- Newsletter

- May 16, 2018

The Plug and Play ADGM programme set to launch in Q3 2018 aims to speed up the growth of FinTech start-ups and innovators.

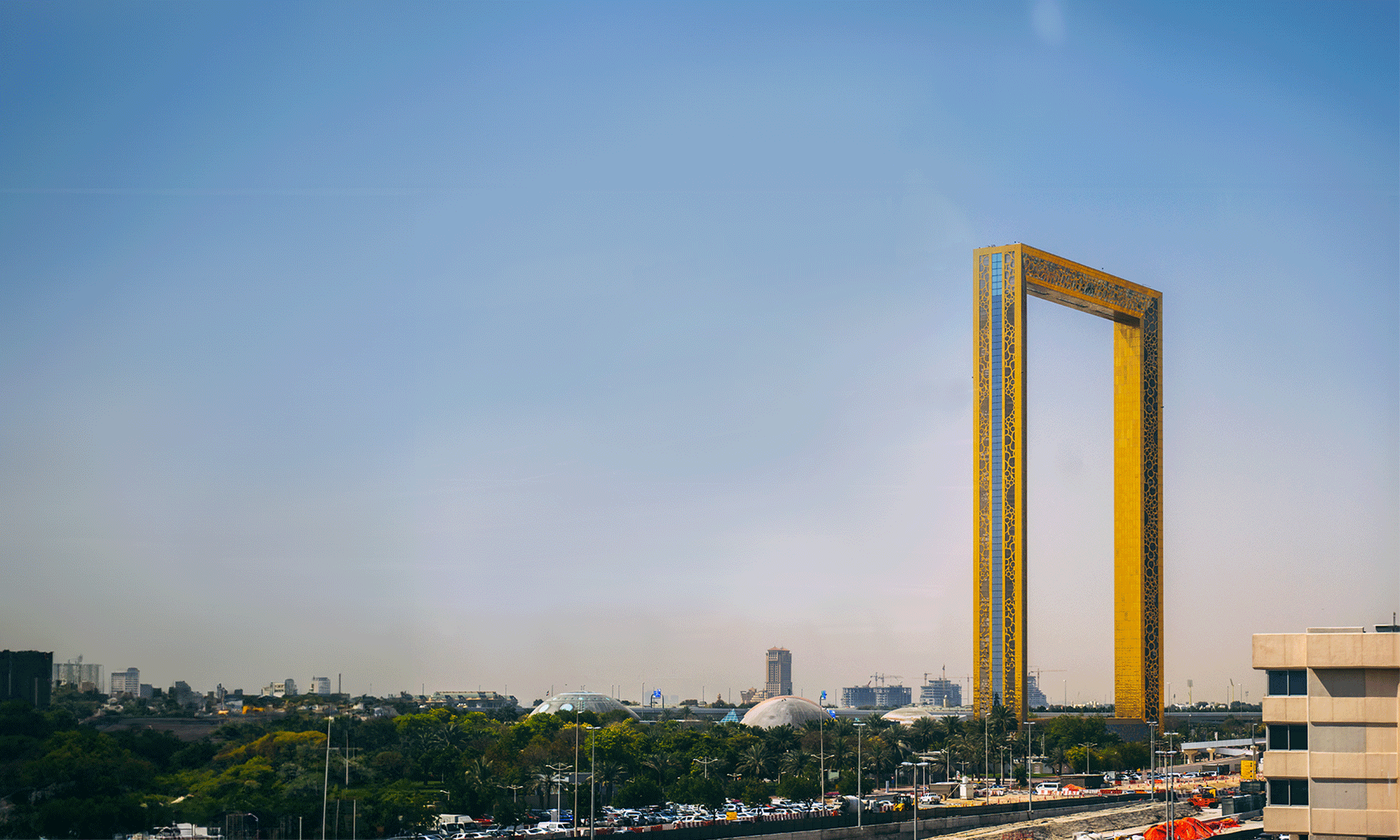

The Abu Dhabi Global Market or ADGM is collaborating with the world’s innovation platform – Plug and Play. They have got together to launch ‘Plug and Play ADGM’ office. The good news is that they have announced the launch date for their FinTech innovation programme starting with Abu Dhabi, the wider Middle East and North Africa, MENA, region.

The Plug and Play ADGM programme is planned to go-live in quarter 3 of 2018 and its primary focus is on stepping up and encouraging the FinTech start-up companies and other innovators, who offer out-of-the-box solutions that take care of the ever-dynamic requirements of the region’s capital markets. The Plug and Play ADGM has its headquarters on the Al Maryah Island.

This will provide a tactical platform connecting the business partners of Plug and Play ADGM to the most appropriate and revolutionary solutions by FinTech start-up companies under the programme. The platform promises the benefits of ADGM’s internationally-aligned FinTech infrastructure and initiatives, for example, the ADGM Regulatory Laboratory, the ADGM FinTech Innovation Centre and ADGM’s network of local and global institutions, FinTech bridges and other industry partners.

The Plug and Play ADGM team’s primary aim is to develop and facilitate FinTech companies and innovators so that they could be ready for the market and function ably and efficiently as per the regulations and framework applicable in Abu Dhabi and this region. This also ensures that company formation in Abu Dhabi becomes easy.

Richard Teng, who is the CEO of Financial Services Regulatory Authority of ADGM said that AGDM and Plug and Play had common goals, such as finding out the requirements and then resolving the difficulties of the financial services sector in the region along with developing and encouraging the finest entrepreneurs, among others.

Omeed Mehrinfar, who is the Managing Partner at Plug and Play in Europe, the Middle East and Africa, said, “Through ADGM being a leading International Financial Centre, with resources such as their RegLab and Innovation Centre in place, we can augment our offerings towards local and international entrepreneurs that are looking to scale their FinTech solutions across the MENA region. The ADGM partnership is also an opportunity for both of our entities to evaluate expanding into other industries and fields as it pertains to the region’s innovation agenda. This mutual roadmap, as well as their team culture and ours were an automatic match.”

- Article

- May 2, 2018

Taking your business internationally could be very advantageous, but there are some things to keep in mind while you plan this move for expansion. It’s true that exploring newer avenues or markets for your products can be exciting; however, it’s not so easy to execute.The question to ask yourself is, is your business ready for it? Without a well thought of strategy, you cannot enjoy the benefits of this transition.

Do’s for global business expansion:

Start with getting the comfort in the new country:

Think of the barriers such as new language, culture, market ethics, regulations etc before you plan your transition.

It’s imperative that you feel secure, confident and comfortable in the new market or country you plan to go into. Why? Because you will be working there once your expansion plan is successful.

Build a trusted team in the country you are targeting:

Without a good support of a trusted team, you cannot aim to have a flawless global move. So look to hire marketing experts, HR leaders, accounting and also legal professionals. But why do you need native people? Because they know all the pros and cons of the market.

Find out about the laws of the land:

Get a basic understanding of the laws of the new land you plan to step into. This refers to being confident about the legal complications while operating internationally which will avoid unnecessary delays and hurdles.

Make changes to your existing business plan including global expansion

Updating your business plan with all the factors regarding international expansion is a must do.

Ensure to include all the updates like the potential markets, your new customers, untapped revenue sources, strategies to import and export, new costs like marketing, travel, shipping, possible partnerships and alliances, legal requirements, and other investment opportunities.

Take into consideration your competitive advantage

Before your expansion into global markets, see if you have any competitive advantage. For instance, for company formation in UAE, first think of a strategy to create a competitive advantage if you already don’t have it. Competitive advantage comes with increased resources, new strategies and innovations. You can enhance your business’ international competitiveness by using systematic processes to renew, exploit and improve your core capabilities.

Don’ts for global expansion:

Assuming that your IP (Intellectual Property) is protected is a big mistake

Before stepping into a new global market, you must think of a strategy for your Intellectual Property rights of your company. See if your IP is protected and what can you do if it is violated.

Expanding without local liaison is a strict No

Other than building a trusted team, you must liaison with local experts or consultants. This could help you in managing and planning the operations smoothly and without any hurdles. For example, if you are thinking of company formation in Singapore, find a find a business consulting firm or local experts who are highly reputed to execute new deals and also handle your company’s information.

Think of a new market strategy

Start with a thorough research of the market in the country you are targeting. Study the culture, market techniques and think of an apt market strategy.

Starting from scratch is a bad idea

There are local experts who assist in building an international model for you. Take help in planning your entry, funding, hiring strategy etc.

So, planning a global expansion is a tough bet; but who says it’s a herculean task? Plan well and keep in mind the do’s and don’ts.

- Article, India

- April 11, 2018

The recent tax treaty between India and Hong Kong will have a high impact on MNCs, funds, and entrepreneurs vis-a-vis investments and transactions in the two countries.It comes into effect in the tax year.

Favorable tax treaties with Singapore, Mauritius, Netherlands, and Cyprus have helped attract investors from these countries to India. Even though Hong Kong and India have had close economic ties for decades, the absence of a tax treaty has deterred investors.

The new treaty will not only encourage investments between the nations but also support existing Hong Kong-based set-ups. The base erosion and profit shifting (BEPS) initiative is the global buzzword– ‘substance-driven’ planning is trumping traditional offshore holdings. Under the circumstances, this treaty gains even more significance.

Here’s a look at how the new India-Hong Kong tax treaty affects MNCs, funds and wealthy families.

Investing in India

India levies capital gain tax on sale of Indian securities at rates of 10-40%. Under their respective bilateral treaties with India, residents of Mauritius, Singapore, and Cyprus were exempted from this tax before 1 April 2017. This date saw an end to this exemption.The treaty with Hong Kong does not offer any such capital gains tax relief either.

While the other treaties provide relief against tax on indirect share transfers, the Hong Kong treaty does not. If a Hong Kong resident owns shares in a Singapore company and the value of these shares are mostly derived from assets in India (through an Indian subsidiary), then he is liable to pay taxin India for transfer of these shares.

Recent reforms have made it easy torepatriate capital from India. There is also no dividend distribution tax – this has tempted many MNCs to set up limited liability partnerships (LLPs) for captive operations. The treaty, however, gives no relief against capital gains tax on transfer of other assets like debt instruments or interests in LLPs.

Withholding tax on interest can go as high as 40%at times – the Hong Kong treaty cuts it down to 10% – much lower than the 15% of the Singapore tax treaty but higher than the 7.5% in the Mauritius treaty. Even with the interest deduction caps introduced last year, businesses in India often use debt as a tax efficient route for funds. Indian regulatory norms are changing, and slowly paving the way for debt investment through easy intra-group loans, debentures and bonds. The treaty helps Hong Kong residents benefit from loans and debt investments in India. Hong Kong has a territorial tax regime, and certain foreign source interests are tax-exempt.

The new treaty accepts pass-through entitieslike limited partnerships and trusts. Different from most Indian tax treaties, this is an opportunity for funds and other investors from Hong Kong to explore such tools to invest into India.

The new treaty provides relief in the purview of anti-avoidance and anti-treaty shopping rules. Additionally, India’s general anti-avoidance rules also apply – these keep a check on investments that are fully tax-driven, with no commercial substance. To claim treaty relief, a resident of Hong Kong must obtain a tax residency certificate (TRC) from the Inland Revenue Department (IRD). The IRD scrutinizes TRC applications to ensure that all activities and decision-making is based out of Hong Kong.

Investors interested in emerging economies like India often look for an investment protection agreement – India and Hong Kong do not have such an arrangement yet.

Operating a Business

Permanent establishments (PE)

India has been consistently broadening its domestic tax rules. Profits resulting from a ‘business connection’ in India attract taxes for foreign enterprises – this is a broader category than the ‘permanent establishment’ (PE) defined under a tax treaty. With the treaty in place, there is more clarity on PE-related tax risks. This allows Hong Kong-based MNCs and businesses to invest and transact freely with Indian entities and makes Company formation in India a smoother process. Indian business groups interested in company formation in Hong Kong, or with existing holding and investment interests in Hong Kong also benefit – their potential tax exposure due to activities in India reduces.

The tax treaty works in favour of Hong Kong-based fund managers too. It defines the PE criteria and provides clarity on the actions of their Indian advisors that may potentially attract taxes for them in India. The agency PE concept now includes persons in India actively involved in contracts that are implemented by the overseas enterprise. This sweeping concept of PE gets relief under the treaty too.The treaty, in tandem with some algo-trading strategies or co-location servers for investments in India, helps establish if the Hong Kong-based funds need to pay taxes in India.

India recently introduced the ‘significant economic presence’ test – overseas enterprises may be taxed based on the magnitude of their Indian revenues and the size of their customer base. This holds true even if they do not have a fixed base, agents or employees in the country. Technology companies call it a ‘virtual PE’ concept. However, Hong Kong-based enterprises transacting with India get a breather under the treaty’s narrower PE threshold.

Withholding taxes – a breather

Indian domestic law allows authorities to tax various payments to Hong Kong-based residents for broadcasting fees, software licenses, and professional and technical service fees.The treaty changes the scope of taxable royalties and technical services to internationally accepted principles. These are generally narrower than domestic law and will provide more clarity to Hong Kong residents. For example, satellite broadcasting fees and software licenses without transfer of copyrights will not attract Indian withholding tax if the Hong Kong resident does not have a PE in India.

Profits from international air transport for airline operators in Hong Kong are exempt from tax in India.Profits from international shipping transport with sources in India will be taxed 50% of the applicable Indian taxes. Hong Kong-based partnerships, with no fixed base in India, need not pay Indian withholding tax on income from professional services.

Benefits for wealthy families

Hong Kong is home to many wealthy families of Indian origin. Clarity on the PE concept brings relief to those with family members and business interests in India. Families with funds and family offices managed from Hong Kong also stand to gain.

Regulatory changes in India have been favorable, and the treaty recognizes Hong Kong resident trusts and partnerships – this could encourage non-resident Indian families to use these instruments to hold assets in India, for asset protection as well as for succession planning.

Any individual ordinarily a resident in Hong Kong, or having stayed in Hong Kong for at least 180 days in a 300-day period for two consecutive assessment years, is considered a resident under the treaty. ‘Ordinary residence’ refers to a considerable presence, permanent home or regular residence in Hong Kong.

The treaty outlines a wide framework for the exchange of information between the two countries, for income tax matters and other proceedings related to customs, goods and services tax. Though the exchange mostly relates to tax years from the treaty’s effective date, prior year relevant data required for a tax year audit may also be shared.

Conclusion

The new treaty between Hong Kong and India, one of the fastest growing economies in the world, makes for exciting investment opportunities. Ease of company formation in India further fuels the investment flow.

While the economic and trade influence of jurisdictions like Singapore is unlikely to wane, the treaty is expected to boost trade and investment between Hong Kong and India.

- Bahrain, Newsletter, Qatar, U.A.E

- April 9, 2018

The officials say that there should be a single point between any two borders when it comes to customs and immigration.

Bahrain –It has been suggested that a reduction of border checkpoints will helps in easing the trade flow in the GCC markets. The GCC Customs Union draft that was made by the Federation of GCC Chambers had this as one of its 75 recommendations.

This draft is now being presented to the GCC Chambers with the help of workshops and the third session was recently at the BCCI or Bahrain Chamber of Commerce and Industry headquarters in Sanabis.

This draft paper is prepared after conducting a feasibility study done by Gulf Organisation for Industrial Consulting (GOIC). It is planned to be presented at the second Gulf Economic Forum, which is scheduled next month in Riyadh.

The secretary-general of the Federation of GCC Chambers, Abdulrahim Hassan Naqi said, The main objective is to help the goods to transit smoothly between the various markets in the GCC.A common market could be a solution, where there would be no checks done by the Customs.

The recommendation is to have a common point between the borders of two countries for immigration and also Customs. So if a vehicle has got a clearance in Bahrain, then there is no need for another check in UAE or Saudi Arabia.

This will reduce the time spent by the vehicles at the border, and also reduce the losses. The discussions with the Customs officials are underway and it is hoped that this plan would be implemented soon.

Mr. Naqi also said that the proposal is still under consideration across GCC. For this, the first workshop happened in Riyadh two weeks ago and the second happened in Bahrain.

The good news is that these after recommendations are implemented, it will improve the intra-GCC business and commerce flow and company formation in GCC will become more feasible and attractive.

The GOIC assistant secretary-general, Shmalan Hamoud Al Jeheidli said that having a Customs Union for GCC will help in reducing the challenges and limitations of moving goods and enhance the intra-GCC trade.

More Competition

This could also increase the competition, increase the production rates and the best utilization of resources at hand; and it could also reduce the consumer prices.

BCCI board member Abdulhakim Al Shemmari said that after 25 years of the announcement of GCC union of Customs, the private sector feels that the end result is way lesser than expected.In the last decade, many proposals have been sent, which aimed at reducing the number of barriers which lie between the nations when it comes to clearances, transportation and also for certification of products.

The Gulf Customs Union means to enhance the wealth and growth and in this, the private sector could replace the income from the oil industry.This union is aimed at growing the business and economic exchange between GCC countries. A GCC Union is surely going to have a big impact.

The one-stop measures at the border were initially announced in December, 2016 and could have taken 18 months for implementation. After it’s put in place, the vehicles will be stopped at only one post for border routine procedures, like passport control, clearance of car and customs. But someone going into Saudi Arabia would only have to go through the Saudi formalities; whereas if you are going to Bahrain, you will need only Bahraini clearance.

At present, it ends up in a chaos and congestion because the drivers have to comply with both Bahraini and Saudi formalities.

The Customs Affairs has shown an upward trend in e-payment transactions done for customs clearance. A 181 per cent rise was recorded in January, when a BD2,845,714 worth of transactions were registered.

- Newsletter

- April 9, 2018

The GCC or Gulf Cooperation Council region has saw a year of inadequate economic performance in the year 2017.However,according to the World Bank’s biannual Gulf Economic Monitor, there is hope and the growth will take an upward turn in 2018 and 2019.

The economies of the GCC region saw a downward trend or a flat growth.The reasons for this were a tighter fiscal policy and lesser oil production, which affected the activity in the so-called non-oil sector. However, the external debt issuance spiked up to finance the huge fiscal deficits.

But the economic growth is now expected to go up gradually. The recent recovery in energy prices, though partial, and the termination of oil production cuts post 2018, and are duction of the fiscal austerity.

The World Bank’s estimate of growth comes to 2.1 percent in the current year, which is expected to rise even more to 2.7 percent in the year 2019. Growth in Saudi Arabia is also projected to bounce back to around 2 percent in 2018-19.

Nadir Mohammed, the World Bank’s country director for the GCC said, “Policy attention is shifting towards deeper structural reforms needed to sever the region’s longer-term fortunes from those of the energy sector.”

“While the recent increase in oil prices provides some breathing space, policy makers should guard against complacency and instead double down on reforms needed to breathe new life into sluggish domestic economies, to create jobs for young people and to diversify the economic base. Any slippage could negatively impact the credibility of the policy framework and dampen investor sentiment.”

Though the fiscal and current account balances have seen growth and improvement, this region is still facing some financing requirements and is still vulnerable to changes in the global risk sentiment and the funding cost.The implementation of the country’s reform plans needs to be robust to hold upall the benefits of better structural reforms and fiscal adjustment, which aim to expand their economies.

Over the long term, the lasting dominance of the hydrocarbon sector in the GCC economies battles for the dynamic implementation of the structural reforms. The structural reforms ideally should be focused on the following: development of the private sector, economic diversification, and labor market and the fiscal reforms. The long-term ambitions of the GCC states are expressed in various countries’ vision statements and their investment plans and aim to develop competitive economies that will utilize all the talents of their people, said the report.The implementation of these structural transformation guidelines or programs needs a continuous political commitment on part of the GCC governments.

Saudi Arabia has already come put with its 12 “vision realization plans” that are associated with its Vision 2030 aspirations. It aims to largely transform their economy in the coming 15 years by aiming to lift the private sector of the economy from current 40 to 65 percent.It also aims to take the small and medium enterprises’ contribution to GDP from the current 20 to 35 percent, said the World Bank report.

Kevin Carey, the practice manager at the World Bank said, “Transforming from an oil-dependent economy to a self-propelled, human capital-oriented one requires some fundamental changes in the mindset; some also call this a new social contract.”

“GCC countries do not need to discard their existing social contracts but rather to upgrade them to reflect new realities of low for long oil prices, increasing global competition and the long-term threats from technological and climate change.”

Some other Arab countries of the GCC states also have other challenges such as equity,sustainability and welfare related to the pension systems. Some of the solutions to improve pension outcomes could be improving the overall efficiency by bringing down the current fragmentation in many of the GCC pension systems.The access and contributions should be simplified and made more systematic by strengthening their ID and IT systems and also the capabilities of the pension administration bodies.The governance of pension institutions should also be strengthened.

If the GCC countries aim to attract all the global talent and think of company formation in GCC, they need to consider possible solutions for expatriates that would help them meet their pension and financial security needs, said the report.

- Newsletter, U.A.E

- April 3, 2018

Reuters released a survey recently that says that the total number of jobs in the finance sector that were to be migrated out of Britain or in other countries because Brexit has gone down by half, as compared to about six months ago.

However, Dubai Multi Commodities Centre or DMCC report said that British organizations, which were finding options overseas, had Dubai on their radar. Many UK-based firms had been showing interest in settling up their offices in the free zone since the Brexit had voted to go out of the European Union about a couple of years back.

The organizations that employ most of UK-based employees in their international finance department reported to Reuters in their last Brexit tracker that they plan to move about 5,000 finance jobs out of Britain by March 2019. However, in March beginning, the DMCC came out with its report named: ‘Brexit: the impact on British business and exploring new trade routes’. Though it nowhere mentioned the total number of British firms they surveyed, it just said that approximately 27 percent of survey respondents were of the view that they had a bigger demand and wish for expansion of international expansion after Brexit happened.About two-thirds of the people said that it was a big possible location for company formation in Dubai.

To state the facts, about 4,000 odd British firms are based out of Dubai today, and around 1,300 of them are located in DMCC. The report also said that the DMCC witnessed a 29 percent climb in the number of British companies, which are all set to open their offices in the free zone. Do you know that this interest shown by the British organizations in setting up their offices in Dubai has gone up to a whopping 192 percent? Therefore, DMCC company formations are on a high demand.

In the press release that came along the DMCC report, the Chairman of the consultancy firm Asia House, Lord Green, said that with the coming of Brexit, we have to accept that it brings along some complexities; therefore, there is a need to promote more British commerce and industries to find newer markets. The UAE in the Middle East is a great option as it provides exceptional business opportunities and hence company formation in Dubai is a good bet.

Lumina, corporate finance firm in Dubai announced that they had appointed Rick Pudner (former group CEO of Emirates NBD) to head their entry into this new zone – the U.K. market. Pudner said that the impacts of Brexit included major capital, financial and other trade consequences for UK mid-market and also for private companies that are working in the Middle East markets.

- Newsletter, U.A.E

- March 29, 2018

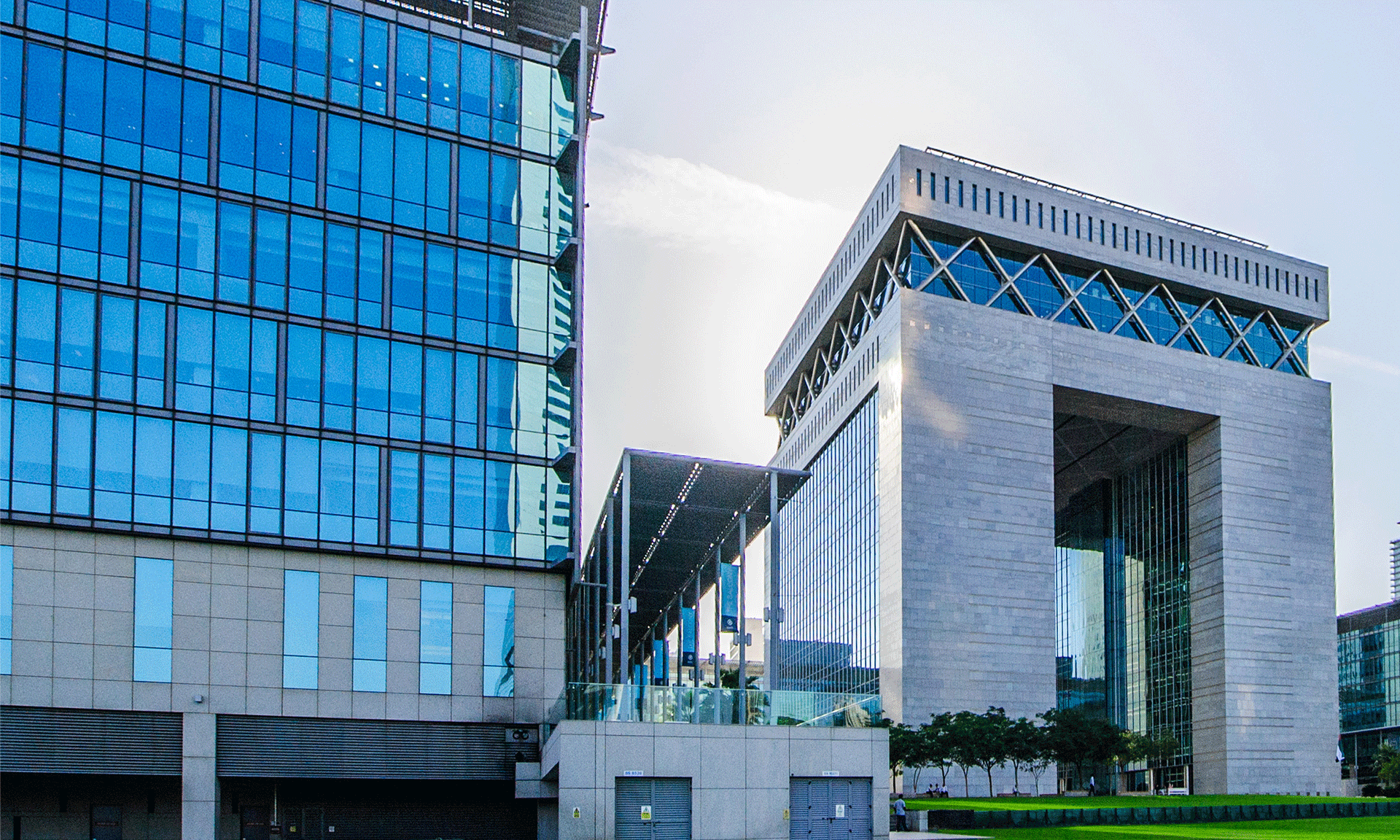

The Dubai International Financial Centre (“DIFC”) is implementing its new foundation’s law with immediate effect from 21st March 2018. The foundations are used for the following objectives and many other purposes:

- As vehicles for family wealth/succession planning;

- In commercial transactions;

- For securitization structures;

- For long-term businesses holding; and

- As anti-hostile takeover instruments.

The DIFC Foundations are attune with the existing broad and sophisticated measures of the Free Zone.

Interested Parties:

The Foundations Regime is delightful news for an extensive range of international and national parties. These parties are inclusive of family businesses seeking continuance and succession planning solutions, family offices, entrepreneurs and business people who also have charitable and philanthropic aspirations. It also includes legal advisors and persons conducting commercial or wealth management activities in or from the DIFC.

Objectives and kinds of foundations:

The aim of the foundation is:

- to serve exclusively charitable objects, and

- one or more of:

- non-charitable purposes; and

- objects to benefit persons specified name, category, or class

Nevertheless, a foundation cannot carry out any profit-making activities, except those objectives which are ancillary or incidental to its goals. As per the law, the Foundation objectives must not be unlawful or against the public policy of the DIFC or the UAE.

The foundations might be subjected to particular governance protocols as per its objectives and activities. Also, they will be required to abide by the other regulatory provisions if engaging in those activities.

Coverage of the Law:

The new law covers the following areas:

- The nature of a DIFC Foundation, including its objectives and the rights of heirs;

- How to establish a Foundation;

- The roles of the different members of the foundation, such as the Founder, Council and the types of property the Foundation can hold and in what circumstances;

- The administration requirements of the Foundation;

- The role of the Registrar;

- The effect of court and arbitral proceedings on the Foundation;

- How to continue a Foundation into or from another jurisdiction;

- How to dissolve a Foundation; and

- Fines and fees concerning the Foundation’s administrative obligations.

Our Assistance:

We at IMC are pleased in assisting our clients in registering and maintaining ongoing compliance with a Foundation by performing the following services:

- Incorporation process assistance,

- Providing valuable opinions on matters of Foundation goals and assets,

- Assisting on the issues of composition and powers of the foundation’s bodies,

- Newsletter

- March 12, 2018

India has once again captured the status of being the world’s fastest growing economy in the October-December quarter. India has outdone China for the first time in the year as there was a rise in the government spending, manufacturing, and services.

India is Asia’s third-largest economy, and it grew by 7.2 percent in December quarter which is the fastest of five quarters as per the Ministry of Statistics. This data beats China’s 6.8 percent and has a forecast 6.9 percent by analysts surveyed by Reuters.

There was an early interest rate hike on the agenda which made India raise its 2017/18 GDP forecast to 6.6 percent from 6.5 percent. Indian manufacturers and service industries are still in a process to overcome interruptions from the launch of national sales tax in July.

In the December quarter, annual growth in the manufacturing sector climbed to 8.1 percent from 6.9 percent in the previous sector while financial and other sectors climbed to 7.2 percent from the previous 5.6 percent.

The expert’s view is that settling down of Goods and Services Tax (GST) reforms will boost growth in the next fiscal year, and the Reserve Bank of India is trying to balance inflation and growth. RBI can also present a hike in the interest rates after the policy meeting on April 5.

We expect a rate hike from RBI, most likely at the August review,” said Abhishek Upadhyay, economist, ICICI Securities Prime Dealership, citing inflationary pressures.

The Reserve bank has not changed its key rate since a 25 basis points cut in August. The impact of Retail inflation eased marginally to 5.1 percent in January from a 17-month high of 5.2 percent in December.

Urjit Patel, RBI governor, this month said the economic recovery was at a nascent stage and called for a cautious approach.

- Newsletter

- March 12, 2018

The new bankruptcy law of Saudi Arabia has raised the expectations of the foreign and local investors for a reliable framework that will reduce risks of conducting business in the Kingdom. This law will help improve the appeal of Saudi Arabia among global investors and will raise significant economic activity in the region as per the view of the analysts.

The primary aim of the law is to allow a bankrupt debtor to resume activity mindful of the creditor’s rights. The Saudi Ministry of Commerce and Investment aims to raise the kingdom’s global ranking in settlement of bankruptcies.

Saudi ranks in the 168th place (out of 190 countries) in the World Bank’s Ease of Doing Business ratings for 2018 in regards to bankruptcy cases. The new law is expected to change the position of the country.

The neighboring country of Saudi Arabia, the UAE had implemented the bankruptcy law back in 2016. It came into effect in 2017, and the objective was to reduce the risk of conducting business in the country. In some cases, it was also the sparing of imprisonment for failure to pay the debt.

Bankruptcy law is meant to support confidence and to smooth up possible new investments needed to support the long list of giga-projects and expected IPOs,” as said by an economics and energy partner at a consultancy firm advising on investment risks in the Middle East.

“It is also a major step forward to increase confidence in Saudi Arabia for investors and operators, all in line with the Vision 2030 drive, and not to be forgotten the MSCI Emerging Market Index Listing,” he added.

The Kingdom has started to implement a motivating economic overhaul that will oversee the launch of major projects and allocate the state’s resources. This projects also includes the substantial 500 billion ‘NEOM’ business zone project. This project’s size is to be more than 33 times the size of New York City.

There was a need for a new, up-to-date bankruptcy law as international investors are apprehensive about issues related to recuperating funds and investments when involved with a Saudi entity over the past years.

The is a preparation of a regulated schedule which details the insolvent status of the debt-ridden companies. It is a combination of US (Chapter 11) and European bankruptcy provisions, and would allow involvement from all parties with interest in the process.

The stock market of the KSA is the Arab area’s most significant bourse and is now placed on the ‘watch list’ of the emerging market index by the global index supplier MSCI. This inclusion is the result of the decision taken in June. A positive result would guarantee the inflow of foreign funds and an increase of business set up in Saudi.

Providing Opportunities

“The adoption of the bankruptcy law is part of the development of the country’s economy and will open up opportunities for new projects to gain access to, and participate in, the market effectively while avoiding any loss that may result from the restructuring of the economy,” as said by Faisal Al Olayan, a Riyadh-based independent economic consultant.

“The bankruptcy law aims at enabling the debtor to recover and resume activity and also takes into account the rights of creditors. The current law in the kingdom does not include an easy way to liquidate the company’s activities,” he added.

Before the introduction of the Bankruptcy law, very scarce regulations were governing the process of declaring bankruptcy, the treatment of creditors and their claims, or the rights obligations of insolvent parties, according to a Saudi-based associate at law firm.

He said that the existing statute was highly reflective of traditional Islamic principles and cultural issues unique to the region, which largely seek to bring disputing parties together in an amicable agreement without forcing a judicially-imposed settlement against either party’s will.

Formal judicial insolvency and bankruptcy proceedings have been fairly uncommon occurrences in Saudi Arabia, and financially distressed parties and their creditors generally seek to work out their disputes and settlements on a private, one-to-one basis.

Long-term disputes

Many disputes are pending in the Kingdom due to the absence of proper bankruptcy laws.

According to a law firm founder “The lack of a formal bankruptcy system meant that restructuring companies often presented financial hurdles that were too difficult to overcome.

Liquidation was the only solution when the debt exceeded the value of the assets, which ends the work of the investor completely, though it could have been resolved by (methods other than) liquidation and balance between the rights of creditors and debtors.

The new Saudi bankruptcy law gives more clarity and transparency, and presents a higher chance of a business resuming activity under the supervision of specialist insolvency experts, he added, without disruption to creditors’ rights.

Enacting a more robust bankruptcy statute has added a level of certainty to the legal environment in Saudi, and clients and companies investing and doing business in Saudi Arabia will feel more comfortable doing so.”

The new bankruptcy law started to take shape in early 2015 when the Ministry of Commerce and Investment (MOCI) released a policy paper for public comment entitled “General Policies of Bankruptcy.” The article suggested a legal framework for bankruptcy and insolvency procedures that coexists with the international standards. The law has been derived from existing structures in the Czech Republic, England and Wales, France, Germany, Japan, Singapore, and the United States, Burns noted.

- Newsletter, U.A.E

- March 12, 2018

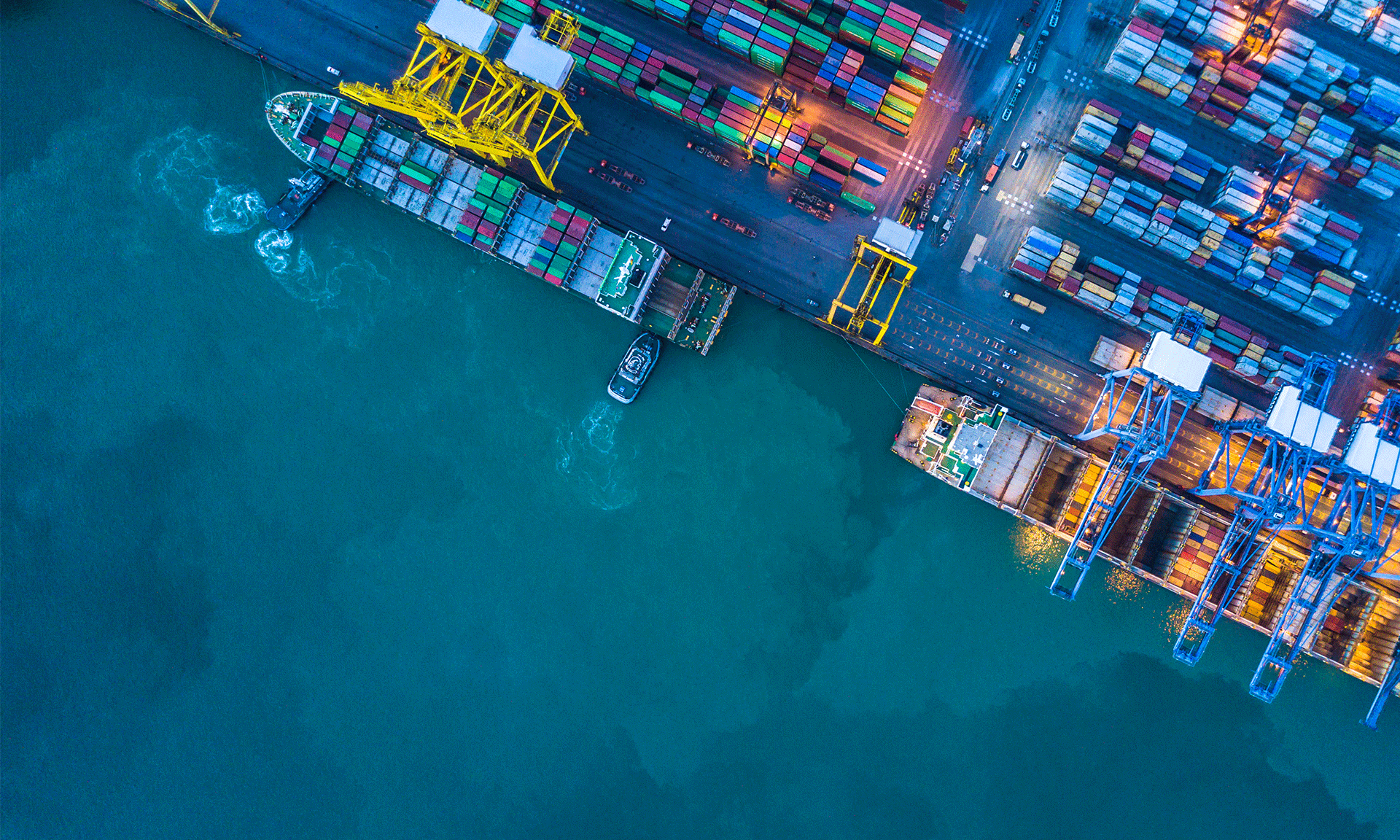

The Jebel Ali Free Zone(JAFZA)’s Food and Beverage (F&B) sector which is a subsidiary of global trade enabler DP world witnessed a growth of 12 percent in 2017. The F&B sector companies rose from 507 to 570 in 2016 with 8,600 employees. This ascertained the attractiveness of company formation in JAFZA by entities seeking to launch and expand their business.

Sultan Ahmed Bin Sulayem, Group Chairman and Chief Executive Officer, DP World, said: “Jafza is building on its track record as the region’s hub for this key sector of the economy, in line with U.A.E. Vision 2021 launched by His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice-President and Prime Minister of the U.A.E. and Ruler of Dubai. The growth reflects our continued focus on developing this industry and attracting more F&B manufacturing businesses to establish themselves here.”

“We are committed to building on our infrastructure, providing a world-class business environment for F&B companies and this event provides a major platform to showcase our business-friendly services and our capacity to support Dubai and the UAE’s economic diversification strategy.”

“The vision of our leadership to establish Dubai as the global Islamic economic capital provides a major boost to our economy by attracting foreign investment, especially those that are Halal food related. The Dubai Industrial Strategy also complements the competitiveness of the food industry where local companies can partner global counterparts to increase exports. We are also focused on research and development in the industry to develop new products and commodities that will suit different tastes and attract consumers.”

JAFZA has F&B business from 75 countries that have a reach of more than 2.5 Billion consumers in the countries of Middle East, Africa, South and East Asia and the CIS. This F&B sector also includes international brands like the AGC, Unilever, Mars, Food Specialities Limited (FSL), Gulf Food Industries, Hunter Foods, and many others. The percentage of F&B companies in the JAFZA; 37 percent are from the Middle East,24 percent from Asia,19 percent from Europe and 10 percent each from Africa and America.

The reason as to why the entities prefer company formation in JAFZA is the high occupancy rate of facilities like land, warehouses, showroom, and offices. These spaces are spread over 1.85 million square meters and accelerate the growth of the F&B industry. JAFZA also featured its F&B track record during the Annual Gulfood 2018 event from February 18 to 22nd.

The Business Monitor International (BMI) research recent reports conclude that the food sales in the region of the Middle East and North Africa will increase by 6.3 percent annually between 2015 and 2020. It will also witness a 7.1 percent annual growth till 2020 due to the factors of robust retail sector investment, the rise of tourists and expatriate population in the coming years.

A Member Firm of Andersen Global

- 175+ Countries

- 525+ Locations

- 17,500+ Professionals

- 2350+ Global Partners

IMC Group

IMC Group