In brief, shares constitute the ownership of a company. After completion of the Singapore company incorporation process, the founders decide who will be the shareholders of the company. Generally, these founders constitute a major stake in the shareholding. It is very important to determine the percentage of holding each of them owns.

Mostly different shares classes are seen in public limited companies, but the concept is not so uncommon in the private limited companies as well, especially when they are in the growing stage.

The laws in Singapore are quite flexible when it comes to issuing shares with different rights. You can classify the shares in many categories like “management shares” with extra voting rights, “Preference shares” without any voting rights, or “redeemable shares”. There is no legal definition for these share classes, so all the rights every class offers should be clearly defined in the Company’s Constitution.

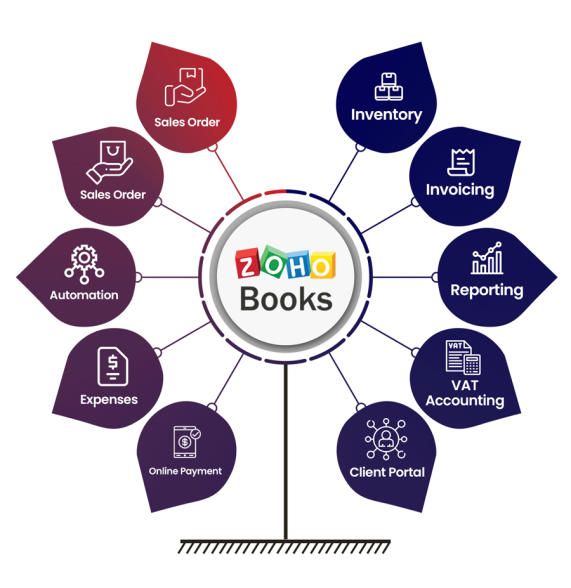

Here are some of the typical share classes of any company formation in Singapore, along with the rights they offer.

Ordinary shares

They are also called simple equity shares and are the most common type of shareholding anyone can own. Holders of ordinary shares are entitled to the profits through dividends, one vote per share, and the surplus assets when the company is wound up. However, there can be a variation in these terms and are generally mentioned in the holding documents.

As compared to preference shares, ordinary shares are of a low priority to the company. For example, when the company distributes a dividend, first the preference shareholders receive their share and then, if remaining, comes the turn for equity shareholders. Also, when a company is wound up, Creditors and preference shares are paid off first and the equity holders in the end. This is the reason why ordinary shareholders are called “residual claimants of the company”.

Preference Shares

These are the shares that provide a priority to the holder in areas such as dividend payment or capital payment while winding up of a company. However, preference shareholders can have more extended rights depending upon the further classification by the company issuing it.

Every company issuing preference shares needs to state the right of holders in Constitution under S 75(1) CA, related to the following points.

- Any rights towards repayment of capital

- Any rights related to participation in surplus assets or profits

- Any voting rights

- Regarding the dividends whether non-cumulative or cumulative

Under s 75(2) CA, if any company fails to comply with the above procedure, the company and every officer will be guilty of an offense and shall be liable to a fine not exceeding $2000.

Now, the voting rights associated with the preference shares depend upon the terms under which they are issued. Hence, it is entirely normal for a company to issue preference shares with increased voting rights or no voting rights, or voting rights on specific matters.

Non-Voting Shares

These shares carry no rights for voting or attending the annual general meetings conducted by the company. Generally, the preference shareholders are the non-voting ones. These shares are mostly issued to (a) the employees of a company (to pay some of the remunerations as dividends, as an incentive to the employees), and (b) the family members of the main shareholders.

Redeemable Shares

These shares are issued on the terms that the company may, or will, buy back the shares at a specified date in the future. This provides the shareholders with a guarantee that their capital is safe and a specified amount will be received either at the specified date or at the option of the company.

If a preferred stock does not have a maturity date, i.e. the date on which a share will be redeemed, then it is called perpetual. Such stocks have a more fluid redemption structure, which can happen on the call date. Although the company is not obligated to do so, it can redeem the share on its first call date which generally falls after five years of issuing. The price at which the company buybacks these shares id slightly higher than the original issuing price.

Deferred Ordinary shares

It is a stock that comes without any right of receiving the company’s assets until other shareholders have been duly paid. Also, these shareholders do not receive any dividends until others have received a minimum amount. The holders of these shares are generally the owners, the founders, venture capitalists, or private investment groups, who have a long-term stake in the company’s performance and growth.

The basic idea behind issuing such shares is to keep the investors and management intact when the company is going through an evolution phase, from a small start-up to a publically-traded brand. This category is very uncommon because the stock units are restricted. It is very important to know that the values of Deferred stocks cannot be calculated until the stakeholder decides to leave the company.

Management Shares

This is that category of shares which rests with the management of the company. The voting rights for management shares are greater than ordinary shares like three votes for one share. The basic idea behind issuing them is to ensure that there is a fair decision taken in a process where all other investors go against the management. At this time, the managers can use their voting rights to turn the decision in the company’s benefit.

Alphabet shares

This is a different class of shares that is generally tied to a specific subsidiary of any corporation. Broadly, you can say that they are shares of common stock that are different in some way from other common stock in the same company. The reason for calling these stocks as alphabet shares is that the classification system used for identifying each class of common stocks uses letters to differentiate it from the parent company’s stock.

Publically traded companies generally issue alphabet stocks when it purchases a business unit from another company. The latter becomes the subsidiary for the former, and the holders are only entitled to the dividends and claims from the subsidiary and not the parent company.

The holders of such stocks may have limited rights for voting. This is to ensure that the inside people can control the working of the acquired subsidiary. For many, issuance of alphabet stocks can be an indication of a complex capital structure. Companies with several subsidiaries or branches may issue different alphabet shares to ensure smooth functioning of operations as well as for controlling the dividend distributions.

Conclusion

All startups indeed choose to give all its shareholders equal voting rights per share, but there is a great sense of flexibility and freedom for the investors and founders to be granted with varying degrees of management control and varying degrees of entitlement to the company’s capital or profits.

The law in Singapore continues to motivate a welcoming dominion for the establishment and growth of businesses, by offering some flexibility of capturing the desires different types of investors have, who may or may not desire greater control in the company’s management, or, who may or may not desire the assurance of a fixed return on their investment made in the company. Anyone who regards the creation of multiple share classes should consider the motive for the distinct classes and, at the same time, fully evaluate the rights supplied to each class.