- Newsletter

- July 15, 2020

In an effort to attract more US investors, the Association of Southeast Asian Nations, or ASEAN as it is more commonly referred to, is now promoting Special Economic Zones in order to become a more powerful trading bloc of member states. These zones are comprised of industrial parks, innovation areas, special export processing areas, and technology parks. Since the ASEAN Economic Community or AEC was established in 2015, they have become increasingly more important to the overall economic picture.

Revenue Statistics

As of 2018, the total revenue from two-way trading between the US and ASEAN has reached $260 billion (USD). Furthermore, the US is now the 4th largest trading partner in the ASEAN. There are 3 key points that have come out of this:

- First, US investors have been presented with new investment opportunities in the ASEAN region, especially in countries such as Malaysia, Singapore, and Vietnam.

- Second, the bloc’s SEZ’s are facilitating more trade between the US and ASEAN through a range of fiscal and non-fiscal incentives.

- Third, Total trade between the two has exceeded the $260 billion (USD) mark reached in 2018. This includes ASEAN exports of commodities, electronics, machinery, and textiles.

While the top ASEAN export categories included electronics, footwear, garments and textiles, and machinery, the largest single exporters included:

- Vietnam – $49.2 billion (USD)

- Malaysia – $39.4 billion (USD)

- Singapore – $27 billion (USD)

ASEAN members agree that US investors who want to take advantage of the SEZ’s should try to be more understanding of those factors that can affect their business.

In Thailand, the government commenced the establishment of 10 SEZs in border areas with Cambodia, Laos, Myanmar and Malaysia with the aim to increase border trade between the countries that was valued at US$32 billion in 2018. While the export to US totaled US$30 billion in 2019, which accounted for exports of rubber tires, semi-conductors, precious stones and computer chips.

Another ASEAN member country, Philippines has 12 SEZs and over 300 economic zones while it exported computer hardware and electronic things amounting to US$12 billion to USA. With bustling trade between US and ASEAN countries, most countries including Indonesia, Myanmar and Cambodia have started investing in manufacturing for export to the western countries, over the years.

Opportunities increasing in Malaysia, Singapore, and Vietnam

While there are numerous countries in the ASEAN bloc, US investors are paying special attention to the countries of Malaysia, Singapore, and Vietnam. Here’s why:

Malaysia – the 5 investment corridors in Malaysia ship $600 million in cell phones, $4 billion in computer chips, and $890 million in semi-conductors annually. As of 2018, these 5 corridors were responsible for the creation of nearly 2 million jobs and increasing investments in new company formation in Malaysia worth $188 billion. In addition to this, the ECER (East Coast Economic Region) is anticipating the addition of 120,000 new jobs and investments reaching $16 billion by 2025.

Singapore – the nation is too small to establish SEZ’s of its own despite having the largest port in shipping volume in the world. Consequently, it has partnered with the Malaysian Government to form the Batam Export Processing Zone and the Iskander SEZ. Both have been successful where new company formation in Singapore is concerned. As a result, the total trade between the US and Singapore reached $57 billion last year.

Vietnam – in 2019, Vietnam ranked 11th in total trade dollars ($25 billion+) with the US with the top exports being $3 billion in cell phones, $1 billion in furniture, and $1.1 billion in garments and textiles. New company formation in Vietnam has included the addition of more export processing facilities and the possible creation of SEZ’s along Vietnam’s lengthy eastern coast. In so doing, they will compete for additional foreign investments with South China.

- Article, Singapore

- July 3, 2020

Singapore is known for transparency in its government and its Accounting policies and procedures. Accounting in Singapore is governed by strict rules, regulations, guidelines, and more that are established by Singapore’s government. Many Singapore-based and international businesses are responding by using accounting software programs that conform to Singapore’s national accounting system. One of these software programs is Zoho books. More about this revolutionary software program will be explained below.

Zoho Books Cloud Accounting

The Zoho Books accounting software program integrates into the vast cloud network. This keeps your Singaporean-based or international business’s information safe, permanent, and accessible from anywhere. It contains many features and tools that will make it easier for your business to easily conform to and follow Singapore’s vast and strict accounting system, guidelines, rules, and more!

You can keep track of your financial and other business operations through the following features that automate them, keep records of them, and store them on a vast and permanent system (the cloud!)

- Automating repeat and mundane/standard tasks – these include data entry for statement and account reconciliation, invoices, various financial/accounting statements, and more!

- Streamlining the tax process – you can simplify the entire process of preparing and tracking tax documents by automating them and putting them online. Now you’ll always know where all your documents are. You’ll also know where you stand in terms of Singapore’s national tax law!

- Have globally accessible data – when you use an accounting program that is connected to the cloud, you’ll store your information on a network that can be accessed from anywhere!

- Use your accounting information with other business programs – since accounting is one of the pillar functions of business, it is necessary to integrate it into all of your other business operations. For example, you can integrate Zoho books into leading CRM software programs. This will streamline your billing cycle and operations. It will also make it easier for you to keep track of your sales pipeline, processes, and cycles.

- You’ll save the environment – by automating your information and placing it on a virtual and global system, you lessen the need for hard copies of your statements and other financial records. This saves trees and the environment. It also eliminates the possibility of losing vital documents, and it helps you better manage your accounting systems and cycles.

Zoho Cloud Accounting Singapore

When you use Zoho Cloud accounting in Singapore, you’ll have access to many features and tools that will give you almost ‘superpower abilities’ in terms of tracking and managing your financial documents and accounting systems. For example, you can instantly create and send out invoices to your customers. This ensures that payment occurs quickly and easily. You can also connect your invoices to be sent out and linked to a system that accepts electronic payments.

You can also do internal account and business management by emailing out regular reports about different and various aspects of company performance. You can improve these metrics through regular meetings with pertinent employees. Zoho offers you access to a dashboard. This provides you with a general overview of all of your business activities and operations from a financial standpoint. You can always ‘be in the loop’ with this valuable feature.

Zoho Accounting Price

Zoho comes in three plans:

- Basic – this one costs nine dollars a month. You’ll get the following features:

- Maximum of 50 contacts

- 2 users

- 5 automated workflows

- Bank reconciliation

- Custom invoices

- Expense tracking

- Projects and timesheets

- Repeat transactions

- Sales approval Budgeting

- Zoho sign integration

- Standard – this will set you back $19 a month. You will get the following features

- All of the basic plan features

- Store up to 500 contacts

- 3 users

- 10 automated workflows/module

- Bills

- Vendor credits

- Reporting tags

- Purchase Approval

- Twillio Integration

- Professional – you’ll pay $29 a month for the following features/abilities:

- All standard plan features

- Store more than 500 contacts

- Up to 10 people can use

- 10 automated workflows/modules

- Purchase orders

- Sales orders

- Inventory

- Custom domain

Zoho Implementation procedure

Follow these steps if you want to start using Zoho in your company:

- Create a diagram of all of your business and sales processes

- Filter out anything not related to CRM

- Import custom fields if you need them

- Prepare and test your data. Then import it

- Use Zoho. test the information and the system to see how it works. Fix any bugs immediately.

Zoho Accounting software

Zoho lets you do the following in relation to Accounting and CRM:

- Invoicing – you’ll get paid immediately by customizing invoices and sending to your customers electronically

- Estimates – you can manage your corporate sales budgets by creating professional invoices. You can then send them out to customers immediately

- Client portal – consolidate your customers’ transactions in an easy to view place and screen. This will give your customers freedom and confidence.

- Expenses – track your expenses accurately and electronically. You’ll be able to upload receipts. This will keep you ‘on top of the ball’ because you’ll always know who you owe money to and where your sales revenue is going.

- Bills – automated billing will help you track and manage your accounts receivables

- Banking – you can easily import and organize all of your banking transactions. This will help your CRM and accounting/financial management systems.

- Projects – by automating your projects, tasks, timelines, deadlines, deliverables, and more, you’ll always know what your real billing hours are. This translates into more savings and revenue for you.

- Inventory – you’ll always know the real story with your inventory when you electronically track it. You’ll automatically be informed of stockouts. You’ll also know the speed at which your inventory moves. You can do sales analysis if you automate your inventory.

- Sales orders – you can automate your sales process. This will allow you to send sales orders and receipts electronically. You can cross-check sales information before shipping orders out to customers.

These are just some of Zoho’s many features that will give you more control over your business processes and operations.

Singapore Zoho Packages

You pay in Singapore dollars for the following packages:

- Free – you pay nothing for these features and abilities

- Maximum of 20 subscriptions

- 1 user

- Hosted payment pages

- Works for many currencies

- Stripe compatible

- Allows offline payments

- Measures data related to customer subscriptions

- 24-hour email customer support on the weekdays

- Basic – you pay $39 a month. The magic that this package will let you work is:

- Ability to store up to 500 clients

- 3 people can use

- 3 automated workflows/modules

- All free plan features plus

- REST API & Webhooks

- Standard – this sets you back $79 a month, but you’ll get these features:

- Store up to 2,000 clients

- 5 people can use

- 10 automated workflows/module’s

- All basic plan features plus

- Web tabs

- Customer portal sign-on

- Domain branding

- Custom buttons

- Professional – you’ll pay $199 a month for:

- Store up to 5,000 users

- 10 people can use

- 10 automated workflows/modules

- All Standard plan features plus

- 24-hour live chat support during the weekdays.

Singapore Zoho subscription

Refer to the previous section for information on this. The Singapore Zoho subscription offers business owners in Singapore access to features that automate crucial business processes and operations. This helps them substantially increase their sales revenue streams and lower their expenses.

Singapore businesses can’t go wrong with Zoho

Indeed, having the Zoho cloud Accounting and CRM program suite is like having a staff of in-house MBA educated consultants working with you. You simply can’t fail in your industry if you choose Zoho.

- Article, U.A.E

- July 2, 2020

9/10 times setting a business in UAE mainland requires a tie up with a local sponsor or a local service. Local Sponsors in Dubai, UAE take care of continuity of the company in UAE. A fact about the Local Sponsor or LSAs is that you cannot expect any civil responsibilities from their end towards the business they are sponsoring. The Local Sponsor could not be held responsible for either achieving soaring profits or the growth of the business. On the contrary, the Local sponsor for business in Dubai ensures to provide facilitation over the business continuity in UAE.

Any foreign company willing to establish a branch in Dubai mainland or other parts of UAE needs to have support from the local service agents in Dubai.

Who are called as Local Service Agents?

Local Sponsors or service agents are UAE nationals, called Emirati who deal especially with the governments’ official and ministry work for the company. They can help in establishing external relations and strengthening the economy of UAE by bringing foreign Investors in the form of new businesses. However, you should be careful about choosing the right Local Sponsor for business in Dubai;

-

If you have a personal contact in the UAE, convince them to become your local sponsor.

-

In case, you do not have someone from UAE by your side, you can seek help from the professional business consultants who in turn suggest reliable local sponsors.

-

Transparency should be the key, as some of the local sponsors may have hidden charges incurred during the contract.

-

Make sure to complete the legal formalities and have everything rightly documented. These documents can include; Contracts, Side agreements and POAs. Managing these well, can help you to protect your business assets in the long run.

Local sponsor in UAE

Many people amongst us get confused among the responsibilities and functions of a local service agent. They could not differentiate between a local service agent and a local sponsor. A local sponsor for business in Dubai is a business partner who is a native Emirati and is willing to sponsor an international firm. The local sponsor will take a significant amount of 51% of the total shares of the company, in lieu of services rendered. In some cases, the company may offer some share of profits. This is a special case with a local sponsor and depends on the agreement made with the sponsor at the time of incorporation. In the case of a Local service agent, the person is provided with an annual fee for a business partnership.

The Local sponsor which is appointed by the foreign companies is generally structured as an LLC (Limited Liability Company). The need of having a local sponsor highly varies upon the company’s structure and nature.

How to find a reliable Local sponsor or LSA?

Now, this is an important thing to get answered. Lots of evidence testifies why there is an acute need of appointing a local sponsor or local service agent for setting up a business in Dubai mainland. Local sponsors for business in Dubai should be reliable and trustworthy so that the branch can rely on them. For Dubai company incorporation and formation, a company can choose an option among individual sponsors, corporate sponsors, and local service agents based on the activity the company will be carrying out. The local sponsor can be an individual or a UAE based company.

Another way from which anyone can come in contact with a professional reliable local sponsor or LSA is through networking. This method is generally recommended. People who own their businesses have particular knowledge about the business flow and operations. No one can rely completely on a random person willing to offer sponsorship services.

It is recommended to opt for local sponsors or agents through consultancy firms as they have presence in the region, are aware of the local laws and obligations and have a reliable network of sponsors they have worked with over the years.

The best locations in UAE for local sponsors are to hire them from major cities such as Dubai and Abu Dhabi. These are the premium locations where big foreign businesses and enterprises love to invest and hence these regions are flooded with locals who are willing to be Local sponsors and service agents.

High profile LSAs are also available but at a little bit premium rates. They generally offer their services via the method of networking and mostly try to provide exclusive services as compared to the local crowd.

Individual or corporate sponsor

Instead of choosing an individual Emirati one can assist a UAE based company. Due to the obvious reason, that via assisting a company, obstacles such as death or retirement may not have any powerful impact on the business flow.

On working with an individual make sure to clear the disputes based on certain assurances related to events like death and retirement. Such assurances give reliability for a longer period.

In the end, you can consider some criteria for choosing the best local partner in the UAE.

-

Any prior experience in sponsorship services.

-

Business background

-

Status in society

-

Native or immigrant UAE based citizen

-

Legal knowledge, especially about procedures of courts of UAE

These sponsors charge the business, according to the type of business and the sponsorship option. In most cases, the average annual sponsorship starts from AED 25,000.

All the agreements between the local service agents or local sponsor and the company should be registered in the concerned courts of Dubai or other parts of UAE. This is the only way by which you can counter in case a legal dispute happens.

Final verdict

Using a local sponsor is not an easy job. In UAE, investors end up getting a reliable trustworthy Local service agent or local sponsor through one of the ways mentioned aboveFew considerations are obvious to mark since not all the random Emirati is compatible with the position of Local Service Agent.

There is a long list of advantages of appointing a local sponsor or a Local service agent in Dubai, UAE. Apart from the main advantage of facilitation in business movements, LLCs which are formed by local partnerships. do not have any strict restrictions on opening and operating multiple branches throughout the UAE.When developing a strong relationship with reliable sponsorships and partnerships in UAE, business hurdles can be overcome without hampering the overall profitability of the business.

- Newsletter, U.A.E

- June 16, 2020

The data sharing technology known as “Blockchain” has been used in the creation of cryptocurrencies such as Bitcoin. Up until recently, it has been used for electronic transactions such as money transfers, payment processors, retail loyalty rewards programs, and more. In the simplest of terms, it is an ingenious method for passing information from Point A to Point B by using blocks of data that can easily be verified by thousands, if not millions of computers throughout the internet.

DIFC Collaborates with Mashreq Bank

However, as of this past March (2020), licensed businesses and corporations are now able to accelerate their compliance with KYC (Know Your Customer) requirements thanks to the use of the Blockchain data sharing platform. The Swedish corporation Norbloc built the platform, which the Dubai International Financial Centre launched in collaboration with the Mashreq Bank. As a result, UAE banks and large corporations can use this platform to transfer authenticated and validated company data in order to share it instantly with major financial institutions.

Faster Access to Open Bank Accounts

The DIFC is responsible for generating the primary KYC record during corporate license application process. One of the primary benefits is that banks will no longer need to spend their resources or time verifying their customer’s identity as this enables UAE companies that are registered with Blockchain to open bank accounts immediately. A consortium of banks including the Abu Dhabi Commercial Bank, Commercial Bank of Dubai, Dubai Economy, Emirates Islamic, Emirates NBD, HSBC, and RAKBANK have become allies in order to speed up the adoption of the initiative. The collaboration will help streamline the processes better and improve the accessibility.

Blockchain Streamlines Banking Processes

Consequently, the heads of these different institutions have stated that they are all in favor of increasing the usage of Blockchain throughout the financial community as it could transform the process of using pen and paper. The DIFC’s initiative regarding the utilization of Blockchain technology will enable banks to streamline the new customer sign-up process. Additionally, the technology promotes the sharing of data between licensing authorities and financial institutions. The use of the KYC Blockchain is only the first of many future applications and developments that can the government will be able to use in the financial sector. Considering the innovations, this is a major step to improve the banking processes.

- Article

- June 15, 2020

If a brand owner seeks to register its trademark in multiple jurisdiction, then Madrid System provides for a convenient and cost effective process. The brand owner can file a single application in one language and pay one set of fees to apply for protection in 122 countries.

Madrid System is the most convenient way to apply, modify, expand and maintain one’s international trademark portfolio.

Can I file my international application under the Madrid System?

If you are domiciled, have an industrial or commercial establishment in, or be a citizen of one of the 122 countries covered by the Madrid System member countries, then you can file your international trademark application under the Madrid System.

What is the international trademark application process?

Stage 1 – Application through Office of Origin

Before the brand owner can file an application under the Madrid System , they must have already registered or have filed an application , in their home IP office – which is referred as the Office of Origin. This registration or application at the Office of Origin is also known as the basic mark . The international application is then submitted through the Office of Origin, which certifies and forwards it to WIPO.

Stage 2 – Review of trademark application by WIPO

Once WIPO receives the international application, it does a formal examination of the mark for obvious errors. Any inconsistencies and errors in the application is informed. Once the mark is approved, WIPO will document and publish the domestic basic mark in the International Register. It will then be published in the WIPO Gazette of International Marks. WIPO will then inform the IP office of each member named in the application.

Please remember that this DOES NOT MEAN that the application is officially approved by the designated trademark office. It also doesn’t mean that the applicant officially hold an active international trademark for their product(s).

Step 3: Examination by dedicated National office

The designated IP offices will review the application and will communicate its decision within the prescribed time limit (12 or 18 months, as applicable). WIPO will record the decision of the office in the international register and inform the applicant, accordingly.

Benefits of international trademark registration

If you have a global presence and seek to register your brand in different territories, then filing under Madrid system host a number of advantages, few of which are:

- The centralised filing system is effective, low cost and time saving.

- One application for multiple territory, in one language and in one currency.

- Only one date to attend to renewal of the trademark, in multiple jurisdiction.

- Process and time line is predictable.

- No need to appoint local representative for each designated territory.

If you would want to move further with your international application, or want to conduct a search prior to filing or want us to monitor your existing international application or want to get a better understanding on how to manage a registration then please contact IMC group, today.

- Newsletter, Saudi Arabia

- June 8, 2020

On May 2nd, Saudi Arabia’s state news agency announced that Social Development Bank introduced an initiative package that would provide small businesses and sole proprietorships with 9 billion Riyals ($2.4 billion USD) in Coronavirus relief funds. This could help aspiring entrepreneurs with their business set-up in Saudi Arabia. In addition to the funding, SDB is also providing a 6-month grace period for installment repayment effective April 1st. The financial boost has been given to counter the slowdown in the economy and will help businesses find the right footing again.

Of the 9 billion Riyals, 8 billion ($2.1 billion USD) will go towards assisting roughly 6,000 businesses. Additionally, the primary focus of the newly created portfolio will be entities in the health care industry as is the need of the time. According to SPA, the state news agency, the initiative will include easier, flexible financing channels through micro-funding mediators for families and self-employed individuals beginning April 1st as well. For many entrepreneurs that were in the pre-launch stage, this will help with company formation in Saudi Arabia. It will give the businesses the financial impetus it needs to incubate and grow even in these troubled times. The government has taken into account the current taxes and other financial considerations and balanced it with the initiative package.

In addition to the above, the initiative includes a health care portfolio that would add an additional 1,000 medical units in order to raise operational capacity.

As with other countries worldwide, Saudi Arabia has taken action to counteract the economic effects of the Coronavirus pandemic by providing financial assistance to those small businesses and self-employed entities that have suffered the most. Plus, the increase of medical units for additional operational capacity will enable the health care sector to manage any cases that may arise in the coming months. When this is combined with social distancing practices, it will help us all get through this safely.

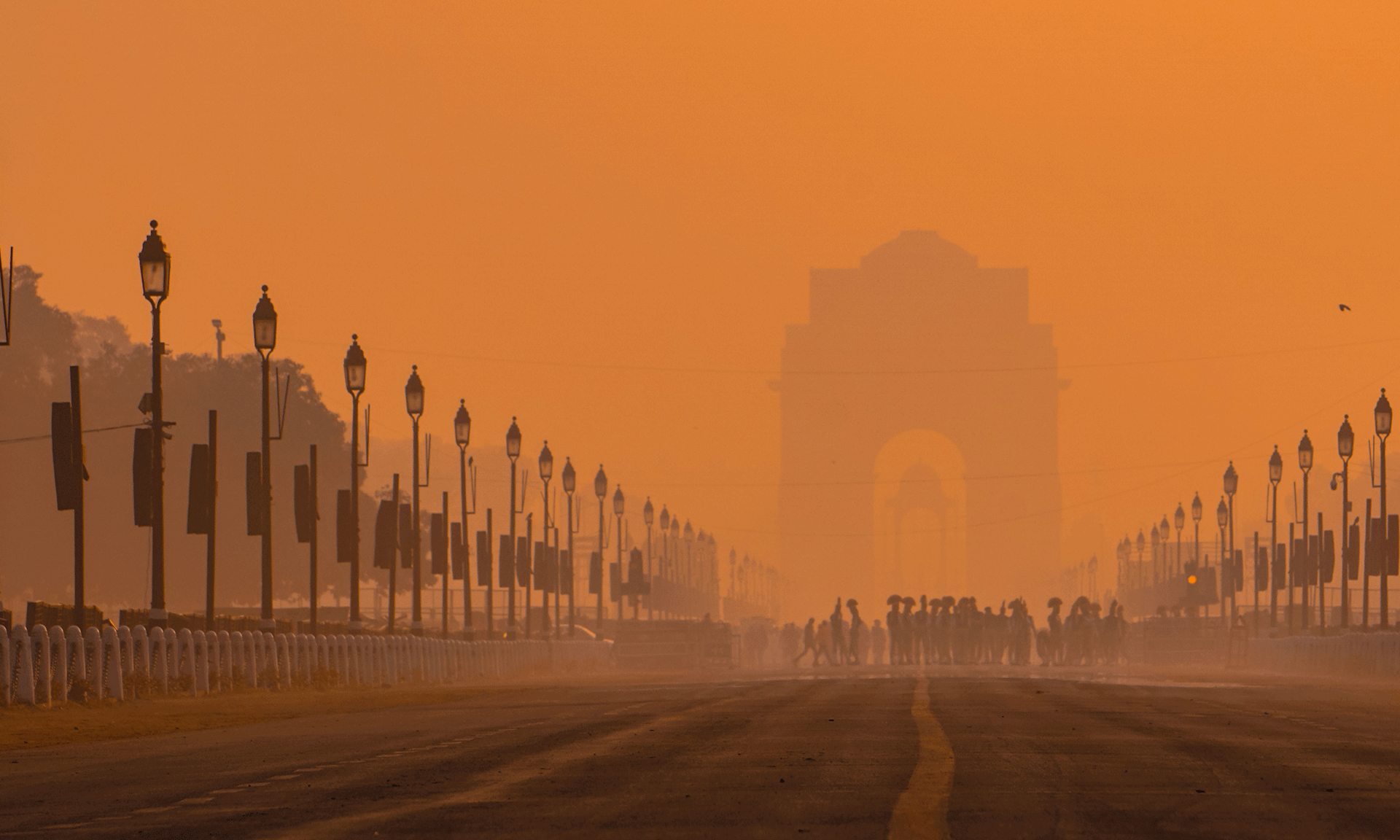

- India, Newsletter

- June 8, 2020

Despite its negative implications, many experts feel that the outbreak of the Coronavirus has created a unique opportunity to bring new business investments to India. They also contend that the country needs to put forth a concerted effort to attract new companies and investments that would create new jobs and generate economic wealth. Ultimately, the goal would be new India company incorporation and promoting “Made in India” products. With improved capabilities and advanced technological skills, India under Modi’s leadership is on the cusp of being in the limelight globally.

However, certain steps must be taken to entice companies away from China. Some of the experts are of the view that with many companies looking to move base elsewhere from China, will find that India is a better place to do business with the multitude of benefits the Modi government has initiated to help improve the ease of doing business.

Many experts contend that the key enticing companies to invest in India is improving contract enforcement and upgrading the country’s infrastructure. The impact seen from the COVID-19 pandemic, is the fact that many countries are looking for alternative manufacturing sites in order to increase their supply chains. When you take India’s lack of bureaucratic red tape, minimal labor costs, and reduced corporate taxes into consideration, the country is on the verge of being the next global manufacturing hub.

With India’s improved tax regimen and reduced taxations, it will help in attracting investments by companies looking to manufacture their products overseas. The tax sops will benefit both India and the overseas companies looking to migrate from China. By improving and seamless integration of FDI policies and trade regulations, India is coming to the forefront runner as a manufacturing hub for various companies and industries.

With more companies planning to move out of China, it holds potential for India to tap into the gap and offer its trade and manufacturing know-how.

Additional Considerations

In order to promote new company formation in India and present companies with an alternative to China-based operations, the Indian Government will need to take certain measures in order to accomplish this goal including:

- establishing a mechanism for laws related to commercial and foreign exchange

- overhauling their power utilities

- putting a contract enforcing mechanism in place by creating specialized commercial courts

In addition to these measures, the government could also consider the reduction of certain related costs such as stamp duties. India has been provided with a unique opportunity due to the Coronavirus and the impact it has had on the global economy. It has literally opened the door for more foreign companies to establish their base of operations in India.

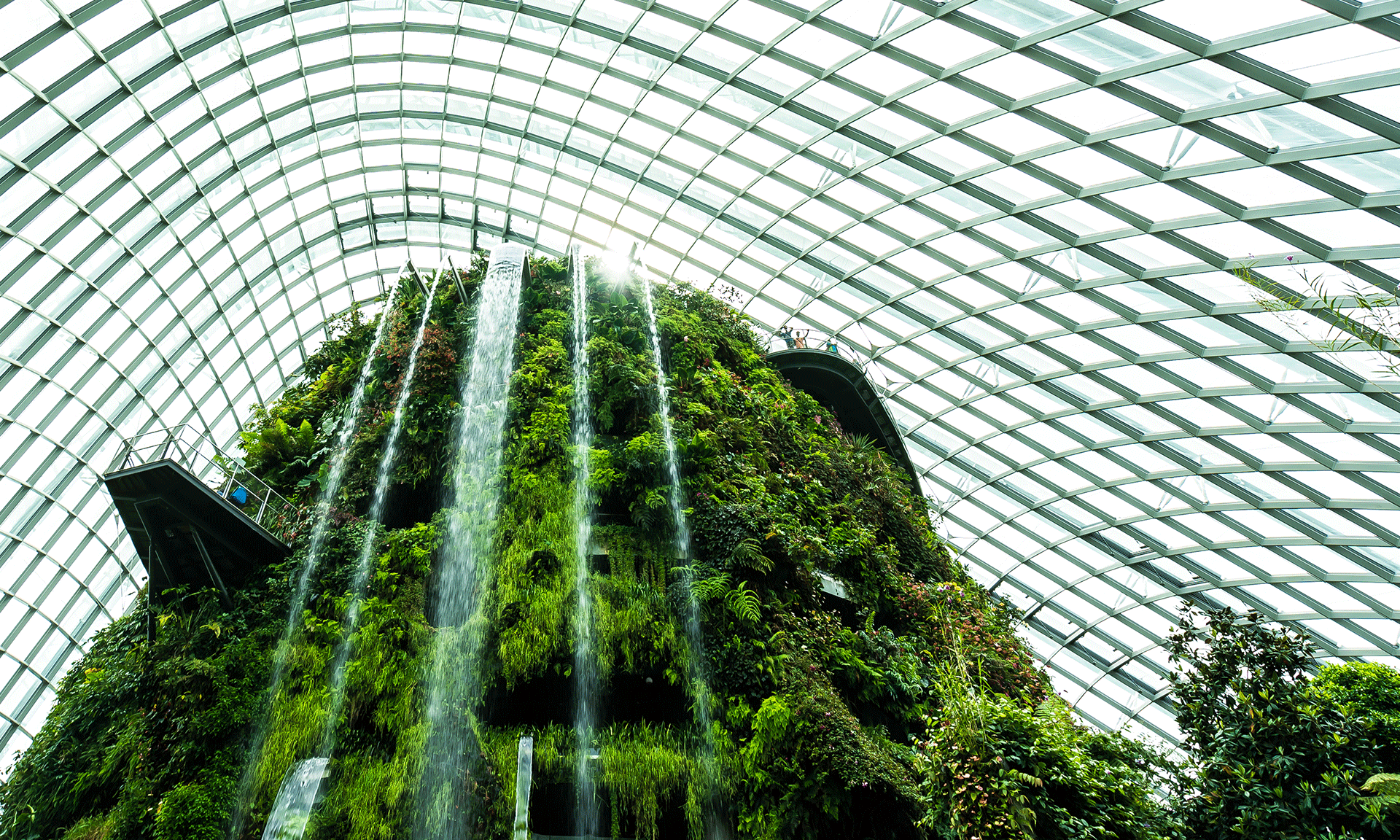

- Newsletter, Singapore

- June 8, 2020

With the recent rise to 3.3% of the resident unemployment rate, Singapore’s Deputy Prime Minister announced on May 23rd that another $33 billion SGD ($23.2 USD) will be allocated to business and workers in order to support the country’s economy. This stimulus, known as the “Fortitude Budget”, contains $2.9 billion SGD for job loss prevention and includes job support enhancements that will help to retain workers by co-paying their salaries. For those looking for Singapore company formation, this might be the apt time to act.

Additional Budgets have been introduced

Furthermore, the stimulus provides the $3.8 billion SGD that will help with controlling the Coronavirus. In addition to this, Deputy Prime Minister Heng Swee Keat, who is also Singapore’s finance minister, was instrumental in introducing:

- the Unity Budget in February ($6.4 billion SGD)

- the Resilience Budget in March ($48 billion SGD)

- the Solidarity Budget in the early part of April ($5.1 billion SGD)

Furthermore, the government added another $3.8 billion SGD to the Solidarity Budget later that same month. Along with these budgets, the government has allocated nearly $100 billion SGD (roughly 20% of Singapore’s GDP) to help overcome the damage the pandemic has done to the country’s economy. They extend their assistance for those investors looking for Singapore company incorporation.

Deputy PM, Heng gave assurance that the government will protect the interests of the workers and will do its best to preserve jobs. The foreign worker tax waiver has been extended for 2 months for those businesses that have not been allowed to resume activities on site. They are introducing a Bill to mandate the landlords to give mandatory rental waiver to SME tenants as there has been a drop in the revenue of these companies in the last few months. To set the trend, the government is giving 2 months waiver on rent for commercial tenants and 30 days waiver for agricultural, office and industrial tenants.

Economic Impact

Heng went on to assure the government that they will try to preserve jobs and protect every employee throughout this crisis. Additionally, the government will extend the foreign worker levy waiver and rebate up to 2 months for businesses that have had to shut down their operations. This includes firms in the building, marine and offshore, and process industry sectors.

- Newsletter, U.A.E

- June 8, 2020

In order to overcome the challenges of the COVID-19 pandemic, the Dubai Airport Free Zone Authority or DAFZA launched a series of economic incentives aimed at helping companies that have suffered losses during this event. In order to mitigate the impact that the virus has had economically throughout various business and industrial sectors, the incentives will provide continuity and flexibility. This could also be beneficial for a business set-up in the Dubai Free Zone.

Counteracting the Negative Economic Impact

According to DAFZA Chairman Sheikh Ahmed bin Saeed Al Maktoum, launching these incentives will lessen the impact of the pandemic on many businesses. By standing with other Free Zone companies, the Chairman believes it will enable companies to overcome the economic challenges associated with the spread of the Coronavirus. The incentive packages will enable companies to mitigate the pandemic’s economic impact while at the same time ensuring the continuity of business in numerous sectors.

He was of the view that even though the world economies over have been affected, the Government stands with the industries and business to mitigate their losses. Some of the important aspects that have been covered include:

- Refunding security deposits on leased commercial spaces

- Refund on the labor guarantees of different companies

- Exemption on rent for retailers for 90 days

- Three-month postponement of lease payments

- New companies get exemption from licensing and registration fees

- Facilitating and streamlining financial payments in easy repayment installments

- Cancellation of fines of companies

Dr. Mohammed Al Zarooni, Director General of DAFZA was of the opinion that these are some of the initiatives that give businesses and companies a reaffirmation that the UAE Government stands behind them to help them overcome the detrimental effects of the pandemic. He said that these are in line with the support offered to the companies as they are important to the local and global economic growth.

Provision of Financial Relief

The initiative will provide financial relief by enabling companies to delay lease payments for 3 months by facilitating monthly installments that will be easier to handle. In other words, Free Zone retailers will be exempt from making lease payments for up to three months if needed. In addition to the above, the Free Zone will refund labor guarantees and security deposits on leased spaces. They will also exempt newer companies from having to pay licensing and registration fees and will cancel all company fines as well. This falls in line with efforts to provide further support for Dubai company incorporation.

With a goal of overcoming difficult conditions immediately and over the long term, DAFZA officials have worked tirelessly to limit the spread of COVID-19 by implementing a number of preventive measures during this difficult period. Additionally, DAFZA has formed a committee for crises and emergencies that has worked 24/7 to follow up on their operations within the Free Zone. In addition to this, they have played a crucial role in ensuring that all Ministry of Health and Prevention directives and instructions, as well as those of other authorities, are being applied properly throughout the Free Zone.

- Newsletter, U.A.E

- June 8, 2020

As part of the United Arab Emirates (UAE) collective effort to diversify the economies of the seven-member nation-states, Dubai’s government recently announced its plans to engage in a major company formation in Dubai project. The exact plans are to create an $870 million e-commerce friendly trade zone that will be populated with companies engaged in digital marketing and various other forms of e-commerce. This area will be located next to Dubai International Airport. It will be called Dubai CommerCity (DCC.)

Dubai’s government collaborated with business set up consultants in Dubai and two nationalized enterprises. These are the Dubai Airport Free Zone Authority (DAFZA) and a property management firm, was Asset Management Group. Covid-19 was a major catalyst in terms of accelerating this project’s movement from the drawing board to actual construction and execution.

DAFZA general director Mohammed Al Zarooni said that the world has an immediate need for world-class eCommerce services. He was of the opinion that Dubai is already experiencing a growing need for an eCommerce trade zone given its rapidly accelerating market demand. The global social distancing measures which governments around the world are currently enforcing is motivating more consumers to shop online. This is giving eCommerce a real boost. The trade zone is scheduled to be operational by the end of 2020.

The entire zone will occupy 2.1 million square feet. It will be separated into three distinct sections: business, social, and logistics. This was according to the Global Construction Review’s report. The project is being developed by the Hong Kong P&T group.

Amna Lootah, DAFZA’s assistant general-director was of the view that they are combining the latest in technologies and infrastructure to create an ecosystem where eCommerce companies can be successfully established and thrive. The main objective in terms of these companies is integration.

The DCC is the first eCommerce free zone that will actively encourage trade and business growth in the Middle East-North Africa (MENA) region. Dubai’s government is luring eCommerce merchants by completely waiving income and corporate tax requirements. These companies will also have subsidized immigration, healthcare, administration, and banking services. They will be supported by warehouses manned by artificial intelligence. Their workers can enjoy free and discounted food in surrounding restaurants and cafes. The project will be completed in a series of phases. The first of which is scheduled to begin in November. The last phase is scheduled to end in 2023.

This project is not Dubai’s first foray into the digital world. Its government actively explored and researched digital wallet technology in 2019. The objective was to find a way around the exorbitantly high government fees that were levied on businesses and consumers. The government created a proposal in 2014 which envisioned using digitization measures to transform Dubai into the ‘happiest city on Earth’. The proposal was one component of the ‘Smart Dubai Program’ which was launched in 2014. The national government is expanding access to financial and banking services for its consumers as part of an effort to finance this.

Dubai may become the next Silicon Valley

DCC is just one of many initiatives by Dubai’s government to ‘plug the city into the digital world.’ Dubai’s government and private enterprises are currently launching many projects to make this a reality. Indeed, with enough luck, Dubai may soon become the next Silicon Valley.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group