- Newsletter, U.A.E

- November 30, 2020

Cabinet Resolution No. (58)/ 2020 regulating Procedures related to Beneficial Owners (the ” Resolution “) came into force on the 27th of August 2020 superseding earlier cabinet resolution of 34 of 2020.

The Resolution imposes new procedural requirements for companies, registered and licensed in the UAE on disclosure and record-keeping to enhance transparency in the UAE’s business climate and develop effective and sustainable executive and regulatory mechanisms on beneficial owner data.

The Resolution requires the UAE licenced companies to prepare and file an Ultimate Beneficial Owners’ (UBOs’) register, a Partners’ or Shareholders’ register and a Nominee Directors’ register with the relevant UAE authority.

The requirement of maintaining and filing Partners’ or Shareholders’ register has already been there in the UAE under the Commercial Companies Law 2015 including respective free zone companies regulations and the Nominee Directors’ and UBOs’ register are newly introduced requirements.

The Resolution is applicable for all companies registered and licensed in the UAE excluding companies in financial free zones (Dubai International Financial Centre and Abu Dhabi Global Markets) and companies directly or indirectly wholly owned by Federal or Emirate.

UBOs’ register needs a careful analysis of a company’s corporate structure, management and control to identify and disclose the real beneficiaries who are natural persons and ultimately own or control a company through the direct or indirect ownership of a minimum 25% of company’s shares. The real beneficiaries also have the right to appoint or dismiss the majority of Directors and/or Managers.

In absence of natural persons owning a minimum of 25% of the company’s shares, then any natural person exercising control over the company by other means shall be identified as the UBO. In case, any natural person doesn’t satisfy this condition too then any natural person responsible for the senior management of the company shall be deemed as the UBO.

The UBO register must document beneficiaries particular about

- Name, Nationality, Date and Place of Birth

- Address

- The basis of and the date when the real person has become the UBO

- Passport details

- Emirates ID

- The date when the natural person ceases to be the UBO

Register of Partners/ Shareholders must contain information about the number of ownership interests held by each partner or shareholder including voting rights attached to such ownership interests and the date of acquisition of ownership interests. It also requires details of any trustee with rights and powers in respect of the company as evidenced from the document establishing a trust.

Register for Nominee Director/ Manager must have details of Directors/ Managers and must be a natural person serving in a Director capacity and acting following guidelines, instructions, or will of another person, the Nominee Manager.

As per the Resolution, the companies must notify the relevant authority about any change or revision in the information provided within 15 days of such change or revision and the registers are required to be updated accordingly.

Companies failing to comply with the requirements of this Resolution, the UAE Ministry of Economy will impose sanctions on these companies. The administrative sanction details are yet to be published.

There should be the primary contact in the company as an authorized agent for submitting information to the authority as well as receiving notifications if any.

All information provided in the registers is to be kept confidential and unavailable to the public domain as per the privacy protection policy of the UAE.

Over the past years, some free zones in the UAE e.g. Dubai Multi Commodities Centre, Jebel Ali Free Zone, TECOM already implemented requirements of UBO information during registration and licensing of companies. The recent announcement of Resolution 58 will now bring uniformity amongst all free zones and mainland companies.

- Article, Bahrain

- November 27, 2020

The Bahrain Economic Development Board (EDB), responsible for promoting Foreign Direct Investment (FDI) in Bahrain particularly focuses on attracting FDI in Manufacturing, Information Technology, Communication, Logistics, Tourism, Financial Services and Leisure sectors. The EDB reinforced its position and commitment as one of most liberal economic institutions by winning the United Nation’s Top Investment Promotion Agency award in the Middle East for its role in attracting large-scale foreign investments and Bahrain company formation.

The Government of Bahrain puts minimum restrictions on the right of ownership and establishment of a foreign company and allows foreign private companies to form and own business enterprises and engage in all forms of profitable ventures.

There only exists a small list of business activities with the Ministry of Industry, Commerce and Tourism (MoICT) restricted to Bahraini ownership such as Press and Publications, Workforce agencies, Clearance offices and Islamic pilgrimages.

The recent amendments announced to the Bahrain Commercial Companies Law ( BCCL) are aimed at furthering Bahrain’s business-friendly reforms to foreign investments and aligning Bahrain’s Economic Vision for 2030 in line with the diversification program of the economy. The amendments include speedy company registration process and stronger corporate governance. Despite global concerns about falling oil prices, FDI flow in Bahrain continues to grow due to reforms in the process of doing business in Bahrain.

Benefits of Establishing a Business in Bahrain

- The strategic location of Bahrain at the centre of the Middle East Gulf countries allows easy access to every market in the Middle East and North Africa.

- Among all GCC member nations, Bahrain offers the lowest cost for Industrial land and office rentals, the basic cost of establishing a business.

- Despite oil and gas being the major contributor to its GDP, Bahrain is diversifying its economy and wooing foreign investors with several business incentives. Bahrain’s economy has grown for many years and has become a key regional and global hub for business.

- Accessing local authorities is much easier in Bahrain in comparison to other neighbouring countries, for support and dispute resolution in business. EDB, MoICT, BDB and Tamkeen also provide support to the foreign investors on how to start a small business in Bahrain.

- Bahrain is one of the most liberal and flexible countries in the Arabian Gulf with a diverse and multicultural population. The country with approximately 50% expatriates has supportive multiple entry visa policies.

- Though Arabic is the national language, English is widely spoken and used in business in Bahrain.

- Bahrain offers multiple incentives to entrepreneurs including 100% foreign ownership, zero taxes, an attractive regulatory environment and an ecosystem designed for promoting startups and providing support in scaling up businesses.

Business Establishments in Bahrain

- With Limited Liability company

- Partnership company

- Holding company

- Single Person company

- Limited Partnership company

- Joint Stock or Shareholding company-Open

- Branch of a Foreign company

- Joint-stock or shareholding company- Closed

A Branch of a Foreign company is one of the most sought after options to foreign investors as it offers a lot of advantages.

Branch of a Foreign Company in Bahrain

Principal Features of Branch of a Foreign Company in Bahrain

- Business operations are only allowed when there is a local office in Bahrain.

- Operational offices can only undertake business operations.

- Representative and regional offices are allowed for marketing and promotional activities only.

- No minimum share capital is needed.

- Appointing a Branch Manager is mandatory.

- A local sponsor is needed for an operational office except when the branches are licensed by Central Bank of Bahrain (CBB) and the Committee for Organizing Engineering Professional Practice (COEPP).

- Banking, Insurance and investment activities are permitted.

- The Parent company needs to issue a Bank Guarantee in favour of the Ministry of Finance and National Economy.

Registration of Branch of a Foreign Company in Bahrain

The process steps involved in registering a Foreign company branch are

- Filling out a registration application form with all necessary details

- Documenting Memorandum of Understanding (MOA) and Articles of Association (AOA) and receiving preliminary approval from the Ministry of Commerce.

- Obtaining local Municipal approval for securing an office space

- Notarizing the MOA and other documents, as appropriate and submitting online to the MoICT

- Opening a national bank account and receiving the capital deposit certificate

- Depositing a guarantee to the bank in the name of the branch, the agent or an official representative and the order of the Ministry of commerce and industry

- Receiving the Certificate of Registration (CR) from the ministry

- Publicizing the incorporation in the Official Gazette

- Registering for Social Insurance for the hiring of employees

Documentation Requirements for Registering a Foreign Company Branch in Bahrain

- Filled application form of company registration

- Pre-approved documents from external entities

- Sponsorship agreement for operational branches

- Copy of CR

- Copy of MOA and AOA

- Resolution of Board of Directors

- Guarantee certificate from the Parent company accepting full responsibility of the Bahrain branch

- Authenticated Power of Attorney whenever necessary, e.g. Outsourced Consultancy Services

IMC helps entrepreneurs and business organizations create value and is committed to delivering services that exceed customers expectations.

We, at IMC, are a group of high calibre professionals acquainted with the Bahraini business and Tax laws including their culture and preferences and can render you every help every time in your quest for a foreign company branch in Bahrain.

- Article, India

- November 23, 2020

Today, the working masses often change organizations in the quest for better career opportunities and paycheques. Now, such job switching results in alterations and merger of the old and new provident fund records of the employees. For amendment in such issues, the legislature launched a Universal Account Number (UAN). This is a unique 12-digit account number given to all EPF members. Using this, you can merge all your EPF accounts.

You will have to write to the EPFO for blocking your previous UAN and assure that you transfer the balance amount to your current active UAN. This can be done online through the official portal. The rules say that every member of the Employees’ Provident Fund Organisation (EPFO) must be having only one UAN.

The UAN permits linking all your provident fund accounts in a single one. This eases the tracking of these accounts. There are a few more advantages of UAN like an employee can exchange funds beginning with one PF account then onto the next one very quickly. One can likewise interface with your Aadhar number to UAN that frees you of the signature requirement for withdrawal or transfer of PF money. In case you are having PPF accounts, you will have to combine them into a single one. Members will have access to downloading the passbook from the EPFO portal in PDF format.

Steps describing the process of merging two EPF accounts

- The KYC process requiring PAN, Voter ID, Bank Account, etc verification must be complete.

- The person must be having a UAN, and it must be linked to the existing EPF account.

- After activating UAN, waiting for three days is mandatory before starting the process of merging EPF accounts.

Online Process of consolidating two EPF Accounts into one using UAN:

- Visit the official website of EPFO.

- Click on services.

- Then select one Employee and one EPF Account link.

- After this selection, you will see a window where the employees of the organization will have to fill in the necessary details like the UAN, phone number, etc.

- After filling in all the details click on the Generate OTP tab and verify the OTP that you receive on your registered mobile number.

The above procedure is easy to complete and, therefore, can be done by the individual itself. An alternative way of doing this is to submit the claim either through the present employer or through the person having the quit from.

Consolidating two EPF accounts is simple and the combined account so formed makes life easier. You get a single amount when you require pulling back your employee’s provident fund. EPFO is presently planning to make Aadhar, the essential address proof after the Aadhar Act of 2016 was passed. Individuals having Aadhar seeded UAN can avoid the hassle of verification of claim forms by the company.

Is the process of linking the UAN and Adhaar beneficial?

You must have figured out the importance of consolidating two EPF accounts into a single one. In the same way, it is extremely essential to comprehend that you should link your UAN with your Aadhar Card. The benefits are many like settlement of payments turns out to be easy, the process gets more precise and much more. So, if you haven’t presented your Aadhar card for the purpose so far, you ought to do it at the earliest.

Offline Process of transferring EPF account

You can apply for the offline transfer through Form 13. The standard procedure of doing the same starts with filling Form-13 after downloading it from the EPFO official website. You can even get this from your new organization HR. Now, in the form, you have to enter the details of your current PF account and submit it to your new organization HR. The Provident fund balance from the previous organization will accordingly begin accounting in the new PF sum. Whether you work in a private organization or a government firm the procedure is the same for all. Each time you switch your job it is simply the new organization detail and the related record that needs to be refreshed.

Frequently Asked Questions.

How can I get a UAN for myself?

Your employers will provide you with the required UAN. It will also be mentioned on the salary slip you receive.

What is the result of having 2 UANs in the same period?

Having two UANs in the same period is completely illegal. You should be having only one UAN, and all your operating EPF accounts must be linked to the same.

What is the portal or official URL or website to log in to the UAN?

You can enter this URL, www.epfindia.gov.in on any search engine like Google and type your username and password to check-in for the necessary UAN details.

Is it mandatory to link EPFO with Aadhaar?

Yes, the EPFO has made it mandatory to link your Aadhaar with your Employee Provident Fund Account to access the portal online. There are other benefits as well as doing the same.

How many days will it take to merge two PF accounts together?

Generally, the time taken is about 20 days for completing the process from the date of submission. However, it might take less time when you operate online.

- Newsletter, U.A.E

- November 17, 2020

The UAE cabinet, headed by His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Ruler of Dubai approved the issuance of a new Federal Decree-Law on Financial Covenants. The law provides a legislative framework that will regulate and boost the country’s wealth management sector and help protect investors and attract foreign investment.

The Federal Decree is an innovative and future-oriented legislative framework accommodating the needs and expectations of both family business owners and other business owners and investors.

The onshore trust law comes in the support and enhancement of the growing wealth management sector in the country. It will act as an integrated system for companies and individuals owning various capital and financial rights and willing to hand their wealth over as a financial covenant to a trust managed by competent and qualified persons or institutions, well versed with various investment patterns and risks due to lack of money management expertise and enough time.

Family-owned businesses, the socio economic cornerstones in the UAE for many years will be the top beneficiaries of the Decree-law as the founders and owners of these companies and businesses, will be able to develop long term stable and sustainable plans for the protection and succession planning of their companies’ assets.

Family business owners are often faced with issues related to the family business continuity and succession, and the Federal Decree will provide solutions to these issues.

Besides the family business, the legislation will also promote the investment infrastructure in the UAE as an additional financial tool for financing and investment in the hands of the investors.

The Decree-Law will help in establishing trust structures onshore as a basis of company and asset holding arrangements similar to the types available in common law jurisdictions such as the UK, Jersey, BVI and Cayman, and protect the wealth of family-owned businesses.

The Federal Decree includes various types of covenants with specific purposes, such as a ” Charitable Trust” created for charitable purposes, or a private trust created to deal in securities and financial markets or for establishing retirement funds or ensuring that benefits are provided to the beneficiaries in exchange of regular contributions paid for the covenant.

Financial Free Zones, the Dubai International Financial Centre (DIFC) and the Abu Dhabi Global Market are excluded from implementing the provisions of the Decree-Law as these zones already have trust laws and their legislations.

The law also highlights the ” bond covenant ” and its importance as the basic document that includes all terms and conditions such as the beneficiary, the conditions for dealing in funds, the method for appointing, removing and replacing the trustee, the effects of termination of the covenant, method of appointing the guard of the covenant with details of executive powers and ways to increase the covenant funds.

The Decree-Law emphasizes a forward-looking initiative of the UAE cabinet to create a competitive business climate and expand the legal framework to serve business owners and attract foreign investors.

- India, Newsletter, Oman

- November 11, 2020

In a bid to boost bilateral trade and investment, India and Oman during the ninth session of India -Oman joint commission meeting (JCM) reviewed the recent developments in businesses and trades and reaffirmed their commitment to expand bilateral trades and encourage businesses to invest in each other’s country to realize untapped potentials in commercial and economic relationships.

The ninth India-Oman CM was held in October 2020 through a virtual platform and was co-chaired by Hardeep Singh Puri, Minister of State for Commerce and Industry and H.E. Mr.Quis bin Mohammed Al Yousef, Minister of Commerce, Industry and Investment Promotion of the Sultanate of Oman.

Bilateral trade between the two countries has increased to USD 5.93 billion in 2019-20 registering a growth of 8.5%. India -Oman agreed to cooperate in the areas of Agriculture and Food Security, Standards and Metrology, Tourism, Information Technology, Health and Pharmaceuticals, MSMEs, Space and Civil Aviation, Renewable Energy, Mining, Culture and Higher Education.

Indian companies are already invested in Oman and in Steel, Cement, Fertilizers, Textile, Cables, Chemicals and Automotive Sectors. There are already more than 4000 Indian business establishments in Oman with an estimated investment of 7.5 billion USD.

Company formation in Oman has been encouraged by the Oman Ministry of Commerce, Industry and Investment promotion and assured liberal benefits for Indian companies.

As per a press release, “Both sides also agreed to expedite their internal procedures for signing ratification of the protocol amending India-Oman Double Taxation Agreement and conclusion of the India-Oman Bilateral Investment Treaty.”

India and Oman reviewed and assessed the progress of the proposed MOUs in different sectors and mutually agreed to conclude them promptly. Indian representatives appreciated Oman for signing the International Solar Alliance Framework Agreement.

India has long been associated in business and trade with Oman and has enjoyed a friendly diplomatic relationship. Increasing bilateral trade and investment between the two countries and a strategic partnership reinforced a need to review and expedite the double taxation treaty and procedural amendments as appropriate.

The India Oman business ties have been robust and expanding for quite some time now and India is Oman’s one of the top trading partners. For Oman, India has been its third-largest source of imports and also the third-largest export market for its non-oil products.

Mr. Hardeep Singh Puri highlighted recent initiatives undertaken by the Indian Government for enhancing the ease of doing business in India and promoting business through Product Linked Incentive (PLI) schemes in various sectors. He also invited Oman business enterprises and Omani Sovereign Wealth Funds to invest in India.

Company formation in India has now become much simpler, transparent and less bureaucratic. IMC, a professionally managed and well-experienced business service consultancy group can help Oman business enterprises to set up companies in India and provide all necessary support from the start to end. IMC is based in one of the Indian metropolitan cities and also has well established operational setups in Dubai and Singapore.

- Newsletter, Saudi Arabia

- November 11, 2020

Saudi Arabia represented by the Saudi Data and AI Authority (SDAIA) and the International Telecommunication Union (ITU) of the United Nations has recently reached a Memorandum of Understanding (MOU) to collaborate on initiatives aimed at supporting, strengthening and optimizing the benefits of Artificial Intelligence (AI) for sustainable development globally.

During the Global AI summit hosted in Riyadh, the Saudi ITU MOU was signed on the second day for making AI best practices available to everyone on this planet. In this collaborative agreement, Saudi Arabia will support ITU in developing initiatives, activities and projects facilitating the UN Sustainable Development Goals (SDGs) through international cooperation, knowledge sharing and multi-stakeholder participation.

As per Saudi Press Agency (SPA), this MOU announced with ITU in a virtual ceremony organized during the Global AI summit 2020 will help to develop an internationally recognized system for mobilizing resources and providing assistance to institutions willing to adopt AI technologies. Dr. Abdullah bin Sharaf Al-Ghamdi, the President of the SDAIA welcomed this MOU as a significant step towards new investments and company formation in Saudi Arabia.

Al-Ghamdi said,” The ITU will share best practices in the field of AI with the Kingdom. This will help in shedding light on how to sponsor and support emerging companies and new incubators in the national space, especially as there is no official framework that currently exists to support the AI readiness of countries and international cooperation.” As per the President,” Around the world, nations have recognized the transformative potential of Artificial Intelligence and are preparing themselves to harness the benefit of AI to support their development strategies and goals.”

“With this announcement of this MOU, Saudi Arabia intends to support ITU to design activities that will help strengthen global efforts to use AI technologies for the advancement of sustainable development and growth. SDAIA has been established to drive AI programs in the Kingdom, and enable Saudi Arabia to become a global leader in AI. Through this partnership we will support the sharing of knowledge and experience among all nations, to further the use of AI for the benefit of humanity.” HE Dr. Al- Ghamdi highlighted.

In his address, the ITU Secretary-General Houlin Zhao said, ” AI is being used to tackle the world’s most pressing challenges, from climate change to the Covid-19 pandemic.” He also greeted the announcement of the MOU and said that the UN agency also looked forward to this partnership with SDAIA for developing initiatives and projects in AI technologies and promoting sustainable developments on a global scale.

The Secretary-General of the ITU also emphasized the importance of this collaborative agreement saying,” We dream of a world where nations harness the power of AI together, where we all exchange ideas and best practices, where we collaborate to unlock the full potential of AI. He also reiterated, “With AI impacting every aspect of today and tomorrow, collaboration is needed more than ever.”

Founded in 2019, the SDAIA is a world-class governing body to drive the Kingdom of Saudi Arabia’s AI innovations and ecosystems and also to lead AI optimization for global economic development and growth.

The Global AI Summit hosted by SDAIA is an international meet and brings the world’s important decision-makers, technologists and investors under a common Umbrella. Human welfare being the driving theme, this event recognizes the global disruption of the Covid pandemic and explores the transformative potential of AI and Smart Technologies to effectively handle the post covid new normal and make the world a better place to live. It is now evident that new AI startups and established global players will now be increasingly attracted to Saudi Arabia and look for how to open branch office in Saudi Arabia.

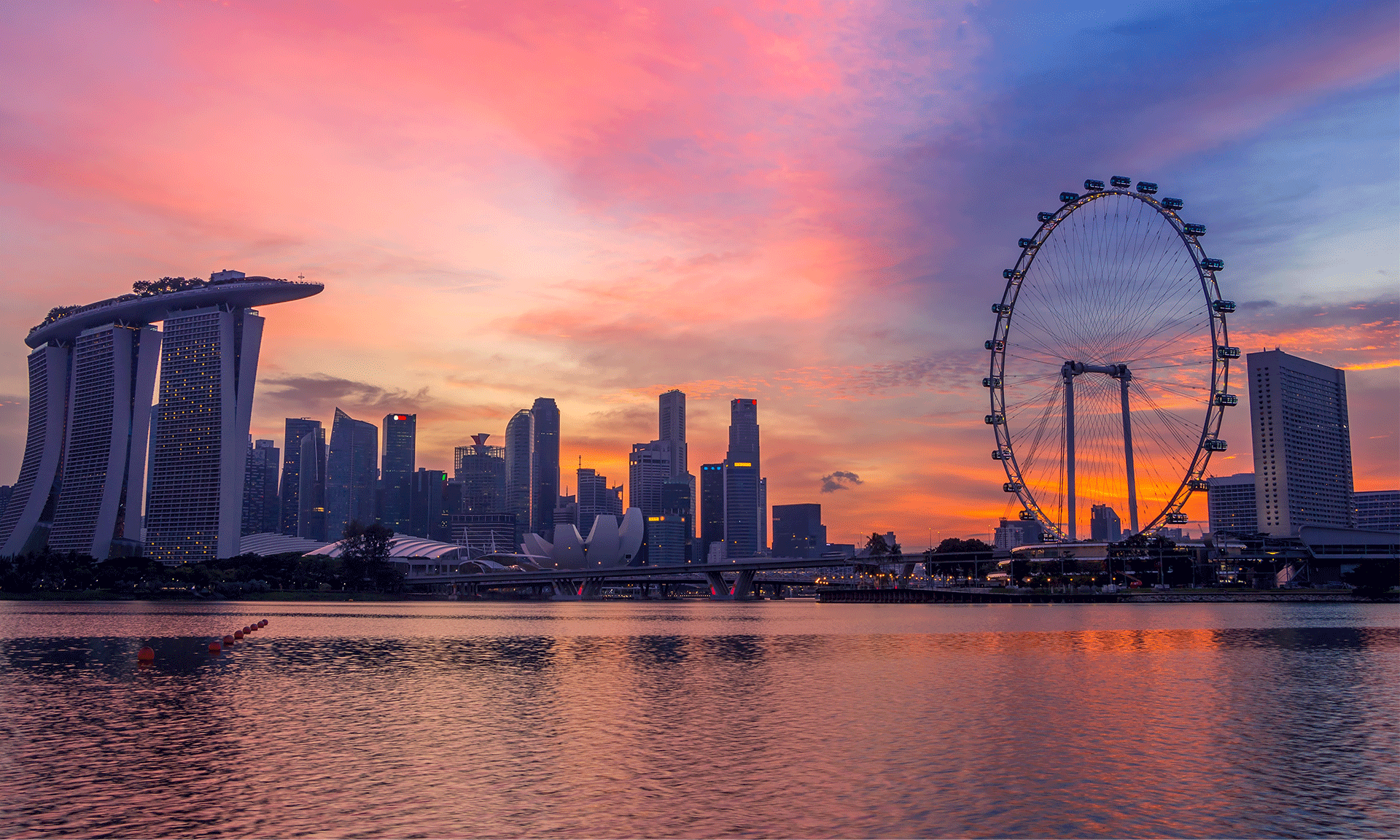

- Newsletter, Singapore

- November 11, 2020

Singapore is one of the leading nations in the World Digital Competitiveness Ranking in 2020 only being second to the USA. Even in 2019, it remained the second most digitally competitive country in the world. This international ranking is based on the ability of any nation to use digital technologies for promoting economic transformation in business, government and other social domains. There is a sizable increase in Foreign Direct Investment in South- East Asia with Singapore attracting the highest investment.

“The Post-Covid world will be characterised by a K-shaped recovery, with two types of economies: those that will recover quickly and those that will recover more slowly,” says Professor Arturo Bris, Director of the IMD World Competitiveness Centre. As per him,”

Recovery is driven by many factors, such as the health of public finances. But also, fundamentally, by the digital competitiveness of those economies”

Germany, on the other hand, has been the biggest contributor to technology and science over centuries; be it in physics, chemistry, cars and consumer products and given birth to most of the Nobel Laureates in Science in the world. Many EU funded projects are controlled and coordinated by German companies and research institutes today and highlight its science and technology innovation in diverse fields including Information and Communication Technologies.

Several initiatives recently announced by Singapore and German authorities will now provide multiple opportunities to the companies from both countries to work together and spearhead their digital transformation of various business processes.

A Memorandum of Understanding (MOU) jointly signed by Enterprise Singapore (ESG) and the Asia Pacific Committee of German Business (APA) on 15th of October, 2020 announced a series of initiatives to be undertaken jointly to support enterprise development through a transformation in sectors of common interest for the two countries.

The joint initiatives are launched to strengthen business ties and exchange technological know-how between Singapore and Germany. The Germany Singapore Business Forum (GSBF) organized twice over the last four years has also been a part of the initiatives. GSBF helped influence Singapore companies to take interest and explore potential business opportunities in Germany.

As part of agreements, ESG and APA will support enterprise development through industrial and digital transformation in sectors of mutual interest including advanced manufacturing, digitalization and innovation, medical technology and healthcare, and future of mobility.

The enterprise development will be realized through increased collaboration in open innovation and by jointly accessing market opportunities in Southeast Asia and Europe.

Under the MOU, a refreshed version of GSBF newly named as GSBF Connect will be jointly organized by ESG and APA to facilitate sector-specific and more frequent collaborations between the two countries.

GSBF Connect will now be sector-specific and will be held throughout the year with the first edition dedicated to the manufacturing sector and planned to run virtually. The second edition is scheduled to take place in December during the Singapore week of innovation and technology.

More than 400 companies from both countries have used this forum over the last four years. The Germany Business missions also increased from 13 to 22 between 2018 and 2019. Over 150 companies have been benefited in 2019 from different sectors such as advanced manufacturing, medical technology and healthcare, the future of mobility and e-sports.

Peter Ong, Chairman of ESG addressed, ” In this changing business environment, our enterprises need to connect with one another in more and better ways. Germany and Singapore are trusted partners who place a high emphasis on delivering quality and innovative products and services.”

“Singapore is attractive to German companies in several ways as a long term partner with whom new technologies and innovative business models can be developed, but also as an experienced bridge builder into the emerging Asian region.”, highlighted Professor Axel Stepken, co-chairman of GSBF connect and TUV SUD AG management board chairman.

Prof Stepken also said,” Singapore has a strong record as a leading Research and Development Hub and digital trendsetter, while German companies are known for their ability to manufacture state-of-the-art machinery and products. I still see many fields and sectors in which we can bring our specific strengths together.”

Singapore and Germany collaboration also include SME funding programme facilitating Partnerships e.g. Singapore firm Move on Technologies and German company Vanguard Automation.

A new four-way partnership was agreed on October 14th between Singapore Polytechnic, German testing, inspection and certification company TUV SUD, Delta Electronics and Singapore’s Smart Transformation Alliance (STA).

Partnering with Germany will inevitably lead to lower integration cost and fewer challenges in the deployment of more advanced automation systems for the Singapore’s local companies embracing industry 4 solutions and more number of foreign companies are expected to pour in for Singapore company incorporation.

- Newsletter, U.A.E

- November 11, 2020

The UAE Ministry of Economy has specially invited the Indian major chambers and business associations to explore investment opportunities in Dubai for MSMEs and other Industries and participate in the Digital Annual Investment Meeting 2020.

The Annual Investment Meeting (AIM) in the UAE, an initiative of the Ministry of Economy is the largest deal-making virtual platform where countries feature investment destinations at their locations and attract Foreign Direct Investments (FDI). The three-day digital event organized in a secured digital environment strengthens networking of investment experts and facilitates key investment strategies.

The theme of AIM revolves around FDI, Small and Medium Enterprises, Startups, Future Cities, Foreign Portfolio Investment and, the One Belt One Road and is held under the patronage of His Highness Sheikh Mohammed Bin Rashid Al Maktoum, the Vice President and Prime Minister of the UAE and the ruler of Dubai.

The UAE is all geared up to for the first virtual AIM 2020 connecting potential investment experts and business professionals and featuring Pre-conference Workshops, Opening Ceremony, Conference, Regional Focus Sessions, Digital Country Presentation, Exhibition, Digital Networking, Made in Series, Startups Pitch Competitions, AIM Awards, Investors Hub and many more.

AIM being a credible and globally prominent Investment Platform has been influential in extending needed resources for learning, showcasing, Investing, Recognizing and Networking and consistently attracted support and participation of Governments and Ministries from many countries over the world. It has also lured infrastructure and project authorities, financial institutions, sovereign wealth funds, venture capitalists, investment experts and professionals, private companies, international organizations and global investors from 140 countries.

Increased business revenues and profit margins are the major objectives for exploring international markets and besides, a presence in other countries also increases the customer base, distributes business risks, helps identify cost-effective global suppliers and recruit new talents.

Over the decades, Dubai has developed a made-for-trade business ecosystem that offers robust infrastructure facilities and a transparent regulatory environment conducive for business growth and success.

Dubai is also a strategic business location with excellent connectivity with India that facilitates India’s exports from SME and MSME sectors to other countries. Company formation and business set up in Dubai are also very simple and free of bureaucratic interventions.

The Dubai Multi Commodities Centre (DMCC), established in 2002 as a free zone commodity marketplace in the heart of Dubai has already attracted more than 17000 global companies, SMEs, and Startups as their second home. Considered as the most prestigious free zone in the UAE for setting up businesses, DMCC has bagged “Global Free Zone of the Year ” five years in a row by Financial Times FDI Magazine. This Free Zone in Dubai is truly remarkable and can be the best place for the Indian Companies to set up businesses in the UAE.

With the Diplomatic Breakthrough with Israel, the UAE will also offer innumerable opportunities in high-end technology, e-commerce, healthcare and renewable sectors to the Indian Industries. The ports and logistics capabilities of both India and the UAE can also be instrumental for ensuring end-to-end integrated supply chain solutions for business growth.

Should Indian business entities want to start a business in the DMCC Free Zone, IMC is always at their service to get started with the right tools and expertise. DMCC Company Formation is always an easy and affordable task with IMC providing the expert and professional support throughout the company formation.

- Newsletter, U.A.E

- November 11, 2020

In every possibility, the UAE’s economy will make a modest comeback in 2021. With the global economy recovering from the severe damages of the Covid 19 pandemic and assuming that the global World Expo takes place as scheduled with the motto of “Sustainability, Mobility and Opportunity”, the projected economy is all set to rebound with more than 3 % increase in its GDP.

UAE is the most developed and diversified economy in the Middle East, Africa and South Asia (MEASA) region and handled the covid pandemic much effectively and decisively in comparison to many countries in the world. The covid cases have been greatly contained by enforcing personal hygiene, ramping up testing capacity and spending heavily in covid public welfare and vaccine development.

Though lockdown of global economies caused a significant drop in oil prices and badly affected the aviation industry, UAE will not be impacted that severely like other oil-producing countries because of the diversified nature of its industries and continued Government support for small and medium enterprises. The business outlook in the UAE is much more promising than other regional players with more than 100 Government initiatives already launched and is still the most attractive nation for a Dubai Company Incorporation.

The Positives for the UAE’s Economic Recovery

Despite many short term challenges, the long-term economic outlook of the UAE can be extremely lucrative for new businesses and industries willing to take advantage of new opportunities with well-planned strategies and risk management. The oil and gas; power and water; petrochemicals; transport; construction and renewable sectors are the major business sectors that could offer plenty of openings for business growth and developments.

- With more than $868 billion of projects already planned and underway and $132 billion under execution, the UAE will be one of the largest project markets in the Middle East and North Africa.

- The postponed Expo 2020 will heighten the post covid business enthusiasm in the UAE.

- The UAE is well considered as the global transit hub and when travelling resumes in 2021, there will be a huge increase in the number of business and tourists.

- Abraham Accords has been signed in September 2020 and a diplomatic breakthrough reached between the UAE and Israel which promises an increased cross border investments in the areas of technology, tourism, security, health care and water with Israel and expansion in the UAE market.

- The Fintech sector has been well supported by the UAE Government and will be instrumental in future business growth.

- There has been improved domestic demand and consumer spending backed by the UAE’s large expatriate community after many months of covid restrictions.

- Reduced oil prices and covid induced drop in GDP will give rise to more than 8% fiscal deficit. However, the fiscal deficit will not pose a serious concern and could be easily financed considering huge assets held with the Sovereign Wealth Funds.

- Separate measures have been taken by the UAE free zone authorities e.g. the DIFC.

- Many business support initiatives from the UAE government for the SMEs with tax relief, incentives and filing extensions.

- AED 1.5 billion economic stimulus package from the UAE Central Bank.

Opportunities in Project and Other Sectors

More than $672 billion worth of projects are in the pipeline in the UAE out of which $417.7 billion is in the construction sector only and the remaining $ 95.3 billion in oil & gas and $ 82.9 billion for transport.

The other industries gaining momentum in demand are food, medical equipment, health care, pharma, e-commerce, delivery services and telecom and will offer tremendous business opportunities to potential investors.

IMC has a local presence in the UAE and can provide you with every support in your new Dubai business ventures with extensive knowledge and know-how on new business set up in Dubai.

- Newsletter, U.A.E

- November 11, 2020

Recent diplomatic breakthroughs between the UAE and Israel have come as a boon for the UAE and Israeli businesses, and also to the other business communities in the MENA and the MEASA regions.

The UAE and Israel signed an agreement in August, 2020 and as per this agreement, the UAE and Israel will establish full diplomatic relations and the UAE becoming the third Arab nations, besides Egypt and Jordan, to fully recognize Israel.

On 20th August 2020: the UAE President Sheikh Khalifa Bin Zayed Al Nahyan issued Federal Decree-Law Number 4 of 2020, abolishing a ban on business and trade dealings that was in force since 1972.

“Trade and investment prospects for the UAE and Israel are a ‘dividend of peace ‘ that will strengthen the newly forged ties between the region’s two most innovative economies,” said Abdulla Bin Touq, the UAE Minister of the economy.

“The prospects of trade and commerce between Israel and the UAE are exciting for both countries,” Mr Bin Touq said in an online seminar organized by the US-UAE Business Council. He also highlighted that the two most powerful economies now trading and working together will give rise to endless economic growth possibilities in the region.

The UAE has long diversified from the hydrocarbon-based economy prevailing in the Gulf region and despite having the 8th largest reserves of oil, only derives 30% of its economic output from oil and remaining 70% coming from fintech and financial services, innovation and technology, construction and real estate, and defence.

The UAE is also a strategically located nation connecting the East to the West with developed logistics support of free zone ports and two reputed Airlines, Etihad and Emirates. It is also a very progressive economy with high levels of foreign investments, extensive double taxation treaty arrangements and business digitalization, and has already established itself as a world-class hub for global businesses and commerce.

Dubai International Financial Centre (DIFC), the special economic free zone with its independent regulatory framework and judicial system, and 100% foreign ownership of companies have given the global economic prominence to the UAE. It is considered as one of the leading financial centres in the world and ranks 14th in the Global Financial Centres Index and higher than Frankfurt, Paris, Zurich, Chicago and Luxembourg.

DIFC, as a free zone is one of the most lucrative business destinations for foreign multinational business entities today and many startups, and established businesses are opting for DIFC company formation.

There are many special economic free zones in the UAE and especially in Dubai accommodating businesses from different sectors such as healthcare, media, technology, logistics and others. The UAE Government with a futuristic mindset also offers lots of incentives to prospective entrepreneurs for the business setup in Dubai.

Israel is an economically developed and technology-driven country with a free market economy. The country ranks first in the availability of scientists and engineers, the number of startups per capita, and venture capital investments per capita. It is considered a high-income country by the world bank.

There is immense potential for business opportunities and economic cooperation between the UAE and Israel in various sectors including logistics, aviation, Agri technologies, green and renewable energy, and food and water security.

The UAE was looking at eight trade and economic agreements with Israel including double taxation and free trade agreements before signing the Abraham Peace Accord in Washington.

Mr. Bin Touq said, “we are already seeing reports of Israeli firms signing deals with Emirati firms and we anticipate a host of joint ventures in almost all sectors.”

This diplomatic peace accord between the UAE and Israel has been an unprecedented and remarkable move in promoting business and humanitarian development in the Middle East region and the overall prosperity of mankind.

It was a memorable day when the first UAE Israel linked commercial flight landed in Abudhabi on 31st August.

Innumerable benefits in cross border trade and investment and in sectors related to health and pharma, tech and innovation, tourism and travel, and agricultural technologies exists between the two countries and will prosper with each passing day. Even Israel will benefit greatly from secure energy supplies from the UAE.

It is hoped that more Gulf countries follow suit and take the path of normalizing relations with Israel for a better cause of wealth creation, peace and harmony, and sustainable development of our world population.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group