- Article, Singapore

- September 16, 2019

Singapore, one of the leading Asian economies is all set to sign a free trade agreement with the Eurasian Economic Union (EAEU) in October 2019. The news is confirmed by Veronika Nikishina, Minister of Trade of the EAEU at the Far Eastern Economic Forum. With this move, Singapore will become the second ASEAN (Association of Southeast Asian Nations) after Vietnam to sign such a deal.

The EAEU is the international organization for regional economic integration. It is a free trade area. Many other countries like Armenia, Belarus, Kyrgyzstan, Kazakhstan and Russia also enjoy free trade with the EAEU. The combined gross domestic product (GDP) of EAEU is approximately US $ 5 trillion. Moreover, the EAEU countries represent a market of around 183 million people which works in its advantage.

The EAEU is strategically located between the European Union and China facilitating easy transport of goods between the two countries i.e. China and Europe. Last year China inked the free trade agreement with the EAEU; however, it was a non-preferential agreement. The negotiations are in line between China and EAEU over tariffs on goods. Once the deal is crystallised, there will be a considerable expansion of trade between China and Russia and goods transport between China and Europe. With this news, Moscow and Beijing have expressed their desire to increase their current bilateral trade volume to US $ 200 billion in the coming four years.

The free trade agreement between Vietnam and EAEU has also seen a boost in bilateral trade with Russia from nil to approximately US $ 250 million per annum within a period of two years. According to the Deputy Prime Minister of Vietnam, the free trade agreement is expected to liberalise next year with additional categories in textiles and agriculture.

Singapore being a hub of financial services in Asia and ASEAN, it is expected that the free trade agreement will include the provisions for financial and related items.

Many other countries including Egypt, Turkey and Serbia are also negotiating with the EAEU to sign the free trade agreement. This further pushes Russia closer to the Asian markets of China and Southeast Asia. The Asian market is likely to see an increase in Russian investment.

For Russian businesses who are eyeing to develop throughout ASEAN and the emerging markets of Indonesia, Philippines, Malaysia, Vietnam and Thailand, Singapore acts as an excellent regional base. Moreover, the ASEAN economies are showing positive GDP growth which further attracts investments into the region.

As per the latest communication from the Russian trade office in Singapore, no official statement has been given on the date of signing of the free trade agreement. But as per the media reports, the free trade agreement between Singapore and EAEU will be signed on October 1.

In the initial phase, the free trade agreement is anticipated to deal with trade in goods and commodities and will not accommodate financial services.

About Us

IMC Group is a leading cross-border advisory firm focusing on AMEA (Asia, Middle East and Africa) markets. If you are looking for company formation in Singapore, you may get in touch with us. Along with Singapore company incorporation, we also offer accounting and business consulting services across the globe.

- India, Newsletter

- September 11, 2019

The government recently allowed foreign direct investment (FDI) in the sectors of coal mining, digital media, and contract manufacturing while simplifying rules for all the single-brand retailers to make it more attractive and appealing for global brands like Apple, Uniqlo and IKEA to come and invest in the country.

Additionally, the finance ministry has informed about new rules that allow 100 percent FDI for insurance intermediaries. These FDI amendments are in line with the recent budget announcements, though a ruling on aviation is still awaited. “The changes in FDI policy will result in making India a more attractive FDI destination, leading to benefits of increased investments, employment and growth,” said Piyush Goyal, the commerce and industry minister.

This simplification of FDI norms has been done days after India’s finance minister Nirmala Sitharaman introduced a draft of new measures to offer a boost to the slowing economy. These steps come amidst a predicted slowdown in the flow of global FDI and are aimed at encouraging investment, particularly in new ventures, provided that domestic firms are denying to pump in money for expanding facilities, quoting the main reason as excess production capacity.

At least two of these amendments are intended for more high-profile businesses. Thus, simpler rules in single-brand retail are basically aimed at supporting international players like Japanese retailer Uniqlo, who can now hope to accept online sales for the next couple of years while it opens its retail outlets. The Swedish household goods and furniture retailer IKEA, for example, could not commence online sales till the time they opened their first store in Hyderabad city recently.

Likewise, by permitting 100 percent FDI in the field of contract manufacturing, the government is hoping to pull in investment from big organizations like Apple that has stayed away from India so far and has been demanding some special sops. Though the government eased rules in the past too for the iPhone manufacturer, by decreasing the sourcing burden, this American giant has not agreed to open stores in the country. In addition, some rules were simplified recently to treat all the exports from India as part of the 30 percent domestic sourcing obligation, Piyush Goyal announced.

The minister also mentioned that the twin moves are basically meant to make Indian companies a part of the international value chain especially at a time when global players are thinking of expanding their footprint much beyond China and setting up in other markets as well.

Various analysts are of the view that the amendment in the rules for the coal mining sector, where 100 percent FDI was permitted in case of captive mines only, is now expected to open the entry for global giants like Shenhua Group, BHP Billiton and Anglo American Plc. Now, these organizations would be permitted to sell the coal that they mine besides the process of handling, separation, washing the coal and crushing it. In the last five years, the government led by Narendra Modi has simplified the rules for the coal sector, and has also moved to a method of auctioning blocks after a Supreme Court order. These steps are intended to tackle with the coal shortages in India, which happens to be among the biggest global producers of the mineral.

- Newsletter, U.A.E

- September 11, 2019

India is Dubai’s second-largest trading partner due to bilateral non-oil trade between the two countries. So if you are thinking of new business setup in Dubai, then this is surely a good idea.

Approximately 2,208 Indian firms joined as new members in Dubai Chamber of Commerce and Industry (DCCI) in the very first six months of this year. This marked an almost 18 percent increase as compared to same time period in last year and also highlighted a mounting confidence in the emirate as an investment hub.

Indian companies accounted for about 24.4 percent of new member firms that got registered with DCCI in the time period between January to June 2019, thus bringing the total figure of Indian members to 38,704.

The latest numbers were released by the DCCI before the official visit of Indian Prime Minister Narendra Modi to the UAE last week.

Hamad Buamim, the President and CEO of DCCI, said that the rise in Indian members joining the Chamber ensues important developments that have reinforced the India-UAE relationship in the past few years, which includes various high-level visits and meetings, strategic cooperation agreements being signed by both the governments, a stable upsurge in bilateral trade and the flow of investment and expansion of direct flights. All these steps taken by both the countries have pulled in more people to go in for Dubai company formation.

India is still Dubai’s second-largest trading partner as it clocked a figure of $31.6 billion (116 billion UAE dirhams) worth of bilateral non-oil trade last year. As per data, currently, the bilateral trade is dominated by mineral products and base metals, precious metals and pearls.

Recent DCCI analysis suggested that there are many areas where India could potentially enhance its exports to the UAE such as pharmaceuticals, vehicles, electrical machinery, apparels and clothing accessories.

Besides that, printed books, carpets, natural pearls and textiles were recognised as high-potential products that could be exported from the UAE to India in the near future.

This year, according to data, almost 9,062 firms joined DCCI as new members in the H1 of 2019, thus marking a year-over-year (y-o-y) increase of approximately 22 percent and getting the organisation’s total membership 240,000 plus.

- Newsletter, Oman

- September 11, 2019

Oman’s Ministry of Commerce and Industry is going to enforce a new law starting January 2020 with an aim to make the country an attractive investment destination. The launch of this law is a move to ascertain the steadiness of foreign investments in the Sultanate.

Mohammed bin Rashid Al Badi, the Acting Director of the Legal Department at the Ministry of Commerce and Industry, was of the view that the ministry will apply the Foreign Capital Investment Law that is issued under Royal Decree No. 50/2019, starting from January 2, 2020. The law is anticipated to come into force after six months of its publication in the official gazette, and while talking about this, Mohammed Al Badi said: “Until the implementation of the new Foreign Capital Investment Law, the law which is already in force will continue to regulate foreign capital investment. The new Foreign Capital Investment Law will apply to all non-Omanis who want to establish a project that is economically feasible for the Sultanate, for which they would use their own capital and assets.”

He also said that for creating an appropriate investment environment in the Sultanate, an investment services centre had been founded at the Ministry of Commerce and Industry for the registration of foreign investors, business setup in Oman and for facilitating various licencing procedures.

It is compulsory for the investment services centre and other applicable organizations to comply with processes and timelines for allotting foreign investors with requisite permits, approvals and licenses. If the applicants fail to get a reply in the stipulated time, it would mean that their application has been rejected.

Al Badi also said that the Foreign Capital Investment Law offers multiple incentives and benefits for foreign investments to foster their stability and flow in the Sultanate, as they eventually have an impact on the economic development. It permits the investor to set up a company or do company formation in Oman in one of the acceptable activities, thus allowing them to own all of the capital.

This law does not specify a minimum benchmark for foreign capital investment in a specific project, as far as it complies with the proposed time frame for its execution as per the economic feasibility study.

He also said that the law does not allow for any substantial changes without the ministry’s approval. “Article 18 of the law gives the investment project the right to avail all of the advantages, incentives and guarantees enjoyed by the national projects in accordance with the laws already practiced in the Sultanate. Additional benefits may also be given to foreign investment projects established in the less developed regions of the Sultanate.”

Article 19 of the law allows the allocation of land or real estate for the investment project specifically under a long term lease. It also permits the right of usufruct without the requirement for the provisions of the Royal Decree controlling the use of land in the Sultanate, or the Land Law, to be complied to. This is as per the rules and guidelines laid out by the regulations in coordination with the pertinent authorities.

These authorities would specify and assign sites in each governorate for setting up of investment projects with the right of usufruct. They would also offer general services like water, gas, electricity, roads, sewage, communications and other such facilities to the project area. Article 21 of the law demands that the investment project can, either by itself or through a third party, import whatever it needs for its setting up process, expansion or operations.

This also includes any production requirements such as raw material, machinery or spare parts and means of transport that are apt for the nature of its activity, without the need for registering itself as an importer.

Al Badi also said that to stabilise the foreign investment in the Sultanate, the Foreign Capital Investment Law provides some guarantees; for example, the rights of investment projects being established in the Sultanate. Article 23 of the Foreign Capital Investment Law No. 50/2019 specifies that projects cannot be detained and investment is now allowed to be frozen or taken into custody, except if there is a court ruling for it. It also gets exemption from taxes of the state.

The newly launched Foreign Capital Investment Law also assures that the investment project cannot be seized, except as per the provisions of the expropriation law in public interest. In that case, a fair compensation needs to be provided without any delay. This is specified in Article 24 of the law. Likewise, the right of usufruct or lease is not permitted to be seized in the case of privatization of the land or real estate; the only exception is in cases that are prescribed either by law or by a court ruling.

- Newsletter, Singapore

- September 11, 2019

The whole world is reeling under the effects of strong economic headwinds coupled with the US-China trade tensions. But that has not stopped Singapore from charming and pulling in huge unexpected amounts of investment commitments.

In first six months of 2019, Singapore has already attracted a whopping $8.1 billion of investment commitments particularly in the manufacturing and services sectors.

This is way higher than the last year’s figure of $5.3 billion of investment commitments for the same period.

In fact, the figures quoted in the Economic Survey of Singapore recently, have already exceeded the lower bound of the Economic Development Board’s (EDB) estimations done in February for the year 2019.

The EDB has forecasted that Singapore is all set to attract anywhere between $8 billion to $10 billion worth of fixed-asset investment commitments in this year, which is in line with previous few years.

In 2018, the country pulled in $10.9 billion worth of investment commitments – a target which seems well within reach.

Song Seng Wun, CIMB economist said last week that these are positive signs, particularly in the technology and chemicals sectors and a good time for company formation in Singapore.

He also said that near-term growth apprehensions, higher operating costs and issues related to manpower should not discourage companies with deep pockets.

It is not surprising that the top ranking foreign investors still continue to be the US and Europe, said Mr Song. The technology, data services, and chemicals industries continue to be dominated by American organizations, closely followed by European companies.

Technology firm named Micron, the social media leader and giant Facebook and British home appliance company called Dyson are just a few of the known companies that have established their shop here.

Chua Hak Bin, Maybank economist cautioned that though companies may state envisioned investment commitments, the real spending could come in much lower.

New fixed-asset investment is pouring in at an important juncture, given that Singapore is in need of boost of a capital expenditure to shield the export downturn.

“We hope that these commitments materialise into actual capex spending and job creation, as there have been episodes in the past where the two have not been correlated,” said Mr. Chua.

He also said that it is not clear that Singapore is gaining from shifts in supply chains because of the US-China trade war or not. “Singapore appears to be gaining more US investments than from China,” he said.

Though manufacturing sector still remains an important pillar of the Singapore economy, Mr. Song is of the view that the services sector could pull in more fixed-asset investments as compared to the manufacturing sector by the end of 2019 and company incorporation in Singapore in services sector would be more.

He also said that the requirement for data, research and development and scientists will surely create jobs and that is why the Singapore Government has been so engrossed in the knowledge economy and the skill-sets that are required to participate in it.

It is also very important to translate investment commitments into real and actual jobs.

- Newsletter, U.A.E

- September 11, 2019

The construction sector in UAE is all set to show a record growth of almost 6 to 10 percent in 2020 in spite of problems like extended deadlines and tight budgets.

Over 50 percent of the industry leaders surveyed in the UAE for a Global Construction Survey mentioned that the construction sector in the country is resilient and is slated to grow because of increasing investment in technology innovation. Therefore, company formation in Dubai in this sector is going to be profitable.

On the other hand, the country’s professionals were still divided on the question if the UAE companies are completing projects within the set timelines and budget, with timelines (44 percent) and cost overruns (44 percent) positioning as the top obstacles facing capital construction projects, as per the survey.

However, the survey report stated that these challenges of timelines and budgetary constraints are being tackled as the industry has adopted practises and procedures to link governance to the outcomes of the projects. The industry leaders in UAE realise that well-managed and executed projects with right management practices and suitable controls are more probable to attain broad measures of success in the future. For people planning business setup in Dubai free zone, these are the few things to be kept in mind.

Other than that, the UAE is already experiencing technological disruption in this sector due to 3D printing and automation. As per the survey’s global findings, the usage of robots in this field, intelligent tools, unmanned aerial vehicles and equipment would continue to automate many repetitive, less complex but high-risk tasks, resulting to a workforce which is even more leaner, specialized and digitally-enabled.

Over 80 percent of the leaders who were surveyed in the UAE were of the opinion that digital modular fabrication is going to be widely implemented in the coming 10 years, which would be followed by intelligent construction equipment (56 percent) and robots (25 percent). Another aspects would be usage of data analytics and predictive modelling, which is likely to play a significant role in the coming five years.

It is being believed that the construction sector is actually the lifeblood of the economy of UAE. The industry leaders are of the opinion that the industry is anticipating single- to double-digit growth in 2019. As the pace of disruption speeds up, the sector leaders would have to consider executing a three-pronged approach to justify governance and controls, enhance human performance and revolutionize with technology to become fully future-ready.

To summarise, a strong workforce coupled with good technological investment is the need of the hour for the sustainable growth of the construction sector in the UAE. It is actually the people who form the backbone of the industry and the sector’s leaders should invest in human capital to spur overall performance and make sure that project deliveries are on track.

- Article, India

- September 10, 2019

The Tamil Nadu government is expecting some changes in the industry, particularly in the auto industry, as the Centre is urging for electric vehicles by 2030 and would like to position itself well in this regard.

Mr. Palaniswami was escorted by a delegation including the Ministers of Industries M.C. Sampath, Revenue and Disaster Management and IT R.B. Udhayakumar, Milk and Dairy Development Rajenthra Bhalaji, Chief Secretary K. Shanmugam, many other government secretaries that included Industries secretary N. Muruganandam and CM’s secretary S. Vijayakumar. Sandeep Chakravorty, India’s Consul General in New York was there as well and he also addressed Thursday’s gathering.

In the meet, Mr. Palaniswami mentioned about former Tamil Nadu Chief Minister Jayalalithaa’s vision for fostering this state as the numero uno State in India and his government’s headway in achieving that dream.

Some recurring themes were observed throughout the event. As per data, Tamil Nadu was India’s second biggest State economy, which was doing better than the national average on multiple economic and developmental fronts, boasting of a highly educated population and also a skilled labour force. He said that the best evidence for the State’s vivacious investment environment is the great success of the Global Investors Meet (GIM) 2019. Tamil Nadu had pulled in approximately $43 billion worth of investments just through 304 MoUs.

Mr. Palaniswami said that in the defence industry corridor which is coming up in Tamil Nadu, his government is taking multiple initiatives to endorse aerospace and defence manufacturing industries. He also added that over 8,000 acres of land has been available at many industrial parks across the State.

While assuring the audience, he said that his State would always stand by everyone and give people the best possible investment experience. Top-level officials, including the Honourable Chief Minister, were also present to validate the commitment of the State government to attract investments.

He also said that investing in Tamil Nadu is like betting on a winning horse as the State is unique in being business-friendly and also welfare-oriented. This had developed the State into both a high consumption economy and a manufacturing hub.

Gaining profit from tension

Mukesh Aghi, the President and CEO of USISPF said that almost 200 U.S. companies, with around $21 billion in investment plans, were eyeing India as an investment destination because of the tariff wars going on between the U.S. and China. The accountability of capitalising on this prospect was divided between the Tamil Nadu and Central governments, according to Frank Wisner, who is a former U.S. Ambassador to India. He said that Centre carries huge responsibilities to come out with laws that ease employment of labour, the acquisition process of land, the dependability of tax systems and accountable and fiscally-minded government operations along with setting up a secure financial sector that is able to fuel investment.

The State, as per Mr. Wisner, would also then need to pitch in with full responsibility to assist in finding land and facilitating clearances, “running interference with Delhi”, offering educational and health infrastructure for the work forces and managerial talent.

The Chief Minister along with his team are slated to fly to San Francisco, Los Angeles, San Jose and then Dubai. He is going to meet with potential investors there and the Tamil diaspora in these places and then visit the Tesla electric vehicle factory located in Fremont, California.

The delegation also met with the Tamil diaspora in New York City this week, as part of the Yaadum Oorae (which means, everywhere is home) theme of the trip. Mr. Palaniswami also launched a website for pulling in more investment to the State, specifically from the Tamil population settled abroad. He said that by using this portal, the investors will be able to offer investment suggestions, which would directly reach the State government. People can also make use of the single window system through this portal.

- Article

- September 4, 2019

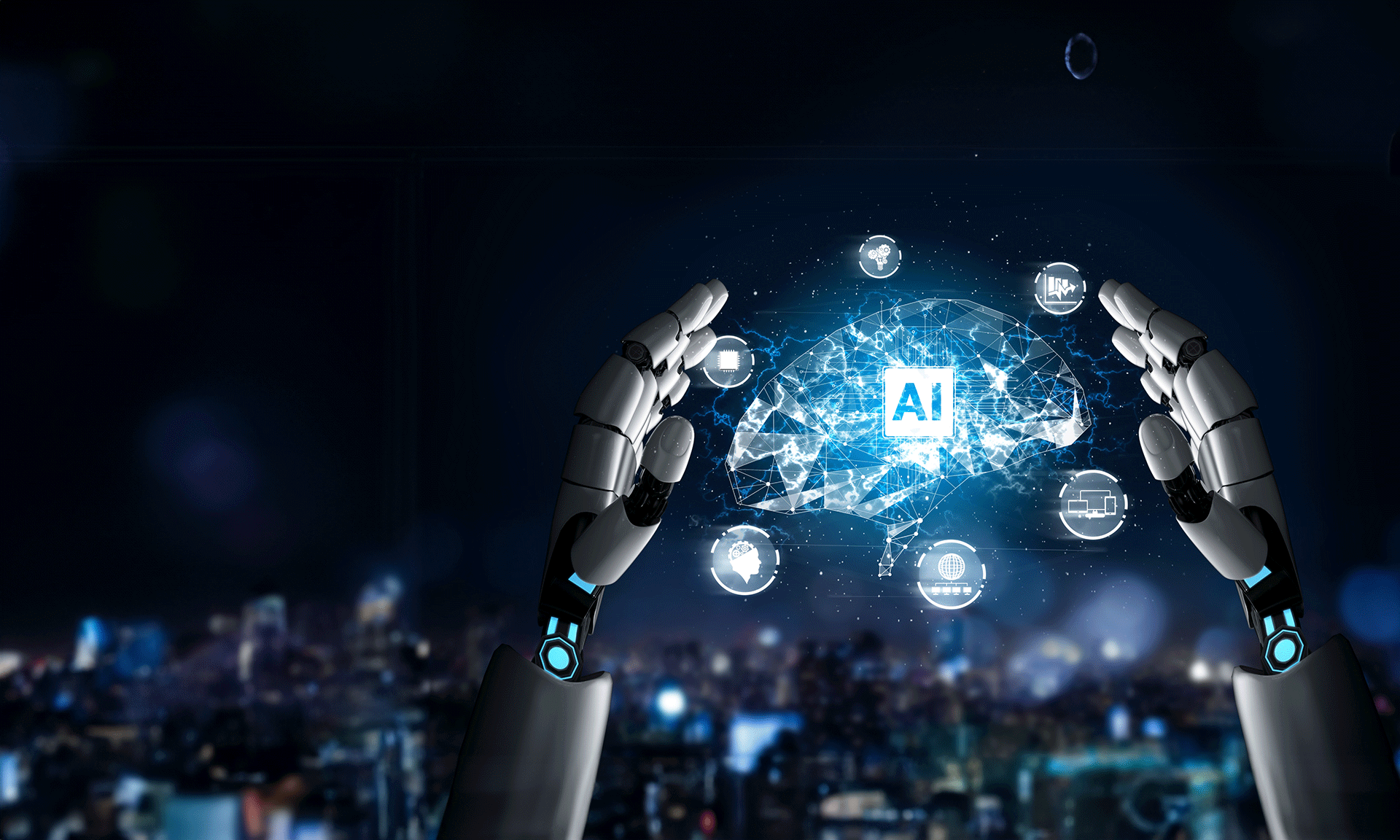

Typically, small-sized accounting firms are more forward-leaning as compared to larger accounting firms. Smaller-sized and more nimble accounting companies these days are introducing AI to their businesses nowadays. This means that they have a big chance of easily outsmarting the larger accounting companies if they remain slow in implementing AI into their accounting services.

The positive news is that the innovations and development in AI and applying machine learning technologies and AI into bookkeeping, is becoming a reality with majority of accounting software companies which are currently offering competencies for automating data entry jobs, reconciliations or even more with their online accounting and bookkeeping services.

By next year, it is possible that accounting jobs such as audits, tax, payroll, banking, etc. would become fully automated by using AI-based technologies and that would disrupt the accounting field in a big way like it has never happened in the last 500 years, thus opening up huge opportunities but some serious challenges also.

Why AI and Machine Learning?

The impact of AI in the near future would be the most significant and huge technological transformation till date. Accounting companies that lack or don’t accept AI implementation particularly in their bookkeeping and accounting processes would not remain competitive in the future. This technology is advancing very fast. The abilities and capabilities of what all AI can achieve today is momentous in terms of both accuracy and cost savings.

AI and machine learning result in:

- Greater employee satisfaction

- More robust recruitment process

- Delighted and happy clients

- Top-quality service offering

What is the Impact of AI and Machine Learning?

Companies which go ahead and implement AI and machine learning will be the only ones who would remain competitive in the accounting field.

In the coming three years, if you still haven’t employed AI technology in your accounting processes, then you would not stay competitive. For example, the companies who have implemented a service such as Vic.ai successfully are now pricing their accounting services differently.

AI and machine learning are primarily altering the way in which outsourced accounting services are assessed, priced, purchased by clients, and also delivered to clients.

AI and Cloud Software

Nowadays, it is getting next to impossible to charge higher hourly fees for any repetitive tasks. If your company is depending on offshoring and RPA, then that is considered as an old way of operating and doing things. AI services is expected to bring more accuracy and even faster turnaround.

AI applications such as Vic.ai work impeccably with traditional cloud accounting systems — enhancing and automating the human element in the equation. Even AI is continually learning and expanding over time. Thus, there is no need for replacing current accounting systems.

You would probably deploy various different AI systems in your software stack in the coming few years. However, the good news is that most of the AI systems usually plug into your fundamental software stack.

Bookkeeping

If you are looking at more practical manner of implementing AI, then bookkeeping jobs stand out. If one uses the best technology available, then invoicing and bank coding is just a matter of reviewing the AI as compared to actually performing the task. This, no doubt, is a stepping stone to thorough automation that we would see soon in future.

Employing AI for tasks such as invoice processing or bank coding involves a phased two-step approach:

- The AI gives suggestions (The accountant determines if there is a need to accept or correct the given suggestions.)

- Once trained, the AI codes would cost automatically (The accountant would then only need to provide feedback in case the AI is below a specified confidence level.)

Changes that come with AI

The procedural changes that AI is fetching may eventually trigger some controversy regarding the security of things due to the transition. However, as accounting benefits would still be felt as the final approvers of all the jobs that are performed by AI, they can keep control of any delicate or sensitive information that they want. Therefore, if all the information is backed up in the cloud, then they’re good to go.

Accounting is a very important part of any company – may be big or small. Due to the continuous evolution of technology nowadays, it’s imperative for any industry to update itself on the latest innovations and technologies if they want to stay ahead of their competition.

AI is revolutionizing the world today, and in particular how data is being handled or used. The potential of AI in the accounting field is immense. The value of AI is predicted to reach the $400 billion mark by 2020. In addition, almost 49% of all paid activities are expected to be automated by AI.

Automating the entire AP workflow

AI technology has already reached quite close to automating the entire AP workflow without any human intervention.

These days, AI and machine learning is being integrated into AP process for automating the entire workflow, which would be able to read invoices, extract the needed data, code the invoice to the accurate general ledger accounts, and then approve the whole process, and finally pay the invoice.

This actually seems like one area where we are underestimating the power of AI on outsourced accounting. It not only impacts how a team is built or the kinds of clients one works with. It also impacts the complete business model, how the product is marketed, how services are sold and delivered, and how they are priced.

One of the biggest advantages that are observed already with some early adopters is very advanced thinking and disruptive changes for how all of it is amalgamated and packaged for clients.

One way to determine how crucial this is for your company and the potential it has to impact the productivity and cost savings is by analysing the total volume of monthly invoices that you are processing currently for a typical client. You could also hire professional accounting and bookkeeping services in Dubai to do this analysis for your firm.

- Article, U.A.E

- August 26, 2019

Dubai has been continuously serving as one of the biggest business hubs worldwide welcoming entrepreneurs, freelancers, industrialists and international investors to set up their corporate space. As more and more corporates set up their business in the country, there has been a proportionate increase in the need for accounting and auditing services in Dubai. These services are essential for every organisation, irrespective of their nature and size.

Moreover, a good audit firm can be extremely beneficial for an organisation as it provides helpful information that not only increases the organisations value but also the credibility of its financial statements. In this article, we will walk you through the necessary details regarding the audit services and how you can choose the best audit firm in Dubai UAE to accelerate the performance of your organisation.

Why Does a Company Need Auditing Services?

Auditing refers to the inspection and assessment of the company’s accounts and all its internal and external matters so as to identify whether all the business transactions conducted by the company are ethical or not. The need for auditing arises because of the following reasons:

- Accountability

Auditing establishes accountability and keeps a track of who is accountable for what. This helps stakeholders to take better business decisions.

- Reliability

Auditing establishes trust and confidence of the financial institutions, tax officers and the company management in the activities of the company.

- Review

Auditing involves conducting a comprehensive review of the financial statements and provides an overall report on the business health which helps to resolve the present as well as future issues.

- Boosts Investment

Audited financial statements attract investors’ attention as they boost the credit rating and creditworthiness of a company.

The above-mentioned points highlight the importance of auditing for an organisation. Outsourcing the auditing and assurance services is very fruitful. We will tell you how.

Why Outsource Audit Services in Dubai UAE?

- Hiring an external audit firm saves cost to the company as compared to maintaining an in-house department for audit and spending on the training and recruitment cost.

- External audit increases the confidence of outsiders in the financial statements of the business.

- The company gains access to highly skilled professional auditors who have sound knowledge regarding the audit process.

- Hiring an external audit firm reduces the chances of financial frauds within the organisation.

What to Look for When Choosing an auditing Firm in Dubai UAE?

- Expertise

While outsourcing auditing services to a third party, it becomes vital to evaluate the strengths and weaknesses of the audit firm before handing the sensitive company information to them.

- Experience

An experienced audit firm who is well versed in providing audit and assurance services and familiar with all the operations of your business is able to handle and make an audit report with more efficiency and accuracy as compared to others.

- Qualification

It is of paramount importance to ensure that the audit firm you are hiring is properly qualified for the job. In order to ensure this, you may review the certifications of the audit firm before hiring them.

- Reputation

It is advisable to hire an audit firm that enjoys a solid reputation in the market. It not only delivers satisfactory results to the business but also gains clients trust in your company. Moreover, an audit firm carrying a bad reputation can adversely harm your business.

- Flexibility

While hiring an audit firm, ensure that you hire an all on one audit firm who can handle a diverse range of audit-related errands. This is especially important because when you hire different firms for different jobs, it becomes extremely tedious and hectic. Moreover, hiring a single firm for all the jobs can cut down on your time and cost.

- Transparency

For an audit firm, it is extremely important to build a strong foundation of trust in order to maintain a long-term relationship between the company and the audit firm. Therefore, it becomes important to choose an audit firm that is transparent in the quality control procedures it follows. In addition, the audit firm should be able to understand the company requirements and maintain complete transparency during the audit process. Even the smallest inconsistency in the audit should be communicated by them to the management before it escalates into a larger issue.

Financial statements handling in UAE involves a lot of complexities. Therefore, it is advisable to hire an experienced and reputed audit firm who is well-versed with the rules and regulations and help you provide accurate and error-free audit reports. IMC Group offers a complete range of audit and assurance services along with outsource finance and accounting services in Dubai to meet the varying business needs of its clients in the dynamic global environment. Our audit experts take care of your audit processes and help you prepare your audit reports in a hassle-free manner. For, further information, you may get in touch with us.

- Newsletter, Singapore

- August 14, 2019

MORE than 40 new standards for budding areas like drones, video analytics, and additive manufacturing would be developed in the coming year, as the Singapore Standards Council (SSC) has decided to step up its efforts on standardisation to keep pace with economic transformation and all the new technologies.

Last year, the industry-led SSC issued 19 new standards for supporting such nascent fields; for example a technical reference on some data interchange for last-mile delivery by using parcel locker networks, and some other technical reference for autonomous vehicles.

Enterprise Singapore (ESG), which supervises the implementation of the Singapore Standardisation Programme steered by the SSC, said that it would also enhance industry collaboration by pulling in more new industry experts who can lead and assist the development of the new standards. This is especially going to be important for nascent areas where better collaboration and discussion are required for identifying the unaddressed and new needs for standards development.

As of now, around 2,000 standards partners are taking part in the Singapore Standardisation Programme, thus representing a diverse array of stakeholders from academia, industry, and government organisations.

SSC is also going to strengthen its contribution and involvement in international fora, so that it can continue to advance Singapore’s interest in standards. As of now, it participates in technical committees which develop international standards in fields such as artificial intelligence, blockchain, circular economy and smart manufacturing.

Additionally, SSC is spearheading the development of some new standards by the International Standards Organisation for cloud computing, bunkering, and water efficiency.

These standards are a set of specifications that are designed to improve and foster innovation, market acceptance, and quality in several products, materials, methods and services, which are reviewed once in a period of five years. While it is voluntary to comply with the Singapore standards, it is mandatory when these standards are utilised by the government bodies in regulations or administrative needs for safety, health or other environmental issues.

ESG was of the view that disruptive developments could cause economic displacement and also offer opportunities for various new business models to flourish, and standards function as guides for best practices, aiding businesses to navigate better and respond to the disruptions.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group