- NEWSLETTER, GLOBAL

- November 12, 2023

The Focus lies on Focusing on Products, Systems, and Applications (PSAs)

Entrepreneurs and IT leaders often focus on products, systems, and applications as they explore their digital journey. Usually, they consider the benefits that the new technology brings to the table. However, this is a conventional path and often falls short in the digitized business ecosystem. Companies providing digital transformation services recommend bringing about a shift in mindset to encourage employees to counter the traditional modes of thinking.

Remember, every digital transformation should consider some fundamental questions at the outset.

- What specific business challenges will these changes resolve?

- How will this transformation differentiate us in the market?

- What are the expected business outcomes?

- To what extent is a mindset shift required for digital transformation success?

- What thought patterns, behaviors, and processes need revamping?

Apart from this, leaders should also consider:

- Whether or not the technology is going to establish a foundation for the company’s market share, innovation optimization in the future, and differentiation

- How leaders can use the technology to lead their teams to success

- How they can provide the necessary training to stride ahead

- How do they anticipate this initiative will benefit the company and its team members?

For a successful digital transformation, these questions serve as the foundation. Any change should directly improve business operations, whether it’s a new tool or process. This should enhance customer experience significantly.

For example, a company offering digital transformation services may deploy new technologies like machine learning or artificial intelligence not just because they are trendy, but capable of enhancing the workflow of their clients, resulting in better operational efficiency, saving time, and building stronger relationships with customers.

Consider changes in behaviour and thought patterns

Considering changes in behaviour and thought patterns is crucial since it presents us with a fundamental insight. Digital transformation largely depends on shifts in thought patterns and behaviours. This results in a realignment of cultures, rather than the technology being used in the process. There’s no denying that technology keeps evolving. However, if employees fail to adapt to their underlying behaviours and thought patterns, the technology will prove to be futile. Rather, employees might consider it to be a burden and not a solution to boost their efficiency.

This requires leaders to try and bring about a shift in the thought patterns and behaviours of the employees. For example, your staff should consider daily communication to be more fluid and collaborative. Being the leader, you must encourage a culture defined by frequent interaction with colleagues for questions, answers, and fresh perspectives.

With these behavioral shifts in place, introducing the new technology solution becomes more effective. Also, leaders should ensure that their employees understand the reason behind incorporating new technology. This, along with the mindset and behaviours of the employees, will help them understand the value that the solution brings to the table. This makes the technology likely to be successful for the organization.

Explore the existing digital intelligence mindsets of your employees

One of the most effective strategies to encourage shifts in behaviour and mindset in employees is to tap into their existing digital intelligence. Many employees already cultivate a digital mindset in their personal lives. Embracing technology makes them more efficient on the professional front.

In the digital transformation services industry, leaders should guide their teams to grow this mindset to the workspace. So, leaders should encourage employees to recognize that they can do the same within the organization as they do in their daily lives outside work. The more you support employees in bringing their innovation mentality to work, the more innovative your organization becomes.

The truth is that digital transformation is ever-evolving, and more changes are likely to come up in the future. Unless you associate digital transformation with your people, the term continues to remain abstract. When leaders initiate a digital transformation initiative in the context of digital transformation services, their priority should be to unpack the term. This will encourage a shift in the behaviour and mindset of the employees. Leaders need to lay the groundwork for a successful digital intelligence strategy. This approach will genuinely drive change and innovation in the organization.

The IMC Group continues to be a trusted company, partnering with global organizations to assist them in their digital transformation journeys. Reach out to us and let’s discuss how you can streamline your operations as you eye digital transformation.

- NEWSLETTER, GLOBAL

- November 11, 2023

Recent years have witnessed ESG advisory firms gain significant traction, showing businesses the way towards sound Environmental, Social, and Governance practices. Businesses, however, are apprehensive about pursuing their ESG goals, considering increased costs. Well, this fear isn’t justified, given that a proper ESG approach can significantly reduce costs and drive the growth of revenue. This explains why successful businesses work closely with established ESG advisory firms to boost revenue streams and reduce costs.

How can ESG mitigate risks while lowering costs?

A disciplined and systematic stance in embracing ESG principles can reduce business risks significantly. This also curtails operational costs.

In the 21st century, businesses have undergone a digital transformation. There’s no denying that the evolution of their digital maturity was a slow process. Similarly, large companies, with their complexity and scale, may require time to realize the full potential of ESG. It is a transformative force having long-term implications. It’s not a quick fix for short-term financial results.

Increasing your revenue through ESG

Regulatory norms often drive ESG adoption by companies. Other factors driving ESG adoption include cost reduction and mitigating risk. It also presents the potential to drive revenue growth. This remains an uncharted territory for many businesses. However, successful companies like Unilever have stood out by embracing ESG policies.

Their approach to embracing ESG helped in making cost savings. Unilever introduced the concept of “Sustainable Living Brands” (SLBs), which embraced strong social and environmental purposes. By 2020, nearly half of Unilever’s sales came from SLBs. Most importantly, there was an impressive 70% improvement in SLBs compared to the rest of the business. As a result, Unilever was able to declare its intention to phase out old brands that lacked a clear purpose. This approach shows how businesses can prioritize social and environmental impact to help customers who have been looking for a deeper meaning in their purchases.

Let’s evaluate the case of Tesla as another instance. Founded in 2004, the company’s commitment to electric vehicles (EVs) has reshaped the automotive industry. With a market capitalization of $650 billion and a cumulative global sale of 4 million EVs, Tesla has outperformed many established automakers.

General Motors, on the other hand, recalled its EV1 electric cars in 2003 and abandoned the EV segment. GM’s market capitalization stands at $37 billion, a fraction of Tesla’s value. Tesla’s innovation-driven approach has propelled its revenue growth, emphasizing the financial prudence of addressing environmental and social concerns.

ESG holds tremendous potential for businesses

ESG opens up the opportunity or companies to contribute positively to the society. In the process, they can open up fresh revenue streams. ESG, sustainability, and climate solutions offer a framework for tapping into this potential. It’s imperative to understand corporate purpose and master ESG principles for businesses to capitalize on the opportunities. Once you identify where the core business purpose meets evolving market needs, you can offer solutions that address the pain points. Accordingly, you can position your brand for long-term success.

Collaborating with an established ESG advisory firm like the IMC Group goes a long way in guiding you toward creating value through ESG initiatives. Combining cost-reduction strategies with revenue-enhancing ESG approaches, you can make a positive impact while ensuring long-term financial sustainability.

- NEWSLETTER,U.A.E

- November 10, 2023

The IMC focuses on the criteria for attaining Qualifying Free Zone Person status in various jurisdictions in the context of global business and corporate tax regulations.

Under the global corporate tax guidelines, Qualifying Free Zone Persons can benefit from a preferential 9% corporate tax rate on their Qualifying Income. However, they need to fulfil the following conditions:

- Establishing a substantial presence within the designated free zone

- Generating Qualifying Income

- Adhering to the Transfer Pricing documentation and Arm’s Length Principle

- Ensuring that non-qualifying revenues remain below specified de-minimis thresholds

- Compiling audited Financial Statements as per local laws

- Fulfilling any additional conditions that the relevant authorities need

Key Insights

With the calendar year drawing to a close in 2023, businesses operating within free zones, with their initial tax periods commencing on or after January 1, 2024, should prioritize evaluating their operations to be eligible for the preferential corporate tax regime (i.e., a 9% corporate tax rate) as applicable.

It is imperative to carry out strategic planning and an early assessment to ensure that businesses meet all the conditions from the very beginning. It takes time to implement any restructuring, resource allocation, adjust processes, or evaluate potential benefits.

Certain steps may be more urgent or important compared to others to ensure compliance from the first day. Taking timely action after identifying those steps holds the key to enjoying the 9% benefit.

Disclaimer

- Article, Global

- November 6, 2023

In today’s digital era, businesses are constantly in pursuit of methods to streamline their operations, boost productivity, and elevate client satisfaction. Among the notable instruments that have made a substantial impact in the business landscape is Zoho.

Zoho offers extensive business tools that operate synergistically, providing a comprehensive solution to your business requirements. Whether your objectives involve client management, inventory oversight, data analysis, or digital document signing, Zoho is well-equipped to meet your needs. In this article, we will delve into how Zoho can potentially transform any business.

Understanding Zoho

What is Zoho?

Optimizing Operations

Enhancing Efficiency with Zoho CRM

Effective Project Management

Boosting Productivity

Fostering Collaboration and Communication

Automation through Zoho Workflow

Enhancing Client Satisfaction

Tailored Client Support

Marketing Insights

Zoho Marketing Hub equips businesses with valuable insights into their marketing campaigns. Companies can customize their marketing strategies to maximize customer engagement and conversions by comprehending customer behaviour and preferences.

Whether the goal is operational streamlining, productivity enhancement, or the elevation of client satisfaction, Zoho stands as a versatile platform that can adapt to the distinct requirements of each business.

Let’s embark on a journey across ten diverse business sectors to witness how Zoho can simplify your operations. Prepare to explore how Zoho can streamline your business, irrespective of your industry. To find a solution, it’s important to work smarter, not harder.

Real Estate

Zoho CRM

Zoho Sign

Zoho Social

Manufacturing

Zoho Inventory

Zoho CRM

Zoho Analytics

Zoho People

Legal Services

Zoho CRM

Zoho WorkDrive

Zoho People

Media and Entertainment

Zoho Backstage

Zoho Projects

Zoho CRM

Finance and Banking

Zoho Analytics

Zoho CRM

Zoho Vault

Travel and Hospitality

Zoho CRM

Zoho Desk

Zoho Campaigns

Zoho Expense

Nonprofit

Zoho CRM

Zoho Creator

Zoho Books

This tool facilitates cost control, financial monitoring, and transparent reporting, ensuring accountability. Additionally, we offer cloud accounting services through Zoho Books.

Zoho People

Software Development

Zoho Sprints

Zoho Developer

Education

Zoho Classes

Zoho CRM

Zoho Office Suite

Zoho People

Agriculture

Zoho Inventory

Zoho CRM

Zoho Analytics

Embarking on your journey with Zoho may seem intricate initially. Nevertheless, you are primed for triumph with xponential Digital as your devoted Zoho Consulting Partner. It specializes in the precise adaptation and enhancement of the Zoho platform to align with sector-specific requisites. Elevate your operational excellence with Zoho, guided by the expertise of xponential Digital.

- Article, Global

- October 19, 2023

Understanding Risk Management

Defining Risk Management

The Components of Risk Management

1. Risk Identification

2. Risk Assessment

3. Risk Mitigation

4. Risk Monitoring and Review

The Significance of Risk Management

1. Safeguarding Financial Stability

2. Enhancing Decision-Making

3. Compliance and Reputation

The ROI of Risk Management

Cost Savings

Competitive Advantage

Long-Term Sustainability

Conclusion

FAQs

Is risk management only for large corporations?

How often should risk management strategies be reviewed?

Can risk management completely eliminate all risks?

Is risk management only about financial risks?

How can I get started with risk management for my organization?

- NEWSLETTER, GLOBAL

- October 10, 2023

In recent years, Environmental, Social, and Governance (ESG) considerations have taken centre stage in corporate boardrooms. ESG has gone a long way in shaping the way businesses operate and make decisions. However, it’s equally crucial to understand the profound impact of ESG practices on entry level enterprises, from the C-suite to middle management and operational roles.

Let’s explore the concept of role-based ESG and how businesses are transforming by embracing this concept. As a business owner or CEO, it’s imperative to understand the wide range of benefits of role-based ESG.

The Hidden Potential of Employee-Driven ESG Initiatives

It’s not uncommon for employees within an organization to make substantial contributions to ESG goals. This can be as simple as sharing rides, reducing single-use plastic, using public transportation, or cycling to work. However, data capturing these individual efforts often goes unnoticed.

Many businesses can relate themselves to this situation where they are taking meaningful strides towards achieving sustainability and net-zero goals. However, they fail to communicate the impact of these actions effectively throughout the organization.

Sustainability reporting has reached an all-time high in the corporate world. As much as 96% of S&P 500 and Russell 1000 companies currently publish their ESG reports. Despite these strides, the influence of ESG initiatives on the average employee remains largely unexplored. Adopting role-based ESG practices is the key to addressing this gap where data integrity lies at its core.

Cultivating a Data-Centric Culture for Role-Based ESG

Businesses need to foster a data-centric culture throughout their organization to implement role-based ESG effectively. Leadership teams are gradually increasingly recognizing the importance of this shift. However, the key challenge lies in engaging employees at different levels of the organization to embrace this approach.

Now, organizations face a question: How do they inspire a ‘we want to do this’ attitude driven by employees rather than a ‘we should do this’ directive from the top?

In this case, the solution lies in capitalizing on qualitative data to validate the actions of employees. When individuals see that their efforts are recognized and contribute to decision-making processes, chances are high that they will engage wholeheartedly. With this approach, there’s limited risk that employees would perceive ESG efforts as mere lip service, a perception that often leads to disengagement.

Organizations can empower individuals by capturing data using different tasks and sharing the results transparently across the company. This provides adequate proof of concept for their actions. The approach is effective in encouraging a data-centric culture while measuring the results simultaneously. This brings about a real change and fosters a sense of empowerment among employees.

Role-Based ESG as a Catalyst for Employee Satisfaction and Social Responsibility

Employees need not fear the adoption of role-based ESG strategies. Companies should assign ESG-related tasks and responsibilities across various roles to cultivate a culture of sustainability and social responsibility. With this approach, they can succeed in delivering a greater degree of job satisfaction and boost the morale of employees, who realize that their efforts eventually have a broader and positive impact on society.

However, companies must adopt a thoughtful stance while implementing these strategies. For each role, ESG responsibilities should be integrated in a manageable and relevant manner. Therefore, organizations must provide relevant resources to their employees, including training, support, and adequate data. This ensures that employees can contribute to the ESG goals of the organization effectively.

Ensuring Authenticity in Role-Based ESG

Fostering a Community of Best Practices

Capturing workforce contributions is crucial to improve and support ESG best practices continually. This can help in shaping and driving the evolution of ESG standards across the organization. Creating a community to share best practices holds immense potential in strengthening ESG efforts. Therefore, a role-based approach to ESG should span every level of an organization to elicit a transformative impact. Businesses embracing this approach can enhance risk management, enhance their reputation and boost profitability.

Eventually, organizations shouldn’t consider ESG to be a niche concern for their boardrooms. It’s a strategic component in every forward-thinking enterprise.

- NEWSLETTER, GLOBAL

- October 10, 2023

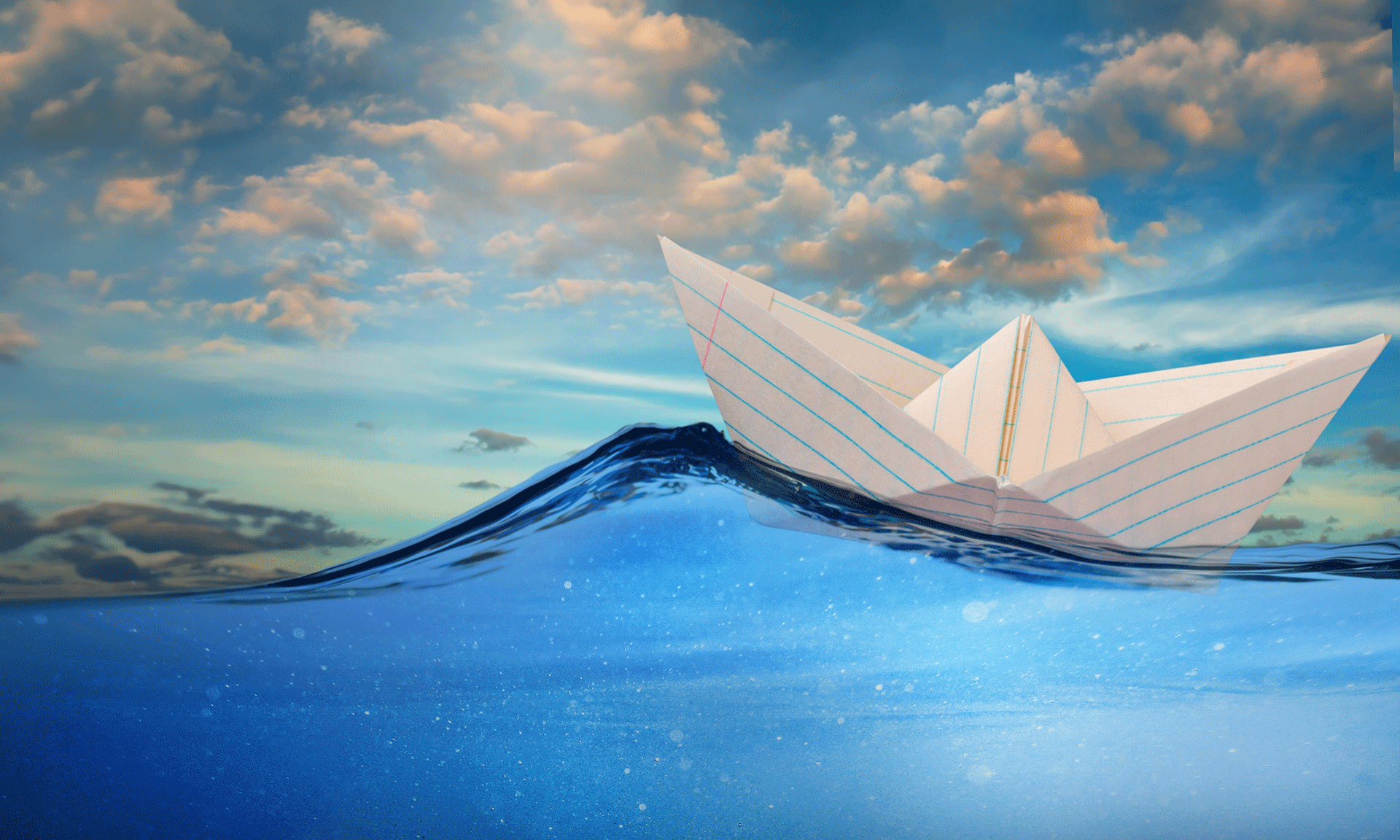

Expanding your workforce globally is a strategic move to set your business on a growth trajectory, boosting productivity. However, the success of your ambitious venture largely hinges on your ability to understand the principles of global payroll compliance. There’s no point in having a global workforce if you can’t pay them accurately and compliantly, right? Therefore, efficient management of an international payroll is imperative for your business to capitalize on the full potential of your global team and drive sustainable growth. No wonder why successful organizations count on specialized companies for global payroll solutions as they scale globally.

For any business expanding internationally, global payroll management appears to be a formidable challenge. From multifaceted compliance requirements to complex tax regulations, the norms keep varying between different countries. Your organization needs to take on these challenges head-on to fully benefit from the untapped growth opportunities and maximize the potential of a global workforce.

5 Key Global Payroll Challenges for Your Organization

1. Understanding Local Tax Laws and Regulations

2. Categorizing Workers

3. Policies to Protect Data

4. Payment Currency

5. Providing Benefits to Employees

How To Overcome Global Payroll Challenges?

1. Outsource Global Payroll Services

2. Employer of Record (EOR)

3. Shadow Payroll System

Outsource Global Payroll Services to Dedicated Teams

With competition raging high in the global business ecosystem, why let payroll compliance impede your growth? Addressing the top global payroll challenges and outsourcing global payroll services, shadow payroll systems, and EOR services can put you on track. The IMC Group offers comprehensive EOR and PEO services to businesses expanding globally, streamlining their compliance process and boosting their efficiency. With professional assistance from our end, you can capitalize on the wealth of a global workforce while ensuring compliance.

- NEWSLETTER, GLOBAL

- October 10, 2023

The steadfast motivation of startups, along with their creative edge and innovative spirit, defines their secret to success in a competitive business ecosystem. Amidst all this enthusiasm, it’s imperative for startups to cultivate a robust culture of governance risk management and compliance. Prioritizing long-term viability and success, these budding organizations should establish these pillars at the outset, particularly in a competitive business environment.

Walking in the shoes of a startup owner or CEO, it pays to know the best practices to ensure proper governance within the startup ecosystem.

Evaluating The State of Governance in Startups

Which areas should startups focus on?

Startups need to prioritize governance, resilience, and financial metrics to remain on the right track. In this regard, a holistic perspective is necessary for startups, where these organizations need to prioritize financial metrics, governance, and operational resilience. They should also consider valuations and factors like integrity, governance, and compliance.

For startups, it’s crucial to strike a balance between growth and profitability while integrating various metrics to ensure sustainable success.

Balancing Governance with Entrepreneurial Spirit

Forward-thinking organizations, including startups, must adopt a strategic stance to balance their freedom to operate independently with governance. While the primary emphasis lies on identifying entrepreneurs with a strong vision, the equation should also have a proper equilibrium between entrepreneurial spirits and corporate governance.

It’s wise to seek enterprise risk management solutions from professional experts who carry out due diligence and evaluate aspects like compliance, operations, and integrity. With professionalism on your side, you can maintain this balance.

Driving Governance with Top Talent

Analyzing funding considerations and investor outlook

Due Diligence Before Investing and Red Flags

In the context of ensuring governance, it should be noted that startups need to work on pre-investment due diligence seriously. The focus should lie on solid unit economics, a robust business thesis, and a well-defined path leading to profitability.

The due diligence process might also reveal certain red flags. This can trigger further investigation or even lead to the withdrawal of investment.

ESG Risks and The Role of Forensic Services

The role of forensic services in due diligence is vital, and this includes commercial, operational, and financial aspects. Startups need to evaluate ESG (Environmental, Social, and Governance) risks stringently. This also points to the importance of governance in the sustainability and evaluation of upcoming organizations. Established companies like the IMC Group specialize in providing GRC insights for industry-specific regulations.

Cybersecurity and Data Privacy Risks

The significance of data privacy and cybersecurity risks in a rapidly digitizing business ecosystem is crucial for startups. These organizations should prioritize data security to remain on the top.

Established companies like the IMC Group specialize in providing due diligence services and audits, besides addressing cybersecurity concerns for startups. While the startup ecosystem looks dynamic, seeking professional consultation to ensure sound governance is the need of the hour.

- NEWSLETTER,SINGAPORE

- October 10, 2023

Singapore has long held its status as a premier destination for international companies. Whether it’s an international expansion or setting up company headquarters, the country has been the focal point for commercial ventures across ASEAN and Asia. The favorable legal and tax regimes largely shape the country’s status as a preferred investment destination in Asia. Singapore boasts a highly integrated financial system, besides being one of the most investor and business-friendly countries in the world. Forward-thinking businesses rightly seek professional assistance for company formation in Singapore to fast-track the process.

Singapore’s financial system is deeply integrated with the global market, positioning the country as a strategic gateway to some of the largest combined free trade areas through ASEAN. This includes free trade agreements (FTAs) in ASEAN-Hong Kong, ASEAN-China, and ASEAN-India.

However, there’s much more for businesses in store in Singapore beyond financial perks and tax incentives. Let’s explore the aspects that make Singapore an ideal destination for businesses.

The Geographic Advantage

Singapore boasts a prime location in the heart of Southeast Asia, located between Indonesia and Malaysia. This strategic positioning provides seamless access to transport and trade links across the region. Being centrally located, Singapore continues to be an alluring destination to some of the most rapidly expanding and vibrant markets of the world.

For investors looking forward to capitalizing on the opportunities in the ASEAN markets, Singapore offers a seamless pathway to business. Thanks to its competitive tax environment, efficient setup procedures, and seamless supply chains, the country stands out as a global destination for investment. In recent years, Singapore has even surpassed traditional regional choices like Malaysia.

Interestingly, the Port of Singapore ranks among the best-connected and busiest global seaports. It connects 120 countries through more than 600 ports across the world. Besides, the Singapore Changi Airport continues to be one of the largest transport hubs in Asia. It handles more than 68 million passengers and over two million tons of air freight annually.

Singapore’s multicultural society, with various cultural and linguistic connections to ASEAN members, delivers a strategic advantage to the country. In Singapore, English is the primary working language. This fosters effective communication with investors from all over the world.

The highly skilled local workforce in Singapore acts as intermediaries for investments in Asia. This ensures a smooth market entry for international businesses, along with optimal profit maximization. No wonder, why Singapore continues to strengthen its position as a key business and management hub in Southeast Asia.

Tax Incentives for International Businesses in Singapore

Singapore welcomes companies with a wide array of fiscal and non-fiscal incentives to strengthen economic development in the country. Applicants need to fulfill stringent criteria, commit to specific investment levels and introduce cutting-edge skills and technology. These incentives aim to promote innovation and economic growth in the country. In return, Singapore offers privileges like reduced corporate income tax rates. The country has several schemes in place like Double Tax Deduction for Internationalization, Start-Up Tax Exemption Scheme, Progressive Wage Credit Scheme, and more. Besides, businesses can tap sector-specific incentives if they operate in industries like tourism, maritime, or biotechnology. To fully benefit from these incentives, it’s imperative to understand the compliance requirements, eligibility criteria, and application procedures.

So, if you aren’t sure about how to set up a local company in Singapore, it’s logical to seek professional support from established companies.

Favorable Corporate Tax Regime in Singapore

A Network of Agreements

One of the paramount advantages of running an international business in Singapore is the extensive network of nearly 100 double taxation agreements (DTAs). The country also has 24 free trade agreements (FTAs) in place which are both limited and comprehensive. They cover different types of income and facilitate tax information exchange. The presence of FTAs with ASEAN member states enhances the country’s competitiveness in the vast market.

The FTAs of Singapore also extend to India, Hong Kong, ASEAN, China, and the EU. Moreover, the country is actively negotiating new FTAs with the Pacific Alliance-Singapore and the Eurasian Economic Union (EAEU).

The Ease of Doing Business

The transparent business and legal regulations in Singapore ensure ready access to essential information online. This simplifies the process of exploring the market for overseas decision-makers. Singapore has consistently benefitted from this transparency and efficiency, earning top rankings in global reports like the World Economic Forum’s Global Competitiveness Report and the World Bank’s Ease of Doing Business report.

From establishment to dissolution, bureaucratic procedures for companies can be executed online through BizFile, ACRA’s (Accounting and Corporate Regulatory Authority) portal for online business filing.

Robust Intellectual Property Protection

Singapore continues to demonstrate high standards of commitment when it comes to safeguarding intellectual property (IP) rights with its transparent legal system. The Intellectual Property Office of Singapore (IPOS) shoulders the responsibility of overseeing this aspect. The country also boasts a specialized IP court and the only office of the World Intellectual Property Organization (WIPO) outside Geneva, the WIPO Arbitration and Mediation Center. Singapore’s Copyright Act, Patent Act, and Trademark Act are in place to streamline global businesses.

The IMC Group, consisting of an expert team of professionals, offers comprehensive Singapore company registration for foreigners assistance. Reach out to us to benefit from a rapid and hassle-free market entry, ensuring legal compliance, and stride ahead with your business.

- NEWSLETTER,U.A.E

- October 10, 2023

Family businesses have long been the driving force behind the thriving economy in the UAE. It significantly contributes to the growth and prosperity of the country. These businesses could operate without a comprehensive legal framework for governing their operations until recently. However, with the introduction of UAE Federal Decree Law No.37 in 2022, circumstances are different for family businesses.

Also known as the New Family Business Law, this is a groundbreaking legislation that marks a crucial moment for family-owned enterprises. It offers a wide range of provisions to strengthen family businesses in the country.

Facilitating Succession Planning

One of the primary objectives of the New Family Business Law is to support succession planning. Although this is a crucial aspect, family-owned companies tend to overlook the priority. Do you know that less than 15% of family businesses manage to survive into a third generation?

To address this issue, the new law facilitates smoother transitions of businesses between two subsequent generations. As a result, you can expect a more seamless ownership transfer for family businesses and control. It ensures that your family business can continue in the years to come. Forward-thinking enterprises are seeking professional assistance for succession planning for Dubai family offices from established companies.

Exception to Statutory Pre-emption Rules

The New Family Business Law introduces an exception to certain statutory pre-emption rules. This empowers family businesses with greater flexibility to manage their ownership structures. Due to this adjustment, they can create different share classes and allocate the same among shareholders.

Family businesses can also adapt to changing circumstances due to this newfound versatility which caters to their evolving needs. In the process, they can cruise on the path to long-term sustainability.

Effective Mechanisms to Resolve Disputes

The introduction of robust dispute resolution mechanisms is one of the benchmarks of the New Family Business Law. In recent times, public disputes have shed light on the challenges that family-owned companies encounter. This often results in adverse consequences for the concerned business.

To address this issue, the law has established “’Family Business Dispute Resolution Committees”. While the effectiveness of these committees is yet to be seen, this marks a significant step toward preventing and resolving disputes. Historically, these disputes have jeopardised the stability of family businesses.

The New Family Business Law applies across all Emirates and free zones within the UAE. Therefore, family businesses across the country would have access to a consistent legal framework. This promotes fairness in their operations.

For professional assistance in personal holding company formation and management and succession planning, reach out to a professional expert at the IMC Group. We continue to be one of the pioneers in assisting family businesses in the UAE.

A Member Firm of Andersen Global

- 170+ Countries

- 390+ Locations

- 13,000+ Professionals

- 1800 + Global Partners

- 170+ Countries

- 390+ Locations

- 13,000+ Professionals

- 1800 + Global Partners

- 170+ Countries

- 390+ Locations

- 13,000+ Professionals

- 1800 + Global Partners