- Article

- July 27, 2018

Yoga, which is an ancient practice, is practiced and followed now by millions of people all across the world. It doesn’t come as a surprise that yoga is now very popular in the UAE too and hence, this poses as an opportunity to start a new business here.

But why only yoga?

UAE is a nation that is working towards holistic development and well-being for its citizens. The UAE government has come up with a new concept – a Minister of Happiness recently and campaigns promoting healthy lifestyle are offered to encourage overall health and good quality of life. The demand for this holistic practice has been growing in the UAE and thus it also shows that there is a need to increase the supply.

But before starting any business, it’s important to be sure of what you want to do and why. A UAE-based businessman David Haddad has come up with the steps to assist you to move from an idea stage to setting up a successful business.

Seven Steps to move your idea to a great business

- Be sure of your concept/idea:

Having an idea isn’t enough. You have to be sure that there is enough demand for what you are planning to offer. For example, if you are thinking of starting a yoga studio, you will have to find out if there is the market for it and if there are customers who would want another yoga studio. What is the differentiating thing you are offering? - Confirm the solution you are offering:

So you are sure of your idea of opening a yoga studio, but how will you be sure that your solution is the best? Outline your concept; take suggestions from your well-wishers and then see where you stand.

- Think what your potential customers would want

The next step is to find ways to entice your possible customers. Think of how you can propagate about your yoga studio. Brochures, cross-promotion, social media?

- Check your skill-set:

Assess your skills now – do you have the skills to open or set up a yoga studio? You may be a good yoga instructor, but do you have entrepreneurial skills? Could you need someone else to help you plan and build a brand and set up your studio?

- Set your targets:

Make a proper plan for setting up your studio. Be it when and how you will make a website for your brand etc, your plan ahead for next few months?

- Work on setting up your business (yoga studio):

Take the steps to set up your studio. Start with finding a good location, find partners if you want or hire contractors. Build a website and make your presence felt on social media.

- Lastly, work on your quality to retain your clients:

You would have heard this one – it’s cheaper to bring a customer back than to find a new one. You can do the following to retain customers:

- Offer good Customer service

- Give loyalty programmes

- Try upselling

- Some considerate gestures

But what is the procedure to set up a yoga business in the UAE?

You could set up your company/yoga studio as a Limited Liability Company (LLC), which is one of the most popular and common types of business entity you can establish in the UAE. Choosing an LLC will allow you a larger scope to do business and also a chance in the future ahead to set up more studios or branches in Dubai, Abu Dhabi or other parts of UAE.

As per the law in the GCC region, one or more local partners should have an ownership of at least 51% of the total shares in an LLC. This means that a foreign investor cannot own more than 49% of a particular business. You could consider partnering with some professional local partnership organization or specialist.

If you are thinking of setting up a yoga center in the UAE, it is necessary to get two approvals – one from the Youth and Sports Welfare and another from the Ministry of Public Health. Make sure to choose the correct local partner to help you. So if you are thinking of company registration in Dubai, get in touch with us. Our trained and professional experts at IMC can not only help you with all the steps in setting up your yoga studio but will also advise you about the particular guidelines you need to follow so that you establish a compliant yoga studio.

- Article

- July 27, 2018

Global growth is expected to improve in 2018 backed by higher growth in emerging markets and in the United States. However, trade tensions and concerns over protectionist actions could have a negative impact on international trade and global growth. In Singapore, the economy grew by 3.6 per cent which is an increase from 2.4 per cent in the year 2016. Sectors such as electronics and transportation are expected to do well, whereas those like offshore engineering and construction are expected to face headwinds. Overall, Singapore’s economy is expected to grow by 2.5 to 3.5 per cent.

The New National Wages Council (“NWC”) has recommended a set of wage guidelines for 2018/2019. These include:

Wage Recommendation for All Workers

The NWC re-establishes the principle that the increase in the wages should be fair and sustainable after taking into account the varied business conditions, the economic outlook across sectors and firms, and the productivity growth. The firms’ business prospects should mirror the increase in built-in wages whereas variable payments should reflect the workers’ contributions and the firms’ performance.

Wage Recommendation for Low-Wage Workers

The NWS is of the belief that it is beneficial to continue to provide quantitative guidelines for low-wage workers. It also believes that the basic wage threshold should be increased from $1,200 to $1,300. Additionally, NWC also encourages companies that have achieved productivity improvements in the year 2017 to provide an additional one-off special payment of $300 to $600, in a lump sum or over several payments, to low-wage workers who earn a basic wage of up to $1,300 per month.

Low-Wage Workers in Outsourced Work

The NWC recommended that the experience and performance of the outsourced workers to be taken into account by the service buyers and service providers when employment contracts are renewed or offered. This would help in avoiding the reset of wages and benefits for such outsourced workers who performed the same job functions when service providers are changed. In addition to this, the NWC also urged the service buyers and service providers to ensure adequate training and improving the employment terms of the outsourced workers by working together.

Employment of Older Workers and Back-to-work Women

The NWC has extended the Special Employment Credit (SEC) until 2019 to support employers hiring older Singaporean workers. The employers hiring Singaporeans aged 55 and above and earning up to $4,000 per month will be provided wage offsets of up to 11%. To recruit and retain back-to-work women as a valued source of talent and manpower, the NWC also encourages the employers to implement family-friendly workplace practices and flexible work arrangements.

Application of Guidelines

The NWC guidelines cover the period from 1 July 2018 to 30 June 2019. The guidelines apply to all employees – professionals, executives, management, and rank-and-file employees. They also cover unionised and non-unionised companies in private as well as public sectors. The recommendations apply to re-employed workers as well.

The NWC noted that the employers should share company wage information, business prospects and performance with the unions to facilitate wage negotiation. It further encourages the employers to address any issues faced by them by working with the employers’ association and unions.

- Article

- July 27, 2018

Thinking of registering your enterprise, but do you worry about complying with all the legal guidelines? It’s not easy for new entrepreneurs to set up and launch their enterprise and also take care of the legal procedures concerning the incorporation of your company. We, at IMC, provide you expert services and solutions by registering your company at reasonable prices and also within a short turn-around time.

What are the steps to register a company as a Private Limited?

So the following four simple steps ensure you a flawless process for Private Limited company formation in India. Let’s see what these are

1. Applying for Digital Signature Certificate (DSC)

The first step is to get Digital Signature Certificates of all the concerned people in this private limited company. You have to first fill the complete e-form available on the MCA portal as per the process prescribed by the Ministry along with all other applications. DSC is issued in a token form, which is valid for about a couple of years.

The personnel involved in the company are Subscribers and Directors for the proposed company. The Subscriber is the promoter of the company and proposed shareholders. The said shareholders are required to file e-MOA and e-AOA by affixing DSCs whereas the proposed directors have to obtain DIN by filling an online application.

Which documents are needed for getting Digital Signature Certificate?

- Applicant’s passport size photograph

- Self-attested address proof

- Self-attested PAN card copy

2. Get a Director Identification Number

Director Identification Number or DIN is basically a unique number, which is assigned to the applicant and allotted for a lifetime by the Ministry of Corporate Affairs. This number is valid until it is either surrendered by the applicant or is withdrawn by the relevant authorities.

The new company’s directors have to intimate the DIN when they incorporate their company. Therefore, getting a DIN is obligatory to be appointed as a director of a company. This number could also be used for appointment as a Designated Partner in an LLP.

Which documents are needed for applying for a DIN?

- Applicant’s passport size photograph

- Self-attested address proof of the applicant

- Self-attested PAN card copy of the applicant

3. Reserving a name for the company

It is necessary to reserve an appropriate name for your new company before filing an application for its incorporation and registration. The application for reserving the name of your Private Limited Company is made by filling the e-Form INC – 1 along with paying the required fee. One application can have a maximum of six probable names along with its significance and in the order of your preference. The Registrar has 100% discretion in approving the name application.

The name should:

- Be easy to remember and with a simple spelling

- Provide a distinct identity to that company

- Be short and simple

- Not have any word which is opposed to public policy or is prohibited

- Not infringe any registered Trademark or should not be identical to any existing company or registered LLP

After the application is approved, the registrar reserves the finally selected name for about a 60-day period. Now, the requisite professional guides the promoters to apply for incorporation of the new company within this prescribed period of 60 days. If the company fails to do so, the reserved name would lapse and then a completely new application will have to be filled.

4. Incorporation Certificate

After the name of your company has been reserved, the next step is to apply for issuing a Certificate of Incorporation. The application for online registration needs to be done by submitting the Simplified Proforma for Incorporating Company Electronically or SPICe forms online.

MoA & AoA drafting procedure

MoA and AoA are basically charter documents needed for registering a Private Limited Company. MoA means Memorandum of Association and AoA stands for Articles of Association.

MoA lists the detailed scope of functions and operations of the company by stating the object and various activities it will perform. Whereas, the AoA details the manner in which the company’s operations and administration will be undertaken.

These documents should also be filed in SPICe forms coupled with the company formation and registration applications. The payment to MoA and AoA is made by attaching the DSCs of subscribers in the online form.

Which documents need to be attached with the application?

- NOC and a copy of the Utility Bill from the owner for the company’s registered official address;

- Rental Agreement of the new registered office along with the rent receipts, in case the office is rented;

- Consent to act as a director by filling the form DIR – 2;

- Affidavit and declaration by first director(s) and first subscriber(s) in the form INC – 9 (duly notarized);

- Self-attested identity proof of the first subscriber(s) and director(s).

- The application has to be submitted along with the prescribed government fee and stamp duty as per the state. The PAN and TN number generation application is also processed along with this application.

- Once the Registrar is satisfied, the Certificate of Incorporation is issued with his seal and signature.

So once you get a Certificate of Incorporation, you also need to getGST registration in India and then your Private Limited Company is ready to start its business activities and operations.

- Article, U.A.E

- July 26, 2018

UAE’s Federal Tax Authority (FTA) is taking steps to allow tourists visiting UAE to claim a refund of 5% Value Added Tax (VAT) they pay whilst visiting the country. The authority’s decision to implement a system that returns VAT to tourists will upgrade UAE’s status as a premier global tourist destination. The system is set to go live in the fourth quarter of 2018. It will apply on all the purchases made by tourists at “participating retailers”.

While departing from UAE, a tourist can claim all the taxes that they have paid on their purchases in the country. The process is simple, accurate, quick and moreover fully automated with no human involvement.

VAT Refund Scheme for UAE

To make it easy for tourists to claim VAT refunds before exiting the country, FTA is installing self-service kiosks in major shopping malls, hotels, and all UAE entry and exit points.

The VAT refund scheme in the UAE enables eligible tourists to receive a portion of the VAT as a refund for products purchased at registered stores. The VAT amount can be claimed through an electronic system at designated spaces without human interaction. Once you submit the required documents, the digital system determines whether the taxes are eligible for a refund. If yes, the tourist is reimbursed via cash or credit card.

Only retailers registered in the “Tax Refund for Tourists Scheme” and connected to the system can offer refunds to eligible tourists. Are you wondering how to claim a VAT refund in the UAE as a tourist? Let’s find out how travelers can get back the VAT charged on their purchases.

Requirements to claim VAT refund for Tourists

- Sales receipt has a tax refund tag attached to the back

- Purchased goods (Please visit the validation desks before checking in your luggage and present your goods to validation staff.)

- Passport

- Boarding pass

Who is eligible for VAT refunds for tourists?

To be eligible for a VAT refund scheme in the UAE, travelling tourists must belong to the following categories. Not all tourists can reclaim VAT on their purchases:

- GCC nationals

- Travelers aged 18+ who are not UAE residents

- Individuals not part of the flight crew for departures from the UAE.

FAQ’s on VAT Refund in the UAE :

1. How can tourist track their VAT refund in the UAE?

Tourists can track their VAT refund status through the Planet Shopper Portal. Once a purchase is made, a link will be sent through SMS. The link provides access to all app features.

2. What is tax-free shopping?

Tax-free shopping in the UAE allows individuals to purchase certain taxable items that will be exported, subject to specific terms and conditions. When shoppers validate their purchases at the point of exit, they can receive a refund of the VAT charged on those goods.

3. When is it possible to request a refund for the tags that have already been validated for export?

According to FTA, refunds for tags validated for export can be claimed within one year of validation.

- Article, U.A.E

- July 25, 2018

Deciding to obtain a beauty salon license in Dubai and starting your own beauty salon is a great idea. People will always be in need of beauty treatments which ensures your business will never suffer and you will generate revenue at a good pace. However, there are some basic beauty salon requirements in Dubai that an entrepreneur needs to follow for smooth set up of his / her business. Let’s look at them.

Beauty Salon Requirements in Dubai

- The planning department of Dubai Municipality must approve the location of the beauty salon.

- There must be a signboard placed in front of the beauty salon.

- The lighting used in the salon must be sufficient and the furniture used must be clean and proper.

- As far as dressing chairs are concerned, they should meet the specific size of 3.0m wide x 3.5m length and strictly must not be less than that.

- The height between the ceiling and the floor of the beauty salon must be more than 2.30m.

- There must be a separate area designated for beauty treatments like a pedicure, manicure, hair removing, and henna designing. The size of each such area must be more than 2.50m x 1.50m with a proper partition.

- There must be a wash basin near the area for facial treatments.

- Fireproof materials must be made use of for preparation area for hair removing materials.

- The beauty salon must necessarily have a water heater in place.

- There must be cupboards and drawers to keep cosmetics and towels.

Basics to Consider for Opening a Salon in Dubai

Before you decide to obtain a beauty salon license in Dubai, it is important you are clear on the basics before you make that decision.

- Type of Salon: Decide on whether you need a hair salon only or would you also be providing additional services like manicures, pedicures, hair straitening, and so on. Next, decide if you are looking to cater to a specific demographic. For example, a men’s only salon or a women’s salon.

- Salon Business Options: Consider whether you want to build your own salon from scratch or you wish to buy a hair salon franchise or buy an already functioning salon. Decide the legal structure – whether you want to own it or become a partner in the business.

- License and Permits: Make sure you have all the local permits and licenses like a basic business license, no objection certificate, and other such important certifications that are necessary for smooth conduct of your business. Be aware of the laws and regulations and it is also wise to invest in a good insurance policy that can protect your business against lawsuits.

- Finances: Estimate your preliminary costs before you begin your business and plan how to would be securing the finances for your salon’s business and its expansion at a later stage.

- Location Hunting: If you plan to run your beauty salon from your residential premises, you need permission from the Dubai Economic Development Department. If not, you can look to set up your business in an affordable location.

Get in touch with us if you are looking to set up your business in Dubai. We look forward to hearing from you.

- Article

- July 25, 2018

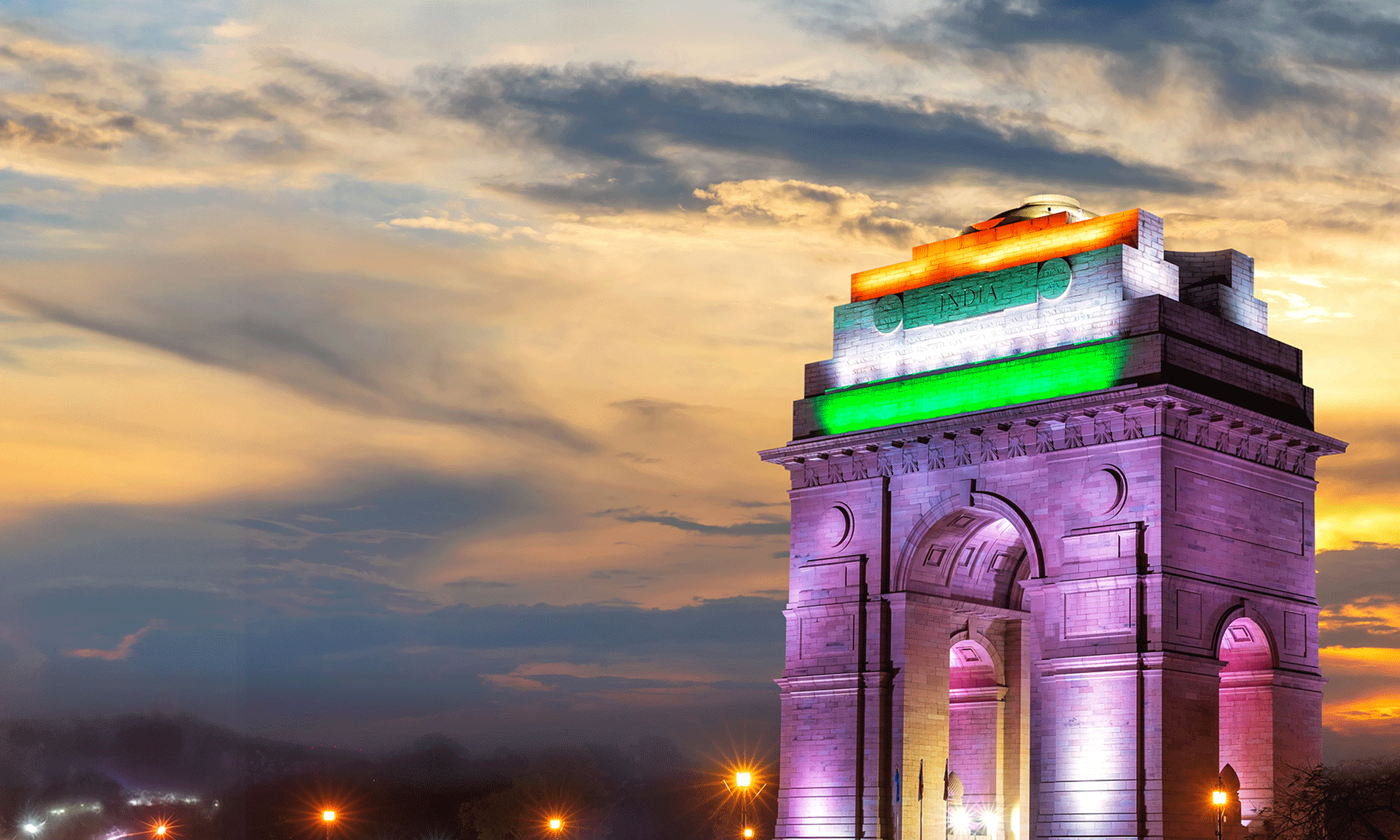

Favourable climate, wonderful coast, architectural monuments, eye-catching buildings, high standard of living makes Dubai one of the Top 10 tourism destinations in the world and attracts the business of travel agency. Especially with the announcement of World Expo 2020, there is a boost in the tourism sector.

So, let’s have a look at how as an individual or company, you can commence a travel agency in the UAE.

Steps on How to Open a Travel Agency in UAE

Obtaining a License

- Inbound Tour Operator – offers tour packages within UAE and services relating to VISA matters, even includes exhibitions and conferences.

- Outbound Tour Operator – offers tour packages and vacations outside Emirates, even includes exhibitions and conferences.

- Travel Agent – offers selling of air tickets, visa support services, accommodation to the tourist, transport services and tours.

- Article, Singapore

- July 25, 2018

- Article, U.A.E

- July 20, 2018

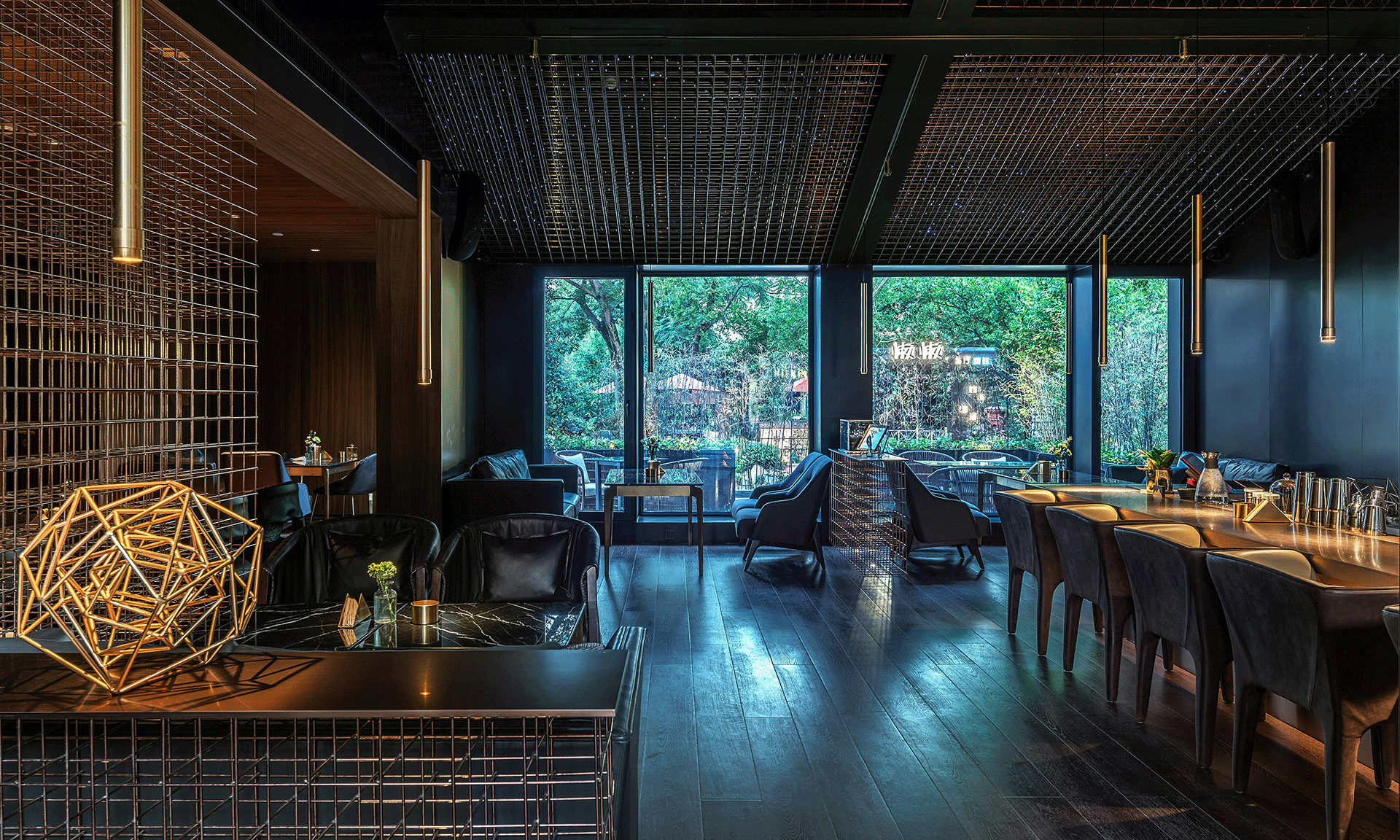

Dubai is known for being a multicultural hub providing numerous opportunities to businesses and corporations. Every year, new investors get drawn to this destination as it is one of the fastest growing economies. The Food Industry is one such business area that offers a lower gestation period and has the fastest revenue generation. As per Euro monitor international forecasts, the Food and Beverage Industry of Dubai is estimated to have 19000 more outlets by the year 2019 alone. If you are looking to obtain a restaurant license in Dubai then we have compiled all the necessary information for your perusal.

How to Open a Restaurant in Dubai?

- Follow the ‘Food Code’: To obtain a restaurant license in Dubai and set up a restaurant business, you need to follow the ‘Food Code’. The Food Code is set in place to ensure food safety and with an endeavour to guide the restaurant owner in following all the regulations required by the Food Industry. It has been designed by the Food Control Department of Dubai Municipality. The Food Code applies to the following types of food establishments in Dubai:

- Cafes and restaurants

- Bakeries

- Food factories

- Supermarkets and grocery stores

- Canteens in hospitals and schools

- Catering units

- Butcheries

- Mobile vending operations

- Food packing material manufacturers and suppliers

- Obtaining a restaurant license in Dubai: In order to set up a restaurant business in Dubai, you need a trading license from the Department of Tourism and Commerce Marketing. You need to specify the category of food establishment you want to operate in as it will be mentioned in your license.

- Approval of Construction Plans: You must get the construction plans for your food establishment approved by the Food Control Department in Dubai. The blueprints of the restaurant must mention the following necessary information:

- Space for storing food and processing

- Entry and exit passages

- Location of the food equipment which will be used in the processing of the food items

- Windows and ventilation system

- Sanitary spaces such as restrooms

- Location of the washing machines

Note:As per the rules, the restaurant must be located at least 30 meters away from waste disposal places that could result in contamination. Also, the surrounding area of at least 10 meters should be clean at all times.

- Documents Required to Obtain A Food License in Dubai: The following documents are required to be submitted by a prospective restaurant owner to the Food Safety Department in Dubai:

- In the case of the restaurant being located outside a shopping centre, the approval from the Planning Department

- The layout of the premises

- The first approval issued by the Department of Economic Development

If you are looking to obtain a special restaurant license in Dubai like liquor license then the procedure differs. Liquor license requires you to make your application with the Dubai police headquarters. You need the following documents:

- Copy of the passport

- Two photos

- Application Fees

- Food Safety Requirements in Dubai: All the restaurants operating in Dubai are required to appoint a duly qualified professional when starting its operations. Such ‘Person in Charge of Training’ would be required to undergo a special training to ensure that all the requirements of food safety are met with. Additionally, the restaurant must also obtain the following licenses:

- A vehicle permit for transporting food products

- A food consignment release license

- A pork permit for handling and serving pork

If you wish to start a business set up in Dubai free zone, get in touch with us.

- Article, U.A.E

- July 19, 2018

Foreign companies looking to open a branch in Dubai can retain full ownership over their business in Dubai by registering a branch office or a representative office. However, as per the guidelines issued by the UAE government, to open a branch in Dubai, every investor company is required to find and appoint a local service agent who is a UAE national or a company wholly owned by UAE citizens. These local sponsors assist in getting your visas, labour card, immigration cards and such other important documentation but are not involved in the working of your business. Our local agents in Dubai can assist you with foreign company registration in Dubai.

How to Open a Branch in Dubai?

- Step 1: Trade Name Reservation – The first crucial step is to appoint a local agent as mentioned above. This local agent will then first approach the Department of Economic Development (DED) and reserve a trade name for the branch office you wish to open.

- Step 2: Initial Approval by Ministry of Economy– After applying for the reservation of a trade name, the local agent will then apply for an initial approval from the Ministry of Economy (MOE) to open a branch in Dubai. For this, the following documents are needed to be submitted:

- Proof of trade name reservation

- Application forms for registration

- Registration and Licence application forms issued by the Department of Economic Development (DED)

- Memorandum of Association (MoA) of the parent company (notarized)

- Articles of Association (AoA) of the parent company (notarized)

- A power of attorney (POA) for the local director

- A copy of the passport and the naturalization book of the local service agent

- A passport copy of the director

- A no-objection letter issued by the parent company

- A copy of the Certificate of Incorporation of the parent company (notarized)

- A board resolution for opening a branch in Dubai by the foreign company’s management

Note: The MoA, AoA and the Certificate of Incorporation must be translated into Arabic and duly notarized.

- Step 3: Obtain License from Department of Economic Development – Once the initial approval has been obtained from the Ministry of Economy, the next step for the local agent is to apply for obtaining a commercial license from the Department of Economic Development. The documents needed for this include the following:

- The approval needed from the Ministry of Economy

- A statement mentioning the business activities that can be carried out, to be issued by the parent company

- Last two years’ audited financial statements of the parent company

- Copies of all the documents submitted earlier to get the initial approval from the Ministry of Economy

- A copy of the property lease agreement of the branch office in Dubai

Commercial License v/s Non-Trading Representative Office License

A foreign company may obtain a trading branch office license (commercial license) or a non-trading representative office license. The main difference between the two is that with a commercial license, the foreign entity can carry out all the commercial activities covered under the trading license and carried out by the parent company. On the other hand, in the case of a representative office in Dubai, you are not allowed to carry out any commercial activities and can only use the office and the license for marketing and promoting the products or services of the foreign parent company. Depending on your requirement, you can either set up a branch office or a representative office in Dubai. The procedure for setting up both are largely the same.

Get in touch with us if you are looking for foreign company registration in Dubai.

- Article, India

- July 17, 2018

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group