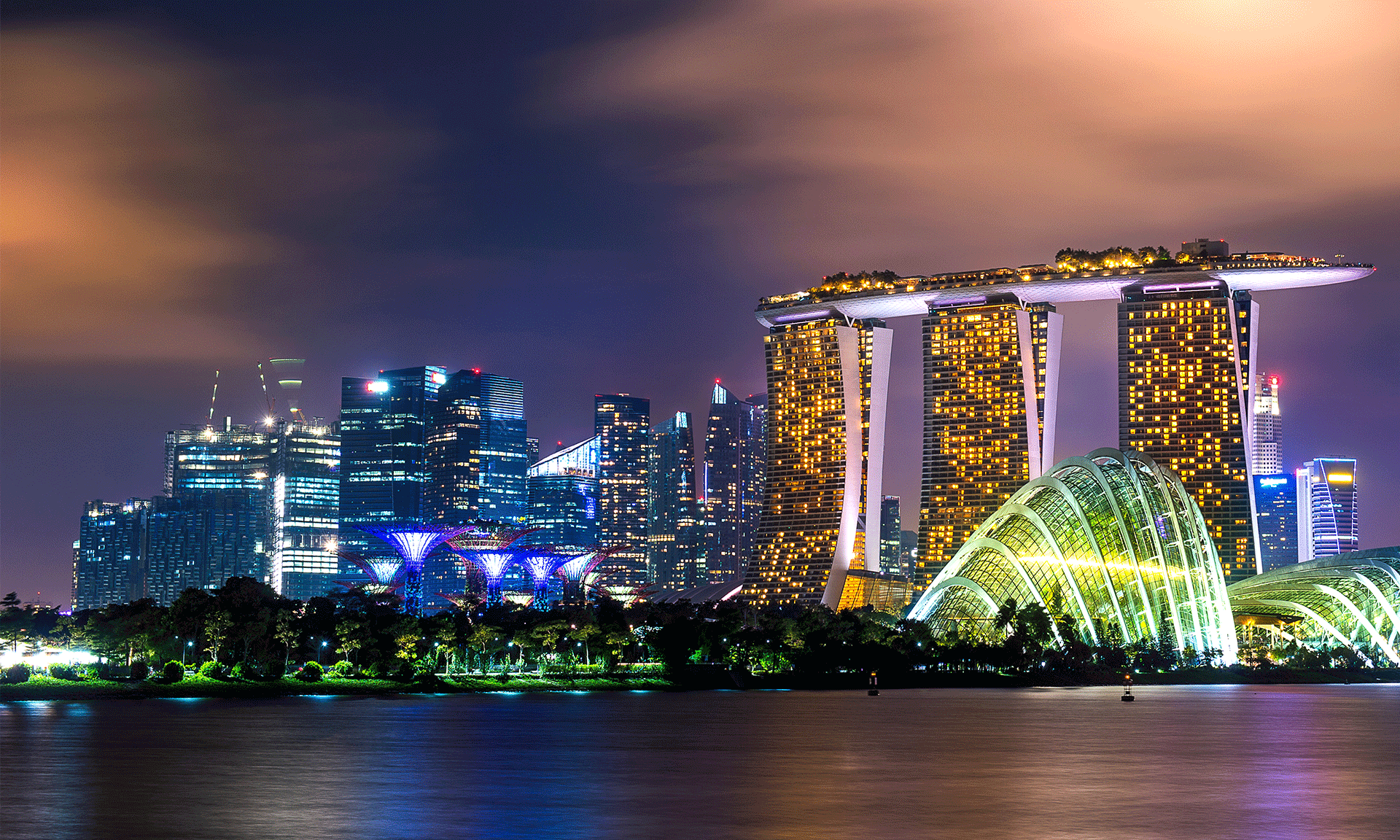

Singapore, a tiny nation and the city-state in Southeast Asia, has become one of the world’s most promising economies today. The economic policies and structures implemented during the middle of the 20th century have started delivering results in the 21st century. A nation almost without any natural resources and ranked 171st in area wise global ranking, Singapore is considered as the most attractive place for work and business with a high standard of living.

The Singapore economy is mainly dependent on manufacturing industries and the export of electronic products. However, financial technology and tourism space are also fast progressing and attracting lots of foreign investments.

Singapore is the economic center in the Asia Pacific region and is ranked as one of the leading nations in economic freedom. It is also recognized as the second most investor-friendly state by the World Bank. Company formation in Singapore is easy and free of bureaucratic hassles.

Factors responsible for the highest growth and investment in Singapore’s Fintech Industry are as follows.

Low Taxes

Singapore has very low tax rates and offers several tax incentives and tax exemptions to the investors. It also follows a forward-looking diplomatic foreign policy and has entered into a Double Taxation Treaty with more than 90 countries, further offering tax reliefs on foreign income sources. It is one of the primary reasons that fintech investors are attracted to Singapore as a tax haven.

Large Mobile Base

Digitalization is the future and has become more so post coronavirus pandemic. Singapore has a huge mobile base, with more than 82% of the population as mobile subscribers. As most fintech businesses are heavily dependent on mobile phones, a large mobile subscriber base helps attract more fintech investments in Singapore.

Success Stories of Local Startups

Successful local startups are also inspiring potential fintech investors to come and establish companies in Singapore. In addition to providing e-transactions platforms to their consumers, local startups offer solutions for lowering the cost of money transfers, digitalization of documents, and cryptocurrency transactions, including digital money-raising platforms. Many more fintech startups are looking for their Singapore company incorporation.

Networking Platforms

Singapore is a great place for networking, and good networking is the essence of innovation and growth of the fintech industry business. Singapore Fintech Festival is a venue where participants from all over the world come and share their experiences and innovative ideas related to financial technology and business. The recent Fintech Festival attracted more than 40,000 participants from over 100 countries who used it as their deal-making platform for future fintech businesses and investments.

Accessibility to testing and implementation

Singapore, the financial hub in Southeast Asia, is surrounded by countries that are not as developed as Singapore. These surrounding developing countries often serve as a testing and implementation grounds for Singapore in innovative financial solutions. The neighboring countries indirectly help Singapore in developing new technologies related to financial services or fintech industries.

High standard of living

Singapore is a rich nation with an average per capita GDP of $ 64,000. Most of its residents are well off and educated. It is thus imperative that an economy with so much money available in the system and aided by high technology and digitalization can propel the fintech business.

B2B business climate

B2B transactions involve two companies rather than a company and an individual. The B2B sector is highly developed in Singapore that handles corporate to corporate transactions. Compared to B2C, B2B transactions are more complex and involve more paperwork, e.g., digital signature. Lots of new fintech startups are offering B2B transactions and choosing Singapore as the most logical destination.

Government Policies and Support

Fintech is one of the smart strategies of the Singapore Government. Sector-specific strategies are being incorporated in Singapore to boost sectoral fintech businesses and investments. “Fintech Fast Track Initiative ” and ” Smart Financial Center ” are part of this wider strategy of propelling sector-specific fintech business. Singapore Fintech Association, a non- profit platform facilitating fintech collaboration, and Singapore Fintech Festival, a widely recognized event, is also the Singapore government’s brainchild. With so much government support complemented by simple and transparent government business policies, Singapore is rapidly climbing up the global fintech investments.

Key Takeaways

Singapore, known as the Financial capital of Southeast Asia, has developed high technological capabilities; strong, simple, and investor-friendly regulatory framework and, highly skilled and educated workforce. These three attributes are mainly responsible for fintech business growth in Singapore, providing innovative solutions to both consumers and financial services industries.

Many reports and rankings worldwide showcase Singapore as a nation with the highest potential for growth in the fintech sector. Singapore ranked 6th in the latest Global Financial Centres Index and rapidly advancing forward to catch up with the UK and USA.

A finer balance and closer alignment between innovation and regulation will surely take Singapore’s fintech business to the next level.

IMC Group

IMC Group