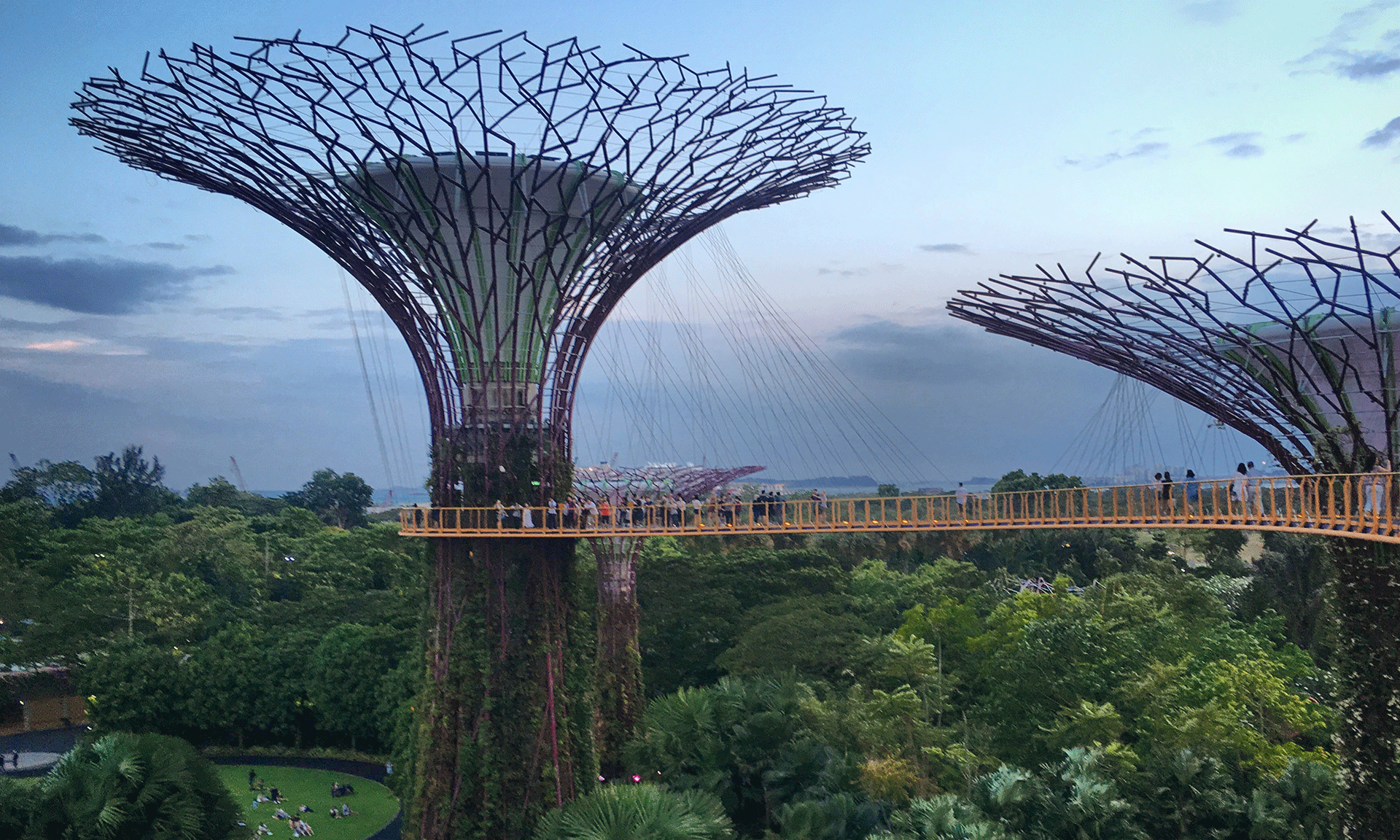

- Article, Singapore

- October 1, 2020

Getting a PR in Singapore will fetch you almost all the same benefits as an originated Singapore citizen. The only key differentiator would be you’ll not be getting any voting rights. To look for corporate or professional penetration in Singapore, you need to have a Permanent Residency pass. Getting a PR will also help you with Singapore Company Incorporation. In other words, if you are looking forward to professional penetration in Singapore, getting a permanent residency will solve all the problems of yours and will ease up the process.

The process to apply for a PR in Singapore is quite complex and involves a lot of steps. Let’s understand each one of them in brief –

1. Decide when to apply for PR

The very first question that pops up is when to apply for a PR in Singapore. Generally one can apply for the PR from the day he or she starts working in that country on an employment pass. However, one of the basic requirements that need to be met before applying for a PR is to have pay slips from a Singaporean Employer for 6 consecutive months. So it eventually means that one should have to wait for six months from the date he or she has started working in a Singaporean company.

2. Calculate your chances of approval

Apart from the type of employment pass, you are holding, and the duration of your employment in Singapore, many other factors need to be kept in mind while thinking about the approval of your PR application.

They are as follows:

- The academic background has a role to play here. The academic degree you hold and from which university or board it is accredited with is considered.

- Your physical presence in Singapore. The chances of getting a PR application approved are directly proportionate to the duration of your presence in Singapore.

- The stability of your employment and a job profile is also taken into consideration for calculating your chances of getting a PR in Singapore.

- Your financial soundness and salary also play an important role.

- Your background will also be checked.

3. Reviewing the requirement for the application

Once you meet all the basic eligibility criteria, you are all set to fill in the application form and proceed with the future course of action. You can download the PR application form very conveniently. You need to download two forms, one is form 4A and the other one is accompanying notes to form 4A. Form 4A comprises of two parts, the first one is the PR application form and the other one is Annexe A. the first one is to be completed by you while Annexe A is to be filled by your employer. The second document contains explanatory notes. The whole applications along with supporting documents can be now submitted online through ICA portal via Sing Pass.

4. File Supporting Documents

The most crucial step in filling an application to get the Permanent Residency of Singapore includes properly filling the supporting documents. In case if you commit even the slightest of the error, your application will be rejected then and there. The list of supporting documents is mentioned in the explanatory document which was downloaded in the fourth step. Let’s lookout for some important guidelines that you need to take into account before filing the documents –

- At the time of submitting the PR application online, you will need to upload the scanned copies of the original documents.

- In case if you have any official document that is in your native language, you need to get it officially translated into English.

- Having any previous experience or recommendation letters are useful. You can even contact your previous employers for any sort of help.

- If you owe any property in Singapore, attaching the documents that state the same will work as a cherry on the cake.

- Attaching a most recent copy of your resume is useful

- Preparing a cover-letter beforehand that articulates your entire journey with Singapore will work for you to get the brownie points.

Documents needed to file your PR application

- Employment Proof.

- Letter of recommendations.

- Education Proof – Degree, Diplomas, and certificates from your high school or universities.

- Proof of your income – salary sleep, your bank passbooks.

- Your most recent CV.

- If you have any property in Singapore- Documents supporting your ownership.

- Documents of your spouse or children.

How Long Does it Take?

What is the cost involved in applying to get a Permanent Residency Pass?

The cost involved in the procedure of filing a PR application is $100 which is non-refundable for each application. In case your application gets approved, you have to pay a sum of $120 which includes the fees of your entry permit, 5 years of re-entry, and an identity card issue.

There are various types of PR schemes for varied classes of individuals. Let’s consider each one of them in brief along with the requirements they have to fulfill.

1. Singapore PR Scheme for Individual Employees

This is the most legit way of getting a PR in Singapore because a lot many skilled workers come to the land to work for the country and directly contribute towards the economical growth. The first step in initiating a PR application process is to relocate to Singapore either with an employment pass or entrepreneurial pass, or a personalized employment pass. After you relocate to Singapore and stay in the country for a minimum of 6 months, you can apply for a PR.

2. Singapore PR Schemes for Investors

One can also apply for a PR through investing in the Global Investor Programme. You can take the benefits of this in two different ways either you or your immediate family members can plan for company formation in Singapore or invest in an established business in the country.

3. Singapore PR Schemes for Artistic Talent

If you are blessed with an artistic eye and are inclined toward curating new art in the form of paintings, music, literature, photography, dance, or a film, then the value of your talent will be appreciated in the Singaporean geographies. The scope of new and modern art has increased rapidly over the year in Singapore. The citizens and the government value the individual talent from other geographies that have that hunger to create something new and something different. Individuals who have a concrete plan to involve and grow Singaporean art and culture with a track record of local engagements to showcase on a global platform are more than welcomed and offered a PR.

After having an insight into the brief procedure of applying for a Singaporean PR, there are a few basic things that need to be catered from the legal and political point of view. These include anyone with a minimum 21 years of age, at least before two to six years from the date of applying for a PR, is even eligible to make the application. The government of Singapore welcomes the arrival of people with “want to create something big and out of the box” to contribute towards the overall growth of the country.

| Stage | Action | Key Requirements / Documents | Approx. Time |

1. Eligibility & Timing | Decide when to apply — you must have held an Employment Pass with 6 consecutive months’ salary slips from a Singapore employer. |

| 6 months (minimum) |

| 2. Self-Assessment | Calculate your chances based on:

|

| – |

| 3. Application Preparation | Download & complete Form 4A (Parts A + Annexe A) and accompanying notes; submit online via ICA/SingPass. |

| – |

| 4. Supporting-Docs Upload | Scan & upload originals (with English translations if needed):

|

| – |

| 5. Processing & Outcome | ICA reviews all materials, conducts background checks, then notifies of outcome. |

| 4–6 months |

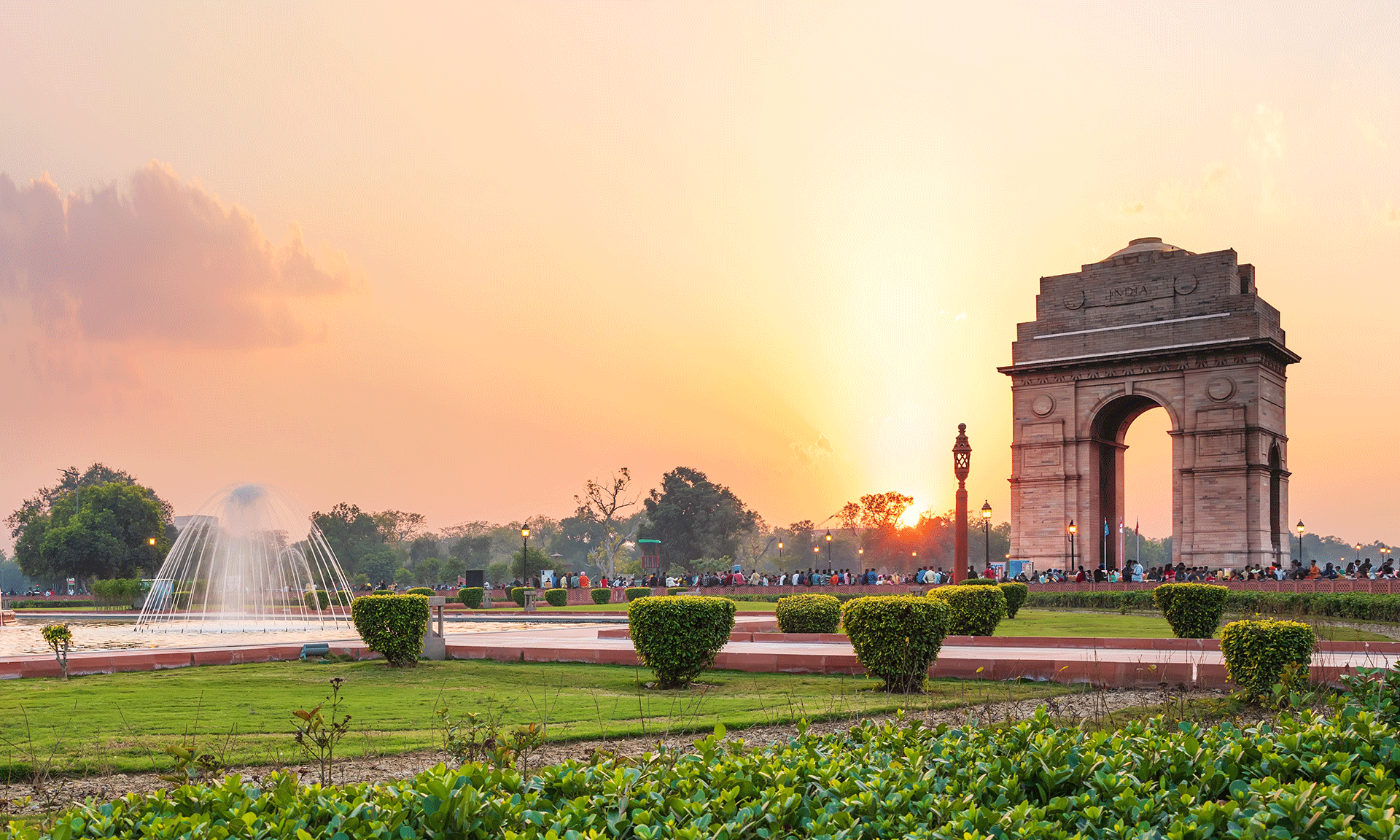

- Article, India

- September 30, 2020

A company in India is an artificial person, and its registration is a complex and lengthy process. There are numerous formalities and paperwork that should be complete before you approach the registrar of companies for incorporation. The following are the basic steps that need to be followed for India company incorporation.

Application for name approval.

You need the approval of the registrar for the name you propose for your company. It should not be prohibited by the Emblems and Names Act, 1950, and should not be identical or closely resemble any existing company name.

You need to send three preferences of names to the Registrar of the state where the company will be situated. The Registrar is expected to approve the name in 14 days of application.

Preparation of MoA

MoA is the key document of any company and is known as the constitution of the company. It describes the company’s objects and scopes with the outside world. For a public limited company, MoA should be signed by at least seven persons and in case of a private limited company, it should be signed by at least two people. It should also be properly stamped with the company’s seal.

Preparation of AoA

It is the document which states the rules and regulations for the internal working of the organization. A public limited company need not file an AOA and it can adopt the model clause prescribed in Table A, schedule 1 of the act. However, a private limited company needs to submit the AoA duly signed by the signatories.

Preparation of other documents

- Consent of directors, duly signed

- Copies of preliminary agreements, MoA, and AoA.

- Power of Attorney by the promoter in favor of one director or an advocate to supervise the registration process

- Required information about the registered office to the registrar of companies within 30 days of registration or commencement of business, whichever is earlier.

- The details of the first directors of the company within 30 days of registration or appointment of such directors.

- A statutory declaration stating that all the necessary documents have been compiled with. An advocate of a High Court or a Supreme court or attorney of a high court or a practicing Chartered Accountant must sign the declaration.

Payment of Fees

The prescribed registration fees and document charges are to be paid to the registrar at the time of registration. The amount of fees varies with the amount of nominal capital, in case of companies with share capital, and according to the number of members in case of companies without share capital.

Certificate of Incorporation

Once all the required documents are submitted with the registrar, he makes scrutiny. If the formalities are found in order, then the registrar will issue the Certificate of incorporation, after entering the name in the Register of Companies. The date mentioned on the certificate is the date of incorporation of the company.

Capital Subscription

Once your company is incorporated, the next step is to raise capital. A private limited company can start doing business just after the issue of the certificate of incorporation, but a public limited company cannot. It requires meeting the minimum subscription of share capital as subscribed by the government.

Steps for raising the funds for the public.

- SEBI approval

- Filing of Prospectus

- Appointment of Brokers, Underwriters, and bankers

- Minimum Subscription

- Application to Stock Exchange

- Allotment of Shares

Commencement of Business

After meeting all the capital requirements, a public company receives a Certificate of Commencement without which it cannot start with the business. The business can, hence, be commenced now and your company can function in the required manner. If you are looking to attract US Companies or any other foreign venture, then that is also possible now.

Filing of additional documents

- A prospectus or a statement in lieu of prospectus has been filed with the Registrar of Companies.

- A declaration that shares payable in cash equivalent to minimum subscription have been received.

- A declaration that directors have taken up their qualification shares and have paid the application and allotment money in the same proportion as others.

- A statement that no money is liable to become refundable to the applicants because of failure to apply for or to obtain permission for shares or debentures to be dealt in on any recognized stock exchange.

- The statutory of the company or a director files a statutory declaration that the requirements relating to the commencement of business have been duly complied with.

- Article, Singapore

- September 23, 2020

What is S Pass?

The S Pass is a work visa designed for mid-skilled foreign professionals, including journalists, accountants, and technicians, who are interested in working in Singapore. Managed by the Singapore Ministry of Manpower (MOM), the S Pass provides qualified candidates with access to a range of career opportunities in the city-state.

The S Pass allows eligible candidates to stay in Singapore for up to two years initially. The visa can be renewed for an additional three years, providing a maximum total stay of five years.

Singapore offers foreign workers various forms of work passes depending on their background. These work passes are issued and handled directly by Singapore’s Ministry of Manpower (MOM). There are four types of schemes for foreign individuals wishing to be employed in Singapore.

- S Pass

- Personalized Employment Pass (PEP)

- The Employment Pass (EP)

- Entrepreneur Pass (Entre Pass)

- The S Pass has strict regulations.

Document Required for S Pass in Singapore

The S Pass is designed for mid-skilled company workers. Technicians, accountants, programmers, typically apply for the S Pass in Singapore. The employer shall apply for your S Pass online through company’s EPOL account with MOM. The number of S Pass holders a company can employ is capped according to its industry’s Dependency Ratio Ceiling (DRC). The documents you need to provide when you apply for an S Pass include

- The S Pass Application Form – filled and notarized

- A formal letter of declaration (justifying your identity and request)

- A copy of your passport’s ‘personal details’ page

- Marriage certificate (if any)

- The business profile of the company you plan to work for

- Copies of all educational certifications, transcripts, mark sheets, etc.

- Proof of professional experience

- Letter of support from a Singaporean professional association or accreditation agency. For instance, a doctor will need to provide an official letter from the Singapore Medical Council, and lawyers will need an official letter from Singapore’s Legal Services Regulatory Authority

Eligibility for the S Pass in Singapore

The S Pass is a type of work visa designed for mid-level skilled workers employed by companies operating in Singapore. An application is assessed based on a point system with consideration for each of the following factors: salary, education qualifications, skills, job type and work experience. Here are the eligibility criteria for S Pass applicants

- There are no nationality-based restrictions

- Work experience in their respective field

- Have a degree, diploma, or technical certificate from accredited institutions

- Guarantee a fixed once-a-month salary of no less than $2,400. Older, more skilled applicants have to cross higher monthly salary brackets

- Family members can only apply if their pass holder earns at least $6,000 per month. They will apply for a Dependent’s Pass for their spouse and children

Here is The Process to apply for Permanent Residency (PR) in Singapore

Application for S Pass

Procedure for application of S Pass Singapore

Here are the steps for applying for an S Pass

- Provide a letter of consent to your employer/third-party member to apply for the pass. The letter should state your employment agreement

- Your employer/agency fills out the S Pass Application Form online

- Attach all the required documents (find a list of required documents on your S Pass Application Form)

- Pay the initial processing fee of $75

- Receive the In-Principle Approval (IPA) letter. Have this letter delivered to you by the employer/third-party

- Enter Singapore on a single-entry visa with the IPA

- Follow the medical documentation guidelines mentioned in the IPA

- Carry documents you’ll need to get your pass issued

Validity of S Pass

Benefits of S Pass

Permanent Residence Eligibility

Getting a Singapore Skilled Workers Pass

- Article, Oman

- September 22, 2020

The process of gaining employment for foreign nationals in the country of Oman has been increasingly regulated as part of the Omanisation initiative. Once a foreign worker is officially employed by an Oman-based company, the employment visa process starts. But in order to get a job offer from these local companies, an employer should prove that the foreign worker possesses the skills and experience that an Omani national cannot offer. Otherwise, an employment visa may not be granted.

There are two types of visas that are commonly used:

- An employment visa: This visa is applicable for individuals who are looking to be employed in Oman

- A Residence only Visa: This visa is applicable for spouses and other family members of an employed person.

Generally, the employer will apply for a residency Visa for an employee before they arrive in Oman. It is also common for the employer to have all the paperwork completed out for the employee before he / she arrives. The employer will also incur any expenses that are related to the same.

Steps involved in the procedure to obtain an employment visa in Oman

1.The employer should obtain a Labour Permit from the Ministry of Manpower

Firstly, an application has to be submitted to the related or specified department in the Ministry of Manpower and simultaneously meet the following requirements:

- The business organization must first be compliant with Omanisation rules and regulations as well as check the assignment of foreign employees for a particular activity or a department.

- The firm must ensure that the number of requested foreign workers is permitted for the specified operation of the firm listed under the company’s specific activities.

- The requested foreign workers in question must hold the correct and required qualifications.

2. Employment Visa Application

A potential individual applying for an employment visa in Oman must qualify the following eligibility criteria;

- The applicant (employee) must be between the ages of 21 and 60 years.

- The employee’s gender and job title must match those specified on the Labour Permit.

Please note that some nationalities require special permits. Find below some of the documents required to apply for an employment visa.

- 2 passport sized photographs

- Passport copy that is valid for not less than six months

- For applicants of certain specified countries, the original and a copy of the medical certificate is required. This must be attested by the Ministry of Health.

- If a foreign national has not completed 2 years with their previous Oman-based company, a release letter will be required. This must be approved by the Directorate General of Passports and Residence.

3. Relocation to Oman

After an employment visa is granted, the employee is free to travel to and from Oman with a copy of the document. Subsequently, they can also apply for a Residence Card.

4. Local medical tests

Upon arrival to Oman, the employee should collect his / her Residence Card from the Royal Oman Police within a month of entry. The employee will then be required to take a blood test and provide biometric information. After the results are collected, the Directorate General of Civil Status will issue a 2 year Oman Resident Card to the employee.

- Article, India

- September 18, 2020

The ownership of any Public Limited or private limited company in India is critically defined by the shareholdings of the company. Transfer of shares implies the voluntary handing of rights and duties of a shareholder, who does not wish to continue as a member of the company, to a person who wants to take the position. This transfer of shares, like any other moveable asset of the company, is possible only when there are no expressed restrictions on the transfer in the articles of association, prepared while Indian Company Incorporation.

Who are the involved parties in the transfer?

- Transferor

- Transferee

- Legal representative (in case deceased)

- Subscribers to the memorandum

- Company (unlisted/listed)

The Companies Act, 2013 lays the following procedure for the transfer of shares.

- The transfer deed should be drawn in the prescribed forms, which is Form SH-4, countersigned by the necessary authority.

- The transfer instrument may not be in the prescribed form only under the following situations.

- Where a nominee or director is transferring shares on behalf of a different body corporate under section 187 of the Companies Act, 2013.

- Where a nominee or director is transferring shares on behalf of some corporation controlled or owned by the state of the central government.

- Shares transferred by way of deposit as a security for repayment of some advance or loan, only when they are made with the following.

Any Scheduled Bank

State Bank of India

State Government

Central Government

Financial Institution

Any Other Banking Companies

Corporations held by the state or central government

The Trustees those who have already filled the declaration

In the case of transferring debentures, you can use a standard format as an instrument of transfer

- Bring the trust deed in case of debentures, the Articles of Association for shares, and the transfer deed that is either registered by the transferee or the transferor or on their behalf in proper accordance with the rules of the Companies Act, 2013.

- The Indian stamp act and the stamp duty notifications clearly say that the transfer deed should necessarily have stamps. The current Stamp Duty Value for transferring shares is 25 paisa for every 100 rupees of the value of the share or part thereof.

- Checking the affixed stamp on the transfer deed for its cancellation, before or at the time of signing it.

- The person who provides his/her initials such as name, signature, and address, as the approver of the transfer must ensure that both the transferee and the transferor should sign the deed in person.

- The relevant allotment letter or share/debenture certificate must be attached and sent to the company along with the transfer deed.

- If the application prepared by the transferor is for partly paid shares, then the company will have to notify the amount on debentures/shares to the transferee. A no-objection certificate is also required from the transferee, within two weeks of the notice’s receipt date.

- If the signed transfer deed is lost then attach the exact value stamp on a written application. In such a case, the board will be registering the transfer on the terms of indemnity whatever it thinks fit.

- If the shares being transferred are already listed on a recognized stock exchange, then there are no fees for the company to charge for the registration of the transfer of debentures or shares.

Cases where the company cannot register a transfer of partly paid shares

- When a company has already given a notice to the transferee in Form No. SH.5

- The date till which the transferee has not issued the no-objection certificate within two weeks of receiving notice from the company.

Approval

All the transfer of shares procedures must be completely approved by the board of directors or any such committee formed by the directors. If the scrutiny is successful and acceptable, then the transfer will get approval with the right authority.

Share Certificate Delivery

Your transfer will become effective only after the approved registration process of the company. The shares certificate gets delivered within one month from the receipt of the company’s instrument (for which transfer request is made).

The time limits associated with the procedure

- A company with a share capital

There should be no registration of any transfer of securities of the Company or member’s interest in the Company, other than beneficial owners, without a proper instrument of transfer within 60 days from the date of execution.

- Application by transferor only

For the company which is private limited in India, the transfer should not be registered until and unless the company has given a notice of the application to the transferor and the transferee gives no-objection certificate within 2 weeks from receipt of the notice.

- The company should deliver the certificates of all the transmitted/allotted/transferred securities in the below-mentioned cases along with the specific time limits.

Debenture allotment: within 6 months from the date of allotment.

In case of subscribers to memorandum – within 2 months from the date of incorporation

In case of allotment of any of its shares – within 2 months from allotment date.

Company’s receipt of the intimation of transmission or instrument of transfer: within 1 month from the date of receipt.

Penalties on parties involved in the transfer process

A penalty of a minimum of 25,000 and a maximum of 5,00,000 is imposed on the company for any wrong or delayed practices.

However, an officer in default is penalized with a minimum of 10,000 and a maximum of 1, 00,000.

For the detailed insight into the share transfer process in India, feel free to get in touch.

- Newsletter, U.A.E

- September 14, 2020

2020 continues to be unpredictable with the UAE incorporating certain changes to the existing ESR (Economic Substance Regulations) policies, in a way to overhaul the existing principles associated with Economic Substance Regulations. As per the existing ESR guidelines, companies based out of the United Arab Emirates had to file reports, showcasing the legislative whereabouts, and tax-related activities.

Premise

Before we move any further, it is necessary to retrace the original guidelines issued on the 30th of April, 2019, as a part of the Resolution 31, postulated by the Cabinet of ministers. Besides that, specific regulations by the MOF (Ministry of Finance) were also put forth on 11th September 2019, via the Ministerial Decision no. 215. To put things in the hindsight, the existing ESR guidelines aimed at removing companies from the EU European Union) backlist and easing out the approaches for handling the Coronavirus pandemic followed by a more accommodative ESR filing deadline.

The Change

The new regulations started coming in on the 10th of August, 2020 as a part of the Resolution 57, to replace and repeal the existing Resolution 31. Similarly, Ministerial Decision 100 also comes to effect which inadvertently supersedes Decision 215 with immediate effect. While the new decisions and regulations were postulated on 10th August and 19th August respectively, official announcements were made on September 2.

Major Changes

As per Resolution 57, the authorities have issued a list of exempted licensees, as per the following categories, including

- Investment funds and relevant setups

- Tax residents associated with jurisdiction other than that of UAE

- Foreign entity branches with taxable income falling outside the purview of UAE jurisdiction

- Entity handled completely by the UAE residents and not associated with the MNE(Multinational Group of Entities), in any given manner

However, to make the most of the exemption, the relevant companies must produce verifiable evidence and file the requisite notification.

Moreover, the Cabinet affirmed the establishment of FTA or the Federal Tax Authority for,

- Assessing the relevance of the licenses as per the ES tests

- Functioning as the National Assessing Authority

- Impose penalties, if and when relevant

- Hearing, ascertaining, and deciding on relevant appeals made by the licensees

- Exchanging information with competent authorities

The changes aimed at restructuring the chain of command and handing over the power to a centralized authority rather than that synonymous with the relevant licensee governing authorities include that of the Ministry of Economy, Free Zone Authorities, and more.

Besides that, changes in regulations and decisions also had an impact on the penalties and associated impositions, with

- Failure to submit notification is now penalized by the US $5,450, readily bumped up from $2,725 (AED 20,000)

- Failing the ES test is now charged at US $13,625 or AED 50,000

Apart from the following, failing the test in the subsequent fiscal year is also charged at a massive AED 400,000 followed by increased chances of license suspension, non-renewal, or revocation

- Providing inaccurate information is also subject to penalties, amounting to AED 50,000

Lastly, the new regulation also includes a provision for Random Inspections by the NSA (National Assessing Authority) officials.

However, more transparency in the discourse, deadlines, and relevant procedures are expected in the days to come.

What do the Changes Mean?

The features changes to the ESR guidelines instruct licensees to cross-check the documentation to stay relevant to the Economic Substance. Every aspect of ESR obligation, related to the Relevant Activities must be reiterated and analyzed to check for compliance failures, erroneous or delayed submission of notifications, delayed filing possibilities, and other forms of risk mitigations for avoiding penalties.

There will also be an online portal, launched by the MOF for filing reports and notifications, electronically, as per the new Decision 100.

ESR Return or Submission by 31st December 2020 is also stressed upon for licensees to verify compliance, once and for all. The ESR Return must declare the following:

- UAE-centric management with a relevant directorate

- Insights into the adequacy related to physical assets, expenditure, and workforce

- CIGA or Core Income Generating Activity channels across the UAE for Relevant Activities

How IMC can help?

Considering the brevity of the situation and the more stringent set of guidelines to adhere to, we, at IMC, might just help you stay within the scope of ESR while ensuring cent percent compliance and adherence to the existing regulations. In case of non-compliance is obvious, our professionals help speed the remediation process, within days.

As a leading global accounting firm, we help you assess the numerous impacts of the recent changes on the business and financial activities while paving the way for a more sustainable future. We conduct preliminary compliance assessments and offer time-intensive and efficient solutions for instilling a culture of holistic statutory and administrative transparency.

- Newsletter, U.A.E

- September 10, 2020

According to Dubai’s Government Authority on commodities trading and enterprise, the DMCC has reduced business set-up fees by 50% to entice international diamond firms for DMCC company formation in Dubai. The 50% discount went into effect this past August and will expire at the end of September of this year. Furthermore, new company registrants will be given a 1-year membership in the DDE (Dubai Diamond Exchange) community of more than 1,000 of the top diamond firms in Dubai.

The Minister of State for Foreign Trade and UAE Ministry of Economy, His Excellency Dr. Thani Bin Ahmed Al Zeyoudi, stated that precious metals and stones trading is a key component of the country’s economic investment diversification agenda. The UAE Ministry of Economy is currently focusing their efforts on generating a new stage of economic development and growth by making the diamond trade a priority. He went on to say that the DMCC should be applauded for their ambitious vision and their efforts, as Dubai has turned a period of turbulence into an opportunity.

Though globally, diamond industry is passing through a volatile time, yet after nearly 2 decades of expeditious growth, Dubai has quickly evolved into the leading hub for the world’s diamond trade. In the 15-year period from 2003 to 2018, the total value of polished and rough diamonds rose from $3.6 billion or Dhs 13.2 billion to $25 billion or Dhs 91.8 billion. The DMCC also revealed their plans for assisting Dubai in becoming the leading international trading hub for colored stones and Laboratory Grown Diamonds (LGD) as well.

While many perceive the current turbulence in the diamond industry as a threat, Dubai sees this as a grand opportunity to promote new business setup in Dubai. For the UAE, the key element of their approach to business is adaptability. The Dubai government is hopeful that the reduced set-up fees will help to eliminate the business entry and supply barriers by supplying the support businesses need during these challenging times. It is widely felt that the future of diamonds is in Dubai.

Chairman of Dubai Gold and Jewellery Group, Tawhid Abdullah had said that Dubai has managed to traverse the difficulties, for UAE to become synonymous with the bustling diamond trade. Even though global trade in diamonds is low-key as of now, Dubai has taken a head start and with DMCC playing a major role in securing stability in precious gems and metal trade.

When the DMCC was established in 2002, it dedicated its efforts to developing an ecosystem of facilities, services, and a state-of-the-art infrastructure that would attract, encourage, and promote diamond trading in Dubai. Thanks to the growth of the DDE, considered by many to be the largest diamond tendering facility in the world, Dubai is now the heart of the diamond trade in this geographic region. Additionally, the DMCC has welcomed Lumex, a company that produces laboratory-grown diamonds, into the Free Zone’s LGD community.

CEO and Co-Founder of Lumex Vishal Mehta recently shared his appreciation for being invited to join the DMCC and praised their efforts at promoting the diamond trade in Dubai. Mehta went on to say that the support being provided by the DMCC has enabled their company formation in Dubai and throughout the Middle East. There are now over 1,000 diamond company members in the DDE. The DMCC is also promoting memberships for laboratory-grown diamond companies. In fact, the DMCC held the very first LGD trade fair at the DDE and had over 50,000 carats on display.

- Newsletter, U.A.E

- September 10, 2020

The pandemic has left the world economies in shambles and the unemployment rate is touching a new high in many countries. Establishing a new company or launching a new business might be counter-productive, according to most people. However, other feel that it is a good time for business setup in Dubai due to the concessions and tax leeway granted by the government agencies.

Setting up businesses take time and if you set up a business and incubate it for a few months, the economy is bound to recover. This will allow businesses get the necessary time to grow as the economy thrives in the post pandemic scenario. While there is “never a convenient time to become an entrepreneur”, experts believe that if you are able to make niche for your small entrepreneurship and get the right leverage, your success will grow as the economy recovers.

If you are thinking about doing it, here are 7 reasons for doing the unthinkable and launching a new business in MENA.

Business opportunities tend to bloom during a recession – when a product or service can find a fit in the global market, new businesses tend to gain momentum over the ensuing months. By arming yourself with the right knowledge, you can fill the needs of many as well as the gaps left by other businesses, by taking the next step for company formation in Bahrain.

Find a U.S.P. (unique selling proposition) – when the status quo is being challenged as it is today, you have to address it head on. The key to company formation in Qatar in these uncertain times is to identify a need and create a solution that will satisfy it. Remember, if you’re not solving something in this business climate, you won’t be successful.

Launching during a crisis may be more cost-effective – numerous free zones and entrepreneurial hubs are offering new business start-up incentives that you might be able to take advantage of. Most UAE free zone authorities are offering application fee waivers as well as discounted business licenses and lease of rental agreements.

MENA is becoming increasingly more digital – businesses are collaborating via Hangouts, Teams, and Zoom. So, the in-office meeting is quickly becoming extinct. This could provide an opportunity for ambitious and savvy entrepreneurs. Keep in mind the fact that there are now more consumers buying items online than ever before.

Striking out on your own during a crisis grabs the attention of investors – the true entrepreneur will see a crisis as an opportunity to establish a niche for themselves. This tells potential investors that you are resilient and not afraid of risk. If your business can thrive during difficult times, you’ll experience explosive growth when times are better.

Unavailable top talent may now be available – during times of crisis, companies are often forced to let go of their best talent which means these individuals are looking for a new place to use their talents. The bottom line is that there are lots of specialists who need to find work and you could fill that need with a little effort.

When the going gets tough, shift into creativity mode – due to the pandemic and its impact on businesses globally, this has created a robust state of creativity. This has caused a shift from survival mode to the start of an entrepreneurial revolution of sorts.

- Newsletter, U.A.E

- September 10, 2020

For companies who are contemplating a new business set-up in Dubai, the following should be helpful in the decision-making process. Despite the business and economic repercussions of the first half of 2020, Dubai has managed to hold its position as a leader in FDI’s or Foreign Direct Investments in the MENA (Middle East and North Africa) region. Based on recent statistics published in Financial Times’ FDI Markets, Dubai was ranked #3 in greenfield FDI’s and 4th in capital flow on a global scale.

Economic Growth and Recovery

Dubai Crown Prince Sheikh Hamdan Bin Mohammed Bin Rashid Al Maktoum recently stated that FDI’s are continuing to flow into the area with current FDI projects valued at AED12 billion ($3.27 billion). This was a positive move that showed other countries are doing business in the UAE and that reinforced the premise that economic laws are conducive in UAE. These projects included the e-commerce, pharmaceutical, and technology sectors. These figures and statistics are a reflection of how attractive the investment environment is in Dubai and how well the economy has been recovering from the Coronavirus pandemic.

Achievements on a Global Scale

Sheikh Hamdan expressed his sincere gratitude as the emirate has been ranked as one of the world’s top destinations for FDI’s. This is attributed to the attractiveness and diversity of investment opportunities in emerging and strategic economic sectors. Dubai was ranked as the #1 FDI destination in the Middle East and North Africa (MENA) region and 11th out of 20 worldwide FDI destinations (see FDI Markets’ Global Venture Capital FDI Ranking 2020 report).

Pertinent statistics indicate that sustained FDI investments in Dubai company incorporation exceeded AED 739 million ($201 million) during the first half of 2020. Rankings published in the “FDI Aerospace Cities of the Future 2020/2021” report showed Dubai as #7 out of the 10 top global destinations while achieving a #2 ranking in global FDI performance in that particular sector. Additionally, Dubai FDI Monitor data showed an increase of 53% in medium to high technology investments during the first half of 2020.

CEO of Dubai FDI, Fahad Al Gergawi emphasized that as the current world leader in global investment destinations, Dubai has already adopted measures to navigate the challenges of the pandemic. He was of the opinion that most of the FDI projects in the H1 2020 were marked by innovations in technology, cash flow and better operational capabilities. The rising trend of improvement in the economic functioning, confirms the advancement of investments in Dubai.

New Growth Opportunities

Director General of Dubai Economy, His Excellency Sami Al Qamzi, stated that Dubai’s successful development of new investment opportunities were attributed to Foreign Direct Investment trends in the first half of 2020. These new opportunities for sustained expansion and growth in Dubai have presented themselves under Sheikh Hamdan’s leadership and directives. This has made the global and local investment communities stronger despite having to overcome the challenges of the Coronavirus pandemic and has benefited DIFC company formation.

In addition to this, Al Qamzi stated that the first half of 2020 saw positive developments in Dubai’s and the UAE’s investment environments that were that were supported by UAE FDI laws and regulations as well as business continuity stimulus packages. Al Qamzi went on to praise the private sector’s role as a strategic partner in overcoming the many challenges of the COVID-19 pandemic. This increased the competition and resilience of the Dubai economy while at the same time ensuring that supply chains wouldn’t be interrupted.

- Newsletter, U.A.E

- September 10, 2020

His Highness Sheikh Mohammed Bin Rashid Al Maktoum recently issued Law No. (9) which regulates Dubai-based family-owned businesses. This will benefit many existing businesses and also benefit those who want to launch a new business setup in Dubai. Law No. (9) seeks to:

- enhance family-owned business contributions for economic and social development

- foster family-owned business expansion and growth

- protect the wealth of families that own businesses in the UAE

Furthermore, this law applies to current and new family-owned businesses including proprietorships and corporate equity securities. Public joint stock companies that are family-owned as well as movable and immovable properties are not regulated by this new law. While this is a progressive approach to the protection of a family’s wealth, it also provides an option for families doing business in UAE to customize the terms within their Family Property Contract. As per the new law, the validity of the ownership contract is extendable for 15 years and can be renewed periodically after that.

This new law was implemented after many family-owned Dubai businesses petitioned the UAE government to adopt economic measures to prevent the impact of the pandemic on their businesses.

Stipulations of the Family Ownership Contract

All parties of the Family Ownership Contract must be immediate family members and have a common goal and single interest in order for it to be legally binding. Additionally, each member’s share must be clearly defined in the contract. Plus, the parties must have all legal rights to the assets and revenues that are found within the scope of the contract. A notary public must attest to the rules and regulations concerning Dubai notaries public as stipulated under Law No. (4) of 2013.

Validity and Renewal Issues

According to Law No. (9) 2020, the validity of the contract can be extended up to 15 years. Renewal for a similar term is possible provided all parties involved in the Family Ownership Contract agree to do so. In addition to regulating the articles of the contract, Law No. (9) also regulates the following:

- authorities and responsibilities of the board and management

- business’s management and structure

- formation of the board of directors or owners

- management’s limitations and powers

The authorities and responsibilities of government entities regarding the formation of a family-owned business is also defined under this new law. Any other legislation that challenges or contradicts the articles of the contract will be annulled.

Finally, should any dispute arise between the members of the Family Property Contract, it shall be settled by a judicial committee made up of family management, financial, and legal experts. This will ensure the confidentiality and privacy of these matters and will help to resolve the dispute in an efficient and timely manner. Last but not least, the law will be valid as of its publishing date in the Official Gazette.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group