- Newsletter

- November 26, 2018

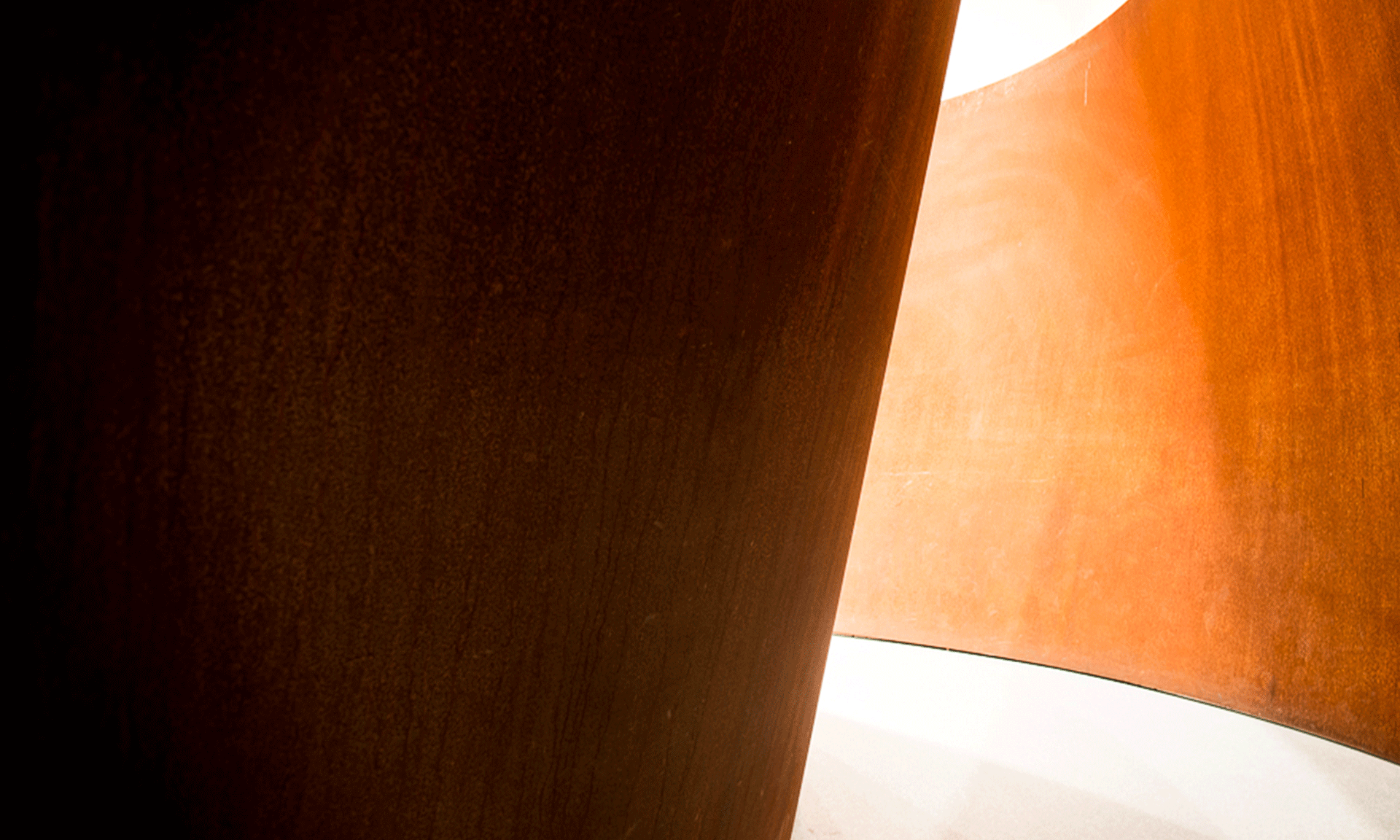

The Dubai International Financial Centre (DIFC) has released a new set of real estate laws and regulations. Keeping with the regulatory developments in Dubai, DIFC has amended its Real Estate and Strata Law and Regulation Regimes.

The amendments to the Real Estate and Strata Law regimes came into effect on 14th November 2018. We have analysed these changes and have summarised them for your understanding. So, let us have a quick glance at the new real estate laws and regulations.

A quick glance at the new laws and regulations

The Real Property Law (DIFC LAW NO. 10 OF 2018) repeals and replaces the Real Property 2007 Law (DIFC Law No. 4 of 2007). Likewise, The Strata Title Law (DIFC Law No. 11 of 2018) amended certain provisions of the Strata Title Law (DIFC Law no. 5 of 2007).

This Law applies to all Real Property within the jurisdiction of the DIFC. It includes land, buildings, and items placed in, on or under the land.

The changes implemented an updated property regime that ensures enhanced and better protection for the DIFC property owners and mortgage holders. Moreover, it also introduced an off-plan register and escrow requirements for developers. The new law ensures that the property purchasers acquire full disclosure on the developments and units being bought. The new law has made it mandatory for the developers to set up escrow accounts for the purposes of pooling amounts paid by the purchasers in an off-plan development.

The Strata Title Law further expands the scope of functions and powers of the Registrar of Real Property (RORP). The registrar now has the power to govern parties that breach their obligation in regards to the law. In order to promote efficiency and impartially in matters of dispute, the new law will enable the DIFC Courts to hear directly from interested parties.

Now, let us look at the key changes introduced by the new laws and regulations.

Key changes introduced by the new laws and regulations in relation to leasing and transfer of interests

- For any DIFC property where the term of lease exceeds 6 months, it is mandatory to register the lease with the DIFC Registrar of Real Property by the lessor. (Earlier registration was mandatory only for properties with lease term more than one year).

- Where the properties are mortgaged, the freehold transfer fee needs to be paid within 50 days from the date of signing the memorandum of understanding between the two parties.

- The Real Property Regulations have further extended the scope of exemptions by providing total 8 exemptions from the payment of freehold transfer fee which is generally charged at 5% of the purchase price or market value.

- While transferring non-freehold interests, a new schedule of registration fees will apply.

Key changes introduced by the new laws and regulations in relation to strata law

- The new law made it mandatory to provide a copy of the proposed Strata Management Statement or Strata Management Statements disclosing the proposed management structure and rules along with additional details of the shared facilities as per the Principal Strata Schemes.

- The new legislation stressed the developer’s obligation to rectify construction defects in the off plan development. Developers are now responsible for repairing, rectifying or replacing all defective building works, materials, equipment and installations of non-structural nature within 1 year and structural nature within 10 years from the date of completion of the building.

- The new legislation also mentions a clear process for registering a lien in a case where the service charges are not paid by the registered owners by the due date. Moreover, if the service charges are unpaid, the person is not allowed to vote at a General Assembly.

The new real estate laws and regulations represent an updated DIFC’s real estate framework post 2007. However, we expect a few more amendments to the framework in the coming time.

If you seek further guidance on the new real estate laws and regulations, you can get in touch with IMC Group who are pioneers in advisory and consulting related to the real estate sector in the UAE. The professionals at IMC Group have requisite knowledge and expertise of the real estate projects in DIFC.

For further information, you can visit www.intuitconsultancy.com or email at [email protected].

Thanks for watching the video. If you found the video useful, do not forget to like it and subscribe to our channel.

- Newsletter

- November 26, 2018

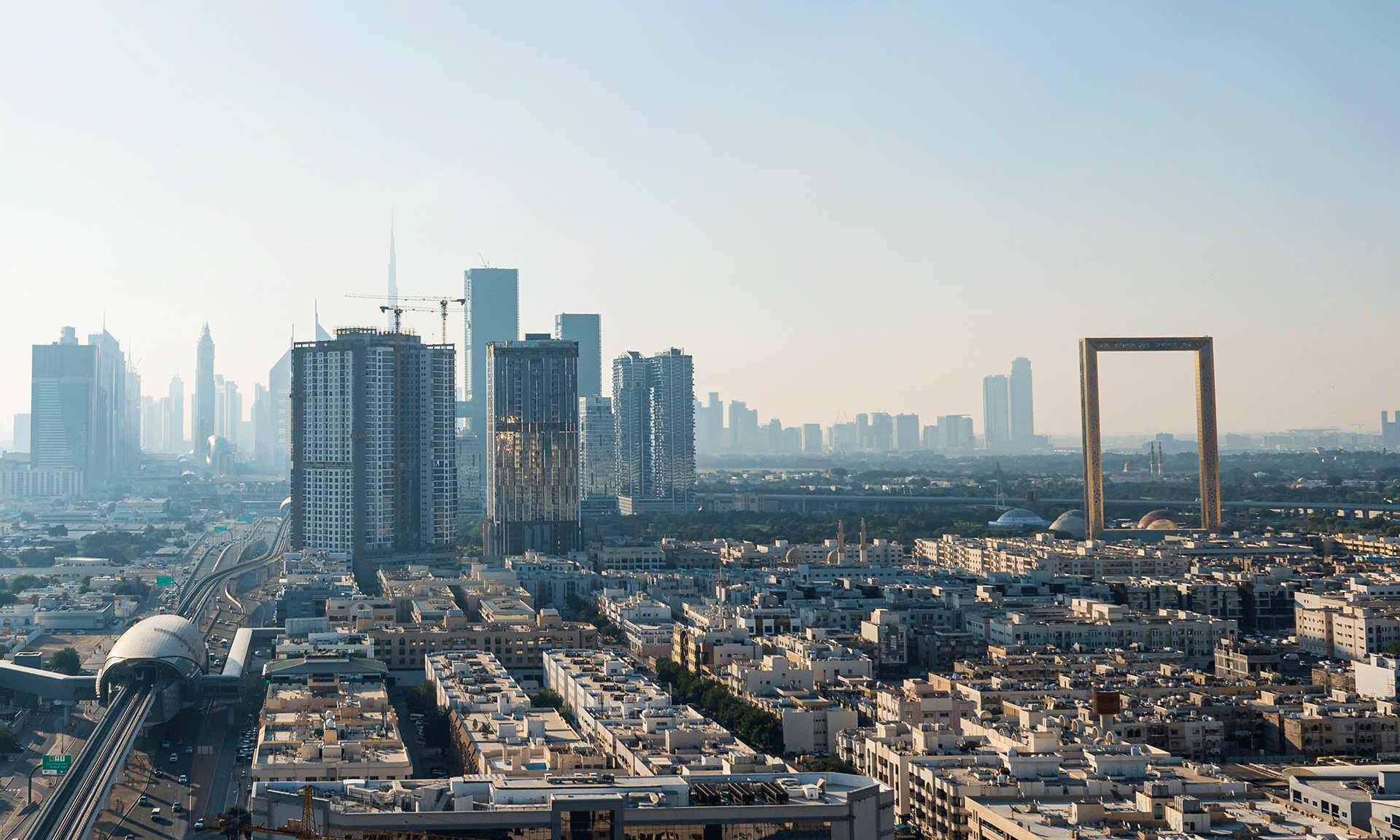

With a view to place Dubai International Financial Centre (DIFC) as the world’s top financial centre, Mohammed bin Rashid, the Vice President and Prime Minister of the UAE and the Ruler of Dubai has enacted changes to the DIFC’s legal and regulatory framework. The new law came into effect on 12th November 2018.

New DIFC Companies Regime

The new law aims to enhance growth and investment in the UAE. The new companies regime makes it easier for companies to do business in the Middle East. It will increase the ease of doing business in the DIFC along with providing appropriate levels of protection to investors in line with international best practices.

The newly enacted law aims to update the overall operating environment for entities based in DIFC, making it the most sophisticated and business-friendly common law jurisdiction in the region. Owing to the new law, DIFC companies will have to adhere to less stringent governance requirements which will allow them to focus majorly on doing their business. This robust and comprehensive legal framework will ensure that businesses and investors can operate easily and with confidence in the DIFC.

The new rule further removes all the ambiguity regarding the scope of powers and responsibilities of the directors. It clearly specifies their scope. The new law promotes transparency by clearly communicating the roles and responsibilities of the officers of DIFC companies.

The new law replaced the former Companies Law and its operating regulations. We will glance through the key changes under the Companies Law and Regulations and Operating Law and Regulations.

Key Changes to the Former Companies Regime

- Key changes in the Companies Law and Regulations

- The new law has abolished limited liability companies and has introduced a new classification of public and private companies. The private and public company regime will now allow maximum flexibility, especially for small private companies. With the introduction of the new law, private companies limited by shares (Ltd.) can have up to 50 shareholders and public companies limited by shares (Plc.) can have any number of shareholders. Moreover, there will be a distinct set of requirements for both of them.

- A public company must operate with at least two directors and a company secretary whereas a private company is not required to appoint a company secretary and can operate with just one director.

- The new law will further expand directors’ duties for DIFC companies. They are expected to disclose any interest in a transaction that is entered into or is proposed to be entered into by the company that conflicts or may conflict with the interests of the company. Furthermore, directors are required to act honestly, lawfully and in good faith keeping the best interest of the company.

- Another change is, a public company is required to have a minimum of USD 1,00,000 capital, of which at least 25% must be paid up. However, a private company is not required to have a minimum share capital.

- The new law also introduced a statutory pre-emption right for existing shareholders of the companies to guard against undue dilution of their existing rights.

- The new law has enacted a new schedule of administrative fines that the Registrar of Companies can impose on a company.

- As per the new law, companies are not required to notify ROC about the initial allotment of shares. Notification is required only in case of subsequent allotments.

- The law further provides new provisions for ‘whistle-blower’ protection.

- The law also enhanced the company accounting and auditing requirements.

- Key changes in the Operating Law and Regulations

- The new law provides a detailed framework for the role of the Registrar of Companies. ROC’s role will now include supervision and monitoring of the DIFC law and ensuring that the companies operating within DIFC are complying with the law.

- The new law further enhanced the licensing regime by providing a detailed framework concerning the licenses issued by the Registrar of Companies and their types. The new licensing regime will enable companies to conduct more business within DIFC or from DIFC. The new law requires companies to file a confirmation statement in case of license renewal.

- The law has strengthened the powers of the Registrar relating to inspection and investigations.

- The law also provides an extension of the ROC’s enforcement powers.

What are the objectives of the legislative changes?

The legislative changes are aimed at providing flexibility to the companies operating in the DIFC. The law further aims to enhance the business environment and reduce entry barriers in the DIFC. Moreover, it will increase the cost-efficiency and flexibility of small businesses, which constitutes a major portion operating within the DIFC.

How can IMC Group help you?

IMC Group is a cross-border advisory firm focusing on providing financial consultancy and advisory services in Asia, Middle East and Africa region. IMC Group can assist you in registering and securing ongoing compliance by advising you on the changes as per the DIFC regime and helping you with the incorporation of a company as per new law. For further information, you can visit www.intuitconsultancy.com or email at [email protected].

- Newsletter

- November 26, 2018

The good news is that Federal Decree No. (19) of 2018 regarding Foreign Direct Investment (the “FDI Law”) which has been long awaited, is now in force. This FDI Law has an objective of creating a rational and balanced business environment which helps in increasing the flow of FDI coming into the UAE by permitting up to 100 percent foreign ownership of companies, which are functioning in certain sectors. In this article, we are going to talk about the main principles of the Foreign Direct Investment Law and the possible impacts and implications that this law would have on all global investors in the UAE.

Before the FDI Law was passed or announced, the foreign ownership of all the companies in the UAE was only allowed up to 49 percent as per the Article 10 of Federal Law No. 2 of 2015 on Commercial Companies. But post the passing of Federal Decree Law No. 18 of 2017 this limit has been relaxed and the UAE Cabinet has been given the freedom to enhance the foreign ownership limit in all the economic sectors and also for businesses involved in certain activities. The FDI Law has now come up with a new framework or guidelines, according to which the Cabinet of UAE can exercise the powers that are given to it as per the Federal Decree Law No. 18 of 2017.

The FDI Law has established the following two lists: (i) a negative list that is meant to set out some sectors, which are termed “unavailable” for foreign investments; and (ii) a positive list which stipulates the sectors and business activities that are available for the foreign investors.

The Negative List

The specific sectors in the UAE economy, which figure out on the negative list currently are:

- Exploration, prospecting and then production of oil;

- Investigation or security agencies, military sectors, and also weapon manufacturing;

- Financial activities such as banking or funding like payment systems or any cash dealings;

- Insurance sector;

- Labour-based services like recruiting of personnel;

- Water, electricity services;

- Postal, telecommunications and all kind of audio-visual services;

- Land and air transport services; and

- Medical sector-related retail trade, which includes private pharmacies.

The UAE Cabinet has the powers to make amendments to this list and add more or remove any current sectors, which are there on the negative list.

The Positive List

Contrary to the negative list, the FDI Law does not give any details of any particular sectors in the UAE economy regarding the positive list. Though the Economy minister has said that the government will soon be publishing this list by the first quarter of next year. The FDI Law permits the authority to the cabinet of the UAE to add any sectors it deems fit, on the positive list and to:

- Authorize the level or percentage of foreign ownership that is allowed in such a sector, which not necessarily has to be 100 percent but could be anything more than 49 percent;

- In case less than 100 percent of ownership is allowed in a particular sector, the government needs to change the foreign ownership level that is permitted depending on the Emirate where this business is set up and functions;

- Mention the limitations and requirements on the legal entity’s form which might carry on the business activities;

- Set a minimum requirement of capital for all the legal entities that are functioning in such sectors; and

- Impose or necessitate the mandatory Emitarisation requirements regarding businesses which are operating in such sectors (that is, instruct that some specified percentage of the UAE residents include the total strength of employees in the business).

The FDI Law has listed the application procedure that all the global investors need to follow if they are requesting for an increase in foreign ownership in a specific sector on the positive list. Not only that, but the FDI Law also describes the appeal procedure in case of a rejected application.

Foreign Direct Investment Projects

A foreign investor can apply to get permission so that they can own over 49 percent of ownership or shares in FDI project provided that the project’s sector is not listed on the negative list. In case the foreign investor gets the permission, they are allowed to set up a foreign investment company (as prescribed under the FDI Law) to hold their interest in the particular project.

Administration

There are two government bodies that have been set up as per the FDI Law to make sure accurate administration and also an implementation of this FDI Law:

- The Foreign Direct Investment Unit, which is called the “Investment Unit”, and

- Foreign Direct Investment Committee, called the “Committee”

Investment Unit’s primary role is to make suggestions and execute (post getting approval from the cabinet of the UAE) FDI policies in the UAE and also to observe and appraise the performance of this foreign direct investment that is permitted.

The Committee is basically responsible for first studying and then submitting their recommendations to the cabinet about the inclusions on the positive and the negative lists. The Committee is also accountable for giving recommendations to the cabinet of UAE on approving of all the license applications of FDI projects, which are still not on the positive list.

Some other provisions

The FDI also lists the provisions and details about how to settle disputes, if any, administrative sanctions, any penalties, fees (which is decided by the UAE cabinet) and rejecting or restraining the total ownership percentages of a global shareholder.

Though the FDI Law has been implemented successfully, it is still subject to interpretation and in the near future, many more clarifications are expected to come, including the sectors which will be on the positive list.

IMC assures you of the expertise and experience it brings to the table in form of a dedicated team of investment specialists who can advise the global investors on topics such as corporate structuring and other such issues in the UAE. If you need any assistance or have any queries related to setting up your business pursuant to the FDI Law, do get in touch with [email protected].

- Uncategorized

- November 20, 2018

Nowadays there is a trend where over 50% of companies globally create a shared service centre and consolidate their Finance and Accounting (F & A) function. There are obvious benefits of doing so – be it commercially or from an efficiency and productivity point of view. However, there are some major challenges too; let’s see what are those.

The advantages of having a shared service centre

There are many benefits of having a shared service centre (SSC) that attract various companies to consider creating one. It not only helps in standardizing the processes, but also leaves little room for errors. Having standard processes helps in creating and also updating the control environment, and it makes it simpler to design reliable input and output reports. What’s more? The end-to-end review work easily is streamlined and the various iterations are minimized.

Having a standardized global process in place also helps in comparing trends going on across various organisations. Also, when we consolidate all processes to single accountancy software, it gets easier to leverage the add-ons, for example more automations and even robotics. Then there are commercial advantages that are derived from centralizing, because one country’s operations do not need to resource their own services.

The roadblocks or challenges of creating a shared service centre

However, creating a shared service centre by centralizing has its own challenges. The biggest challenge is ensuring compliance with the local rules and regulations in each country where the business is operating. These variations of the local rules and guidelines take the cost to a higher level, because being compliant in-country certainly requires more processes to be added in order to develop and monitor, example data reconciliation and other tools for oversight and tracking. In addition, this increases complexities, which only a professional organization like IMC can help you deal with. You would also need expert assistance to take care of local taxes and the requirements of financial reporting.

Knowing the language of the land

Another major issue that crops up is knowing the local language. In various countries like France, Russia, Spain and Romania, where the reports, returns and all the accounting documents have to be mandatorily made and filed in the local language. It surely is tough to acquire language skills in a shared services centre of a certain location. To deal with this, you would need to depend on the local professionals.

However, it is not possible to hire representatives of each language globally in an SSC. In such a situation, IMC and its accounting services can help you take care of these requirements with its qualified and expert professionals in each field. All our offices are staffed with local language-speaking professionals who are equipped with the required skills, know-how and local contacts.

Knowledge of the local rules and regulations

The accounting and other tax rules vary from country to country. There could be some common points, but every country would have their unique rules and regulations and also different reporting requirements. Various countries have local GAAP, which is quite different from the commonly-applicable IFRS or US GAAP (France, Romania, Russia etc.). In such a case, IFRS or US GAAP accounts have to be converted into local GAAP and it is important to ensure that the local regulations for foreign currency revaluation, depreciation, or fixed asset capitalization are considered.

Though everyone seems to be aligning rules with regards to VAT and General Sales Tax, various corporate income taxes and other withholding taxes are actually based on each country’s precise rules and the requirements for expense deductibility. Even the sufficient supporting documentation varies in each country. Therefore, it’s not an easy task for an SSC to possess all the knowledge and be up-to-date about every jurisdiction globally.

It is also important to maintain contact with the local tax authorities to stay compliant. Hence before considering creating an SSC, it is wise to first begin the transition with a comparatively easy region in terms of rules and also seek professional advice to identify the particular output reports that need to be standardized, and which all country-specific variations are to be considered.

- Article

- November 15, 2018

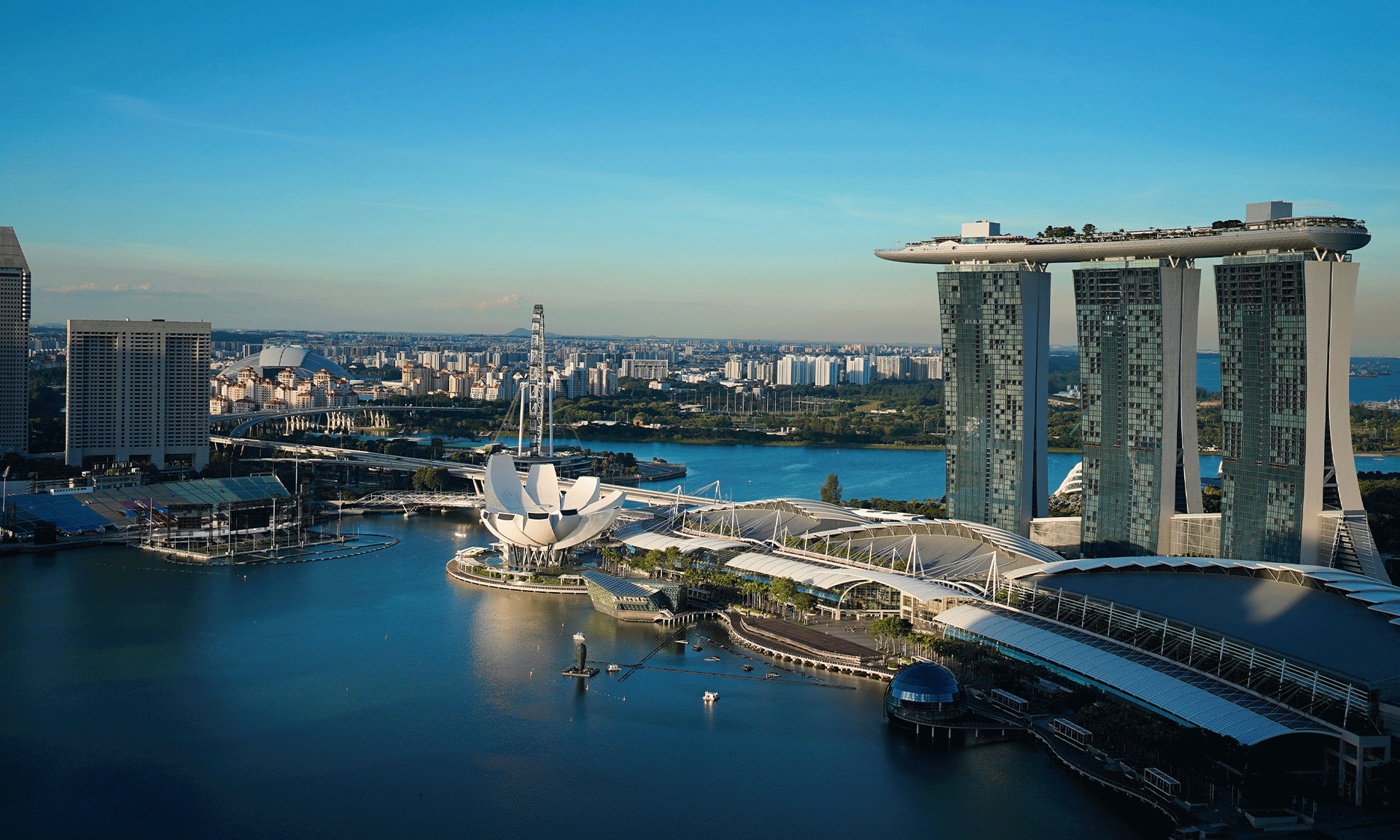

Ms. Indranee Rajah, the Second Minister for Finance, moved the Variable Capital Companies Bill (“the Bill”) for first reading in the Parliament on 10th September 2018.

Background of the Variable Capital Companies Bill

Variable Capital Companies Bill will serve the needs of investment fund and establish a culture for incorporation and operation of a new corporate structure in Singapore. With VCC, the fund managers in Singapore will be encouraged to set up the domicile of their investment funds within the country. This will further help the country in strengthening its position as a full-service international fund management centre.

The VCC structure shall be in line with the current suite structure that is available to the Singapore’s fund managers. Unit trusts and investment companies are the most commonly used investment fund structures. Due to the restrictions under the Companies Act (Cap. 50) (“CA”) in Singapore, the investment funds constituted as investment companies are very rare. The restrictions affect the regular functioning of the investment companies in a way that they have the lesser flexibility to pay a dividend, redeem shares, etc. In order to resolve such issues, there are specialised corporate structures for investment funds established by the international fund jurisdictions.

The VCC Bill is prepared by the Monetary Authority of Singapore (“MAS”) after conducting a public consultation about the proposed regulatory framework. The respondents were positive on the VCC structure and the proposed regulatory framework by MAS. The bill is prepared by the MAS after incorporating all the possible public feedback.

Provisions of the VCC Bill

Since the investment fund companies faced a lot of restrictions, the VCC Bill shall include the following features that will ease the operations of a VCC as an investment fund.

Variable Capital Structure

To give relief to the investment fund companies, the bill shall give permission to such companies to redeem its shares without shareholders’ approval, pay dividends using their capital and enable the investors to exit their investments whenever they wish to. On the other hand, the companies under the Companies Act can distribute dividend only out of its profits and face numerous restrictions on capital reduction.

Sub-funds with Segregated Assets and Liabilities

VCC Bill allows the companies to establish themselves as a standalone or umbrella structure with multiple sub-funds having different objectives of investment. The umbrella structure helps the companies in reducing their cost in the form of having common service providers like a custodian, fund managers, auditor, etc. Under the umbrella structure, they can also have sub-fund having the same board of directors. In addition, these companies can also consolidate its administrative functions like preparing a prospectus, holding a general meeting, etc.

The sub-funds can have its own set of investors, but it is not a separate entity in the eyes of law. The risk that assets and liabilities of one sub-fund can be merged with another sub-fund is always there. To overcome this risk, the bill necessitates each sub-fund to segregate their assets and liabilities. This is done to ensure that the assets of one sub-fund are not used to meet the liabilities of another sub-fund. Furthermore, during insolvency, each sub-fund must wound up separately.

Fund Manager under VCC Bill

According to Bill, every VCC must compulsorily appoint a fund manager who is regulated by the MAS to manage the investments. This will enable supervision of the functioning of the fund manager. In addition, it would ensure that the VCC is not using the funds for unlawful purposes or the company is not running as an offshore vehicle without any actual activity relating to managing the investment in Singapore.

Accounting and Governance

With the introduction of the VCC Bill, the scope of the accounting standards which can be used in preparing a VCC’s financial statements has considerably increased. The bill allows the companies to use the International Financial Reporting Standards and US Generally Accepted Accounting Principles apart from Singapore accounting standards and recommended accounting principles. This will give more flexibility to the investment funds and serve the needs of the global investors efficiently.

The register of VCC shareholders shall not be made public to meet the privacy needs of the investors. This practice is in line with other major jurisdiction such as Hong Kong, UK, etc. The aim of MAS is to prevent the VCC from being used for illegal purposes like money laundering, terror financing, etc. Therefore, the VCC is required to regularly update the register of the shareholders and provide the information to the regulatory authorities whenever asked for it.

Re-domiciliation

The new bill shall encourage the foreign corporate fund structures which are similar to VCCs to re-domicile as VCCs in Singapore. This, in turn, will lead to fund managers in offshore jurisdictions to co-locate fund domiciliation with their fund management activities in Singapore.

Insolvency Provisions

A VCC Amendment Bill shall be placed in 2019 to replace the provision of the insolvency of a VCC and its sub-funds that are adapted from the Companies Act. Furthermore, the provisions under the Insolvency, Restructuring, and Dissolution Bill (“Insolvency Bill”), shall also be amended. Therefore, the VCC insolvency regime shall align with the VCC Amendment Bill with the other corporate structure in Singapore.

Administration of VCCs

The administrator of the new bill and registrar of the VCCs shall be the Accounting and Corporate Regulatory Authority (“ACRA”). However, ACRA shall not look into matters of anti-money laundering and counter-financing of terrorism obligations of VCCs, they shall be overseen by MAS.

For more such updates on new rules and regulations issued in Singapore, keep following out articles. IMC Group is a cross-border advisory firm focusing on providing financial services to various companies. Some of the services that IMC Group provides includes market entry services, corporate services, international tax, corporate finance, investment advisory, global mobility, private client & family advisory, outsourcing solutions, business advisory and mergers, and acquisitions.

- Uncategorized

- November 13, 2018

A new Decree Law No. 19 of 2018 has been issued after the announcements made earlier this year on the loosening of domestic ownership restrictions. The new Decree-Law compliments the Federal Law No. (18) of 2017 and amends the Federal Law No. (2) of 2015 on Commercial Companies. The amendment provides that the law relating to the mandatory holding of 51% shareholding of LLCs by UAE national or entities might soon be lifted through the resolution of the UAE Cabinet for specific sectors.

The new law aims to attract more foreign investment and boost the economic growth of the country making the country the first pick among global investors. It aims to promote the country’s investment environment. The law further states that a “Foreign Direct Investment Committee” shall be formed through a resolution to overcome the technicalities of implementing the new Decree-Law. The committee will be headed by the Ministry of Economy and will be responsible for referring the sectors and activities to the UAE Cabinet that can avail the benefit of the scheme.

The Cabinet will soon issue the list of sectors that can have increased foreign ownership. The Cabinet will also approve the different types of restrictions that can be applied to the various sectors where foreign ownership is 49% to 100%. In addition, the restriction can be on the office location, on the capital, and on the Emiratisation policies.

A negative list of the sectors that shall not be impacted by the Decree has already been made available. It includes sectors like insurance services, financing, banking, transport services including land and air, medical retail services and commercial agency services.

The Cabinet will also take into consideration the impact on the economy of the sectors that will have a positive effect from the scheme. The impact shall be seen on the innovation front, job opportunities created for UAE citizens and the profile of foreign investors in the country.

About Us

IMC Group is a global firm that serves entrepreneurial clients including SMEs, blue-chip companies, individual entrepreneurs, multinationals, etc. We assist not only in establishing a new business but also ensuring that firms run as per the different laws and regulation. We are a one stop solution for all the business needs. Just drop in an email and get in touch with us.

- Newsletter

- November 12, 2018

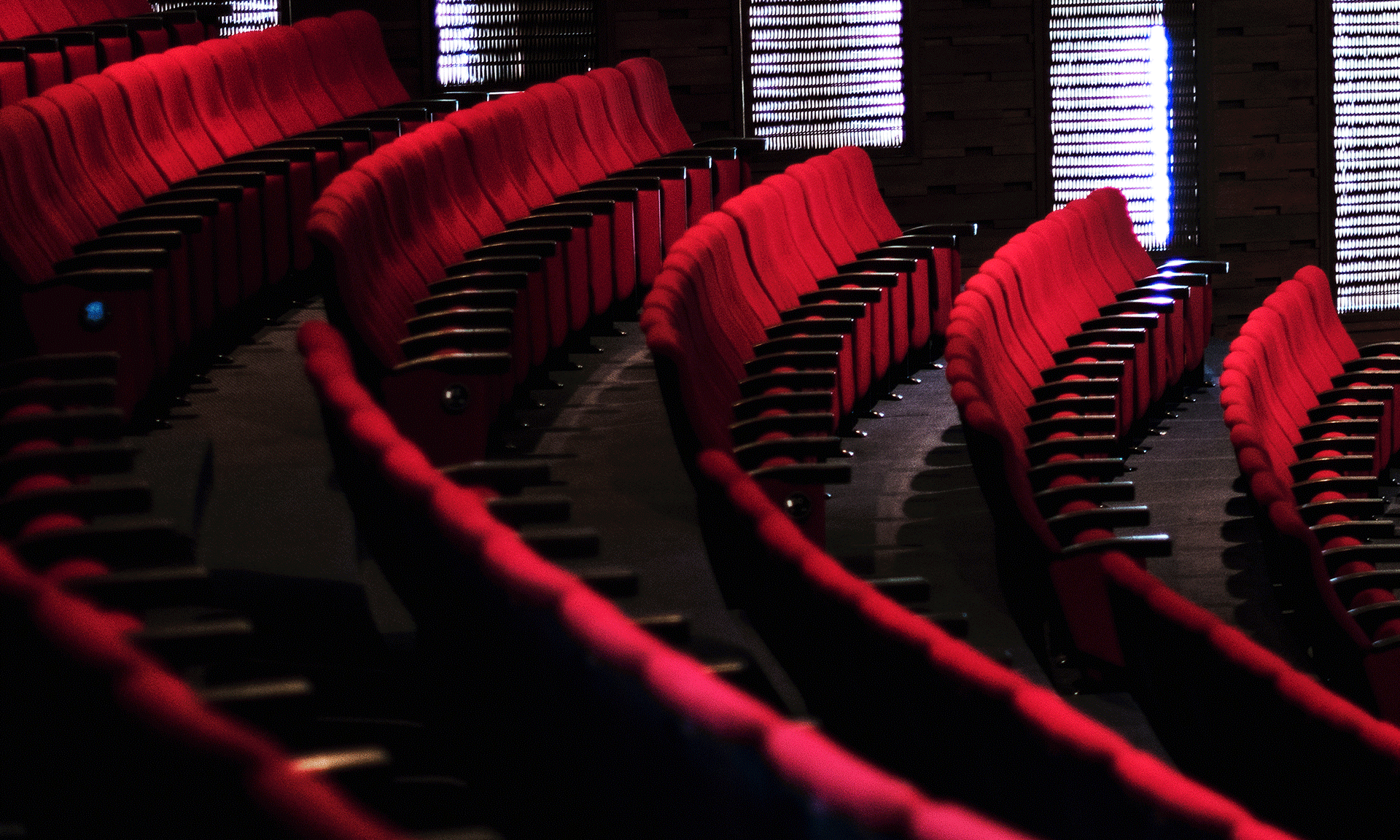

Carnival Cinemas is eyeing the remote areas of Saudi Arabia to open up 500 screens spanning in the next five years.

There’s ample good news for movie lovers in the Kingdom. Two more cinema chains have recently announcing their plans to open approximately 500 screens in even remote areas of Saudi Arabia, thus making the movie future brighter, especially for those who aim for digging gold from the nation’s profitable box-office market.

PV Sunil, who is the Managing Director of Carnival Cinemas, which is one of the fastest-growing and biggest multiplex chains in India said that Saudi is a huge country. Because of that, there is an opportunity for all the players who want to operate here and also co-exist harmoniously. Though there is going to be a lot of competition in this market from the global operators who are all set to do business in this exciting cinema market.

During the inaugural MENA Cinema Forum, which took place in Dubai recently, Sunil shared that Carnival Cinemas is going to soon open about 500 screens across the country spread in the next five years, especially with a focus on the remote areas.

He also confirmed that they are in a position to obtain the operational license, and they already have the required distribution license. However, as soon as they get the operational license, they plan to start the opening of the multiplexes in the Kingdom.

Then there is Novo Cinemas, which already has 11 screens in the UAE and also one in Bahrain; it has also announced that it is considering starting its business in Saudi Arabia. The coming times would see partnership deals happening with both, which have resulted in four licenses already being awarded to big cinema operators since Saudi Arabia officially ended a 35-year ban on cinemas beginning this year. As of now, there are some theaters in Riyadh, although VOX is planning to open a few in Jeddah by 2018 end.

Debbie Stanford-Kristiansen, who is the CEO of Novo Cinemas, which is headquartered in Dubai, shared that the company plans to open its first cinema screens in Saudi Arabia in 2019 end or last quarter. She feels that Saudi is an important market, and Novo Cinemas, which started in the year 2000, is a leader in this business in this region and it is only apt for the company to now step into KSA.

As per the latest research conducted by PriceWaterhouseCoopers (PWC), the total number of cinema screens is going to shoot up by 38.4% to 1,800 in the MENA region in the coming three to five years. More than $3.54 billion worth of investments in cinema screens across the Kingdom is forecasted to boost this industry’s expansion plans.

Ashish Shukla, who is the CEO of Cinepolis Gulf, shared the expansion plans on the occasion of the MENA Cinema Forum. Earlier in 2018, Saudi Arabia approved its fourth operational license for adding new screens to Lux Entertainment, which is a joint venture between Cinepolis, the largest cineplex chain in Mexico, Al-Tayer Group and Al-Hokair Group for Tourism and Development. Lux Entertainment has plans to open new 300 cinema screens in around 15 cities in Saudi Arabia in the coming five years.

Some more licenses have been given to AMC Theaters, which is an American chain owned by the Wanda Group. They plan to open 40 new cinemas in 15 cities in the Kingdom over the coming five years, and anywhere between 50 to 100 screens in around 25 cities by the year 2030. VOX Cinemas, which is one of Saudi Arabia’s biggest movie chains, is planning to open 600 new screens by the year 2022, whereas the Al-Rashed United Group – Empire Cinema is also planning to start 30 new cinemas in the nation in over the coming three years.

Cinepolis, which is one of the largest global cinema operators, currently has 5,371 screens and around 1.1 million cinema seats in almost 15 nations. Ashish Shukla was of the view that the Gulf is one of the biggest growth opportunities for the company as the Kingdom is on top when it comes to the investment potential.

Cameron Mitchell, who is the CEO of Majid Al-Futtaim Cinemas, whose subsidiary is VOX Cinemas, said that the Kingdom will soon experience many exciting developments and additions in the film industry, such as the enhancement of locally-produced content and films, and also international Hollywood filmmakers using the Gulf as a destination for filming.

He also mentioned his excitement about their Riyadh Front location, The Roof, and also the opening of the Mall of Saudi, which will soon be the best cinema in the world.

Mitchell shared that his company aims to make sure that its thriving business in the country is led by Saudi nationals, with the business having a 98.8% Saudization scheme, having achieved 98% till date. He also said that the company will be supporting local filmmakers because VOX is “desperate for more local content.”

Earlier in 2018, VOX had signed a much-talked-about distribution deal with Myrkott, which is the Saudi production company involved in YouTube animated series “Masameer” which has as of now attracted over 700 million views across social media.

Mohamed Al-Hashemi, who is the country manager for Saudi Arabia at Majid Al-Futtaim, said that the Kingdom’s market is special because of a couple of reasons; first, because of its population and the purchasing power and second, because it is a virgin market.

UAE has already attracted Hollywood movie makers to shoot some of the blockbusters such as “Mission Impossible: Ghost Protocol” and “Fast & Furious 7,” Al-Hashemi is positive that now movie producers would consider the Kingdom for its shoot locations.

Arturo Guillén, who is the vice present for EMEA and India for movies at comScore (an analytical organization that analyzes cinema trends), said that Saudi is currently becoming the centre of attention of all the global cinema population. The main reason for this is the huge potential of this market to reach the Top 10 market slot globally in the coming five years. This means global box-office earnings of around $1 billion per year. Seeing these numbers, Saudi can definitely be a competition to Hollywood soon.

- Newsletter

- November 12, 2018

The good news is that professionals, managers, and executives will now have access to the basic employee benefits, which they couldn’t enjoy earlier. A very anticipated bill to make amends to the Singapore Employment Act (EA) was finally announced on October 2, 2018, in the parliament.

One of the biggest proposed changes is about expanding the core provisions of the EA to all professionals, managers, and executives (PME), irrespective of their salary slabs. As of now, the PMEs who have an earning of over S$4,500 per month are not covered under the EA, and the companies or employers have been determining their employment terms majorly through contracts. However, PMEs would now be permitted to get the basic statutory benefits like annual leave, leave for medical reasons and hospitalization, and also protection against unjust or unfair dismissal.

The changes are also slated to impact some major employment practices such as termination of employment, managing disciplinary action, making and keeping of HR records, administering statutory employee benefits, giving allowable salary deductions and automatic transfer of employees due to some business re-organisation.

This bill also includes the below-mentioned major changes:

- Raise in Salary Limit for any Additional EA Protections: The salary limit or cap for employees (except workmen and PMEs) who enjoy additional protection and all the other benefits under Part IV of the EA, like overtime and rest days, would be now enhanced from S$2,500 per month to S$2,600 per month.

- Statutory Annual Leave which is Applicable to all Employees: The annual leave requirements listed in the EA have been extended and are now applicable to all the employees without any exceptions. Earlier only those people covered under Part IV were permitted to enjoy statutory annual leave.

- Augmentation of Dispute Resolution Services: The specific forum which hears the wrongful or unjust dismissal claims would be now changed to the Employment Claims Tribunal. Earlier the Ministry of Manpower took care of it.

- New Definition of “Dismissal”: As per the new definition of Dismissal, it will now include “the resignation of an employee if the employee can show, on a balance of probabilities that the employee did not resign voluntarily but was forced to do so because of any conduct or omission, or course of conduct or omissions, engaged in by the employer.”

- The compulsion to Present Additional Information on the Retrenchment of Employees: Employers have to, if ordered by the Commissioner of Labour, furnish all needed information regarding the retrenchment of any employee. As of now, the employers or organizations having 10 or more employees have to mandatorily notify the Ministry of Manpower in case five or more employees are retrenched in a period of six months.

The bill is forecasted to be put into effect in April next year. Employers and organizations should get ready for all the changes by revisiting their policies and also the contracts for all employees.

- Newsletter

- November 12, 2018

Dubai Internet City has signed an agreement with the Russian Export Centre for launching the first Russian Centre for Digital Innovations and ICT.

The announcement of the opening of the centre in Dubai Internet City is happening when the UAE and Russia have reported growth of $1.2 billion in 2017 in bilateral trade between the countries.

Dubai Internet City or DIC has recently signed an agreement with the Russian Export Centre (REC) to launch the first ever Russian Centre for Digital Innovations and Information and Communication Technologies located in Dubai.

The centre has been planned in a space of over 20,000 sq ft in DIC and is the first of a total of four global centres that are being planned. It will be the first assurance to investment promotion of this magnitude by Russia outside of its borders.

This centre’s opening is announced at a time when Russia and the UAE reported substantial growth of to $1.2 billion in 2017 in bilateral trade between the countries.

Top leaders of both the countries have pledged to strengthen their trade and industry relationship, after an important two-day visit by Sheikh Mohammed Bin Zayed Al Nahyan, who is the Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces to Russia.

Earlier in 2018, leaders of both the nations also reviewed their bilateral relations, spoke about cooperation, and finally signed the dotted line for a new strategic partnership.

Ammar Al Malik, who is the managing director of Dubai Internet City and Dubai Outsource City said that “The UAE and Russia have shared close business ties for decades, and for DIC to be chosen as the first overseas destination by REC is a true testament to Dubai’s key position as a global business destination. The Russian Centre for Digital Innovations and ICT in UAE, along with other innovation centres and labs that DIC is home to, will serve as a catalyst for this vision.”

Marat Korovaev, who is heading the IT Export Support Department, REC was of the view that Dubai’s goal and plans for taking the position of the smartest city in the world are really second to none and the Russian IT industry will definitely add significantly to the triumph of this vision.

Various factors such as the bilateral ties, favoring and simple business processes, and a fostering environment which bolsters new innovation and exchange of best practices, have incited on the selection of Dubai and DIC as the first-ever destination for the total of four planned centers located outside of Russia. It is the right time for company incorporation in Dubai or DMCC company formation. In case you require any professional help regarding this, do get in touch with us at IMC.

Besides opening this centre, the DIC and Russian Export Centre will come together and support UAE-based and Russia’s technology businesses and companies of all sizes, which includes all the start-ups and also entrepreneurs, thus supporting DIC’s pledge to offer a thriving and fostering ecosystem for organizations and businesses to grow.

- Newsletter

- November 12, 2018

The recent amendments to the UAE visa law would now allow an extension of 30 days to the visitor or tourist visas twice, which makes it a total of 60 days, without leaving the country.

As per the new rules which were announced earlier in 2018, the residency visa particularly for widows and divorced women and their children would now be extended for one year without a sponsor beginning from the date of husband’s death or the date of the divorce.

Residency visas for students who are being sponsored by their parents would also be renewed for one year after completion of their high school or university or when they turn 18. This will again be permitted to be renewed for next 12 months.

Those who violate or delay in applying as per the new rules would be permitted a 10-day grace period, post which they would have to pay a fine of AED 100 per day ($30). Nevertheless, for the next one month or 30 days, the extension would be granted from the date on which the previous entry permit expired.

Before their first extension gets over, the visitors can send a request to get a second extension for 30 days additional days.

There would be a fee of AED 600 (equivalent to $165) for the extension of entry permits, per extension. The fee does not apply to those people who are residing in the GCC and the companions of GCC citizens, and also those who have any special entry permits.

Brigadier Saeed Rakan Al Rashidi, who is the acting director-general of the Foreigners Affairs and Ports Department at the ICS said that the new visa laws would depend on particular conditions and regulations.

He said that “The widow or divorced woman and their children must have had their residency visas sponsored by the deceased or former husband at the time of death or divorce.”

He also mentioned that residency visas should compulsorily be valid during the time of divorce or death and the children’s residency period should not exceed that of the mother.

He also emphasized the point that the woman should have the financial ability to support her family.

All the applications should be submitted online and physically at Tas’heel offices and residency departments in various locations of the country.

So if you are looking for the best pro services in Dubai or residence visa services in Dubai, do get in touch with us at IMC and we would be glad to assist you.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group