- NEWSLETTER, INDIA

- November 1, 2022

Free Trade agreements (FTAs) are arrangements between two or more countries or trading blocs that primarily agree to reduce or eliminate trade restrictions including customs tariff and/or non-tariff barriers, import quotas, and export limits on substantial trade between them.

FTAs, normally cover trade in goods such as agricultural or industrial products or trade in services including banking, construction, trading etc. FTAs can also cover other areas such as intellectual property rights (IPRs), investment, government procurement etc.

India has been aggressively pursuing FTAs with other countries to promote international trade relations and has so far signed thirteen FTAs.

The Comprehensive Economic Cooperation Agreement (CEPA) with the Association of Southeast Asian Nations (ASEAN) has long been in focus for India as the two regions share similar cultural and religious traditions besides proximity and booming markets.

The Framework Agreement on CEPA between the ASEAN and India was signed in October 2003 and established a legal basis to conclude other agreements, including Trade in Goods Agreement, Trade in Services Agreement, and Investment Agreement forming the ASEAN-Indian Free Trade Area (AIFTA).

During 2021-22, the value of merchandise trade between India and ASEAN countries stood at a whopping 110.40 billion SGD and mainly due to a few key agreements that boosted India-ASEAN trade relations including FTAs with Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam for goods, services and investment.

The ASEAN-India Trade in Goods Agreement (AITIGA) was signed and enforced on 1 January 2010. Under this Agreement, ASEAN Member States and India agreed to open their respective markets by progressively reducing and eliminating duties on 76.4% coverage of goods and reducing tariffs on over 90% of goods.

The last decade witnessed a significant surge in merchandise trade between the ASEAN and India primarily due to this AITIGA with exports rising by 23% and imports soaring by 55%. Rising imports have been mainly from Cambodia, Singapore, and Vietnam. As the balance of trade is very crucial in all FTAs, the two regions are putting in continuous discussions to ensure the same.

India concluded a Comprehensive Economic Cooperation Agreement (CECA) with Singapore in 2005 and since then, there has been a remarkable increase in bilateral trade between the two countries.

Amongst the ASEAN nations, Singapore is India’s largest trade and investment partner and accounted for 27.3% of India’s overall trade with ASEAN in 2021-22. Singapore is also the leading source of Foreign Direct Investment into India and accounted for almost 136.653 billion INR over the last 20 years totaling around 23% of the total FDI inflows.

Concession in tariff for an additional 30 products has also been agreed upon between India and Singapore for ensuring a balance of trade with the liberalized rule of origin for exports, rationalized product-specific rules, and provisions on Certificate of Origin.

India-Malaysia Comprehensive Economic Cooperation Agreement (MICECA) was reached in 2011 and included concessions and reductions in tariffs for trading certain goods, services, investments, and movement of natural persons.

Both India and Malaysia strongly upheld the spirit of MICECA even during the Covid pandemic and maintained their strong bilateral trade relations with a 26% increase in trade during 2021 between the two nations.

While Malaysian exports soared by 5.9 billion SGD, Indian exports rose by 3.12 billion SGD during this period. Import duty reduction by India also benefited Malaysian companies dealing with palm oil and palm oil products.

India Thailand Early Harvest Scheme (EHS) was signed in 2006 as an initial phase of FTA to identify and include specific products for tariff reduction during the ongoing negotiations for a trade pact. With EHS in place, India and Thailand moved ahead confidently and 82 products including fruits, processed food, gems and jewellery, iron and steel, auto parts and electronic goods were identified for tariff liberalization.

The ASEAN and India are both mature and growing economies and trade & investment ties between these two trade blocs will promote international businesses in a big way.

- NEWSLETTER,U.A.E

- November 1, 2022

There has been a huge surge in business license issuance in Dubai during the first half of 2022 with an almost 25% jump in the number of licenses issued compared to the first half of 2021 totaling 45,653.

The new UAE visa laws have been proven to be a boon, especially for startups and are opening floodgates of opportunities for entrepreneurs, investors, job seekers, IT professionals and tourists. These visa reforms are aiding the country’s economy in a great way as per insights gathered from an industry veteran.

Industry experts believe that visa reforms in the gulf led by UAE and Saudi Arabia have not only increased economic activities in the region but also created new jobs and attracted talent from overseas. Besides bringing reforms to existing visas, USE also introduced new visas to benefit from enhanced economic activities. The business entry visa allowing prospective investors and entrepreneurs entry into the country multiple times over an extended period would also be very helpful to attract foreign direct investment as this period could be best and effectively utilized for market research by the investors before they finally embark upon a new business setup in Dubai UAE.

Industry experts strongly believe that the economy of UAE will register very good growth during 2022 and 2023, rising around 5.2% and 4.2% respectively on the back of the government’s reforms initiatives including new visa laws. The economic growth of UAE has also been attributed to Expo 2020 which has played a key role in supporting the country’s economy, predicted to reach 33.4 billion USD by 2031, industry veterans highlight.

The current exponential growth in Dubai’s infrastructure and construction sectors also resulted in huge economic development and is mainly driven by investments made by foreign entities, industry experts emphasize. The policy and structural reforms undertaken by the government have made UAE the centre of attraction for trade and investment worldwide, believe the experts.

Experts agree that reforms introduced for easy business licensing also complement the visa rules and go hand in hand with increased business activities in Dubai UAE. Business activity usually decides the time to obtain a license and may typically take 3 days to 4 weeks. A reputed and professional PRO service in Dubai UAE can help prospective investors get licenses in an easy and hassle-free manner.

Real estate investment and advisory firms report that the construction project market of UAE witnessed a rebound during 2021, with residential construction being the highest-performing sector. The trend has been continuing so far in 2022 as there are several successful launches of residential projects in Dubai and across other emirates.

The covid-19 pandemic has made Work-From-Home (WFH) the new normal and becomes a blessing in disguise for the construction sector. Home buyers are currently demanding more spacious and luxurious living spaces in communities having recreational and other facilities including swimming pools & gyms along with commercial outlets such as restaurants and shopping malls. Again here the UAE government’s new visa legislation allowing property investors to get a Golden Visa in the event of buying a property worth Dhs 2 million played the role of a catalyst, believe the industry experts. Besides construction and real estate, the other sectors that benefit from the liberalized new visa rules are tourism, trading and e-commerce.

- NEWSLETTER,U.A.E

- November 1, 2022

UAE is branching out into new virtual realms with the launch of the Dubai Metaverse Strategy, designed to propel the Emirate’s economy into the future. A new era of blockchain technology has emerged that would promote Dubai as the Global Capital of Web 3.0 with a scrupulously documented regulatory framework.

Today, the UAE is considered to be one of the top metaverse economies in the world and Dubai, with its recent metaverse strategy, is seen as a pioneer in offering the most advanced metaverse and blockchain ecosystem worldwide.

Blockchain technology, which is essentially an immutable distributed ledger that facilitates the process of recording transactions and tracking assets in a business network, finds widespread usage in Cryptocurrency, Non-Fungible Tokens or Tokenized assets and the metaverse.

Metaverse is a virtual space where people can interact with digital objects. We need to create our digital avatars to enter the metaverse, an expansive network of real-time 3D worlds and simulations. A decentralized metaverse incorporates blockchain technology and blockchain-powered assets. Web 3.0 is the World Wide Web, www as our internet, however advanced, incorporating concepts such as decentralization, blockchain technologies and tokenized economics.

The emergence of web 3.0 and metaverse presents endless possibilities of how this innovation can positively impact the economy of UAE through industries and communities.

Dubai Metaverse Strategy

Originally announced in June 2022 by Dubai Ruler Sheikh Mohammed bin Rashid Al Maktoum, the strategy aims at ensuring that the metaverse increases its contribution to 1% of the emirate’s overall GDP.

The Dubai Metaverse Strategy focuses on four sectors including tourism, education, government services and retail &real estate to become one of the leading economies in the world and a major hub for the global metaverse community.

The strategy was officially unveiled at the Dubai Metaverse Assembly on September 28, 2022. Headed by the Dubai Crown Prince, Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, heads this strategy which has five main pillars including innovation, government implementation of metaverse technologies and talent development and will be focused on extended reality, augmented reality, virtual reality, mixed reality and digital twins.

The strategy also aims at doubling the number of blockchain companies in Dubai plus generating 40K new jobs in this field.

Unveiling of the metaverse strategy will witness Dubai host more than 1,000 companies in the blockchain and metaverse sectors that presently contribute 500 million USD current for the UAE’s national economy. This contribution would considerably increase in the future, experts predict. Four billion dollars of the country’s GDP in the coming five years is targeted through the Dubai metaverse strategy.

The strategy plans to build multiple secure platforms for metaverse users by developing a standardized system as per international standards along with a regulated infrastructure for controlled inclusion and enhanced simulation of such innovative technologies.

Metaverse- Application

The application of the metaverse is widespread with the following key applications.

Healthcare

Augmented reality, AR is the best example of a metaverse application in the healthcare sector helping surgeons in various surgical procedures.

Education

Virtual reality, VR is an example of a metaverse application in the education sector where a VR headset helps students attain a high level of effectiveness in comprehending concepts through visuals. Students also get increasingly motivated to learn with the use of VR technology.

Real Estate

Real estate is another glowing example of metaverse application through VR where real estate agents can leverage the power of this technology for offering immersive virtual tours of properties to prospective buyers.

Defence

Defence is another area where metaverse technology finds many applications. Tactical Augmented Reality (TAR) like night-vision goggles (NVG) can display a soldier’s precise location.

Metaverse applications are becoming huge in many industries and facilitating their transformation through seamless virtual operations.

Metaverse Market

Metaverse market size globally will be valued at 1.6 trillion USD by 2030. Many multinationals like Meta (Facebook), Microsoft, Google, and Nvidia are also making significant investments in the metaverse. Mubadala Capital, a leading global venture platform has been proactive and making investments in the blockchain technology space.

Metaverse in UAE

The metaverse strategy is in perfect alignment with the UAE Artificial Intelligence strategy. The Ministry of Health and Prevention, in its proactive stance, has launched a blockchain platform to ensure that medical data is secure.

The Dubai government formed the Dubai Virtual Assets Regulatory Authority (VARA) to help safeguard investments in crypto and NFTs. As MetaHQ is established, the VARA has started functioning as the regulatory body for foreign transactions providing a safeguard for investors in the virtual asset industry for the first time.

Business and Dubai Metaverse

Facebook, the global major presently named Meta, has opened its headquarters in the country.

Dubai has already documented and implemented business setup regulations in fintech, blockchain, and Web 3.0 to safeguard crypto and digital assets. Dubai World Trade Center (DWTC) is dedicated to virtual assets.

Dubai’s fintech sector offers tremendous opportunities for business in the digital space and is currently valued at 2.5 billion dollars. The Dubai International Financial Center (DIFC) Innovation Hub is the first ecosystem in the gulf with more than 2,400 companies in fintech. Dubai Financial Services Authority (DFSA) has been made responsible for overseeing the regulation of investment tokens.

Dubai – The Crypto Hub

Dubai’s metaverse strategy aims to make the city the crypto capital of the world, with over 400 businesses operating in the crypto space including Crypto.com, FTX, and Binance, the leading and famous FinTech and cryptocurrency firms with licenses in possession.

Business Licences – Metaverse

Investors seeing for a company formation in Dubai in the metaverse space must engage with the following government authorities who are responsible for offering metaverse services license.

- Dubai Economy and Tourism (DET)

- Dubai Silicon Oasis Authority (DSOA)

- Dubai Multi Commodities Center (DMCC)

- International Free Zone Authority (IFZA)

- NEWSLETTER,U.A.E

- November 1, 2022

The UAE has been witnessing a rapid surge in the number of UK businesses, effectively growing by 23% year-on-year, with many UK businesses entering the middle-eastern market through new company formation in Dubai UAE.

The growing British business setup in Dubai is happening at a time when the economic forecast from the British Chambers of Commerce (BCC) points to an economic recession in the UK predicting the economy slowing down by the end of 2022, mostly due to the staggering and unabated inflation soaring to 14%. Multiple factors such as lower consumer demand and weaker currency against the USD, higher energy costs and slower growth in international trade and investment are responsible for this massive decline.

While the UK economy slips into recession, the economy of the UAE shows resilience and stability due to higher oil prices, lower taxes and booming consumer demand. UAE’s thriving economy is driving increasing numbers of UK investors to the emirates to consolidate their operations and hedge risk.

With a surge in market entry of new British businesses, there has also been a higher demand for reputed and professional business setup consultants in Dubai UAE who can facilitate setting up new enterprises.

The business-friendly landscape and pro-business policies of the UAE are also attracting UK investors and entrepreneurs to its shore. The UAE government has also been instrumental in bringing in several progressive and strategic reforms in the recent past including the introduction of long-term visa categories, full foreign ownership etc. to promote foreign direct investment through new company incorporation. Foreign investors and entrepreneurs, aggressively looking for business expansion are moving to the UAE to protect their businesses from recessionary slowdowns.

British companies are also preferring to expand in the UAE due to higher market demand for their products and services. Given the economic slump in the UK, British investors are increasingly pursuing to diversify their businesses in other geographies with stable economies and higher market demands.

Besides Dubai, Abu Dhabi Global Market (ADGM) has also witnessed a growing interest amongst the new British investors and entrepreneurs in setting up new companies. Transparent policies, easy business setup processes and a robust regulatory framework are mainly attributing to this increased interest.

- NEWSLETTER,U.A.E

- November 1, 2022

The Abu Dhabi Department of Economic Development (ADDED) has recently signed nine agreements for onboarding nine leading institutions into the Investor Journey programme. With these agreements in place, investors and entrepreneurs can now apply for business bank accounts, business operational support, telecommunications and corporate insurance services directly on the ADDED portal itself.

The new institutions onboarding this program are First Abu Dhabi Bank (FAB), Emirates Development Bank (EDB), Finance House, Al Maryah Community Bank, Emirates Integrated Telecommunications Company (du), Telecommunications Group (e&), Islamic Arab Insurance Company (SALAMA), Emirates Zone Companies Representation, and Datack International Business Management.

Various needs of existing and prospective businesses, entrepreneurs and investors are addressed by the ‘Investor Journey’ of ADDED that took off in 2021, through seamless integration and an ecosystem of advanced services to new business ideas for company formation in Abu Dhabi.

Investors can access the services, transactions and procedures of various government bodies on a single platform and can have an unmatched digital experience.

Sameh Abdulla Al Qubaisi, the Director General, of Economic Affairs, ADDED noted, “Expanding the network of ‘Investor Journey’ partners and integrating new services is part of our efforts to further strengthen Abu Dhabi’s robust business ecosystem by working closely with best-in-class partners in various sectors to enrich investors’ experiences. These efforts are paying off, and we remain focused on continuously improving our regulations, systems, and services. As digitalization is a major trend in today’s economy and everyday life, we believe employing cutting-edge technologies will empower investors and entrepreneurs, who play a major role in achieving objectives of sustainable development.”

BAbu Dhabi Media Office reported that the 9 new joiners being associated with more than 25 other government and private sector entities and agencies would further promote and expand the business ecosystem of Abu Dhabi and make the private and public sector partnerships stronger. The ‘Investor Journey’ program will also facilitate business set up in Dubai UAE.

Gulf Information Technology Exhibition, Gitex Global 2022 witnessed the participation of ADDED and the unveiling of Phase 2 of ‘Investor Journey’ integrating more services and business setup tools and features.

The ADDED portal is provided with an informative simulator to help investors smoothly navigate through their business journey with an interactive map powered by the UAE’s leading real estate portal to easily identify and choose the location and commercial space.

Abu Dhabi Global Markets (ADGM), made a strategic economic partnership with ADDED and announced the launch of Abu Dhabi Financial Week (ADFW), which will take place from 14 to 18 November 2022. The success of ADGM’s FinTech Abu Dhabi Festival inspired the event.

- Article, Bahrain

- October 27, 2022

Overview

According to the 2020 Index of Economic Freedom, Bahrain is the fourth freest economy in the Middle East and North Africa (MENA) region and is the 63rd freest economy in the world. Ranked 43rd among 190 economies in the ease of doing business, Bahrain has also been recognized as a High-Income country by the World Bank and the country’s high income can be attributed to oil and natural gas, aluminum export and tourism.

It was in 1970 when the Kingdom of Bahrain started growing into a Financial centre in the Arabian Peninsula and started attracting banks, insurance companies and investment firms from across the globe. Presently Bahrain has more than 114 banks including 23 retail and 69 overseas banks; 2 specialized banks and more than 400 financial institutions and rightfully claimed its position as one of the financial hubs among GCC countries. The central bank of Bahrain (CBB) regulates the banking and insurance sectors and foreign exchange offices.

The regulatory and accounting systems of the financial sector in Bahrain are transparent and comply with the world standard. For decades, the Government has supported the financial sector to reduce its reliance on oil and gas, and use it as the main driver of economic growth. Currently, the financial sector contributes to more than 17% of Bahrain’s GDP.

Besides the financial sector, Bahrain has diversified its economy in other non-oil sectors including manufacturing, real estate. aviation and communications. Alba, one of the largest Aluminum smelters in the world is a living testimony of the government’s commitment to economic diversification, industrialization and privatization.

Benefits of Company Formation in Bahrain

- 100% foreign ownership is allowed

- Free-holding of properties for foreigners

- No restrictions on repatriation of capital and profits and no exchange controls

- A reliable and efficient communication system

- No excessively strict Visa, Residence & Work permit requirement inhibiting foreign investors and expats moving freely in Bahrain

- Nil corporate Tax

- Abundant cheap energy

- Excellent support services from local authorities

- The long reputation of political stability, safety and security

- Nil personal income tax

- World-class infrastructure facilities

- Strategic location for cross border trade and investments

- Availability of Multiple Entry Visa with five years validity

Investment Climate in Bahrain

The investment climate is generally positive for company formation in Bahrain, a country with a liberal foreign investment outlook and continuously looking for foreign investors and businesses.

The Government of Bahrain, in its endeavour to attract foreign direct investments, offers a lot of incentives to foreign investors for doing business in Bahrain. Many attractive incentives are offered from various Bahrain based institutions namely the Bahrain Logistics Zone (BLZ), Bahrain Development Bank (BDB), Bahrain Economic Development Board (EDB), Bahrain International Investment Park (BIIP), and Tamkeen, the semi-autonomous government agency of Bahrain.

A few of the incentives offered are

- Assistance in company registration in Bahrain and starting business operations

- Financial Grant

- Duty-free access to other GCC countries for products manufactured in Bahrain

- Exemptions of import duties on plant and machinery

Promoting Investment and Trade: Free Trade Zones (FTZ) and Free Port

Entire Bahrain itself can be termed as a large Free-Zone as it is tax-exempt, doesn’t impose any restrictions on foreign ownership for most of the businesses and levies minimum customs duties.

Americans and GCC nationals are officially treated as Bahrainis and there is no restriction on 100% foreign ownership for any businesses and industries at all.

Bahrain has three main FTZs including Bahrain Logistics Zones (BLZ), Bahrain International Investment Park (BIIP) and Bahrain International Airport (BIP) and offers no annual rental, 50% lower utility cost and nil customs duty. Foreign-owned companies enjoy similar benefits for doing business in Bahrain and have access to the same investment opportunities as Bahraini companies.

Bahrain’s primary commercial seaport, Khalifa Bin Salman Port provides a free transit zone to facilitate duty-free import of equipment and machinery into the country.

Expatriates are permitted to own land in designated areas in Bahrain. Americans and non-GCC nationals can also own commercial and residential properties including properties used for tourism, banking and finance, health projects, and training centres.

To strengthen its position as a startup hub and to promote the investment ecosystem through new company formation in Bahrain, the Government introduced in 2018 the Bahrain FinTech Bay, the largest FinTech hub in the MENA region. Four new laws were also enacted on data protection, bankruptcy, competition and health insurance.

Bahrain also launched the USD100 million Al Waha venture capital fund for Bahraini investments and set up a USD100 million ‘Superfund’ as a growth initiative of start-ups.

Types of Companies in Bahrain

The Bahrain Commercial Companies Law (BCCL) enacted in 1971 and subsequently amended in 2001, defines and regulates the companies in Bahrain.

Following BCCL requirements, Bahrain companies are classified as under

1. Joint Stock Company (JSC)

This is one of the popular corporate vehicles in Bahrain and consists of two or more partners as shareholders. The partners are not liable for the company’s debt and obligations except the amount equaling the value of their shares.

These are two types including

Public Joint Stock Company

The minimum paid-up capital is BHD 1 million with one mandatory auditor.

Closed Joint Stock Company

The minimum paid-up capital is BHD 250,000 with each share not exceeding 100. One auditor is mandatory with 100% foreign ownership.

2. Limited Liability Company (LLC)

Also known as the With Limited Liability Company ( WLL) is a popular business structure for foreign investors and offers 100% foreign ownership for most businesses. There can be a maximum of 50 partners responsible for the debt and obligations of the company. One mandatory auditor with an office in Bahrain. Must have two directors and two partners as a minimum. The minimum share capital requirement is BHD 100,000

3. Single Person Company (SPC)

It is also a preferred company vehicle in Bahrain and is owned by one single member owning the entire business and unlimited liability for company debts and obligations. The minimum paid-up capital is BHD 50,000. Must have one Director and one partner with an office in Bahrain.

4. Limited Partnership Company (LPC)

This is also a major company type with a partnership between two members or two corporate bodies personally liable for the debts and obligations of the company. There should be two partners and a minimum of two Directors. Must have a local office in Bahrain. There are subcategories of partnership companies such as Simple Limited Partnership Company, Limited Partnership by share.

Decree 28 of 2020, has been issued on 28th September 2020 documenting various amendments to certain provisions of BCCL, Law 21of 2001 as a part of Bahrain’s ongoing commitment to developing its ‘compliance and regulatory frameworks ‘ at par with international best practice. The regulations have not been issued yet and likely to be enforced in the coming months.

Few highlights of Proposed amendments are

- A merger of SPC with WLL

- For WLL companies, no restriction on maximum shareholders

- Not-for-Profit companies, a new chapter added to BCCL & may be set up as the WLL

- For WLL, the minimum share capital requirement has been removed

- JSC can increase capital by converting debt to equity

- LPC not permitted to adopt a trading name

New Company Registration in Bahrain

The Bahrain Ministry of Industry Commerce and Tourism (MoICT) has launched an online commercial registration portal known as “Sijilat” to facilitate the commercial registration process.

Through Sijilat, businesses can obtain a license and other requisite approvals from the relevant authorities. The business registration process usually takes two to three weeks however can take longer if a business requires specialized approvals.

Normally most businesses outsource consultancy services for company registration in Bahrain to assist them through the commercial registration process.

Besides obtaining primary approval to register a company, most business owners must also obtain licenses from the following entities to operate their businesses:

The government also provides industrial lands at reduced rental rates for short periods as an incentive towards foreign investment through new company formation in Bahrain.

- MoICT

- The Municipality in which their business will be located

- The National Bureau for Revenue, Compulsory if the business revenue expected to exceed BD 37,500

- Ministry of Electricity and Water

- Labour Market Regulatory Authority

- General Organization for Social Insurance

Pre-incorporation Steps for company registration in Bahrain

- Selecting your business type and activities

- Deciding on the Share Capital

- Selection of Outsourced services for Company Registration in Bahrain

- Choosing a Company Name

- Determining the Shareholding Pattern

- Assigning Shareholders Designations

Process Steps for company registration in Bahrain

- Submitting Application to MoICT with details of applicant and company name, type of business, the total number of shareholders, total share capital, shareholding patterns, passport copies, visa status etc.

- Commercial Registration (CR) is issued without a license once the application is reviewed and approved by MoICT

- Obtaining the requisite business Licenses based on your business activity

- Articles of Association (AOA) and Memorandum of Association (MOA) are to be documented and submitted for approval. Once accepted, MOA & AOA are to be notarized and the copies to be submitted online

- Obtaining Bank Deposit Certificate from the bank and submitting online to MoICT

Documents for Company Registration in Bahrain

The main documents required for company registration in Bahrain are

- Duly filled company registration application form

- Capital Deposit Certificate

- Copies of Passport and Visa for company shareholders

- Power of Attorney for Outsourced Consultant

- Company Business Plan

- Commercial office address details

- Copies of Certificates of education and training of the applicant

- MOA and AOA

Tax Considerations in Bahrain

Bahraini companies are completely free of taxation except for companies in oil, gas, oil exploration, mining and refining sectors taxed at 46%.

Value-added tax (VAT) is imposed on goods and services at a uniform rate of 5%. Financial and insurance services and real estate business are VAT exempt. No VAT is levied on food items and education. Oil and gas exploration is also free of VAT.

Foreign Commercial and residential properties attract 10% Municipal Tax and 2% stamp duty is levied on sales and registration of real estate properties.

The import duty of 5% levied on imported goods. Alcohol and cigarettes attract 125% and 100% duty. All imported goods in Bahrain need customs clearance from the Director-General of Customs.

Bahrain is free of withholding tax, capital gains tax and payroll tax.

All companies are required to submit audited financial statements within 6 months of financial year-end and file quarterly tax returns. Non- compliance attracts 1% monthly fines.

Bahrain has a Double Taxation Avoidance Agreement (DTAA) with more than 40 countries motivating foreign entrepreneurs for company formation in Bahrain.

Takeaway

Like all other countries in the world, the recent Covid-19 pandemic and fall in global oil prices made it difficult for Bahrain to generate revenue and reduce government spending. In April 2020, Bahrain announced a BDH 4.3 billion (USD11.4 billion and equivalent to 29% of the country’s GDP), eight-point stimulus package to support the economic slowdown caused by the Covid-19 restrictions. Several subsidies have also been introduced to foreign-owned and local companies including utility bills coverage and waiver of tourism and industrial land fees to ease doing business in Bahrain.

Though Bahrain’s investor-friendly, liberal and tax-free business scenario is becoming increasingly attractive to foreign investors, setting up a new business establishment is very competitive, arduous and time-consuming. Outsourcing of a business service agency is hugely beneficial to facilitate and support the company registration in Bahrain and here comes IMC as your perfect business partner.

IMC has a long presence in GCC countries as a Business Process Services (BPS) provider and has acquired a total understanding and knowledge of the functioning of Bahraini government bodies.

A customer-centric affordable services company supported by a team of enthusiastic result-oriented professionals, IMC can cater to all your needs for doing business in Bahrain.

Pre-Incorporation Advice

IMC has the experience and expertise to advice customers on the suitable company type taking in to account the laws of the land and the unique customer’s needs. We have the experience having handled different industries and geographies across the world. We understand finance and the legal framework required to handle a company’s operations. We will advise on the percentage of shareholding allowed for foreigners, and the rights which go with that percentage and other such business matters. IMC has been operating in GCC for over 10 years.

Types Of Companies

- With Limited Liability Company (W.L.L.)

- Partnership Company

- Bahrain Shareholding Company (B.S.C.) – public

- Bahrain Shareholding Company (B.S.C.) – closed

- Simple Commandite Company

- Commandite by Shares

- Single Person Company

- Branch of a Foreign Company

- Holding Company

Documents Required For Company Formation

- Company Registration application form

- Draft Memorandum of Association

- Board of Directors resolution resolving to establish the company in Bahrain (for corporate partners)

- National ID card (Central Population Registry (CPR)) copies of the company’s representatives. If the partners are not present themselves to register the company, copies of the ID cards of their lawyers/other representatives must be provided

- CVs of individual partners

- Lease agreement as proof of the company’s commercial address

Free Zones in Bahrain

The island nation of Bahrain is diversifying its economy away from unsustainable hydrocarbons resources to sectors such as banking and finance, trade and industry, retail and tourism. Its physical link to Saudi Arabia – via the King Fahd Causeway, constructed in 1986 – has facilitated trade, tourism and retail.In 2013, Bahrain was ranked as the 12th most- free economy in the world by the US’ Heritage Foundation think tank. Bahrain is home to THREESpecial Economic Zones, all of which were ranked in the top 20 locations for inward investment, economic development and business expansion in FDI Magazine’s Global Free Zones of the Future 2012/13 report.

Advantages

- FZ companies do not require a Bahrain national shareholder for trading and commercial activities. While it is mandatory to rent a free zone office at a low rent, it is not necessary to hire staff

- Land rental rebates of 100% in government industrial areas for the first three years

- Electricity rebates of 50% for the first five years of operation

- No duties are imposed on goods imported and exported from the Free Zone

Bahrain International Airport (BIA)

Bahrain International airport sits in 19th place in the free zones of the future list, and is ranked fifth-best airport zone in the world. Offering cargo facilities, offices and retail space, the foreign trade zone has no customs duties. It is governed by Mumtalakat, the government vehicle for Bahrain’s non-oil and gas investments, established in June 2006 by royal decree.100% foreign ownership is allowed and it has a “bonded cargo terminal” allowing for delayed payment of duties until products leave the facility.

Bahrain Logistics Zone (BLZ)

The Bahrain Logistics Zone was established in 2008 next to Khalifa bin Salman port, the island’s main harbour. Placed 16th in the FDI Magazine ranking, the port zone offers land plots of 3,000 square metres and more for lease. The 100- hectare zone focuses on third-party logistics, storage and distribution (for export and re- export), as well as other logistics services and activities. In the first quarter of 2013, container throughput stood at 95,828 20-foot equivalent units, with an average processing time of 32 minutes.The BLZ is ideal for regarding-exporting and logistics companies benefiting from zero-tax and duty exemptions. It is also a boutique center for manufacturers in component assembly, packaging, testing, and repair companies.

Bahrain International Investment Park (BIIP)

BIIP offers100 per cent foreign ownership of companies, duty-free access to GCC markets, exemption from import duties on both raw materials and equipment and 100 per cent repatriation of capital. Located 5 kilometers from Bahrain International airport, BIIP consists of 2.5 million sq m of leasable land, costing $1.33 a sq m a year to rent. GCC free zones are considered as being outside the country, so goods are taxed at 5 per cent when exported to Bahrain. BIIP is not treated as a free zone, so is not subject to the 5 per cent tax when shipping goods to Bahrain.The Bahrain International Investment Park is ideal for large manufacturing operations, including food process, medical technology, electronics, and materials. Export led services including insurance claims, administration, and software and information systems.

Access to Bahrain double tax treatiesYes

| Type | Limited Liability Company (WLL) |

| Under Bahrain law, foreigners can own | 100% |

| Share Capital | US$ 133,000 |

| Director | Minimum Two |

| Memorandum & Articles of Association | Yes |

| Shareholders | Minimum two |

| Can the entity hire expatriate staff in Bahrain | Yes |

| Bahrain Resident Secretary Required | Yes |

| Statutory Audit Required | Yes |

| How long to open Corporate Bank Account | One Day |

| Annual Tax | Must be filed |

| Timeframe for Incorporation | 1 month |

- Article, Qatar

- October 27, 2022

Overview

Qatar formally called the State of Qatar. The capital is Doha. It is a sovereign Arab emirate, placed Western Asia. Qatar has the world’s third biggest characteristic gas saves and oil holds. Qatar has one of the quickest developing economies on the planet. To achieve better profits of investor it has adopted open market policy. It is essential to note that foreign direct investment is promoted and foreign entities are welcomed in Qatar to help grow the economy. In addition, there are various incentives available to attract foreign capital including tax breaks and exemptions from customs duty. The Qatar Investment Authority is established by the government for the purposes of company registration and company formation in Qatar. This article follows details involved during company setup in Qatar.

Company Registration & Company Formation in Qatar

- With specific special cases, Qatar’s foreign investment law limits foreign ownership of local entities to 49% of the entity’s capital for a company setup

- An LLC company formation in Qatar is the most commonly used business entity

- Foreign investment is not allowed in commercial agencies and real estate

- The representative company formation in Qatar is 100% foreign owned and controlled, it is not allowed to make direct sales in Qatar. Such an office will only engaged in activities such as promoting the business of the parent company and market research

Company Registration & Company Formation in Qatar

- With specific special cases, Qatar’s foreign investment law limits foreign ownership of local entities to 49% of the entity’s capital for a company setup

- An LLC company formation in Qatar is the most commonly used business entity

- Foreign investment is not allowed in commercial agencies and real estate

- The representative company formation in Qatar is 100% foreign owned and controlled, it is not allowed to make direct sales in Qatar. Such an office will only engaged in activities such as promoting the business of the parent company and market research

Accounting & Tax

- The corporate income tax rate has been cut to a flat rate of 10%.There is no personal income tax in Qatar

- Qatar has 33 Agreements for the Avoidance of Double Taxation

Timeframe for Incorporation2 weeks

| Type | Limited Liability Company (WLL) |

| Under Qatar law, foreigners can own | 100% |

| Share Capital | QR 200,000 |

| Directors | One |

| Shareholders | Two |

| Memorandum & Article of Association | Yes |

| Can the entity hire expatriate staff in Qatar | Yes |

| Qatar Resident Secretary Required | Yes |

| Statutory audit required | Yes |

| How long to open Corporate Bank Account? | 2 weeks |

| Annual Return | Must be filed |

| Annual Tax | Must be filed |

| Access to Qatar double tax treaties | Yes |

Government Links

- Article, Kuwait

- October 27, 2022

Types of Business Entities in Kuwait

Companies in Kuwait are established under the Commercial Companies Law (the CCL).The following business structures are available to non-Kuwaitis to undertake business / commercial activities in Kuwaitis.

- Limited Liability Companies

- Shareholding Company

- Branch Company

- Partnership Company

- Joint Venture Companies

Limited Liability Companies (WLL)

Limited liability companies, usually referred to as ‘With Limited Liability (WLL), are the most commonly used corporate form of entity in Kuwait and are considered equivalent to French SARLs, German GmbHs or private companies in the United Kingdom. The key features are,

- WLL companies are not permitted to engage in banking, insurance or to act as a pure investment fund

- Maximum percentage of shareholding by a non- Kuwaiti in a WLL should be 49%(except if such WLL has obtained an approval from the KDIPA)

- Ownership interests are represented by shares of the WLL companies

- Minimum Capital requirement is 1,000 KWS

Joint Ventures

A joint venture is an entity formed by two or more natural or legal persons who are jointly and severally liable. The key aspects of the joint ventures are as follows:

- It does not have legal existence

- It does not need to be recorded in the commercial register of the Ministry of Commerce and Industry. However, the partners of the joint venture must be separately registered in their own names

- The contract defines the objects and terms of the joint Venture. This form of business structure is usually used to carry out construction projects (i.e. construction of power plants, roads, etc.)

- In the event the joint venture involves a foreign partner, then the entity conducts operations through the trade license of the Kuwaiti member of the joint venture

Branch

Foreign corporate bodies are not permitted to set up a branch in Kuwait (except in cases where the foreign corporate body has obtained an approval from KDIPA). If the foreign corporate bodies do not wish to operate in Kuwait through a participation in a shareholding company or a limited liability company, it may engage in business in Kuwait only through a Kuwaiti commercial agent or a Kuwaiti service agent (as explained below).Under the CCL a branch is not a recognized legal form for foreign investors. It should be noted however that for the purpose of tax filing and certain other practical purposes, it is convenient to refer to Kuwait operations of foreign corporate bodies as “branch” operations.

Agent / Distributor

Agencies are governed by Law No. 36 of 1964, which regulates the following:

- Commercial agents which are engaged in promoting products for their principal or negotiate and conclude deals on behalf of their principal

- Distributors which are engaged in promotion, import and distribution of the products of their principal

- Service agents or sponsors who are appointed by foreign companies intending to engage in government contract works

Timeframe for Incorporation3 Months

| Type | Limited Liability Company (WLL) |

| Under Kuwait law, foreigners can own | 49% |

| Share Capital | KD 7,500 |

| Memorandum & Articles of Association | Yes |

| Shareholders | Minimum Two |

| Can the entity hire expatriate staff in Kuwait | Yes |

| Tax Registration Certificate Required | Yes |

| Kuwait Resident Secretary Required | Yes |

| Statutory Audit required | Yes |

| How long to open Corporate Bank Account? | 1 Day |

| Annual Return | Must be filed |

| Annual Tax | Must be filed |

| Access to Kuwait double tax treaties | Yes |

Government Links

- Article, Oman

- October 27, 2022

Overview

- Overview

- Benefits of Company Formation in Oman

- Business Climate in Oman

- Types of Companies in Oman And Applicable Requirements

- Partnership Companies

- Foreign Company Branches

- Process of Registèring a Company in Oman

- Documents Required for Registration of Company in Oman

- Free Zones in Oman

- Accounting and Tax

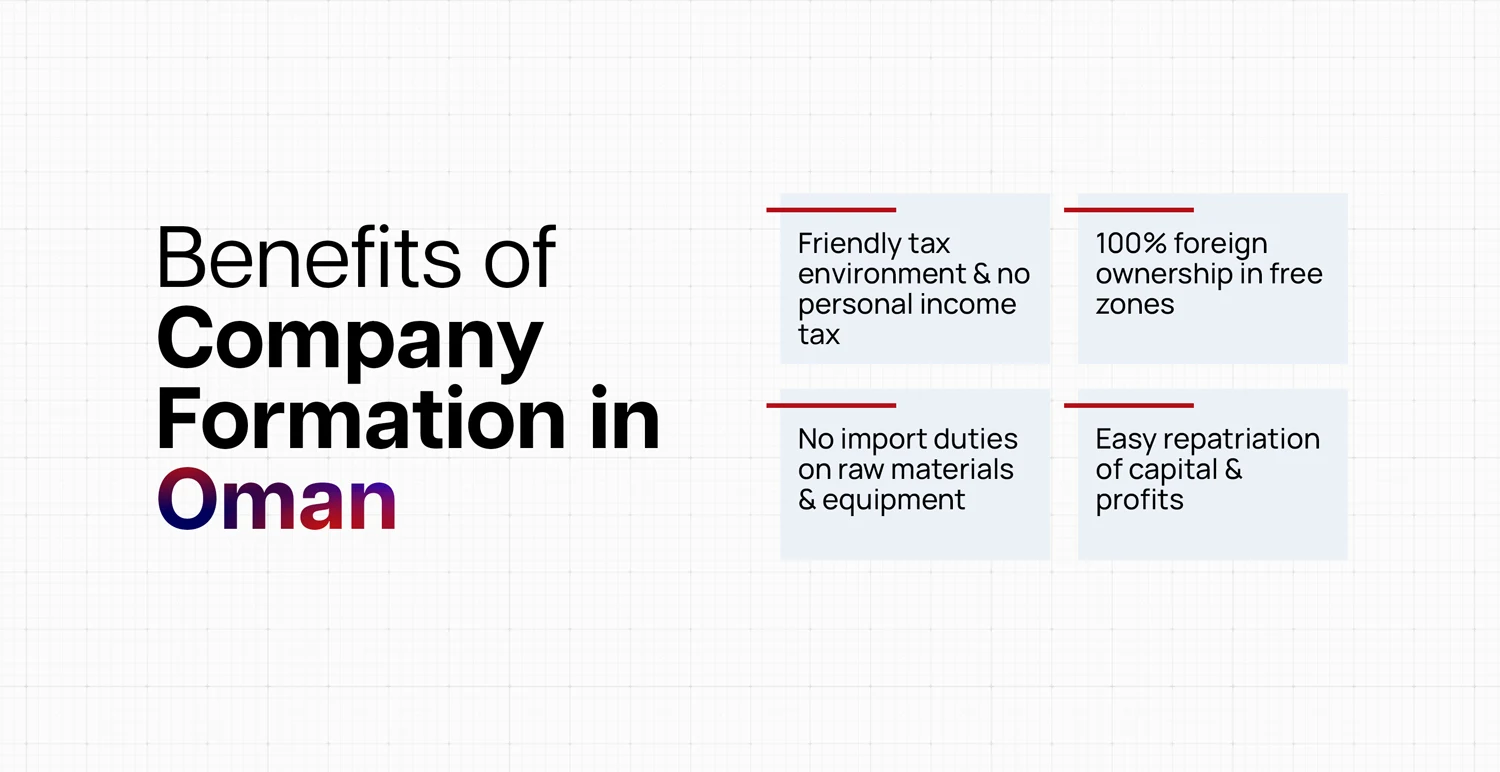

Benefits of Company Formation in Oman

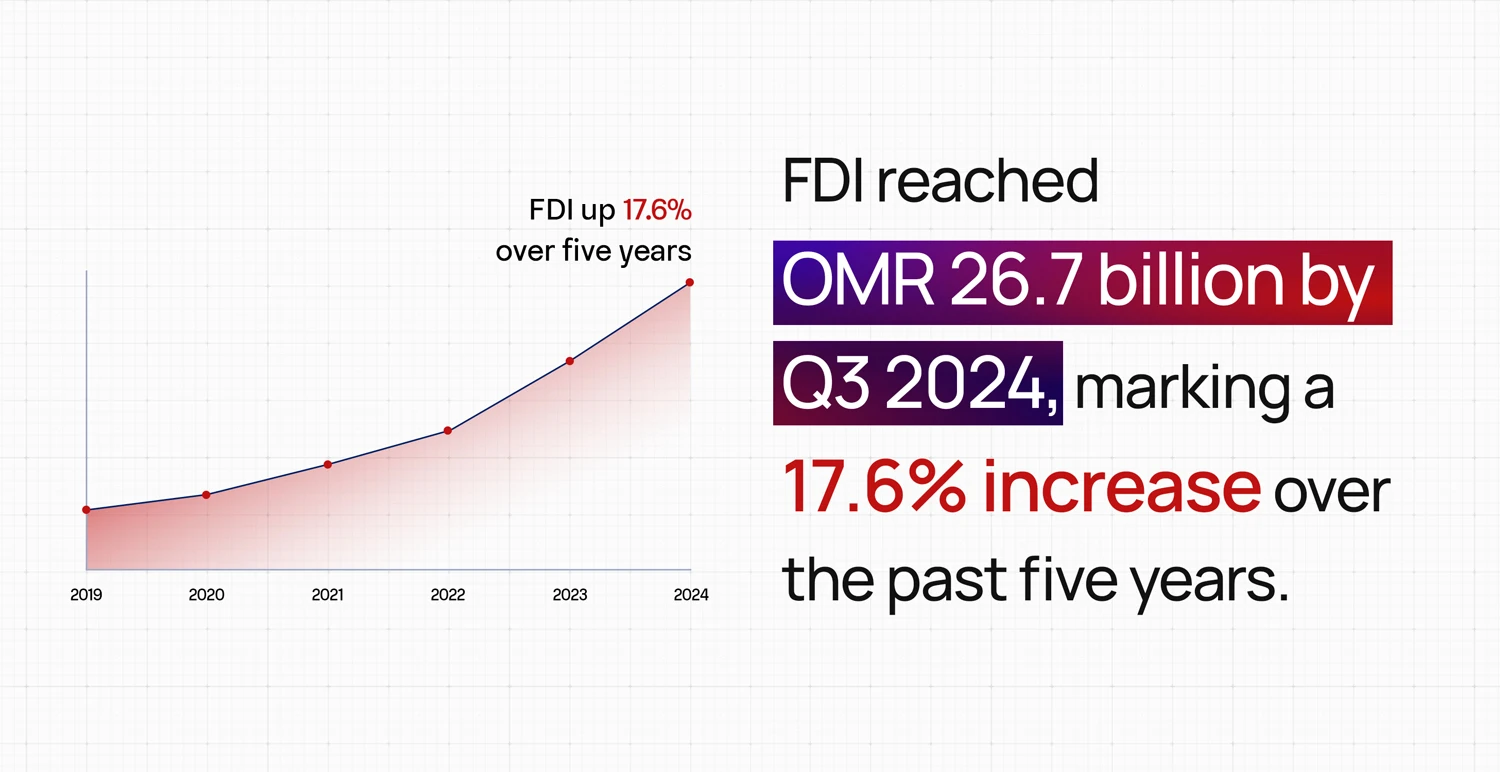

Oman has many untapped investments and business potential in many industries such as tourism, mining, fisheries, logistics and manufacturing and the government always encourages foreign direct investment and offers various incentives and free zones to promote a business-friendly economic environment and lure foreign entrepreneurs for doing business in Oman.

Oman offers many opportunities for foreign investors to become a long term business and investment partner and invest in company formation in Oman.

Friendly Taxation Policy

Import Exemptions

Capital & Profit Repatriation

Foreign Ownership

Strategic Location

Political & Economic Stability

Diversification

Infrastructure

Transparent Legal System

International Presence

Natural Resources

Land Availability

Language

Business Climate in Oman

Barring a few numbers of trades and services, no restrictions are imposed on company formation in Oman and doing business on its soil. 100% foreign ownership of Omani companies would now be allowed under the new Foreign Capital Investment Law (FCIL) RD 50/2019 proposed in January 2020.

A few of the 37 commercial activities not allowed for 100% Foreign ownership are mentioned as under.

- Translation and Photocopying

- Tailoring

- Vehicle and Automotive Repairs

- Sale of Drinking water

- Hairdressing and Salon Services

- Fishing

- Rehabilitation Centres

- Taxi Services

The restricted services, however, contribute to a small portion of Oman Economy and the new law would open up promising new sectors for 100% foreign investment and enthuse overseas companies for doing business in Oman.

The Ministry of Commerce and Industry ( MOCI) has embraced significant modernizing initiatives under the new FCIL regulation to facilitate and promote investor-friendly regimes in the Sultanate of Oman.

The new FCIL law doesn’t also stipulate the minimum share capital requirement which can transform the foreign investment landscape in Oman. The existing practice requiring a company with one or more foreign shareholders to have a minimum starting share capital of OMR 150,000 which is approximately $390,000 has now been relaxed by MOCI. However, being a new regulation it needs reconfirmation from MOCI on a case to case basis.

The new FCIL law is a revolutionary step towards globalization and modernization of Oman and will invariably bring a plethora of opportunities to the foreign business communities.

Types of Companies in Oman And Applicable Requirements

Business setup with a Local company

A locally incorporated company can take several forms

- Proprietorship Company

- Limited Liability Company

- Free Zone Company

- Joint Stock Company

- Holding Company

- Limited Partnership Company

- General Partnership Company

- Joint Ventures

Business setup with a foreign entity

There are three ways one can do business with a foreign entity

- Branch office

- Commercial Agencies

- Representative office

Most of the Omani Companies are LLCs or limited liability companies that foreigners are willing to invest and do business with. The number of founding members should be minimum two and maximum forty.

A foreign company is permitted to own a maximum of 70% of shares of an Omani company. If there is a free trade agreement with the country of foreign national, a higher %age of shares can be allowed.

The current minimum share capital requirement for a foreign-owned LLC is OMR 150,000 unless wholly owned by Oman citizens or GCC or FTA nationals for whom the initial capital investment requirement is OMR 20,000.

For joint stock and holding companies, the initial minimum capital requirement is OMR 500,000 and OMR 2 million respectively. Initial capital requirements are usually much higher for banks, financial services and insurance companies.

Partnership Companies

The features of Omani Partnership companies are

- Formed by two or more stakeholders

- Needs registration within a month of execution of partnership agreement in the Commercial Register

- Needs approval of all partners before transferring the individual interest

- Name of the partnership must spell that it is a partnership

- Any mishaps with one partner dissolve the partnership unless all other partners agree to continue

Proprietorship

Foreign Company Branches

Proprietorship

Process of Registèring a Company in Oman

1. Reserving a Company Name

2. Submitting Incorporation documents

On approval of company name, shareholders documents and company constitution along with the bank certificate and authorized signatory form needs to be submitted to MOCI for company registration in Oman.

3. Registering with Oman Chamber of Commerce and Industries (OCCI)

4. Designing a Company Seal

5. Obtaining approvals from Government Authorities

Based on company type, size and nature of business; you need to obtain a set of approvals from the appropriate authorities for company registration in Oman and include

- Tax Registration

- Oman police registration/li>

- Registration with the Ministry of Manpower

- Industrial, environmental and other permits and licenses

- Municipality License

- Registration with Oman Police

- Import Export License as appropriate

- Registration with Public Authority of Social Insurance

6. Post Registration Process

Documents Required for Registration of Company in Oman

Company registration in Oman requires the following essential documents

- Memorandum and Articles of Association

- Tax Registration Certificate

- Shareholders’ Visas and Passports

- Chamber of Commerce and Industry affiliation certificate

- Certificate of Initial Deposit

- Identity Cards of Shareholders

- Filled Company Registration Form

Tax Laws in Oman

Various aspects of Taxation in Oman are

- Registration with the Secretariat General of the Ministry of Finance is mandatory for all taxable entities

- A provisional return of income tax must be filed within 3 months of the applicable accounting period

- A uniform 12% tax rate is applicable for all companies irrespective of nationality and size, and profit up to OMR 30,000 is exempt from tax

- The final tax return must be filed within 6 months of the applicable accounting period

Tax Exemptions

The following are exempt from income tax in Oman

- Dividends received from an Omani company

- Gains on the disposal of Securities listed in Muscat Stock market

- Omani marine companies

- Foreign Airlines

- Investment funds

- Foreign companies engaged in the exploration of gas and oil

- Foreign companies working for government projects

Withholding Tax

- Royalties

- Management Fees

- Provision of Services

- Consideration for R&D

- Consideration for Computer Software

Indirect Tax

- Oman doesn’t impose any VAT or Sales Tax or Property tax; plans to implement VAT from April 2021 at a rate of 5%

- Stamp duty of 3% is levied in real estate transactions

- 5% Import duty as in other GCC countries on goods entering Oman

Personal Tax

- No personal income tax in Oman

Free Zones in Oman

Free Zones

- Salalah free zone

- Shohar free zone

- Al Mazunah free zone

Besides, there are eight Industrial Estates such as Rusayl, Sohar, Raysut, Sur, Nizwa Al Buraimi, Sumail, Al Muzanah offering highly attractive land rents, tax holidays, exemptions on machinery and equipment.

Special Economic Zones (SEZ)

- Duqm SEZ

- Knowledge Oasis Muscat

Accounting and Tax

| Type | Limited Liability Company (WLL) |

| Under Oman law, foreigners can own | 70% |

| Share Capital | OMR 20,000 |

| Memorandum & Articles of Association | Yes |

| Shareholders | Minimum Two |

| Can the entity hire expatriate staff in Oman | Yes |

| Tax Registration Certificate Required | Yes |

| Saudi Resident Secretary Required | Yes |

| Statutory Audit Required | Yes |

| How Long to open corporate Bank Account? | 3 weeks |

| Annual Return | Must be Filed |

| Annual Tax | Must be Filed |

| Access to Oman double tax treaties | Yes |

- Article, Saudi Arabia

- October 26, 2022

Why set up a Company in Saudi Arabia

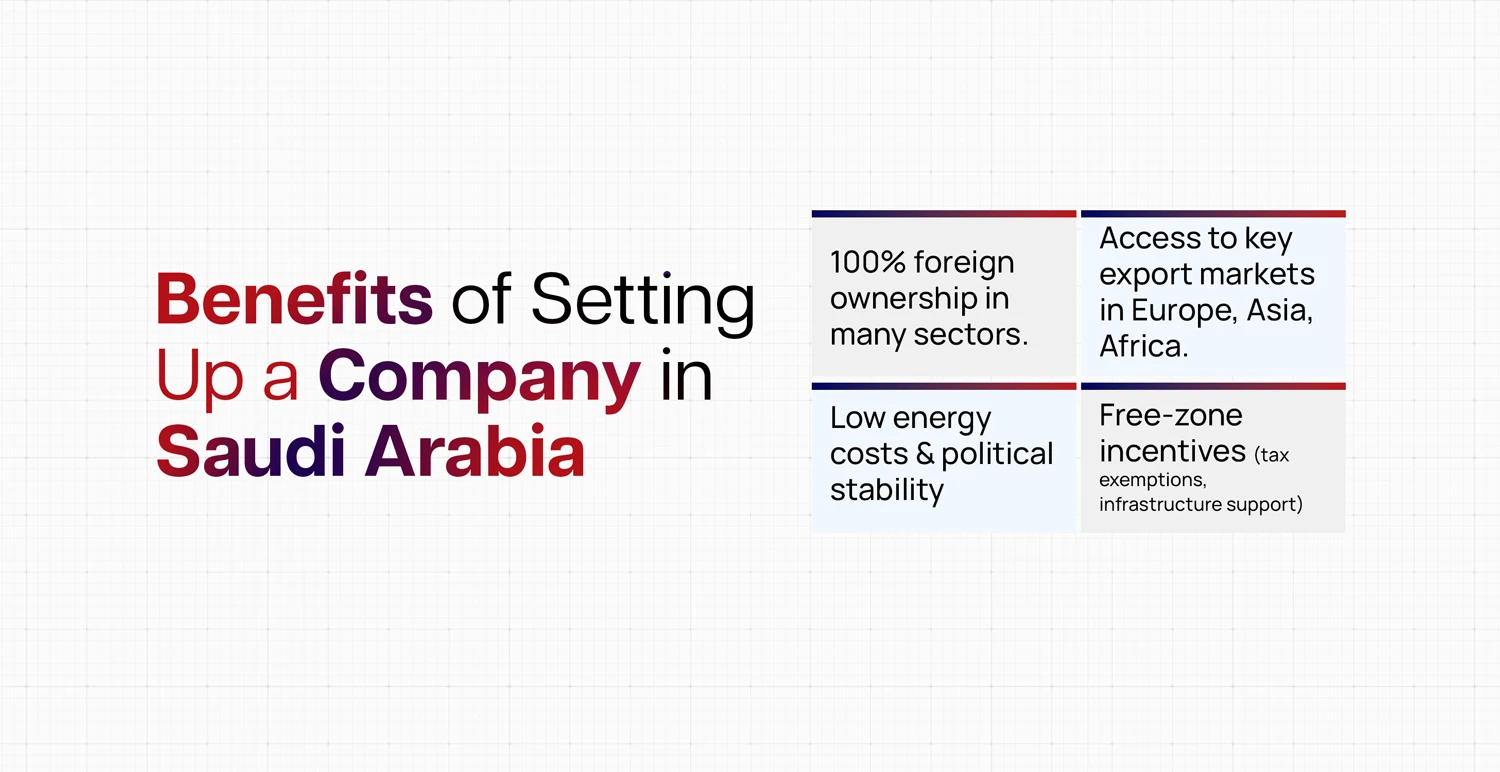

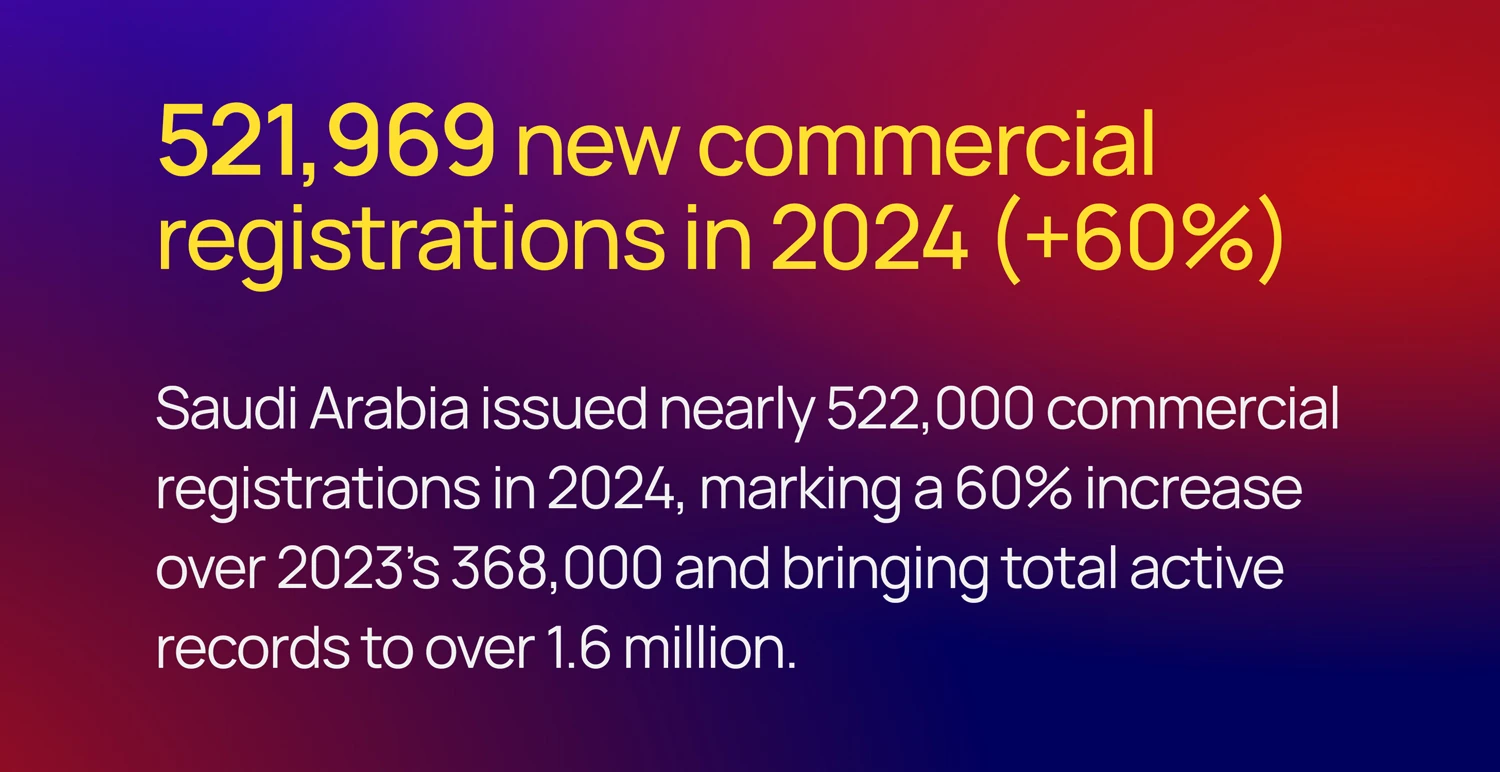

Best known for its huge oil industry, Saudi Arabia is the largest free-market economy in the Middle East and North Africa (MENA) with an approximate 28% share of total Arab GDP. The geographic location provides easy access to many export markets including Europe, Asia and Africa. Domestic consumption driven by a young and wealthy community is increasing steadily and continuously expanding local demand and accelerating the rate of company formation in Saudi Arabia.

KSA with the highest level of safe and secure business climate and political stability offers low energy cost and 100% foreign ownership in retail and wholesale sectors as a large privatization programme.

World Bank Regional Director of the Gulf Cooperation Council (GCC) and MENA, Issam Abousleiman said, “Saudi Arabia’s impressive reforms in doing business this year show its commitment to fulfilling the main pillar of its National Vision 2030: a thriving economy.” He also highlighted, ” Easing the business climate for local entrepreneurs to thrive as well as foreign investors to work in the Kingdom shows a forward path to creating more jobs for Saudi youth and women, and creating sustainable, inclusive growth.”

Major reforms attracting more foreign investments and doing business in Saudi Arabia are

- A one-stop system simplifying and easing business startups

- Protection of minority investors

- Simple and easier Enforcement of contracts

- Easier availability of credits through new insolvency law and secured transactions law

- Online platform for construction permits

- Cross border trading and investments

- Easy resolution of insolvency and financial restructuring

- Streamlining availability of power

- Why set up a Company in Saudi Arabia

- Which sectors are promising for new business set up in Saudi Arabia

- How many types of companies in Saudi Arabia

- How to form a Company in Saudi Arabia

- How free zones helped diversify Saudi Arabian Economy

- What legal requirements to be considered before Company Formation in Saudi Arabia

- Accounting and Tax

- Corporate tax rate for unlisted Company is 35%

Which sectors are promising for new business set up in Saudi Arabia

High standards of living and a young society are boosting the domestic demand and various business sectors are offering immense success and growth possibilities in the KSA now. Following are some lucrative sectors for doing business in Saudi Arabia.

- Tourism and Hospitality

- Steel Manufacturing

- Engineering and Technology

- Real Estate

- Lubricants, Glass and Plastics

- Education

- Healthcare and Pharmaceutical

- Financial services

- Media and Entertainment

How many types of companies in Saudi Arabia

Saudi Arabia, one of the largest emerging economies in the MENA and the MEASA regions offer many different corporate vehicles to its prospective business owners and investors. An understanding of the right corporate entity is important before an investment decision is made.

Company formation in Saudi Arabia and operations of the corporate entities come under the New Companies Regulations (NCR) act came into existence on 2nd May 2016.

The five forms of companies available for both local and foreign businesses in Saudi Arabia are

- Limited Liability Company (LLC) It is the most commonly formed company in Saudi Arabia. It allows minimum liability for owner’s against company debt. An LLC company is not permitted more than 50 shareholders.

- Joint Stock Company (JSC) It consists of capital that is divided into shares of equal value.

- Single Member Limited Liability Company (SMLLC) It is a limited liability company and can have a sole owner who owns all the shares of the company. There are many benefits of owning an SMLLC and one can’t own more than one such company.

- Limited Partnership Company (LLP) It is a partnership company in which some or all partners have limited liability with elements of partnerships and corporations.

Besides, special business forms are available to foreign companies for doing business in Saudi Arabia.

- Joint Ventures

- Branch Office

- Representative Office

How to form a Company in Saudi Arabia

1. Pre-incorporation Process- Planning and Strategy

During this process, due diligence is done on the optimum business type, paid-up capital and license requirement. Following are list items to be considered during this phase

- The name of Business/ Company

- The Type of Business Entity; LLC, JSC, Branch Offices or other types

- Organizing Documents such as Business License, Certificate of Incorporation, Board Resolution, Power of Attorneys etc.

2. Incorporation Process

Once everything has been planned and reviewed, the company registration in Saudi Arabia can be started with simultaneously working on different steps to optimize the time duration. The steps involved are

- Application for Investment License

All non-GCC foreign investors need to apply to the Saudi Arabian General Investment Authority (SAGIA). Nature and size of the investment activity with key financial information on the company’s operation should be clearly stated and the SAGIA application form to be filled in. The SAGIA will then issue a pre-approved certificate confirming the company’s registration with 100% foreign ownership, as appropriate. - Articles of Association

This will need to be submitted to the Ministry of Commerce and Investment and once approved, the document needs to be notarized to register for Commercial Registration certification and Tax Number, and subsequent publication of Articles of Association with a company name in the newspaper. - Registration of Company Name

The name for company registration in Saudi Arabia must be reserved with the Unified Centre and get approved before submitting incorporation forms, articles of association and the deed of establishment. - SAGIA Foreign Business Investment License

On successful submission of all documents such as the CR, Tax Registration, Municipality License and Bank’s Share Capital deposit letter and approval, SAGIA issues foreign business investment license and allows the company to sign contracts, issue invoices and hire employees. - MERAS Registration

It is a government program mainly for foreign company registration in Saudi Arabia and managed by Saudi Business Centre for facilitating procedures and providing services for business operations to speed up the business setup process. Companies can register with a municipality under MERAS and a physical office will be required for registration. The complete registration has to be submitted to the Saudi Arabia Ministry of Commerce and Industry (MOCI)

The Certificate of Registration (CR) is normally issued in 6 weeks and the company does tax registration. Under MERAS, companies can notarize the Articles of Association online, register with the Ministry of Labor and Social Development (MLSD) the General Organization for Social Insurance (GOSI) and the General Authority of Zakat & Tax (GAZT) including registration with Wasel. - Creating Company Seal

Company seal needed for contractual agreements, shareholders and management resolutions, Government documents, Official letters and notices must bear the CR number and Company name. - Registration at Chamber of Commerce

Within 30 days of registration of CR, all business entities seeking company registration in Saudi Arabia need to submit the certificate of membership obtained from the Chamber of Commerce and Industries (CCI). - Bank Account Opening

A local bank account required to be opened within 90 days of issuance of Commercial Certificate.

3. Post-incorporation Process and Staying Compliant

Once the company is incorporated, the following activities need to be initiated for completion of the entire process of company formation in Saudi Arabia.

- Saudi Employment Visas

- Conversion of Bank Account to a corporate bank account

How free zones helped diversify Saudi Arabian Economy

Saudi Arabia has implemented two types of free zones to attract foreign investments in economic and industrial activities. While industrial free zones are dedicated mostly for manufacturing industries, the economic free zones were launched for basic economic activities such as Agriculture, Healthcare, Education, Logistics, Science and Research etc.

The industrial cities were built during the 1980s and subsequently transformed into great economic hubs. Economic cities were established at the start of this century and are still being developed. Both the industrial and economic free zones allow 100% foreign ownership besides offering tax exemptions and low tax rates.

Free zones development plan mainly emphasized the need to diversify the country’s economy and reduce its reliance on oil and gas through the utilization of non-oil resources.

Presently, Saudi Arabia, has 28 industrial cities administered and maintained by Saudi Industrial Property Authority and offering custom duty exemption on raw material and equipment, easy availability of loans up to 75% of the capital, extended repayment period of loans up to 20 years and low land lease. Two most famous industrial cities are Yanbu and Jubail and major petrochemicals, fertilizers, steel, iron and chemical manufacturing facilities are located here.

Tax incentives are yet to be implemented in the economic cities which would include custom duty exemptions on raw materials and machinery, lower tax on training and salary cost and overall tax exemptions on some specific business units. Famous economic cities are Jazan economic city, Knowledge economic city and Prince Abdulaziz Bin Mousaed Economic city.

What legal requirements to be considered before Company Formation in Saudi Arabia

Tax Structure in Saudi Arabia

No personal income tax is levied on employees earnings however, companies are taxed based on the company type and business set up.

All registered companies come under the jurisdiction of corporate tax including companies and branches owned by foreign investors. The applicable tax rate is 20% for non-listed companies.

Tax is imposed based on net profits. Incomes earned through interest are also taxed for non- Saudi and non-GCC nationals. The Saudi and GCC nationals, however, need to pay a 2.5% religious tax called Zakat tax.

Withholding taxes are levied on entities who make payments to foreigners e.g rent and management fees. Withholding tax rates are imposed at different tax rates and 20% for management fees, 15% for royalties, and 5% for rent, airline tickets & freight and international telecommunications services.

Activities Prohibited for Foreign Investors

100% Foreign investment is allowed in the service sector. Trading and retail business are mostly prohibited from foreign investors. Following is a list of prohibited activities that include but not limited to

- Defence and military equipment manufacturing including uniforms and related devices

- Security Services and Investigation Agencies

- Brokerage companies in Real Estate

- Drilling and Exploration of Oil and Gas

- Fishery Business

- Real Estate Investment in Medinah and Makkah

- Printing and Publication Business

Minimum Paid Up Capital

Though there is no statutory minimum capital requirement, normally SAGIA requires foreign LLCs to have SAR 500,000 capital minimum. Based on activities, the minimum paid-up capital requirements are

- 100% Foreign Commercial: SAR 30 million with a commitment for at least SAR 200 million investment in the first five years

- Commercial with 25% Saudi Partner: SAR 7 million and a minimum SAR 20 million contribution from the foreign investor

- Service & Property Investment, Real Estate SAR 30 million

- Trading SAR 20 million

- Service Transport: SAR 500, 000

- Agriculture: SAR 25 million

- Contracting: SAR 500,000

Accounting and Tax

There is no personal income tax on income earned by individual and employees. However, there are three type of taxes levied on the Companies based on the shareholding structures.

Where a company is owned by both Saudi and non-Saudi interests, the portion of taxable income attributable to the non-Saudi interest is subject to Corporate tax, and the Saudi share goes into the basis on which Zakat is assessed.

- Corporate Tax: on all registered entities including companies or branch having foreign ownership.

- Withholding tax: on entities making payment to non-residents, such as for rent, loyalties and management fees

- Zakat (Islamic wealth tax): Zakat, a religious levy, is charged on the company’s Zakatbase at 2.5%. Saudi citizen investors (and citizens of the GCC countries, who are considered to be Saudi citizens for Saudi tax purposes) are liable for Zakat

- Drilling and Exploration of Oil and Gas

- Fishery Business

- Real Estate Investment in Medinah and Makkah

- Printing and Publication Business

Corporate tax rate for unlisted Company is 35%

Basis for Corporate Taxation:

- Tax is on the net adjusted profits

- The share of profits attributable to interests owned by non-Saudi / non-GCC nationals is subject to income tax

- The share of profits attributable to interests owned by Saudi / GCC nationals is subject to Zakat (religious levy)

Withholding tax rates

- Rent 5%

- Royalty or proceeds 15%

- Management fees 20%

- Payments for airline tickets, air or maritime freight 5%

- Payments for international telecommunications services 5%

| Type | Limited Liability Company (WLL) |

| Under Saudi Law, Foreigners Can own | 100% (in certain activities) subject of FSI approval and manufacturing / trading requires local national participation |

| Share Capital | SR 500,000 |

| Director | Minimum One |

| Shareholders | Minimum Two |

| Memorandum & Article of Association | Yes |

| Can the Entity hire Expatriate in Saudi | Yes |

| Saudi Resident Secretary Required | Yes |

| Statutory Audit Required | Yes |

| How Long to open corporate Bank Account? | 4 Days |

| Timeframe for Incorporation | 6 Months |

| Annual Return | Must be Filed |

| Annual Tax | Must be Filed |

| Access to Saudi Double Tax Treaties | Yes |

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group