- Article, U.A.E

- December 16, 2020

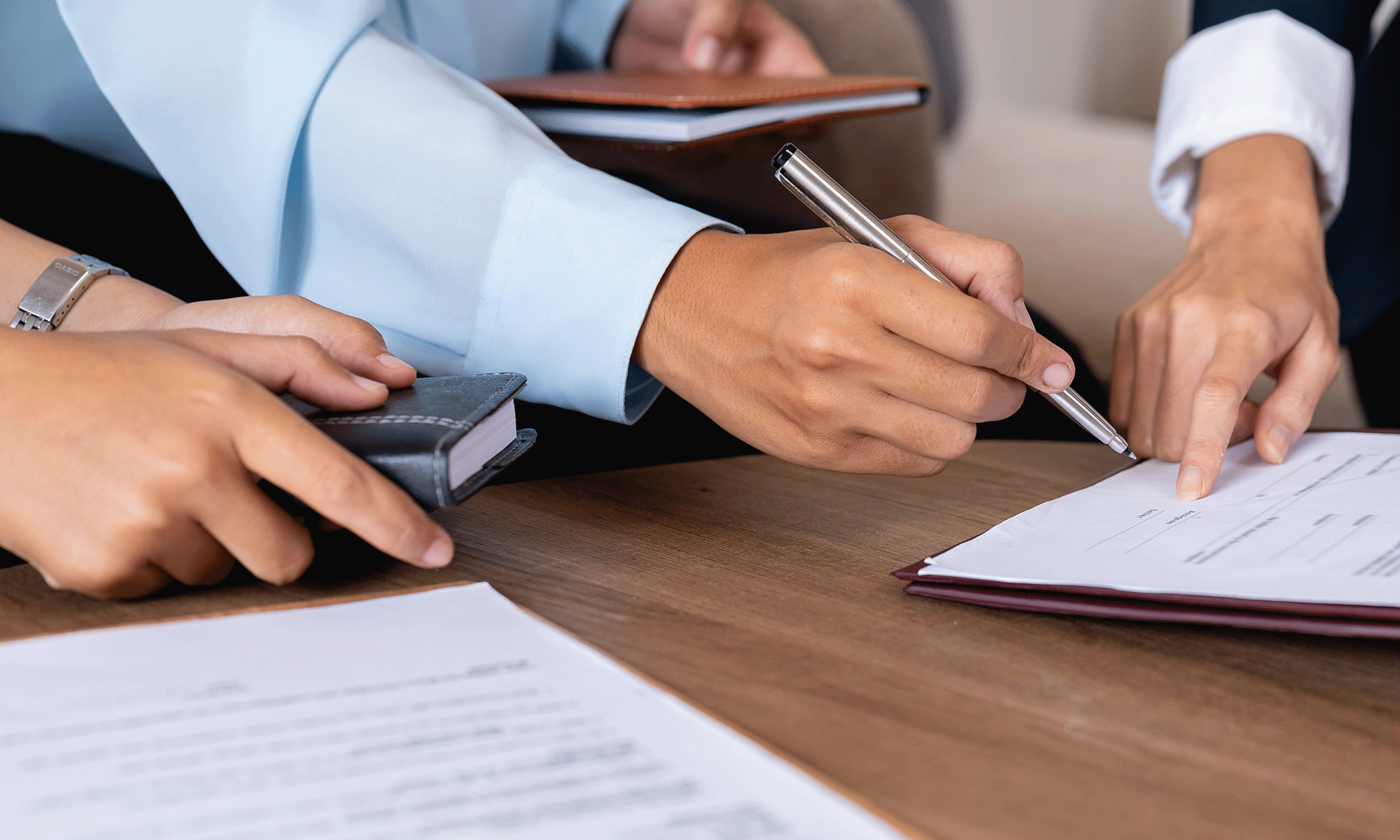

First time in history, the UAE Central Bank (CBUAE) has launched a new Regulation of new activity on “Loan Based Crowdfunding” in mainland UAE that spells out the rules for issuing Crowdfunding Licenses under the CBUAE.

Crowdfunding is the method of raising funds usually through the licensed online platforms to financially support projects, ventures and charities. It aims to amass small funds from a large number of individuals or organizations who invest in crowdfunding projects for a potential profit and reward.

Crowdfunding is typically technology-driven alternative finance of crowdsourcing that is witnessing rapid growth worldwide for both investors and businesses. The online crowdfunding platforms act as intermediaries raising funds from people instead of conventional sources of funds such as banks, mutual funds etc.

The regulation, currently in force was released recently and published in the official gazette on 28th of October 2020.

The CBUAE launched this regulation for loan based Crowdfunding Platforms (CFPS) operating in onshore UAE to license and regulate online platforms connecting lenders and borrowers. It also aims to support administering the resulting loans.

Equity and donation-based crowdfunding investment platforms are exempt from this regulation.

This Crowdfunding Regulation is fairly wide in scope and encompasses companies that are not based in the UAE if

- Incorporated or hosted in the UAE

- Use an address in the UAE for correspondence

- Provide Crowdfunding to the clients residing in the UAE

Crowdfunding platforms located outside the UAE including those based in the Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM) also come under the purview of this new regulation.

The crowdfunding company needs to be a company incorporated in the UAE under the Commercial Companies Law excluding Joint Partnership and Simple Commandite Company.

Depending on the category of license, there is a capital requirement of AED one million or AED 300,000. The crowdfunding company also needs to submit a bank guarantee equal to the value of the paid-up capital.

The same level of governance rules and oversight applies to a crowdfunding company as that of a regulated financial entity including the management fit and other appropriate criteria, internal controls, risk management, auditing and conflict of interest.

The crowdfunding companies must comply with all the applicable Emiratization requirements as and when required.

Every platform engaged in loan-based crowdfunding is categorized based on annual cumulative loans facilitated that dictates minimum capital requirement and are

- Category 1 with AED 5 million cumulative loans facilitated in a year

- Category 2 of smaller platforms with less than AED 5 million cumulative loans facilitated in a year

The borrower in crowdfunding activity needs to be a UAE registered company and can not be an individual, sole proprietorship or a company registered outside the UAE.

The regulation doesn’t impose any restrictions on the lenders onboard, however, grouped the lenders based on the financial status as

- Retail lender and not a market counterparty

- A market counterparty with evidence of assets exceeding AED 2 million outside of the primary residence with a self-attestation of being a market counterparty

The regulation imposes various obligations on the crowdfunding company such as assessing the suitability of lenders, anti-money laundering, borrower diligence and risk assessment through loan administration.

The regulation also specifies clear disclosure requirements for both the borrowers and lenders.

Individual and cumulative lending limits are also imposed for retail or market counterparty lenders as well as borrowing limits, AED 10 million per borrower in any financial year.

The crowdfunding funds must be held in segregated accounts with the UAE banks subjected to regular audits.

The regulation is a welcome move for the UAE’s financial industry and would increase the funding options for customers.

- India, Newsletter

- December 15, 2020

The year 2020 celebrates India-Vietnam 42nd bilateral trade anniversary. India Vietnam relations have been steadily growing marked by economic, commercial and strategic engagements over the past four decades. India ranks 7th in the list of top trading partners of Vietnam while Vietnam has emerged as the 18th largest trading partner of India.

The increasing trade and investment ties between the two countries have prompted many Indian companies making investments in Vietnam in various sectors.

By 2020 both countries had aimed for a trade worth USD 15 billion with trade growing considerably from USD 5 billion to USD 13.7 billion between 2016 and 2019. Covid 19 pandemic, however, disrupted global economies and the India Vietnam trade volume shrunk by 9.9 per cent to almost USD 12.3 billion in the last financial year. The steady and rapid growth in trade between the two countries can only be understood by the fact that it was only USD 200 million in the year 2000.

Unprecedented volatility has gripped the global investment and trade environment and forced businesses to diversify supply chains away from China and has made India Vietnam trade routes for international business more significant.

Major areas of focus in India Vietnam trade and investment include energy, food processing, sugar, tea, coffee, mineral exploration, manufacturing, IT, agrochemicals and automotive components.

India is one of the fastest-growing economies in the world today and ranks 5th globally in terms of GDP. The ASEAN-India Free Trade Area ( AIFTA), which Vietnam is also a part of, had come into effect in 2010 as a result of convergence in interests of all parties in enhancing their economic ties across the Asia Pacific. This Free Trade Agreement (FTA) exempts tariffs for more than 80 per cent of goods traded between ASEAN and India.

Vietnam has quickly emerged as a lucrative and highly effective location for the manufacturing industries in electronics and telecom segments who are relocating from China because of higher cost and US-China trade war. The country could successfully revive customer confidence by swift and efficient containment of the pandemic. Vietnam is increasingly recognized as a preferred manufacturing hub for companies to diversify their supply chains.

Vietnam has improved its global ranking in ease of doing business ranking 70 amongst 170 economies and has incentivized its business environment enabling Indian investors to establish their operations in its thriving economy.

India, on the other hand, has world-class expertise in IT services, pharmaceuticals, oil and gas and can greatly benefit Vietnam. There also exists export opportunities for iron and steel, zinc and man-made staple fibres from India to Vietnam.

India also has a large middle class in its 1.3 billion population and offers Vietnam a huge market. India’s customs duty exemption for ASEAN products also makes India an attractive destination for Vietnamese exports. There is a huge prospect in developing services related to wholesale and retail trade, business support, transportation and storage including trade opportunities in cotton and knitted clothing.

Exports from Vietnam to India include mobile phones, machinery, computer technology, electronic components, natural rubber, chemicals and coffee while Vietnamese imports from India essentially consists of meat and fishery products, corn, steel, pharmaceuticals, automobiles, cotton, textile and leather accessories and machinery.

Vietnam is strategically located offering access to other South Asian markets with proximity to manufacturing hubs and has a friendly and conducive investment climate which have helped it gain popularity as preferred manufacturing and sourcing location.

The increasing importance of Vietnam in global manufacturing and supply chain is potentially beneficial to India for its bilateral trade and investment ties with this nation. India’s business conglomerates have already invested close to USD 2 billion in Vietnam with more than 200 investment projects.

Several Indian business entities have already invested and shown interest in establishing operations in Vietnam including Tata, Adani, Mahindra and HCL Technologies to name a few.

Vietnam provides numerous attractive reasons to woo foreign investors such as favourable investment policies, increased access to markets, free trade agreements, political stability, economic growth, low labour cost and young workforce.

Indian Government has long initiated business and trade tie-ups with Vietnam as an impetus to promote textile trade and investment between the two countries and sanctioned USD 300 million Line of Credit to Vietnam in 2014.

Despite disruptions in the global economy, Vietnam remains resilient in its economic growth prospects in coming years and provides investment opportunities to Indian investors in Agriculture, Seafood, Information Technology, Automotive Components, Assembling and manufacturing of Agri Machineries and Infrastructure.

Vietnam has introduced several incentives to attract foreign direct investment to the country including preferential corporate income tax rates, import duty exemptions, exemption of taxes from royalties, reduction in land rental fees, and privileges awarded to build-operate-transfer (BOT), build-transfer-operate (BTO) and build-transfer (BT) projects and projects in Special Economic Zones.

The incentives offered are primarily focused for promoting FDI in high technology sectors, underprivileged regions, labour-intensive industries, and other priority sectors such as education and health where foreign entities receive red carpet welcome for company formation in Vietnam.

In the long term, Vietnam can increase its investments in India by taking advantage of the India Government’s policy reform of loosening up of FDI quota for foods and beverages sector and 100 per cent allowance of FDI in the e-commerce, and foods manufacturing space and explore the company registration in India.

The India-ASEAN FTA however may be reviewed and analyzed for trade loss after India announced its decision to opt-out of the Regional Comprehensive Economic Partnership (RCEP).

- Newsletter, Singapore

- December 15, 2020

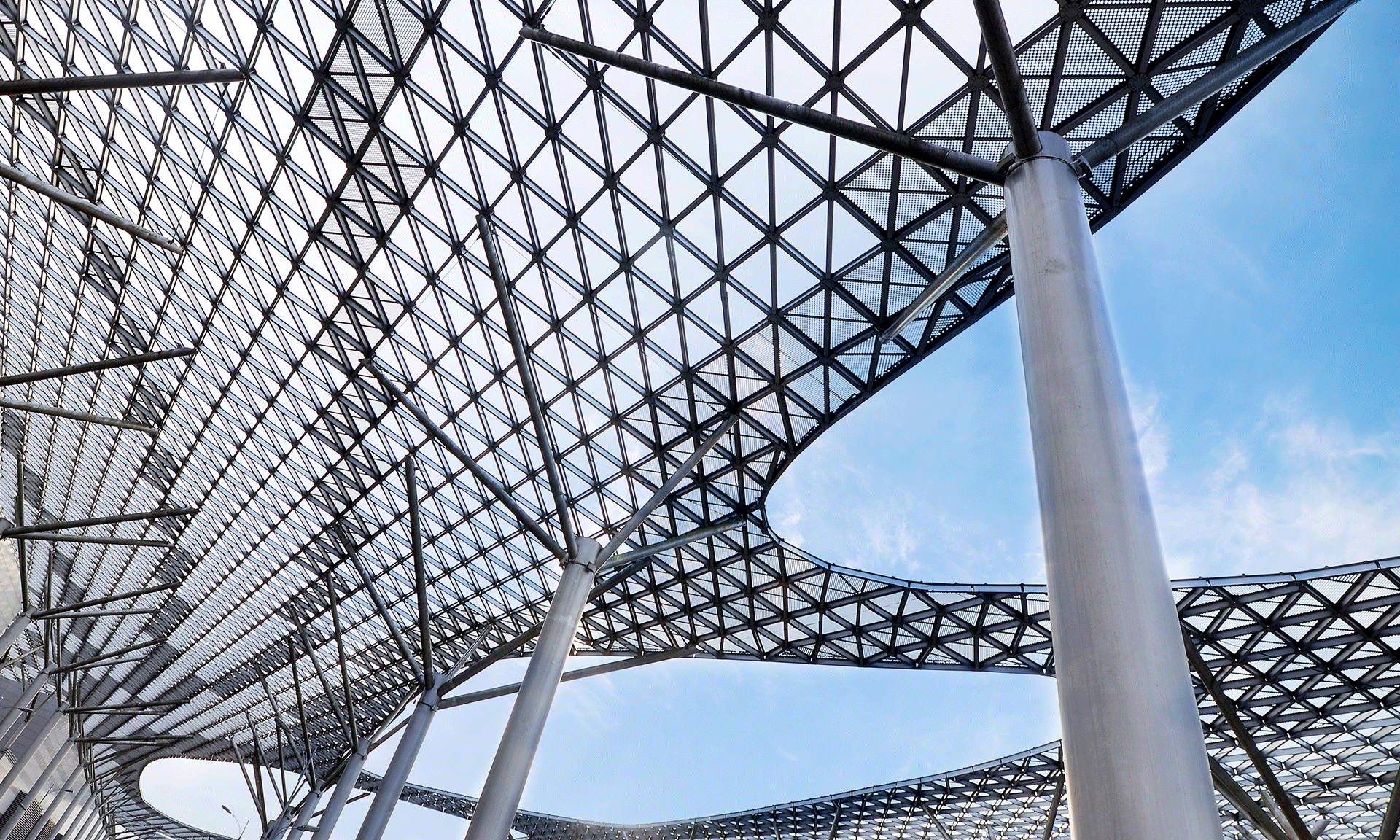

Oman has many export-oriented Economic Zones and Industrial Estates to attract foreign investors to the country and help promote economic development. With world-class and highly advanced infrastructure, the Sultanate’s economic zones offer several investment incentives, tax holidays and simplified procedures for licenses and permits supporting the free zones’ competitive business environment.

Oman has set up three Free Trade Zones (FTZ) namely Sahar Salalah and Al Muzanah, and two Special Economic Zones (SEZ) called Duqm and Knowledge Oasis Muscat. Besides the FTZ and SEZ, there are also six major Industrial Estates including Rusayl, Raysut, Sur, Nizwa, Al Buraimi and Sumail which offer highly attractive land rents, tax exemptions and equipment duty waiver.

The FTZs and SEZs are categorized based on commercial activities and incentives offered. Different zones are formed for different sectors and all zones are designed for foreign companies to benefit from Oman’s position as a regional manufacturing and distribution base. The purpose of setting up these economic zones is to attract different types of businesses to the country.

In a press briefing to The Business Times, Mr Anwar Muqaibal, the Consul General of the Sultanate of Oman to Singapore said: “There is no minimum share capital requirement for Oman’s free zones. Importers enjoy tax exemptions as no duties are imposed on goods imported and exported from the free zones. Oman free trade zone companies are allowed to trade within Oman without a local agent.”

The Duqm SEZ has long been considered as the place that will balance regional development by energizing the Al Wusta governorate and diversifying Oman’s revenue sources and employment opportunities of Omanis, added SEZAD, the regulator of the economic zone.

Duqm, established in 2011 is the newest SEZ and also the biggest in the Middle East region. It includes functional zones: Duqm, a deepwater port, a dry dock, a regional airport, a heavy/medium and light industries complex with a refinery and petrochemical complex, a residential and commercial space, tourism and logistics service areas and an industrial fisheries complex with a port and offers unique foreign investment opportunities in Oman.

Oman’s Consul General highlighted: “The port entered into an early operations phase in 2012 and currently remains in this stage with a fully functional commercial quay capable of handling heavy-lift project cargo, general cargo, dry bulk and containers.”

The development, management and regulation of the SEZ are administered by the Special Economic Zone Authority at Duqm, SEZAD which is responsible for the management of entire economic activities in Duqm, including long term strategies of infrastructure development and investment. The urban expansion of Duqm city and environmental protection are also overseen by SEZAD.

“Oman has taken important steps to make it’s economy more competitive and conducive to foreign direct investment. Incentives include a five year renewable tax holiday, subsidized plant facilities and utilities, and customs duties relief on equipment and raw materials for the first 10 years of a firm’s operation in Oman,” Mr Muquaibal added.

Mr Muquaibal also said: “Oman’s strategic location connecting the Persian Gulf and the Indian Ocean with east Africa and the Red Sea could also boost the country’s economy. The Duqm Special Economic Zone, which is among the largest in the world, could become the commercial thread between Oman, South Asia and China’s Belt and Road initiative.”

Trade exhibitions and investment events promotions are also planned at a global level to woo more foreign investors for doing business in Oman.

Skill enhancement of the local Omanis has also been planned by the Oman Government so they can be hired by foreign investors contributing to the nation’s economy.

“As the Sultanate remains a very stable country, Oman has good prospects and is an ideal location with its easy market entry,” emphasized Mr Muquaibal.

Referring to Oman and Singapore bilateral relations, the Consul General remarked that ties between the Sultanate of Oman and Singapore date back centuries as both countries share the same aspiration for economic prosperity and social stability.

Mr Muquaibal added that his priorities in the coming months would be to enhance economic relations between the two countries by promoting investment opportunities in Oman and encouraging Singaporean businesses to explore them.

With the tourism sector gradually opening up, this sector also becomes a priority as Oman remains a very attractive destination being unique in the region not commercialized and largely untouched with its mesmerizing scenic coastlines.

Another item on the list of Consul General’s priorities is promoting the visit of high-level Omani officials and specialists from different sectors to Singapore for exploring and investing in health, logistics and manufacturing sectors.

Hyflux, CrimsonLogic and SembCorp are the main business ties Singapore already has with the Sultanate of Oman. Hyflux’s first destination was in 2009 for setting up one desalination facility in Salalah and then in Qurayyat in 2014 to design, build, own and operate an independent water project.

CrimsonLogic has signed an MOU with local Omani SMEs in the IT sector and is also engaged in developing a customs management platform with an office in Oman. SemdCrop won a 15-year contract to supply power and water to the Oman Power and Water Procurement Company.

“Singapore businesses should be looking into investing in agriculture and fisheries, manufacturing, logistics and transport, energy and mining, and tourism,” remarked Mr Muquaibal.

Oman also has business entities in Singapore. The Bank Muscat runs a Singapore Representative Office since 2011 and OQ Trading Company Oman also has a presence in Singapore.

As per Mr Muquaibal said that the Sultanate of Oman is a hidden jewel in the Middle East region and worth exploring by Singaporean business entrepreneurs.

- Newsletter, Saudi Arabia

- December 15, 2020

Saudi Arabia has enacted a new Professional Companies Law (PCL) that will have a direct effect on professional partnerships existing in the Saudi Arabian market including those providing engineering consultancy, legal and accounting services to name a few as well as the new entrants in the market.

A Royal Decree was issued on 25th September 2019 approving the issuance of the new Professional Companies Law and the Saudi Ministry of Commerce and Investment issued the implementing Regulations of this new law on 26th March 2020 (together “The New Professional Companies Law”) that marks a welcome development in the professional services field.

The New Professional Companies Law has now entered into force and is in effect in the Kingdom of Saudi Arabia.

The New Professional Companies Law (PCL 2020) represents a sea change of its predecessor which was issued 29 years ago in 1991 in how professionals will be able to constitute their businesses. The PCL 2020 markedly addresses some of the fundamental limitations of the old law many of which are resolved in the new PCL.

The PCL defines a Professional Company as

- “a civil company that operates independently, which is incorporated by an individual (or more) who are licensed to legally carry out one (or more) profession, or with others, for the purpose of practising professions.”

The concept of Profession in Saudi Law, therefore, lies in business activities which require a professional license granted by a legally recognized regulatory body. This will include legal, audit, engineering, accounting and any other activities of identical nature.

Under the old law, professional companies could only be formed via one single vehicle of incorporation, being a general partnership with unlimited liability for their partners. Under the new PCL 2020, the vehicles of incorporation have been expanded and professional companies in the Kingdom of Saudi Arabia can now be formed as

- General Partnerships as in the old law

- Limited Partnerships

- Joint Stock Companies (including single shareholder Joint Stock Companies)

- Limited Liability Companies ( including single shareholder Joint Stock Companies)

The flexibility of choosing a vehicle under PCL 2020 for the intended professional company is a welcome improvement and will help the investors who would prefer to incorporate their businesses in a form other than General Partnerships.

The ability to form a professional company as a single shareholder limited liability company or single shareholder joint-stock company should provide investors who wish to have absolute control that flexibility and autonomy.

Another major development under PCL 2020 is the permissibility of professional companies to undertake more than one distinct profession as one professional company engaged in engineering consulting may also provide accounting services.

This new development under PCL 2020 may make inroads for strategic consortiums across different disciplines which was not a choice under the old law.

The new PCL 2020 also allows for a natural person who is not a licensed professional or a juristic person to be a partner or shareholder in the professional company incorporated as a limited liability company or a joint-stock company. The new law thus essentially permits unlicensed parties to potentially bring strategic benefits such as business knowledge, capital and liquidity to the professional company and possess its ownership.

Under this new law, however, the unlicensed parties can’t own more than 30 per cent of professional company’s capital and this threshold of 30 per cent can only be increased by the Minister of Commerce.

The new as well as the old professional companies law refers to the MOC, Ministry of Commerce as the sole regulator of professional companies.

The new PCL 2020 can be seen as a new dawn for professional companies existing in the Saudi Arabian market and desiring to restructure their holdings as well as the prospective entrants who don’t currently have a presence in the Kingdom and are looking for a professional company formation in Saudi Arabia.

- Newsletter, U.A.E

- December 15, 2020

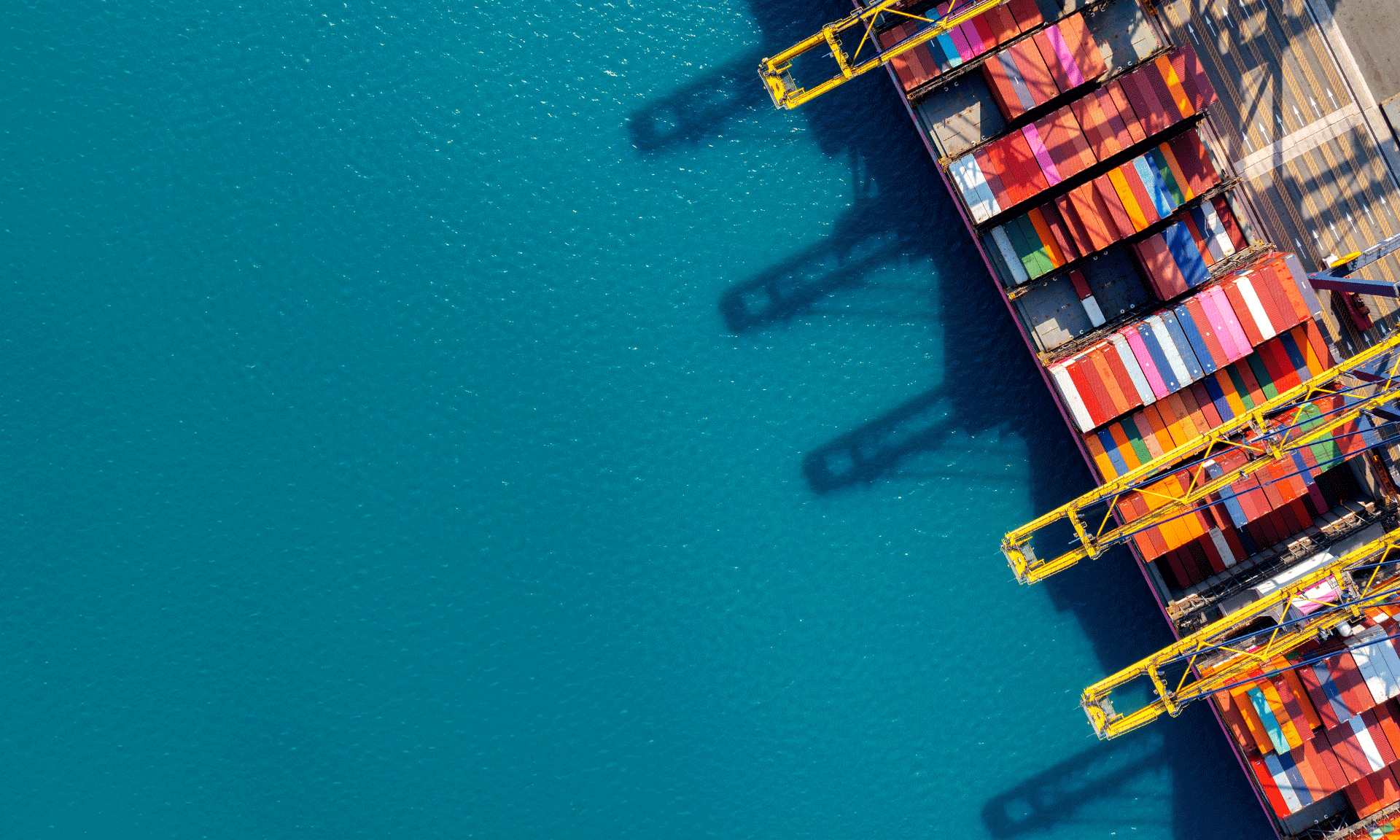

Jebel Ali Free Zone, Jafza, flagship free zone of DP World, UAE Region’s leading business and logistics hub showcased its customers the trade payments protection solutions it has initiated in partnership with Etihad Credit Insurance, ECI, the UAE Federal export credit company on 19th November 2020.

Jafza has launched ECI’s tailored solutions to support UAE based businesses and increase export trade by offering protection against commercial and non-commercial risks.

During a well-attended webinar titled, “Etihad Credit Insurance Collaboration: Trade with Protection”, Jafza based companies were guided through the ECI’s solutions as part of the free zone’s drive to ensure the growth of businesses, while lowering the cost of export, by reducing the risk of non-payments, and funding, by lowering banking pre and post-shipment funding in the current unprecedented economic climate.

More than 8000 companies in the Jebel Ali free zone are set to directly benefit from the strategic collaboration of Jafza and ECI, giving the export business a major boost and a competitive edge in the regional and global markets.

Jafza’s partnership with ECI will be a game-changer for the export of goods and services as ECI’s support increases cash flow, enables trade and contributes towards sustaining growth even as the markets recover.

Jafza believes that ECI’s range of export credit, financing and investment insurance products will directly benefit Jafza’s customers, particularly the SMEs.

The shared objectives of ECI and Jafza represent the vision of the leadership to establish the UAE as a preferred global hub for exports. Jafza is working closely with ECI to take this partnership forward and reinforce its commitment to business continuity with confidence.

ECI has issued more than 1600 revolving credit guarantees additionally for a total exposure amount of Dhs. 2 billion in the first half of 2020, which is equivalent to Dhs. 4 billion guaranteed non-oil trade coverage. About 55 per cent of the total revolving credit limits were issued to large private exporters and 17 per cent to SMEs, while the remaining 38 per cent were issued in favour of UAE Government companies.

The main sectors to benefit from this credit lines are Foods and Beverages, Healthcare and Pharmaceuticals, Automotive, Petrochemicals, Cable, Steel and Building materials, accommodating some of the major sectors present in the free zone. ECI’s solutions were chosen by Jafza for its customers after carefully analyzing the advantages they deliver.

The range of conventional and Shariah-compliant export credit financing and investment insurance solutions offered by ECI cover the exporters and the entire supply chain against commercial and political risks, allowing Jafza customers to manage and mitigate risks effectively.

Jafza, which generated trade worth 99.5 billion USD in 2019, is widely responsible for promoting the non-oil sector of Dubai and the UAE,

ECI plays the role of a catalyst in accelerating the country’s non-oil economy trade, investments, and strategic sectors development, in line with the UAE National Agenda leading to the UAE Vision 2021.

Jafza is one of the world’s leading free trade zones and is home to over 8000 multinational companies. Jafza accounts for 23.9% of total FDI (Foreign Direct Investment) flow into Dubai, sustaining the employment of more than 135,000 people in the United Arab Emirates.

Jafza has a strategic location providing market access to more than 3.5 billion people and creates an integrated multimodal hub offering sea, air and land connectivity, complemented by extensive logistics facilities. The port and free zone contributed 33.4 per cent of Dubai’s GDP in 2017. Jebel Ali Port and Free Zone are considered by the global business community as the most ideal location for a business set up in Dubai.

Jafza is the most sought after business hub between Asia, Europe and Africa, connecting some of the fastest growing and consumer markets globally. With over 30 years’ experience, Jafza focuses on long term customer relationships, building alliances with multinational investors and providing world-class infrastructure and support.

Jafza, a business opportunity provider offers its customers easy and efficient access to substantial business opportunities in the region. The Jafza ECI collaboration will further boost FDI flow and more number of global investors are expected to opt for Jafza company formation.

- Newsletter, U.A.E

- December 15, 2020

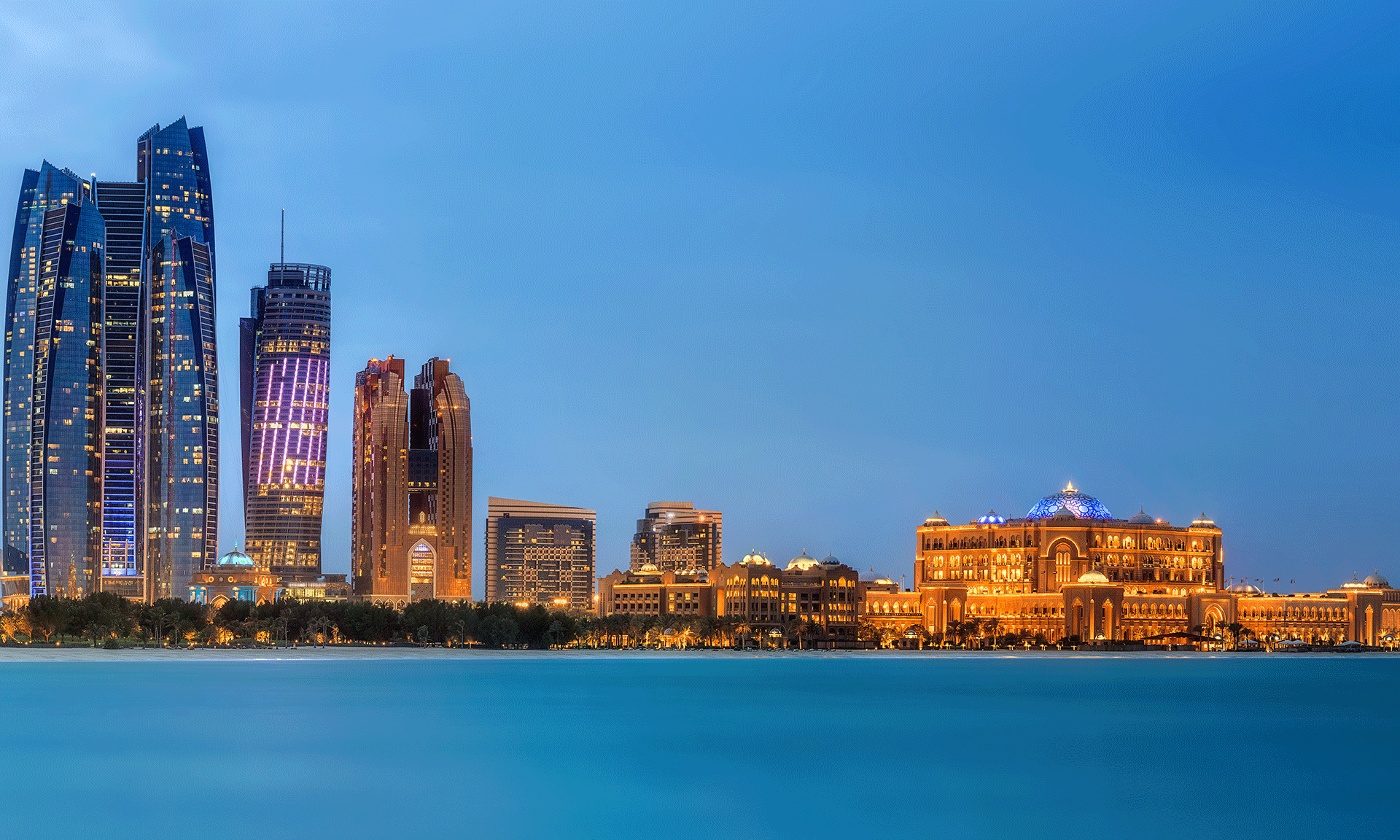

Dubai International Financial Centre (DIFC), a top ten global financial centre, and the leading financial hub for the Middle East, Africa and South Asia (MEASA) region and home to the largest most developed financial and FinTech ecosystems in the region with a presence of 72 countries, has signed a memorandum of understanding with Hapoalim Bank of Israel, one of the largest bank and financial services company in Israel. The agreement aims at cooperation across financial activities and will benefit both countries in a wide range of mutually beneficial opportunities.

Bank Hapoalim, the leading bank in Israel and headquartered in Tel Aviv is engaged in corporate and private banking services. The bank was founded in 1921 and is a publicly-traded banking corporation organized and operating under Israeli law listed on the Tel Aviv Stock Exchange (TASE).

As per the agreement signed on 21st November 2020, Bank Hapoalim will become a global partner of the DIFC and will also become a part of DIFC worldwide network of banks, financial centres, regulators and companies disrupting financial and technology sectors and embracing the highest legal, regulatory and operating standards.

The MOU signed with the DIFC will enable bank Hapoalim to avail banking and innovation opportunities in the MEASA regions.

The agreement reached will enable DIFC to help Emirates facilitate economic growth from the finance and innovation sectors. Besides, the MOU will support the DIFC vision to drive the future of finance from Dubai. The agreement also demonstrates the contribution of DIFC to the UAE’s willingness to forge business ties with Israel and promote Israeli business setup in Dubai.

The agreement also marks a step towards bank Hapoalim establishing the bank’s first regional presence outside Israel. Both the entities recognize the importance of collaborative efforts through knowledge sharing, delegations hosting and industry events promotional activities.

FinTech and investment experts from Hapoalim bank will also be invited to take part in exclusive events including the forthcoming DIFC Fintech Hive Investor Day and explore opportunities for company formation in Dubai.

Arif Amiri, CEO of DIFC Authority commented: ” Our partnership provides Bank Hapoalim with access to the most developed, broad and deep financial ecosystem in the region, allowing them to capitalize on the most lucrative banking, capital markets, asset management, innovation and fintech opportunities available.”

Arif Amiri also said: “We hope the agreement will provide us with a unique Dubai-Israel opportunity to accelerate our future of finance agenda and stimulate innovation with Bank Hapoalim through the DIFC Innovation Hub.”

Dov Kotler, CEO of Bank Hapoalim remarked: “It will provide Israeli fintech entrepreneurs with a gateway to the dynamic and vibrant Dubai ecosystem, and help foster cross border innovation. It is an honour to be the first Israeli bank to construct this important bridge for innovation.”

The CEO of Bank Hapoalim also added: “The agreement signed with Dubai International Financial Centre is an important milestone. We hope to serve, extend and strengthen the financial relationship between our two countries.”

Emirates NBD, a Dubai based lender signed an MOU with Israel’s Bank Hapoalim in September 2020 allowing Israeli clients to transact directly in the UAE.

Abu Dhabi Global Market (ADGM) and Bank Hapoalim have also signed an agreement to jointly innovate on fintech services, ecosystems and market opportunities, the official news agency WAM reported on 21st November 2020.

As per the agreement, ADGM and Bank Hapoalim will collaborate on fintech projects in the fields of international trade, business and financial services activities between the UAE and Israel.

ADGM and Bank Hapoalim will also support fintech companies and entrepreneurs seeking to scale their presence across the UAE and Israeli markets.

Dhaher bin Dhaher Al AlMheiri, CEO of the ADGM Registration Authority said: ” ADGM is continuously working with strategic partners, locally and internationally, to further the Abu Dhabi and UAE’s economic plans and technology agenda, and we are excited to partner with Bank Hapoalim to advance the banking and financial services in both jurisdictions. “

Dov Kotler, CEO of Bank Hapoalim nominated speaker at the upcoming FinTech Abu Dhabi festival commented: ” The agreement with Abu Dhabi Global Market is a breakthrough pact that we hope will serve to extend and strengthen the financial cooperation between the UAE and Israel. It will enable fintech companies, customers of Bank Hapoalim, access to a new world of opportunities. It is a great honour to be the first bank to sign such an agreement that will contribute to the establishment of the relationship between our two countries and economies.”

- Newsletter, U.A.E

- December 15, 2020

A high-level Israeli delegation led by the Federation of Israeli Chamber of Commerce (FICC) and consisting of representatives of the FICC, Israeli Manufacturers Association and the Israel Export Institute visited Dubai Chamber of Commerce and Industry headquarters on Monday, 9th November 2020 to discuss and lay out the groundwork for exploring prospects of trade and cooperation between Dubai and Israel and to facilitate business set up in Dubai.

The invitation for Israeli delegation was sent by the President and Chairman of Dubai Chamber of Commerce and Industry, H.E. Hammad Buamim who also serves as the Chairman of World Chambers Federation.

The visit of the business delegation is a part of the trade mission organized by the Dubai Chamber and aims to familiarize Israeli businessmen with the economy, business environment and competitive advantage of Dubai.

The delegation also aims to set the stage for Emirati and Israeli business ties and promote relations with the institutions in industry, trade and investment of both countries.

The visit was in line with the efforts of Dubai Chamber to maximize opportunities for Dubai’s dynamic private sector, create fertile ground for investments from local, regional and global stakeholders, and provide training for education and skills to boost the capacity of its members to carry out business activities.

Importantly, the visit was organized only after two months of signing a strategic partnership between Dubai Chamber and Tel Aviv Chamber of Commerce, represented by the FICC to oversee bilateral economic cooperation benefitting both countries’ business ecosystems.

As per press release, with the partnership agreement, both the nations will produce a joint study identifying synergistic sectors of mutual interest, plan a roadmap of virtual events and commit to organizing a business delegation and mutual hosts. It would also include hosting a joint business forum and support for new businesses, startups and scale-ups with available resources and programs.

Through the entire week, the delegation met with officials from Dubai Exports, Dubai Airport Free Zone, Dubai South, Expo 2020 Dubai, Jebel Ali Free Zone, DP World, Dubai Future Foundation, Dubai World Trade Centre and Dubai Multi Commodities Centre. The Israeli delegation also visited the Sheikh Mohammed Centre for Cultural Understanding.

The delegation was headed by Uriel Lynn, President of the FICC and also accompanied David Castel, CEO, Haifa Chamber of Commerce, FICC; Amir Shani, Vice President, FICC; Adiv Baruch, Chairman, Israel Export & International Cooperation Institute; Zeev Lavie, VP, International Relations Division & Business Development, FICC; Gadi Ariely, DG, Israel Export & International Cooperation Institute; Sabine Segal, Deputy Director-General for International Business Affairs Israel Export and International Cooperation Institute; and Avshalom Vilan, Secretary-General, Israel Farmers’ Federation.

H.E. Hammad Buamim and Dubai Chamber officials and directors received the delegation and HE. Buamim expressed his optimism about the prospects for developing and promoting Dubai- Israel trade. He also emphasized saying that there exists a huge potential for companies of both countries to explore and forge mutually beneficial partnerships and capitalize on new market opportunities.

H.E.Buamim also highlighted the competitive advantage that Dubai can provide Israeli companies as a strategic trade hub offering access to the emerging markets across the GCC and Africa and South Asia.

Dubai Chamber’s President and CEO also stressed upon the fact of Dubai’s strengthening position as a worldwide preferred market for startups and noted that the Emirate continues to launch new business incentives to attract innovative entrepreneurs and top talents, including long term residency visas and recently a virtual work visa for Dubai company incorporation.

There is a growing demand for high tech, pharmaceutical and electronic products in the UAE generating numerous investment opportunities that Israeli companies can benefit from, given their strong expertise and advanced solutions in these fields, H.E. Buamim commented.

Sustainable Agriculture, food security banking, fintech, cybersecurity and space economy have also been identified as high potential areas where the UAE and Israel can build new partnerships, Dubai Chamber’s head noted.

Uriel Lynn, President FICC described the visit as an important step towards developing UAE-Israel trade relations, promoting mutual understanding and facilitating cross-border cooperation across several economic sectors of mutual interest.

- Article, India

- December 8, 2020

The introduction of TDS was done to collect tax from the primary income source. Its concept says that the deductor, a person liable to make a payment of a particular nature to some other person, known as a deductee, has to deduct the applicable tax at source and remit this amount in the Central Government’s account.

The credit of the amount so deducted which is calculated based on the TDS certificate or Form 26AS issued by the deductor, shall be provided to the deductee, from whose income, the tax has been deducted at the source.

Tds Interest on Late Payment

There are two kinds of TDS interest provisions when the payment is not made on time:

TDS Interest when the deduction is late:

The interest rate for the late deduction of TDS is 1% pm. This interest rate is applicable from the date on which the tax was actually deductible to the deduction date. The default Section for TDS Interest related to late deduction is 201A. The TDS return can be filed only after the interest payment is done.TDS Interest when the payment is late:

Section 201(1A) says that the interest payment for late TDS deposit post deduction is at the rate of 1.5% pm. The calculation of such interest is done only on a monthly basis and not on the number of days which is the reason behind considering part of a month as a full month. Such interest amount is calculated to the date on which TDS is due.

There exists a provision for paying the late payment TDS interest before actually paying the TDS return or after its demand has been raised by TRACES. There also exists a provision for adjusting such an interest from the amount pending in any Challan related to TDS under any section. This interest paid on delayed deposits of TDS is not counted as an expenditure under the IT Act of Singapore.

Tds Not Deducted In Case Of Payments Made To Residents

According to the Section 201 of the Finance Act, the payer not deducting the entire or a part of the tax amount on the payment being forwarded to the resident payee is not counted to be an assessee-in-default for that tax which he has not deducted, if the following listed conditions are satisfied:

- The return is already provided by the resident recipient under section 139.

- The recipient of the resident has taken into account the above-mentioned income in its return of income.

- The resident recipient has paid the taxes due on its income that is declared in such return of income.

- A payee of the resident has furnished a certificate to this effect from an account in Form no. 26A

Penalty Levied For Late Or Short Payment Of Tds:

The penalty can be imposed on the payer to the extent of an amount that was not remitted or deducted. The payer will be punished with meticulous imprisonment for a term not less than 3 months and this can even extend up to 7 years. Also, the payer does not pay the tax amount that is deducted to the account of the Central Government, in addition to a fine in the case. This can be considered under the provisions of Chapter XVII-B of Section 276B.

Late Filing Consequences

From 1st July 2012, any delay in submitting the e-TDS statement will result in a compulsory fee of rupees 200 per day till the return is finally filed. However, in this case, the total fee doesn’t exceed the total TDS amount deducted for the given quarter.

Before the filing of such an e-TDS statement, the payment of the late filing fee needs to be done. If the filing of the e-TDS statement gets delayed for more than one year, or the details such as Challan, PAN, and TDS amount, mentioned in the statement are incorrect, the assessee will have to bear a penalty ranging from rupees 10 thousand to 1 lakh, as per the decision of the Assessing Officer.

- Newsletter, U.A.E

- December 7, 2020

Subsequent to the consultations with European Union and Organization for Economic Co-operation and Development OECD, the Cabinet of Ministers of UAE updated the 2019 Cabinet Decision No. 31, pertaining to the Economic Substance regulations (ESR). The upended regulations were announced by the Cabinet Resolution No. 57 in August 2020. Additionally, the Ministerial Decision No. 100 was released that gave supplementary information on the implemented Relevant Activities Guide.

As per the laws mentioned under Economic Substance Regulations, it will be applicable in retrospect from January 2019 on al licensees in UAE. Thus, all licensees will need to re-evaluate their ESR categories and make the relevant changes as per the newly amended laws and regulations. It will require all licensees to again file the FY 2019 notifications at the Ministry of Finance portal, while the ESR reports will be required to be uploaded within 12 months. The portal will be live in December 2020.

Key Amendments

As per the amendments done in August 2020 in the Economic Substance Regulations, here is a quick purview:

Role of FTA and RA: UAE Federal Tax Authority (FTA) is now the National Assessing Authority and will oversee the enforcement of economic substance tests. While the Regulatory Authorities shall be responsible for collection and checks on the authenticity of reports and notifications submitted by the license holders.

Amendment of the term Licensee: It now stands for unincorporated partnerships, juridical individuals that carry on with relevant activities that is companies established in the Free Zones- Abu Dhabi Global Market and the Dubai International Financial Centre. Those that are no longer under the ESR include sole proprietors, foundations and trusts.

Exemptions to Licensees: In the past, the ESR exemptions were granted to companies/entities with 51% indirect/direct government ownership has been revoked. Now, only these licensee categories are exempted:

- UAE offices of foreign companies

- Tax residents staying away from UAE

- Investment funds

- Licensees granted exemption by Ministry of Finance (they will be required to file notifications and sufficient evidence for exemptions)

Specification on Notification

Now on, exempted licensees and licensees carrying on with relevant activity have to be done within 6 months of the FY end. While the deadline is within 12 months of the year end- December 2020.

Clarifications on ESR Test

There are no major changes to the ESR tests. However, some changes that have been included are that the directors of the licensee do not have to be UAE resident, but the Board of directors need meet in UAE based on the activity levels of the Licensee.

Economic Substance Report

The company needs to submit the ESR to the MoF while the Licensee’s FY report has to contain:

- Category of relevant activity that is conducted

- Gross income, type of operational costs and assets in UAE

- Place and location of business

- Details of full-time employees in UAE

- Financial statements

- Declaration if or not the Licensee adheres to the Economic Substance Test

Companies that need to comply with the ESR

All of the businesses and companies that are registered in the UAE doing relevant activity need to comply with the provisions of the ESR. These include:

- Banking and Insurance

- Distribution and Service Centers

- Finance – Lease Business

- Investment Fund management companies

- Holding Company Business

- Shipping companies

- Intellectual property Business

Penalties

There has been an increase in the penalties. In the first year, failure to submit report or the requirements of the ESR is AED 50,000. In the second year, it is AED 400,000. If the Licensee fails to submit notifications, the levy is AED 20,000. If there is continuous non-compliance, the license will be revoked.

Thus, the new regulations will ensure that the Licensees will undertake the required measures to adhere to the current Economic Substance Regulations to streamline and fall within the purview of the government required compliances.

- Article, Singapore

- November 30, 2020

Singapore is often lauded for having low corporate tax rates and a transparent tax filing system. The country also offers several tax incentives that draw global investments, making it one of the world’s most ‘‘business-friendly’’ countries. Thus, if you are planning to register a company here or opening a branch of an existing business, knowing about the corporate taxation is important.

Corporate Taxes in Singapore – Who Is Legally Required to Pay?

Any company that is supervised and managed from Singapore is an official tax resident in the country. However, not all branches of multinational companies qualify as tax residents. If the company is not managed in Singapore, it doesn’t qualify, even if the company holds its day-to-day operations in Singapore. Being “managed in Singapore” means that the company’s strategic decisions (e.g., company policies) are discussed in Singapore.

However, even companies that don’t get the coveted tax-residency status have to pay corporate tax on any taxable income consequent of their activities in Singapore. But, these companies will not enjoy the several benefits that tax resident companies enjoy.

Singapore levies taxes on profits and not on revenue. Profits of your Singapore company will be taxed at 17% (with an effective tax rate often lower due to various tax incentives and tax exemptions available to Singapore-resident companies).

How to Become a Singaporean tax-resident?

Every year, companies get 12 months to shift their management department to Singapore. They have to have one year of management, board meetings, strategic decisions, etc. conducted in Singapore in their Year of Assessment (YA). For instance, for the Year of Assessment 2020, the 12-month period will be 1st April 2019 to 31st March 2020.

A company incorporated in Singapore is not automatically considered a tax resident of Singapore.

To be considered a tax resident of Singapore, a company must be controlled and managed from Singapore. According to IRAS, controlled and managed refers to, “making decisions on strategic matters, such as those on company policy and strategy.”

In general, the location of board meetings is a key factor in determining where a company is controlled and managed.

Furthermore, the location of company personnel who have a key role in the company’s decision making can also determine tax residency.

Typically, a company is deemed to be a non-resident if board meetings and key management personnel are located outside of Singapore–even if the day-to-day operations of the company are in Singapore.

For example, foreign-based holding companies that only earn passive income are normally considered non-residents since these companies are run with instructions from owners and shareholders who are based outside Singapore.

Note that the tax residency of a company can change from year to year.

Following are the benefits of being a Singapore tax resident companies with Singapore tax residency enjoy the following benefits:

- Tax benefits provided under Avoidance of Double Taxation Agreements (DTAs)

- Tax exemption on foreign-sourced dividends, foreign branch profits, and foreign-sourced service income

- Tax exemption for new startups

How Do Companies Benefit from Singapore’s Income Tax System?

Singapore is renowned for having a single-tier corporate income tax system. Stakeholders don’t have to pay taxes twice on their incomes. The tax filed by a company on its deductible income is the closing tax payment. All dividend installments paid to the company’s shareholders are exempt from additional taxation. Such a lenient taxation system is not common. Here are a few reasons why this taxation system is so lucrative for global companies –

- The profits of your Singapore company will be taxed at 17% (with an effective tax rate often lower due to various tax incentives and tax exemptions available to Singapore-resident companies)

- No taxation on capital gains

- No tax on post-taxation profit payments to shareholders. Companies only pay taxes on profits. Post-tax profit distribution (i.e. dividends) to shareholders is tax-free.

- Certain type of foreign-source income is exempt from taxation in Singapore

Singapore offers generous incentives and tax breaks when investing in new and promising industries, R&D, and productivity-enhancing technologies

- No Double Taxation of Income

- Singapore has tax agreements with more than ninety countries.

- All foreign tax credit is exempted.

- Companies from countries that don’t have a tax agreement with Singapore are provided with a unilateral tax credit system which respects foreign tax on all income from foreign companies.

What are Corporate Tax Rates?

Startup Companies Tax Exmeption | |||||

Chargeable Income (SGD) | % exempt from Tax | Amount of Tax Exempted (SGD) | |||

First 100,000 | 75% | 75,000 | |||

Next 100,000 | 50% | 50,000 | |||

Total 200,000 | 125,000 | ||||

All companies will be given 25% corporate income tax rebate, capped at $15,000 for YA 2020 | |||||

Example: | |||||

Chargeable Income (SGD) | Tax before Rebate | Effective Tax Rate | |||

100,000 | 4,250 | 4.25 | |||

200,000 | 12,750 | 6.38 | |||

300,000 | 29,750 | 9.92 | |||

400,000 | 46,750 | 11.69 | |||

500,000 | 63,750 | 12.75 | |||

600,000 | 80,750 | 13.46 | |||

1,000,000 | 148,750 | 14.88 | |||

2,000,000 | 318,750 | 15.94 | |||

3,000,000 | 488,750 | 16.29 | |||

5,000,000 | 828,750 | 16.58 | |||

10,000,000 | 1,678,750 | 16.79 | |||

Partial Tax Exemption – For all Companies not fulfill the condition of SUTE YA 2020 | |||||

Partial Tax Exemption | |||||

Chargeable Income (SGD) | % exempt from Tax | Amount of Tax Exempted (SGD) | |||

First 10,000 | 75% | 7,500 | |||

Next 190,000 | 50% | 95,000 | |||

Total 200,000 | 102,500 | ||||

Example: | |||||

Chargeable Income (SGD) | Tax before Rebate | Effective Tax Rate | |||

200,000 | 16,575 | 8.29 | |||

300,000 | 33,575 | 11.19 | |||

400,000 | 50,575 | 12.64 | |||

500,000 | 67,575 | 13.52 | |||

1,000,000 | 152,575 | 15.26 | |||

2,000,000 | 322,575 | 16.13 | |||

3,000,000 | 492,575 | 16.42 | |||

5,000,000 | 832,575 | 16.65 | |||

10,000,000 | 1,682,575 | 16.83 | |||

20,000,000 | 3,382,575 | 16.91 | |||

All companies will be given 25% corporate income tax rebate, capped at $15,000 for YA 2020 | |||||

What is Taxable Income?

Taxable income in Singapore’s single-tier territorial tax system includes –

- Profits from the trade/business.

- Royalties, premiums, interests on the property, and other earnings from investments.

- Earnings from investments also include rent from a property.

- Other income that is considered ‘‘revenue.’’

What are Net Income and Taxable Income?

As per the Income Tax Act of Singapore, any earnings made in Singapore and money sent to Singapore from an overseas source is taxable. However, net profits are, in most cases, not taxable. Some of the costs sustained by companies may or may not be deductible. Some incomes may even be taxed as a non-corporate income.

There are other forms of taxation levied on any overseas income received in Singapore. ‘‘Exemptions on Foreign Sourced Income” is an official guideline by the Singapore Income Tax Act, which deals with such sources of revenue. Some examples of exemptions include income from foreign-based dividend payments, branch profits, etc.

What Happens if a Company Loses Money?

As per the provisions prescribed in the Singaporean Income Tax Act, companies are allowed to deduct permissible costs from the money meant for taxation. This loss cumulates until a company record statutory income. The authorities allow companies to use taxable revenue only if there are no considerable changes in ownership or other important commercial activities.

What are the major Tax Incentives for Companies?

Singapore offers lucrative tax incentives for startup companies. A tax incentive scheme for startups was launched in 2005 (“SUTE”). The new companies have to meet these criteria for their first three years – consecutive YAs depending on where the YA falls to avail exemption under SUTE:

- The company’s total share capital is beneficially held directly by no more than 20 shareholders throughout the basis period for that YA where:

- All of the shareholders are individuals; or

- At least one shareholder is an individual holding at least 10% of the issued ordinary shares of the company

- Property and investment holding companies are not eligible for SUTE

YA 2020 Onwards

New companies that qualify are given a 75% tax exemption on the first S$100,000 of taxable income and an additional 50% exemption on the next S$100,000 of taxable income.

Partial tax exemption (PTE) scheme for companies

All companies qualify for PTE unless the company already claims under the tax exemption scheme for new startups. Under PTE, companies enjoy the following exemptions.

YA 2020 Onwards

- 75% tax exemption on the first $10,000 of normal chargeable income and

- A 50% tax exemption on the next $190,000 of normal chargeable income

If you are looking to know more about taxes and business in Singapore, you can hire the services of professionals.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners