The private equity sector has weathered unprecedented headwinds over the last year, as evident from reports and market trends. In this post, let’s explore the challenges and triumphs of the private equity sector. A global economic slowdown and rising interest rates have overshadowed traditional avenues. This calls for a re-evaluation of strategies to look out for further resilience in the investment market.

Insights from a research reveal a promising future for the private equity market. By the fiscal-year 2028, the overall assets under management are likely to surge to 8.5 trillion. This is likely to be driven by a compound annualized growth rate of 10%. With this trend, a larger number of individuals will be seeking professional assistance from private client and family advisory service providers.

A surge in the participation of affluent families and individuals is one of the predicted reason this expected growth. With family offices participating in equity investments in large numbers, the focus shifts to the investment landscape and alternative investments.

Shift Towards Retail-Friendly Platforms

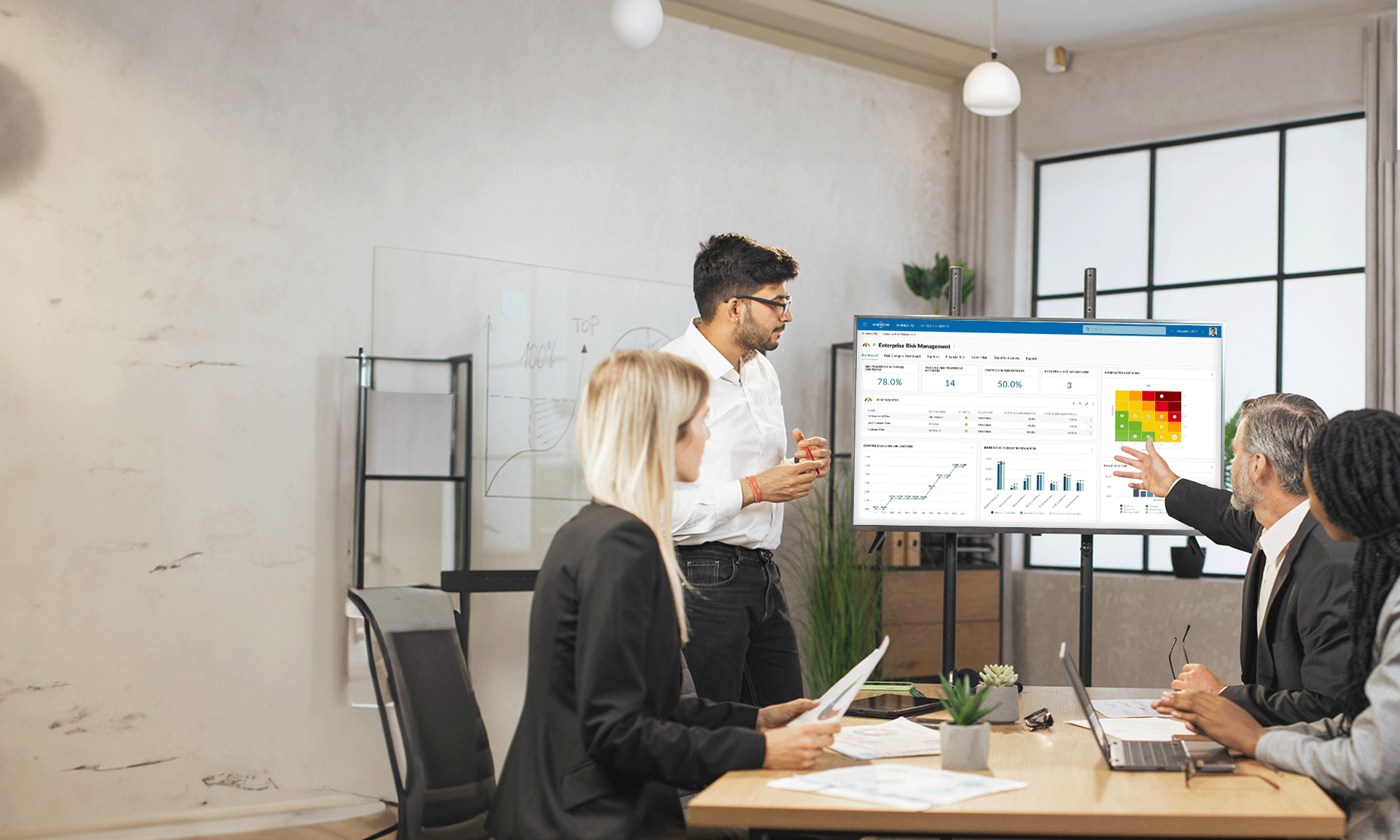

According to research, despite a challenging start to the year with a negative 4.5% one-year net internal rate of return, private equity remains resilient. Industry leaders have recognized an inflection point and have been successful in embracing private wealth as a crucial source to raise capital.

The shift towards retail-friendly platforms has been a crucial trend in recent years. Top platforms have lower minimum investments that start from $25,000. Thus, these platforms ensure access to exclusive opportunities that were reserved for institutional investors traditionally.

With the investment landscape evolving, wealth managers are re-evaluating their recommended allocations. Top wealth management companies are largely recommending alternative investments to wealthy clients. Another survey revealed that for the wealthiest families, private equity holdings have soared to 26% of their portfolio assets. As much as 41% expressed their intentions to expand their private equity exposure in the following year.

Experts have rightly pointed out that private equity looks lucrative, since investors can access promising companies in the early phase of their lifecycles. Thus, they can perform better than historical records. This explains why such companies appeal to hungry investors.

The forecast reveals that although returns have been lower in recent years, there’s a divergence between managers. This explains the importance of exploring economic headwinds adeptly. Successful managers will look forward to driving operational improvements, setting themselves apart from the ones heavily reliant on favorable conditions for financing.

How The Private Equity Market Stands In The Coming Years?

A resurgence awaits the private equity market in the coming years. Experts identified two key factors in this regard: stabilizing rising interest rates and a shift in the exit environment. The recent slowing down of global economies will make leading markets look more promising, leading to smoother closures of deals in the coming years.

The resilience of private equity is worth noting, considering the lucrative returns that the market holds for investors. Wealthy individuals and single family office in Dubai need to embrace these opportunities. With adapting strategies to explore market dynamics, the IMC Group remains at the forefront of shaping a prosperous future of its esteemed clients.

IMC Group

IMC Group