- Bahrain, Newsletter

- April 9, 2020

There are seven IT companies that are interested in investing approximately $3.1 million or 210 crore rupees for Bahrain company formation. The monetary investment will help to improve Bahrain’s technology and communication. Bahrain Economic Development Board has approved the seven IT consultants of India to invest in Bahrain’s developmental sectors. The seven Indian IT firms include IT consultants, software developers, and hardware developers. The announcement of investment was made in 2019 through an official statement.

It is needless to say that India is an emerging global power, and this is the reason the Gulf country is keen to collaborate with India. According to the officials, India has been developing its IT sectors, and Bahrain wants to be a strategic partner in the technology domain. In order to make the investment easier, The Central Bank of Bahrain is trying to provide an investment-friendly environment. Once the investment is made, the digital business like data privacy technology, Robo advisory for monitoring the insurance, and regulatory sandbox will thrive.

- Newsletter

- April 9, 2020

The world economy is staggering under the pressure of the CoVID-19 pandemic, which has now affected nearly 193 countries and impacted the livelihood of countless people all over the globe.

As social distancing is the norm now, the businesses of all sizes are finding it hard to maintain a smooth run. The situation has impacted global economies, with billions of dollars already been spent and the markets brimming with uncertainty.

Difficult times for the businesses

The silver lining for the businesses

Going for cloud software, for Accounting and Bookkeeping Services, helps the businesses to fight all the unprecedented challenges that can arise. It helps businesses in the communication, delegation, and monitoring of the work, as well as ensuring the safety of the teams working from homes. Thus, cloud-based solutions are the way to help businesses keep up the details of compliance and accounting, in the times of such crisis.

Advantages associated with business accounting software

1. Widespread accessibility:

A cloud accounting software is for you if you want access to your bank accounts, view the data, track sales, and inventory from anywhere and at any time. The technology allows you to view your data in real-time and access what you need without any glitches.

2. Work faster and smarter:

Bookkeeping can turn out to be a rather tiring and monotonous job with all the daily dose of invoicing, billing, and so on. When you Outsource Finance and Accounting Services by using an automated cloud accounting software, you not only get relief from doing all of these, but also get the assurance that everything is being taken care of accurately.

3. Easy data backup and storage:

Automated cloud accounting software frees you from those much-known troubles of backing up and storing data. Small businesses can take advantage of low cost but high-quality cloud software solutions, which will not be affected by the fact that the employees are working from their homes.

4. Secured data & privacy:

You get role-based access controls in all cloud accounting software solutions; there is no need for you to worry about privacy or data breaches. Compliance can be made even simpler when AI-enabled tools are added to the mix.

Summing up

- Newsletter, Singapore

- April 9, 2020

Mr Chan Chun Sing, the Trade and Industry Minister of Singapore, recently announced that the Government has multiple relief measures planned to be executed to support the workers and businesses in the coming 3-6 months, as the CoVID-19 outbreak continues to threaten the country.

In a recent interview, he mentioned that delivering the necessary support packages is of the utmost priority for now, and the Government is ready to dole out more aids if needed. The Government announced a support package of a whooping S$48 billion last week for shoring up support for the economy, Along with the amount of S$6.4 billion previously mentioned in the budget this year, the Government is known to be earmarking about S$55 billion, or roughly eleven per cent of the GDP

When asked about the number of businesses the supplementary budget of the Government can support and for what duration of time, Mr Chan clearly stated that the exact number of businesses that may go under is difficult to be specified right now, but the Government will make sure to try and make the maximum number of businesses stay afloat.

He further added that the current priority is to put the available budget and schemes to use for helping the businesses and workers manage the next 3-6 months. The Government is ready to launch a couple of schemes that will help businesses with their immediate financial needs.

Mr Chan cited measures like the Job Support Scheme and property tax rebates to help businesses stay afloat.

The massive support package is expected to save many jobs, and help the ones that might get displaced to get rehired to other available roles. Apart from the short term issues, the support package is also expected to address the long term problems of the country. It includes continued efforts for strengthening the abilities of local workers and businesses, like building digital capacities, such that Singapore can be the first one to rise at a time when the recovery is found. Besides, it’s all about reinstating the confidence in the nation’s economy.

Mr Chan said that the depth of the nation’s reserves and the size of the announced package would make the people confident about the ability of the nation to brave the storm, and in fact, it will also be noted keenly by other observers. So, when it comes to an investment decision in the future, the observers will definitely think of Singapore as one of the nations that they can believe in.

It was also noted by him that the workers and businesses would be relieved in knowing the fact that the Government has enough in the national reserves to give out aids.

The Minister also mentioned that supply chains had witnessed serious disruption, And the bigger question is how these businesses can maintain their capabilities and connectivity for the country. He said that the short-term challenge is a loss in the ability of selling, but the bigger concern is the loss in the ability to produce, which indicates the fall of company capabilities.

- Newsletter, U.A.E

- April 9, 2020

ESR or Economic Substance Regulation submission had the deadline of March 31, but due to the pandemic of COVID-19 in these days, a few free zones have extended the deadline for the companies.

As they postponed the deadline for the companies, Younis Haji Al Khouri, Undersecretary at the Ministry of Finance recently announced the fact that the cut-off date is June 30 and they will make certain that all the regulations are followed as per the deadline, given by the Ministry of Finance. He has also added this move ensure ultimate compliance.

Dubai International Financial Centre had also asked the entities for submitting the ultimate economic substance notification on the DIFC portal. Though the March 31, 2020 deadline is no longer applicable, and this has been mentioned on their official website. UAE is a committed member of the OECD Inclusive Framework.Thus, it had come with a Resolution on the Economic Substance on April 30, 2019. It had done so

As per the evaluation of tax framework of United Arab Emirates as well. The ultimate rules and regulation required companies, which simply carry out the relevant activities, to maintain the sufficient economic presence in a nation regarding some of the activities they undertake. It is applied to financial year commencing on or from January 1, 2019.

Abu Dhabi Global Markets have also stated in a recent note that ESR notification got extended until further notice comes. Keeping the recent situation or this pandemic in mind, this can be considered as one of the big reliefs in the general business. Businesses and companies can utilise this extension for analysing their business details and financial aspects.

- Newsletter, U.A.E

- April 9, 2020

Recently Expo Dubai has conducted a virtual meeting of the Steering committee with all representatives from different nations.They discussed the ultimate impact of Coronavirus, COVID-19 which has impacted the Global preparations of Expo 2020 Dubai.The nations that took part in it explained the worldwide precautionary measures to the Steering Committee.These measures were mandatory for making the involved people totally safe.

According to their assessment, every nation now has an economic crisis.The members of Dubai Expo 2020 reaffirmed all of their solidarity along with the international community as this will simply navigate through the ramifications, which have already resulted from this unprecedented global disaster.

Expo 2020 Dubai has ample representatives from the whole world and during this situation; they are trying hard to come out of it.So, recently, they reaffirmed the UAE commitment for working hand in hand.They want all of their foreign and international partners to come forward and then deliver the World Expo that holds true to the founding purpose.

Though, everybody already knows about the postponement of Dubai Expo 2020, but, they are still trying to find a way.The entire committee has agreed collectively for discovering with BIE,The Bureau International des Expositions, BIE, will now on work with all of the Member States and Expo 2020 Dubai directors to set up the change in dates.Though they have already announced the date, the general assembly has also stated a fact that the final decision can be postponed.

Eventually, if there are any certain changes on the absolute decision on the deferment, then only the General Assembly and also the BIE’s Executive Committee can do these.According to the rule, if the dates need change, then at least 2/3rd of the Member States of the Organization should vote. And if the votes do not come in favour of general assembly, then the change in the date cannot happen.

Recently, the Minister of State for International Cooperation, Reem Al Hashemy, has given stress on this specific matter.He is also the Director General of Expo 2020 Dubai.He has stated that this entire global situation is moving quite fast, and this is unpredictable.As plenty of countries are going through the situation, so they will follow due to BIE processes on deciding to delay the Expo 2020.

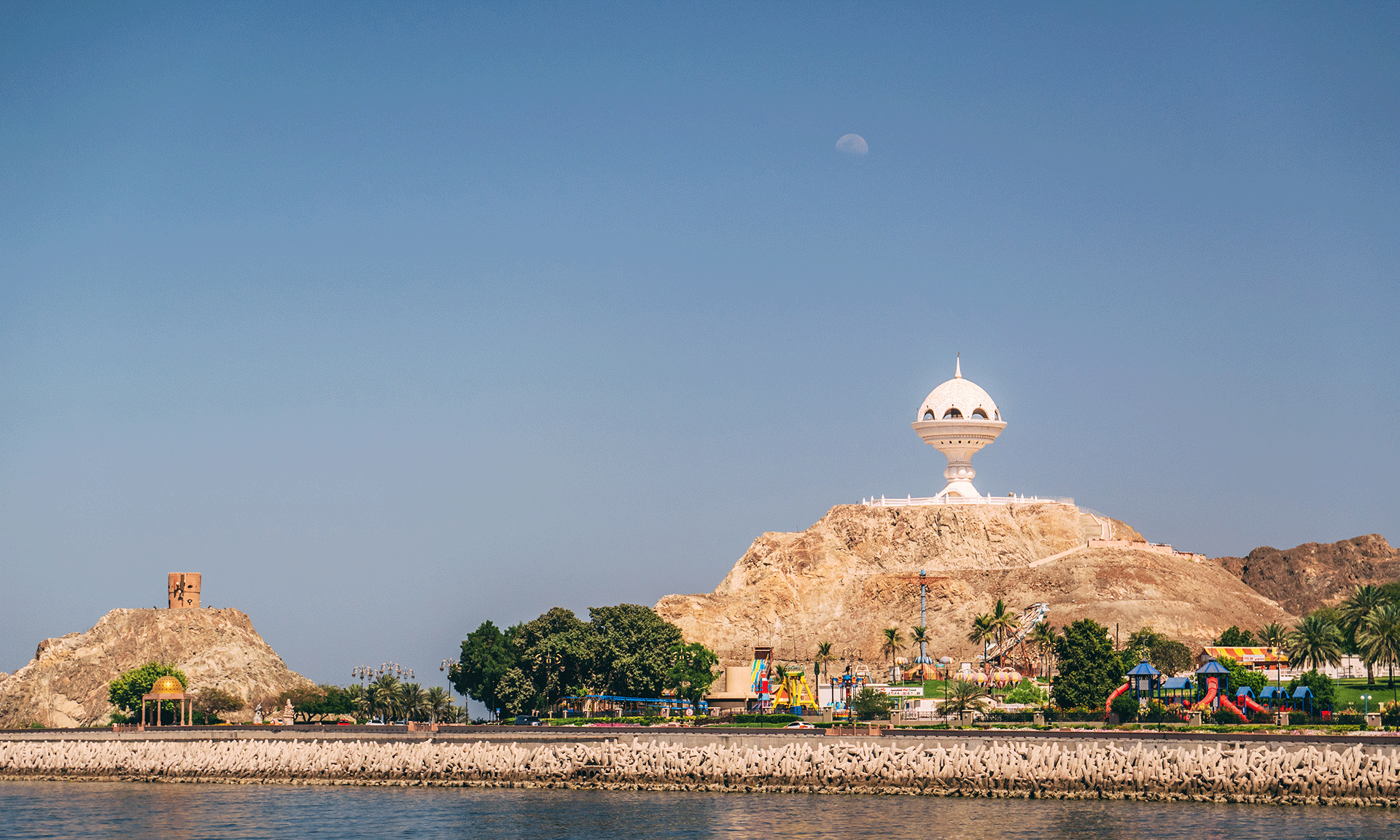

- Article, Oman

- March 31, 2020

In the last 40 years, Oman has made significant progress towards economic growth. Besides, it is one of the most favourable locations for business investment in the Middle East region. Some of the top factors that attract foreign investment into the country are business friendly climate, political stability, world-class infrastructure and ease of doing business, among others. Besides, Oman has strong incentive schemes that include custom duty exemptions, subsidised interest rates and income tax exemptions.

In addition, the recently introduced Foreign Capital Investment Law (FCIL) effective as of 2nd January 2020 also aims to boost doing business in Oman. The new law ensures the stability of foreign investment in Oman. This is done by offering numerous incentives and advantages to encourage business flow in the country.

100% Foreign Ownership Requirements

With the introduction of the new law, foreign companies, investors and citizens in Oman can have 100% ownership in many industries in mainland Oman. Although, few activities in the mainland Oman still require local ownership or local partner with a minority shareholding. In all, there are around 37 activities that are restricted for 100% foreign ownership which includes transportation, manpower recruitment, translation services, automotive and vehicle repairs and tailoring to name a few.

Requirement Relating To Consultancy Services In Oman

If you are offering consultancy services, you need local Omani shareholder that can be a company or an individual. The local partner needs to hold at least 35% shares in the company. Although the minimum share capital requirement to own OMR 150,000 has been relaxed. However, a part amount from this needs to be shown as proof of funds.

Documents Required For 100% Foreign Owned Business Setup In Oman

Individual shareholders need to furnish their passport copy. While corporate shareholders need to furnish company incorporation documents such as memorandum of association, trade license, certificate of incorporation, certificate of incumbency and a board resolution and power of attorney regarding Oman company formation. The above mentioned documents should be notarised, legalised and attested by the country of origin. The concerned authority needs to send these documents to the PPG in Oman for legal translation and stamping.

Other Requirements Include:

Business plan with details including investment cost, project description and commencement date of the project.

CR application form with the below mentioned details:

- Proposed name of the company

- Shareholding structure with the percentage of holding and details of the nationality of the shareholders.

- Proposed company grade ranging between 4 to 1 (1 being the excellent grade). For Grade 4, the share capital requirement is OMR 20,000 and it goes up to OMR 150,000 for Grade 1, and OMR 250,000 for an excellent grade. There is no longer a requirement to deposit the share capital before opening a company.

- Company’s financial year.

- Activities that the company proposes to carry out.

- Details of the manager and authorised signatories of the company.

Procedure To Set-Up LLC Company In Oman With 100% Foreign Ownership

- Firstly, obtain the Commercial Registration with the Ministry of Commerce and Industry giving details of the trade name, Business Plan and CR Application form.

- Obtain the Chamber of Commerce Registration.

- Make arrangements for office or warehouse lease.

- Make an application for Municipality License.

- For annual audit and tax purposes, you need to make an application for registration with the Ministry of Finance.

- If you need to apply for labour quota or staff visas, you need to make an application with the Ministry of Manpower.

- To be able to apply for visas with Royal Oman Police, you need a PRO registration on the Commercial Registration.

- Depending on the business activities, if any additional approvals are required that must be taken.

Fee For Setting Up A Company In Oman With 100% Foreign Ownership

With the enforcement of new law, the overall government registration fee is OMR 3500. This covers the fee for the Ministry of Commerce and Industry, Chamber of Commerce, Ministry of Finance and Ministry of Manpower. Besides this, you have to pay for the Municipality Licence cost depending on the value of lease and activities undertaken by the company. The registration fee of Oman Customs Government is OR 20.

How Can IMC Group Help You?

IMC Group has been operating in the GCC for over 10 years. We can assist you in setting up a 100% foreign owned company in Oman. We can also advise you on the shareholding percentage requirements for foreigners and the rights which go with that percentage and other such business matters. In addition, we can also assist you with drafting your incorporation documents, listing out the documents required to be filed, documents to be notarized and other formalities. For more information, get in touch with us.

- Newsletter, U.A.E

- March 16, 2020

There seems to be an upsurge in the real estate arena of Dubai thanks to the years of reforming the real estate policies to draw in the investors. The reforms seem to be working now that the investors are gaining their confidence back about the UAE real estate market. The initiatives that have brought about this change include increasing the flexibility of debt payments by the financial institutes, favourable plans for payment, and long term visas for the professionals and investors.

It seems that the confidence of the investors started rising ever since the news of Dubai Expo 2020 was announced. This was good news for the real estate investors interested in the country because it was a sign of the potential of the market for attracting buyers. A couple of investors have already delivered projects worth multimillions of AED. And, the good news lies not just in the fact that they have delivered the project, but rather in the fact that most of these projects have sold out completely. After all, the popular belief in the real estate world says that the delivery of the project is as important as it is to get it to sell out.

Now, let’s take a look at some of the data to get a better understanding of the market conditions. The last quarter of last year hit a record of sorts by closing nearly five thousand real estate transactions. This was the highest property sales recorded since the year 2008, and the residential stocks of Dubai are projected to hit 6, 37,000 in the year 2020.

The Expo 2020 has been touted, by the Dubai government, as the largest event ever to take place in the UAE. Dubai is to play host to one hundred and ninety countries, and millions of visitors from all over the globe are slated to join the event. The event will carry on for one hundred and seventy-three days, and have various themes like sustainability and innovation in the Arab region.

There is clear evidence that the Expo has changed the face of the economy for the past hosts of it. There is a noticeable growth in local economies and the price of real estate.

Dubai is ready to spend billions to make Expo the biggest event ever in the world. The organizers are expecting eleven million visitors from the UAE and fourteen million from overseas. Going by the recent reports, the Expo 2020 is slated to prove a boost of AED 122.6 billion to the local economy, along with creating over 49,700 permanent jobs this year. Investors are also confident that it will lead to the overall development of the business scene in Dubai.

The investments made in Expo and the money spent by the government in building its infrastructure are one of the main factors keeping the country’s economy on the right track during recent times. It has been predicted that the Expo can help the economic growth of Dubai to range from 3.8% to 4.5% in the future.

The Expo will create job opportunities in varied sectors like tourism and travels, engineering and infrastructural development, architecture, and service industries.

With the right amount of push from the Expo, the real estate sector of Dubai is on a roll now. The developers expect that after the Expo, investors will want to make the country their base because the infrastructural facilities and regulations can make it as lucrative as the other global cities, such as Paris, London, or New York.

Though the leading investments in real estate come from the Chinese and the local Emiratis, the developers have noted that even Indians are now considering Dubai for investments in real estate. Dubai has the luxury factor coupled with great prices compared to what is available in their home country, which attracts the Indian investments. For instance, residential properties have an average price of AED 1,000 – 12,000 per sq. Ft. in Dubai, which is roughly INR 20,000 – 24,000.

The time to invest in the real estate scene of Dubai is right now because of factors that go beyond the usual buying and selling properties. When you think of the average returns you can earn anywhere in the world, the figures stand at five to six per cent, and maybe seven to eight per cent on a great day. But, Dubai can easily take it to ten to twelve per cent for all day.

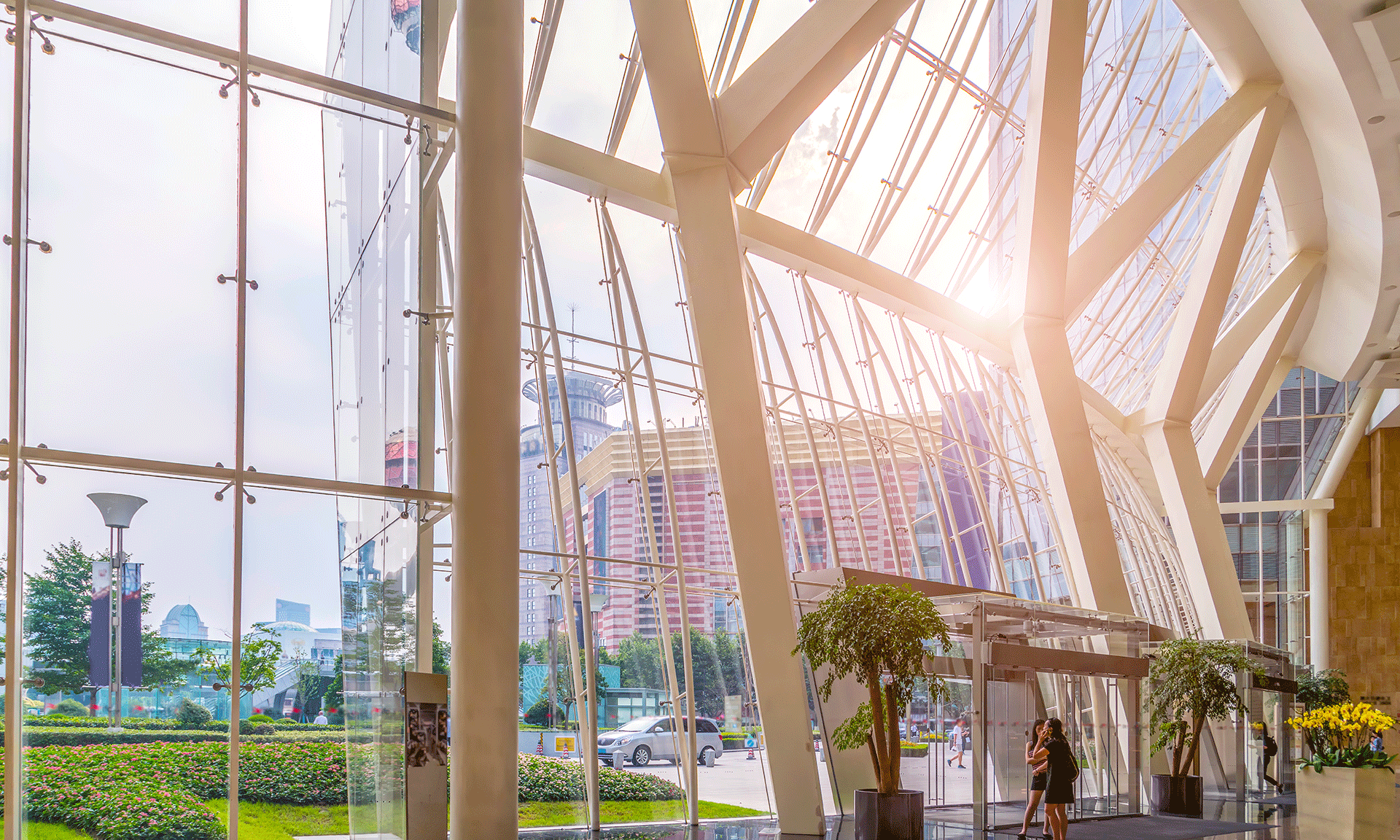

- Newsletter, Singapore

- March 16, 2020

With Singapore still tackling COVID-19, the Budget Statement was delivered in the Parliament by Finance Minister and Deputy Prime Minister, Mr. Heng Swee Keat, on February 18, 2020.

The changes in the tax structure seen this year are nothing groundbreaking, but it still reflects the values held by Singapore during these times of global structural shift and economic uncertainties. Because of the headwinds being faced by the country, several tax measures introduced this year aim at stabilizing the economy and supporting the businesses. In the international front, the country is well-poised to benefit from the geopolitical changes. There have been several refinements, enhancements, and extensions of tax schemes to make Singapore one of the prime financial hubs all over the world. However, the basic tax structure remains the same as the government believes it to be competitive enough and well-suited for Doing Business in Singapore.

Some of the notable highlights, regarding taxes, in the current budget are given below.

1. Corporate Tax benefits offered to the companies for stabilizing the economy

- Twenty-five percent income tax rebate per company, within the limit of S$15,000, for the year of assessment 2020

- Improvements in the carry back relief schemes for the year of assessment 2020

- Greater relief for renovation and refurbishments, plants & machinery for the year of assessment 2021

2. GST remains unchanged for now, but there might be some changes in GST for the cross-border activities of a company.

- No GST hikes from seven percent to nine percent for the year 2021, but it might be implemented before 2025

- GST levied on digital payments and imported services

3. The Mergers & Acquisitions scheme to be extended till 31 December 2025, with conditions applied

- No stamp duty reliefs for the tools executed after or on April 1, 2020

- No waiver application allowed for the foreign holdings of Singaporean subsidiaries for the acquisition they made after or on April 1, 2020

4. Promoting venture capitalism and maintaining a competitive market by refining, enhancing, and extending tax incentive schemes

- Extending the ‘safe harbor’ clause for disposing of ordinary shares till December 31, 2027

- Tax benefits for fun management businesses and venture capital businesses enhanced and extended

- Refining, enhancing and extending tax incentives for different industries, which include particular financial markets, maritime businesses, and insurance firms.

Twenty-five percent income tax rebates will be given to the corporate ventures, within the limit of S$15,000, for the year of assessment 2020. The small and medium enterprises will benefit considerably from it, and so will the companies facing minor cash crunches.

Mergers & Acquisitions Schemes Extended, but with certain limitations

The Mergers & Acquisitions scheme, introduced in the year 2010, was meant to foster growth and restructuring of the companies through the scheme. This scheme states that a Singaporean company legally acquiring the shares of another company might be entitled to certain tax rebates.

To qualify for this scheme, the main holding company of the acquiring company needs to be a legal tax resident in the country. This condition was waivered in 2012 for particular companies, including foreign MNCs that have headquarters in the country under the Headquarters Tax Incentive Program.

There will be an extension of the Mergers & Acquisitions scheme for qualifying acquisitions made before or on December 31, 2025. But, there will be certain limitations on the scheme, such as:

- The stamp duty reliefs under the scheme will end up lapsing for Singapore company incorporation after or on April 1, 2020

- Lapse of waiver for share acquisitions made after April 1, 2020. The MNCs that incorporate Singaporean subsidiaries might not be able to fulfill the conditions of the scheme under this clause.

The present tax benefits under the Mergers & Acquisitions scheme incorporate, an allowance based on purchase considerations that are limited at S$10 million for all the qualifying acquisitions in the year of assessment, and a double-tax reduction on the transaction costs spent for acquiring the qualified shares that are limited at S$100,000. The limits on double-tax reduction and Mergers & Acquisitions rebates are aimed to benefit the growth and development of small and medium enterprises. The other conditions and limitations of the Mergers & Acquisitions scheme continue to remain the same.

- Newsletter, Saudi Arabia

- March 16, 2020

“Saudi Arabia is now shifting its interest from studies to creating sustainable environments for attracting investments,” stated Mohammad Al Tuwaijri, the Minister of Economy and Planning in Saudi Arabia.

There are three pillars for catching in incentives, and they are creating clear strategies for measuring performance, offering diversified sources of finance by way of lucid plans through ministries, and the vital role of investment funds. Tuwaijri further stated that the investment funds would be coming in from the National Development Fund, aimed towards supporting all the areas and ministries to use investment opportunities.

In other words, doing business in Saudi Arabia would now be a possibility for every business investor. That’s good news added to the fact that three pillars are offered for attracting investments.

The government in Saudi Arabia is taking up many assignments and even financing the same for offering major benefits to the private sector, said the Minister at a Municipal Investment Forum held on 24-26 February in Riyadh.

The Minister further put down that Saudi Arabia is putting in the best efforts in creating sufficient infrastructure in the long run. The infrastructure will be in perfect line with Vision 2030 in collaboration with the municipalities.

Speaking on investment incentives and as queried by Mubasher, Tuwaijri stressed on the legislative facet of investment incentives in the future. He further added that the Saudi government is working on offering the infrastructure required for different sectors and projects.

The economy in Saudi Arabia is a thriving one, with the nation being the only member of the G-20 major economies from the Gulf region. The oil-based business in Saudi Arabia, along with petroleum, accounts for around 87% of budget revenues, 90% export earning revenues, and 42% GDP. With recent declines in the export of oil, the government here is looking to offer new business opportunities to entrepreneurs seeking Saudi Arabia as a great destination for doing business.

A record number of major business reforms were carried out in this Gulf country in 2019. This earned the nation a position in the Top 10 Universal Business Climate Improvers of 2020. This report came from the Doing Business 2020 publication of the World Bank Group.

There were a total of eight reforms implemented by Saudi Arabia in different business areas. The country ranks 62nd in the list of countries offering the ease of business. It means company registration in Saudi Arabia will not be a matter of great concern for business investors.

Thanks to the reforms meant towards improving the interests of the minority investors, the country now has the third position universally on this indicator. It ranks just after Singapore and New Zealand. The destinations considered easiest for doing business in the world. In addition to this, new reforms being made in the field of getting electricity have made it easy for new businesses to get fast electricity connections in the country.

Coming up with a new business gets easier in Saudi Arabia as the nation has now introduced a one-stop store that merges multiple post-registration and pre-registration procedures. Getting structural permits has also become easier because of the evolution of new online podiums.

- Newsletter, Oman

- March 16, 2020

New foreign investment law in Oman is all set to simplify and facilitate the processes for getting permits, licenses and approvals required by foreign investors.

Small businesses generally relate to the regular lifestyles of people. So, to make it easier for such businesses to find their foundation in Oman, the foreign investment law ratifications have been put in place. With this doing business in Oman has become easier for small entrepreneurs.

By way of the foreign investment law, small businesses have been exempted from 100% ownership. This new law is aimed towards improving the corporate climate of Oman and in making it more attractive for the entrepreneurs.

According to the law that has been introduced in Oman, Foreign investment will take place through companies or establishments in the form of the permitted activity. They will be the owner of invested foreign capital on the whole, or they will be making contributions to the same. Also, a license in regards to this activity will be issued by governing authorities. Hence, company formation in Oman shall no longer be a matter of great concern.

Nevertheless, in the best interest of the small-time businessmen in Oman, there has been an exemption of foreign ownership for 37 businesses. This includes photocopying solutions, translation, laundry, tailoring (for men and women), transportation, vehicle repairs, drinking water sale, recruitment and manpower solutions, salon and hairdressing services, fishing, driving instructions, rehabilitation homes meant for orphans, disabled and elderly and taxi services.

The Omani entrepreneurs have welcomed this move on the part of the government. Speaking on the subject, an entrepreneur from Oman put down, “Many Omanis are thriving on small-time local businesses that cannot withstand straight competition from the foreign investors”.

In his interview with the Observer, the entrepreneur further added, “It is also necessary to bring about a reduction in the prices of certain services to make them worth possessing by the common citizens. This would pave the door for small business growth which is not possible in the presence of the bigger giants in the market.”

While further clarity is being expected on the part of the common people and the small business owners in the future, there are some major developments confirmed in regards to the Foreign Investment Law.

Minister of Commerce & Industry will be issuing executive riles under this new law. The regulations added will include significant changes from the old Foreign Investment Law.

As per reports published in newspapers, the executive rules shall come to the forefront by 30th July 2020. A complete list of small business activities where foreign investment shall remain exempted is also likely to be introduced in no time.

The new Foreign Investment Law will not affect the existing laws concerning the GCC investments, Public Establishment for free zones and Industrial Estates and Special Economic Zone.

As per suggestions by the Minister of Commerce & Industry, the power of granting single approvals for the establishment, operation and management of strategic development assignments shall rest with the Cabinet.

All procedures and rules governing the approvals and the process of granting land for different investment projects shall be set out by the executive regulations.

While small businesses eagerly await the introduction of the executive regulations for clarifying some points in the new Foreign Investment Law, the law has indeed relaxed the foreign investment command in Oman to a considerable extent. Specifically speaking, it has boosted the atmosphere for business in Oman by granting 100% foreign ownership to the majority of the business activities.

It is believed that the new Foreign Investment Law will be marking tremendous liberalization in the Sultanate’s history. The law lays emphasis on creating an attractive and robust investment environment for foreign investors and businesses in Oman. The law will be spurring investment; driving economic growth and generating employment for sure.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group