- India, Newsletter, U.A.E

- November 9, 2021

Driven by common goals and philosophy for regional peace, economic growth & sustainability, India and Israel joined hands for a trilateral economic summit in Dubai on Tuesday, 19th October 2021. Business leaders from India, UAE and Israel could well visualize the potential of trilateral cooperation in many fields and projects and long cherished a collaborative approach to address the same. The economic summit was attended by more than 250 delegates, industry experts and Government Officials from the three countries.

The agenda of the summit was to discuss measures for assessing and optimising trilateral opportunities in trade and investment. The Economic Summit was a one-day forum and a joint effort of the Consulates of Israel and India in Dubai, the Israel Export Institute, the Indian Business and Professional Council (IBPC), Bank Hapoalim, Bank of Baroda and media partner Khaleej Times. Bank of Baroda and IBPC Dubai also sponsored the summit.

The summit witnessed several panellists and experts highlight prospects of joint projects in various fields. After the general discussion session, the sectoral panel discussions were held in the fields of technology, agritech, infrastructure, clean energy, food technology, water technology, tourism & smart cities, technology collaboration including harnessing the potential of the medical and health care sector.

The brainstorming and discussion sessions centred around the possible joint projects and assessing mutual benefits. India was represented by the three young unicorn panellists Nikhil Kamath of Zerodha, Nishant Pitti and Prashant Pitti of Ease My Trip and Sujeet Kumar of Udaan.

Abraham Peace Accords and recent government policy reforms in UAE and India made the delegates strongly believe in the trilateral synergy and an economic force to reckon with. All of them actively participated in the economic summit and Indian companies were invited to visit Israel for exploring collaborative opportunities in various sectors.

The Consul-General of India to Dubai, Dr Aman Puri termed this event as a ‘force multiplier’ and said, “The Indian business community in the UAE could significantly leverage the strengths of this trilateral to boost the economic growth of all nations.” He also mentioned this event as an ideal platform for the three countries to explore areas of collaboration and partnership in both private and public enterprises.

“This trilateral economic summit is taking place at an opportune time with the first anniversary of the signing of the Abraham Accords having been commemorated recently. I would like to congratulate both the UAE and Israel on their outstanding efforts in fostering regional peace and trust. The Abraham Accords was a landmark event that has not only had a significant impact on trade interest between the UAE and Israel but also helped to promote regional peace and prosperity. I commend the vision and commitment of the UAE and Israel leaders as well as the people of the two countries in forging such a historic, multilateral alliance that will have a significant positive impact on all nations,” Dr Puri remarked.

Dr Puri emphasized that India being the third-largest start-up ecosystem could bring tremendous growth opportunities from a company formation in India. He identified Israel as a powerhouse of research & development including startups and appreciated UAE for its relentless support for SMEs and startups and numerous incentives for new company formation in Dubai.

Ilan Sztulman, Consul General of Israel to Dubai also highlighted the opportunities of this trilateral summit for mutual collaboration and doing business together. He noted saying, “This forum is symbolic as it comes immediately after the signing of the important economic cooperation agreement between Israel, the United States, the United Arab Emirates and India on shared issues of concern in the region and globally.”

All the three countries, Israel, India and the UAE are tech-centric and have a deep interest in technology and once together can be an innovative force, the Chairman of IBPC commented.

The President, Manufacturers Association of Israel and CEO, Unipharm Ltd. Dr Ron Tomer noted that these three nations are complementary to each other and can make a win-win situation for everyone. He also informed that Israel’s FTA with India was in progress and the same with UAE was under discussion.

Chairman, KEF Holdings Faizal Kottikollon shared his thoughts on the major healthcare and education projects currently undergoing in India where a collaborative approach can benefit all three countries.

Many eminent personalities from the business and industrial arena took part in the event such as Adiv Baruch, Chairman of the Israel Export Institute; Ahmad Sultan Al Haddad, COO, JAFZA; Professor Leonardo Leiderman, Chief Economic Advisor, Bank Hapoalim and Professor of Economics and Business, Tel Aviv University; and many more.

The combined strengths of India, Israel and the UAE can propel the trilateral trade between the countries to a high of USD 110 billion by 2030, many top diplomats and industry experts have commented.

The comments came up during an event organised by the International Federation of Indo-Israel Chambers of Commerce (IFIICC) to discuss the ongoing business collaborations being facilitated by IFIICC across various sectors.

“The international business potential backed by Israeli innovation, UAE’s visionary leadership and strategic partnership of both nations with India could be USD 110 billion by 2030,” Head of the Israeli mission in Dubai, Consul General Ilan Sztulman said in a press release issued by IFIICC.

As India has a very constructive partnership with the UAE and also enjoys an equally wonderful relationship with Israel, post-Abraham Peace Accord between Israel and UAE can be the most opportune period to bring everything together for the economic good of the citizens of the three counties and open floodgates of opportunities for new business setup in the region.

- Newsletter

- November 2, 2021

On 8 October 2021, the Organization for Economic Cooperation and Development (OECD) / G20 Inclusive Framework on Base Erosion and Profit Shifting (BEPS) released a statement on the two-pillar solution which states the agreement of 136 out of 140 Inclusive Framework members on core design features developed in the BEPS 2.0 project. The decision has received support from major economies including the United Arab Emirates, the Kingdom of Saudi Arabia, Qatar, Bahrain and Oman.

The announcement reflects the progress made by the OECD on the two pillar solution to overcome the tax challenges arising from the digitalization of the economy.

IMC Group has deeply analysed the statement and has summarised the new components agreed by the IF members for Pillar One and Pillar Two. Our alert also summarises the implementation plan for the same.

Agreed Components of Pillar One

The October statement is a build on the July statement that focuses on the conceptual agreement on fundamental reforms to international tax rules. Furthermore, it provides clarity on certain key parameters. IF further provided clarification in regard to Amount A and confirmed completion of technical work for the application of Amount B by the end of 2022. The new agreed components are as follows:

Amount A

- Scope: The scope of Amount A is restated without any change. It states that Multinational Enterprises (MNEs) with global turnover above EUR 20 billion and profitability above 10% are within the scope of Pillar One rules. The calculation of turnover and profitability shall be done using an averaging mechanism.

- Allocation: October statement amended the previously defined residual profit allocation from 20% and 30% range to 25%. This means MNEs will now reallocate 25% of their residual profit (profit in excess of 10% of revenue) to market jurisdictions.

- Tax certainty: A mandatory and binding dispute resolution mechanism will be in place for all issues pertaining to Amount A. For a few developing countries, an electivebinding dispute resolution mechanism will be in place. The eligibility conditions to access this mechanism will be reviewed on a regular basis.

- Unilateral measures: The multilateral convention (MLC) through which Amount A is to be implemented requires the removal of all Digital Services Taxes and other relevant similar measures to all companies. Furthermore, no new measures are to be imposed on any company from 8 October 2021 until 31 December 2023 or the coming into force of the MLC.

Amount B

The statement clarifies that the application of the arm’s length principle to in-country baseline marketing and distribution activities will be simplified and streamlined. There will be a specific focus on the needs of low-capacity countries. The said work shall be completed by the end of 2022.

Agreed Components of Pillar Two

Pillar Two consists of two interlocking domestic rules, an income inclusion rule and an undertaxed payment rule as well as a treaty-based rule for the benefit of developing countries. The new components in pillar Two are as follows:

- Rate: The Inclusive Framework has agreed that a global minimum tax rate shall be 15% calculated on a country by country basis. The phrase “at least” has been removed from the statement.

- Scope: The rules will apply to MNEs that meet the EUR 750 million thresholds.

- Undertaxed Payment Rule (UTPR) exclusion: MNEs that have a maximum of EUR 50 million tangible assets abroad and operate in less than 5 other jurisdictions are excluded for a period of 5 years from the application of the UTPR.

- Effective Tax Rate (ETR) calculation: The earlier provided timeframe of 3 to 4 years has now been revised to 4 years for existing distribution tax systems earnings. The ETR calculation however remains unchanged.

Substantial activity exclusion: Certain incomes earned by MNEs are excluded from the computation of the ETR. The same is calculated at 5% based on a percentage of its tangible assets and payroll expenses. The term “at least” has been removed. The conditions for exclusion are as follows:

– The transitional period has been increased to 10 years.

– Exclusion amount is 8% of the carrying value of tangible assets and 10% of payroll. The same will be reduced annually.

De minimis exclusion: Furthermore, if MNE has revenue less than EUR 10 million and has profits less than EUR 1 million, a de minimis exclusion will also be applicable.

- Subject to tax rule (STTR): The STTR has been fixed at 9% from the previously mentioned range between 7.5% and 9%.

Implementation Plan for Pillar Two

The statement also highlighted the implementation plan for pillar two which is as follows:

- Pillar Two is anticipated to be brought into law in 2022 and will be made effective in 2023, with the UTPR coming into effect in 2024.

- Model rules to give effect to the GloBE rules will be developed by the end of November 2021. It will define the scope and set out the mechanics of the GloBE rules.

- Model tax treaty provision for the STTR and commentaries will be made effective by the end of November 2021. A multilateral instrument will be developed by the IF by mid-2022 to facilitate the smooth implementation of the STTR in relevant bilateral treaties.

- A detailed implementation framework will be developed by OECD by the end of 2022 to facilitate coordinated implementation of the GloBE rules.

End Note

With the new statement coming into effect, the tax and finance teams need to stay abreast with the changes in the existing tax landscape. They need to access the potential challenges the businesses are likely to face.

How Can IMC Group Help?

IMC Group is keeping a tap of all the changes that are happening from time to time. We can help you prepare an effective roadmap to sail through these changes.

Our international tax team can also assist you in determining the applicability and potential impact of Pillar One and Pillar Two on your business and how to go about its implementation.

For further information, get in touch with us now!

- Newsletter, U.A.E

- October 26, 2021

Economic Substance Regulation has been issued in the UAE since April 2019. Since its introduction, there have been various updates and amendments to the rule.

IMC Group has deeply studied and analysed the upcoming Economic Substance Regulation in order to guide businesses through the ESR filing obligations and help them prepare for the same.

Applicability of Economic Substance Regulation

The Economic Substance Regulations broadly apply to all United Arab Emirates onshore as well as free zone legal entities that carry out one or more of the 9 ESR “Relevant Activities” referred to as “licensees”.

The “Relevant Activities” are as follows:

- Banking

- Distribution and service centre

- Fund management

- Headquarters

- Holding company

- Insurance

- Intellectual property

- Finance and leasing

- Shipping

ESR Filing Requirements

The entities that fall within the scope of the regulations are required to submit a notification form and an Economic Substance Report to the respective regulatory authority.

The annual filing obligations for such entities are as follows:

- Notification

A notification must be filed within 6 months from the end of the financial year declaring that the entity undertakes Relevant Activity, even if no income was earned from such activity during the financial year; and

- Report

In case of income earned from Relevant Activity, a report must be filed within 12 months from the end of the financial year declaring certain business information demonstrating economic substance. The information includes income figures, expenses, assets, number of employees, etc.

Note:

An entity is not required to file the report for any financial period in which it has not earned income from a relevant activity or if it meets the conditions for being exempt. However, a notification must be filled regardless.

Exemption from the Regulation

The following entities are specifically exempted from the regulations:

- Investment funds

- UAE branches of a foreign entity provided the branch’s income is taxed in a foreign jurisdiction

- Tax resident entities in a foreign jurisdiction

- Wholly-owned entities by UAE residents or nationals that are not part of a multinational group, if they carry on business in the UAE.

Reporting Deadlines

Below are the reporting deadlines for a selection of financial year ends:

Fiscal Year End | Notification Filing Deadline | Report Filing Deadline |

31 Dec 2020 | 30 Jun 2021 | 31 Dec 2021 |

31 Mar 2021 | 30 Sept 2021 | 31 Mar 2022 |

30 Jun 2021 | 31 Dec 2021 | 30 Jun 2022 |

30 Sept 2021 | 31 Mar 2022 | 30 Sept 2022 |

31 Dec 2021 | 30 Jun 2022 | 31 Dec 2022 |

Key Actions

On the completion of a given financial year, entities are required to determine their upcoming ESR filing obligations and take the necessary steps to ensure timely filing along with submitting the supporting documentation.

Penalty for Non-Compliance

In case of non-compliance, entities will have to bear wide-ranging and significant penalties which are as follows:

- AED 20,000 – For failure to submit a notification

- AED 50,000 – For failure to submit an Economic Substance report

- AED 50,000 – For failure to provide accurate or complete information

- AED 50,000 (first failure) and AED 400,000 (second failure) – For failure to demonstrate sufficient economic substance in the UAE

Key ESR Considerations

Before the end of the financial year, all UAE entities must consider the following ESR matters and ensure timely action, where relevant.

- Assess whether the entity has conducted any Relevant Activity during the period and has generated income from the same. This is a crucial assessment as it determines its specific UAE ESR compliance requirements for that financial year.

- Entities that are earning income from any Relevant Activity during the period need to review their compliance with the applicable ESR tests (Directed and Managed, Core Income Generating and Adequate).

- Post review, entities should address the potential areas of non-compliance, if any.

- In case where the entity’s ability to comply with the regulations got impacted due to COVID-19, it should look for temporary measures such as appointing alternate directors in the UAE to attend local meetings.

- Entities should ensure control and supervision over any outsourcing arrangements. This can be done by way of entering into contractual agreements or correspondence.

The above-mentioned guideline provides an opportunity for the entities to take the necessary actions to comply with the ESR within the stipulated timelines.

How can IMC Group help?

IMC Group can help you navigate through the Economic Substance Regulation and guidelines based on your jurisdiction. You may book a consultation with our expert to know how the new update will affect you and the way forward.

- Newsletter, U.A.E

- October 19, 2021

At Intuit Management Consultancy, we are a leading cross-border advisory firm that caters to large companies, multinational corporations, small and medium-sized enterprises, high net worth individuals, family-owned businesses, and start-ups. We offer a wide range of services to our esteemed clientele which includes business setup solutions, corporate advisory services, global mobility, tax advisory services, and more.

It has recently come to our attention that according to Clutch’s list of top B2B companies, we are highlighted as one of the top accounting firms in the United Arab Emirates.

If you haven’t heard of Clutch before, it’s an established B2B reviews platform that helps firms across the globe connect with the solution providers that they need in order to improve effectiveness and increase productivity. The ratings and reviews platform publishes the most extensive and referenced client reviews in the B2B services market.

Throughout the year, Clutch highlights its highest-ranking firms across industries and locations. The Clutch Leader Awards recognize companies’ commitment to building their expertise, providing stellar customer service, and producing high-quality results for clients.

We couldn’t have won this award without our amazing clients. We are extremely grateful for their continued support and trust and we are especially thankful to those who took the time to leave us a review on our Clutch profile. Here’s what they had to say about working with us:

“The workflow is quite effective. They are also good in following up with us to get the required details so that things get completed on time.” – CEO, Aspire Systems

“Professional and Transparent approach and always kept us posted on the options available. We also were very happy with their level of continuous feedback on status.” – Managing Director, Multivista Global Pvt. Ltd.

Want to get in touch with the Intuit team? Simply fill out the form and a member of the Intuit team will be in contact shortly!

- Newsletter, U.A.E

- October 11, 2021

As Dubai Expo 2020 kicked off its inaugural ceremony with much splendour on 1st October 2021, the global business community became upbeat about a sustainable economic future with increased collaboration, innovation and opportunities in trade and investment. The six-month-long event with 192 participating countries, thousands of corporations and millions of visitors will indeed rekindle business interactions for putting the growth engine on track after widespread economic devastation due to the covid pandemic. Industry experts are also confident in the huge inflow of foreign investments in the UAE and several new business set up in Dubai.

The world fair, first in the Middle East coincides with the 75th year of Indian independence and will be the perfect venue for displaying its vibrant culture, innovative core and technological prowess over the coming six months.

Union Minister of Commerce and Industry, Piyush Goyal inaugurated the India Pavilion on October 1, Friday and said in a press briefing, “It is an outreach to the whole world to showcase a new India, an emerging technologically driven self-confident India. Dubai Expo 2020 is an opportunity to showcase India’s potential.”

The India Pavilion, located at Al Forsan Park next to the Opportunity District is one of the largest at the Dubai Expo and features an innovative moving facade with more than 600 rotating screens symbolizing ‘India on the Move’ and displays 75 stories of 75 years of Indian independence with an engrossing stimulus of “constant change” and “timeless endurance” at the front.

In line with Dubai Expo 2020 theme “Connecting Minds, Creating the Future”, India Pavilion is created on “Openness, Opportunity, Growth” and is centred on 11 primary themes including Climate and Biodiversity, Rural and Urban Development, Tolerance and Inclusivity, space, Golden Jubilee, Knowledge and Learning, Travel and Connectivity, Global Goals, Health and Wellness, Food & Agriculture, Livelihoods, and Water; and each having a dedicated zone under one high tech gigantic structure.

The India pavilion consists of four floors and displays its past, present and future powered by the latest technologies of Augmented Reality and Projection Mapping. The massive and captivating pavilion is an innovative combination of the Space program, Ayurveda, Yoga and a rapidly growing USD 3.5 trillion economy and also displays enormous opportunities rendered by its vast 1.3 billion population. The Pavilion also hosts an amphitheatre, conference halls, state pavilions, restaurants, and many other facilities.

While the first floor displays India’s cultural vibrancy, the second floor exhibits enormous opportunities to be derived from the India-UAE partnerships. The third floor is dedicated to corporate India and its growing strength and credibility in various sectors.

The Pavilion is designed to provide the visitors with an unforgettable experience of India’s unity in diversity, treasures and traditions, spectacular achievements, technological breakthroughs and myriad business opportunities. It is meant to inject a feeling of futuristic, modern and digitally strong India while simultaneously showcasing the beauty of Indian art, cuisine and culture.

India pavilion has planned to organize lots of conferences, B2B meets, cultural events, food festivals, online workshops, cinemas, debates, and competitions and will be visited by many social and political celebrities including business leaders and corporate heavyweights.

Fifteen Indian states and Union Territories including nine ministries from the Centre are taking part in this expo, which will be continuing till March 31, 2022.

The participating States and Union Territories at the India Pavilion are Gujarat, Karnataka, Ladakh, Telangana, Rajasthan, Maharashtra, Uttar Pradesh, Kerala, Jammu and Kashmir, Goa, Andhra Pradesh, Chhattisgarh, Jharkhand, Himachal Pradesh and Haryana and display respective region’s business advantages and growth opportunities.

Large Indian companies are also participating such as Tatas, Reliance, Vedanta, Hinduja Group, Adani, L&T, ITC, Hindustan Unilever Limited, Ease My Trip, Oyo, Standard Chartered Bank, Trident Group, Baidyanath, Apollo Hospital, Daawat Rice, Bank of Baroda, Patanjali, Dabur etc. and some leading UAE based business houses such as KEF Holdings, IFFCO, Aster, Lulu Group.

India put a brave front in its fight against the Covid pandemic and could successfully mitigate the adverse economic effects through the huge vaccination drive. The roll-out of several economic packages including the introduction of reform policies by the government has prepared the stage for a sustainable and robust economic growth phase to make the country a USD 5 trillion economy by 2025.

India has forged strong ties with the UAE and the proposed FTA between the two sides is likely to be signed during March next year. In a press meet during Expo 2020, Piyush Goyal remarked that the FTA holds tremendous potential for both the countries to enhance trade and investment and many investors in India are keen on Dubai company incorporation.

The Expo has presented India with a unique and strategic advantage and the country has planned to exploit it fully by focussing on countless opportunities that the country can provide to the global business and investing community. Addressing the nation on its 75th Independence Day, PM Modi said that no force on earth can stop India to realize her dreams and invited the citizens to be the flag bearers for global peace and safety. “The world’s economic revival is linked to the growth of India. The country is ready to do whatever it can to further global good and prosperity. This is an India that is reforming, performing and transforming,” Modi emphasized in his speech on Dubai Expo 2020.

- India, Newsletter

- October 10, 2021

Indian Prime Minister Narendra Modi set out on a three-day tour to the US from 22-25 September for attending the first in-person Quad Summit and began his visit schedule in the US on 23rd, Thursday by attending a session with prominent American CEOs from five different key sectors and appraised them on the business opportunities and key benefits of company registration in India.

Modi landed in the US on Wednesday and held face-to-face meetings with President Joe Biden and his deputy Kamala Harris and ahead of these official meetings met the CEOs of Qualcomm, Adobe, First Solar, General Atomics and Blackstone.

Two of the CEOs were Indian-Americans named Shantanu Narayen from Adobe and Vivek Lall from General Atomics. The other three were Cristiano E Amon from Qualcomm, Mark Widmar from First Solar, and Stephen A Schwarzman from Blackstone.

During his one-to-one meetings with the CEOs, Prime Minister Narendra Modi deliberated on the economic opportunities in India and emphasized saying,

“Will attend the QUAD meeting, and would also interact with leading CEOs to highlight economic opportunities in India.”

Modi’s meeting with the American CEOs from five key areas echoed the policies and priorities of the Indian government.

Meeting with Adobe CEO meant that the IT and digitization of the economy has been the topmost priority of the Indian government.

The meeting with Vivek Lall was significant considering General Atomics as a pioneer in drone technologies and one of the leading manufacturers of state-of-the-art military drones. General Atomics has already provided India with a few drones and is in the process of supplying a significant number of drones for Indian defence. The CEO of General Atomics was born in Indonesia and presently settled in California, for more than 10 years. He has been responsible for finalizing defence deals with American allies and clinched a business of USD 18 billion. The US only allows sharing of advanced defence technologies to its partners. Qualcomm is the global leader in 3G, 4G and next-generation wireless technology innovation for more than 30 years and pioneering the ways to 5G connectivity. The meeting with Qualcomm CEO, Cristiano Amon was important in the face of India’s push for the 5G technology adoption and revealed the company’s commitment to fulfilling Narendra Modi’s vision of transforming his country into a digitally empowered society. The San Diego-based company is in the manufacturing of software, semiconductors and services related to wireless technology and has offices in India. Large investments from Qualcomm were expected by the Indian PM.

As India is harnessing solar power for a prosperous rural India and taking huge initiatives in meeting its energy demand from clean and renewable energy, the meeting with Mark Widmar, the CEO of First Solar assumed significance as the company is the leader in providing comprehensive photovoltaic (PV) solar solutions globally.

The Arizona-based company has already recognized India’s geographic location as most conducive for solar power generation and announced a 3.3 GW of capacity solar plant in India with a USD 684 million project cost.

Blackstone is reputed around the world as a professionally managed investment firm that invests capital on behalf of pension funds, hedge funds, large institutions and individuals. Stephen A. Schwarzman is the Chairman, CEO, and Co-founder of this company and in 2019 has launched the first Real Estate Investment Trust (REIT) in India with Embassy group and then another two REITs in the country. The company asserted that it would invest another USD 40 billion in India over the next five years.

PM Modi also interacted with the CEOs from the US oil and gas sectors to discuss plans for addressing the country’s growing energy needs.

“It is impossible to come to Houston and not talk energy! Had a wonderful interaction with leading energy sector CEOs. We discussed methods to harness opportunities in the energy sector,” Modi remarked.

The American CEOs appreciated India’s moves in promoting doing business in India and welcomed measures taken by Modi’s government to liberalise the Indian economy including corporate tax structure revision. The CEOs assured their business presence in India and thanked the PM for the support initiatives being undertaken by his government. A complete guide on doing business in India can facilitate business setup in the country for aspiring American companies and investors.

- India, Newsletter

- October 9, 2021

India and the United Kingdom are aiming to resume negotiations on a Free Trade Agreement (FTA) on 1 November 2021 as the two countries agreed for an Early Harvest Agreement by March 2022 that would allow both to establish selective gains in commodities and services. India and UK arrived at this decision soon after a virtual meeting held between the Indian Commerce and Industry Minister Piyush Goyal and his British counterpart, Secretary of State Elizabeth Truss on Monday13 September 2021.

The announcement comes when India has initiated fast-tracking of FTA negotiations with several other countries including the European Union, Australia, United Arab Emirates, and Canada for promoting FDI with the help of a complete guide on doing business in India.

“Proposed FTA between India and the UK is expected to unlock extraordinary business opportunities and generate jobs. Both sides have renewed their commitment to boosting trade in a manner which benefits all,” a statement from the Indian Commerce and Industry Ministry revealed.

Earlier on September 3, Goyal said in an industry event that India was working on multiple FTAs with other democracies who believe in transparent, fair and rule-based investment and trade opportunities as a part of its renewed strategy to move past protectionism, reduce trade deficits and attract foreign investors for company formation in India.

“Substantial work has already been done and extensive stakeholder consultations have been held involving industry/business associations, export promotion councils, buyers/sellers associations, regulatory bodies, ministries/departments, public research bodies, etc,” Indian Commerce and Industry Ministry noted.

Goyal mentioned the formation of bilateral working groups (BWGs) for different tracks to identify and understand the ambitions, interests and sensitivities of each other to accelerate the negotiation progress. Regular meetings were convened amongst the BWGs and most of the work was almost over.

He believed BWG discussions will help both sides in understanding each other’s policy regimes and resume joint scoping discussions from 1st October for finalization of terms of reference and launching of negotiations in November.

“An interim trade agreement, as the first step of an FTA, would allow both of us to immensely benefit from the early gains of the partnership,” Goyal remarked. There is a need to strike a balance between commitments and concessions in goods and services, he emphasized.

There will be a reduction or elimination of tariffs on some selected goods during the interim trade agreement. In services, certain services of mutual interest may be included in the interim agreement. “If necessary, we may also explore signing a few Mutual Recognition Agreements in selective services like nursing and architecture services,” Goyal noted.

The UK Secretary of State for International Trade added, “Today Piyush Goyal and I launched trade working groups to lay the groundwork for our forthcoming UK-India trade deal, which will: boost access to more than a billion consumers; bolster our science and tech industries; and support jobs in both countries.” According to the UK government, regular ministerial dialogues between the two sides will help explore potential areas in the trade agreement encompassing tariffs, standards, Intellectual Property, trade remedy measures and data regulation.

In a bid to expand its market after Brexit, the UK has struck several FTAs and primarily with some of the largest and fastest-growing economies in the Indo-Pacific region. The UK has signed 68 deals and has reached FTAs with Vietnam, Singapore, Japan, South Korea, and Australia. A deal with India shall mean the promotion of exports, lowered tariffs, easing of regulations and enhanced bilateral trade.

Increasing UK-India trade has been dubbed a huge opportunity by the UK, given India’s position as one of the world’s biggest and fastest-growing economies and home to more than a billion consumers.

India is one of the key trading partners of the UK and the trade between the two countries stood at USD15.45 billion in 2019-20 and USD13.11 billion in 2020-21 with a trade balance in favour of India.

Data provided by the Ministry of External Affairs (MEA) revealed that during 2019-2020, India invested in 120 projects and generated 5,429 new jobs in the UK. For the UK, India was the second-largest source of foreign direct investment (FDI) in 2019 just after the US. There are more than 850 Indian companies currently operating in the UK and their combined revenue is almost Euro 41.2 billion, as per the ‘India meets UK” report- 2020 by CII- Grant Thornton.

Clinching an early Harvest deal will be favourable for both India and the UK and provide many benefits for enhancing economic recovery in the post-pandemic era and generate huge enthusiasm and momentum before signing the final FTA.

Newly introduced policies of India namely ‘Make in India’ and ‘Atma Nirbhar Bharat’ will be complemented once the FTA negotiations with trading partners come to fruition.

- Newsletter, U.A.E

- October 8, 2021

The property investors in Dubai can now avail three years visa with a minimum investment of Dh750,000 against Dh1 million required earlier, an official notification on the website of the Dubai Land Department (DLD) says. Previously the investor visa used to have a validity of 2 years and has also been extended now.

The visa facility is made available to the property investors by DLD through Taskeen Programme when an individual owns a property valued at a minimum of Dh750,000. The visa is renewable on the expiration of validity after three years.

This is a much awaited and highly welcome move to the real estate developers who demanded a long-term property visa for reviving the languishing real estate market. It is believed that the reduction in minimum investment amount would be an added advantage for real estate developers and help improve the sentiment of global investors willing to participate in Dubai’s flourishing real estate market during the historic event of Dubai Expo 2020. The property developers can see an increase in demand which in turn will boost the construction sector.

The government move has also been seen as timely and strategic as it would attract wealthy individuals in the middle east, many of whom are witnessing a growing geopolitical instability in the region, to own permanent residential property in Dubai and UAE for long term prospects and stability and would be an additional stimulus for the country’s economic growth.

For wealthy families across the world, Dubai is already well known for its high standards of living, world-class healthcare facilities, highest standards of safety, economic stability, ease of doing business, and with the roll-out of this new scheme, it shall further promote its competitiveness amongst the global investors and facilitate the business establishment and new company formation in Dubai.

Increased participation of entry-level buyers is expected for Dubai real estate assets and would present an opportunity to the real estate developers in selling off their existing properties and freeing up their blocked capital for new projects. Though it would take some time to correctly ascertain the exact ramifications of this move, it is unequivocally agreed by all quarters associated with Dubai Properties that the confidence of property developers in Dubai will be many times boosted on the back of extension of visa validity.

The Dubai real estate sector has started showing signs of recovery after being severely hit by the pandemic as almost 10% of expatriates had to leave Dubai due to job losses and many residential properties stayed vacant amidst a fall in real estate prices.

Emaar Properties, one of the biggest property developers In Dubai witnessed its sales skyrocket to a new high of USD 2.63 billion during the second quarter of 2021 and the official sales price index released by the DLD was also seen rising. August 2021 recorded the highest property sales of almost 4 billion USD last achieved more than a decade ago.

Dubai residency law mandates certain documents for investor visa application including the passport of the investor and an electronic copy of the title deed certificate. Owning a property with a minimum value of Dh750,000 is also mandatory for the applicant. For mortgaged properties, 50% of the property value or a minimum of Dh750,000 payment must be made to the bank. A mortgage bank statement along with a no objection letter in Arabic is needed for the visa application process. As the visa application process varies from emirate to emirate, involves several steps and can be overly complex at times needing expert knowledge on Dubai residency law, professional Dubai based Investor visa services are normally recommended for speedy visa processing and future follow-ups with the General Directorate of Residency and Foreign Affairs ( GDRFA), Dubai.

Dubai issues golden visas which are also long-term UAE investor visas only issued to eligible investors for a five or ten-year residency based on the size of their investment in the UAE and sponsor an investor’s spouse, children, one manager and one advisor.

While the 10-year residency visa applies to investors of at least Dh10 million, a 5-year residency visa needs a minimum investment of Dh 5 million. The long-term investor visa also mandates an additional set of requirements established by the GDRFA-Dubai and visas are granted to selected individuals belonging to specialized fields such as technical, research, science, medicine etc.

- India, Newsletter

- October 8, 2021

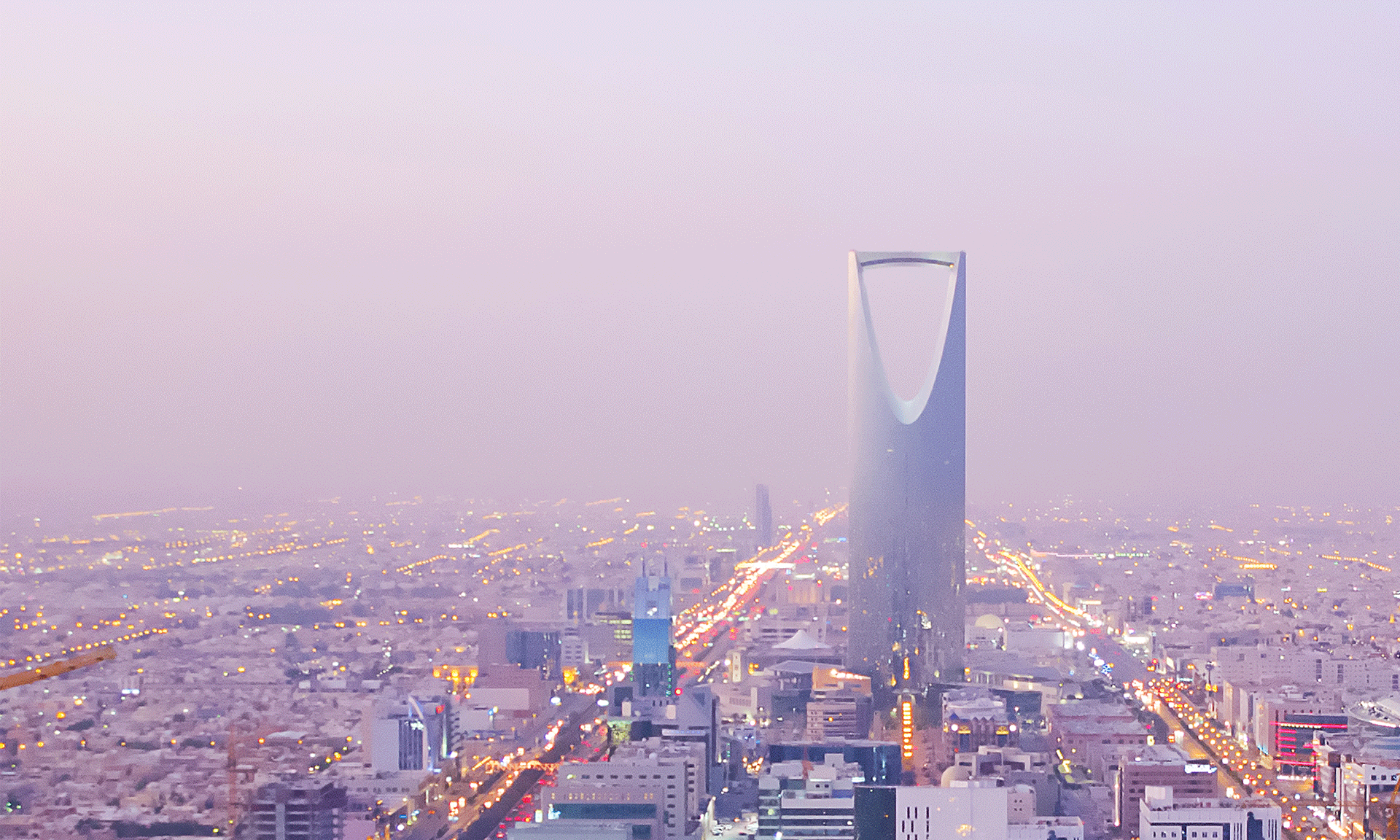

External Affairs Minister Dr S Jaishankar visited Hyderabad House in New Delhi on Sunday, the 19th of September 2021 to receive and meet the Foreign Minister of Saudi Arabia, on his three-day visit to New Delhi. It was the first Ministerial visit from Saudi Arabia since the time of the covid pandemic outbreak.

The two Ministers discussed the status and progress of implementation of the Strategic Partnership Council Agreement including measures for strengthening the partnership between the two countries in healthcare, trade, investment, energy, defence and security.

Indian Prime Minister Narendra Modi met Saudi Arabia’s Foreign Minister on Monday, the 20th and Tweeted saying, “Pleased to receive Foreign Minister of Saudi Arabia, Prince Faisal bin Farhan Al Saud. Exchanged views on ongoing bilateral cooperation initiatives and regional situations. Conveyed my regards to His Majesty the King and His Highness the Crown Prince”

The Prime Minister reiterated the willingness of India to witness larger investment from Saudi Arabia in the country’s industrial sectors including energy, IT and defence manufacturing in an in-person meeting with Saudi Arabia’s Foreign Minister Prince Faisal bin Farhan Al Saud in New Delhi on Monday.

The two countries’ views and perspectives on regional developments were discussed in the meeting like the situation in Afghanistan, an official press release noted. Several bilateral cooperation initiatives that have been recently undertaken by India and Saudi Arabia were also discussed and reviewed in this meeting.

The historic visit of His Royal Highness Crown Prince to India in February 2019 along with the country’s Deputy Prime Minister and the Minister of Defence was instrumental in Saudi-India bilateral ties and paved the way for a promising relationship between the two countries. The Crown Prince announced a Strategic Partnership Council between the two countries, led by Himself and Prime Minister of India and supported by the ministerial representation from the two countries and encompassing the entire range of strategic relationships.

The Indian Prime Minister visited Saudi Arabia on 29 October 2019 and the two sides set up the Strategic Partnership Council as announced by His Royal Highness Crown Prince earlier. The Strategic Partnership Council formed by the two countries is to explore increased cooperation in trade and investment in several industry sectors, defence and counter-terrorism.

Saudi Arabia’s Ambassador to New Delhi, Dr Mohammed Al Sati previously highlighted that his country values India as a close ally and strategic business partner. Bilateral cooperation in areas of training, knowledge sharing and the fight against terrorism was emphasized in his speech. Dr Al Sati also praised India in its handling of the covid pandemic including the economic relief package provided by the Indian government.

The world’s largest oil exporter earlier confirmed saying that Saudi Arabia’s investment plans in India are on track and more than 100 billion USD investment in Indian petrochemical, infrastructure, refining, mining, and manufacturing, agriculture and several other sectors would be made as announced by Crown Prince Mohammed bin Salman in 2020. Saudi Public Investment Fund (PIF) already planned for an investment of approximately USD 1.3 billion in Reliance Retail and USD 1.5 billion in Reliance’s Jio platform.

The Reliance Saudi Aramco deal is also on the verge of finalization as Saudi Arabia commits a steady supply of crude oil for Reliance refineries and makes an investment in India’s energy sector by purchasing a stake in Reliance Industries for an estimated 20 to 25 billion USD. An investment in the West Coast refinery petrochemical project is also on the cards as per a report. A complete guide on doing business in India is helping Saudi entrepreneurs and investors in planning and launching their Indian business operations.

The Indian Prime Minister in the recently held meeting with the Saudi Foreign Minister sought greater investments from Saudi Arabia and urged that Saudi entrepreneurs come for new company formation in India in energy, IT and defence manufacturing as these sectors can offer huge growth opportunities to benefit from. Saudi Arabia’s efforts in ensuring the safety and health of Indian ex-pats and workers during the Covid-19 pandemic was also appreciated by the Prime Minister.

The recent political crisis in Afghanistan was also discussed between the Saudi Foreign Minister and Indian External Affairs Minister. India has taken a ‘wait and Watch’ stance and also started discussions with other gulf countries e.g., UAE, Qatar, and Bahrain, Jaishankar remarked. Indian Prime Minister, Narendra Modi had earlier said that the matter regarding recognition of the new set-up in Afghanistan should be a collective decision of the global community.

- Newsletter, Singapore

- October 7, 2021

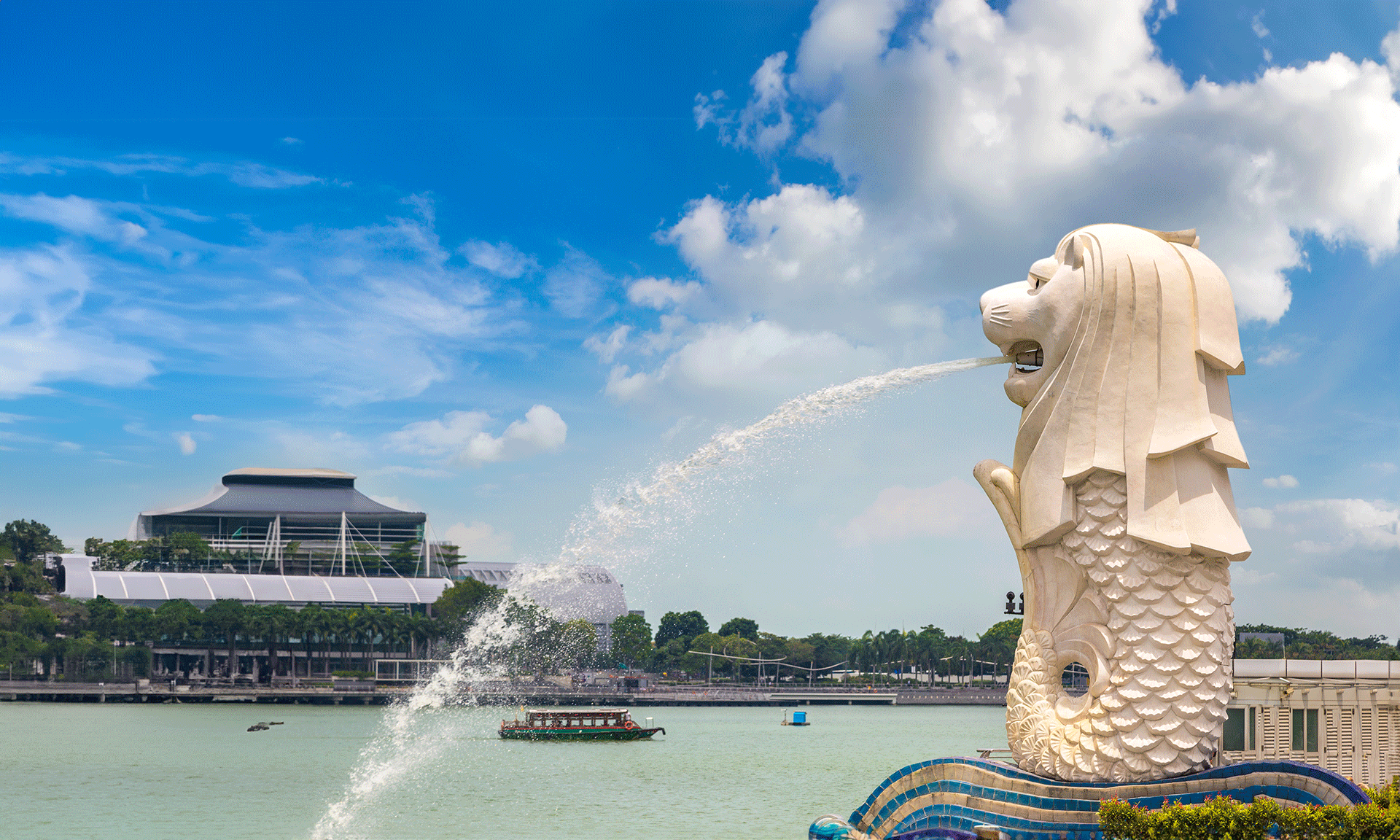

The Association of Southeast Asian Nations (ASEAN) long enjoyed a robust and thriving trade and investment relationship with the US and the region is perceived by many American companies as potentially attractive for exploring business opportunities. This has been further fuelled by the recent Regional Comprehensive Economic Partnership (RCEP) signed on 15 November 2020 at a virtual ASEAN Summit hosted by Vietnam, an agreement between the 10 member states of the ASEAN and five of its free trade agreement (FTA) partners.

The RCEP is significant for both US businesses and investors due to the huge size of the participating economies amounting to 29% of the world’s GDP with 30% of the world’s population and having a market value of almost USD 25 trillion. The ASEAN economy also has a vast consumer base of approximately 2.5 billion of which an estimated 1 billion hail from the middle-class.

The RCEP will establish a comprehensive economic partnership based on the existing bilateral ASEAN agreements with individual FTA partners and be governed by a set of rules and standards such as better market access and reduced trade barriers. For American investors who look for one of the best Singapore company incorporation, RCEP will help by providing many trade and investment opportunities in new areas.

As per researchers, technology adoption has taken the front seat in the ASEAN to support economies and societies after the Covid pandemic and mainly for streamlining supply chains through initialization. The US high-tech companies can play a decisive role in accelerating this transformation and make distribution channels more effective. The supply chain has become the centre stage in almost all American companies’ long term business strategies due to the unprecedented disruptions experienced by the pandemic and made it more relevant for them to explore supply chain partners within ASEAN regional partners for digital integration of distribution processes.

Increased consumerism boosted by a resilient supply chain will promote sectors including FMCG, pharmaceutical and medical & diagnostic devices. Many US multinationals are now eager to relocate their manufacturing facilities closer to ASEAN and especially to Singapore, the new Silicon Valley in Asia as the city-state provides the highest level of technology adoption, political stability, safest business climate and strong manufacturing capabilities to make their businesses more competitive.

The ASEAN renewable energy sector has also got a big push recently in the face of increasing clean energy demand due to rapid industrialization and the US businesses can offer clean energy solutions to the participating economies.

A recent survey conducted by Standard Chartered revealed that the majority of the US companies expect considerable business growth in numerous business sectors of ASEAN during the next 12 months. While 93% of corporations expected an increase in revenue, an increase in production was anticipated by 86% of respondents. 60% of the respondents surveyed were optimistic about business expansion in Singapore followed by Indonesia and Thailand that were favoured by 45% and 43% of executives surveyed.

57% of the American companies looking for business opportunities in the ASEAN considered Singapore as their most preferred destination for regional marketing and administrative head offices and 43% favoured it for their innovation and R&D centre in ASEAN.

Several American corporations are critically assessing the USSFTA and RCEP synergy for making Singapore the primary hub to reach out to the vast ASEAN market. Besides the accessibility to a huge market and customer base, skilled workforce and diversified product portfolios have been considered to be the other two most important factors, the survey noted. 70% of respondents reasoned market access as the major driving factor while workforce and diversified product footprints were cited as the main cause by 53% and 40% of companies. Almost half of the surveyed participants expressed their desire to increase investment in Singapore over the next few years.

Singapore is also advantageous as a regional hub due to well-developed banking systems and other financial and logistics support services not readily available in other countries in the ASEAN. Many multinational banks in Singapore offer facilities to foreign entrepreneurs for opening a bank account seamlessly for Singapore company incorporation and meeting their financial needs in the Asia-Pacific region and beyond. US Companies incorporated in Singapore can also be 100 per cent owned by American companies.

A very competitive corporate income tax rate of 17% prevails in Singapore and profits realized overseas is excluded from taxation by the government. No capital gain or inheritance tax is also applicable to foreign American investors.

Besides all advantages, challenges are also being examined by the American businesses while considering Singapore for investment purposes. Amongst these challenges, the current global geopolitical instability reduced consumer spending and the health crisis was cited as the biggest challenges by 73%, 65% & 63% of people respectively. Acclimatizing the business model in the ASEAN was also cited as a great challenge by 68% of participants.

The US has been the worst affected by the coronavirus with the highest number of deaths and many ultra-rich families are becoming vulnerable and looking for a safer haven with world-class health and medical facilities. Singapore naturally comes as the first choice with zero counts of mishaps and high levels of control in combating the virus.

A new and innovative investment vehicle has also been introduced by the Singapore government last year, known as the Variable Capital Company, making it more attractive for American family offices and private equity firms. More than 260 VCCs have already been formed as per data available from the Monetary Authority of Singapore (MAS).

The number of single family offices in Singapore has increased by almost two times over the last two years as it is relatively easier for the ultra-rich to settle in Singapore. Google co-founder Sergey Brin and Shu Ping, the Chinese billionaire, have established family offices in Singapore. American Investment Management company, Bridgewater founder Ray Dalio recently announced establishing a family office in Singapore. The family office of late Microsoft founder Paul Allen also figures in the list.

The Singapore authorities are relentlessly striving to attract high-quality investors and UHNWIs from the USA and make the country the most desired destination for US high-tech multinationals.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group