For ambitious small and medium enterprises (SMEs), growth comes with its fair share of complexities. As headcounts expand, managing payroll and HR in-house can become an unwieldy burden that drains resources better spent on core business priorities.

Yet many SME leaders hesitate to outsource these functions, fearing loss of control or lacking awareness of the value proposition. Join us as we explore how modern payroll outsourcing solutions have evolved into an indispensable growth strategy for forward-thinking SMEs.

The Old Model vs. Today’s Solutions

Traditionally, payroll outsourcing meant handing off the workload to an external provider and losing visibility into the process. But thanks to cloud computing, today’s solutions offer far greater transparency, control and configuration options.

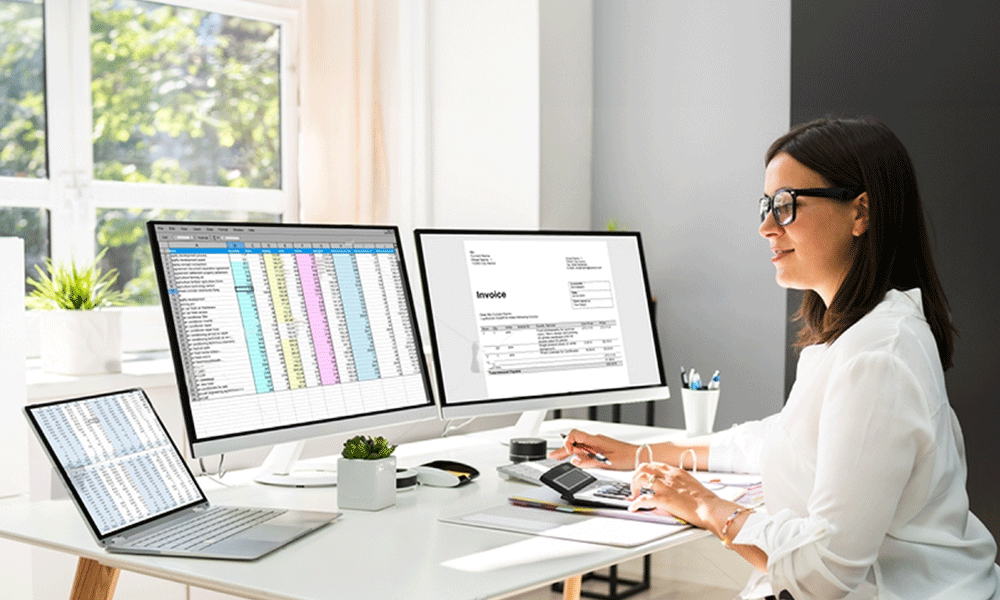

Rather than installing on-premise software and servers, cloud-based payroll systems allow access from anywhere via intuitive web and mobile interfaces. This gives SMEs real-time visibility into payroll data and flexibility to tailor the system to their needs.

Integration with other business software is seamless, enabling easy data sharing across finance, HR and other functions. The combination of cloud platforms and managed service providers creates a new paradigm for payroll outsourcing.

Saving Time and Money

For growing SMEs, time is a precious resource and cash flow must be optimised. Outsourced payroll solutions deliver compelling advantages here.

Streamlining manual tasks, reducing errors, providing self-service options for employees and automating compliance allow SME leaders and finance teams to focus on higher-value priorities rather than administrative burdens.

The economies of scale leveraged by outsourcing partners keep costs variable and scalable rather than saddling SMEs with expensive legacy systems requiring significant IT investment and maintenance.

These advantages have made outsourced payroll solutions highly cost-effective even for smaller SMEs while generating major efficiency gains.

Access to Expertise

Navigating ever-evolving payroll laws, tax codes and HR regulations poses challenges for in-house SME teams, exposing them to compliance risks. But for outsourcing partners, this is their sole focus.

Their teams have specialised expertise and experience optimising payroll workflows and staying compliant as requirements change. This reduces liability while ensuring accuracy.

Strategic providers also offer guidance on minimising tax exposure, enhancing benefits packages to attract talent and developing competitive compensation strategies. Their insights strengthen SMEs’ human capital management.

Rethinking Control

With the right provider, outsourced payroll enhances rather than minimises SME oversight. Web and mobile access offers real-time visibility into payroll data, processing status and compliance documentation.

Configurable dashboards, self-service reporting and transparency into provider workflows reinforce control while eliminating manual monitoring. And integration with complementary business software centralises data for a holistic view across HR, finance and operations.

The New Solution for Growth

As SMEs evolve from startups to scale-ups, managing payroll in-house ceases to be viable. But modern outsourced solutions flip the script on traditional models to empower fast-growing companies. By partnering with specialists like IMC Group, SMEs can leverage tailored solutions that relieve administrative burdens, provide valuable expertise, drive efficiencies and support the flexibility needed to scale successfully. By leveraging IMC Group’s expertise in maximizing profits through outsourcing for small businesses, SMEs can implement customized outsourcing strategies to enhance productivity and cash flow. This provides the fuel for profitability and strategic growth.

IMC Group

IMC Group