- India, Newsletter

- June 8, 2020

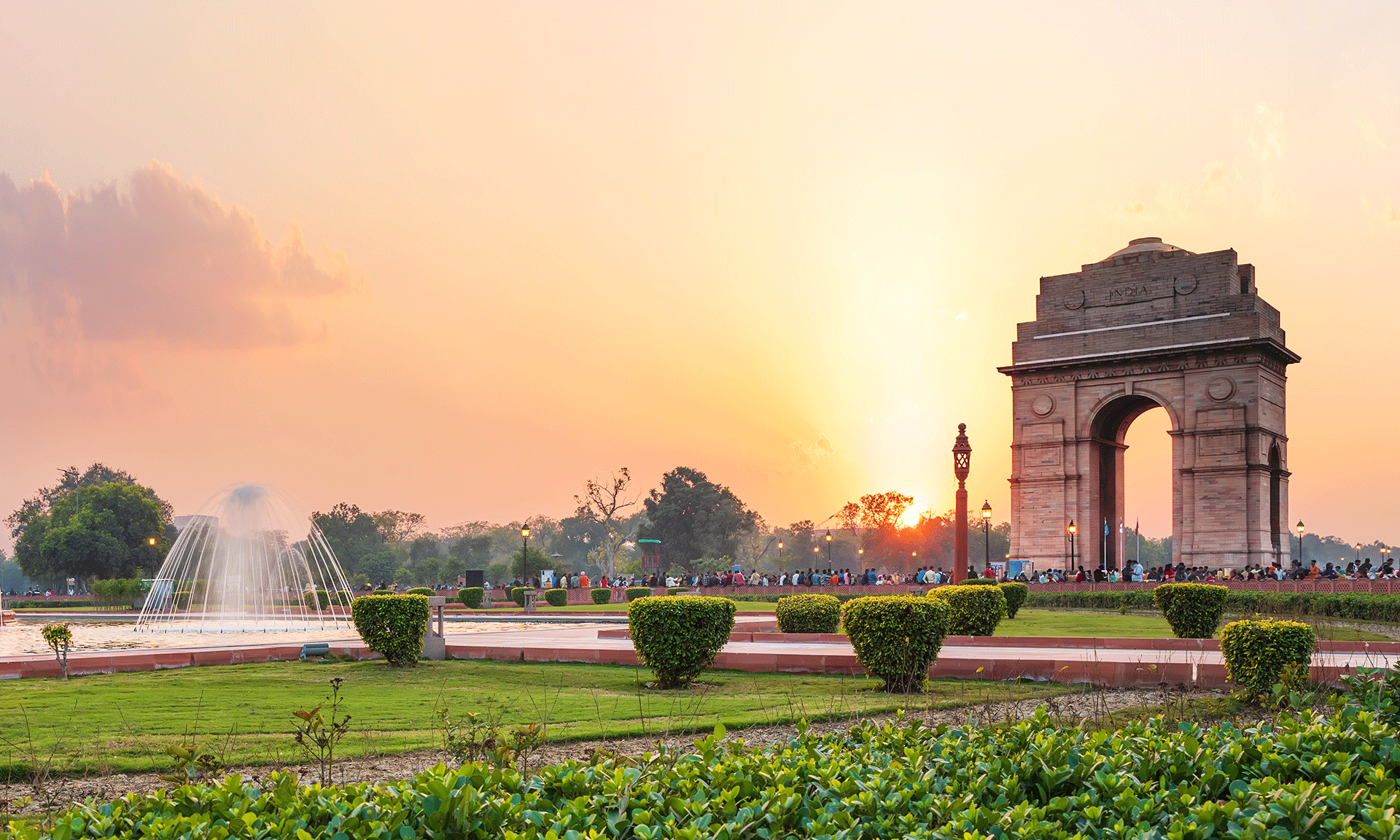

As the US continues blaming Beijing for the role it played in creating the COVID-19 virus and the Coronavirus pandemic, India is now looking to attract US companies away from China and promoting India company incorporation. This past April, the Indian government contacted over 1,000 US companies and provided incentives for them to leave China and establish their operations in India. The country has placed the highest priority on the following industries:

- auto parts manufacturers

- food processing units

- leather

- medical equipment suppliers

- textiles

According to Indian Government officials involved in the effort, more than 550 products could be affected by this relocation. In a recent interview, Prime Minister Narendra Modi stated an investment surge of this magnitude would shore up India’s economy which has been devastated by the lockdown that was put in place to combat the virus. Consequently, the need to create new jobs is even more urgent now that there are an estimated 122 million individuals that lost their jobs as a result of the pandemic.

With the constant blame and battering by US President Trump, China is seeing worsening global trade ties due to the mismanagement of the COVID-19 outbreak. With more companies planning to moving out of China for diversification of supply chain, many European Union members are looking to reduce dependence on China.

For India, a surge in the foreign investments will be a way to boost the battered economy due to the long lockdown to control the COVID-19 outbreak. It will help Prime Minister Modi realize the target of improving the manufacturing sector to meet the aim of 25% of GDP by 2022. Additionally, it will help push through the required reforms in taxes, land and labor laws. Most of the foreign forms have been informed that India is more economical than moving their manufacturing to their own countries.

Bringing in new India company formation would also provide an opportunity to pass labor, land, and tax reforms that have been stalled by bureaucratic red tape and have hindered significant business investments for many years. While this would also enable India to establish a strong presence in numerous global supply chains, it will require some very serious governance and infrastructure investments as well. It is well known that India has long been facing tough competition based in southeast and southern Asia.

In terms of affordable labor and the securing of land, India is better economically for companies than Japan or the US despite the overall costs being higher than what they are in China. The Indian Government has also offered assurances that they would consider requests to change the labor laws which have always been viewed as a major obstacle for many companies. The government is also considering delaying digital transaction taxes for e-commerce companies as well.

With abundant capital available in the US versus other countries, India is poised to respond those US companies looking to end their relationship with China. More and more companies are now realizing there is no longer a need to keep all of one’s eggs in a single basket, or in this case, China.

- Article, Singapore

- June 2, 2020

A trademark is a type of intellectual property rights which includes any word, name, symbol, device, or any combination, used or intended to be used to identify and distinguish the goods/services of one seller or provider from those of others, and to indicate the source of the goods/services.

By and large, it is not necessary to register your mark in Singapore. However, registering the mark shall:

- Prevents other to adopt the same or similar mark;

- Help to effectively enforce your rights over the mark;

- Allows the registered owner to capitalize the trademark by licensing or assigning it;

- Give right to use the symbol ®; and

- Provide up to 400% tax rebates from the Government under the ‘Productivity and Innovation Credit Scheme’. This rebate is provided in order to balance the costs of registering for a trademark.

How to register a trademark in Singapore?

Before filing the application for trademark registration in Singapore, it is essential that you have ascertained that:

- the mark is distinct and capable of being represented graphically;

- does not conflict with a prior existing mark; and

- is not descriptive.

Once the above is confirmed, one may proceed to file the application with the authorities. The registration process in Singapore can be summarized in the following four stages:

Stage 1 : Filing Application

The application for the trademark will contain the following information:

- name and address of the applicant(s);

- graphical representation of the mark;

- class and description of the goods/services for which the trademark is applied for;

- period of use (if any); and

- application fees.

When applying for a trademark registration in Singapore, it is important to make sure that the goods and services listed in the application must comply with ICGS (International Classification of Goods and Services).

Intellectual Property Office of Singapore (IPOS) oversees the Trademark Registration process. A registrar will check if the above-mentioned requirements has been complied with. If so, the application will proceed to Stage 2.

Stage 2 : Examination

At this stage, a formal search is conducted by the registrar to rule out any conflict. The registrar will also scrutinize an application to determine if a mark can be registered in accordance to the Singapore Trademark Laws. For example, a mark that contains an in-distinctive character does not conform to the Trademark Laws. If the mark is acceptable, the registration process will move to Stage 3.

Stage 3 : Publication

The applicant is notified regarding the acceptance of the application for registration once it has been scrutinized for possible anomalies. An accepted application is published in the trademark journal which enables the interested parties to oppose to the registration of a mark within two months from the date of publication. The trademark office notifies an applicant if any objection has been filed against a mark, if not the application proceeds to Stage 4.

Stage 4 : Registration

A trademark will be registered if all objections were cleared up in favor of an applicant or if no objection was received from any party. A registration certificate is issued to an applicant after the completion of this process. Upon registration, the mark is granted protection for a period of 10 years and the trademark owner can use the symbol ® with the registered trademark.

If your business is looking to get a mark registered in Singapore or wants to get a clarity of the prefiling checklist, call IMC Group today. We shall be happy to assist you with your queries and the application process.

- Newsletter, U.A.E

- May 25, 2020

In the wake of the scourging global pandemic i.e. the Coronavirus threat, the existing ESR or the Economic Substance Regulations pertaining to the UAE get a decisive and much-anticipated makeover. While businesses are usually required to file the ESR notifications each year within 31st of March, the pandemic has shifted the deadlines to 30th of June.

We believe that our readers would still want certain insights regarding the ESR compliance before getting the exact point of this declaration, straight from the Ministry of Finance.

ESR or Economic Substance Regulation entails to one form of financial compliance that requires businesses or rather licensees to declare a few essential details to the Financial Regulatory Authority. While the concept was originally formulated by the European Union, the UAE jumped onto the ESR bandwagon, in 2018.

The main aim of this regulatory compliance was to ensure adherence with the interests of the Economic Substance and to make sure that businesses aren’t conducted only to cater to the more premium tax regime. Needless to say, the ESR duly revolution the Tax Policy within the country besides making room for improved transparency, fairest possible tax competition, and BEPS Implementation.

From UAE’s standpoint, ESR concerns compliance with the following factors:

- Licensees abiding by the concept of Relevant Activity

- Even if Relevant Activity is in picture, the entire portion of the gross business income is in direct relation with the relevant business activity and applies for taxing in a jurisdiction outside the UAE or not.

- The timeframe of the Financial Year pertaining to the Licensee, which is strictly from an accounting standpoint

In order to abide by this regulatory compliance, businesses must file notifications at the specified time, form, and the approved manner. Lastly, the ESR guidelines apply to offshore, onshore, and Free Zone companies, provided income is generated via Relevant Activities.

The Pandemic Shift

The UAE government feels that any kind of meeting or association, in order to discuss about the ESR isn’t prudent enough during the existing scenario. This is why filing dates have been revisited, to manage the risks of non-compliance.

As mentioned by the Undersecretary, Ministry of Finance, UAE, Mr Younis Haji Al Khouri, the cutoff date for filing nomination under ESR has now been extended up to 30th of June. Although this piece of information has already been communicated to the concerned regulators, there are a few who have cut short the dates to ensure proper compliance.

There are quite a few firms and individual associations that have already modified the dates, in addition to the government’s official notification. These include:

Association Name: DAFZA or the Dubai Airport Free Zone Authority

Cut-off Date: May 3rd, 2020

Additional Details: Filing guidelines available

Association Name: ADGM or the Abu Dhabi Global Market

Cut-off Date: Not announced yet but certainly extends beyond 31st March

Additional Details: Guidance available in regard to better understanding of the filing process

Association Name: DSO or the Dubai Silicon Authority

Cut-Off Date: Extended but date yet to be announced

Additional Details: Guidance available online

Association Name: DIFC or the Dubai International Financial Center

Cut- off Date: Official date is yet to be announced but IMC believes that it would be 30th June, 2020

Additional Details: Filing guidelines are already up on the website with proper guidance

Association Name: RAKICC or the Ras Al Khaimah International Corporate Center

Cut Off Date: 30th June, 2020

Additional Details: Guidance available

Association Name: DMCC or the Dubai Multi Commodities Center

Cut Off Date: 30th June, 2020

Additional Details: Guidance to be uploaded soon

Penalties

Provided licensees fail to abide by the deadlines and file notifications accordingly, penalties in the ballpark of AED 10,000 to even AED 50,000 can be levied.

How IMC can help?

With the pandemic leading to the date extension, businesses in the UAE, precisely the International Groups, now have the opportunity to revisit the drawing board and assess whether they are following the Relevant Activity guidelines to the T or not.

We, at IMC, are currently helping our clients ascertain the non-compliance threats related to the ESR while offering remedial measures to mitigate the risks related to business sustenance.

- Newsletter, U.A.E

- May 21, 2020

What is a VAT Refund?

Under FTA regulations, all registered businesses must submit a VAT return outlining the details of their sales and purchases for the tax period. Input VAT refers to the amount paid to suppliers for purchases or expenses, while Output VAT refers to the amount collected from sales. The input VAT amount can be offset against the output VAT amount.

Due to its complexity, businesses should seek expert advice to claim a VAT refund in the UAE before submitting a VAT refund form.

Timeline for VAT Refunds

VAT Refund: Helpful Tips

First and foremost, the tax refund file must be complete and fully prepared before you submit it to the tax office. Furthermore, all VAT refund procedures must be compiled correctly to receive your claim amount quickly and without any delays. The more common factors that can result in a delay include:

- Difficult administrative procedures

- Incorrect or insufficient documentation

- Missing deadlines when replying to the Federal Tax Authority

- Not understanding the indirect tax rules

Keep in mind that delayed or missed refunds and unclaimed tax credits can result in a negative cash flow and “tax leaks”, both of which can increase your costs of doing business and reduce your profitability in the process.

As a relief measure and in response to the COVID-19 (Coronavirus) pandemic, UAE businesses can expect to receive their VAT refunds earlier than usual. A number of tax professionals now believe that the Federal Tax Authority has accelerated the refund process for those businesses that have already submitted their returns.

We are here to help with Your VAT Refund

Our tax agency is registered with the Federal Tax Authority and is comprised of a team of professionals that are dedicated to providing the highest quality service and your satisfaction. We are happy to share our tax refund experience and expertise, especially when it comes to complicated, detailed, and tedious bureaucratic processes. We can assist you with:

Reviewing VAT returns, calculations of refundable VAT, working papers and check documentation for filing refunds

- Prepare documents and data templates for VAT refund applications as per laws

- Check for VAT non-compliance for your company

- Prepare and submit the VAT refund application

- Look over the VAT refund report on missing documents/points, respond to queries of FTA and re-submit after corrections

- Manage correspondence and communication with Federal Tax Authority

- Visit the tax office and handle the finalization of the VAT refunds

- India, Newsletter

- May 20, 2020

Considering the detrimental effect of the COVID-19 pandemic that has led to the lockdown for over 8 weeks, Prime Minister Narendra Modi recently announced a special economic package of Rs. 20 lakh crores. He stressed on the importance of being self-reliant as a road map for successful economic development. He said that after carefully formulating economic support to all sections of the society, it will focus on not just a single industry or business but covers MSMEs, cottage industries and all local businesses.

Announcing the relief package under ‘Atmanirbhar Bharat Abhiyan’, he stressed that it will not only strengthen the Indian supply chain globally but will ensure that land, labor, law and liquidity will boost all economic sections of the businesses and industries including agriculture.

The mega economic package is being seen as a big boost to the businesses and industries that have suffered a setback due to the lockdown imposed to combat the COVID-19 pandemic. There have been many projections about India’s economic growth that it might just be 2% in the current financial year. The PM’s economic package has been unveiled based on similar economic boost given by other countries like Japan and USA. The relief package is built on five pillars – demography, system, economy, demand, and infrastructure.

PM Narendra Modi said that the pandemic has taught the country that being self-reliant is the only way forward. He said being vocal about local products will help businesses flourish again and facilitate the economy. He was confident that 21st century belonged to India as with new energy and determination, the nation will move forward. The relief package is about 10% of the Indian GDP and the details were outlined by the Finance Minister, Nirmala Sitharaman. Covering all aspects of the Indian economy, not just the large industries, PSUs but Micro, Small and Medium Enterprises (MSMEs) and agriculture sector were given equal impetus by the allocation of funds. When most countries are dependent on imports, this relief package is all about facilitating the Indian economy and local manufacturing and production.

He quoted the making of PPEs and N95 masks as an example. Though these items were being imported earlier, with the advent of the demand during pandemic, the local production of these items has created a new industrial need. Now, 2 lakh units are being manufactured every day locally. About the pandemic, the PM Narendra Modi was of the view that India needs to learn to live with it while the lockdown bought some time for the government to strengthen the healthcare system.

During the first lockdown, the MSMEs has got impetus from the government to reduce dependence on imports and stress on Make in India. The MSMEs had sought regulations to streamline the prices on various products manufactured by different industries with tax holidays and discounts. They suggested that post- COVID 19, government identifies industries that are heavily dependent on Chinese imports and encourage Make in India for those products.

- Newsletter, Saudi Arabia

- May 20, 2020

The Saudi Arabian Government recently announced that the VAT or Value Added Tax will be increased from 5% to 15% as of July 1st, 2020. The increase is one of several measures that have been taken in response to steadily declining government revenues associated with the impact of the Coronavirus on the Saudi Arabian economy. Reports state that the decline in revenues is attributed to increased healthcare costs, lower oil prices, and reduced economic activity.

How will the VAT increase affect Businesses?

Due to the enhancement of VAT rate, most of the businesses in all industries will be affected in Kingdom of Saudi Arabia (KSA). Additionally, business can expect a higher amount of scrutiny from the General Authority of Zakat and Tax (GAZT) because the VAT has become an important component of the revenue to the state. It is time for businesses to review their costs as even those businesses that are exempt shall be affected.

Whether your sales are fully or partially exempt, you could experience increased costs directly associated with the 10% VAT increase. Furthermore, the increase will have an impact on all Saudi Arabian industry sectors including the financial, insurance, and real estate sectors. Although consumers will feel the impact of the VAT increase as well, it remains unknown as to whether or not the lower VAT rate will still apply to foods and utilities in order to mitigate the effects of the increase.

Due to the difference in timing between VAT payments and recovery, businesses can expect the increased tax to impact their cash flow. Consequently, cash flow planning efforts will have a renewed significance. Additionally, business owners should review their internal operating processes and systems so as to reflect the higher rate. In the coming weeks, businesses and consumers can expect to see additional guidance for transitional rules released by the authorities.

The rate increase has affected cash flow of businesses as there has been a difference in the timing of VAT recovery and payments. Thus, the importance of cash flow planning has emerged as a significant aspect of keeping businesses afloat. It is time to take a deeper look at the processes and internal systems of businesses as there is an increased VAT rate.

Additional Considerations

Taxpayers should begin monitoring the impact of the VAT rate increase immediately so they can measure the effect on their cash flow, chain of supply, and daily operations. As a reminder to taxpayers, the window for making voluntary disclosures without fees or penalties will remain open until June 30th as per last month’s VAT incentive alerts. This will enable businesses to fully ensure that they are compliant with VAT regulations.

If your company needs assistance for business and corporate advisory consulting or tax advisory services, contact IMC Group.

- Article, Singapore

- May 19, 2020

Enhanced SME Working Capital Loan

-

The SME Working Capital Loan (which has been subsumed under the Enterprise Financing Scheme), will be enhanced to increase the maximum loan quantum to S$1 million.

-

The Government’s risk share will be increased to 90% and SMEs may request for deferment of principal repayment for one year.

-

Maximum repayment period shall be 5 years.

-

Interest rate shall be Subject to the Participating Financial Institutions (PFI’s) assessments of risks involved.

Eligibility Criteria:

-

Be a business entity* that is registered and physically present in Singapore;

-

At least 30% local equity held directly or indirectly by Singaporean(s) and/or Singapore PR(s), determined by the ultimate individual ownership.

-

Maximum Borrower Group** revenue cap of S$500 million for all enterprises.

-

For “SME Working Capital”, the SME definition refers to Group revenue of up to S$100 million or maximum employment of 200 employees.

Notes:

* ACRA registered Sole Proprietorship, Partnership, Limited Liability Partnerships and Companies are eligible to apply for the enhanced SME Working Capital Loan.

** Borrower Group consists of the following:

- Borrower; and

- Corporate shareholders that hold more than 50% of the total shareholding of the applicant company, and any subsequent corporate parents (all levels up), and subsidiaries all levels down. (Annual sales turnover and employment size is computed on a group basis.)

Temporary Bridging Loan Program For Enterprises

-

Eligible enterprises may borrow up to $5 million under The Temporary Bridging Loan Programme (TBLP) with the interest rate capped at 5% p.a.

-

The Government will provide 90% risk-share on these loans for new applications initiated from 8 April until 31 March 2021.

-

Eligible enterprises under the TBLP may also apply for up to 1 year deferral of principal repayment to help manage their debt, subject to assessment by the PFIs.

Eligibility Criteria:

-

Be a business entity* that is registered and physically present in Singapore.

-

At least 30% local equity held directly or indirectly by Singaporean(s) and/or Singapore PR(s), determined by the ultimate individual ownership.

Note:

* ACRA registered Sole Proprietorship, Partnership, Limited Liability Partnerships and Companies are eligible to apply for the Temporary Bridging Loan. Approval of the loan is subject to the PFI’s assessment.

Enterprise Financing Scheme (EFS) – Trade Loan Program For Singapore-based Enterprises

-

Eligible Enterprises will be able to borrow up to S$10 million to finance short-term import, export and guarantee needs.

-

The Government will co-share up to 90% of the borrowing risk for new applications initiated from 8 April 2020 until 31 March 2021.

Eligibility Criteria:

-

Be registered and operating in Singapore.

-

Have a minimum of 30% local shareholding.

-

Maximum Borrower Group* revenue cap of S$500 million for all enterprises

Note:

* Borrower Group consists of the borrower as well as corporate shareholders that hold more than 50% of the total shareholding of the applicant company, and any subsequent corporate parents (all levels up) and subsidiaries all levels down. (Annual sales turnover and employment size are computed on a group basis).

SG Together Enhancing Enterprise Resilience (STEER)

-

The Government will increase the dollar for dollar matching; S$1 for every S$2 raised by funds set up by the Trade Associations and Chambers (TAC) or industry groupings, up to S$1 million per fund.

-

To apply for the STEER programme, interested TACs and industry groupings can submit their proposals to Enterprise Singapore.

-

Proposals will be assessed on a case-by-case basis by Enterprise Singapore to ensure that the programme’s intent is met, and to consider operational arrangements, including the rigour of the fund management process, number of local small- and medium-sized enterprises (SMEs) supported, and types of assistance to be provided.

-

Upon qualifying for STEER, TACs and industry groupings will need to use the funds within 18 months.

-

Interested TACs and industry groupings can apply for the STEER programme from 3 Mar 2020 to 2 Mar 2021.

Medium And Longer-term Measures

1. Enterprise Development Grant

-

The Government is aiming to reach out to 3,000 SMEs with the Enterprise Development Grant (EDG) that provides maximum support level of up to 80% support in three areas: Core Capabilities, Innovation and Productivity, and Market Access.

-

For enterprises that are most severely impacted by COVID-19, the maximum support level may be raised to 90% on a case-by-case basis.

-

Applications will be assessed by Enterprise Singapore based on project scope, project outcomes and competency of service provider.

Eligibility:

-

Enterprise must be registered and operating in Singapore.

-

Have a minimum of 30% local shareholding (Singaporean/PR).

-

Be in a financially viable position to start and complete the project.

2. Market Readiness Assistance (MRA) Grant

-

Small and medium enterprises (SMEs) will receive an international boost with the Market Readiness Assistance (MRA) grant to help take your business overseas.

-

Eligible SMEs will receive the following support:

- Up to 70% of eligible costs, capped at S$100,000 per company per new market* from 1 April 2020 to 31 March 2023 that covers:

- Overseas market promotion (capped at S$20,000

- Overseas market set-up (capped at S$30,000)

- Overseas business development (capped at S$50,000)

-

The MRA Grant support level of up to 70% will be extended until 31 Mar 2023.

Eligibility:

-

Business entity is registered/incorporated in Singapore.

-

New market entry criteria, i.e. target overseas country whereby the applicant has not exceeded S$100,000 in overseas sales in each of the last three preceding years.

-

At least 30% local shareholding (Singaporean/PR).

-

Group Annual Sales Turnover of not more than S$100 million; OR Company’s Group Employment Size of not more than 200 employees.

3. Automatic Deferment Of Corporate Income Tax (CIT) Payments

-

All companies with CIT payments due in the months of April, May and June 2020 will be granted an automatic three-month deferment of these payments. The CIT payments that are deferred from April, May and June 2020 will be collected in July, August and September 2020 respectively.

-

Companies can expect to receive a letter from IRAS by April 2020.

4. Corproate Tax Rebate For YA 2020

-

Companies will be granted a rebate of 25 per cent of tax payable, capped at $15,000, for the year of assessment 2020 – a move that will cost the Government about $400 million.

5. Property Tax Measures

Imposing obligations on property owners to pass on the PTR in full to tenants

-

Non-residential properties will be granted property tax rebate for the period 1 January 2020 to 31 December 2020. Commercial properties badly affected by COVID-19 like hotels, serviced apartments, tourist attractions, shops and restaurants will receive a 100% rebate. Other non-residential properties such as offices and industrial properties will get a 30% rebate on their property tax payable.

-

IRAS will send out the rebate notices by 31 May 2020. Property owners can expect to receive their refunds by 30 June 2020.

6. Jobs Support Scheme

-

The Jobs Support Scheme (JSS) introduced where eligible employers would receive a 25% cash grant (up from 8%) on the gross monthly wages of each local employee (Singapore Citizens and Permanent Residents) for the months of October to December 2019, subject to a monthly wage cap of $4,600 per employee.

-

Higher tiers of support on top of the base rate of 25% will also be given to businesses in severely-affected sectors.

-

The JSS will also be extended to cover nine months of wages (up from three months), which will be paid in two additional tranches in July 2020 and October 2020.

-

Under the Solidarity Budget, the wage subsidy for all firms will be raised to 75% of gross monthly wages for the first $4,600 of wages paid to all local employees in April 2020. The first JSS payout will be brought forward from May to April 2020.

-

With the extended circuit breaker period till 1 Jun 2020, the 75% wage support on the first $4600 of gross monthly wages for local employees across all sectors will be extended for another month, i.e. in the month of May 2020.

-

The JSS payout has also been extended to cover wages of employees of a company who are also shareholders and directors of the company (shareholder-directors).

-

Employers do not need to apply for the JSS. The grant will be computed based on CPF contribution data.

All local companies can take advantages of above grants, scheme, loans and measures.

We IMC are at your service, please feel free to contact if any queries:

Pankaj Kumar

[email protected]

+65 92340891

- Newsletter, U.A.E

- May 18, 2020

As per the recent FDI law update, 100% foreign ownership is allowed in mainland companies in certain sectors of the economy. The resolution allows 122 economic activities in which FDI is permitted. This list includes economic activities across various sectors including agriculture, manufacturing and services (including healthcare, hospitality, construction, education, among others). This move aims to strengthen the UAE’s commitment to become the preferred foreign investment destination in the region.

The UAE government is making every effort to raise the industrial sector’s contribution to the GDP and foster economic growth by working towards building a sustainable and diversified economy. In fact, the country is all set to achieve its mission – UAE Vision 2021 and UAE Centennial 2071 – a long-term government plan spanning over five decades. The recent FDI regulations will further boost this plan.

It is worth noting that the UAE’s economy still stands strong despite the recent crude oil price fluctuations and global slowdown caused due to COVID-19 pandemic. Besides, the country’s economy is heading towards major diversification and focusing on building a future based on non-oil sectors.

While companies are facing a bigger challenge of addressing supply chain issues and additional manufacturing locations, UAE also focuses on achieving advanced technology outputs in order to transform its business models.

UAE enjoys the advantage of its strategic location on the new Southern Silk Road between Asia, Europe and Africa. Besides, it also ranks high in all the five areas of manufacturing environment viz, infrastructure and innovation, energy and transportation, policies and regulations, workforce quality and unrestricted adaption of automobile and Artificial Intelligence facilities. The favourable economic environment results in increased productivity which in turn helps develop transformative technologies helpful for developments in the fields of Artificial Intelligence, Advanced Innovation, Fourth Industrial Resolution, etc.

With the global crises, there are uncertainties regarding economic growth. During such times, UAE is focusing on finishing its infrastructure and strategic projects which were kept on hold for a long time. This is further set to boost investment in the region. The manufacturing sector is largely benefitting from this move. Manufacturing sectors are given special attention as they help achieve these projects in all economic sectors such as medicine, aviation, renewable and nuclear energy, military, aluminium, plastic, food, engineering, robotics, space, biotechnology, artificial intelligence, self-propelled vehicles, etc.

For businesses setup in UAE, this new FDI law update will prove to be very fruitful. If you are looking for company formation in Dubai, you may consider reaching IMC Group.

- India, Newsletter

- May 14, 2020

As per the Income Tax Act, 1961 Section 6 provides for the residential status of the individual based on the stay during the financial year that commences from April to March every year. This year due to the hardship created by the Coronavirus pandemic, foreign nationals and non-resident Indian visitors who have come to India for business, employment, or personal reasons have been unable to leave and return home. As a result, the CBDT (Central Board of Direct Taxes) has relaxed residency rules under Section 6 of the Act vide Circular No. 11/2020 dated May 8th, so that visitors who are compelled to stay will not have to change their non-residential status. Residency rules have been relaxed as follows:

- For those individuals who haven’t been able to leave the country on or before March 31st and have been quarantined as a result of the COVID-19 pandemic after March 1st and evacuated on or before March 31st

- For those individuals who haven’t been able to leave the country on or before March 31st from the date of quarantine until their departure (or March 31st as may be the case) or has evacuated India on or before March 31st

The CBDT’s clarification will provide relief for individuals who were about to exceed the threshold for non-resident status/RNOR (Resident but Not Ordinarily Resident) because of being quarantined in India during the financial year of 2019-20. Currently, there is no relief being provided for an extended stay during the 2020-21 fiscal year. However, the CBDT is aware of the issue and is reassuring individuals that they will be provided with relaxed residency rules. The Organization for Economic Corporation and Development (OECD) has given guidelines to encourage countries to adopt coordinated measures adopted by Ireland, UK and Australia.

Consequently, relief will be provided to those individuals who were visiting India and were unable to leave because of the COVID-19 lockdown. Individuals should have the proper documentation and be able to demonstrate that they were forced to stay in India because of the lockdown. Furthermore, the OECD (Organization for Economic Co-operation and Development) has recommended that tax authorities shouldn’t change an individual’s residential status of senior executives and main functionaries of the companies, based on these circumstances.

Additionally, the circular did not provide relaxation in regard to any ‘permanent establishment’ (PE) of the company that are staying under the lockdown or forced extension of the stay period.

- Newsletter, Saudi Arabia

- May 11, 2020

In order to mitigate the developmental and economic impact of the Coronavirus on the Saudi Arabian private sector, the General Authority of Zakat and Tax (GAZT) recently launched a number of incentives that will provide support for taxpayers and stimulate the economy. These General Authority of Zakat and Tax incentives in Saudi Arabia fall in line with:

- The International Monetary Fund recommendations for global tax authorities

- Ministry of Finance resolution announcements

- Royal Decree No. 45089 dated March 18th, 2020

The scope of these incentives applies to companies doing Business in Saudi Arabia and that failed to meet their registration obligations and enables them to register for VAT. Here is a quick recap of the provided incentives related to the VAT as it gives the taxpayers a chance to get relief from penalties.

As the opportunity is time bound till end of June, experts recommend that the companies and taxpayers look over the past tax returns and disclose all of the errors or omissions under this window of opportunity. The following is a summary of these incentives as they relate to the VAT:

- Eligibility and timeframe – benefits are extended to all registered taxpayers as well as those that are required to register according to KSA VAT legislations (includes non-residents who are required to pay VAT in Saudi Arabia. In addition to this, any VAT registration as well as return amendments made between March 18th and June 30th, 2020 will be eligible for benefits.

- Late registrations – for resident and non-resident entries that should have been registered prior to the original date of March 18th, NO penalties will be imposed from 18th March to 20th June 2020 and this holds valid for non-resident taxpayers.

- Returns and voluntary disclosures – VAT returns that were due prior to March 18th can be filed up until June 30th without incurring penalties. Taxpayers are allowed to make amendments to previously submitted returns up until June 30th without incurring penalties. Furthermore, that can apply for an installment plan and make payments during the incentive period. Previously audited GAZT returns can also be amended while those returns that are undergoing an audit can be amended by contacting the GAZT directly.

It should also be noted that there are limitations that will apply where these incentives are concerned. For example, any additional taxes or penalties that were imposed prior to the date of the initiative will not be cancelled. Additionally, any requests for tax refunds due to VAT returns amendments will no longer be accepted. They will be processed as per the current KSA VAT Legislation. For additional information or to learn if these new VAT incentives apply to you, contact a VAT consultant in Saudi Arabia.

Thus, to claim benefits under this new scheme, all previous liabilities need to be cleared before 1st July 2020. Thus, it is time to review the previous and current VAT position to keep your tax returns in order and smoothen the process.

If your company is looking for professional assistance with VAT and tax filing procedures, contact Intuit Management Consultancy (IMC Group). With years in the

Industry, we offer business set up solutions, tax advisory, international tax structuring, bookkeeping and VAT. Call us today and let us help you.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group