- Newsletter, Saudi Arabia

- March 17, 2021

Qiddiya Investment Company (QIC) and the General Authority for Small and Medium Enterprises (Monshaat) in the Kingdom of Saudi Arabia came into an agreement and signed two memoranda of understanding (MoUs).

The agreements are intended to enhance bilateral cooperation between the two entities and provide QIC with access to the “Jadeer” portal, the database of local SMEs, and develop Qiddiya as a destination that provides an open and supportive business environment for SMEs.

Philippe Gas, the CEO of QIC noted, “These two MoUs reflect our continuous effort to enhance cooperation and strategic partnerships with local entities involved in national transformation, in line with the ambitions of Saudi Vision 2030.”

Gas also emphasized, “These MoUs mean that local SMEs will be able to easily access information about the Qiddiya project and the numerous opportunities available in QIC.”

The comments were made after the deal with Monsha’at Governor Saleh bin Ibrahim Al Rasheed was signed off by Philippe Gas of QIC.

Governor of Monshaat Eng. Saleh bin Ibrahim Al-Rasheed remarked, “These MoUs highlight Monshaat’s keenness to enhance cooperation with the public and private sectors and to create an environment that stimulates the growth and prosperity of small and medium-sized enterprises.”

He stressed, “It will help to increase competitiveness and will contribute to the development of local entities by boosting and developing the standard of SMEs in the Kingdom.”

“It will also support them to reach the opportunities provided by the public and private sectors, including those offered by QIC”, the Governor also highlighted.

Under the first MoU, QIC will provide Monshaat with commercial opportunities across the key sectors of hospitality, tourism, and entertainment encompassing all areas of the business such as contracting, supply, logistics, IT, maintenance, public services, and many more.

Certain conditions will need to be fulfilled by service providers, that will help Monshaat to rehabilitate SMEs and formulate policies, standards, and strategies to raise the productivity of these enterprises and increase their contribution to the GDP.

This will eventually enhance the contribution of local entities to the major projects which are presently being implemented in the Kingdom and are in the pipeline for implementation after their company registration in Saudi Arabia.

Monshaat will help QIC build its innovation center that would benefit from Monshaat’s experience in this field and will also give QIC access to its research facilities and centers.

Moreover, Monshaat will provide access to Qiddiya of statistical information to be used in developing Qiddiya’s various project sectors.

The second MoU will give Qiddiya access to Monsha’at’s “Jadeer” portal, a database of SMEs operating in the Kingdom of Saudi Arabia and categorized by sector including a list of emerging companies that benefit from business incubators.

This access to the digital and research facilities of Monsha’at will give Qiddiya easier communication between QIC and other entities in sectors where there exist opportunities for collaboration and will also improve the decision-making process for the QIC and make it an attractive environment for SMEs and emerging companies.

This initiative comes as an important recognition of Saudi Arabia’s broader economic and social outlook focusing on boosting SMEs to a level that they can contribute significantly to Saudi gross domestic product by 2030 through meaningful business collaboration with foreign entities aspiring for new business setup in Saudi Arabia.

- Newsletter, U.A.E

- March 17, 2021

Abu Dhabi National Exhibitions Company (ADNEC) and Expo Tel Aviv, the leading exhibition center of Israel, enters into partnership to encourage and promote further collaboration and cooperation in the business of travel and tourism sector in the region. The MOU signed will help in identifying and capitalizing on the business opportunities for the Middle East’s business tourism sector and will facilitate new business setup in Abu Dhabi.

The Memorandum of Understanding (MoU) signed between the two leading exhibition centers will forge a relationship and enhance their respective new business pipelines and increase opportunities for collaboration at both venues as reported by the state news agency.

The MoU demonstrates the greater spirit of cooperation between the United Arab Emirates (UAE) and Israel. The agreement was signed at a virtual signing ceremony between Humaid Matar Al Dhaheri, Managing Director and Group CEO of ADNEC, and Tamir Dayan, CEO of Expo Tel Aviv.

Humaid Al Dhaheri in his comments about the agreement added, “Our relationship with Expo Tel Aviv will enable the wider growth of the business tourism sector in the UAE and wider region, which ADNEC consistently seeks to promote. This strategic partnership showcases ADNEC’s efforts in fostering intraregional cooperation and will offer new developments for the transfer of knowledge to local audiences. Through this partnership, we aim to foster innovation and business opportunities between our two nations.”

Al Dhaheri remarked, “Additionally, this partnership will continue to boost ADNEC’s leading status as a key destination for business tourism. Our efforts to identify opportunities for collaboration with a range of regional and global partners are ongoing, strengthening the Middle East’s and the world’s business tourism sector.”

Tamir Dayan of Expo Tel Aviv remarked, “The Abu Dhabi National Exhibitions Company and Expo Tel Aviv provide models for regional leadership in the business tourism sector. Our mutual expertise in the design, delivery, and execution of world-class events makes us natural partners. Israel and The Emirates will probably be the first countries in the world to be vaccinated against the coronavirus and lead the exhibitions industry forward and now through this MoU, we are aiming to foster our cooperation, providing further opportunities for the transfer of knowledge and expertise between our two entities. My colleagues and I look forward to working with our Emirati partners in identifying and capitalizing on new opportunities for the Middle East’s business tourism sector, and welcoming new visitors from the UAE and beyond in Tel Aviv.”

ADNEC is committed to encouraging and promoting regional collaboration in the business tourism and events sector in the region, which is evident from a range of agreements and partnerships that have been signed with other countries in the Middle East. The continued focus of ADNEC on encouraging and exploring the greater outreach opportunities with event organizers and associations in Israel at the backdrop of the historic signing of the Abraham Accords in 2020 will provide new opportunities for pan-regional collaboration and cooperation including Israeli foreign investments by encouraging business entities to explore how to start business in Abu Dhabi Global Market.

Municipally owned Expo Tel Aviv is the leading and foremost international convention center in Israel’s leading and center city of an economy, commerce, culture, and media. The center hosts approximately 400 events every year that include both local and international conventions and exhibitions, along with events, fairs, and shows. Founded in 1933, the Expo Tel Aviv International Convention Centre houses eight pavilions and 20 conference halls, 45,000 sqm of exhibition and conference space. A 400 room hotel is also currently being developed. Expo Tel Aviv attracts over 3 million visitors each year and also hosted and broadcasted the 2019 Eurovision Contest to 200 million viewers across the globe.

- Article, Singapore

- March 11, 2021

The company law in Singapore mandates that as a business owner, you must appoint a Company Secretary responsible for compliance with all applicable laws and regulations. The Secretary also keeps all the company board members informed of their legal responsibilities towards the company and provides directions on how they should operate. Commonly termed as the compliance officer of a business entity, how to change corporate secretary Singapore calls for a well thought out judgment.

There are times when as a business owner you are not happy with the performance of your company secretary and are forced to replace him/her with someone better. Though unpleasant, you might need to dispense your company secretary and engage someone else. The procedures involved in changing your Singapore company secretary are sometimes long and tedious and it is always your best option to take external help from company secretary services Singapore.

When does the need for changing your Singapore company secretary arise?

It is not uncommon for companies to consider how to change corporate secretary Singapore. There may be many reasons that compel you to change your company secretary however the main ones are

- The company secretary is not dedicated and often unreachable after office hours.

- The secretary can not handle compliance and administration simultaneously and effectively.

- The company secretary can not keep the company functions aware of their impending company law deadlines e.g. accounts not informed timely on filing returns to regulatory authorities.

- The information given on company-related matters is incomplete and inaccurate.

- The secretary fails to maintain appropriate documentation and compliance on company legal matters.

- The remuneration of a company secretary is high and unreasonable.

What are the procedural requirements for changing your Singapore company secretary?

Before arriving at your final decision on how to change corporate secretary Singapore, it would be a wise move to directly communicate with your company secretary for understanding his/ her points and resolving the issues. Also, take the views of other management professionals of your company about the performance including collecting procedural information from company secretarial services Singapore. The decision for removal shouldn’t be subjective, rather needs to be founded on facts and figures.

Is it a mutually agreed separation with your Singapore company secretary?

It becomes easier and simpler when the company secretary is convinced and agrees to the decision of being removed from the company. It is then a straightforward process with any concern about how to change corporate secretary Singapore and only needs some documents to be organized.

- The resignation letter from your Singapore company secretary.

- A resolution in black and white from the Director.

Once these requirements are arranged, ACRA needs to be notified about the resignation. The transition including shifting over the responsibilities and sharing g of administrative records can take place at a later date.

Is it a forced separation with your Singapore company secretary?

As the business owner, you possess the right to dispense with your appointed Singapore company secretary, even when she/he may not agree and refuse to leave. This may lead to some complications and turns unpleasant when a secretary has to be removed without his/her consent.

Before deciding on how to change corporate secretary Singapore, it would be better to inform the company secretary in advance about your decision to remove him/her. The removal necessitates passing a board resolution to remove the company secretary. Once the resolution is done, you need to inform ACRA about the removal of the company’s secretary. It is also necessary and important to file a cessation within 14 days after the removal. ACRA will impose a late lodgement fee in case the company fails to update timely and within the prescribed time frame.

Conclusion:

A Singapore company secretary is crucial to your businesses in Singapore as ACRA attaches a lot of importance to company secretary policies. Hence, any decision on how to change corporate secretary Singapore must be made at the right time and place as it wouldn’t be prudent to remove him/her during AGM preparations and other important business proceedings.

- Newsletter

- March 7, 2021

On 5 January 2021, in a landmark declaration and signing of ‘solidarity and stability’ agreement during the 41st GCC Summit held in the city of Al-Ula; the UAE, Saudi Arabia, Bahrain, and the rest of the Gulf Cooperation Council (GCC) member states, including Egypt, signed the “Al-Ula Declaration” of ‘solidarity and stability’ marking the end of a three and a half year trade and diplomatic restrictions against the State of Qatar, severed on 5th of June 2017.

Although the “Al-Ula Declaration” has not been formally made public, re-establishment of political and economic ties between Qatar and other GCC countries including the UAE, Saudi Arabia, Bahrain, and Egypt has been made amply clear through the public statements made by senior Saudi, UAE, Egyptian, Bahraini and Kuwaiti officials.

Restoration of diplomatic ties with Qatar has led to the reopening of Qatar’s land, sea, and air borders to other GCC countries which were closed in the aftermath of diplomatic disputes resulting in the closure of airspace, land, and marine borders since 2017.

Qatar and Saudi Arabia share a land border that is now open for traffic including the marine borders between Qatar, Bahrain, Saudi Arabia, and the United Arab Emirates. The airspaces of Bahrain, Egypt, Saudi Arabia, and the United Arab Emirates are now open and the aircrafts originating from Qatar can enter others’ territory after the announcement was made.

Following the Al-Ula declaration, Saudi Arabia and the UAE have taken immediate steps to re-open all land, marine, and air passages for both inbound and outbound movements, to and fro, Qatar, and the concerned authorities in both countries have issued appropriate directives to this effect.

Resumption of air traffic between the UAE and Qatar happened from 9 January 2021 when the General Civil Aviation Authority (GCAA) of UAE declared re-opening of airspace stating that the GCAA would resume both scheduled and unscheduled flights between the two countries.

In similar efforts, on 8 January Abu Dhabi ports for Qatar vessels were opened and vessels were scheduled to depart the UAE for Qatar as the next port of destination.

Saudi Arabia too had announced similar measures that took effect from the evening of 4 January. The Civil Aviation Affairs (CAA) at the Ministry of Transportation and Telecommunications of Bahrain also announced the opening of Bahraini airspace for Qatar-registered aircraft, commencing 11 January. Similarly, according to the Egyptian Ministry of Civil Aviation, Egypt had reopened its airspace on 12 January, allowing Egypt Air and Qatar Airways as well as other Qatari airlines, to resume air traffic.

Trade and Business for both Qatar and the four GCC nation-states including Egypt look very promising in the near future which is also pointed out by S & P Global Ratings who added, ” We expect that the resolution of the boycott will support improvement in the region’s broader business and investment environment.”

In the wake of the restrictions imposed in 2017, most businesses in Qatar needed to re-strategize and reinvent their supply routes and procurement models to avoid the strategically located restricted jurisdictions including the UAE and KSA.

It is not only Qatar, during this embargo all businesses operating in the gulf had faced severe disruptions to transportation and supply routes, and workaround supply chains adversely impacted all businesses with higher operating cost and time.

Due to the recent development and lifting of the restrictions, it has now become paramount for businesses and organizations with operational presence in Qatar to realize and comprehend the implications of this trade development. It is believed that this recent agreement will present many opportunities to relook into the logistics and supply chain for optimizing overall business performance through business process reengineering and the right determination of customs and trade implications of such a supply chain and business model will be crucial for re-configuration.

Critically reviewing and assessing new supply chains with value stream mapping, businesses will identify how existing supply chains need to be changed for improved performance. Import duties and taxes can be an area of significant importance in optimizing the routing of goods around the GCC region.

As Qatar has introduced and demarcated several Free Zones, many multinational and GCC-based businesses should find the country economically preferable for new business establishments with access to numerous incentives to benefit from including tax holidays and customs duty reliefs on imports.

Businesses expected to reap the maximum benefit out of this deal will be the banking, import-export, travel and tourism, aviation, and hospitality sectors.

Even with the official lifting of the restrictions against Qatar, it is likely to take some time before the administrative decisions are enacted in full force and spirit to fully resume the shipment of goods between the Quartet and Qatar. The customs clearance protocols also need to be standardized. Though it would be too early to predict the outcomes, it will be a strong and important foundation for the economic prosperity and political stability in the GCC region. The 2022 FIFA world cup scheduled to be organized in Qatar will also act as a catalyst for the enhancement of business and trade.

- Newsletter, Singapore

- March 5, 2021

Effect of New Regulation on Existing DP Holders

From May 1, 2021, foreigners staying in Singapore on Dependant’s Passes shall need a work pass to work here instead of a Letter of Consent (LOC) issued from the Ministry of Manpower (MOM).

This new rule will need the employers of DP holders to apply for either an Employment Pass (EP) or S Pass or work permit for them as the case may be, subject to similar requirements applicable to other foreigners as relevant qualifying salary, dependency ratio ceiling and levies. For spouses and family members already working in Singapore, this new rule of work pass requirement will come into force once their current letter of consent expires. On the expiration of LOC, employers of DP holders must apply for an applicable work pass if they wish to continue hiring them.

Reasons for Introducing New Regulation

Manpower Minister Josephine Teo announced the change on Wednesday, 3rd March 2021 during the parliamentary debate on her ministry’s budget, saying that it is “for consistency with recent work pass moves” facilitating the transition to work pass and alignment with other foreign workers. The move is intended to bring consistency to the work pass framework, said the ministry.

Mrs. Teo also set out her ministry’s priorities in managing the foreign workforce and balancing the need for foreigners in some sectors while strengthening the Singaporean core, which several MPs had asked about. The Local Qualifying Salary used by MOM is aimed at determining if local workers are meaningfully employed and not just given token salaries and allow the employer to hire foreign workers.

She said: “Our fundamental objective is always to serve the interests of Singaporean workers. Access to foreign workers is meant to help grow a larger economic pie than we otherwise can. Therefore, the foreign workforce must act as a complement to our local workforce.”

Minister Josephine Teo noted, “We will provide sufficient time for existing DP holders working on a LOC, as well as their employers, to transit to this new arrangement. Most of them meet prevailing work pass criteria. Those that do not will have to cease working in Singapore.” She also highlighted that most of the DP holders do not work during their stay in Singapore and represent only about 1 percent of all work pass holders.

As for skilled foreigners on Employment Passes, MOM aims to ensure.

- Foreign professionals complement locals, and

- Employers practice fair hiring and improve the diversity of their foreign professionals, managers, executives, and technicians.

Existing Regulation

An Employment Pass or S Pass holder must earn a fixed monthly salary of at least SGD 6,000 to bring their spouse or unmarried children under 21 years old to Singapore on Dependant’s Passes.

Presently, dependents of S Pass holders only need to apply for a relevant work pass if they want to work in Singapore, while dependents of skilled foreign professionals or entrepreneurs on Employment Passes, EntrePasses, or Personalised Employment Passes can apply for a LOC.

Effect of New Regulation on Existing DP Business Owners

With this new rule coming into force, only DP holders belonging to the ‘business owners category’ can work using a LOC, and only if.

- They own at least 30 percent of the company shares as a sole proprietor, partner, or company director and

- Their business creates local employment. They must employ at least one Singaporean or permanent resident earning at least the prevailing local qualifying salary of SGD 1,400 and make contributions to the employee’s Central Provident Fund accounts for at least three months.

Effect on ‘Would Be’ Business Owners

Applying for an Employment Pass (EP)

Applying and receiving an EP pass to work in Singapore include the following.

- You need to secure a job offer first

- The employer puts an application online on behalf of you for the EP with supporting documents

- Approval and Issuance of EP in your name

- Renewal of EP after 2 years for the first time and then subsequent renewals every 3 years

Increased Salary Requirements for EP

The salary requirements for Employment Pass holders were raised two times last year, from SGD 3900 to 4500 and at least SGD 5000 for individuals working in the financial sector in a bid to tighten the framework. The S Pass qualifying salaries were also raised.

The qualifying salaries for older and experienced EP applicants in the age bracket of 40 years and above were also raised to almost double the minimum qualifying salaries of younger EP applicants.

The MOM has also tightened other rules on family members of foreigners discouraging them to come to Singapore on DPs or long-term visit passes, according to Straits Times.

The S Pass policy has been tightened in the previous two years with sectoral quotas being curtailed and the qualifying salary raised twice last year.

The qualifying salary for EP holders was raised twice during last year, and the ministry will explore possible refinements, Mrs.Teo added.

Enhancement of Capability Transfer Programme to further boost Skill Transfer to Locals

An extension of the Capability Transfer Programme has been planned for another three years, until end-September 2024, to ensure effective skills transfer to locals.

The program was originally launched in 2017 and provides up to 90 percent funding for a company or industry projects to bring in foreign specialists to train locals or send local workers on overseas training attachments especially in the areas Singapore doesn’t have much expertise.

About SGD 5 million has been budgeted so far to support projects in 20 sectors, noted Mrs. Teo, also adding that the program remains a useful complement to other schemes that support company transformation and the development of local Singaporeans.

In his last month’s Budget speech, DPM Heng announced this extension of the capability transfer program. He highlighted that as at the end of last year, more than 140 companies and over 970 Singaporeans and permanent residents have benefited, or are expected to benefit, from 40 projects under this scheme.

Mrs. Teo also said that the purpose of this program extension is to encourage greater take-up of the program however adding that the Government reviews all of its business support schemes from time to time to streamline them.

Likely Modifications to S Pass and Employment Pass in Recent Future

For the S Pass holders earning a fixed monthly salary of at least SGD 2,500, the employers should expect further changes to rules over this decade, said Mrs. Teo.

S Pass policy has been tightened over the last two years, with sector quotas being cut and the qualifying salary being raised twice last year. Deputy Prime Minister Heng Swee Keat declared a cut in the manufacturing sector S Pass quota from 20 percent to 15 percent by 2023 in the Budget speech last month.

She said that MOM will focus instead on helping companies become more manpower-lean while strengthening their Singaporean core.

She remarked that periodic adjustments will continue to be made to the local qualifying salary, as the minimum salary for locals to count towards a firm’s headcount in calculating the work permit and S Pass quota, to ensure locals are not hired on a token salary. It will not be increased this year to give firms time to recover from the impact of the Covid-19 pandemic.

The salary threshold is by no means a perfect gatekeeper of quality, but it is easy to understand and administer,” she said.

She explained that this method is favored over an EP quota, which would limit Singapore’s ability to compete for the most cutting-edge investments amid the worldwide shortage of tech and digital skills, hurting Singaporeans’ longer-term career prospects.

She added that implementing levy charges for EP holders, as Non-Constituency MP Leong Mun Wai of the Progress Singapore Party called for last week, may not be useful either since companies can employ overseas knowledge workers remotely.

Mr. Leong asked during the budget session whether Singaporean workers have been disadvantaged because foreigners do not have to make Central Provident Fund contributions, and there is no requirement for succession planning when firms apply for grants.

Mrs. Teo replied that last year, amid the pandemic, the foreign workforce contracted by over 180,000 in number and the local workforce grew modestly.

- Article, Singapore

- March 1, 2021

Are you already thinking of expanding or starting your business in Singapore? What is the first thing that pops in your mind? A modern office space with a neat lobby and beautiful interiors? Everything beautiful has its price. Why pay exorbitant rental bills for office space when you can support your business from the comfort of your home?

Nonetheless, for incorporating your company in Singapore, the most important credential is a registered business address. People who are just starting or expanding to new locations in Singapore must read on to know the answer to all their questions.

How can I incorporate without going for physical office space?

We all know that Singapore has a space crunch, and not all businesses can afford a physical office because of very little revenue to spend on an expense that can be so easily avoided. We recommend going for virtual office spaces.

Virtual office spaces are not only manageable financially, but they also give a boost to your business when employees can work from their homes from any corner of the world. IMC can help you attain one such space for your business. There are various packages for such a subscription, and it generally includes a registered business address, communication services like phone and receptionist services, mailboxes, and mailing address.

If you plan to incorporate without a physical address, then virtual office spaces might be the answer. You can own a physical space without coming to the office and paying rent for the entire office space. Meanwhile, you can also carry out all your business using the internet. Whenever a communication arrives at your mailing address, we will let you know.

Is Virtual Office considered for Incorporating a company in Singapore?

A virtual office with a registered business address is as real as a physical office space in Singapore. You might have many doubts because we understand that it might be difficult to buy what we are saying. To strengthen what we are saying, we will state the ACRA’s criteria for your business’s physical space.

- The address of the office must be a physical location situated within Singapore

- The physical office space should be accessible by anybody for at least 5 hours every day

Guide to Incorporating Your Business in Singapore: Essential Checklist

Tips on Choosing the best virtual office space

1. Rental costs on a physical space

Saving costs on a rental space can be the top of your mind priority if you start small. If you have an internet business with digital services only, then a virtual office space might do wonders for you. On the other hand, if you are a business that needs most of your staff to be present in the office to conduct business, then a virtual office space might not be of use to you.

Moreover, while selecting your virtual office space package (which can range from a few hundred dollars to thousands of dollars), read the services offered to you in the package. Companies that do not provide the mailing address as a part of the package and ask you to top it up with these services with extra charges applied.

2. Work from home is a choice, not a necessity

3. If you want a work culture that should be flexible even when your business is small and still growing

4. The quality of services provided

5. Privacy

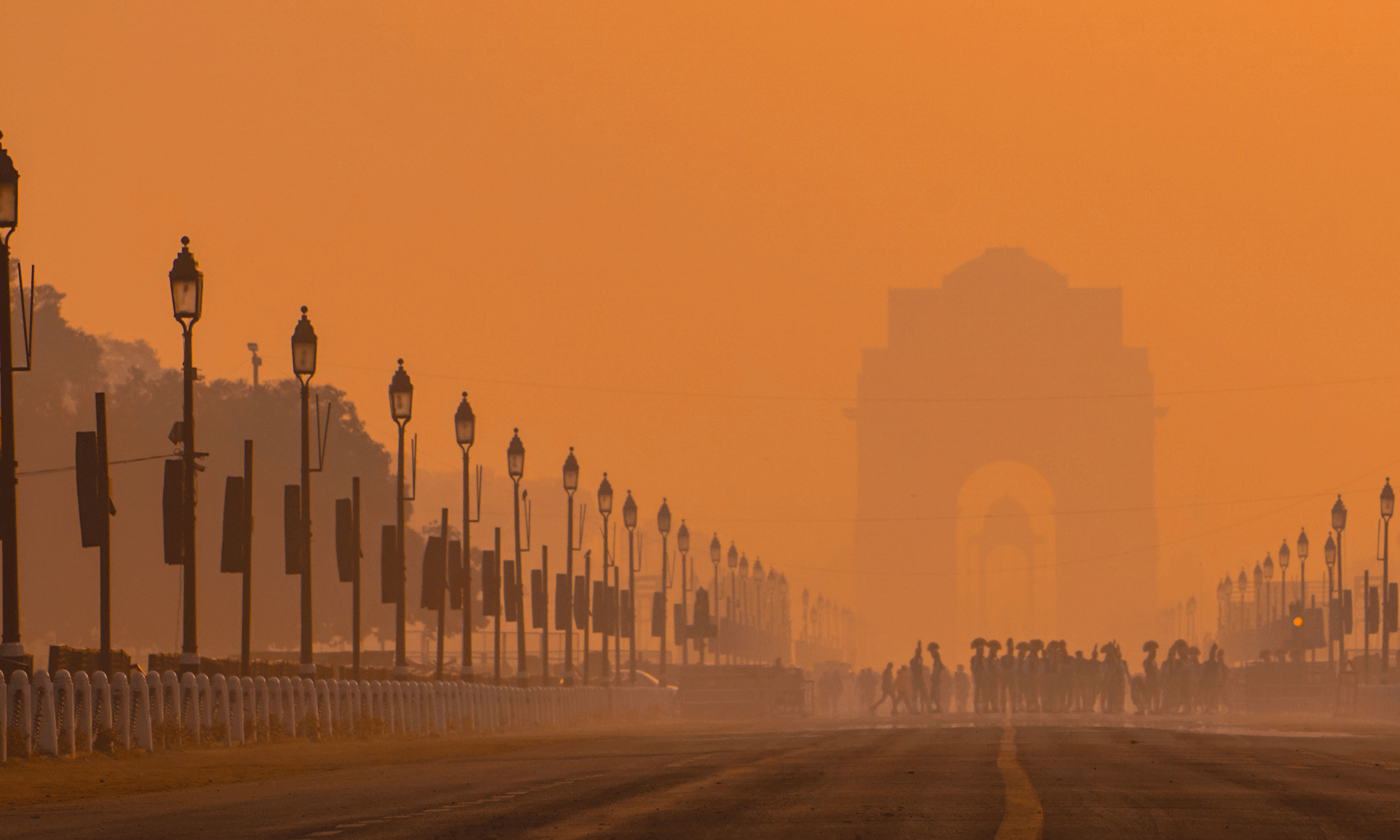

- Article, India

- February 20, 2021

Summary

The United Kingdom and India enjoy long-standing business legacy and deep-rooted diplomatic and economic ties with a strong existing robust bilateral investment relationship that is all set to further flourish during the post Brexit era and boost up UK’s investment for many new India company incorporation.

How is UK India Business Relationship?

Several facts and figures available from the UK India Business Council demonstrate the strength of the relationship and the strong business ecosystem the private sector companies have built-in India. From 2000 to 2016, the UK invested approximately $24 billion in India and increased its investment by almost 8 per cent. between 2015 and 2016. The UK also ranked as the largest of all foreign investors into India.

The operating environments in both countries are congenial to mutual investment and business relationships. An ongoing focus on ease of doing business is expected to give huge dividends.

A Bilateral Investment Treaty providing, protecting and promoting FDI flows would be the harbinger towards a long-term UK-India trade and investment relationship where lots of future scopes exist that can mutually benefit the two countries and enable the potential of both the economies to be realised in the fullest extent. It is also noteworthy that both governments are striving hard to push the pace of their country’s economic development.

The long legacy and historical ties have put India as one of the preferred business destinations for many UK companies, and the UK Government is firmly committed to promoting its existing investment relationship with India, world’s largest democracy and marketplace with great economic powers.

There has been a sharp increase in the number of UK companies entering India since 2000 and the number of new business incorporations over the last two decades greatly outnumbered those that took place in the entire 20th century.

Why an UK Investor Should Register and Incorporate a Company in India?

Following are some key reasons prompting the UK investors for a business set up in India

1. Improved Ranking in Global Competitive Index

2. Improvement in Ease of Doing Business Index

3. Make in India and Swachh Bharat, Clean India Campaigns and Digital India Initiative

4. Improvement in Online Application System for starting a business

5. Betterment in Credit Access

6. More Transparent Payment of Taxes

7. Introduction of GST for a more uniform tax system

8. Improved Legal System

9. Greater Political Stability

10. An young and talented workforce

What Should be the Market Entry Strategy in India?

A private limited company formation is the commonest, easiest and fastest type of Indian market entry strategy for foreign nationals and foreign companies with 100 per cent foreign direct investment into a private limited company or limited company under the automatic route where no Central Government permission is needed. Thus incorporation of a private limited company as a wholly-owned subsidiary of a foreign company or joint venture is the cheapest entry strategy for foreign companies and foreign nationals into India.

A private limited company provides limited liability protection to its shareholders and In the event of any unforeseen losses giving rise to statutory or legal liabilities, the shareholders of the company are not held responsible. Private limited companies can raise equity capital from prospective persons or entities interested in becoming a shareholder. Companies can also raise money from angel venture capital firms, private equity firms, hedge funds and arch investors. Debt financing from banks, NBFCs and other financial institutions are also possible.

How do UK Investors Register and Incorporate a Company in India?

The registration and incorporation of a private limited company can be done in less than two weeks subject to the availability of the following documents.

- PAN Card

- Residential Proof

- Authorization letter from the Landlord of registered office space

- Address Proof

- Registered Office Proof

- Proof of any utility service like telephone, gas, electricity, etc.

The procedural steps on how to register private limited company in India are documented in details online and include the following

Step 1. Submission of Application for digital signatures to eMudhra

Step 2. Submission of Name Approval Request to MCA

Step 3. Preparation and collection of incorporation documents based on the MCA approved name

Step 4. The signing of incorporation documents by all Directors & Shareholders

Step 5: Submission of incorporation documents to MCA for approval

Step 6. Incorporation of the company

Step 7. Issuance of incorporation certificate & PAN

The Fine Print

The Indian government is putting all-round efforts to protect and promote FDI inflows and promising to secure a long-term UK-India trade and investment relationship and help close existing gaps and enable the full potential of both the economies to come to a success.

The UK is constantly seeking to build strong relationships with India after Brexit by realizing the enormous business opportunities due to the recent announcement of India government’s manifesto proposing to spend more than £1 trillion on infrastructure and nearly £10 billion for farming with continued policy reforms. The results should be positive for companies in housing, transport, construction, property, agriculture and financial investment sectors.

- Article, U.A.E

- February 19, 2021

ADGM Background

Abu Dhabi Global Market is an award-winning international financial centre and free zone located on Al Maryah Island in the heart of Abu Dhabi. Its strategic location helps to serve the growing economies of the Middle East, Africa and Asia.

Since the time it came into operations in 2015, it has gained immense global recognition for its robust, progressive and responsive business-friendly ecosystem. Besides, it is an ideal location for businesses operating in the financial sector, particularly private banking, wealth management, insurance and asset management.

Some of the compelling reasons to consider setting up a company in ADGM are 0% corporate and personal tax, 100% company ownership, 100% repatriation of capital and profits, 100% import and export tax exemption and no currency restrictions.

Legal Framework of ADGM

The ADGM free zone is governed by its own rules and regulations and is controlled by three independent authorities – the Registration Authority, the Financial Services Regulatory Authority and the ADGM Courts.

ADGM came into existence in accordance with Federal Legislation and Abu Dhabi Legislation including Abu Dhabi Law No. 4 of 2013 with its own civil and commercial laws. The free zone offers a world-class legal system and regulatory regime.

Setting Up in ADGM

The four broad categories of businesses that can set up in ADGM are financial businesses, non-financial businesses, retail and Special Purpose Vehicles. Let us see each category in detail.

1. Financial Business

As an International Financial Centre, ADGM offers a conducive environment to financial businesses along with the geographical advantage of serving growing economies. Let us see, which type of companies can set-up under financial business.

Banking

- Corporate and transaction banking

- Private banking and wealth management

- Investment banking

- Money service business

- Digital banking

Wealth and asset management

- Investment management

- Funds and fund management

- Asset servicing

- Virtual assets activities

- Securities

Capital markets

- Brokerage

- Market infrastructure

FinTech

- FinTech

- RegLab

2. Non-Financial Business

Along with financial businesses, ADGM also provides a legal and operational platform for non-financial businesses. Let us see, which type of companies can set-up in ADGM under non-financial business.

Corporate

- Corporate headquarters

- Corporate treasury

- Family offices and foundations

- Professional services

- Tech start-ups

- Associations

3. Retail

ADGM also offers a dynamic environment for retail businesses. Some of the permitted retail activities in Al Maryah Island include wholesale and retail trade, manufacturing, transportation and storage, repair of motor vehicles and motorcycles, accommodation and food service activities, scientific and technical activities, information and communication, arts, entertainment and recreation and administrative support service activities, among others.

4. Special Purpose Vehicles (SPVs)

SPVs are passive holding companies that come into existence with an intention of isolating financial and legal risk by ring-fencing certain assets and liabilities. The SPV regime at ADGM

Procedure to Set-up in ADGM

If you are looking to set-up in ADGM, there are various options available for you. You can incorporate as a business limited by shares where you will need at least 2 directors, or you can open a branch of the company which is already established in the UAE or any other foreign country.

When you decide to set-up in ADGM, you will be required to fill up an online application form through ADGM online registry solutions. You can also opt to apply offline by paying some extra fees.

The ADGM registration process is as follows:

- Before filling and submitting the business application form, you will be provided with a special business development team to discuss the requirements of your business.

- After receiving the approval from the authorities, you need to fill up the online registration or incorporation form and submit the required documents mentioned in the form.

- On receiving approval, you will be issued a commercial license within a week.

- In order to proceed with the visa processing, you need to apply for a FAWRI account and Establishment Card.

So, this was a brief process of setting up a business in ADGM. However, the specifics of the process largely depend on the kind of business you wish to carry on, type of license and so on. Therefore, it is advisable to consult an expert who can guide you through the entire process and ensure smooth and timely incorporation.

For any assistance related to business set up and allied services in ADGM free zone, you may get in touch with IMC Group.

- Article, Singapore

- February 17, 2021

To run a business effectively, the owner needs to make certain changes, adaptations, and improvisations from time to time. These changes give rise to expenditures. Apart from these, businesses also have to bear certain fixed costs. So, business expenses are those that one needs to pay for running the business smoothly. While preparing the annual returns, most organizations calculate their expenses that encompasses all the business expenditures, fixed or variable, to make sure that the total income is minimized.

However, most of our expenditures cannot be recognized as deductible expenses. Before discussing the list of deductible or non-deductible expenses, you should know the basic difference between the two.

So, all the expenses that can be deducted from a business’s income before it is subjected to taxation are known as deductible expenses. Whereas all the expenses that cannot be subtracted from a business’s income before taxation are known as non-deductible expenses.

Deductible expenses help in reducing one’s tax liability. A non-deductible expense, on the other hand, does not affect your tax bill. Expenses that are always deductible include investment losses, charitable contributions, etc. A business can claim a tax deduction only if the expenses are exclusively and wholly incurred in income production. Still there, are some complexities to comprehend the distinguishment in expenses.

For expenses to fit into the category of deductible expenses, it needs to satisfy the following conditions:

- Expenses that are solely incurred in the production of income.

- Expenses that are not a contingent liability, i.e. it is not dependent on any event that may or may not occur in the coming future. In other words, expenses must be incurred. An expense is said to be ‘incurred’ only when the legal liability to pay such expense has arisen, regardless of the actual payment date.

- Expenses that are revenue, and not capital, in nature.

- Expenses that aren’t specifically prohibited from deduction under any provisions of the Income Tax Act.

Non-deductible business expenses are those which do not fulfill the above-mentioned conditions. This includes your personal expenses like travel, leisure, entertainment, basically that are not related to the running of your business, and capital expenses that are expenses incurred for incorporating a company’s purchase of fixed assets. A vast majority of your personal spendings are non-tax-deductible. The tax authority considers does not consider natural expenditures in favor of a reduction in the amount of money you are having at your disposal. Deductible expenses, for example, a loss resulting from office embezzlement or stock trading, for instance, are considered to actually reduce the amount of income you effectively earn, thereby resulting in a lower base of tax.

Deductions considered as context-specific

Several expenses can be deducted from your income only under specific cases. Like, money spent on clothing expenses is deductible, only up to a certain specified limit, if it can be deemed a business expense. Healthcare spending is a deductible expense, only up to the extent where it doesn’t exceed 7.5 percent of your adjusted gross income. The canvas, brushes, and oil you purchased for your paintings are deductible only if you can demonstrate that you were treating the art of painting as a money-making venture and not a hobby, for instance.

Therefore, tax-filers usually must necessarily go through the relevant section of the tax code or consult a professional tax accountant before they can actually determine if a particular expense is deductible or not.

Itemizing Your Deductions

Note that even if you have deductible expenses, itemizing your deductions is crucial before subtracting these from your actual taxable income. For individual filers, this implies filling out Schedule A, where you are required to list and add up all of your deductible expenses for the financial year you are filing the return for. The Internal Revenue Service of Singapore permits you to take a “standard deduction” if you have decided not to itemize your deductible expenses.

The standard deduction assumes that even those filers who don’t wish to take the time and effort for itemizing deductions will most likely have deductible expenses and allows them to reduce their gross income by some standard amount depending upon their marital status and age. It is an extremely convenient solution for those filers whose itemized deductions would fall below or only slightly exceed the standard deduction.

Let’s consider certain examples of Deductible and non-deductible expenses.

Deductible Expenses

- Accounting fee

- Administrative expenses

- Advertisement

- Auditors’ remuneration

- Commission

- CPF, foreign workers’ levy, skills development levy

- Directors’ fees

- Directors’ remuneration

- Employee Equity-based Remuneration (EEBR) Scheme

- Employment Assistance Payment (EAP)

- Entertainment

- Exchange loss (revenue and trade in nature)

- Exhibition expense

- Periodicals & newspapers

- Postage

- Printing and stationery

- Property tax

- Provision for doubtful and bad debts

- Provision for obsolete stocks (specific)

- Secretarial fees

- Staff remuneration (Salary, bonus, and allowance)

- Staff training

- Staff Welfare/Benefits

- Statutory and regulatory expenses

- Stock obsolescence

- Supplementary retirement scheme

Non-deductible expenses

- Amortization

- Bad debts (non-trade debtors)

- Certificate of Entitlement (COE) for vehicles

- Depreciation (you can claim capital allowances in its place)

- Dividend payments made on preference shares

- Donation

- Impairment loss on non-trade debts

- Singapore income tax and any tax levied on an income from a country outside Singapore

- Installation of fixed assets

- Interest expenses on non-income-producing assets(Interest adjustment)

- Legal and professional fees (capital or Non-trade transactions)

- Medical expense (amount exceeding 1%/2% of total remuneration if a company is under PMBS or TMIS

- Motor vehicle expenses (RU-Plated and S-plated cars)

- Penalties

- Prepaid expenses (not concerning the relevant basis period)

- Domestic and Private expenses (which are not incurred for business purpose)

- Private hire car

- Provision for bad and doubtful debts (Note impairment loss on trade)

- Provision of obsolete stocks (general)

- Ex-gratia retrenchment payments and outplacement support cost, where there is a complete business cessation.

- Transport (S-plated and RU-plated cars)

- Newsletter, Singapore

- February 11, 2021

A free trade agreement (FTA) between the United Kingdom (UK) and Singapore has come into force since the 1st of January 2021, enacting companies to derive the same trading benefits even when the UK leaves the European Union.

The EU-Singapore Free Trade Agreement is not applicable any further for trade between the two nations as soon as the new deal kicked in, noted the Singapore Ministry of Trade and Industry (MTI).

The UK is Singapore’s third and second-largest trading partner for goods and services and also the top investment destination in Europe. Singapore, on the other hand, becomes the UK’s largest trade and investment partner in South-east Asia and many UK citizens opt for Singapore company incorporation.

The UK-Singapore FTA was signed on December 10th, 2020 by Minister for Trade and Industry Chan Chun Sing and UK Secretary of State for International Trade Elizabeth Truss.

The Ministry of Trade and Industry (MTI) said the UK-Singapore FTA offers certainty and clarity in trading arrangements between both countries.

Both countries completed their respective domestic procedures for the FTA’s provisional application that allowed them to make provisional treaty commitments until the FTA got vetted by both countries.

The most relevant features of this FTA include the elimination of tariff for goods trade, EU & ASEAN combination, business-friendly rules of origin, waiver of technical and non-tariff barriers, enhanced market access to the services sector, more opportunities in government procurement, and enhanced intellectual property rights.

Similar timelines as in the EU FTA will be followed for tariff reductions with tariffs abolished for 84% of all tariff lines for every Singapore product entering the UK from January 2021. As agreed in the FTA with the EU, the remaining products will be freed from tariff from 21 November 2024.

As agreed with the EU, Singapore and UK companies will continue to use EU materials and parts in their exports to each other’s markets. Similarly, materials and parts used by Singapore and sourced from other ASEAN member states may also qualify under liberal rules of origin for exports to the UK supporting bilateral trade between the two countries.

The UK Singapore FTA removes unnecessary barriers to bilateral trade between the two countries and focuses on reducing overall costs of exports for Singapore and UK business entities. The primary purpose is to ensure a level playing field for companies from both countries and enhance trade between Singapore and the UK. Electronics, automotive and parts, renewable energy, pharmaceuticals, and meat and meat products are the main sectors to benefit from this FTA.

Asian food products from Singapore will receive greater market access in the UK and will get a tariff-free entry under flexible rules of origin. Though evidence is needed that these food products are manufactured in Singapore any need for proving the ingredients grown or produced in Singapore is not essential.

The trade agreement allows both countries to continue enjoying the benefits of comprehensive Intellectual Property Rights including copyright etc.

The UK FTA provides enhanced market access for service providers, professionals and investors, and will create a level playing field for businesses in each other’s markets. The agreement covers services such as architecture, engineering, management consultancy, advertising, computer-related, environmental, postal and courier, maintenance and repair of ships and aircraft, international maritime transport, and hotels and restaurant services.

The FTA will also support financial services businesses in both countries. Existing UK Banks in Singapore will be allowed to expand their businesses through more Singapore company formation for banking and other financial services.

The UK will also grant Singapore companies enhanced access to participate in UK government procurement opportunities at both the city and municipal level. Companies that will benefit include those in the transport, financial services, and utility sectors.

The UK Singapore FTA not only maintains the same benefits that Singapore and UK companies were receiving under the trade agreement with the EU but widens the opportunities for companies of either country encouraging businesses to utilize every available benefit.

Finally, with this agreement, Singapore and the UK have committed to start negotiations for a high standard investment protection agreement within two years of the FTA coming into force, and aim to conclude the negotiations within four years.

The Minister of Trade and Industry added, “This will ensure that our bilateral investments will be covered by robust and up-to-date treaty protections, and provide our businesses and investors with the certainty of investment protection.”

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group