An Overview

Individual wealth and private capital have grown significantly over the past decade and Singapore has witnessed a surge in Single-Family Offices (SFOs) growing fivefold over the past couple of years. As confirmed by the Monetary Authority of Singapore (MAS) the SFOs are neither registered nor licensed entities and as of December 2020, there were some 400 SFOs in Singapore with an estimated asset of USD 20 billion.

What are Single Family Offices?

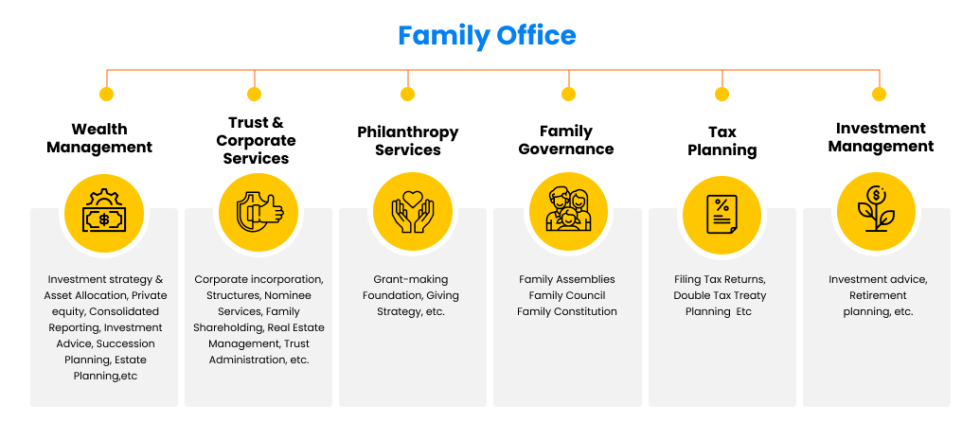

Though managing investments and related finance and administration activities are the key functions, the SFOs may also involve other activities including management of accounts, tax filing and compliance, managing charities, family governance and lifestyle management, risk management and wealth and succession planning.

Generally, financial advisors, investment analysts, legal and tax professionals are employed by SFOs for wealth planning and operational matters.

Why is Singapore chosen for Single Family Offices?

- Reduced risks of regulatory changes and business environment.

- Political stability.

- World Class infrastructure.

- Transparent Legal System.

- Presence of investment and international banks.

- Regulated financial market.

- High standard of living.

- Expertise in business services, banking and Fintech.

- A competitive corporate tax rate.

- Strategic location in the middle of Asia.

- Good Business connectivity.

- Availability of financially skilled manpower.No Bureaucracy.

- Availability of Tax Incentives.

What are the Activities carried out by Single Family Offices?

The tasks that usually come under the purview of the SFOs are

- Technologies usually outsourced except for the handling of social media.

- Bookkeeping, accounting, budgeting and cash flow planning are often outsourced to accounting services in Singapore .

- Tax and wealth planning, only regulatory compliance is done in-house while tax planning is outsourced.

- Operations except hiring and employment are usually managed by external services.

- Investments including planning, policymaking, asset allocation are done in-house.

- Legal services are outsourced.

- Family governance, education and succession planning are mostly outsourced.

- Charitable services are managed by external sources.

- Risk management about fraud and data theft, insurance, managed both in-house and by external agencies.

What is the business form of Single-Family offices?

An SFO structure normally involves a holding company or a trust directly owning both the SFO and the fund entity as assets. Single-family offices are normally formed by wealthy families desirous to manage and control their finances, businesses and various aspects of their lives and each beneficiary is a connected person to the settlers of that trust or a charity.

The SFO structure aims for achieving dual purposes, firstly obtaining the licensing exemptions and then availing tax exemptions including tax incentives. However, being eligible for tax incentives under the Income Tax Act, a fund manager must have real operations in Singapore as per the Section 13X incentive. The law also stipulates that an SFO must engage a minimum of three investment professionals, each having five years of investment experience.

The register of shareholders of the holding company is centrally maintained and treated as a non-public register with effect from 2020 and the information on ultimate beneficial owners are never shared.

Likewise, the trust companies are needed to collect and maintain information about the ultimate beneficial owners of the trusts they administer, but there is no public register of trusts or their ultimate beneficial owners.

How are Single Family Offices incorporated?

Several regulatory and administrative requirements are involved in establishing an SFO including the registration of the corporate structures, bank account opening, annual filing of tax returns and adhering to common reporting standards (CRS) and foreign account tax compliance act (FATCA).

By incorporating your Singapore Company on an SFO platform, you will enjoy several benefits including easy wealth transfer without probate, asset protection, asset allocation flexibility considering future succession planning, confidentiality, and ease of charities and donations.

Singapore Trust Companies Act (Cap. 336) applies to SFOs with the MAS as the regulatory authority. Wealthy families can either choose to outsource a licensed professional trustee or set up their own Private Trust Companies (PTC) requiring no licence. A licensed trust company however must be engaged in monitoring counter money laundering and terror financing activities.

Setting up an SFO in Singapore is mostly simple and straightforward however corporate service providers with adequate fund management and administration expertise often become the necessity for effective SFO operations who can help evaluate ongoing NAVs and performance about other asset classes, identify annual audit and exemption requirements, choose annual and semi-annual financial reporting, register with ACRA, engage a company secretary and appoint a nominee shareholder for signing company’s constitution.

How is the taxation for Single Family Offices?

The prevailing corporate tax rate is 17% in Singapore on income sourced and/or remitted in the country. There is no capital gains tax with many tax exemptions available. Singapore also entered the Double Tax Avoidance Agreement (DTAA) with many countries and offers tax exemption to resident corporate taxpayers on foreign dividends.

The legal and tax environment makes Singapore a preferred destination for establishing an SFO and the following points are considered from a taxation perspective

- Individual tax residency based on the number of days spent in Singapore.

- Compliance obligations.

- Reporting requirements under CRS.

- Transfer pricing.

- Immigration under Global Investor Program.

Change to Income Tax Act; Effective December 31st, 2021.

As a result of the 2020 Revised Edition of Acts, the following sections will be renumbered in the Income Tax Act:

- Section 13CA is now renumbered as section 13D,

- Section 13R is now renumbered as 13O, and

- Section 13X is now renumbered as 13U.

From 18 April 2022, the criteria for Section 13O and 13U schemes will be more stringent.

The Monetary Authority of Singapore (MAS) has announced more stringent criteria for the family office incentive schemes. These new requirements for new applications under section 13O (previously section 13R) and section 13U (previously section 13X) will be effective from 18 April 2022 onwards.

The criteria for the section 13O scheme have been updated to include a minimum fund size, investment professionals to be employed by the manager, and local business spending. There is also a new requirement for funds to invest in local businesses.

| Section 13O | Section 13U | |

| Minimum AUM (based on Net Asset Value) | S$10 million at point of application which is to be increased to S$20 million within 2 years. | S$ 50 million at point of application (no change). |

| Investment Professionals | Minimum of 2, with a 1 year grace period that may be given to employ the 2nd investment professional. | Minimum of 3 with at least one of them not being a family member. A 1 year grace period may be granted to meet this requirement. |

| Local investments | 10% of AUM or $10 million, whichever is lower. A 1 year grace period will be granted if this cannot be met at time of application. | |

| – AUM < S$50 m | S$200,000 | S$500,000 |

| – $50 m > AUM >= S$100 m | S$500,000 | S$500,000 |

| – AUM >= S$100 m | S$1 million | $1 million |

Local investments include investments in equities listed on local stock exchange, equity investments in unlisted Singapore companies, qualifying debt securities and funds distributed by fund managers in Singapore.

The minimum amount of total business spending is now based on amount of Assets Under Management (AUM).

What is family wealth is invested by Single Family Offices?

The SFOs normally don’t focus on equity investment of other companies shares and normally make their major investments in

- Buying residential properties.

- Buying shares of private equity firms.

- Real estate investment.

- Ownership and investment in fund structures.

What are the challenges encountered by Single Family Offices?

The following are the three issues encountered by SFOs in Singapore

- Cross-border tax issues at the individual level due to the presence of a family in several tax jurisdictions due to its global presence.

- Inefficient tax structure due to inappropriate business form.

- Lack of a formalised governance structure due to the absence of proper policies and procedures.

Conclusion

High-net-worth families have currently embraced Singapore for setting up SFOs though traditionally they have been popular and well-established in North America and Europe.

The high growth trajectory of SFOs in Asia is comparatively recent and projects the unprecedented economic upliftment of this continent. Wealth accumulation has become faster by businesses in Asia than in any other part of the world and also driving new SFOs being formed in Singapore.

The need for proper succession planning has never been so important before the tremendous rise in family wealth and can only be successfully addressed by outsourcing professional service providers.