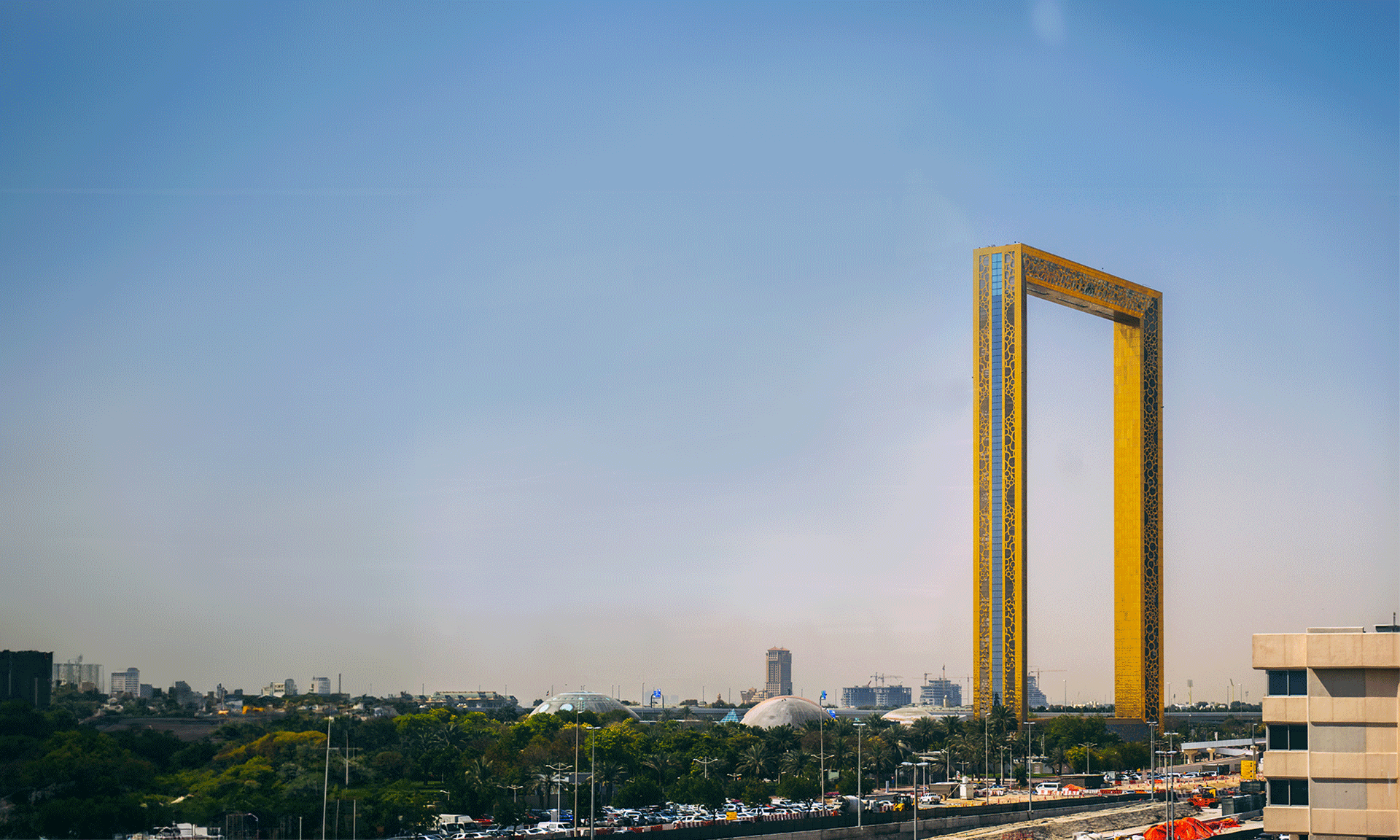

As part of the United Arab Emirates (UAE) collective effort to diversify the economies of the seven-member nation-states, Dubai’s government recently announced its plans to engage in a major company formation in Dubai project. The exact plans are to create an $870 million e-commerce friendly trade zone that will be populated with companies engaged in digital marketing and various other forms of e-commerce. This area will be located next to Dubai International Airport. It will be called Dubai CommerCity (DCC.)

Dubai’s government collaborated with business set up consultants in Dubai and two nationalized enterprises. These are the Dubai Airport Free Zone Authority (DAFZA) and a property management firm, was Asset Management Group. Covid-19 was a major catalyst in terms of accelerating this project’s movement from the drawing board to actual construction and execution.

DAFZA general director Mohammed Al Zarooni said that the world has an immediate need for world-class eCommerce services. He was of the opinion that Dubai is already experiencing a growing need for an eCommerce trade zone given its rapidly accelerating market demand. The global social distancing measures which governments around the world are currently enforcing is motivating more consumers to shop online. This is giving eCommerce a real boost. The trade zone is scheduled to be operational by the end of 2020.

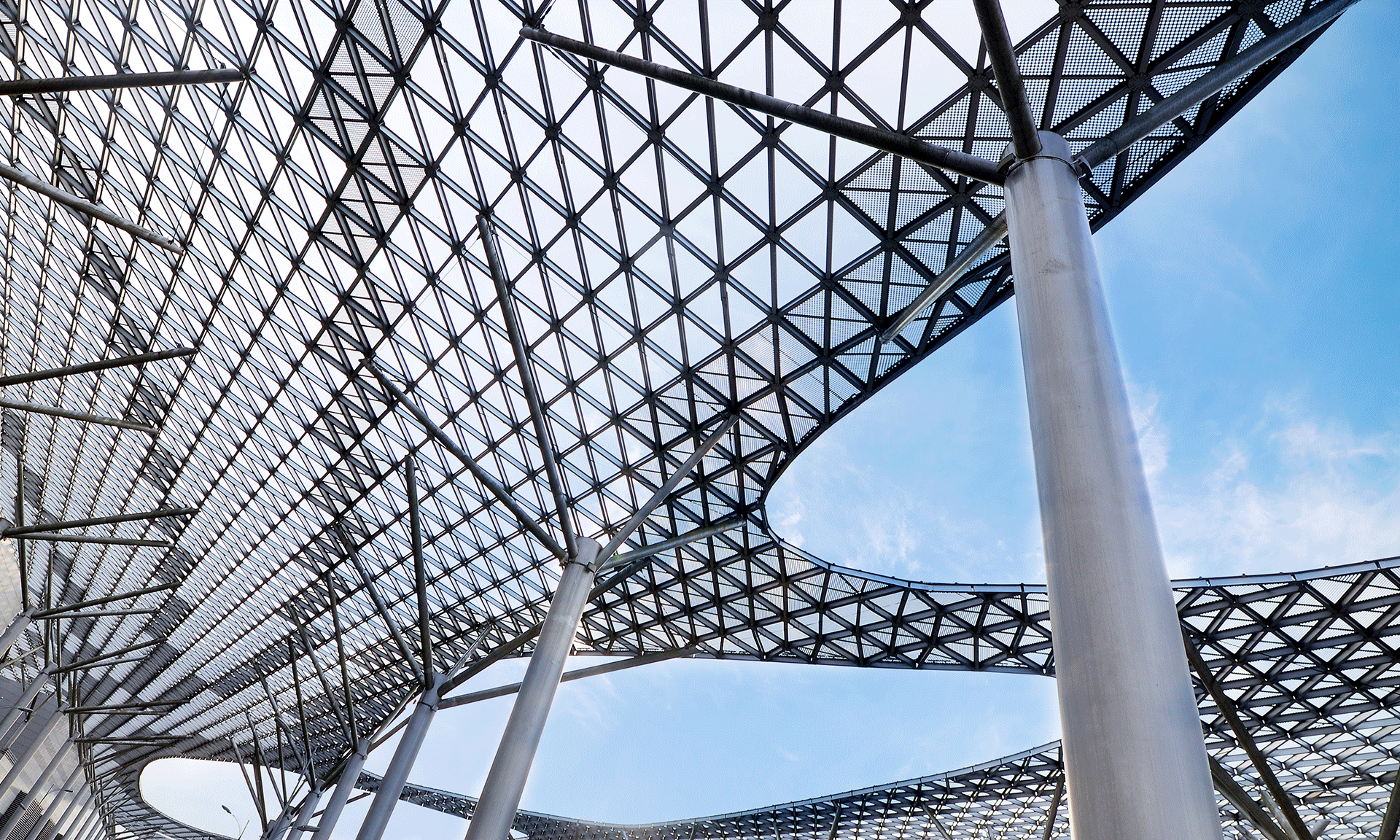

The entire zone will occupy 2.1 million square feet. It will be separated into three distinct sections: business, social, and logistics. This was according to the Global Construction Review’s report. The project is being developed by the Hong Kong P&T group.

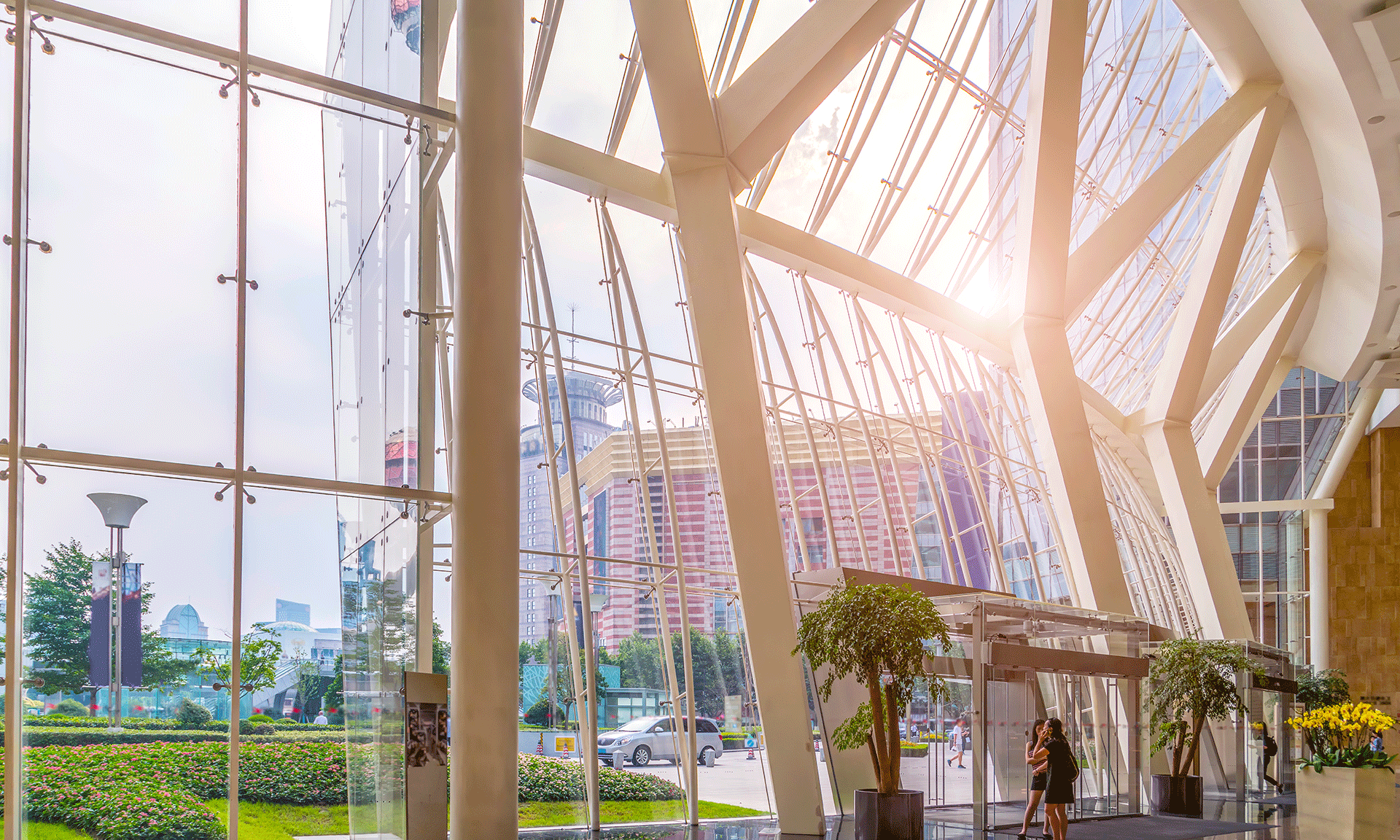

Amna Lootah, DAFZA’s assistant general-director was of the view that they are combining the latest in technologies and infrastructure to create an ecosystem where eCommerce companies can be successfully established and thrive. The main objective in terms of these companies is integration.

The DCC is the first eCommerce free zone that will actively encourage trade and business growth in the Middle East-North Africa (MENA) region. Dubai’s government is luring eCommerce merchants by completely waiving income and corporate tax requirements. These companies will also have subsidized immigration, healthcare, administration, and banking services. They will be supported by warehouses manned by artificial intelligence. Their workers can enjoy free and discounted food in surrounding restaurants and cafes. The project will be completed in a series of phases. The first of which is scheduled to begin in November. The last phase is scheduled to end in 2023.

This project is not Dubai’s first foray into the digital world. Its government actively explored and researched digital wallet technology in 2019. The objective was to find a way around the exorbitantly high government fees that were levied on businesses and consumers. The government created a proposal in 2014 which envisioned using digitization measures to transform Dubai into the ‘happiest city on Earth’. The proposal was one component of the ‘Smart Dubai Program’ which was launched in 2014. The national government is expanding access to financial and banking services for its consumers as part of an effort to finance this.

Dubai may become the next Silicon Valley

DCC is just one of many initiatives by Dubai’s government to ‘plug the city into the digital world.’ Dubai’s government and private enterprises are currently launching many projects to make this a reality. Indeed, with enough luck, Dubai may soon become the next Silicon Valley.

IMC Group

IMC Group