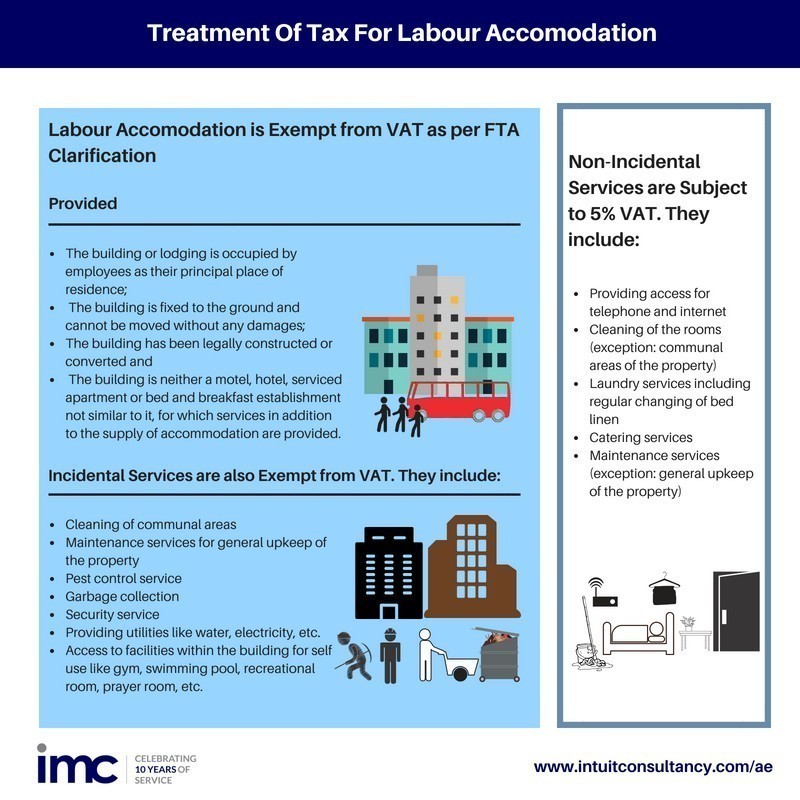

UAE Federal Tax Authority has published a clarification on the Value Added Tax (VAT) treatment for labour accommodation. As per the clarification, labour accommodation is exempt from the VAT. Incidental services which are basic and considered necessary are also exempt. While non-incidental services which are beyond the basic provision are subject to 5% VAT.

IMC Group

IMC Group