- Article, U.A.E

- March 21, 2025

The UAE has positioned itself as a global leader in AI regulation and innovation. The Middle Eastern country became the first nation to establish a Ministry of Artificial Intelligence back in 2017, which demonstrates its proactive stance and commitment to developing AI responsibly. This initiative set the stage for the National AI Strategy 2031. Advanced AI technologies are likely to be integrated into key sectors like healthcare, education, and transportation, potentially giving a $91.2 billion boost to the economy.

As businesses from different verticals thrive in the competitive AI environment, it’s essential for them to align with stringent data protection laws. Across the world, authorities have set up ethical AI guidelines and frameworks for governance. Therefore, organizations must deploy AI responsibly to prevent regulatory pitfalls. Naturally, businesses are seeking professional compliance advisory services from established consultants to remain on the right track.

- What do AI Regulations in the UAE mean for businesses?

- The Establishment of the UAE AI Office

- Compliance Implications for Different Industries

- Deploying Effective Frameworks for AI Governance

- Tips for UAE Businesses to Strengthen Data Privacy and Security Measures

- Adhering to data protection laws

- Securely storing and transmitting data

- Implementing consent management for AI systems

- Overseeing data transfers beyond borders

- How Can Businesses Implement Ethical AI Development Practices?

- Tips for Formulating AI Compliance Strategies for the Future

- Seek Professional AI Compliance Advisory Services

What do AI Regulations in the UAE mean for businesses?

With the National AI Strategy 2031 in focus, the UAE has developed a robust legal framework for businesses operating in the country. The Federal Decree-Law No. 45 of 2021 on Personal Data Protection (PDPL) is one of the newly formulated guidelines. These regulations aim to safeguard privacy and ethical standards while promoting responsible AI applications.

The National Artificial Intelligence Ethics Guidelines further uphold principles like fairness, transparency, and accountability while businesses make decisions based on AI.

The Establishment of the UAE AI Office

Working closely with the UAE Council for Artificial Intelligence, the UAE AI Office shoulders the responsibility of ensuring compliance. These responsibilities include:

- Conducting research on artificial intelligence

- Facilitates collaborations between public and private companies

- Helping businesses align their AI initiatives with national policies

Therefore, businesses in the UAE must conduct regular audits for their AI systems to remain compliant.

Compliance Implications for Different Industries

Regulations on the use of AI impact different sectors like:

- Healthcare

- Energy

- Logistics

- Cybersecurity

- Tourism

Businesses operating in these industries need to adhere to strict rules for data protection. This is particularly important while handling cross-border data transfers. According to the PDPL, it’s mandatory to make sure that either the destination country has equivalent data protection norms or individuals provide explicit consent.

Organizations violating compliance policies face severe penalties, which range between AED 500,000 and AED 1 million, along with imprisonment.

Deploying Effective Frameworks for AI Governance

Businesses in the UAE must formulate effective frameworks to ensure their AI governance.

- Forming a committee for regulating AI ethics: Businesses must establish an AI ethics committee to oversee their AI operations. This should be a multidisciplinary team consisting of AI specialists, legal experts, and ethicists who ensure that their AI applications align with ethical norms.

- Establishing AI guidelines and policies: A properly formulated AI governance policy should outline how a company must approach fairness, transparency, and accountability. These norms must include risk mitigation strategies for AI. Particularly, they must cover areas like data protection, intellectual property rights, and management of algorithmic bias.

- Performing risk assessments for AI: Regular risk assessments help in identifying vulnerabilities in AI models, like security threats or potential bias. Businesses must maintain records of these evaluations and conduct periodic audits to adapt their frameworks to emerging risks.

- Training employees to comply with AI regulations: Besides formulating policies, organizations must invest in employee training programs to educate their staff on AI regulations in the UAE. Workshops and compliance refresher courses can significantly reduce the risk of unintentional regulatory breaches.

Tips for UAE Businesses to Strengthen Data Privacy and Security Measures

Adhering to data protection laws

According to the Federal Decree-Law No. 45 of 2021 (PDPL), businesses must strictly adhere to data protection laws while handling the personal information of residents in the UAE. Key mandates as per this law include:

- Obtaining explicit consent from users

- Uphold data access rights

- Comply with lawful processing standards

Regulations are even more stringent for sensitive data like government records and healthcare information.

Securely storing and transmitting data

Businesses must adopt robust cybersecurity protocols to comply with regulations in the UAE. These includes:

- End-to-end encryption

- Access controls

- Breach notification mechanisms

Regular penetration testing and security audits further strengthen the resilience of AI systems.

Implementing consent management for AI systems

Overseeing data transfers beyond borders

How Can Businesses Implement Ethical AI Development Practices?

New businesses as well as established companies in the UAE are seeking professional consultations to incorporate ethical AI development practices. The goal of having a transparent mechanism include:

- Detecting bias in AI and eliminating it

- Ensuring transparent decision-making using AI

- Controlling AI systems through human oversight

- Performing regular audits for AI

Tips for Formulating AI Compliance Strategies for the Future

For businesses operating in the UAE, it’s imperative to develop futuristic strategies. Working with seasoned experts, these organizations must deploy practical measures to establish future-proof policies while using AI.

Here are some effective guidelines that businesses must follow while establishing their compliance strategies.

- Staying updated with regulatory changes

- Engaging in collaborations in the respective industries

- Investing in technologies to comply with AI

- Preparing for global AI regulations

Seek Professional AI Compliance Advisory Services

Business leaders consider complying with AI regulations in the UAE as an opportunity to establish ethical leadership and innovation. Working with experienced consultants at the IMC Group for compliance advisory services, businesses can prioritize data security and stay ahead of regulatory trends. A proactive approach, backed by top consultants, can help global businesses thrive in the evolving AI ecosystem in the Middle East. Complying with AI regulations protects businesses from legal risks and helps organizations build trust with their customers and partners.

- Article, U.A.E

- March 19, 2025

Achieving business success in Dubai starts with a solid financial strategy, precise record-keeping, and strict adherence to local regulations. From managing the complexities of corporate taxes to handling detailed payroll processes, accounting services in Dubai can quickly become demanding—especially for small and mid-sized businesses. That’s why many companies outsource these tasks to top accounting firms rather than maintaining in-house teams.

Why Accounting and Auditing Matter?

Proper accounting and auditing practices give you the following:

- Accurate Financial Snapshots – Real-time insights into revenue, expenses, and profitability.

- Regulatory Compliance – Keeping pace with UAE tax codes and labour laws to avoid penalties.

- Strategic Planning – Making well-informed decisions backed by reliable financial data.

Auditing for Greater Financial Integrity

Challenges for Businesses in Dubai

Whether you operate a startup or a large corporation, accounting and bookkeeping services in Dubai demand staying current with evolving regulations, payroll mandates, and various taxation policies. In-house accounting can be expensive, prompting many firms to hire specialized accounting services in Dubai. By doing so, they benefit from:

- Cost Efficiency – Lower overhead without sacrificing expertise.

- Full Compliance – Professionals who stay updated on every rule change.

- Better Decision-Making – Detailed financial reports that guide resource allocation and growth strategies.

Why Partner with a Reputable Accounting Firm

A trustworthy accounting provider can:

- Streamline Bookkeeping & Reporting – Using cutting-edge software and best practices to track transactions.

- Deliver Thorough Audits – Ensuring accuracy and rectifying discrepancies before they escalate.

- Offer Tailored Financial Advice – Helping refine business strategies and enhance operational efficiency.

- Bolster Investor Confidence – Presenting transparent, audited financial statements to stakeholders.

- Mitigate Risk – Reducing the likelihood of tax or compliance infractions.

Our List of the Top 20 Accounting Firms

IMC Group Dubai

IMC Group Dubai is a leading provider of accounting and bookkeeping services. Their offerings range from daily bookkeeping to advanced financial advisory, ensuring tailored solutions that meet the region’s regulatory needs. With a skilled team of accountants, auditors, and tax specialists, they deliver accurate financial reports and strategic insights for SMEs and larger businesses.

In addition to core services, IMC Group Dubai offers strategic planning, business consulting, and compliance support to help clients navigate UAE tax regulations and financial reporting standards, minimizing the risk of penalties. This proactive approach allows clients to focus on their core operations and secure their financial management.

IMC Group Dubai prioritizes client-centricity, customizing service packages for each organization and building long-term partnerships based on trust and measurable results. Consequently, businesses improve financial stability, streamline operations, and explore growth opportunities in Dubai’s dynamic economy.

Ernst & Young

Deloitte

Requirements vary depending on business activity, legal structure, and free zone regulations. Some entities must conduct annual audits to maintain their licenses, while others do so voluntarily for better financial oversight.

Look for a firm’s track record, industry specialization, and certifications (such as being licensed by the UAE authorities). Also, consider the scope of services, technology adoption, and how well they align with your specific operational and budgetary needs.

PwC

KPMG Services

Fees can differ widely based on a firm’s reputation, the complexity of your financial records, and the range of services required. Some firms offer fixed-fee packages, while others may charge hourly rates for specific tasks. Always clarify pricing models upfront.

Many firms cater to SMEs and startups with tailored service packages. Outsourcing accounting can be incredibly cost-effective for smaller businesses that don’t require a full-time in-house accounting team.

KBA

BMS Auditing

Maintaining monthly or quarterly updates is generally recommended, though some industries may need weekly or even daily oversight. Regular updates ensure real-time insights into cash flow, expenses, and revenue trends, enabling prompt decision-making.

Several firms, especially the larger international networks or those with a global presence, have specialized teams for cross-border operations. They can guide you through double taxation treaties, international transfer pricing, and overseas compliance requirements.

Reputable accounting firms implement strict data protection policies and use secure software to safeguard client information. Before finalizing an agreement, discuss the firm’s confidentiality clauses, data handling procedures, and cybersecurity measures.

Reyson Badger

AVSC

Yes. Most accounting firms in Dubai offer VAT and tax-related services, including registration, filing, and advisory. They ensure compliance with UAE’s tax regulations, helping you avoid potential fines or penalties.

Professional firms regularly follow updates from government bodies such as the Ministry of Finance, Federal Tax Authority, and local free zones. Many also participate in ongoing training or certification programs to keep pace with changing legislation.

HLB HAMT

NAM Accountants

CDA Audit

Xact Accounting Services

Many offer strategic advisory, risk assessment, digital transformation support, and CFO-level consulting. They can deliver cost-saving recommendations, help craft business growth strategies, and streamline financial operations for long-term stability.

Yes. Specialized teams within certain firms handle due diligence, financial modelling, and risk evaluation for M&A activities, ensuring you make informed decisions backed by precise financial data.

Outsourcing can be more cost-effective and flexible, especially for SMEs or businesses with fluctuating financial needs. However, large enterprises with complex transactions might benefit from an in-house specialist. Evaluate the scope of your requirements and budget constraints before deciding.

Crowe UAE

Mazare UAE

BDO UAE

Aviaan Accounting

Mazars Lower Gulf

Protiviti UAE

Moore Stephens Lower Gulf

Emerging Tech in Accounting & Bookkeeping

- Article, SINGAPORE

- March 14, 2025

Singapore continues to be a top destination for businesses with its strong regulatory framework and commitment to transparency. The ACRA (Accounting and Corporate Regulatory Authority) is the prime governing body that defines the integrity of this system. This authority ensures that public accountants, businesses, and corporate service providers comply with legal obligations.

Naturally, successful organizations reach out to experts for compliance advisory services. Failing to meet the requirements set by ACRA can lead to legal consequences and financial penalties. The last thing any business would want is reputational damage, right?

We have compiled this essential checklist to help businesses stay compliant in 2025.

- Your 2025 ACRA Compliance Roadmap

- The Yearly Obligation of the Annual General Meeting (AGM)

- Businesses Must File Their Annual Return (AR) With ACRA

- Keeping ACRA Updated on Changes in Business

- Updating Information on Shareholders

- Lodging the Register of Registrable Controllers (RORC)

- Responsibilities of Directors in Financial Reporting

- Additional Compliance Responsibilities

- Professional Compliance Advisory Services from Experts

Your 2025 ACRA Compliance Roadmap

Once a company is officially registered with ACRA, it needs to complete the post-incorporation formalities. After this, ongoing compliance becomes essential. Here’s a breakdown of the critical requirements.

- Annual General Meeting (AGM)

- Situational or circumstantial updates

Let’s break down the key compliance requirements that every company based in Singapore must follow.

The Yearly Obligation of the Annual General Meeting (AGM)

AGM Exemptions for Private Companies

- Send financial statements to members within five months after the financial year-end.

- Are dormant private companies that do not need to prepare financial statements.

When an AGM is Required?

Despite these exemptions, the law provides safeguards to protect shareholders’ rights:

1. Member Requests:

2. Director's Role:

- Arrange the meeting within six months after the financial year-end.

- Request more time from ACRA if needed.

3. Financial Statement Review Requests:

- The company must hold a general meeting within 14 days of the request.

- Directors must ensure this meeting is arranged within the same period.

Why it matters?

Businesses Must File Their Annual Return (AR) With ACRA

- Listed companies must file Annual Returns (AR) within five months after the financial year-end (FYE).

- All other companies must file Annual Returns (AR) within seven months after the financial year-end (FYE).

For companies with an FYE before 31st August 2018, the older rule applies. They need to file within 30 days of the AGM.

Financial reporting: The financial statements of your business must comply with Singapore Financial Reporting Standards (SFRS). You need to submit it as a part of the Annual Return.Keeping ACRA Updated on Changes in Business

It’s essential for businesses to update ACRA regarding any significant changes within the prescribed timelines. This includes:

- Change in business names: It’s essential to obtain prior approval from members and file the same with ACRA

- Changes in company details: If there’s any change in business activities, registered address, the organization must report the same within 14 days to ACRA..

- Changes in directors and secretaries: In case there’s a change in appointments, resignations, or details of directors or secretaries, it must be updated promptly with ACRA.

Updating Information on Shareholders

Lodging the Register of Registrable Controllers (RORC)

- Setting up the RORC within 30 days of incorporation.

- Filing RORC updates with ACRA within two business days after any changes.

Penalties for non-compliance: In case a business fails to maintain the RORC or update any vital information, it can result in hefty fines or legal action.

Responsibilities of Directors in Financial Reporting

- Preparing accurate financial statements as per SFRS

- Making sure that statements provide a true and fair view of the financial health of the company

- Filing the audited or unaudited financial statements in XBRL format unless there’s an exemption

Legal action may be initiated against directors who neglect these duties under the Financial Reporting Surveillance Programme (FRSP). That’s why, leading companies seek compliance advisory services from established professionals.

Additional Compliance Responsibilities

Besides statutory filings, businesses must also comply with other operational regulations. These include:

- Keeping track of changes in ACRA regulations to stay ahead of updates on compliance

- Documenting board resolutions and minutes of meeting

- Maintaining clear and accurate accounting records

- Filing corporate income tax returns with the Inland Revenue Authority of Singapore (IRAS)

- Submitting periodic GST returns, if applicable

- Ensuring valid employment contracts under the Employment Act

- Bringing into light any conflicts of interest by directors

- Contributing to the Central Provident Fund (CPF) for eligible employees

- Acquiring business licenses specific to industries, like those for F&B, retail, or finance

- Holding valid employment passes for foreign workers

- Renewing business licenses on time to prevent penalties

- Maintaining statutory registers of shareholders, Nominee Director, directors, RORC and secretaries

- Adhering to the Personal Data Protection Act (PDPA) to protect the information of customers

Professional Compliance Advisory Services from Experts

Businesses in Singapore often find it challenging to understand its corporate compliance environment. However, adhering to the established regulations is something non-negotiable. That’s why, most organizations eyeing success reach out to reputed professionals at the IMC Group for compliance advisory services. These experts will help you understand how to file annual returns for your business. This ensures that enterprises can remain compliant and prevent penalties, thereby maintaining credibility and smooth operations.

- NEWSLETTER,U.A.E

- March 10, 2025

Strategic Reforms Leading to the Growth of M&A Activities

The GCC region led the way with 580 deals valued at $90 billion. It’s worth mentioning that cross-border deals played a vital role, contributing to 52% of the total volume and 74% of the deal value.

Experts reveal that businesses in the region are actively looking for growth opportunities. Particularly, they are exploring sectors like insurance, asset management, real estate, power, utilities, and technology sectors. Successful organizations are also seeking M&A advisory services from experienced consultants to enhance regional collaborations in the Asian and European markets.

Major Players and Key Deals

M&A activities in the MENA region were primarily dominated by major players like Sovereign wealth funds (SWFs). This included the Abu Dhabi Investment Authority (ADIA), Mubadala Investment, and Saudi Arabia’s Public Investment Fund (PIF). The strategic investments of these firms continue to reshape the economic landscape of the region. Leading companies are looking for comprehensive due diligence services from reputed experts before entering these transactions.

The $12.4 billion acquisition of Truist Insurance by Clayton Dubilier & Rice, Stone Point Capital, and Mubadala Investment marked the largest deal of 2024. Some of the other notable transactions included:

- Saudi Aramco’s $8.9 billion acquisition of a 5% stake in Rabigh Refining and Petrochemical Company.

- The $8.3 billion purchase of a 60% stake in Zhuhai Wanda Commercial Management Group by PAG, Mubadala, and ADIA.

Interestingly, outbound M&A deals accounted for 61% of the total deal value. Across 199 transactions, the value of outbound deals reached $56.6 billion. On the other hand, inbound deals recorded an 18% surge in volume and 42% in value, reaching $11.4 billion. Naturally, these players have been seeking comprehensive due diligence services from top consultants to ensure successful deals.

Leading Investment Destinations - UAE and KSA

IN 2024, the UAE emerged as the top investment hub. It recorded as many as 96 inbound deals, with a total valuation of $7.6 billion. The country accounts for 67% of the total inbound deal value. This growth was led by the technology sector, particularly domains like AI, digital transformation, and cybersecurity. One of the significant deals in this space was the $1.5 billion acquisition of Abu Dhabi’s Group 42 by Microsoft.

Saudi Arabia followed the suit, contributing significantly to the regional M&A transactions. Together, the UAE and KSA recorded 318 deals valued at $29.6 billion. In 2024, these two nations have been ranked among the MENA bidders. This reinforces their positions as dominant players in the M&A space.

Outside MENA, the US was the largest acquirer. The country completed 48 transactions worth $4.6 billion. Meanwhile, MENA investors favored the U.S., with 41 deals totalling $19.9 billion.

Domestic M&A on the Rise

In terms of disclosed deal value, oil and gas remained the top sector. It accounted for 37% of the total domestic deal value, recording $9.0 billion. Saudi Aramco’s $8.9 billion stake acquisition in Rabigh Refining and Petrochemical Company was the key driver of this growth.

The Future of M&A in MENA

Experts have observed that technology continues to be the most attractive sector for investors. It constitutes 23% of total inbound and domestic M&A deals. The MENA region is undergoing a transformation in productivity, thanks to the rise of AI and digital transformation. This is significantly shaping capital allocation for deals.

Looking ahead, 2025 promises strong momentum for M&A activities in the MENA region. With professional M&A advisory services from reputed consultants like the IMC Group, businesses are looking to strike major deals. Fresh opportunities await both domestic and international investors in the MENA region in 2025.

- NEWSLETTER, INDIA

- March 10, 2025

In India, MSMEs are growing at an incredible pace. Currently, these organizations contribute 27% to the country’s GDP, besides accounting for 45% of the manufacturing output of the country. Yet, many of these businesses struggle with financial management. This is primarily due to a lack of dedicated financial leadership.

That’s where fractional CFOs come in. Now, businesses need not hire a full-time chief financial officer. With top professionals offering CFO advisory services, organizations can access top-tier financial expertise on demand. This model is gaining traction in India, immensely benefitting MSMEs with their financial planning, regulatory compliance, and risk management solutions. Most importantly, they need not incur heavy costs associated with hiring a full-time employee.

Bridging the Gap of Financial Expertise

Many MSMEs are run by passionate entrepreneurs with deep industry knowledge. However, it’s not a financial strategy that they always specialize in. As businesses keep expanding, they face increasingly complex economic challenges. These include cash flow management, budgeting, compliance, and growth planning.

A fractional CFO for SME’s and startups offers the perfect balance. These professionals bring years of experience to the table, guiding businesses and helping them with financial best practices. This ensures stability and long-term growth for organizations in India. Fractional CFOs help MSMEs streamline operations, cut unnecessary costs, and improve their overall economic health.

A Cost-Effective Alternative to Full-Time CFOs

Hiring a full-time CFO in India can be a substantial investment. However, businesses can opt for fractional CFO services, which provide the same level of expertise at a more cost-effective and strategic price point, making it a practical and financially efficient choice for companies.

Thus, businesses in India benefit from the flexibility of this model. These firms need to pay only for the financial guidance they need, which can range from a few hours a week to a complete project. As a result, MSMEs can scale their financial management as they expand without straining their budgets.

Dealing with Regulatory Challenges

In India, financial regulations are constantly evolving. Thus, MSMEs need to monitor tax laws, GST compliance, and banking regulations continuously. Many businesses struggle to keep up, which leads to costly mistakes and penalties.

A fractional CFO for SME’s and startups ensures compliance with these changing regulations. They adopt a proactive stance in addressing economic risks and streamline tax planning. Thus, these professionals make sure that businesses in India adhere to the laws. This significantly reduces risks for firms and helps them build financial credibility which proves vital for securing loans and investments.

Strategic Insights for Smarter Decision-Making

Apart from compliance, a fractional CFO helps businesses make better financial decisions. These professionals provide valuable insights into cash flow trends, budgeting, and profitability. MSMEs, backed by data-driven strategies, can optimize costs and predict the inflow of revenue while planning for growth in the future.

Businesses that are looking to scale must work with a fractional CFO to develop a strong financial strategy. From expansions to mergers and securing funding from investors, CFOs play a critical role in financial planning and execution.

Proper Risk Management

Business risks come in many forms, ranging from economic downturns to cash flow crunches or unforeseen expenses. Even profitable businesses tend to struggle without proper risk management.

Fractional CFOs bring expertise to the table, identifying financial vulnerabilities and building effective strategies to mitigate risks. They help businesses prepare for tough times, ensuring financial resilience in times of challenge.

Professional CFO Advisory Services for MSMEs in India

Hiring a fractional CFO for expert financial leadership can put MSMEs in India on their growth trajectory. These professionals help businesses explore fresh opportunities as they optimize capital, secure funding, and ensure sustainable profitability.

With the right financial strategies in place, businesses can focus on innovation and expansion. Small and medium-sized businesses must partner with the IMC Group, a leading advisory service provider offering fractional CFO for SME’s and startups. These experts offer high-level financial solutions on a flexible basis, allowing businesses to strengthen their financial foundations.

- NEWSLETTER,U.A.E

- March 10, 2025

The Growth of the Financial Market in Dubai

According to the Dubai International Financial Centre (DIFC), the number of hedge funds within the DIFC has recorded a 50% growth, reaching a total of 75 firms. Some of the high-profile players have set up their operations in Dubai. The growth of family offices in the Middle East can be largely attributed to the business-friendly regulations and growing investor base in Dubai.

Beyond hedge funds, the broader financial ecosystem in this city is thriving. Currently, the DIFC hosts over 410 wealth and asset management firms, with 6,920 registered entities. This marks an impressive 25% Y-o-Y increment. This boom has also translated into a 10% rise in employment within the DIFC, pushing the total workforce to over 46,000.

Family Offices Managing Over $1 Trillion

The appeal of Dubai to the wealthy class extends well beyond institutional finance. This is evident from the increasing popularity of single-family offices in Dubai. Family offices, which manage substantial private wealth, currently oversee assets exceeding $1 trillion. The DIFC alone accounts for more than $700 billion in AUM, reflecting a remarkable 58% growth over the past year.

The tax advantages that wealthy investors enjoy in Dubai, along with factors like global connectivity and a stable financial environment, make it a preferred hub for this class. The strong regulatory framework in the city has also been instrumental in attracting prominent family offices looking for long-term wealth preservation and strategic investment opportunities.

Rise of Exclusive Peer Networks in Dubai

Why are UHNWIs Moving to Dubai?

The financial success of Dubai exists solely due to its tax advantages and financial regulations. Its demographic position makes it a crucial link between Europe, Asia, and Africa. This provides businesses with strategic access to global markets.

The political stability in the emirate, advanced infrastructure, and focus on technical innovation further enhance its reputation as a financial hub.

Following the suit of Dubai, Abu Dhabi is also emerging as a crucial financial hub. The Abu Dhabi Global Market (ADGM) has witnessed a 31% jump in company registrations in just the first half of 2024. This surge is driven by major financial institutions that have been expanding their presence in the Middle East.

A Promising Future for Wealth Management

The promising growth trajectory of Dubai as a leading hub for wealth management makes it a focal point for wealth management firms. As its financial ecosystem expands, the surge in the number of ultra-wealthy residents is likely to continue. A successful single-family office in Dubai must consult experienced and qualified professionals to benefit from their expertise. IMC Group has a team of experienced experts who can provide qualified advisory services to family offices.

- NEWSLETTER,SINGAPORE

- March 10, 2025

Over the last decade, Singapore has firmly established itself as a premier destination for the world’s wealthiest individuals to safeguard their assets. As a result of this trend, the country has witnessed a surge in the number of family offices.

In 2024, Singapore witnessed a net rise of approximately 3,500 high-net-worth individuals. This figure stood at 3,200 in 2023. Some of the prominent figures who set up single family offices in Singapore include Sergey Brin, the co-founder of Google, Chinese billionaire Liang Xinjun, Indian billionaire Mukesh Ambani, and American hedge fund investor Ray Dalio. The influx of wealthy individuals further positions Singapore as a stable and investor-friendly destination.

What makes Singapore the Ideal Hub for Family Offices?

The rise of Singapore as a preferred hub for setting up family offices is the result of meticulous policymaking and governance over the decades. The country attracts wealthy individuals with its favourable business environment, political stability, and robust legal framework.

Some of the key factors that position Singapore as the ideal hub for family offices are presented below.

- The country is ranked as the third least corrupt country globally and the most transparent nation in Asia.

- For 15 consecutive years, Singapore has been recognized as the best place to conduct business.

- Singapore is regulatory environments for financial institutions in Asia and the world.

- The strategic location of the country makes it a gateway to booming markets in Asia.

- With a stable currency and legal framework, Singapore has evolved into an attractive hub for secure investments and long-term wealth preservation.

Residency Perks for Family Offices

The residency policies in Singapore, formed through the Singapore Global Investor Program (GIP), are highly favourable for family offices. Under Plan C, qualifying family office leaders can apply for permanent residency. This empowers them to live and work in the country, while they benefit from its lucrative investment environment.

Let’s take a look at these numbers that demonstrate the growth of family offices in Singapore.

- Singapore is projected to be the millionaire capital in the Asia-Pacific region by 2030. 13% of the Singaporean population are likely to be classified as millionaires by 2030.

- Currently, more than 2,000 family offices operate in Singapore, marking a 43% Y-o-Y increment.

- Singapore headquarters 59% of all family offices in Asia.

- Currently, Singapore has 244,800 millionaires and 47 billionaires.

- Singapore has surpassed London and is currently positioned as the 4th wealthiest city in the world.

Much of this new wealth comes from Hong Kong, Mainland China, Southeast Asia, and India. Also, American UHNWIs are increasingly expressing their interest in investing in Singapore.

How Do Family Offices in Singapore Invest?

- Private capital markets: Direct investments, a preference shared throughout Asia.

- Technology and AI: AI and health tech will be emerging as dominant investment avenues, particularly in the next few years.

- ESG and philanthropy: According to new tax laws, family offices need to allocate a minimum of at least 10% or up to S$10 million of their assets to local investments.

- The role of single-family offices in Singapore is crucial, as wealthy individuals continue to shift towards professional management of their finances.

The Shift Toward Professional Wealth Management

A report reveals that 43% of family offices in the Asia-Pacific region are shifting towards professional, non-family leadership. This figure surpasses the global average of 29%. Many SFOs are now hiring from financial services, consulting, and accounting backgrounds, and outsourcing specialized functions to external experts.

As the challenge and complexity of wealth management in Singapore continue to rise, many family offices in Singapore are turning to third-party service providers. Particularly, functions like bookkeeping, compliance, IT integration, and back-office operations are professionally managed by outsourced service providers. Interestingly, 85% of respondents in a survey believe that family offices should outsource middle and back-office functions to curtail costs and improve efficiency.

Professional Consultation for Family Offices in Singapore

The family office sector in Singapore is poised for consistent growth. It is largely driven by the country’s stable economy, world-class infrastructure, and favourable environment for investors. An increasing number of single family offices in Singapore are turning to established consultants like the IMC Group for professional advisory solutions. As global wealth continues to flow into Singapore, the country is consolidating its position as the premier destination for family offices in Asia.

- NEWSLETTER, INDIA

- March 10, 2025

With the Indian government negotiating new Free Trade Agreements (FTAs) and revising existing treaties, the country’s trade policy looks in good shape in 2025. India is engaging with key partners like the US, UK, EU, and ASEAN while also expanding its reach to the Gulf Nations, Latin America, and Africa. All these agreements are set to reshape the business environment in India. This promises greater access to the market, along with sustained economic growth.

With the trade environment looking lucrative, businesses are seeking professional assistance for company formation in India from experts.

The Expanding FTA Environment in India

Currently, India has 13 active FTAs and several ongoing negotiations. The country is also re-evaluating its investment treaties and preferential trade agreements, prioritizing contemporary economic priorities. India is strategically balancing the interests of global investors with national economic goals.

Here are some of the active FTAs of India.

- SAFTA (South Asian Free Trade Area)

- India-Sri Lanka FTA

- India-ASEAN FTA (Expanded to include services in 2014)

- India-Japan CEPA

- India-South Korea CEPA

- India-UAE CEPA (Implemented in 2022)

- India-Australia ECTA (Signed in 2022)

Different Types of Trade Agreements in India

In this section, let’s take a look at the different types of trade agreements in India.

- Free trade agreements (FTAs): FTAs are comprehensive packs that eliminate trade barriers or reduce them between countries.

- Preferential trade agreements (PTAs): PTAs involve limited reduction of tariffs on selected goods. For instance, businesses might consider the India-MERCOSUR and India-Chile PTAs.

- Comprehensive economic partnerships/cooperation agreements (CEPAs/CECAs): CEPAs and CECAs cover cooperation on trade, investment, and regulatory aspects. Examples include the India-South Korea CEPA and the India-Singapore CECA.

- Bilateral investment treaties (BITs): BITs are formulated to protect investments, ensuring fair treatment for businesses and easy resolution of disputes.

- Regional trade agreements (RTAs): RTAs involve multilateral trade integration agreements like SAFTA and APTA.

Key FTA Developments in 2025

India is making significant strides in trade negotiations. Have an overview of the most notable updates.

- United Kingdom: Negotiations between India and the UK resumed in early 2025, following 14 rounds of discussions since January 2022.

- United States: India is looking to achieve bilateral trade agreements of $500 billion with the US by 2030. Discussions for a comprehensive FTA are likely to take place within the next 6-8 months.

- European Union: The next round of FTA talks between India and the EU is set to take place in March 2025 in Brussels.

- Oman: India and Oman are working on a Comprehensive Economic Partnership Agreement (CEPA). The negotiations began in 2023, with significant progress taking place since then.

- European Free Trade Association (EFTA): India and the EFTA signed a Trade and Economic Partnership Agreement (TEPA) in March 2024. It is likely to come into effect by the end of 2025.

- ASEAN: A review of the ASEAN-India Trade in Goods Agreement (AITIGA) is underway, with the fifth Joint Committee meeting scheduled for February 2025 in Jakarta.

- Qatar: India and Qatar are in discussions for a potential FTA. These countries are aiming to double trade to $28 billion over the next five years.

Other Trade Negotiations to Watch

- India-Canada CEPA: Discussions between India and Canada have been on hold since September 2023.

- India-GCC FTA: Negotiations restarted in 2022, with formal discussions expected to commence in 2025.

Revamping Investment Treaties of India

In February 2025, Finance Minister Nirmala Sitharaman announced plans to revamp India’s Model Bilateral Investment Treaty (BIT). This is likely to attract more foreign investment to the country. Currently, India is negotiating BITs with countries like UK, Saudi Arabia, Qatar, and the EU. The goal is to provide investors with better protections while maintaining flexible policies.

India has shifted from the 2016 Model BIT considering the concerns of its Western trade partners. The 2016 model largely emphasized state control, while the current approach is much friendlier to investors.

Some of the notable BITs in force include:

- India-UAE BIT: Signed in 2024, providing strong protections to investors.

- India-Uzbekistan BIT: Strengthening investment flows.

- India-Switzerland BIT (Pending): Following the EFTA-India TEPA, Switzerland is pushing for a new BIT after India canceled older treaties.

Professional Advisory Solutions for Company Formation in India

- NEWSLETTER,U.A.E

- March 10, 2025

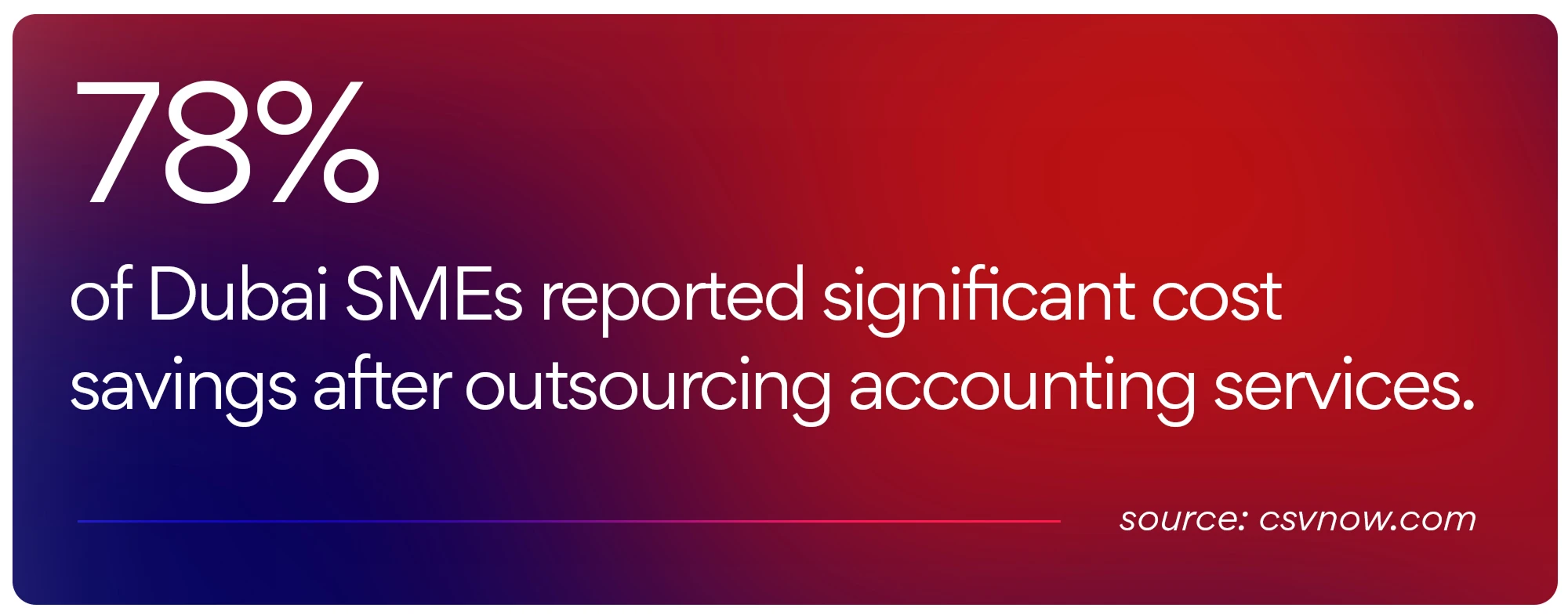

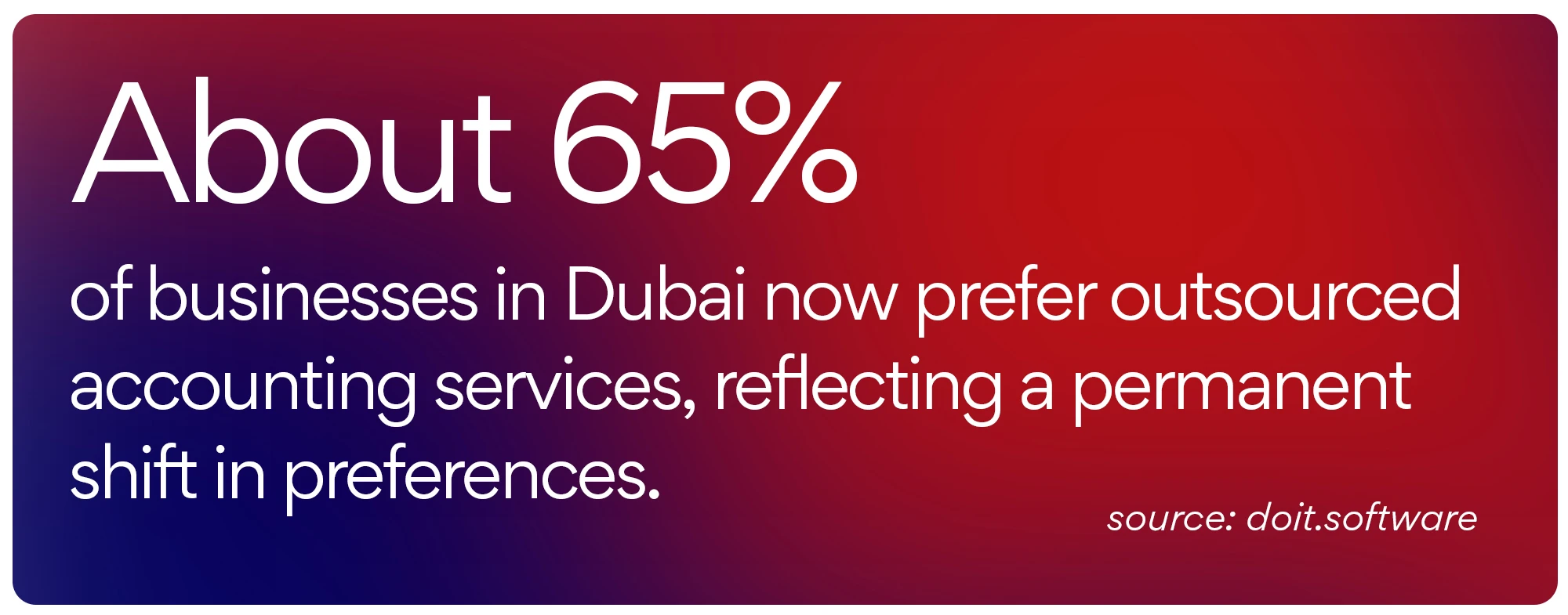

A majority of these firms are turning to established professionals offering outsourcing accounting services to streamline their business finance management. This enables companies to access advanced technologies and benefit from professional insights without incurring the overhead cost of a full-time in-house team. With this approach, firms can focus more on core business activities and strategic initiatives for growth.

Cost Efficiency and Flexibility

The clear financial benefit that organizations experience on outsourcing accounting services is one of the key drivers behind this shift. When businesses maintain an internal accounting department, they need to make significant investments in salaries, ongoing training, and infrastructure.

However, outsourcing presents firms with a more flexible and cost-effective alternative. Working with a trusted partner, businesses need to pay only for the services they require. This helps them significantly curtail costs. Eventually, SMEs can reallocate their resources towards growth and innovation.

Growing companies are capitalizing on the benefits of outsourcing accounting services, with professional advisors handling complex financial regulations. Naturally, business owners can devote more time to expanding market share and exploring new opportunities.

Thriving in the Dynamic Regulatory Environment in the UAE

The regulatory framework in the UAE continues to evolve. For SMEs, it’s a challenge to stay abreast with the latest financial standards. Outsourcing service providers are well-equipped to monitor these changes and help their clients remain compliant. This proactive approach minimizes the risk of penalties and helps companies avoid costly disruptions.

SMEs gain access to a team that constantly remains updated on regulatory developments. This level of expertise is crucial for businesses that need to adapt to new tax laws. Proper adherence to reporting standards ensure that they can keep their operations running smoothly.

Access to Specialized Expertise

Beyond cost savings, outsourced accounting services provide access to expertise that can significantly benefit an SME. Specialized professionals bring a wealth of experience to SMEs, providing strategic financial insights besides managing routine accounting tasks. Their industry knowledge and best practices, along with advanced accounting software, helps in streamlining financial operations and enhances the decision-making process of emerging companies.

Thus, SMEs can consult experts on various matters like tax planning, audit preparation, and financial forecasting. This professional insight allows businesses to optimize their financial strategies.

Improving Data Accuracy and Financial Reporting

With the adoption of outsourced accounting services, SMEs have also benefitted in terms of data accuracy and the quality of financial reporting. Leading outsourced service providers use sophisticated digital tools and platforms that ensure precise and timely record-keeping. This technological edge enhances transparency and supports better decision-making with accurate predictions.

For SMEs, data accuracy is critical, particularly in an environment where reliable financial information helps in managing risks.

Outsourced Accounting Services from Top Professionals

As small and medium businesses operating in the UAE brace up to strengthen their focus and core competencies, they are partnering external experts to delegate accounting tasks. Top companies providing outsourced accounting services, like the IMC Group, can help SMEs build stronger business models. While the professionals take care of their accounting department, businesses can invest more on product development and expanding their market in the Middle East.

- Article, Global

- March 7, 2025

Hiring a Virtual CFO vs. Full-time CFO – Cost and Benefits

How a Virtual CFO Can Support Financial Decision-making for SMEs?

Key Financial Challenges Startups Face and How Virtual CFOs Solve Them?

Some of the key financial challenges that most startups experience include the following:

- Cash flow management: Startups often struggle with cash flow management, which leads to liquidity problems. Unpredictable revenue streams and extra expenses create financial instability in the business. A virtual CFO can help with expense optimization and payment strategy to maintain cash flow.

- Financial Reporting and Compliance: Startups face challenges in navigating financial regulations, such as legal compliances and penalties. The CFO can play an important role in managing TDS and GST returns and preparing proper reports in alignment with Indian Accounting Standards (IAS).

- Lack of financial planning: Startups often lack proper financial planning, leading to numerous missed opportunities. Having a virtual CFO onboard can be essential in streamlining the financial process and preventing the risks of wrong financial decisions.

How a Virtual CFO can Help Small Businesses Scale and Manage Growth?

- The virtual CFO services can help with the business’s cash flow management.

- Virtual CFOs help to automate and streamline all the financial processes.

- They can bring CFO advisory services on customized solutions for your business to drive growth.

- Virtual CFOs help with strategic growth planning and determining business scalability.

Conclusion

Virtual CFO services can be highly beneficial for your business, especially in making better financial decisions. If you are a startup or medium-sized business, virtual CFOs can help you scale your business in a remote setting. As a result, this can help drive better financial growth for your business.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group