign Investors

100% Foreign investment is allowed in the service sector. Trading and retail business are mostly prohibited from foreign investors. Following is a list of prohibited activities that include but not limited to

- Defence and military equipment manufacturing including uniforms and related devices

- Security Services and Investigation Agencies

- Brokerage companies in Real Estate

- Drilling and Exploration of Oil and Gas

- Fishery Business

- Real Estate Investment in Medinah and Makkah

- Printing and Publication Business

Minimum Paid Up Capital

Though there is no statutory minimum capital requirement, normally SAGIA requires foreign LLCs to have SAR 500,000 capital minimum. Based on activities, the minimum paid-up capital requirements are

- 100% Foreign Commercial: SAR 30 million with a commitment for at least SAR 200 million investment in the first five years

- Commercial with 25% Saudi Partner: SAR 7 million and a minimum SAR 20 million contribution from the foreign investor

- Service & Property Investment, Real Estate SAR 30 million

- Trading SAR 20 million

- Service Transport: SAR 500, 000

- Agriculture: SAR 25 million

- Contracting: SAR 500,000

Accounting and Tax

There is no personal income tax on income earned by individual and employees. However, there are three type of taxes levied on the Companies based on the shareholding structures.

Where a company is owned by both Saudi and non-Saudi interests, the portion of taxable income attributable to the non-Saudi interest is subject to Corporate tax, and the Saudi share goes into the basis on which Zakat is assessed.

- Corporate Tax: on all registered entities including companies or branch having foreign ownership.

- Withholding tax: on entities making payment to non-residents, such as for rent, loyalties and management fees

- Zakat (Islamic wealth tax): Zakat, a religious levy, is charged on the company’s Zakatbase at 2.5%. Saudi citizen investors (and citizens of the GCC countries, who are considered to be Saudi citizens for Saudi tax purposes) are liable for Zakat

- Drilling and Exploration of Oil and Gas

- Fishery Business

- Real Estate Investment in Medinah and Makkah

- Printing and Publication Business

Corporate tax rate for unlisted Company is 35%

Basis for Corporate Taxation:

- Tax is on the net adjusted profits

- The share of profits attributable to interests owned by non-Saudi / non-GCC nationals is subject to income tax

- The share of profits attributable to interests owned by Saudi / GCC nationals is subject to Zakat (religious levy)

Withholding tax rates

- Rent 5%

- Royalty or proceeds 15%

- Management fees 20%

- Payments for airline tickets, air or maritime freight 5%

- Payments for international telecommunications services 5%

| Type | Limited Liability Company (WLL) |

| Under Saudi Law, Foreigners Can own | 100% (in certain activities) subject of FSI approval and manufacturing / trading requires local national participation |

| Share Capital | SR 500,000 |

| Director | Minimum One |

| Shareholders | Minimum Two |

| Memorandum & Article of Association | Yes |

| Can the Entity hire Expatriate in Saudi | Yes |

| Saudi Resident Secretary Required | Yes |

| Statutory Audit Required | Yes |

| How Long to open corporate Bank Account? | 4 Days |

| Timeframe for Incorporation | 6 Months |

| Annual Return | Must be Filed |

| Annual Tax | Must be Filed |

| Access to Saudi Double Tax Treaties | Yes |

IMC Group

IMC Group