- NEWSLETTER,U.A.E

- August 13, 2024

The corporate tax framework in the UAE for free zone entities has been structured to foster economic growth, providing businesses with a favourable tax environment. Companies operating within specific free zones significantly benefit from a 0% tax rate on qualifying income. However, it’s imperative for organizations to understand the essentials regarding qualifying and non-qualifying activities and know the clauses that the tax regime presents to them.

Forward-thinking companies look out for professional assistance for business set up in Dubai. In this edition, let’s have a look at the prime conditions businesses should fulfil to qualify for the Free Zone Person (QFZP) Status.

Conditions to Meet to Qualify as a Free Zone Person

- Juridical person: The entity must be incorporated, established, or registered within a free zone.

- Adequate assets: The entity must maintain adequate assets, full-time employees, and operating expenditures within the free zone.

- Qualifying income: The income of the business should be derived from transactions with other free zone persons, activities classified as qualifying, or the ownership/exploitation of qualifying intellectual property.

- Arm’s Length principle: Transactions with related parties must comply with this principle to ensure fair market value.

- Transfer pricing documentation: Proper documentation must be maintained for transfer pricing.

- Audited financial statements: The entity must prepare and maintain audited financial statements.

- De Minimis requirements: Non-qualifying revenue should not exceed the lower of AED 5 million or 5% of total revenue.

Identifying Qualifying Activities

Production of goods within the free zone

- Trading in minerals, energy, raw metals, and agricultural commodities

- Owning, managing, and operating ships

- Fund and wealth management services

- Treasury and financing services

- Distributing goods from designated zones

- Logistics services

Non-Qualifying Activities

- Transactions with natural persons

- Insurance and banking activities

- Leasing and financing

- Ownership or exploitation of immovable property outside the free zone

De Minimis Requirements

Dealing with Real Estate

General Anti-Avoidance Rule (GAAR) Provisions

4 Compliance Strategies Recommended by Tax Experts

Here are a few compliance strategies that tax experts recommend businesses.

- Maintaining adequate substance: Companies must ensure they have sufficient assets, employees, and operational expenditures within the free zone to retain their QFZP status.

- Proper transfer pricing: Businesses need to comply with the arm’s length principle and maintain comprehensive transfer pricing documentation. This ensures that transactions with related parties reflect fair values and are ready for scrutiny from tax authorities.

- Fulfilling de minimis requirements: Organizations must monitor the sources of their revenue regularly to ensure compliance with de minimis requirements. In case they exceed the threshold, they may lose their QFZP status as well as the associated tax benefits.

- Complying with GAAR: For businesses, it’s important to assess their tax arrangements and make sure that they remain commercially substantive, and aren’t designed only for tax benefits. A proactive stance regarding GAAR provisions significantly mitigates the risk of adverse tax assessments and penalties.

- Article, U.A.E

- August 9, 2024

- What is the UAE's ICP Smart Services

- Key Functions of ICP Smart Services

- What ICP Smart Services Can Do for You

- How to Use ICP Smart Services: Step-by-Step Overview

- Why Using ICP Smart Services Is a Good Idea

- Who Needs to Sign Up for ICP Smart Services

- How To Sign Up for ICP Smart Services

- How to Apply for Various Services Through ICP Smart Services UAE

- Comparison between ICP Smart Services vs Traditional Government Services in UAE

- How to Use ICP Smart Services to Get a Visa

- UAE Golden Visa application via ICP Smart Services

- Tracking Your Visa Application in ICP Smart Services

- Conclusion

What is the UAE's ICP Smart Services

ICP Smart Services is a new tool that lets the government offer many services online. The UAE wants to improve digital government and service delivery significantly, and this method is part of that. It gives residents, tourists, and companies a smooth and unified experience. It lets them get the services they need without visiting government buildings.

Key Functions of ICP Smart Services

- Track Application Status: Check the progress of visa or ID applications in real time.

- Update and Edit Online Records: Make corrections or changes to personal or visa-related information digitally.

- Business and License Support: Handle trade license renewals and link business-related services under one portal.

- Appeals, Refunds, and Fine Payments: Submit appeals, request fee refunds, and settle fines through the portal.

- Online Access to All Visa Services: Use a single platform for all visa-related needs, from new applications to renewals.

What ICP Smart Services Can Do for You

Visa Services

Typical ICP Smart Services Timeframes for Different UAE Visa Types

| Visa Type | Total Time Estimate |

|---|---|

| Tourist Visa | 2- 5 Days |

| Transit Visa | 1 - 3 Days |

| Employment / Work Visa | 9 - 20 Days |

| Golden / Long‑Term Visa | 16 - 35 Days |

| Domestic Worker Visa | 14 - 22 Days |

Emirates ID Services

Passport Services

Residency Services

Security Clearance and Permits

How to Use ICP Smart Services: Step-by-Step Overview

1. Choose Your Access Point

2. Browse by Category

3. Prepare Before Applying

Have the following details ready:

- Eligibility criteria

- Required documents

- Processing timelines

- Applicable fees

4. Apply Online

5. Fast & Convenient

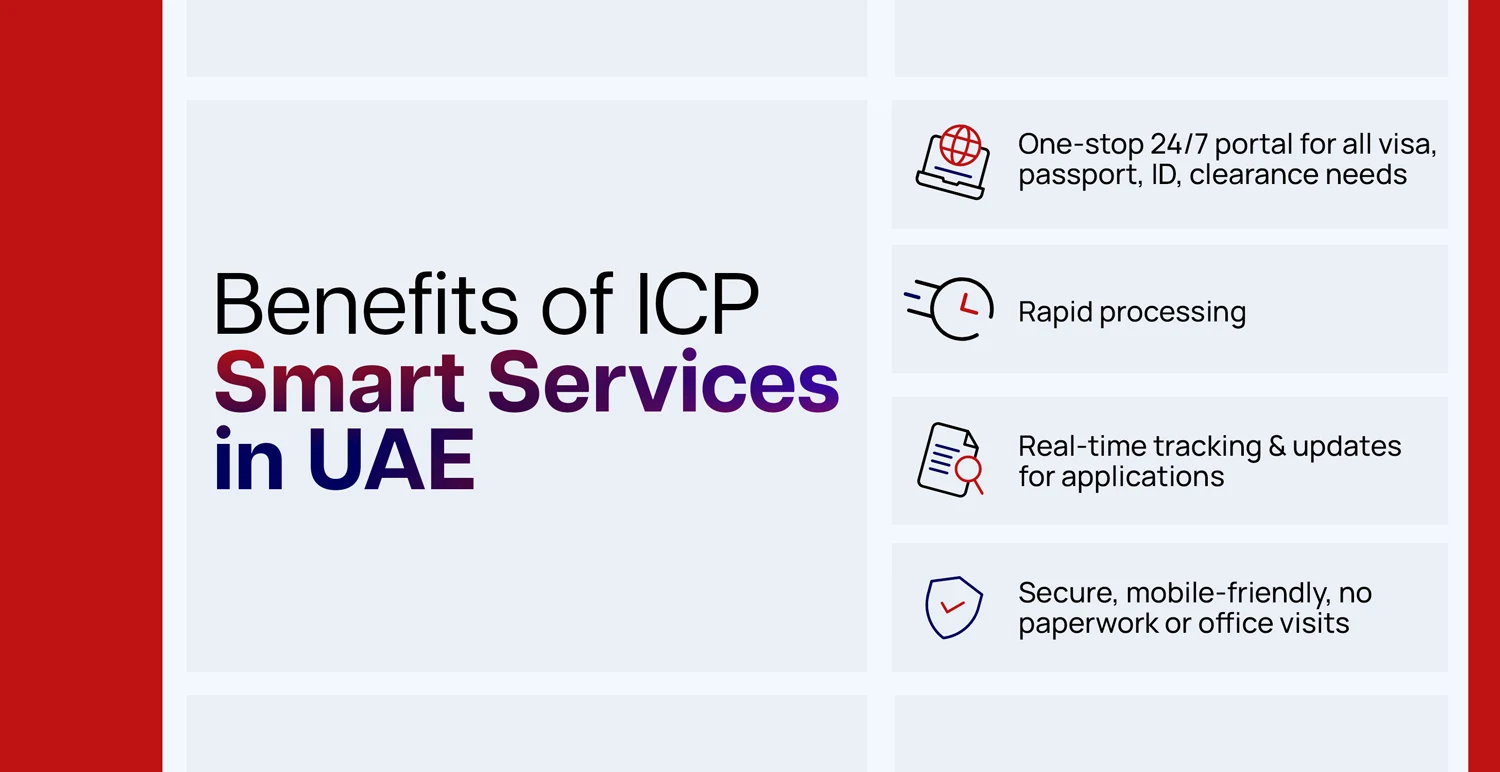

Why Using ICP Smart Services Is a Good Idea

Convenience

Efficiency

Transparency

User-Friendly Interface

Cost-Effective

Who Needs to Sign Up for ICP Smart Services

- UAE Nationals: People who live in the UAE must sign up for ICP Smart Services to use many government services. These include issuing passports, managing Emirates IDs, and keeping civil status records.

- Residents: Everyone in the UAE must register to handle services linked to residency. It includes getting new IDs, asking for Emirates ID cards, and changing personal information about their status.

- Visitors: ICP Smart Services lets people visiting the UAE apply for visas and extend their stay. It makes sure that everything goes smoothly and efficiently during their stay.

- Businesses: ICP Smart Services is what companies in the UAE must use to keep track of their employees' visas and residency permits. It is essential for those thinking about company formation in Dubai and its regulations.

- Expatriates: People living and working outside the UAE must register to manage their residency and job status. It makes the process of living and working in the country easier and faster.

- GCC Nationals: ICP Smart Services allows GCC nationals to access residency and identity-related services while staying in the UAE. Although they don’t need a visa, they must register to use services such as Emirates ID issuance or residency-related updates.

| Category | Service Type | Who It's For |

|---|---|---|

| Citizens | Emirates ID | UAE nationals needing documentation |

| Foreign Professionals | Residency | Expats—specialists, investors, etc. |

| Foreign Employees | Visa | Expat workers sponsored by employers |

| Corporates & SMEs | Business | Business entities, including SMEs |

How To Sign Up for ICP Smart Services

- Visit The Official Website: Open the official page and Login to the ICP Smart Services.

- Make An Account: Press the "Sign Up" or "Register" button. Type in your name, email address, and phone number, among other things. For your account, make a nickname and password.

- Check Your Email: You will get an email with a proof link. Click the link to confirm your email address is correct.

- Complete Your Profile: Sign in to your account and add details to finish your page. These include your Emirates ID number - for residents - or your passport number - for visitors.

- Send In the Papers: Upload whatever documentation the service you wish to utilize requests, such as a copy of your Emirates ID or your passport.

- Turn On Your Account: After you send in and verify all of your information, your account will activate. It will let you use all the services that they offer.

How to Apply for Various Services Through ICP Smart Services UAE

- Sign In To Your Account: Enter your login and password to access the ICP Smart Services portal.

- Select The Service You Require: Review the service offering and choose the one you require.

- Complete The Application Form: Complete the application form with all the pertinent data. Verify all the material to prevent delays using accuracy.

- Upload The Documents You Need: You can send your application back with any necessary papers found here.

- Pay The Fees: Take advantage of the online payment choices to pay the service fee.

- Send in the Application: Recheck your application to ensure everything is correct. Send in the application and write down the reference number so that you can keep track of it.

- Stay up to Date: You will get email or text message updates about the progress of your application. Sign in to your account to see real-time changes and the progress of your task.

Comparison between ICP Smart Services vs Traditional Government Services in UAE

| Aspect | ICP Smart Services | Traditional Services |

|---|---|---|

| How You Apply | Online through a website or app | In-person visit to government offices |

| Time of Access | Open all day, every day | Limited to office working hours |

| Processing Time | Many services are completed within 1–2 days | Often takes longer due to paperwork and queues |

| Tracking Your Request | You can check the status online instantly | Usually requires calls or waiting for an update |

| Submitting Documents | Upload soft copies directly on the portal | You need to print and carry physical copies |

| Payments | Made online through secure payment options | Usually paid at counters or via offline methods |

| Languages Available | English and Arabic supported on the platform | Mostly Arabic, limited translation help |

| Support | Help available through chatbot, call, and FAQ | May need to visit or call different offices |

| Need to Visit Office | Not required for most services | Usually required for submission or signatures |

| What It Covers | Visas, Emirates ID, Golden Visa, Family Book updates, etc. | Same services, but more manual involvement |

| User Experience | One account to manage all services, fewer steps | May involve long queues and multiple forms |

| System Connection | Linked to other UAE databases for faster checks | Verification may take longer as systems aren’t always connected |

How to Use ICP Smart Services to Get a Visa

- Sign In to Your ICP Account: Type in your login information to get into your account.

- Click On Visa Services: Go to the main page and choose "Visa Services."

- Pick The Type of Visa: Choose the type of visa you want to apply for, such as a work visa, a residential visa, or a tourist visa.

- Fill Out the Application Form: Give all the information they need, like your name, address, card number, and trip plans.

- Upload Documents to Support: Attach any necessary papers, like copies of your passport, photos, and any other documents given to you.

- Pay the Visa Fee: Pay the visa fee online.

- Send In Your Application: Go over your application and send it in. Write down the application reference number to keep track of it.

- Get Your Visa: If approved, you will get your visa by email. Print out the ticket and bring it on your journey if you need to.

UAE Golden Visa application via ICP Smart Services

Investors, business owners, and skilled workers can get a lot out of the Golden Visa UAE, which is a long-term residency card. The Golden Visa is granted to skilled professionals, researchers, top students, doctors, entrepreneurs, and investors. It supports long-term residency for those contributing to the UAE’s growth. The visa is valid for 10 years and provides key advantages such as full business ownership, no local sponsor requirement, and the ability to sponsor family members.

Using the ICP Smart Services website, here’s how to apply for the ICP Golden Visa:

- Sign In to Your ICP Account: Use your login information to enter your ICP Smart Services account.

- Choose ICP Application for A Golden Visa: Go to the "Golden Visa" area and pick the kind of Golden Visa you can get. For instance, an investment, a developer, or a highly skilled worker.

- Fill Out the Application Form: Submit a lot of information about your past, your skills, and why you want to get a Golden Visa.

- Upload The Documents You Need: You can attach proof of funding, business ownership, or professional skills.

- Pay The Fee for The Application: Use the online payment method to pay the money for the Golden Visa application fee.

- Send In Your Application: Go over your ICP Golden VISA application and send it in. Keep the reference number close by so you can check on the progress of your application.

- Get Your Golden Visa: You will be told when you are approved, and the Golden Visa will be sent to you. You can pick up your visa at the designated office or have it sent to your home.

Tracking Your Visa Application in ICP Smart Services

- Sign In to Your ICP Account: Type in your login information to get into your account.

- Click On Application Tracking: Go to the menu and choose "Track Application."

- Enter the Application Reference Number: Type in the reference number you received when you sent in your application.

- Check On Your Application: The system will show you how your application is doing right now. Check to see if your entry has been accepted, is still being reviewed, or needs more information.

- Sign Up to Get Notifications: Real-time alerts sent to the email or phone number you provided will keep you updated. There will be quick communication if the state of your application changes.

Tips to Keep Your ICP UAE Visa Tracking Smooth

- Use ICP Smart Services to monitor real-time status—entry permit approval, under review, or pending docs

- Sign up for notifications to receive instant alerts

- Always double-check your application/reference number

- Expect slight delays during holidays or due to extra document requests

Conclusion

FAQs

What is the ICP Smart Services platform used for?

Why is my application on ICP Smart Services delayed or showing pending?

What documents are required for visa renewal through ICP?

Is it mandatory for GCC citizens to register on ICP?

Do I need an account to use ICP Smart Services?

How to check UAE visa status in ICP Portal?

How to check UAE visa validity in ICP Portal?

Author Bio

- NEWSLETTER, INDIA

- August 9, 2024

Key Drivers of M&A in India

- Adjacent Market Acquisitions: Financial institutions strategically acquire businesses in related markets to enhance their capabilities and capitalize on cross-selling opportunities.

- Foreign Investments: Companies are increasingly exploring foreign investments to gain access to advanced technologies, boost capital, and adhere to global best practices.

- Regulatory and Profitability Pressures: The evolving regulatory landscape, combined with a strong focus on profitability, necessitates business consolidation and restructuring efforts.

Sector-Specific Trends to Watch in 2024

- Credit Sector: India's vast economy presents a significant opportunity for debt expansion. Banks and fintech firms are increasingly collaborating to adopt co-lending models, while Non-Banking Financial Companies (NBFCs) continue to consolidate to meet the growing demand for credit.

- Insurance Sector: Global insurers are entering joint ventures with Indian companies to enhance distribution and operational capabilities. Noteworthy transactions include Zurich Insurance Group acquiring a stake in Kotak Mahindra Bank's insurance arm.

- Asset and Wealth Management: M&A activity thrives as new entrants and established players aim to expand their market shares. Joint ventures like the partnership between Invesco and Hinduja Group highlight the sector's growth potential.

Emerging Trends in M&A

- Restructuring: Financial services companies are divesting non-core assets and non-performing loans to strengthen their balance sheets. While stable asset appraisals and better capitalization have reduced the immediate need for such deals, restructuring remains a crucial strategy.

- Environmental, Social, and Governance (ESG): ESG criteria increasingly influence investment decisions. Geopolitical tensions have heightened awareness of ESG risks, leading some investors to reassess their strategies.

- Technology and Digital Transformation: Digitalization and artificial intelligence (AI) remain top priorities for financial services companies. In the coming months, M&A activities will likely focus on leveraging data, improving operational efficiency, accelerating transactions, and enhancing cybersecurity.

- Private Equity: Specialized private equity investors target sectors like fintech, brokerage, and regtech. As leverage constraints and higher capital costs become more prominent, the focus gradually shifts towards value creation.

Conclusion

India’s financial services sector presents a dynamic landscape for M&A activities driven by economic growth, technological innovation, and evolving regulatory frameworks. IMC stands at the forefront of these developments, offering expert advisory services to help businesses navigate the complexities of M&A in India. Whether through restructuring, digital transformation, or tapping into new markets, IMC is poised to support your M&A journey, ensuring you capitalize on the lucrative opportunities.

Visit IMC M&A Advisory Services for more insights on how IMC can assist with Mergers and Acquisitions in India.

- NEWSLETTER, GLOBAL

- July 30, 2024

Global enterprises encounter fresh tax risks as the business paradigm shifts towards the remote and hybrid models. Governments have implemented the Pillar Two global minimum tax project in different countries led by the Organisation for Economic Cooperation and Development (OECD). One of the prime challenges is that companies deduct payroll taxes based on the location where their employees work or reside and now where they receive their payment. If a worker is present in an unknown jurisdiction, the business can be exposed to Pillar Two taxes.

Cross-border workforce mobility can have a dual impact on taxation. It creates a potential risk for tax and compliance demands, like the permanent establishment (PE). It also leads to the recalibrating of supply chains and operational models. Therefore, understanding the implications of Pillar Two tax and tracking the location of employees to comply with it is not just important but essential for preparedness.

The pandemic of 2020 exposed how fragile supply chains can be. It also highlighted the importance of resilience, bringing about changes in operational structures. Now, businesses face a fundamental question—whether their current operating models are still perfect for the purpose, considering factors like labour empowerment, the use of technology, and changing dynamics. Since Pillar Two introduced a global minimum tax rate, businesses are re-evaluating how attractive their principal locations can be.

Reviewing the priorities for businesses

For global enterprises, it’s imperative to understand the pivotal role that the workforce plays in executing Pillar Two strategies. Experts suggest that the real challenge lies beyond tax compliance. It is all about managing people, which turns out to be more vital and complex.

Leading companies like the IMC Group, which provides global mobility tax solutions, can help businesses move talent globally with minimal inconvenience and delay.

Understanding where your employees are working

For global businesses, it’s imperative to understand where their employees are working. The key challenges to address are the popularity of hybrid and remote work, particularly across borders, and the lack of proper tracking mechanisms.

Forward-thinking businesses must focus on the immediate demands of new tax regulations. This will help them remain proactive. Besides, they should address workforce policies like mobility, considering their potential impact on tax outcomes. Dedicated tax teams should ensure that employees work for the right entities, considering where they perform their activities.

Understanding complex compliance

Workforce Assumptions No Longer Adequate

Seeking Professional Assistance in a Complex Compliance Environment

- NEWSLETTER, GLOBAL

- July 29, 2024

Human resources continue to be the most valuable asset for any enterprise operating globally. With HR outsourcing expanding rapidly, organizations are collaborating with experts offering global mobility services to mitigate common challenges. Businesses expanding overseas outsource a wide range of services, including payroll management, recruiting, compliance, and benefits administration.

Outsourcing is a strategic approach to addressing the complexities of running global operations, including managing multilingual staff, diverse labour laws, and intricate tax regulations. Successful businesses entrust these responsibilities to outsourced service providers, thereby focusing on growth.

Overcoming Challenges with the Right Outsourcing Partner

The HR outsourcing market is projected to grow significantly by 2027, with an approximate increment of $13.6 billion. However, it’s imperative to choose the right outsourcing partner. Otherwise, the service provider can complicate operations with mismanaged data, substandard quality of services, and compliance issues.

This explains why global businesses look to partner with an experienced provider to benefit from their professional expertise. This approach ensures compliance with employment laws and streamlines the recruitment processes, instilling a sense of confidence and security. Ultimately, this enhances the satisfaction of your employees, besides freeing up resources to be allocated for core business activities.

Save Time and Cost

Forward-thinking businesses consider outsourcing HR functions to save both money and time. Tasks like hiring, employment law compliance, and managing complex tax systems can be delegated to third-party providers, leaving adequate time for businesses to focus on critical issues. Besides, outsourcing leads to significant cost savings, particularly for companies expanding globally, promoting financial security and efficiency.

Enterprises that outsource HR services can reduce expenses related to salaries, training, development and insurance. All these costs are associated with maintaining an in-house team. Moreover, outsourcing reduces costs like payroll, hiring, recruitment, and compliance.

Risk Management

Scalability and Flexibility

One of the prime benefits of HR outsourcing is the flexibility it offers. As businesses grow on an international scale, it’s imperative for them to align their HR policies with local employment laws.

Often, inhouse teams lack the necessary expertise to handle this complexity. Outsourcing provides the flexibility to scale operations and ensure global compliance, which proves crucial for successful expansion.

The Future Outlook for HR Outsourcing

For rapidly expanding global businesses, HR outsourcing proves to be a transformative force. Entrusting dedicated professionals to manage outsourced services, companies can stay ahead of changes in employment laws and regulations without investing significant time.

Interestingly, 32% of organizations in the US outsource at least one HR process, while 51% of businesses outsource benefits administration. This trend is picking up pace in all major global business hubs. In June 2023, the satisfaction rate for outsourced recruitment processes was remarkably high at 97%. With global operations and remote work evolving, the role of outsourced HR support becomes increasingly crucial.

Outsource Payroll Management Services to professionals

One of the prime benefits of outsourcing HR services and payroll management is the ability to address the diverse needs of global workforces without expanding the internal teams. As global firms struggle with compliance regulations and remote work changing operational paradigms, successful businesses look for outsourced payroll management services from specialists. The IMC Group continues to be one of the most trusted teams of outsourced service providers, standing out with their expertise. Global businesses entrust these experts with various processes and prioritize their core competencies.

- Publications

- July 24, 2024

On July 23, 2024, the Finance Minister, Ms. Nirmala Sitharaman, unveiled the Union Budget for the financial year 2024-25. As the first Budget of the newly elected government, it aimed to foster excitement and anticipation. This Budget focuses on achieving fiscal federalism while committing to fiscal consolidation to prevent inflation.

Key initiatives include rationalizing personal income-tax rates, enhancing social welfare, promoting inclusive development, boosting investor confidence, and facilitating ease of doing business.

Please complete your details below to download:

- NEWSLETTER, GLOBAL

- July 23, 2024

The financial services sector continues to face challenges for mergers and acquisitions (M&A) in the latter half of 2024. As geopolitical tensions and macroeconomic conditions lead to uncertainty, key players in the industry are under pressure to use M&A to drive transformation and growth.

Throughout 2024, this trend is likely to prevail in the M&A market. Particularly, organizations are increasingly finding it challenging to execute mega deals due to instability in the market and regulatory hurdles. Leading businesses are turning to established advisors like the IMC Group for professional mergers and acquisitions advisory services. However, certain factors indicate that M&A activity will have a positive medium-term outlook. Cross-sector trends like digitalization, sustainability, workforce challenges, and sector-specific pressures like cost management and asset quality are driving the need for transformation.

Strategic Importance of M&A

Global M&A Trends to watch out in 2024

1. Pent-Up Demand and Strategic Necessity

Following the pandemic, the prolonged period of reduced M&A activity has created significant pent-up demand in the private equity sector. With over 27,000 global portfolio companies and investments aging beyond the typical exit timeline, the pressure on PE firms to realize returns is mounting. This high demand is poised to drive a surge in deals as market conditions stabilize.

Corporate firms are also taking advantage of M&A transactions to accelerate growth and adapt to dynamic changes like AI advancements. Therefore, M&A activities are likely to revive even amid ongoing uncertainties.

2. AI as a Catalyst for M&A

Artificial Intelligence, particularly generative AI, is reshaping business models and creating new avenues for growth. Its potential to enhance efficiencies, generate new revenue streams, and disrupt traditional industries makes it a key driver for M&A.

Global enterprises are increasingly looking to acquire AI capabilities, talent, and technology to stay competitive. This trend is likely to drive different types of transactions, from traditional M&A to innovative partnerships.

3. Sector-Specific Drivers

Global M&A trends have varying influence on different sectors. For instance, sectors like energy and technology have witnessed substantial deal values due to high-profile megadeals. However, overall transaction volumes across most sectors have declined.

This inversion of sector trends reveals the uneven recovery and the specific opportunities and challenges within each industry. Businesses in sectors like technology and financial services are likely to pursue M&A transactions aggressively. In the process, they will maintain their competitive edge and drive innovation.

4. Geopolitical and Macroeconomic Uncertainties

High interest rates, geopolitical tensions, and political uncertainties have created a challenging environment for M&A activities globally. As a result, organizations approaching such deals have adopted a cautious approach, leading to a decline in the volume of deals.

However, as these uncertainties begin to resolve with reduced interest rates and greater political clarity after elections, M&A activity is expected to rebound. With these persistent issues getting resolved, dealmakers can confidently approach transactions, fuelling greater M&A activities driven by the pent-up demand in the market.

Professional advisory services for successful M&A transactions

Considering the complexities related to regulations and the importance of due diligence, it’s advisable to seek professional support from the experts at IMC Group for successful M&A transactions. Businesses must also check out their recent guide for successful M&A deals and seek professional support to be on the right track.

Mergers and acquisitions remain vital strategies for financial services companies to grow in a challenging industry. With experts on their side, businesses can understand current trends and strategic needs to better position themselves in the evolving market.

- NEWSLETTER, GLOBAL

- July 18, 2024

The Current State of Mergers & Acquisitions

Key Challenges Associated with M&A Transactions

The primary motivation for companies to pursue M&A is to accelerate growth. This growth may not be achievable as competitively or quickly through traditional processes. M&A deals are common in the technological sector. It is often used to differentiate or enhance product offerings and increase the market share by expanding demographic reach. Therefore, it’s imperative to have a clear objective for the acquisition so that businesses aren’t deprived of attractive secondary benefits.

For instance, if the objective of an organization is product expansion, the risk of failure increases if it tries to acquire a company with a product difficult to integrate.

M&A represents “inorganic” growth since it can rapidly pacify the growth trajectory of an organization. However, these transactions shouldn’t replace the steady progress of organic growth. Both these types of growth define a sustainable and balanced business strategy.

Why Is It Essential to Balance Organic Growth With Inorganic Growth?

A robust long-term business strategy requires balancing inorganic and organic growth. With organic growth, businesses benefit from stable and incremental progress. However, this might not always keep up with the dynamics in the market. Inorganic growth through M&A, on the other hand, can lead to rapid scaling, with new technologies at the disposal. One of the best aspects associated with inorganic growth is instant access to the market.

With this dual approach, businesses can seize emerging opportunities without overlooking their internal development. One proven strategy to balance these approaches is to progressively align partnerships, which allow organizations to test potential acquisitions and evaluate their compatibility in culture, technology, and operations.

Practical Considerations for the Success of M&A Activities

The high failure rate of M&A deals defines the importance of careful planning and execution. For CEOs and founders, merging or acquiring another company can be a major decision. Financial investors or large shareholders may push for M&A to boost short-term valuations, potentially disregarding long-term benefits. However, it’s imperative to weigh the primary reasons for the M&A and assess whether there’s a cultural fit between the companies involved. Misaligned cultures can doom a merger, even if all other factors are favorable.

It’s crucial for leaders to be transparent with their teams. They must define roles clearly and manage the expectations throughout the M&A process. Buy-in from the entire C-suite and board members is essential, as their enthusiasm and open communication often determine the success of an M&A deal. With clear objectives and understanding as the priority, organizations must approach M&A to ensure cultural compatibility. This calls for strategic business planning, as it enables businesses to deal with complex business problems successfully and optimize their growth potential.

Professional Mergers and Acquisitions Advisory Services from Experts

- Article, Global

- July 12, 2024

What Exactly is Operational Due Diligence

Why Does Operational Due Diligence Matter?

For various reasons, comprehensive operational due diligence is vital:

- Risk Identification: Investors can identify risks that might affect the target company’s performance after the sale by examining its operating framework. Some risks could be inefficient operations, old technology, or relying too much on critical employees.

- Value Realization: Finding ways to make things better can unlock value. For instance, simplifying procedures or modernizing technology can save expenses and enable more seamless operation.

- Alignment Strategically: It is crucial to ensure the selected firm’s activities match the strategic objectives of the one seeking to purchase it. Knowing this will support both a seamless transfer and long-term success.

Important Areas of Emphasizing in Operational Due Diligence

Several key elements of operational due diligence demand thorough investigation:

- Management and Leadership: It is essential to look at how skilled and stable the management team is. Investors need to know that the team can move the business forward. It is something they have to do, especially during the transition period.

- Processes and Systems: Checking how efficient and successful the business’s systems and processes are can help find places where they could be better. Production methods, IT systems, and supply chain management are all part of this.

- Organizational Structure: To ensure you’ll work well with the new company, you should know about its organizational system and attitude. This means examining the company’s human resources, employees’ happiness, and general work culture.

Best Practices in Operating Due Diligence Conducting

Following best practices is crucial for ODD to be as effective as it may be:

- Hire Professionals: Hire Due Diligence Services who know much about the business and how things work. Their opinions can help you learn more about the target company’s good and bad points.

- Comprehensive Checklists: Create thorough plans specific to the business and the steps involved. It ensures you do not miss any important detail during the due diligence process.

- Continuous Monitoring: Being careful with operations shouldn’t just happen once. After a purchase, ongoing tracking helps deal with any problems that come up and makes sure that operations are in line with strategic goals.

Conclusion

Operational due diligence is an essential part of the purchase process. It gives investors a clear picture of the chosen company’s business strengths and weaknesses. Using Due Diligence Services helps investors make wise decisions. Before merging or acquiring another firm, one must undertake extensive operational due diligence in today’s ever-shifting corporate environment.

At IMC, we provide comprehensive due diligence services, ensuring you have the critical insights needed to make informed and confident business decisions.

- Newsletter, Singapore

- July 11, 2024

With the mission to deliver higher monetary returns to their clients, family offices in Singapore are shifting their focus and investment strategies. A large number of family offices are opting to invest directly in private companies rather than through traditional channels. This shift marks a significant trend in investment tactics, driven by their unique competencies and the objective to grow long-term capital. The success of a single family office in Singapore defines its popularity among wealthy families and individuals.

The Rise of Direct Investments

A survey reveals that as much as 62% of family offices have made at least six direct investments in private companies last year. This approach involves purchasing stakes in companies or providing direct lending, bypassing traditional investment vehicles.

In 2024, 71% of family offices have decided to increase their direct investments or maintain their existing levels. This trend explains the role of family offices in private markets. These organizations have been potentially reshaping the dynamics of private equity, besides fostering innovation in investment strategies.

Benefits and Challenges

Co-investing and Strategic Partnerships

Family offices are increasingly co-investing alongside traditional private equity firms. This is a collaborative approach that reduces fees and enhances the potential for higher returns by sharing interests and diversifying portfolios.

Direct investments in private companies capture the illiquidity premium. This strategy falls in line with the long-term wealth preservation goals of family offices, thereby ensuring stability and sustainability across generations.

As family offices continue to evolve into formidable players in private markets, their strategic investments and partnerships are set to influence the future landscape of global investments.

The IMC Group continues to be a trusted partner for family offices investing. With dedicated assistance from experts, a professional consultation can put the investments in the right avenues.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group