- NEWSLETTER, INDIA

- December 7, 2022

The India-Australia Economic Cooperation and Trade Agreement (ECTA) will kick off on December 29, 2022, after nine months the two sides signed a deal and will almost double the bilateral commerce to USD 45-50 billion over the next five years.

This ECTA is a win-win partnership agreement and besides, promoting bilateral relations between the two countries will attract many Australian businesses for company formation in India.

“The (Anthony) Albanese government welcomes confirmation today that the Indian Government has completed its domestic requirements to enable implementation of the Australia-India Economic Cooperation and Trade Agreement (ECTA),” Australian Minister for Trade and Tourism Don Farrell noted in a statement on Wednesday, November 30, 2022.

“This trade agreement will deliver new market access opportunities for Australian businesses and consumers from 29 December 2022,” the official statement added.

The pact, which was first agreed upon on April 2, 2022, would result in duty-free access to Indian exporters of more than 6,000 broad categories of products, primarily from the labor-intensive sectors including textiles and apparel, leather and footwear, furniture, sports goods, jewelry, many engineering products and machinery in the Australian market.

These labor-intensive sectors stand to gain immensely and also include a few agricultural and fish products and electrical goods.

Under the ECTA, Australia will provide zero-duty access to India for about 96.4% of exports, in value terms, from the first day covering several products that attract 4-5% of customs duty in Australia presently.

The Indian goods exported to Australia were valued at USD 8.3 billion and goods imported from Australia were USD 16.75 billion in 2021-22.

Once the ECTA was approved by the Australian parliament, Union Minister of Commerce and Industry Piyush Goyal said that the initial size of bilateral trade between India-Australia can reach a whooping figure, almost USD 45-50 billion in the next 5-6 years.

In a press briefing, Goyal highlighted, “Initial size of bilateral trade between India-Australia Economic Cooperation Trade Agreement (IndAus ECTA) can go up to around USD 45-50 billion in the next 5-6 years.”

Piyush Goyal noted, “It is a landmark moment for Australia and India, would like to congratulate the PMs of India and Australia for achieving this significant milestone today. These are 2 democracies with shared interests on the world stage.”

During the conference, Goyal confirmed that this is the first time in “Australian history” that the country is providing duty-free import on 100% of items. He also said that this is the first Trade Pact with a developed nation after a decade.

Referring to the relationship enjoyed between Indian Prime Minister Narendra Modi and the Australian government, Goyal termed it a “strong bond” and emphasized that this ECTA is a big recognition for India and its growing status and capabilities that the businesses offer to the world both in goods and services.

“The textile sector will benefit. Gem and jewelry sector are also excited as they will be able to sell their high-value jewelry in Australia,” the minister highlighted.

“The wine industry has welcomed this trade. The Indian wine industry will grow. The Indian wine industry would be able to export Indian wine to Australia,” he noted.

He also said that with the India-Australia ECTA now in place, the pharmaceutical industry will also be promoted as medicines have already undergone a stringent and rigorous approval process from the USA. The UK will also have a fast-track mechanism to get regulatory approval in Australia.

This trade agreement will deepen the economic ties between the two countries and provide Indian market access opportunities for Australian businesses and how to register private limited companies in India.

- NEWSLETTER, GLOBAL

- December 7, 2022

One of the most crucial aspects of any SME is finance and accounting which need to be streamlined and meticulously organized for sustainable growth. Contrary to the belief that this is something to be handled at the financial year-end, finance and accounting should be a continuous and year-long operation and must be carried out with much expertise and accuracy.

While some SMEs choose to have their finance and accounting operation in-house, this often becomes difficult due to frequent regulatory changes and revisions in compliance policies, new accounting rules, and financial regulations, and last but not the least, increased operating costs for internal accounting teams due to recruitment and training cost, employee salaries, taxes, incentives, and bonuses. Higher operating costs, in most instances, put SMEs in a tighter spot because of their limited budgets and monetary resources.

Surveys reveal that outsourced accounting services are an industry trend and one of the most popularly outsourced functions for SMEs. Businesses benefit a lot from outsourced finance and accounting services due to lower operating costs, improved accuracy and effectiveness of finance and accounting data, better financial decision making, and zero regulatory non-compliance. It is projected that over the next 4-5 years, the market for finance and accounting outsourcing globally would grow to USD 53.4 billion at a CAGR of 5.9%.

Today new age digital technologies have significantly eliminated most of the manual accounting tasks and made finance and accounting processes more simplified and automated. When outsourced, SMEs can have access to such technologies at a lower cost than arranging infrastructure and resources internally for the needed technological tools. Most of the IT services are outsourced by banking and financial institutions and toward upgrading and automating finance and accounting functions.

Outsourced accounting and finance can result in huge monetary savings for SMEs besides saving time, reducing financial paperwork, and better utilization of human capital. The top benefits of outsourcing accounting services are detailed below.

Reduced Cost

When reputed and professional services are hired; recruitment, training and operating expenses, employee benefit expenses, maintenance, infrastructure costs, and other overheads are significantly lowered. Such outsourced services are scalable, and the cost of services can be optimized based on needs.

Enhanced Reputation and Goodwill

Accurate and transparent financial statements prepared by independent and qualified professionals as CPAs and complying with regulatory authorities enhance investors’ confidence and promote the credibility of SMEs.

Improved Cash Flow

Timely and proper accounting and readily available financial statements help optimize the accounts payables and receivables, the cash flow cycles and improve cash management and sustainability of a business.

Improved Tax Management

Managing tax often poses difficulties for many SMEs. Outsourced services are seasoned and expert tax professionals who help reduce tax liability, improve profits and eliminate penalties with their tax knowledge and sector-specific tax awareness.

Improved Management Decisions

Outsourced services provide and maintain accurate books of accounts continuously and help SMEs with visual data on financial trends and problem areas for timely and improved management decisions. Areas of cost escalations and cost reduction opportunities are easily identified, and quick actions are initiated.

Easier Fund Raising

Outsourced service providers make financial statements transparent and simple to attract potential investors as the investors can clearly understand all the risks and opportunities involved in the business.

Easier Access to Technology

Outsourced services by their knowledge and expertise can easily identify the technological requirements of SMEs and provide customized accounting software for simplifying and automating accounting and bookkeeping processes. Cloud-based software available with the outsourced services is upgraded at no extra cost and can speed up financial transactions saving money for SMEs.

Reduced Accounting Errors

Outsourced experts and experienced services with ready access to technology and regulatory requirements, can ensure error-free accounting quickly eliminating monetary sanctions.

Improved Payroll

Automated and seamless payroll procedures help HR focus on core functions improving value for the company. Timely payment makes employees happy and more productive.

Improved Security

Outsourced services use the latest software and carry out frequent audits of the accounts of SMEs ensuring no data breaches and financial fraud. The finance and accounting functions are on continuous supervision of outsourced services.

The Takeaway

Cash is the oxygen for a business and no company, even a profitable one, cannot survive without cash. The top reason why outsource accounting and finance are to manage and optimize cash flows and ensure the sustainability of an SME. The outsourced services also help generate cash through effective cost management and cost reduction initiatives.

- NEWSLETTER, GLOBAL

- December 7, 2022

Today, our world has become borderless, the time zones have become inconsequential, and businesses are increasingly dependent on the movement of employees around the world for their global expansion.

The importance of employee mobility has heightened for many businesses, especially after the Covid 19 pandemic and both employers and employees are increasingly looking for a dynamic workplace.

International employee and talent mobility plays an important role in any successful international business today however, that brings with it a plethora of challenges, risks, and opportunities. For availing the opportunities presented, businesses must possess the right knowledge and advice for mitigating the risks and challenges they encounter and effectively managing employee and talent transfers.

Global mobility service providers can help businesses build, manage, control, and support globally distributed employees and talents through their unique and enhanced service offerings bringing ease and flexibility to employee workplaces, their payment system, and many more.

Many companies across the globe are now engaging global employee mobility service providers to employ a whooping number of employees around different parts of the world to remain competitive both in their hiring process and business.

As flexibility is becoming the topmost important for employees, global employee mobility service providers are constantly endeavoring to make things easier for employees with comfortable living, working, and payment systems. Global Mobility Services also help establish global mobility strategy and programs for businesses and streamline international relocations to hire global talent.

Global Mobility Services have its own experienced and professional teams and can support its clients with immigration guidance and verification of eligibility before employment and relocation including many other supports like payroll in local currencies, taxation, compliance, local benefits, etc.

When it comes to immigration, Global Mobility Services help their clients easily navigate complex governmental regulations and immigration laws for quick relocation of employees. They also help in managing employee work permits & visas, cross-border support, documentation, and legalization services. They even help track employee work permits and visa expiry and renewal.

Under the services of payments, compensation, and rewards, Global Mobility Services provides global payroll solutions, and manages payments and reward reporting through an integrated, end-to-end process ensuring error-free global reporting and local compliance at an affordable and optimum cost. They also support their clients in global compensation management, social security, and pensions including review of remuneration packages, payroll preparation and reporting, and year-end employee tax compliance.

While global employee mobility can have considerable benefits for a business, it also comes with its fair share of challenges including complex visa processes, high expenses of moving employees and shipping costs of household possessions, different rules for employee wages and benefits across different countries, family assistance like schooling and lastly different compliance requirements with labor, tax, and payroll laws in different countries. Global Mobility Services help its clients in successfully addressing these challenges and support global employee relocation and retention of world-class talent. The clients can opt for an end-to-end global mobility solution that enables seamless global hiring and mobility for legal employees.

Gone are those days of allocating costly resources to lengthy and complex setups for facilitating relocation during global hiring. Global Mobility Services has never been so supportive and indispensable.

- Newsletter, Singapore

- December 6, 2022

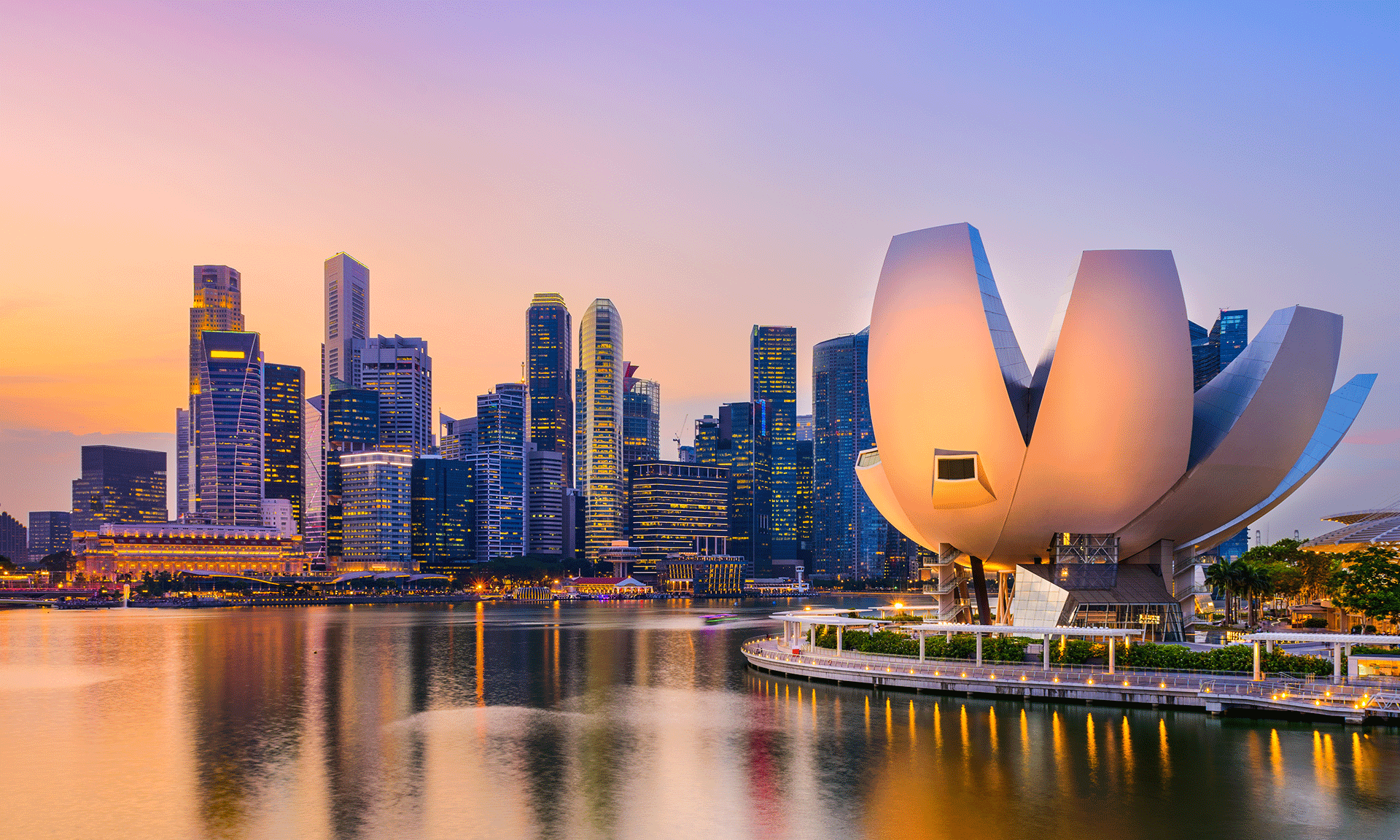

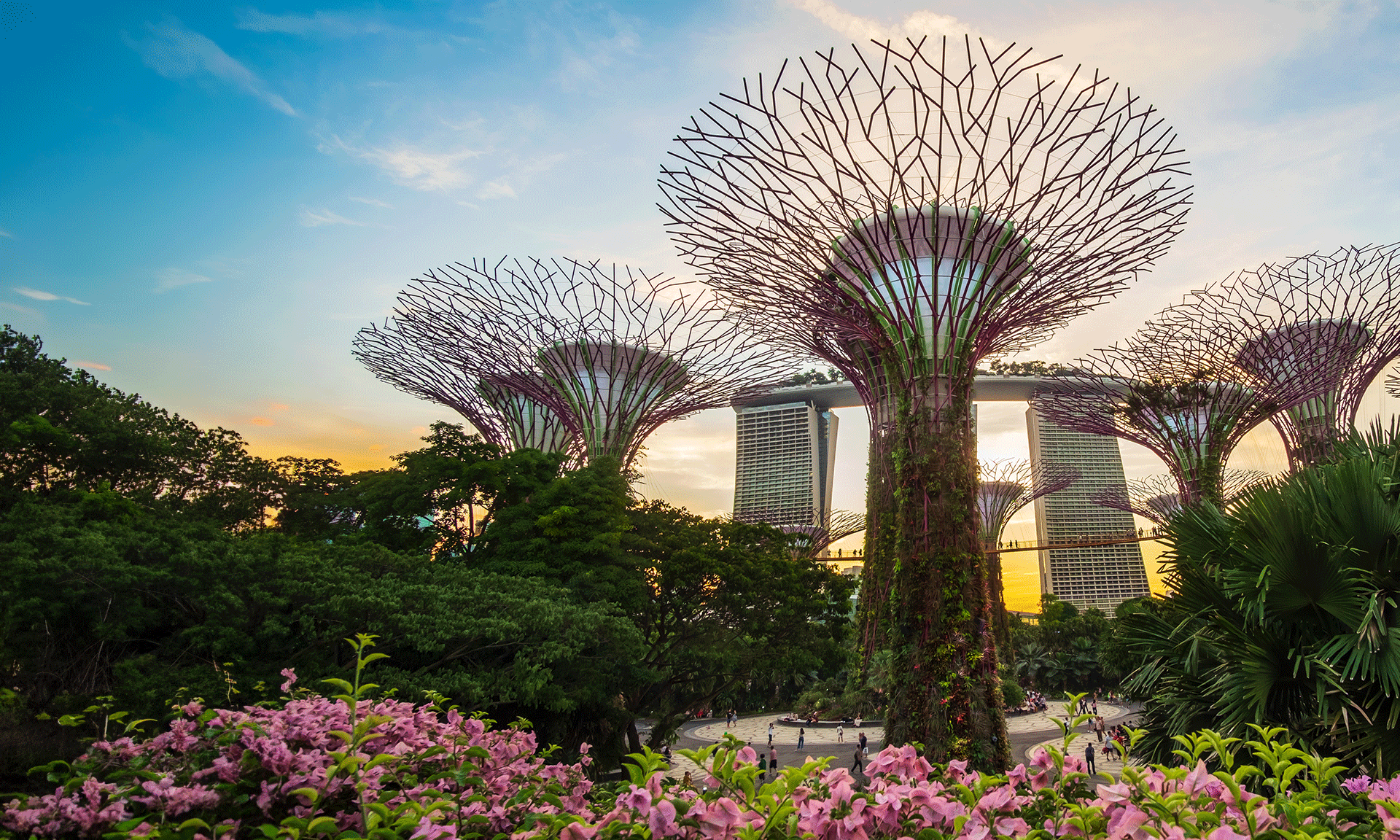

Singapore is the dream destination for investors, entrepreneurs, and expatriates alike including all businesses looking for Singapore company incorporation to expand into Asia. Companies prefer Singapore for their businesses as it has grown and developed into a financial hub, conducive for trade having world-class infrastructure, and a stable, transparent, and progressive legal and regulatory framework.

The government’s policies, for long, have positioned this city-state as a business-friendly and open-to-trade nation, attracting foreign direct investment inflows and welcoming overseas businesses to set up shop on its shores following a simple and transparent Singapore company registration process.

Many multinational corporations are already establishing their presence in Singapore, which is the fourth largest financial center globally, home to the biggest foreign exchange in Asia-Pacific, and often known as the financial capital of the South Asian region.

There has been a continuous and consistent inflow of foreign investments in Singapore from different parts of the world and especially from China. The country has a geostrategic location as the heart of the ASEAN free trade bloc enjoying free trade agreements with both China and India.

Many Chinese investors in Singapore are aggressively pursuing businesses in digital economies and are poised to build Singapore up as an Asian nodal point in new technology. Huge Chinese investments are flowing into Singapore and in tech-based ventures including AI, Crypto & Blockchain, Fintech, etc. These Chinese-backed tech ventures are also bringing in huge monetary rewards to Chinese investors at the time of IPOs.

Chinese belt and road initiatives are playing an important role in attracting FDI inflow into Singapore as they include plans to connect Singapore to many ASEAN nations and develop several free trade zones on outlying islands. Singapore is thus all set to play a leading and competitive role in FDI inflow into the South Asian region.

Singapore is a member of both ASEAN and Regional Comprehensive Economic Partnership (RCEP) agreements and witnessing significant investments in manufacturing and digitization, infrastructure, and technology including digital financial services, digital payment token services for crypto exchange, developing autonomous driving platforms, and technology with connected smart transportation services.

Cybersecurity, robotics, cloud technology, digital industrial platform development, industrial metaverse, data center development as digital infrastructure, and cross-border connectivity are also areas attracting huge foreign investments in Singapore.

Singapore’s GDP forecast for the H2 of 2022 is up 4.8% year-on-year, after growth of four percent in H1 of 2022. The nation registered a GDP growth of 7.6 percent in 2021 when the economy bounced from the impact of the COVID-19 pandemic. Singapore witnessed growth in manufacturing output by 13.8% year on year in May 2022. The World Bank ranks Singapore as a high-income economy with a gross national income of USD 72,794 per capita in 2021.

There is no surprise that Singapore’s political stability, openness to global investment, and economic strength make it an ideal destination for investors including foreign business owners seeking to invest in Singapore. It is evident from the fact that the majority of the assets under management (AUM) in Singapore originate overseas.

The most alluring for foreign investors is the quality of life the city-state offers and the most relieving is the presence of professional Business Consulting firms who can guide how to setup a local company in Singapore in the quickest possible time.

- NEWSLETTER,U.A.E

- December 6, 2022

UAE Economic Substance Regulations were rolled out by the UAE in April 2019 and amended afterward by Cabinet Resolution, 57 of 2020, and Ministerial Decision, 100 of 2020.

ESR is a comparatively new regulation and requires several reports for virtually all UAE private companies. Though it is a new regulation, the Ministry of Finance (MoF) has remained strongly committed to its effective implementation and started imposing hefty penalties on companies not complying with the ESR.

Tests specified in Article 6 for the Economic Substance in UAE are used to determine the monetary penalty by the MoF in case the companies fail to demonstrate the following.

- The core income-generating activity is conducted within the UAE

- The relevant activity is directed and managed in the UAE, and

- There are adequate assets and employees engaged within the UAE

The most specific about ESR’s deliberation is that the relevant activity is “directed and managed” in the UAE to be exhibited by the business entity.

A relevant activity to be “directed and managed” in the UAE, there must be an adequate number of meetings to be convened and attended in the UAE by the board of directors physically.

There is no specific mention of the number of board meetings that would make it adequate and satisfy the “directed and managed” condition except that the adequate number of meetings will be determined by the nature of the relevant activity being carried out in UAE and the amount of income generated from the relevant activity of the company.

Mere convening board meetings for the sake of fulfilling the requirement of the ESR test may not be sufficient to satisfy and convince the MoF that the relevant activity, conducted by an entity, is being directed and managed in the UAE and may attract more severe penalties.

To remain compliant with the ESR and avoid penalties, companies in the UAE must carry out their businesses in the UAE only. As UAE becomes an international financial hub, the regulation is only expected to intensify in the future with increased supervision from the MoF.

- NEWSLETTER,U.A.E

- December 6, 2022

The UAE Government, on October 10, 2022, issued Decree Law No. 37 on Family Businesses and published it in the official gazette. The New Law shall come into force on January 10, 2023, three months from the date of publication.

The issuance of this new legislation has been seen as a much-welcome move from the government reiterating the nation’s commitment to supporting family organizations and businesses. The new law recognizes the vital role of family businesses and offices in the sustainable development of the UAE economy besides being the most significant contributor to employment generation in the UAE

Objectives of the New Decree Law

This Decree-Law is being enforced to establish a comprehensive legal framework to regulate the ownership and governance of family businesses, make the legal framework accessible to all family businesses and facilitate their success across generations, ensure family business continuity, promote the role of the private sector in the growth of the national economy and community contribution, stipulate measures to resolve family business-related disputes through committees in the local courts and enhance the contribution of family businesses to the economic competitiveness of the emirates.

The New Decree Law also focuses on establishing best practices for a succession of family businesses, in terms of ownership and control, over future generations. The New Law also provides an increased level of support for family businesses from the state machinery.

Key Features of the New Decree Law

- Stipulated the requirement of maintaining a unified register by the government for all family businesses

- Stipulated eligibility requirements for the application of registration on the register for the family office in UAE

- Stipulated applicability of the new law for all companies established under the Federal Companies Law or applicable legislation in the Freezone, excluding public joint stock companies and general partnership companies

- Introduced two separate categories of shares with voting rights and profit participation rights as agreed between family members

- Established regulation requirements on share transfer between members of the same family and between others from outside the family

- Provided measures to prevent existing shareholders from selling their stakes to outsiders

- Introduced a family charter under the new law to enable family members to agree on important issues including profit-sharing methods and requisite education, training, and qualification requirements of family members

- Encouraged and outlined various tools for family office structures and governance including family council, family assembly, and family constitution to help family businesses thrive

- Stipulated the establishment of a committee in each Emirate called the “Committee for the Resolution of Family Business Disputes” by a decision of the Minister of Justice or the head of the local judicial authority

- Specified the composition and the procedure for the settlement of disputes of family businesses, chaired by a judge and assisted by two experienced and competent persons in the legal, financial, and family business management fields

- Regulated insolvency and bankruptcy of family member shareholders

What HR procedures do I contract out?

The New Law is seen as a positive development in terms of family office regulations in the UAE as it includes issues not previously addressed. The new law may not be the panacea for all issues related to family businesses and offices however, it does address the majority of the issues and associated challenges under the existing legislative framework that was previously addressed inadequately on the objective of ensuring the continuity of family businesses and offices in the UAE.

- Article, Global

- November 24, 2022

So, in order to assist you in your global expansion efforts, you have chosen to work with a global PEO (Professional Employer Organization). That’s a great initial step but roll up your sleeves because the journey ahead is not as easy as this step. Now you should concentrate on getting the PEO Partner, which is best suitable for you, which should be a trustworthy partner who will strengthen your company’s reputation.

Selecting the correct PEOs plays an important role when it comes to streamlining your expansion in new areas. If you are successful in this step, then you’ll be able to lower employee turnover, significantly decrease costs, quickly expand your organization, and most importantly will be able to carry on your business without any interruptions.

Then comes the question of choosing which PEO will supplement your growth, as there are so many?

This is where we can come for your assistance in finding the best PEO in Dubai. We have enumerated 5 questions that one must ask himself before making the move on selecting the best PEO Services in Dubai. So without any further ado, let’s begin!

What kind of support do they provide, first?

- Will your PEO be there for you if you need assistance with an HR issue?

- Do you need to reach out to a call centre or can the PEO company send someone to meet you in person? Will your organization’s needs be met by the same committed team, or for each time when there is a new problem, you deal with a different person?

- What HR or business processes can they handle?

Payroll management, providing employee benefits, assisting clients with compliance, and managing routine HR tasks like onboarding paperwork are all core PEO services. Some PEOs, however, take on additional tasks.

You can locate a PEO that provides services in a variety of areas, from hiring and employee training to workplace safety and performance evaluations, if you require them. Consider the advantages and disadvantages of hiring internally versus outsourcing before committing to these extra services.

What HR procedures do I contract out?

It can be challenging to remember which tasks your internal HR team should take care of and which ones you should delegate to a PEO when you divide your HR duties among them. Is it the PEO’s responsibility to ensure that employees register on time for benefits, for instance, or do you have to take care of that yourself?

To determine how many internal HR employees you’ll need to manage the remainder, ask the PEO precisely what services they provide.

What software do they use for payroll?

Payroll Services in Dubai and other HR technology should be offered by your PEO. One advantage is that you will have access to the most recent technology.

It’s important to consider whether you and your HR team will feel comfortable learning and using this technology because you and they will need to use it frequently. Do they provide a comparable service? To make sure the technology is suitable for your team before enrolling, ask if you can test it out first.

Don’t wait until you’re already bound by a contract before you realise you might be working for the wrong company. You can find the best partner for your workforce by inquiring the aforementioned five questions of prospective PEOs beforehand.

Conclusion

In addition to being expensive, running a business frequently requires spending too much time on time-consuming tasks. Because of this, an increasing number of companies are using PEOs (Professional Employer Organizations) to outsource tasks like payroll, risk management, and HR (human resources) for Global Mobility Services. But if you don’t ask the right question, it can be difficult to find the right PEO. Contact us right away if you have any questions; we have all the answers!

FAQ’s

What assistance do you offer in helping us draft employment contracts that are acceptable and legal?

The Global PEO should be aware of the particulars of the hire, as well as the nation, and should provide your team with best practises recommendations.

What kind of technology does PEO provide?

In the end, you select an HR solution in order to simplify your life. The platform must be simple to use for the solution to be effective.

What HR or business processes can they handle?

Payroll management, providing employee benefits, assisting clients with compliance, and managing routine HR tasks like onboarding paperwork are all core PEO services. Some PEOs, however, take on additional tasks.

- Article, U.A.E

- November 14, 2022

Overview

To get better prepared for the UAE corporate tax regime, calculation of the final amount of the Corporate Tax (CT) payable for a financial year must be learnt and clearly understood by all businesses. Compliance to CT is vital for companies and a well reputed professional Corporate tax advisory in Dubai, UAE can provide effective tax solutions to help companies comply with CT requirements. With all the needed expertise and knowledge, such tax consultants can help calculate CT payable very accurately with all applicable tax incentives e.g. deductions, exemptions in perspective and save money for the companies.

Though the final print of UAE CT as a set of regulations or laws is yet to be officially published, businesses can refer to the Public Consultation Document that provides information on the major aspects of CT. Final tax related decisions however must be made after official announcement of CT laws. The final amount of CT payable for an assessment year will be determined from the taxable income for the relevant financial year.

The Proposed Tax Bracket

As announced by the UAE Ministry of Finance (MOF), Corporate Tax in UAE will apply at a standard rate of 9% with the below mentioned tax brackets and rates:

- 0% for taxable income up to AED 375,000

- 9% for taxable income above AED 375,000

- A different and possibly higher tax rate which is not yet specified for large multinationals fulfilling certain specific criteria

Method of CT Payable Calculation

The Public Consultation Document issued in April 2022 by the MOF has outlined a method for calculating the CT payable for a financial year. Businesses can seek additional information and advice from a reputed Dubai based professional tax consultant, IMC Group to accurately evaluate the CT liability as specified in the consultation document.

The 9 % CT will be imposed on businesses only if the taxable value exceeds AED 375,000. CT in UAE is calculated at a flat 9% rate of the net profit shown in the company’s financial statements after deducting all applicable deductions and excluding the exempted income. Any taxes paid in overseas jurisdictions will also be allowed for reduction from the profit shown in the financial statement. The net profit derived after all deductions will be considered as taxable income.

Hence, all applicable deductions when subtracted from the net profit will give the net income. When the exempt income of AED 375,000 is deducted from this net income, we can arrive at the taxable income. CT @ 9% on this taxable income will give the final tax liability. Foreign Tax Credit, if any when subtracted from this final tax liability, will give the Final CT Payable.

UAE CT will apply to UAE resident companies on their global income including overseas income which may be subject to a similar tax like UAE CT in another jurisdiction outside of UAE. The proposed UAE CT regime, for avoiding double taxation, will allow a credit for the tax paid in an overseas jurisdiction on the foreign sourced income against the UAE CT liability as a foreign tax credit.

The maximum Foreign Tax Credit that can be availed will be determined by the amount of tax that is paid in the foreign jurisdiction; or the UAE CT payable on the foreign sourced income and whichever is lower.

Unutilised Foreign Tax Credit, if any can not be carried forward or adjusted back to other tax periods. The Federal-Tax-Authority (FTA) will not refund any unutilised Foreign Tax Credit.

UAE Corporate Tax Relief for Small Businesses

The corporate tax regime involves a certain level of complexity which is unavoidable, especially in a diversified economy like the UAE. However, the UAE government has made provisions to keep the UAE corporate tax regime as simple as possible, which may help businesses to minimise their compliance costs. In line with this policy, the UAE corporate tax regime will provide relief for small businesses in the form of simplified financial and tax reporting obligations. The provision for small business relief is significant as the relative burden of tax compliance is disproportionately higher for small and medium-sized businesses across the world. Small business owners can consult with corporate tax advisors in Dubai to know further about the relief for small businesses under the corporate tax regime.

Hire the Best Corporate Tax Consultants in Dubai, UAE

Corporate tax agents in Dubai such as Jitendra Chartered Accountants (JCA) can advise business owners on critical tax matters such as the calculation of payable tax. JCA has a team of corporate tax advisors in Dubai who can help the businesses to comply with such complex provisions in the corporate tax regime.

Our services at JCA as Corporate Tax Consultants include CT Assessment & Advisory Services (one-time or retainer basis), CT Compliance Services & CT Agent Services to Represent to Federal Tax Authority (FTA) of UAE in case of any notices served by FTA. Ensure corporate tax compliance and avoid relevant penalties by availing of JCA’s corporate tax services in Dubai, UAE. JCA offers customised tax solutions to allow businesses to comply with the UAE corporate tax hassle-free.

- Article, U.A.E

- November 9, 2022

Overview

The UAE Corporate Tax (CT) regime, as per the Public Consultation Document released by the Ministry of Finance (MOF) on 28 April 2022 proposes to exempt certain forms of income from taxation to prevent incidences of double taxation.

For the UAE-based companies, the Income generated from investments in other companies and income earned from operations undertaken outside the UAE, either through foreign subsidiaries or foreign branches is primarily exempted from UAE CT.

The exempt income scheme to be administered by the Federal Tax Authority shall include participation exemption or similar principles followed in international markets.

Exempt Incomes Under UAE CT

The following income shall be in general exempt from income tax. There will be no UAE withholding tax on domestic and cross-border payments.

Dividend Income

UAE companies earning dividend income from their qualifying shareholding shall not be liable to pay income tax. This would help prevent double taxation as profit money paid as dividends are already taxed once. All the domestic dividends earned from UAE companies will be CT exempt including dividends paid by a Free Zone entity enjoying CT holidays.

Dividend incomes from foreign companies will also be CT-exempt.

Capital Gains

UAE corporate shareholders will be exempted from CT on capital gains earned from the sale of shares of a subsidiary company as it would avoid double taxation of corporate profits.

Capital gains from the sale of shares in a Free Zone Person will be exempt from corporate tax in the event of the Free Zone Person being a holding company and most of its income being earned from shareholdings in subsidiary companies.

Capital gains from the sale of shares in both UAE companies and foreign companies are CT exempt subject to fulfilling certain conditions such as the UAE shareholder company owning a minimum of 5% of the shares of the subsidiary company and the CT rate of foreign companies being at least 9%.

Profit of Foreign Branch

UAE companies can avail of CT exemption either through the credit method or through the exemption method. They can claim a foreign tax credit for taxes paid in the foreign branch country or claim an exemption for their foreign branch profits.

Claiming for foreign branch profit exemption will be irrevocable and will apply to all foreign branches of the UAE company. The exemption for foreign branch profits can’t be availed if the foreign branch doesn’t come under a tax jurisdiction with a sufficient level of tax. Better insights on availing foreign branch profit exemption become possible when a company prefers to outsource the professional services of a corporate tax advisory in UAE.

Other Incomes

Profits made from a reorganization of groups and intra-group transactions shall be CT-exempt. Exemption can also be availed for income earned by a non-resident operating or leasing aircraft or ships as well as any associated equipment for international transportation. However, the such exemption can only be sought if similar tax treatment, as reciprocation, is granted to a UAE business in the relevant foreign jurisdiction.

The Bottom Line

The UAE companies must evaluate if they can fulfill the prescribed conditions, as and when appropriate, to avail the exempt income scheme and an understanding of the types of income exempt from the UAE corporate tax regime will help businesses prepare better.

Seeking professional help from corporate tax consultants in Dubai will enable you to assess the potential impact of corporate tax on your business. You can consult with the best corporate tax advisors in Dubai such as Jitendra Chartered Accountants (JCA) to prepare effectively for the corporate tax.

IMC Group is one of the leading corporate tax services providers in UAE and can help companies with smooth and seamless transition to the new tax regime. The services mainly include corporate tax assessment, corporate tax compliance and corporate tax agency.

- NEWSLETTER,SINGAPORE

- November 1, 2022

Technology companies based in the United Kingdom (UK) are eyeing Singapore as the gateway as they plan to expand into the Asia Pacific region and will leverage the UK-Singapore Digital Economy Agreement (DEA) encompassing the digitized trade in services and goods to support and enhance regional growth.

Starting September 21 2022, a major delegation of 24 cutting-edge technology companies based in the UK and exploring growth opportunities in the Asia Pacific, spent a week in Singapore hosted by the British High Commission and interacted with Singapore Government agencies including the GovTech, Cyber Security Agency; Defense Science and Technology Agency; the Infocomm Media Development Authority and the Ministry of Law.

On visiting Singapore and engaging with Singapore government authorities, the UK tech companies initiated the UK-Singapore Digital Economy Dialogue for the first time to enhance the benefits of digital trade, strengthen technology partnerships at both the government and business levels, and ensure a balance between technological innovation and regulatory framework.

The British Government in an official statement reported that 24 British technology companies who intend to expand in the Asia-Pacific region and explore projects related to driverless vehicles, lawtech, cybersecurity, and deeptech were warmly welcomed by Singapore.

DEA, the first digital economy deal between two major digitized and advanced economies in the world acted as the springboard for the UK technology companies’ expansion in the Asia Pacific. Digital trade between these two nations is presently worth over £17 billion per year. The UK tech companies visiting Singapore intend to use the DEA to support and promote their expansion into the Asia Pacific and explore opportunities for Singapore Company Incorporation.

Tech Nation, the leading growth platform in the UK for technology companies, also organized a delegation the same week and scheduled a programme of 90 meetings with investors and entrepreneurs.

“Singapore is a gateway to the rest of Southeast Asia, which has a digital economy projected to reach $1 trillion by 2030. The region has the demographics and openness that scaleups are looking for,” the UK Trade Commissioner for the Asia Pacific, Natalie Black highlighted.

She also said, “Our UK-Singapore Digital Economy Agreement will make the most of this opportunity – bringing together two high-tech nations in a living agreement that keeps up with the pace of digital innovation.”

Gabriel Lim, secretary of the Ministry of Trade and Industry, emphasized that this visit was an opportunity to help businesses, particularly startups and SMEs, “to seize new growth opportunities across our combined and growing digital markets.”

Lawtech deals with technologies that replace the conventional methods for legal services delivery or legal transactions by law firms or lawyers, presenting a bright spot for future business growth and ten UK-based lawtech firms visited Singapore to explore business opportunities in the Asia Pacific.

The UK-Singapore DEA is the first international trade agreement to include certain low-tech specifics. The British lawtech business is valued at £11.4 billion, as per data from Tech Nation research. The UK has traditionally remained the leader in law services and has the largest legal services market in Europe and second in the world just after the US.

The DEA focuses on helping law firms identify collaboration opportunities to exploit markets in the UK and Singapore as it brings two legal giants to the same podium with certain specific provisions that enhance electronic contracts and signatures; secure international data flows; and protection of vital proprietary data.

Businesses from both the UK and Singapore feel more confident as the DEA guarantees transparency in digital trading between the two countries. Funding for expansion in the Asia-Pacific will not be a problem for British technology companies and startups as many Single family offices in Singapore would be more than willing to invest in these companies.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group