- Article, Saudi Arabia

- June 9, 2021

Essentially an oil-based economy, Saudi Arabia enjoys a great global reputation as a business-friendly nation. The country is a member of several international institutions including WTO, G20, GCC, OPEC etc. and offers huge investment opportunities. Construction, real estate, healthcare and life sciences, education, energy, chemicals, IT and Industrial Manufacturing are the most sought after non-oil business sectors for company registration in Saudi Arabia.

Saudi Arabia recently made significant improvement in all its global business indices rankings and as per the latest “ease of doing business” report of the World Bank advanced 30 places to 62nd from its 92nd ranking in 2018.

The World Bank reported the Kingdom as one of the greatest reformers in economic and social aspects propelled by the Saudi Vision 2030 which introduced many regulatory and policy reforms to simplify doing business in Saudi Arabia and attract foreign investment in the country.

The Kingdom has been a staunch advocate of technological innovation to bring improvement in many diverse areas such as education, health care and desalination and power distribution. King Abdulaziz City for Science and Technology (KACST)) as well as the already planned USD 500 billion high-tech mega-city will also help in fuelling the country’s economic growth.

- Licensing in Special Economic Zones & Free Zones

- What are the business structures in Saudi Arabia?

- What are the procedures to set up a business in Saudi Arabia?

- Who can set up a business in Saudi Arabia?

- Why are foreigners preferring Saudi Arabia as a future business destination?

- How is the tax structure in Saudi Arabia?

Licensing in Special Economic Zones & Free Zones

- King Abdullah Economic City, NEOM and KAEC offer up to 50% corporate tax holidays.

- Customs-duty exemptions on machinery and raw materials imported into free zones.

- One-stop-shop licensing via zone authority accelerates approvals (often within 4–6 weeks).

- Sector-specific incentives (e.g. logistics, ICT, biotech) with pre-approved land plots.

- Simplified foreign-ownership rules—100% foreign shareholding permitted in most zones.

What are the business structures in Saudi Arabia?

The following business structures are available in Saudi Arabia as per the company regulations

- Branches of a foreign company most commonly incorporated by foreign investors.

- Joint Stock Company.

- Joint ventures.

- Representative Office (Technical and Scientific Office, TSO).

- Limited Liability Companies also preferred by most foreign investors.

- Limited partnership.

- General partnership.

What are the procedures to set up a business in Saudi Arabia?

- Obtaining an investment license from the Saudi Arabian General Investment Authority (SAGIA).

- Notarizing the articles of association.

- Opening a local bank account and making the initial deposit.

- Registering with the Customs department.

- Registering with the Ministry of Labor.

- Register with the Mudad Business Portal to facilitate admin and finance procedures for your business entity.

- Reserving the company name and submitting AOA, articles of association and other mandatory documents.

- Making payment for company registration.

- Registering with the General Organization for Social Insurance (GOSI).

- Registering with the Chamber of Commerce.

- Obtaining a municipality license.

- Registering with the electronic Qiwa HR portal.

- All documents needed for submission must be translated into the Arabic language for filing with the regulatory bodies.

- Obtain investor (Mubadara) visa via MISA portal, valid for two years and renewable.

- Secure work-permit (Iqama) by submitting medical and biometric checks through Absher.

- Sponsor family “Dependents Visas” once Iqama is active—typical processing in 2–3 weeks.

- Use Qiwa’s integrated services for visa status tracking, renewals and exit/re-entry visas. Factor in SAR 1,200–1,800 annual government fees per expat for visa and Muqeem service.

Who can set up a business in Saudi Arabia?

Local Sponsorship & Saudization Requirements

- Appoint a Service Agent (for 100% foreign LLCs) or Local Partner (for shareholding vehicles).

- Draft and notarize the local-sponsorship agreement to define rights, fees and control.

- Comply with Nitaqat quotas—maintain minimum percentages of Saudi nationals on payroll.

- Leverage HRDF training grants to upskill Saudi hires and meet Saudization targets.

- Annual Saudization audits via Ministry of Labor portal, with remedial action plans if shortfall.

All non-Saudi nationals as per the foreign investment act are allowed to make investments in the Kingdom and can become stakeholders in minority, majority or 100 per cent foreign-owned ventures. However, there are sectors where foreign investment is not allowed as per the “negative list” issued by the government.

The sectors not included on the negative list should be treated as open to foreign investments. Saudi foreign investment act allows equal opportunities to non-Saudi firms. Expropriation of foreign-owned assets is only permitted as an exception under Saudi laws. The Kingdom permits buying property and allows businesses to sponsor their employees.

Why are foreigners preferring Saudi Arabia as a future business destination?

Specifically designed to attract foreign investment, Saudi Arabia extends the following incentives to the foreign investors

- Export credit financing.

- Subsidized power, water and natural gas.

- Financial incentives for R&D projects that enable economic growth.

- Loan facilities for industrial investments both in public and private sectors.

- For foreign investors investing in some underdeveloped provinces including Jazan, Najran, Al-Baha, Al-Jouf, Ha’il and Northern territory, the government allows 10-year tax concessions.

- Customs duty waiver on some specific materials, machinery and equipment.

- Employment-related support by Human Resources Development Fund (HRDF).

- No major restrictions by the Saudi Arabia Monetary Authority (SAMA) on the inward or outward movement of funds by companies.

- An LLC can be incorporated by one shareholder instead of a minimum of two mandated earlier.

- Reduction in minimum share capital requirement for JSCs to SR500,000 from SR2,000,000).

- Reduction in the minimum number of shareholders for JSCs to two from five.

- Reduction in yearly statutory reserve requirements for LLC shareholders to 30 per cent from 50 per cent earlier.

- Annual financial audit and GOSI/Zakat filings due by end of fiscal year (Dec 31).

- Corporate governance: hold two board meetings per year, maintain minutes and register.

- File commercial-registry renewal and Mudad updates every 12 months via MCI portal.

- Submit Qiwa-based labor-law compliance reports quarterly (Saudization, work hours).

- Implement AML/KYC program updates per SAMA circulars, with periodic internal reviews.

How is the tax structure in Saudi Arabia?

A resident corporation is taxed on income generated in Saudi Arabia and considered resident when registered as per the regulations for companies in Saudi Arabia or its head office in the country.

Any non-resident carrying out income generation activities through a permanent entity is taxed on income accrued to it.

Only non-Saudi investors are liable for income tax and GCC nationals are treated as Saudi citizens for tax purposes. Non-Saudi taxpayer’s share of a resident company or a Non-resident’s income from a permanent establishment in Saudi Arabia attracts 20 per cent corporate income tax and Zakat at a flat 2.5 per cent rate.

A company in Saudi Arabia having both Saudi and foreign shareholders is liable for corporate income tax based on the portion of taxable income from the non-Saudi operation, while only religious tax Zakat is applied to Saudi business activities. Saudi Arabia doesn’t provide any foreign tax relief to foreign companies.

Withholding tax is levied while distributing dividends to the non-residents including non-resident GCC shareholders and at a 5 per cent rate.

Capital gains are subject to Zakat and the government doesn’t levy any tax on capital duty, stamp duty and real estate duty.

There is no withholding tax on payments made to non-residents for the import of goods.

Conclusion

The Ministry of Investment of Saudi Arabia (MISA) has several branches in Riyadh, Jeddah, Dammam, Medina, and Jubail to serve the investors and address their issues.

Many industrial sites are built to attract foreign investors in Riyadh, Jeddah, Dammam, Qaseem, Al-Ahsa and Mecca offering subsidiary companies tax exemptions for 5 years with subsidized electricity, water, fuel etc.

Due to the covid pandemic, the Saudi government deferred income tax and zakat filing for 3 including the postponement of filing of withholding tax returns for the months. of March, April and May for 3 months. The government is also planning additional tax and financial incentives to mitigate the adverse effects of the pandemic.

- Newsletter, U.A.E

- June 9, 2021

Cabinet Decision No. 49 of 2021 has announced amendments of certain provisions of the old cabinet decision No. 40 of 2017 regulating the Administrative Penalties for Violation of Tax Laws in the UAE. This has also been confirmed by the Federal Tax Authority (FTA) on 29th May 2021.

Before this newly issued cabinet decision 49 of 2021, heavy penalties often used to be imposed on taxpayers for non-compliance with the VAT and excise rules and regulations. Though the imposition of the high penalty was originally aimed for increased tax compliance, it often put the taxpayers in difficult and stressful situations.

The amendments brought in are designed to help tax registrants and support them in fulfilling their tax obligations. It is hoped that the relaxation of penalties passed by the government should enhance the competitiveness of UAE for conducting business.

“The new amendment will become effective on 28th June 2021 and will reduce many administrative penalties imposed for violating tax laws. This comes as part of the wise leadership’s directives to implement the tax system according to the best standards that ensure further growth for the national economy and help achieve transparency and economic momentum, providing an ideal and resilient tax legislative environment that encourages self-compliance and keeps pace with change through constant issuance of decisions in accordance with phased requirements,” highlighted Khalid Ali Al-Bustani, the Director-General of the FTA in a press release on Saturday.

The Director-General wanted the tax registrants to avail the benefits announced in the new amendment. The newly passed decision offers additional reliefs to the tax-paying business sectors and shall support them in meeting their tax obligations with ease effectively contributing towards the enhancement of UAE’s economic growth.

Al-Bustani also stated that 16 different types of administrative penalties under the old cabinet decision of 2017 have either been reduced or the earlier method of calculating penalties amended (TAXP001). He also explained that the reductions are primarily enacted for tax penalties including administrative violations on Tax Procedures, Federal Decree-Law on Excise Tax, and Federal Decree-Law on Value Added Tax (VAT).

Al-Bustani added

“The amendment includes fundamental amendments that provide more facilities to help taxable persons achieve self-compliance and encourage the speeding up of voluntary declaration. Under these amendments, a late payment penalty will not be imposed on voluntary disclosures if payment is settled within 20 business days of submitting the voluntary disclosure, and the sooner the taxable person declares and pays due tax according to periods specified by the decision, the lower the value of the penalties will be. This constitutes an incentive and a good opportunity for tax registrants who have errors in declarations, tax assessments, or requests for tax refunds, to speed up the implementation of voluntary declaration procedures and avoid increasing penalties.”

In a press briefing, FTA noted that the tax authority shall redetermine the administrative penalties (TAXP002) enforced on the taxpayers before the final rollout of the amendment scheduled on 28th June 2021 and will include the reassessment of the penalties which have not been fully paid, to be equal to 30% of the total of such unpaid penalties. It was emphasized that to take advantage of such a scheme, the taxpayers must settle their payable tax in full by no later than December 31st, 2021, and 30% of the total administrative penalties due and unpaid by 27th June 2021, by no later than December 31st, 2021. The detailed implementation procedure shall however be decided on a later date, the FTA remarked.

Two new detailed clarifications on this amendment have already been published by the FTA within the framework of the ‘public clarification service’ provided on the FTA’s official website and as a part of their ongoing awareness program.

The public clarifications hosted on FTA’s website are meant for making the existing and potential taxpayers more acquainted with tax aspects with easier and simpler explanations and help them put into effect the UAE’s tax principles effectively.

01

The first public clarification (TAXP001) includes some basic amendments made to the table of administrative violations and penalties related to the application of Federal Law on Tax Procedures (Cabinet decision No. 51 2021) for ensuring the right interpretation of these amended penalties and with added certainty.

02

The second public clarification (TAXP001) specifies the methods and procedures used for re-determining some of the administrative penalties imposed in the old cabinet decision that would come in force before the effective due date of the new amendment on 28th June 2021.

The Cabinet Decision No. 49 of 2021 however presents both opportunities and threats to businesses falling under VAT executive regulations.

Though an early voluntary disclosure of any tax fallout is encouraged with the enactment of nominal penalties, it would be quite a large amount for cases where non-compliance is not detected timely and not disclosed. It becomes of paramount importance to critically review records and audit findings for identification of non-compliance in VAT payment and preferably get their systems re-audited by an experienced and qualified third party.

It is also important for companies to identify the applicability of disclosure by reviewing VAT treatments in previous years.

It shall also be equally necessary to identify any unpaid tax penalties if the companies can benefit from the tax reliefs announced.

How IMC can help you?

IMC with its many years of extensive and proven experience in tax compliance, management and planning in the GCC region and especially in the UAE can support companies in identifying all taxation and planning aspects of businesses in light of the recent amendments.

Once a business is aware of any tax errors, it will need to consider which penalties may be applicable (e.g. penalties for the errors, late payment penalties, etc.) and the steps that should be taken to minimize the impact of the penalties.

The new amendments in VAT executive regulations are welcome and expected to address the requirement clarifications of the business community before rollout.

- Article, Singapore

- June 3, 2021

An Overview

Individual wealth and private capital have grown significantly over the past decade and Singapore has witnessed a surge in Single-Family Offices (SFOs) growing fivefold over the past couple of years. As confirmed by the Monetary Authority of Singapore (MAS) the SFOs are neither registered nor licensed entities and as of December 2020, there were some 400 SFOs in Singapore with an estimated asset of USD 20 billion.

What are Single Family Offices?

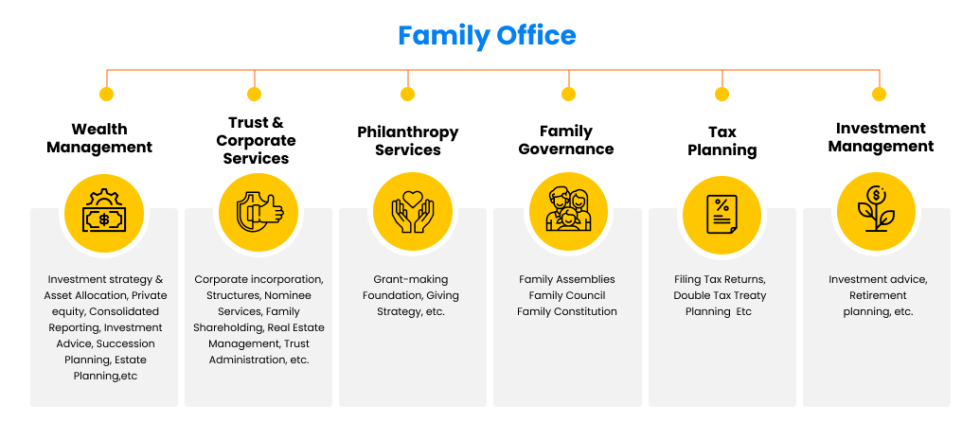

Though managing investments and related finance and administration activities are the key functions, the SFOs may also involve other activities including management of accounts, tax filing and compliance, managing charities, family governance and lifestyle management, risk management and wealth and succession planning.

Generally, financial advisors, investment analysts, legal and tax professionals are employed by SFOs for wealth planning and operational matters.

Why is Singapore chosen for Single Family Offices?

- Reduced risks of regulatory changes and business environment.

- Political stability.

- World Class infrastructure.

- Transparent Legal System.

- Presence of investment and international banks.

- Regulated financial market.

- High standard of living.

- Expertise in business services, banking and Fintech.

- A competitive corporate tax rate.

- Strategic location in the middle of Asia.

- Good Business connectivity.

- Availability of financially skilled manpower.No Bureaucracy.

- Availability of Tax Incentives.

What are the Activities carried out by Single Family Offices?

The tasks that usually come under the purview of the SFOs are

- Technologies usually outsourced except for the handling of social media.

- Bookkeeping, accounting, budgeting and cash flow planning are often outsourced to accounting services in Singapore .

- Tax and wealth planning, only regulatory compliance is done in-house while tax planning is outsourced.

- Operations except hiring and employment are usually managed by external services.

- Investments including planning, policymaking, asset allocation are done in-house.

- Legal services are outsourced.

- Family governance, education and succession planning are mostly outsourced.

- Charitable services are managed by external sources.

- Risk management about fraud and data theft, insurance, managed both in-house and by external agencies.

What is the business form of Single-Family offices?

An SFO structure normally involves a holding company or a trust directly owning both the SFO and the fund entity as assets. Single-family offices are normally formed by wealthy families desirous to manage and control their finances, businesses and various aspects of their lives and each beneficiary is a connected person to the settlers of that trust or a charity.

The SFO structure aims for achieving dual purposes, firstly obtaining the licensing exemptions and then availing tax exemptions including tax incentives. However, being eligible for tax incentives under the Income Tax Act, a fund manager must have real operations in Singapore as per the Section 13X incentive. The law also stipulates that an SFO must engage a minimum of three investment professionals, each having five years of investment experience.

The register of shareholders of the holding company is centrally maintained and treated as a non-public register with effect from 2020 and the information on ultimate beneficial owners are never shared.

Likewise, the trust companies are needed to collect and maintain information about the ultimate beneficial owners of the trusts they administer, but there is no public register of trusts or their ultimate beneficial owners.

How are Single Family Offices incorporated?

Several regulatory and administrative requirements are involved in establishing an SFO including the registration of the corporate structures, bank account opening, annual filing of tax returns and adhering to common reporting standards (CRS) and foreign account tax compliance act (FATCA).

By incorporating your Singapore Company on an SFO platform, you will enjoy several benefits including easy wealth transfer without probate, asset protection, asset allocation flexibility considering future succession planning, confidentiality, and ease of charities and donations.

Singapore Trust Companies Act (Cap. 336) applies to SFOs with the MAS as the regulatory authority. Wealthy families can either choose to outsource a licensed professional trustee or set up their own Private Trust Companies (PTC) requiring no licence. A licensed trust company however must be engaged in monitoring counter money laundering and terror financing activities.

Setting up an SFO in Singapore is mostly simple and straightforward however corporate service providers with adequate fund management and administration expertise often become the necessity for effective SFO operations who can help evaluate ongoing NAVs and performance about other asset classes, identify annual audit and exemption requirements, choose annual and semi-annual financial reporting, register with ACRA, engage a company secretary and appoint a nominee shareholder for signing company’s constitution.

How is the taxation for Single Family Offices?

The prevailing corporate tax rate is 17% in Singapore on income sourced and/or remitted in the country. There is no capital gains tax with many tax exemptions available. Singapore also entered the Double Tax Avoidance Agreement (DTAA) with many countries and offers tax exemption to resident corporate taxpayers on foreign dividends.

The legal and tax environment makes Singapore a preferred destination for establishing an SFO and the following points are considered from a taxation perspective

- Individual tax residency based on the number of days spent in Singapore.

- Compliance obligations.

- Reporting requirements under CRS.

- Transfer pricing.

- Immigration under Global Investor Program.

Change to Income Tax Act; Effective December 31st, 2021.

As a result of the 2020 Revised Edition of Acts, the following sections will be renumbered in the Income Tax Act:

- Section 13CA is now renumbered as section 13D,

- Section 13R is now renumbered as 13O, and

- Section 13X is now renumbered as 13U.

From 18 April 2022, the criteria for Section 13O and 13U schemes will be more stringent.

The Monetary Authority of Singapore (MAS) has announced more stringent criteria for the family office incentive schemes. These new requirements for new applications under section 13O (previously section 13R) and section 13U (previously section 13X) will be effective from 18 April 2022 onwards.

The criteria for the section 13O scheme have been updated to include a minimum fund size, investment professionals to be employed by the manager, and local business spending. There is also a new requirement for funds to invest in local businesses.

| Section 13O | Section 13U | |

| Minimum AUM (based on Net Asset Value) | S$10 million at point of application which is to be increased to S$20 million within 2 years. | S$ 50 million at point of application (no change). |

| Investment Professionals | Minimum of 2, with a 1 year grace period that may be given to employ the 2nd investment professional. | Minimum of 3 with at least one of them not being a family member. A 1 year grace period may be granted to meet this requirement. |

| Local investments | 10% of AUM or $10 million, whichever is lower. A 1 year grace period will be granted if this cannot be met at time of application. | |

| – AUM < S$50 m | S$200,000 | S$500,000 |

| – $50 m > AUM >= S$100 m | S$500,000 | S$500,000 |

| – AUM >= S$100 m | S$1 million | $1 million |

Local investments include investments in equities listed on local stock exchange, equity investments in unlisted Singapore companies, qualifying debt securities and funds distributed by fund managers in Singapore.

The minimum amount of total business spending is now based on amount of Assets Under Management (AUM).

What is family wealth is invested by Single Family Offices?

The SFOs normally don’t focus on equity investment of other companies shares and normally make their major investments in

- Buying residential properties.

- Buying shares of private equity firms.

- Real estate investment.

- Ownership and investment in fund structures.

What are the challenges encountered by Single Family Offices?

The following are the three issues encountered by SFOs in Singapore

- Cross-border tax issues at the individual level due to the presence of a family in several tax jurisdictions due to its global presence.

- Inefficient tax structure due to inappropriate business form.

- Lack of a formalised governance structure due to the absence of proper policies and procedures.

Conclusion

High-net-worth families have currently embraced Singapore for setting up SFOs though traditionally they have been popular and well-established in North America and Europe.

The high growth trajectory of SFOs in Asia is comparatively recent and projects the unprecedented economic upliftment of this continent. Wealth accumulation has become faster by businesses in Asia than in any other part of the world and also driving new SFOs being formed in Singapore.

The need for proper succession planning has never been so important before the tremendous rise in family wealth and can only be successfully addressed by outsourcing professional service providers.

A Complete guide for doing business in Singapore

- Article, Singapore

- May 27, 2021

A Dependant’s Pass holder looking for a company setup in Singapore and running a business can now apply for a letter of consent subject to fulfilling certain eligibility criteria. Business operations however can only be started after receiving the LOC.

Eligibility Criteria

1. For being eligible to apply for a LOC, you need to own one of the following types of businesses

- Locally incorporated ACRA-registered Sole Proprietorship business or

- Locally incorporated ACRA-registered Partnership Business or

- If you are a Director of a company and in possession of a minimum 30 per cent shareholding in an ACRA-registered business

2. For being eligible for a renewal of the LOC, the following conditions apply

You shall require to hire a minimum of one Singaporean / Permanent Resident

- Earning the prevailing Local Qualifying Salary as a minimum and

- Receiving CPF contributions for at least 3 months

Local Qualifying Salary (LQS)

Earlier known as the Full-Time Equivalent salary, the Local Qualifying Salary (LQS) is used for determining the number of local employees that can be used to calculate your Work Permit and S Pass quota entitlement.

The LQS ensures that local workers when hired are not paid on a token sum to add to their headcount for S Pass and Work Permit quota entitlement to access foreign workers rather employed meaningfully. LQS also ensures that the government maintains effective quota control keeping pace with income levels.

A Singaporean or a Permanent Resident employee contractually hired under a set of terms and conditions, including the company’s director, is counted as one local employee if they earn the LQS of at least SGD 1,400 per month.

Existing LOC DP holders who are business owners

If you are a DP holder and running a business on an existing LOC, you are allowed to continue to do so till it remains valid or you can apply for a one-off renewal of the LOC until 30 April 2022. and after that, they must meet the eligibility criteria for LOC renewal or otherwise obtain an applicable Singapore work pass to continue working.

Validity of the Pass

- For First-time Applicants, the pass is valid either one year from the date of issuance or up to the expiry of DP and whichever time is shorter

- For Subsequent renewals, the validity remains up to the date expiry of DP

- The DP is cancelled

- The DP is expired

- The business ceased to be active needing cancellation of the LOC

Application Process for LOC for DP holders who are business owners

You can apply for a Letter of Consent to work in Singapore if you are an eligible Dependant’s Pass holder who wishes to operate a business.

Application for LOC is free and usually takes 4 weeks unless other information is sought by the regulatory authority. EP Online provides online services for the LOC.

Before submitting your application for LOC, you need to verify if your DP has a minimum of 3 months validity or else, you must renew your Dependant’s Pass before applying.

The Processing time for LOC is normally 4 weeks maximum in most cases.

The Process

1. Submitting an online request to apply for a LOC.

You normally receive the feedback of your application request within one week. Once your application request is approved, you can go ahead and apply for the LOC using EP Online.

You may also engage an authorized employment agent or a third party for submitting an online LOC application request.

2. Verifying your application status after 3 weeks unless additional information is needed.

3. Logging in to EP Online and printing the LOC.

Renewal, Cancellation or Replacement of a LOC for DP holders who are business owners

You are required to renew your LOC before its expiry. However, if you can also cancel your LOC if you so desire in case your business ceases to be active or operational. In case your LOC is lost or damaged you can request a replacement.

Replacement of your LOC

You must report once your LOC is lost and then make a request for a replacement.

Cancellation of your LOC

You must make a cancellation request within one week after your business becomes non-operational. You are allowed to put your cancellation request up to 2 weeks in advance

Except for advance requests, LOC cancellation is done immediately by logging in to the myMOM portal.

- Newsletter, U.A.E

- May 17, 2021

Dubai is one of the most open economies in the world with a strategic location between Asia, Africa, and Europe. Even at a time when the pandemic gripped the world in 2020, Dubai witnessed USD 3.26 billion FDI during the first half of 2020 and ranked fourth globally with several new business setups in Dubai.

To fuel entrepreneurship and grow the country’s SME sector, a special position of Minister of State for Entrepreneurship and SMEs was created during the July 2020 cabinet reshuffle. The Dubai government also initiated several support services to enhance the non-oil private sector’s contribution to economic growth and in line with the Dubai Vision 2021.

The Dubai government is leading from the front to mitigate the adverse effects of the covid pandemic and regulatory authorities are relentlessly striving to develop and ease regulatory and legal frameworks for Dubai company incorporation besides the identification of alternative funding routes and providing additional government support.

“We find a paradigm shift in the thought process of investors. The freedom to do business and safety are the key drivers of growth in the SME sector. The paperless e-governance added to the transparency and precision in administrative matters. Over the past decade, the UAE has evolved as the most sought-after destination for investors to set up their establishment so that they can cater to clients in MENA, and South Asia,” highlighted Syam Panayickal Prabhu, Founder and Managing Director, Aurion.

Dubai’s 50 free zones reverberate at the core of its startup ecosystem comprising some of the world’s leading free zones including Dubai Silicon Oasis (DSOA) or IFZA, Dubai International Financial Centre (DIFC), Jebel Ali Free Zone (JAFZA), and Dubai Multi Commodities Centre (DMCC) and offer numerous advantages to new businesses including 100% foreign ownership, zero corporate tax, nil import-export duties, 100 percent repatriation of revenues and profits, minimum documentation requirements and easier startup, easy recruitment and visa processes.

Saud Salim Al Mazrouei, Director, Hamriyah Free Zone Authority added, “Free zones are a driving force in the growth of the economy in the UAE. They help stimulate economic development, create jobs, boost and diversify exports, and expedite the industrialization process of an economy at lower costs for the government. Incidents like the Covid-19 pandemic with a sudden drop in oil price can serve as a catalyst for long-term sustainable economic reform.

There are also 6 business accelerators and 5 incubators in Dubai to support startups and SMEs including DIFC’s FinTech Hive and Dtec at DSOA providing support through startup incubation and venture capital funding. The Dubai Future Accelerators program facilitates partnerships between public and private sector organizations and startups in Dubai.

Dubai has long been eyeing a leading world position in innovation and technology, and financial technology acronymed as FinTech playing the most pivotal role in accelerating the business growth of Dubai startups during the covid pandemic. DIFC FinTech Hive is offering accelerator programs for FinTech startups with a total of USD 100 million funding support that has already benefited four companies.

Most important for the growth of the SMEs and startups is the availability of funds and Dubai is continuing its efforts to look for additional and alternative funding for addressing economic diversification strategy. Venture capital and crowdfunding are being encouraged by the Dubai government for sustaining startups and SMEs even with lower assets and proven and credible track records. As per a survey conducted by Dubai SMEs, almost 9 percent of SMEs received additional funding through the venture capital route.

Dubai also offers abundant diverse and talented human capital and secured top global ranking in terms of employee training and workforce motivation.

Though the IMF and World Bank have lowered the economic recovery forecast for all major economies, Dubai expects a fast V-shaped recovery in 2021 facilitated by Dubai Expo 2020 which promises to add USD 33.4 billion to the UAE economy by 2031.

As the consequences of the Covid-19 pandemic becoming severe, the Dubai government has started firing its arsenals on all cylinders to boost the economic diversification program and focusing on some strategic sectors including commercial trade, tourism, renewable energy, manufacturing, media, financial services, aviation and healthcare, and all SMEs and startups in general.

The increased economic contribution of private sectors to the national GDP is at the top of Dubai’s agenda as per the UAE’s Vision 2021 which was 70% some two years ago and is now expected to reach 80 percent by 2021.

In Dubai, almost 99 percent of companies from the private sector belong to the SME and Startup category and are projected to contribute nearly 46 percent of Dubai’s GDP.

“As always, the UAE is doing a fantastic job at attracting international interest on all levels of business and lifestyle, and therefore, it remains a top-ranked international destination to do business and to live”, commented Karl Hougaard, Founder and Managing Partner, Trade License Zone in a recent interview.

- Newsletter, Saudi Arabia

- May 17, 2021

Saudi Central Bank (SAMA) data reveals that 2020 witnessed the highest inflow of foreign investments in the Kingdom of Saudi Arabia (KSA) surpassing SR 2 trillion (USD 0.53 trillion) and rising 9 per cent YOY despite global economic turmoil caused by covid 19 pandemics. A USD 46.21 billion as new investment from overseas was generated by the KSA that promoted new foreign company formation in Saudi Arabia.

The whooping FDI was termed as significant by Fadhel Al- Buainain, a member of Shoura Council and positioned Saudi Arabia as one of the most attractive destinations for foreign investors because of diversified government investment programs and supportive legislative processes of the country’s investment ecosystem.

Al-Buainain also a director of Saudi Financial Association highlighted that SR173.3 billion investment at a time of global travel restrictions reinforced the fact that KSA effectively handled the challenges caused by the pandemic and successfully addressed the issue of the country’s reserve.

“Certainly, foreign capital is looking for opportunities in emerging markets . . . especially the Saudi market, which provides investment opportunities, safety and rewarding returns, in addition to important partnerships in major global pioneering projects,” Al-Buainain noted.

Partnerships were led by the sovereign wealth fund and the Public Investment Fund and opportunities were presented as a part of the Vision 2030 program, he added.

The increased FDI inflow was attributed to “the significant improvement in the investment environment in the Kingdom” and the up gradation of investment laws, remarked Talat Zaki Hafiz, an economist and financial analyst by profession. He also highlighted big government projects e.g. The Line and renewable energy projects as additional attractions for global investors.

Hafiz said, “The announcement of the SR27 trillions ($7 trillion) that will be spent by the government over the coming 10 years has attracted the attention of foreign investors.”

He also added, “I believe the decision of the government to diversify its economy away from oil has created huge investment opportunities to foreign and local investors.”

KSA issued 466 investment licenses to foreign investors for doing business in Saudi Arabia in the fourth quarter of 2020, a 60 per cent increase compared to the previous year and December adding 189 investment licenses. The overall FDI rose by more than 20 per cent during 2020 and increased 80 per cent to touch USD 1.9 billion with the economy growing to pre-pandemic levels. KSA also made remarkable improvement in the World Bank’s ‘ease of doing business ‘ index, advancing 30 points in the global ranking.

Issam Abousleiman, World Bank regional director for GCC said, “Saudi Arabia’s impressive reforms in doing business this year show its commitment to fulfilling the main pillar of its National Vision 2030 — a thriving economy.”

“Easing the business climate for local entrepreneurs to thrive as well as foreign investors to work in the Kingdom shows a forward path to creating more jobs for Saudi youth and women, and creating sustainable, inclusive growth,” he highlighted.

New businesses and startups witnessed the maximum surge with the cost of starting a new business dipping to an all-time low of 5.4 per cent of per capita income compared to 16.7 per cent in other parts of the MENA region.

“One of the most important factors that attracted foreign investors is the issuance of new legislation and amendments in some existing legislation,” noted Ayed Alblaihshi, a municipal investment specialist.

Access to the online construction permit, easy availability of electricity, enhanced access to credit, easy export and import laws including more transparent insolvency rules are some of the reforms that aided the country in achieving this feat, the World Bank reported.

- Newsletter

- May 17, 2021

The opportunity and freedom to strike global trade deals have long been cited as one of the main reasons for the UK leaving the European Union (EU).

In recent times it was also supported by Lord Edward Lister, co-chair of the UAE-UK Business council and a former Downing St chief of staff, revealing to business forums that the UK has made initial advancements towards striking free-trade deals with the Arabian Gulf countries.

Citing trade and business partnership with the UAE as unprecedented, Mr Lister, spoke to an online forum on Wednesday, 28th April 2021 and claimed that significant developments have been taking place for establishing trade ties with the GCC countries.

“There is a lot of work underway at the moment – the consultation is shortly about to start on it – on new trade arrangements into the Gulf, which will be a free-trade agreement,” he added and pointed out the involvement of the UK government in this regard.

“As the UAE reaches its 50th anniversary, the two countries’ friendship is going through a revival at the moment”, commented Ahmed Ali Al Sayegh, Minister of State of UAE & Chairman of ADGM and a co-chair of the business council.

Me. Al Sayegh also highlighted that the UAE and the UK have been taking leadership roles in the covid 19 vaccination drive and are optimistic of complete recovery from the pandemic with a resurgence from the social and economic issues caused by Covid-19.

The UAE Minister of State also noted saying, “This is such a pivotal year for both countries and it offers us an unprecedented opportunity for growing our trade and investment relationship.”

“We have both taken great strides in addressing the Covid crisis by vaccinating and hopefully our economies will be growing back through the investments we are making in infrastructure, technology and skills,” he commented.

It was one year ago when the UK left the EU politically and excited from the Union’s single market at the end of 2020. Since quitting, the UK wanted to forge new trade deals with potential economic partners in the world and especially with the Arabian Gulf countries providing better market access and a more conducive business and investment climate.

The former Chief of Staff aged 71, recently stepped down as the official envoy to the Gulf as he anticipated that developing circumstances of trade deals need someone else to play a bigger role and in a permanent capacity. He also sounded optimistic about the pandemic recovery and hoped for more resilient economies of the two countries with new trade and investment partnerships and business setup in Dubai.

The UAE and UK governments reached a partnership agreement in March, with Mubadala Investment Company as a strategic investment program and agreed to invest a total of 800 million pounds (USD 1.11 billion) in the British life sciences industry and stretched over the next five years.

Rebalancing the economy by adhering to some of the proven principles demonstrated by the UAE has also been a priority for London as the covid 19 pandemics has brought out some weaknesses of the British system to the surface.

“We’ve all learnt some terrible lessons from Covid,” Mr Lister remarked and also added saying, “We’ve got to have a much more resilient supply chain in place.” “The number one area there is food security and agricultural technology”, he noted emphasizing “The ‘build back better’ policy of the prime minister is a desire to increase economic production, particularly in the regions of Britain.”

Investments made jointly with a wealth fund for growth areas is a rare event for the British government as done in the Mubadala agreement in March, Mr Lister added.

He claimed that the recent partnership would unfold increased opportunities and the executive director of Mubadala’s UAE clusters, Badr Al Olama also reciprocated. As per him, this would lead to more investment opportunities and pave the path for more UAE and UK strategic investments and company formation in Dubai.

“We want to develop the new dynamic sectors such as energy transition and life sciences,” Mr Al Olama said.

- Newsletter, Oman

- May 17, 2021

The Value Added Tax (VAT), a consumption tax system has been enforced in Oman on Friday, the 16th April 2021 and the Sultanate has become the fourth country to join the other three GCC member states including the UAE, Saudi Arabia, and Bahrain to introduce this tax.

VAT was originally planned by Oman Tax Authority (OTA) in October 2020 vide Ministerial Decision 53/2021 and Official Gazette no.1383 publishing the regulations with implementation requirements and provided almost six months to the Omanis to be prepared for this tax. The country also plans to enact income tax in the foreseeable future to become the first Gulf nation to do so.

Oman has levied a 5 per cent VAT in line with the ‘Oman Vision 2040’ to diversify its oil-based economy to non-oil sectors e.g. manufacturing, travels and tourism and logistics and also to address its Fiscal Balance Plan for the future.

Both UAE and Saudi Arabia introduced this tax system on 1st January 2018 followed by Bahrain which implemented VAT after one year on 1st January 2019. The Kingdom of Saudi Arabia has already increased its VAT rate by 3 times taking it to 15 per cent since July 2020 to support its healthcare system including relief works and preventive measures for the pandemic.

An OMR400 million (USD 1.04 billion) has been estimated to be raised from this consumption tax this year that comes around 1.5 per cent of the country’s GDP and would help bring down its fiscal deficit.

A Common VAT Agreement was signed by the six GCC countries in June 2016 and the 5% VAT rate announced by Oman is consistent with this GCC Unified Agreement. There are also provisions made in Oman VAT law for zero-rating and exemptions. It is to be noted that the 5 per cent tax rate is one of the lowest rates as per the prevailing global standard.

While Qatar has planned to implement the VAT system in the second or third quarter of 2021 almost streamlining its tax administration system, Dhareeba; the Kuwait government is yet to confirm the VAT implementation schedule. Kuwait parliament deferred the implementation date many times in the past however as reported by the International Monetary Fund (IMF), the country is likely to enact its VAT law by 2022.

The below-mentioned supplies are treated as zero-rated as per the Oman VAT Law and don’t attract VAT due to social necessity.

- Supply of certain food products

- Supply of some specified medicines and medical equipment

- Investment in gold, silver, and platinum.

- Supplies related to the transport of goods or passengers made internationally or within the GCC countries including services in connection with transport

- Cargo and passengers related to international trade

- Supplies related to oil, oil derivatives and natural gas

- Some specific supplies made outside GCC countries under certain conditions

- All goods and services exempt from VAT in Oman and supplied to non-GCC countries

As per conditions outlined in the Oman VAT Executive-Regulation, the following essential services are exempt from VAT as per the Oman VAT Law.

- Financial services

- Healthcare services

- Goods and Services related to health care

- Goods and services related to education

- Resale of residential properties

- Transport of local passengers

- Renting of properties meant for residential purposes

Certain imported goods also enjoy the VAT- exempt status under Oman VAT law including returned goods, personal luggage, etc.

Excluding the above-mentioned supplies, all other goods and services in Oman attract VAT at the standard rate of 5% and as mentioned in the Oman VAT Law.

- Newsletter, Singapore

- May 17, 2021

The poorest in our society are the most affected class by covid 19 pandemic with minimum and no access to modern digital technologies including telephone, internet, television, and computers.

The digital divide refers and reflects this existing gap and inequalities emphasizing the importance of bridging the digital divide by providing digital infrastructures, services, and applications with an all-inclusive approach and empowering unprivileged individuals and societies to effectively utilize the information and communication technologies. It is feared that expanding digital technology can heighten digital inequalities with disinformation, harassment, and abuse, especially to women and children.

For combating the covid pandemic with sustainable growth, the UN President of the General Assembly recently convened a virtual one-day High-level Thematic Debate on Digital Cooperation and Connectivity on Tuesday, 27 April 2021, in the UN’s General Assembly Hall headquartered in the USA. The meeting was headed by the UN general assembly president Volkan Bozkir and aired online with some international speakers delivering speeches.

Singapore Minister of communications and Information, Mr. Iswaran participated in this high-level thematic debate and noted that though covid 19 has speeded up the digital transformation drive through the world, it has also increased the danger of inequalities between “the digital haves and have-nots”.

As per Roland Berger’s Digital Inclusion index 2020, Singapore ranked first among 82 countries across the world and Mr. Iswaran highlighted the need for an “inclusive, innovative, and interoperable,” digital future and expressed Singapore’s willingness to work in unison with other member states of the UN.

The one-day thematic debate stressed the immediate need for political commitment at the highest levels to address the digital divide in the current Covid-19 situation. The debate was held in response to requests made by the member states and was represented by private and civil society sectors including participants from more than 60 countries.

“To ensure that digital transformation efforts are inclusive, countries around the world must recognize the diverse circumstances faced by nations”, Mr. Iswaran deliberated in his speech.

He also emphasized that the measures taken by different countries and the experiences gained can be shared on UN platforms such as Internet Governance Forum for a strong and focused approach on digital inclusion.

“The platform brings together various stakeholders from the private and public sectors to discuss public policy issues relating to the Internet. The UN Roadmap for Digital Cooperation, which was released in June last year, is also a good start,” said Mr. Iswaran.

The UN has come up with a road map for bridging the digital divide that includes achieving universal connectivity by 2030, creating a more equitable world by promoting digital public goods, digital inclusion for all including the most vulnerable sections, strong digital capacity building, protection of human rights, global cooperation on AI, improving digital security, and lastly, a strong and effective architecture for digital cooperation.

“Singapore has a Digital Readiness Blueprint that could serve as a useful reference for other countries in fostering digital inclusion”, Mr. Iswaran pointed out.

The Singapore digital readiness blueprint acts as a guide to equip all segments of society including children in lower-income households, senior citizens, micro, small and medium-sized enterprises with digital skills and access.

“Countries must also be innovative in their efforts to end the digital divide”, emphasized Mr. Iswaran.

“The accelerated pace of digital transformation has created opportunities but is also profoundly disruptive to some, and requires complex trade-offs,” Mr. Iswaran narrated.

“In Singapore, the Digital for Life movement that was launched in February will encourage ground-up projects that bridge the digital divide”, he emphasized. As per him, the move shall provide resources to enhance basic computer skills.

Singapore treats the ‘Bridge the Digital Divide’ initiative as corporate social responsibility and advocates a new company set up in Singapore upon the policy of partnerships and collaboration with non-profit organizations and individuals working together for this cause.

The Minister also highlighted the importance of an interoperable digital framework for a brighter global digital environment that would help individuals and businesses gain access to global opportunities.

“In Asian, initiatives like the ASEAN Data Management Framework will help to facilitate the flow of data across borders to unlock new business opportunities, especially for SMEs”, Mr. Iswaran remarked.

He also added that the data management framework shall promote data governance including management and protection of data.

The first ASEAN Digital Ministers’ Meeting held in January approved this initiative led by Singapore.

In an effort towards bridging the digital divide, the Singapore government solicits and encourages mobile, laptop, tablet, and other digital gadgets donations from investors looking for company registration in Singapore.

- Newsletter, U.A.E

- May 17, 2021

UAE Minister of State for Financial Affairs, Obaid Humaid Al Tayer participated in the recently held spring meeting of the International Monetary and Financial Committee (IMFC) convened in a virtual format together with the annual meetings of the International Monetary Fund (IMF) and the World Bank Group during April 5 to 11 2021.

Ministers of Finance and development, Central Bankers, representatives of civil society organisations and private sector executives attended this meeting to discuss global economic concerns, the latest global economic developments and the financial and economic outlook due to the Covid-19 pandemic. The agenda of the meeting also included poverty eradication, the effectiveness of financial aids, global economic and financial systems including issues of high debt risks and international economic and development policies.

The Minister of State for Financial Affairs emphasized UAE’s resolve to work hand in hand with the international communities to overcome the risks and challenges posed by the pandemic and ensure sustainable economic recovery and growth.

Abdulhamid Saeed, Governor of the UAE Central Bank, Kristalina Georgieva, Managing Director of the International Monetary Fund, and many finance ministers from different countries also took part in this meeting.

Al Tayer appreciated IMF’s initiatives and timely interventions for world economic recovery with a revised growth prospect of six per cent for 2021 globally from a negative growth experienced during the previous year that also supported more foreign company formation in Dubai.

The minister also echoed similar concerns as reflected by IMF over the possibility of an imbalanced economic recovery in the Mena region widening the inequality gap arising out of disproportionate economic and social effects and stressed upon fiscal priorities aimed for achieving inclusive sustainable economic development.

“We welcome the Global Policy Agenda devised by Kristalina Georgieva, managing director of the International Monetary Fund, as a comprehensive framework for recovery. The UAE will continue supporting the IMF’s endeavours to mitigate the financial and economic repercussions of the pandemic to achieve global recovery and attain strong, sustainable, balanced and comprehensive economic growth,” he remarked.

Al Tayer added that healthcare continued to be the topmost priority including production and distribution of vaccines for speedy economic recovery. He also informed that USE joined the global efforts to develop and produce covid 19 vaccines with a targeted figure of 200 million doses of Hayat-Vax vaccine annually.

The minister welcomed the initiative of IMF to reallocate Special Drawing Rights (SDRs) for middle and low-income countries as it would help them to fund healthcare systems and take preventive measures against the virus. He also appealed for increased lending and technological support to these countries.

He also noted, “Beyond just recovery, we must pursue socially inclusive and environmentally sustainable models of growth as the only path forward in the post-COVID-19 era, where the IMF can support by facilitating the exchange of expertise, supporting capacity building, and enabling funding efforts.”

Al Tayer added: “As a general principle, we urge the IMF to advance its climate agenda in accordance to the Paris Agreement, which enjoys multilateral consensus, by supporting countries to achieve their Nationally Determined Contributions, while considering their national circumstances and development priorities.”

UAE has taken several social, economic and political measures to mitigate the adverse effects of the pandemic and has demonstrated its commitment by promoting new business set up in Dubai, he highlighted. He also made some additional recommendations including maintenance of a strong, adequately resourced and quota-based fund and highlighted the need for transparent communication to win and maintain public trust.

The IMF Board of Governors responsible for monitoring and management of the world financial and monetary system and timely actions on disruptive issues e.g. covid 19 pandemics are provided with appropriate reports and suggestions during the IMFC meetings.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group