Achieving business success in Dubai starts with a solid financial strategy, precise record-keeping, and strict adherence to local regulations. From managing the complexities of corporate taxes to handling detailed payroll processes, accounting services in Dubai can quickly become demanding—especially for small and mid-sized businesses. That’s why many companies outsource these tasks to top accounting firms rather than maintaining in-house teams.

Why Accounting and Auditing Matter?

Proper accounting and auditing practices give you the following:

- Accurate Financial Snapshots – Real-time insights into revenue, expenses, and profitability.

- Regulatory Compliance – Keeping pace with UAE tax codes and labour laws to avoid penalties.

- Strategic Planning – Making well-informed decisions backed by reliable financial data.

Auditing for Greater Financial Integrity

Challenges for Businesses in Dubai

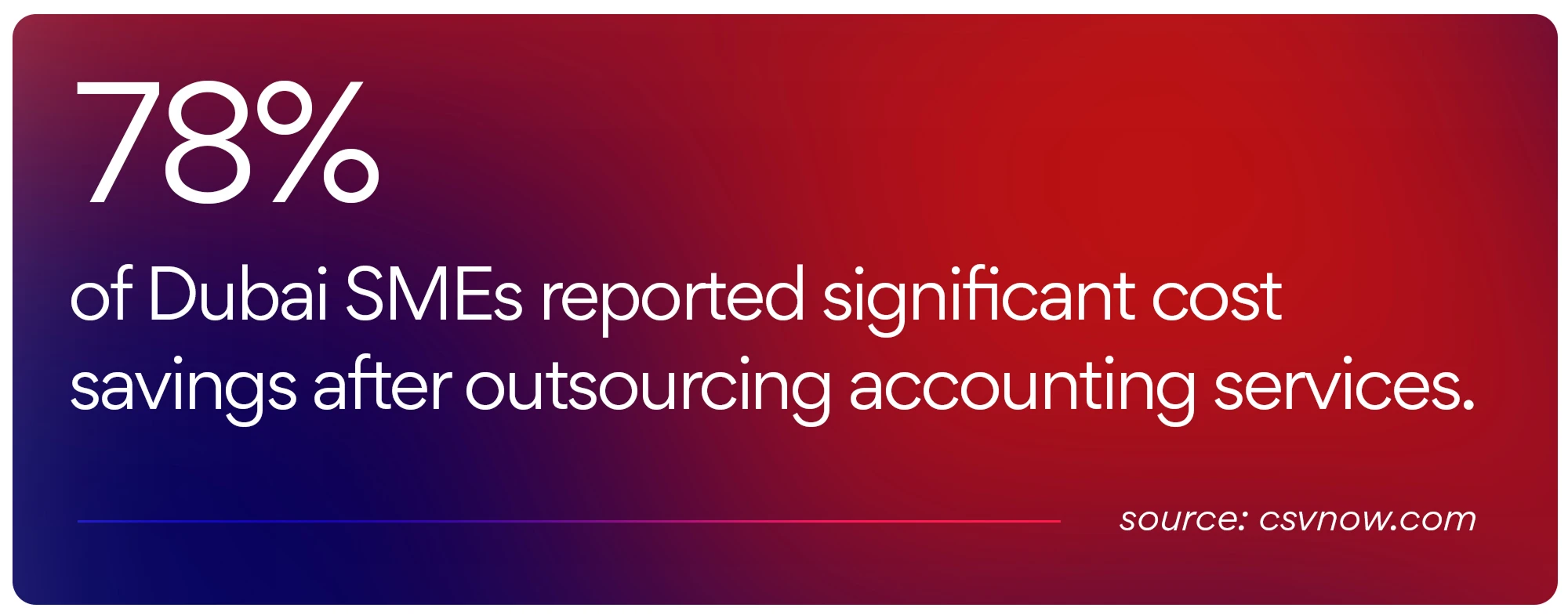

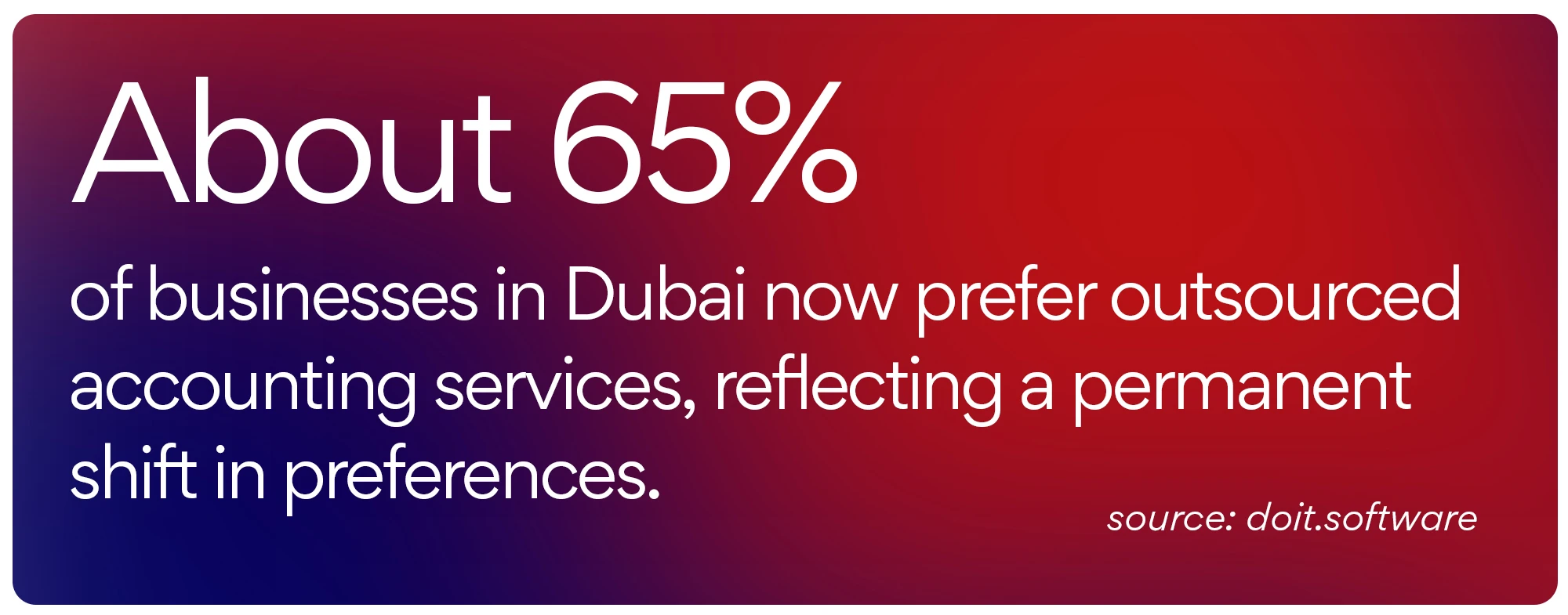

Whether you operate a startup or a large corporation, accounting and bookkeeping services in Dubai demand staying current with evolving regulations, payroll mandates, and various taxation policies. In-house accounting can be expensive, prompting many firms to hire specialized accounting services in Dubai. By doing so, they benefit from:

- Cost Efficiency – Lower overhead without sacrificing expertise.

- Full Compliance – Professionals who stay updated on every rule change.

- Better Decision-Making – Detailed financial reports that guide resource allocation and growth strategies.

Why Partner with a Reputable Accounting Firm

A trustworthy accounting provider can:

- Streamline Bookkeeping & Reporting – Using cutting-edge software and best practices to track transactions.

- Deliver Thorough Audits – Ensuring accuracy and rectifying discrepancies before they escalate.

- Offer Tailored Financial Advice – Helping refine business strategies and enhance operational efficiency.

- Bolster Investor Confidence – Presenting transparent, audited financial statements to stakeholders.

- Mitigate Risk – Reducing the likelihood of tax or compliance infractions.

Our List of the Top 20 Accounting Firms

IMC Group Dubai

IMC Group Dubai is a leading provider of accounting and bookkeeping services. Their offerings range from daily bookkeeping to advanced financial advisory, ensuring tailored solutions that meet the region’s regulatory needs. With a skilled team of accountants, auditors, and tax specialists, they deliver accurate financial reports and strategic insights for SMEs and larger businesses.

In addition to core services, IMC Group Dubai offers strategic planning, business consulting, and compliance support to help clients navigate UAE tax regulations and financial reporting standards, minimizing the risk of penalties. This proactive approach allows clients to focus on their core operations and secure their financial management.

IMC Group Dubai prioritizes client-centricity, customizing service packages for each organization and building long-term partnerships based on trust and measurable results. Consequently, businesses improve financial stability, streamline operations, and explore growth opportunities in Dubai’s dynamic economy.

Ernst & Young

Deloitte

Requirements vary depending on business activity, legal structure, and free zone regulations. Some entities must conduct annual audits to maintain their licenses, while others do so voluntarily for better financial oversight.

Look for a firm’s track record, industry specialization, and certifications (such as being licensed by the UAE authorities). Also, consider the scope of services, technology adoption, and how well they align with your specific operational and budgetary needs.

PwC

KPMG Services

Fees can differ widely based on a firm’s reputation, the complexity of your financial records, and the range of services required. Some firms offer fixed-fee packages, while others may charge hourly rates for specific tasks. Always clarify pricing models upfront.

Many firms cater to SMEs and startups with tailored service packages. Outsourcing accounting can be incredibly cost-effective for smaller businesses that don’t require a full-time in-house accounting team.

KBA

BMS Auditing

Maintaining monthly or quarterly updates is generally recommended, though some industries may need weekly or even daily oversight. Regular updates ensure real-time insights into cash flow, expenses, and revenue trends, enabling prompt decision-making.

Several firms, especially the larger international networks or those with a global presence, have specialized teams for cross-border operations. They can guide you through double taxation treaties, international transfer pricing, and overseas compliance requirements.

Reputable accounting firms implement strict data protection policies and use secure software to safeguard client information. Before finalizing an agreement, discuss the firm’s confidentiality clauses, data handling procedures, and cybersecurity measures.

Reyson Badger

AVSC

Yes. Most accounting firms in Dubai offer VAT and tax-related services, including registration, filing, and advisory. They ensure compliance with UAE’s tax regulations, helping you avoid potential fines or penalties.

Professional firms regularly follow updates from government bodies such as the Ministry of Finance, Federal Tax Authority, and local free zones. Many also participate in ongoing training or certification programs to keep pace with changing legislation.

HLB HAMT

NAM Accountants

CDA Audit

Xact Accounting Services

Many offer strategic advisory, risk assessment, digital transformation support, and CFO-level consulting. They can deliver cost-saving recommendations, help craft business growth strategies, and streamline financial operations for long-term stability.

Yes. Specialized teams within certain firms handle due diligence, financial modelling, and risk evaluation for M&A activities, ensuring you make informed decisions backed by precise financial data.

Outsourcing can be more cost-effective and flexible, especially for SMEs or businesses with fluctuating financial needs. However, large enterprises with complex transactions might benefit from an in-house specialist. Evaluate the scope of your requirements and budget constraints before deciding.

IMC Group

IMC Group