According to the Monetary Authority of Singapore (MAS), the assets under management in Singapore have seen a substantial increase over the decade from 2012 to 2021, reaching SGD 5.4 trillion. This marks a three-fold growth from SGD 1.6 trillion in 2021 and recorded a 16% increase in assets in the 2021 itself.

Most of this growth came from outside of Singapore, of which about one-third really is from Asia-Pacific countries. Singapore’s reputations as are stable and well-regulated financial centre has earned it the nickname “Switzerland of the East”. The country’s favourable business environment and its position as a hub for wealth management have made it an attractive destination for investors around the world.

In early 2020, the Monetary Authority of Singapore (MAS) introduced the Variable Capital Company framework, which was designed to attract investment funds, including Single Family Offices. This piece of legislation has proved to be a crucial step towards enhancing the investment landscape in the country.

What is a Single Family Office?

A Single Family Office (SFO) is a private company that provides comprehensive wealth management services for a single wealthy family. It offers a wide range of services, including investment management, estate planning, tax planning, financial planning, asset protection, philanthropy, and family governance.

How to set up single family office in Singapore?

What are some things that you might need to consider before setting up a Single Family Office?

As the world’s second-largest group of billionaires resides in Mainland China, the high-net-worth (HNW) and ultra-high-net-worth (UHNW) sector in Asia has grown by 7.9% despite the Covid-19 pandemic. This growth has presented new challenges for HNWI`s and UHNWI`s in terms of wealth management, estate planning, succession, budgeting, and philanthropy.

Traditional fund management may not be equipped to handle the complex and diverse financial portfolios of HNWI`s and UHNWI`s while meeting their needs. This is where the concept of a Single Family Office comes in as a new solution for wealth management for these individuals.

What attracts ambitious entrepreneurs to set up a Customized Single Family Office solutions in Singapore?

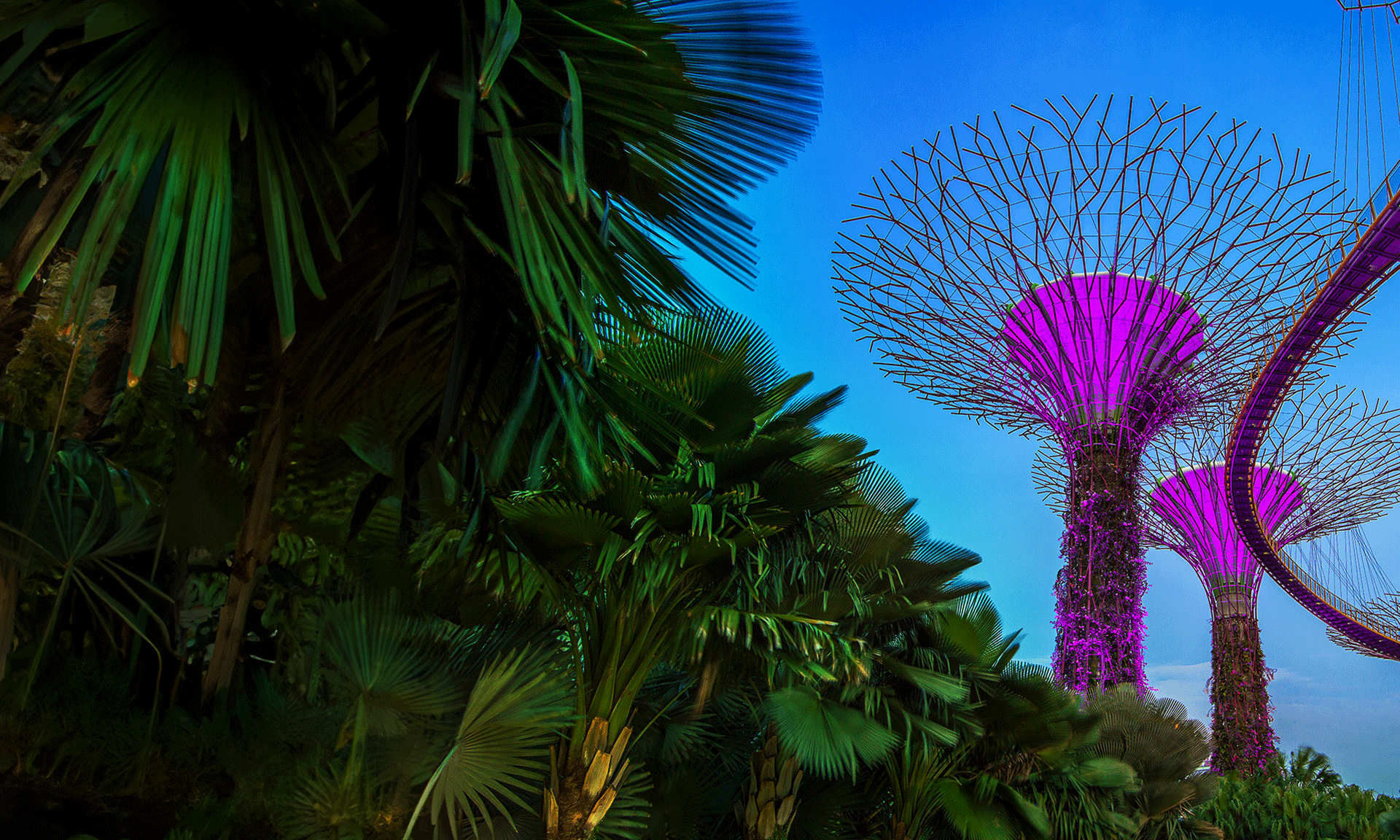

Making it an attractive destination for both local and foreign investors, in addition to its favourable business environment, Singapore is known for its high standard of living, excellent healthcare system, and top-notch educational institutions. The city-state has a multicultural population, making it a melting pot of different cultures, traditions, and cuisines. This contributes to a rich and diverse cultural experience for its residents and visitors.

Furthermore, the government of Singapore has made significant investments in infrastructure and technology, which has helped to make it one of the most technologically advanced countries in the world. This has led to the growth of numerous high-tech industries such as IT, biotechnology, and engineering.

What are your Goals for setting up a Single Family Office?

The objective of setting up a Single family office should always be defined and clear, but the primary goal would be is to secure the wealth and legacy of future generations. To achieve this, it requires a comprehensive wealth management strategy that takes into account not just the immediate future but also long-term planning.

Overall, an increasing number of Single Family Offices in Singapore are taking advantage of Singapore’s favourable laws and regulations in setting up their Entity, to build a legacy that goes beyond not just financial growth but accumulation of wealth.

IMC is the trusted Single Family Office advisor and supports services that are available to assist with setting up a strategic office in Singapore. The company’s wealth management services can help you in providing tailored investment management, estate planning, trust and fiduciary services, tax planning, financial planning, asset protection, and philanthropy, all aimed at ensuring the continued prosperity of your family.

Our family governance experts can also assist you in creating a vision and mission statement for your family office, one that outlines your goals and aspirations, whether it’s in finance, technology, property, or environmental protection.

IMC Group

IMC Group