- NEWSLETTER,U.A.E

- December 12, 2023

Challenges in Sharia-Compliant Estate Planning

- It’s challenging to address the evolving dynamics of local GCC assets within Sharia-compliant estate plans. There has been a visible shift toward increased inclusion and significance in comparison to non-GCC assets

- Another hurdle is to explore the uncharted territories of domestic estate planning solutions like the UAE federal trust regime and common law private foundations

- Managing the web of multiple (non-GCC) jurisdictions remains a challenge, which is influenced by the demographic location of family businesses and different nationalities or tax residencies of family members

- The absence of standardization and harmonization in legal frameworks governing Sharia-compliant estate planning across different GCC countries continues to be a challenge. For affluent families, this lack of uniformity poses significant challenges to encompass all their assets within the GCC

Emerging Trends Shaping the Future of Succession and Estate Planning

1. Domestic Structuring

2. Growing Wealth in the GCC

3. Increased Awareness of Estate Planning

4. ESG and Impact Investing

5. Family Offices Becoming Professional

6. Technology in Estate Planning

7. Affordability of UAE Foundation

8. Multiple Structures for Estate Planning

9. Professional Estate Planning Advisors

- NEWSLETTER,U.A.E

- December 12, 2023

The UAE continues to be a preferred hub for entrepreneurs and investors seeking global opportunities to expand. While the country might be synonymous with a tax-free environment, entrepreneurs should be aware of recent changes in its corporate tax regime. With the recent implementation of the Federal Decree-Law No. 47/2022 on the Taxation of Corporations and Businesses, the tax-free environment has witnessed a change in paradigm. Effective from 1st June 2023, this new corporate tax regime in the UAE has been drawing the attention of investors. Forward-thinking organizations can reach out to established professionals for corporate tax advisory in Dubai to ensure compliance and manage their tax obligations.

Considering the gravity of the new corporate tax regime on your organization, it pays to understand the impact of taxation in the Free Zone areas in the UAE. In this comprehensive guide, you will get a clear understanding of the classifications, regulations, and benefits associated with Corporate Tax in the UAE Free Zones.

What Do Free Zones Mean For Your Business In The UAE?

Free Zone Persons

What Are The Corporate Tax Rates For Free Zone Companies?

Based on their classification, corporate tax rates may vary for Free Zone companies.

- QFZP (Qualifying Free Zone Person): Eligible for a 0% tax rate on qualifying income.

- NQFZP (Non-Qualifying Free Zone Person): Not meeting specific conditions, leading to different tax implications.

Avoid a AED 10,000 fine by Meeting UAE's Corporate Tax Deadlines. Contact us for Expert Tax Compliance Guidance and Protect your Business.

Criteria for Qualifying Free Zone Person (QFZP)

- Fulfill Adequate Substance in the UAE such as having sufficient assets, being involved in activities to generate income, having mandatory operating expenses and qualified employees

- As explained in Cabinet Decision No. 55 of 2023, the entity must get “Qualifying Income”

- Avoiding the applicability of the 9% tax rate

- Adherence with Arm’s Length & Transfer Pricing Rules

- Fulfilling other conditions outlined in the Cabinet Decision No. 139 of 2023

Taxation for Three Types of Business Activities in Free Zones

Business activities in Free Zones fall into three categories: qualifying activities, excluded activities, and other activities.

- Qualifying activities: Approved activities are defined as per the parameters of Cabinet Decision No. 139 of 2023. Companies actively involved in these operations may be eligible for tax incentives or exemptions.

- Excluded activities: Restricted activities include a list of operations that do not align with the criteria for tax benefits or exemptions mentioned under Approved activities. For businesses, it’s crucial to identify whether or not their activities come under this category.

- Other activities: These include activities that aren’t mentioned explicitly under the Qualifying or Excluded Activities lists. For these activities, the tax implications are decided after considering their nature and respective tax regulations.

Qualifying Income Categories

- Transactions with Other Free Zone Persons, including qualifying income that covers all the transactions excluding the ones originating from Excluded Activities

- Transactions with Non-Free Zone Persons, where qualifying income includes revenue generated exclusively from Qualifying Activities, where Excluded Activities is considered ineligible

- All Other Transactions, where Qualifying Income may include extra revenue, and has to meet de minimis requirements

Tax on Accountable Income

- Tax on Accountable Establishment Income: Income attributed to Domestic or Foreign Permanent Establishments of Free Zone Persons is calculated at a 9% tax rate.

- Tax on Accountable Income to Establishments and Immovable Property: Tax rates on accountable income may vary on the basis of the nature of transactions and parties involved. It is crucial for businesses to understand these aspects to comply with tax regulations in Free Zones.

- NEWSLETTER,SINGAPORE

- December 12, 2023

In a recent survey carried out by CBRE, Singapore emerged as the third most preferred destination for cross-border real estate investment in the Asia-Pacific region in 2022. With the real estate industry in Singapore looking promising, it presents lucrative opportunities amidst stability and resilience. Being a forward-thinking investor, you might be thinking about how to start real estate business in Singapore. Whether you are considering your first real estate venture or happen to be a seasoned investor, this newsletter will help you gain the essential knowledge to make strategic decisions.

Singapore has emerged as a prime hub for global investors to put their money into real estate. The government of Singapore came up with a strategic approach while combating the challenges posed by the Covid-19 pandemic. As a result, the country’s real estate industry has witnessed a steady increment in property prices. Along with its strong global commercial infrastructure, the booming real estate market positions the country as a promising and secure investment destination, where you can capitalize on mid- to long-term benefits.

What Makes Singapore A Prime Investment Hub for Real Estate Investors?

- Sophisticated digital infrastructure: Singapore boasts edge-cutting digital infrastructure, a crucial aspect defining efficiency and connectivity for modern investors.

- Competitive workforce: The country has a workforce known for its competitiveness and diversity. For businesses seeking a skilled pool of talent, Singapore has emerged as a top investment destination.

- Expanding Central Business District: Singapore’s Central Business District has been consistently expanding, further strengthening the country’s position as a regional centre of business and wealth. For savvy investors, it holds immense potential for returns.

- Work-life balance: The typical Singaporean lifestyle is defined by the much-needed work-life balance. This makes it a preferred destination for both expatriates and residents.

- Low crime rate: Given that safety is paramount, the country boasts a negligible crime rate. Thus, a secure environment helps businesses and investors thrive.

- Political and economic stability: With political and economic stability ensuring a peaceful environment for residents and businesses, investors are drawn towards the country for secure deals.

- Strong dollar value: The Singaporean dollar has been performing pretty well compared to other currencies. This makes it a preferred hub for investment in the long run, particularly in the real estate segment.

- Regulation of financial institutions: In Singapore, financial institutions remain under the scrutiny of the authorities. This serves as a source of confidence for investors, who trust the financial ecosystem in the country while investing in real estate.

Your Guide to Residential Real Estate Investment in Singapore

1. Preliminary Considerations

2. Hiring a Professional Team

Consulting one of the trusted agent works wonders, provided the professional addresses your interests, not the sellers’. Identifying investment hot spot for wealthy foreigners in Singapore is crucial, and having a professional agent to guide you largely helps. Besides, it’s advisable to consult an experienced real estate lawyer, who can help you identify the potential pitfalls of the property and understand necessary legal aspects. In case financing is a part of your plan, make sure to loop in a financial adviser.

3. Structure your Real Estate Purchase

4. Get Financial Advice

5. Choosing your Property

6. Focus on the Buying Process

7. Get Tax Advice

8. Securing your Investment

Professional Support Matters during Property Investments in Singapore

The real estate market in Singapore presents a wealth of opportunities for those looking to invest wisely. The IMC Group continues to be your trusted partner for Singapore company incorporation, besides providing professional advice regarding taxation and finance. Supporting you at every step, we provide valuable insights and personalized solutions for your real estate ventures in Singapore.

- Article, India

- December 8, 2023

India’s currency has weakened due to a significant outflow of funds. However, its strong underlying strengths and projected growth continue to make it an appealing prospect for foreign investors.

Indian investors can invest from anywhere via several routes: Foreign Direct Investment (FDI), Foreign Portfolio Investment (FPI), Foreign Venture Capital Investment, and Alternative Investment Fund.

Today’s topic of discussion is one of the most popular investment paths – Foreign Portfolio Investment (FPI).

- What is Foreign Portfolio Investment (FPI)?

- Can you provide information about India's main laws and regulations for a Foreign Portfolio Investor (FPI)?

- What are the different Types/Categories of Foreign Portfolio Investors in India?

- What are the advantages of registering as a Category I FPI compared to Category II?

- What are the key operational aspects to consider when making a foreign portfolio investment?

- What tax compliances must an FPI follow under the Income Tax Act of 1961?

- FPIs face several burning issues under the current tax regime

- Areas Where IMC Can Assist FPIs

What is Foreign Portfolio Investment (FPI)?

Can you provide information about India's main laws and regulations for a Foreign Portfolio Investor (FPI)?

What are the different Types/Categories of Foreign Portfolio Investors in India?

An applicant can obtain an FPI license under SEBI regulations in one of two categories below:

(a) “Category I FPI”, mainly includes:

- Investors associated with the government or government entities

- Pension funds and university funds are two separate types of financial entities

- Entities like asset managers, banks, and investment advisors should be appropriately regulated

- Entities that meet the eligibility criteria set by the Financial Action Task Force (FATF) member countries

(b) “Category II FPI” includes all investors who are not eligible under Category I:

- Funds that are appropriately regulated cannot be considered as Category-I foreign portfolio investors

- Endowments and foundations are charitable organizations supporting a specific cause or mission

- “Corporate bodies” refers to organizations or groups legally recognized as distinct entities from their members or owners

- Family offices

- Individuals

- Unregulated funds can take the form of limited partnerships and trusts.

What are the advantages of registering as a Category I FPI compared to Category II?

The main advantages of category I are listed below:

(a) Determining the eligibility to issue Offshore Derivative Instruments (ODIs);

(b) Compared to Category II FPIs, Category I FPIs enjoy easier compliance with certain KYC norms.

(c) Regarding stock and currency derivatives, the position limits have been increased.

Category I FPIs are exempt from the Indian Income-tax Act’s “Indirect Transfer” provisions. These provisions apply to overseas investors who transfer shares/interest in an overseas entity with assets in India.

What are the key operational aspects to consider when making a foreign portfolio investment?

The following are the significant operational features:

1. Appoint a legal representative:

To obtain an FPI license under SEBI regulations in India, it is necessary to appoint a legal representative to assist in the process. The application needs to be submitted in the prescribed format, along with all the required documentation. Financial institutions authorized by the Reserve Bank of India can act as legal representatives and reputable law firms.

2. Appoint a Tax advisor:

If you are an FPI working in India, complying with all tax obligations is essential. A tax advisor can help you with this by maintaining records, issuing certificates for repatriating funds out of India, handling annual tax compliances, and representing you before tax authorities. By hiring a tax advisor, you can ensure that you meet all the requirements and avoid any legal issues related to taxes in India.

3. Appoint a Domestic Custodian

Before investing in India, appointing a domestic custodian to provide custodial services such as banking and Demat operations for your securities is essential. A domestic custodian refers to any entity registered with SEBI to carry out the activity of providing custodial services for securities.

What tax compliances must an FPI follow under the Income Tax Act of 1961?

Foreign Portfolio Investors invest in securities such as shares, bonds, debentures, and units of business trust, earning income in the form of dividends, interest, and capital gains. They must remit this income and capital investment out of India regularly.

To remit funds, deposit the applicable income tax with the government treasury. Taxes depend on the nature of the income and can be paid through withholding or self-assessment. Also, the banker must have a tax advisor’s certificate to remit the funds.

FPIs must file an annual tax return electronically at the end of each Indian financial year. If requested, tax authorities may scrutinize the return.

FPIs face several burning issues under the current tax regime

Many Foreign Portfolio Investors (FPIs) structured as non-corporates have to pay a higher surcharge rate on their income from capital gains. As a result, several FPIs are contemplating converting their structure from non-corporate to corporate. However, this conversion may attract General Anti Avoidance Rules (GAAR) under Indian tax laws.

FPIs with fund managers in India with potential business connections must satisfy prescribed conditions.

Areas Where IMC Can Assist FPIs:

- Assisted in guidance and helped with organizing the FPI route

- Support setting up the structure under the FPI route

- Obtain transaction information from the custodian and maintain records

- Computation of tax liability on securities per the Indian Income Tax Act, Double Taxation Avoidance Agreement, and Multilateral Instrument

- Issuance of certificate for repatriation of funds as per Income-tax Act and RBI guidelines

- Organising and filing Annual Income Tax Returns

- Assisting in responding to and managing notices or letters issued by tax authorities and providing related advisory services

- During tax proceedings, one can review assessment orders

- Communication with the tax authorities

- NEWSLETTER,U.A.E

- December 8, 2023

This is to inform you that the Economic Substance Regulation (ESR) requires reporting by December 31, 2023, for the Financial Year ending December 31, 2022.

The Economic Substance Regulations (ESR) in the United Arab Emirates (UAE) require certain legal entities in domestic and free zones to conduct one or more of nine relevant activities (RA) (referred to as “licensees”) to comply with annual filing obligations.

Licensees earning income and meeting under the exempted licensee criteria (for instance, if a licensee operates as a branch of a foreign entity and its income is taxed in a foreign jurisdiction) must submit a notification but are exempt from filing a report.

Navigate ESR with Experts

There are other exemptions. The Ministry of Finance has recently released updated instructions in Ministerial Decision No. 100 of 2020, which can help firms determine whether they conduct a relevant activity and are exempted licensees.

Key Factors to Consider

Relevant Activities (RA): As per the UAE Ministry of Finance’s ESR Regulation, the responsibility for submitting an ESR Notification and ESR Report lies with Licensees involved in any pertinent activities and generating specified relevant income outlined in the regulation.

Reminder about the Deadline: The deadline to submit the ESR Report is approaching. We strongly encourage you to act promptly, to guarantee compliance with the regulatory obligations.

An entity must submit a notification within six months from the end of the fiscal year (FY) stating its engagement in RA, regardless of whether the licensee is exempt from the ESR or generates income from RA.

A report outlining specific business details should be filed within 12 months after the conclusion of the Fiscal Year, solely if income was derived during the period from RA and the licensee was not exempt from the ESR.

Consequences of Non-Compliance: Not submitting the ESR report by the specified deadline may lead to an administrative penalty of AED 50,000. It’s essential to adhere to the resolution’s provisions by submitting the report and any pertinent information or documentation to avoid these penalties. Furthermore, failure to comply with the Economic Substance regime for the year ending 31 December 2022 will have severe results, such as suspension or cancellation of your business license.

Suggested Steps for Your Business

ESR Evaluation: We advise all Licensees to undertake a thorough ESR assessment, irrespective of involvement in pertinent activities, and, if applicable, to submit an ESR notification and report via the MoF portal.

Accountability for Pertinent Activities: Licensees involved in relevant activities and generating relevant income are obligated to file the ESR Notification and ESR Report. They will be answerable to their respective regulatory authorities.

Key ESR Factors to Consider before the end of the Financial Year

- The entity needs to evaluate if it engaged in and earned income from any of the nine RAs within the period. This assessment is crucial as it determines the entity's specific ESR compliance needs for the fiscal year

- Entities that have generated income from RA during the fiscal year should assess their adherence to the relevant ESR evaluations, namely the directed and managed test, core revenue generating activities (CIGA) test, and adequate examination

- After the review, entities should promptly undertake all essential measures before the fiscal year's conclusion to rectify any potential non-compliant areas (i.e., ensuring adherence to all relevant ESR tests)

- Regarding the CIGA test, entities must showcase control and supervision over any outsourced arrangements during the fiscal year. This can be illustrated, for instance, through contractual agreements or correspondence

- Given the FTA ESR audits, Licensees should gather pertinent supporting documents regarding their ESR compliance obligations and maintain them on file. Should they be chosen for an audit, Licensees have a brief timeframe of 5 working days to furnish the FTA with all requested documentation (i.e., demonstrating compliance with the ESR tests)

How Can IMC Be Your Trusted Ally?

Navigating the complexities of compliance with regulatory bodies such as the Federal Tax Authority (FTA) and the Ministry of Finance (MOF) can be challenging. At IMC, we understand the importance of staying in good standing with these authorities. That’s why we’re here to assist you in conducting a thorough ESR assessment and ensuring clear communication of your status to the regulatory authority.

By partnering with us and addressing these requirements promptly, you can avoid the stress of potential conflicts and significant penalties. Remember, we’re just a call or an email away for any additional guidance or questions you might have. Let’s tackle these challenges together, with ease and confidence.

- NEWSLETTER, GLOBAL

- November 28, 2023

Compliance leaders find themselves at a crossroads in 2023 with a plethora of challenges to address. Amidst political tensions, economic volatility, and a competitive labor market, they have little resources at their disposal, with more to achieve. No wonder compliance leaders heavily rely on established service providers for governance risk and compliance. Standing in 2023, three pivotal compliance function trends demand strategic attention. These involve embracing increased investments in technology, adapting to changing labor markets and working on tighter budgets.

Prioritizing these challenges, compliance leaders need to optimize their staffing decisions and expenses, adjust existing budgets, and take care of optimal productivity in their departments. Besides, strategic investments in technology are to be made as required.

Optimizing Budgets Amid Economic Strain

With rising interest rates and fears of yet another recession looming, organizations are reeling under the pressure to operate within more constrained budgetary restrictions. Compliance leaders find themselves grappling with increased workloads while respecting regulatory norms stemming from the pandemic. They need to maximize efficiency while maintaining cost efficiency.

Industry experts focus on retaining personnel, given that a substantial part of compliance budgets is necessary for staffing. Besides, industries have witnessed a surge in interest in technology solutions, which is largely driven by the push towards automation. This has turned out to be a pivotal factor in augmenting productivity during economic depressions.

Adapting to Evolving Labor Markets

Compliance departments have significant decline in the number of FTE (full-time employees) since 2020. This trend is likely to dominate the industry till 2023. The challenge seems to have intensified with intense geopolitical tensions, greater regulatory scrutiny, and a competitive talent market. This explains why organizations are finding it increasingly challenging to retain existing staff or scale up their departments.

Addressing this crisis calls for an innovative approach to retain talent and maintain workflow efficiently.

Technology Investments on the Horizon

Ensuring Compliance Through Enterprise Risk Management Solutions

Amidst uncertainties and challenges in the global business ecosystem, enterprise risk management solutions have emerged as indispensable tools like Corporater for compliance leaders. ERM solutions are a critical component of the recommended technology investments by experts in 2023. It offers a holistic approach to identifying, evaluating, and mitigating risks. These solutions leverage advanced analytics and automation to help compliance teams sail through the evolving regulatory landscapes seamlessly.

IMC and Corporater: Innovating Compliance Management and Tracking Solutions

The IMC Group continues to be a reliable partner for ERM solutions. From managing hotlines to enhancing ethics training and strengthening risk management systems, a professional hand from this established team ensures sustainable compliance resilience. We offer a comprehensive range of services in partnership with Corporater to empower organizations to make informed, responsible decisions while being risk-aware, ensuring sustainable growth.

Corporater is a global software company that offers integrated solutions for governance, risk, compliance, and performance management to medium and large organizations worldwide. Top Fortune 500 companies use their solutions.

IMC has partnered with Corporater to offer efficient and effective business solutions to companies worldwide. Along with Corporater, IMC assists in overcoming various challenges, and it offers a comprehensive solution to manage all aspects of business governance, including performance, risk, compliance, policies, standards, and audits.

- NEWSLETTER, GLOBAL

- November 27, 2023

Walking in the shoes of a CEO or business head, there’s no denying that the digitized business landscape presents a plethora of risks to your business. Whether you are a startup or the leader of a conglomerate, it pays to draw a strategic line of defence to mitigate these risks. Forward-thinking organizations adopt governance risk and compliance software early on to address the challenges using sophisticated technologies comprehensively.

Well, risk assessment continues to be a strategic tool for businesses regarding decision-making. A meticulous and structured approach makes the strategy effective. Let’s take a look at the tried-and-tested tools and methods to assess and mitigate business risk.

What Are The Different Stages of Risk Assessment?

1. Identifying Risks

2. Quantifying the Risk

3. Prioritize the Risks

The next logical approach for you is to prioritize the risks to take action. Organizations need to evaluate the threats, prioritize them, and eventually determine the ones that they should address first based on their significance.

Established companies specializing in enterprise risk management solutions deploy instruments such as risk matrices. Tools help them prioritize the risks based on their threat potential, which helps them recommend strategic solutions.

4. Weigh Each Risk

As a part of the risk prioritization process, it’s essential to understand the relative magnitude of each risk against others. Based on the risk appetite, businesses need to address the situation.

Therefore, the best way to approach the situation is to compare established benchmarks in the industry, predetermined threshold, and past experiences to decide the most suitable way to respond to the threat.

5. Risk Mitigation and Management

6. Monitor the Situation and Review it

Best Risk Assessment Methods for Businesses

1. Qualitative Assessments

This type of assessment is based on non-numerical data, which is primarily descriptive. It is applicable in scenarios where businesses find it challenging to gather numerical data. Qualitative assessments work wonders while capitalizing on the power of experience, intuition, and expertise to evaluate risks.

Under qualitative assessments, businesses can adopt different techniques like SWOT analysis. Here, they explore both the external and internal elements that impact their decisions or projects. It helps in identifying their threats, opportunities, strengths, and weaknesses.

Also, some businesses use the expert judgment method, which works on insights from those holding expertise. You also have the Delphi method, which involves a structured dialogue among experts.

2. Quantitative Assessments

This is where businesses work extensively on numerical data. Quantitative assessments involve financial, numerical, and statistical analyses, where they gain a more data-centric or systematic perspective on the threats.

Some techniques under quantitative assessments include Monte Carlo simulation, decision trees, and sensitivity analysis.

3. Other Types of Assessments

Beyond qualitative and quantitative analysis, businesses also need to deploy other types of risk assessment mechanisms. These include:

- Scenario Analysis: This method involves evaluating businesses by considering different situations that may arise in the future. With this approach, businesses can evaluate the best, worst, and most probable situations. Thus, they gain adequate insights to visualize and weigh the potential rewards and risks.

- Stress Testing: Stress testing is another approach where businesses scrutinize their potential vulnerabilities in a particular system. The models are designed to emulate drastic conditions. Accordingly, they work on the best way out.

- Comparative Risk Assessment: A comparative perspective is used in this approach where businesses compare potential risks against each other. Thus, they can detect the threats that require immediate attention. Generally, this becomes vital when businesses run out of resources.

- Hybrid Risk Assessment Method: Under this mechanism, businesses need to prioritize adaptability. At times, no single technique can bail you out of the threats. This requires you to use both qualitative and quantitative risk management strategies to mitigate the threat. Since more than a single method of risk mitigation is involved in this approach, it is known as a hybrid risk assessment method.

Deciding on the Right Risk Assessment Approach

Working closely with an established professional is the key to assessing your business risk. The IMC continues to be one of the best companies for governance risk management and compliance services. With professional backing, businesses can strategically choose the right combination of risk-mitigation strategies. Prioritizing the objectives and stature of your business, the experts can show you the way through troubled waters. Our clients can benefit from our expertise in risk management combined with Corporater’s advanced Governance, Performance, Risk and Compliance software, resulting in a comprehensive, top-tier solution.

Corporater is a powerful Business Management Platform (BMP) software that helps organizations create a digital blueprint of their enterprise, thoroughly view their business, and operate efficiently as a connected enterprise. All solutions built on Corporater BMP can be seamlessly integrated or used independently as purpose-built point solutions.

IMC has partnered with Corporater to provide end-to-end technology-enabled managed services, assisting businesses with their market-leading GPRC software solutions.

- Article, Global

- November 21, 2023

In the ever-expanding global business landscape, organizations often find themselves employing a workforce that spans international borders. While this presents numerous advantages, such as access to a diverse talent pool and new markets, it also brings a unique set of challenges, with international taxation being one of the most complex and critical issues to address. This article delves into the intricate world of international taxation, offering insights and strategies to help you navigate the complexities and ensure compliance while optimizing your global workforce.

Global mobility services play a pivotal role in assisting businesses in managing the tax complexities associated with an internationally dispersed workforce. These services encompass a range of specialized solutions, including tax planning, compliance, and advisory services, tailored to the specific needs of companies with global operations. Leveraging the expertise of global mobility services providers can be instrumental in streamlining tax-related processes and reducing potential risks and liabilities.

With the assistance of global mobility services, businesses can effectively address international taxation challenges, allowing them to remain compliant with tax regulations in various countries and optimize their global workforce. In a world where borders are becoming increasingly blurred in the realm of international business, partnering with global mobility services providers is an essential step toward ensuring your organization’s success on a global scale.

Understanding the Basics

International Taxation - What Is It?

Key Players in International Taxation

Home Country: This is the country where your company is headquartered. It has a say in how your global income is taxed.

Host Country: The country where your employees are based or where your company operates is known as the host country. It can also tax your income.

Tax Treaties: Many countries enter tax treaties to prevent double taxation. These treaties determine how income is allocated and taxed between the home and host country.

The Significance of Compliance

Tax Compliance in the Employee’s Host Country

An employer with employees working in multiple international locations must comply with the host country’s local and national tax laws. When dealing with a global workforce, paying close attention to tax compliance in the employee’s host country is crucial.

It is essential to remember a few key things, such as:

1. Understanding Local Tax Laws

2. Employee Classification

3. Withholding Taxes

4. Reporting Requirements

5. Seek Professional Guidance

Cross Border Employees Need a Plan for Addressing International Tax Issues

1. Employee Education

2. Tax Compliance Support

3. Structuring Compensation Packages

4. Regular Compliance Checks

Regularly review the tax compliance of your cross-border employees. Ensure compliance with tax obligations to avoid future issues.

Having a well-thought-out plan in place not only facilitates a smoother experience for your international employees but also protects your organization from potential tax and legal complications.

What Qualities to Seek in a Mobility Tax Specialist

1. International Tax Expertise

2. Cross-Border Experience

3. Regulatory Knowledge

4. Problem-Solving Skills

5. Communication and Education

In conclusion, international tax rules for global workforces can be intricate, but with careful planning, education, and the correct tax professionals, businesses can ensure compliance while optimizing their global operations. Addressing the tax obligations of cross-border employees, having a robust plan for international tax issues, and selecting the right mobility tax specialist, such as IMC Group, are key steps in successfully navigating this complex landscape.

IMC Group, with its expertise in global mobility services and international tax matters, can be a valuable partner for businesses looking to manage their tax complexities effectively. They offer comprehensive solutions to help organizations streamline their international operations while remaining in compliance with tax regulations across different countries.

By embracing these principles and collaborating with trusted partners, businesses can thrive in the global marketplace, leaving the borders of taxation behind. Remember that expanding your business across international borders offers tremendous opportunities and brings unique challenges. Understanding and addressing these challenges is essential for your organization’s success in the global arena. So, embrace the opportunities, navigate the complexities, and ensure compliance – because taxation knows no borders in international business.

- NEWSLETTER,U.A.E

- November 13, 2023

In the dynamic business environment in the United Arab Emirates, foundations have emerged as a powerful tool for safeguarding wealth and ensuring seamless succession planning. Foundations were introduced in 2017 in the UAE and have gained prominence quickly. Currently, they find their place in three of the free zones in the UAE, including RAKICC, ADGM, and DIFC.

A foundation in the UAE is an independent legal entity allowing individuals to consolidate their wealth while keeping their personal assets distinct from their business interests. This separation takes place by endowing assets to the foundation, which holds them in its name. During your company formation in Dubai, you may decide to establish a foundation and take advantage of its benefits.

A foundation is free from shareholders and works as an ‘orphan’ entity. These foundations are managed according to their charter and help beneficiaries, who often belong to the same family. This striking feature of foundations makes them suitable for succession planning.

Advantages of Establishing a Foundation in the UAE

1. Protecting Assets

2. Privacy

Since foundation beneficiaries remain confidential, they ensure discreet family wealth management. It reduces the potential for claims or judicial actions from third parties trying to exploit the wealth of the founder. This significantly secures the financial interests of the family.

A confidential foundation structure enhances the bargaining power of the founder in business acquisitions and negotiations. It mitigates the risk of the founder or heirs being targeted by individuals with malicious motives to access their wealth.

3. Flexibility

4. Effective Succession Planning

5. Better Family Governance

6. Philanthropic Opportunities

Foundations in the UAE also provide philanthropic opportunities. Founders have the scope to align their foundations with humanitarian and ethical values. This enables them to support causes and initiatives holding personal significance.

This is an ongoing support and can involve making regular donations to charitable organizations, education, medical research, etc. Therefore, the legacy of the founder extends beyond preserving wealth and contributes to the society.

7. Legacy in Perpetuity

The IMC is a trusted and experienced business setup consultant in Dubai, providing expert guidance to entrepreneurs and corporations establishing a new company in the UAE’s thriving economy. Our dedicated team offers customized solutions to ensure that your venture in Dubai is set up with professionalism and a deep understanding of the local market. Let us help you establish your business with precision and expertise.

- NEWSLETTER,SINGAPORE

- November 13, 2023

In a move to encourage higher investment in social and environmental causes, the Monetary Authority of Singapore (MAS) has updated its guidelines for SFOs (Single Family Offices) looking for tax incentives under the Section 13O and Section 13U schemes. These changes are likely to benefit your single family office in Singapore, fetching you better tax incentives and shift the focus to develop sustainable investment practices.

Have a look at the key policy updates and their respective implications.

Minimum Assets Under Management (AUM)

- Currently, the minimum AUM for the 13O Scheme stands at S$20 million while applying. This has to be maintained throughout the incentive period, eliminating any grace period

- At S$50 million, the minimum AUM for the 13U Scheme remains unchanged while applying as well as the period throughout incentives

- The updated norms highlight the need for SFOs to have a financial buffer in their plans. This ensures that they can fulfill the criteria even when markets remain volatile

Investment Professionals (IPs)

- The 13O Scheme makes it mandatory for an SFO to use at least two IPs, where there should be at least one non-family member IP

- IPs in Singapore should hold relevant qualifications for fund management and maintain tax residency

- According to the 13U Scheme requires at least three IPs, including one non-family member IP

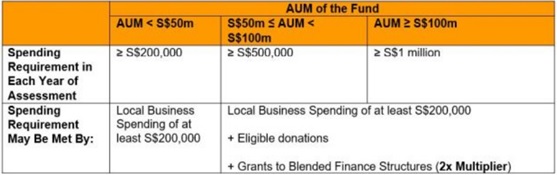

Minimum Spending Requirement

- According to the 13O Scheme, local business expenses should be at least S$200,000 per financial year. This is subject to the Tiered Spending Requirement Framework

- According to the 13U Scheme, at least S$500,000 has to be spent on local businesses in a financial year, also subject to the same framework

Tiered Spending Requirement Framework

Capital Deployment Requirement (CDR)

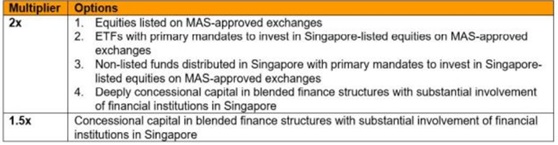

- Under the updated guidelines, funds must allocate at least 10% of their AUM or S$10 million for particular local investments

- The list of eligible investments has been expanded to include climate-related projects and blended finance structures that involve substantial participation from Singapore-licensed/registered financial institutions

- Multipliers have been introduced to incentivize certain investments, helping SFOs meet the Capital Deployment Requirement and facilitating their contributions to the local economy.

These newly introduced guidelines aim to make the 13O and 13U Schemes more flexible for Single Family Offices. This will foster an environment conducive to sustainable investments and economic growth. Besides, they promote a higher degree of professionalism within the SFO sector. In the process, Singapore further solidifies its position as a dynamic hub for family officers, emerging as a leader in responsible wealth management.

With Singapore’s SFOs growing popularity, you may partner with one of the trusted companies like the IMC Group to make the most of the opportunities. Professionals can help you maximize your tax incentives as you grow your single family office in the country.

A Member Firm of Andersen Global

- 170+ Countries

- 390+ Locations

- 13,000+ Professionals

- 1800 + Global Partners

- 170+ Countries

- 390+ Locations

- 13,000+ Professionals

- 1800 + Global Partners

- 170+ Countries

- 390+ Locations

- 13,000+ Professionals

- 1800 + Global Partners