Bahrain has become a huge attraction for investment opportunities in the past few years. As per the World Bank’s report in 2019 on doing business in Bahrain, the Kingdom has ranked as one of the best places for doing investment and it continues to make the most of it.

Investors from across the globe are now confident that Bahrain offers a rewarding investment environment, which brings us to the importance of forming or registering a company in the Kingdom.

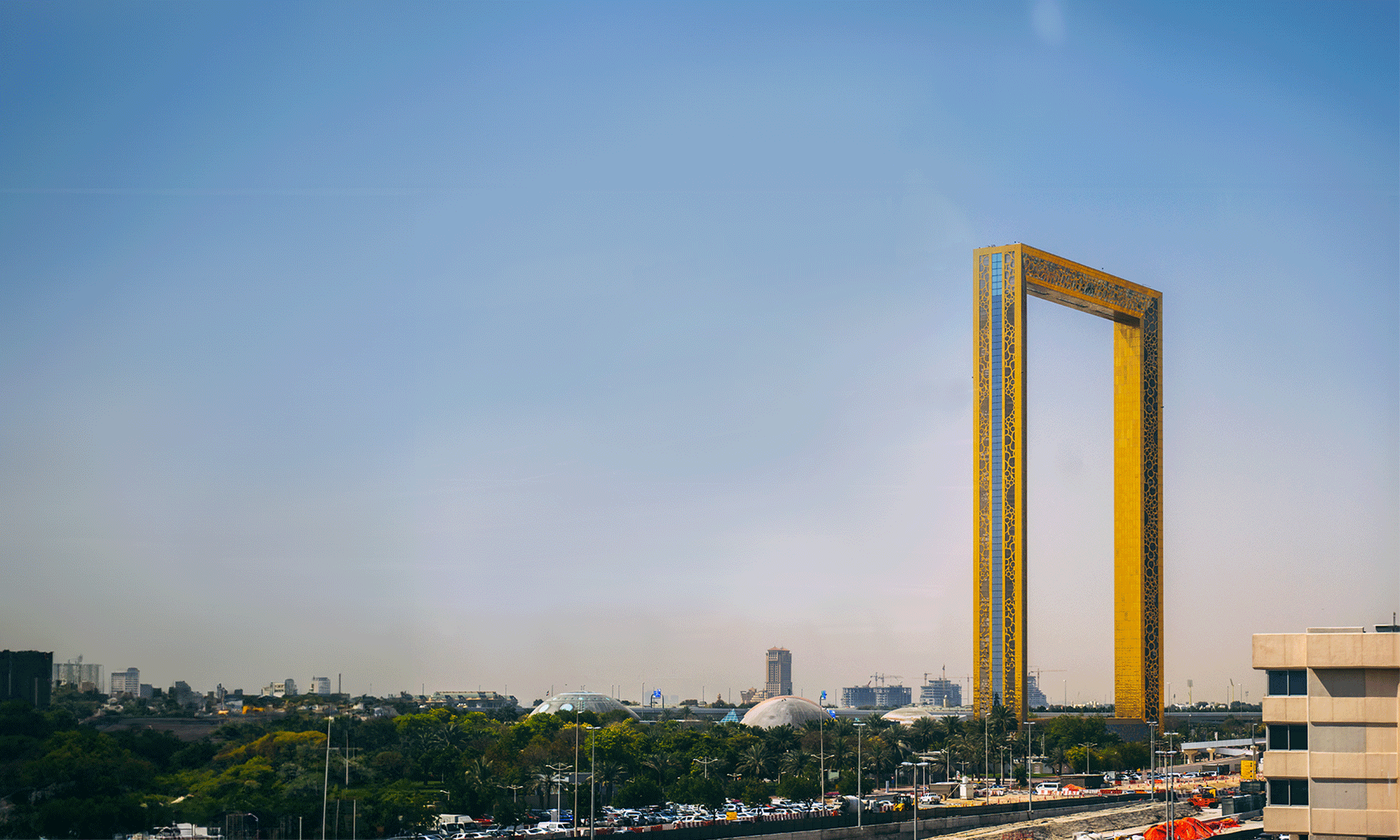

Bahrain is an island Kingdom made up of a group of islands, located in the stretch of the Qatar peninsula and the north-eastern coast of Saudi Arabia. The government here welcomes foreign investment in Bahrain with open arms so as to boost its economy. As a result, the economic laws of the Kingdom have been significantly liberalized. Bahrain also recently passed some laws liberalizing foreign property ownership and tightened its anti-money laundering laws. In addition, the visa and immigration policies are made simpler to encourage business development and ease the process of setting up a foreign company in Bahrain.

Private organizations and firms, specifically in Information and Communications Technology (ICT), Tourism, Education, Banking, Healthcare and downstream industries and Financial Services & Insurance (BFSI) are flourishing in Bahrain.

Bahrain is a country that focuses on development and offers a business-friendly backdrop that is cosmopolitan, safe and unsurpassed in the Arabian Gulf.

Why should you invest in Bahrain?

Being a developing country in the Middle East, Bahrain is all set to grow and advance in a big way. Let’s take a look at some advantages of investing in Bahrain:

- The customs duty in the Kingdom is low, hence it favours exports

- The corporate policies are quite business-friendly

- The legal system is clear, coherent and simple

- The banking sector is developing at a fast pace, resulting in advanced banking facilities

- There is a huge scope of business growth and expansion

- The people of the Kingdom are pleasant and its culture is very supportive of entrepreneurial and industrial growth

- It has an advanced infrastructure, which is well-equipped with facilities to make the company incorporation procedure in Bahrain simpler

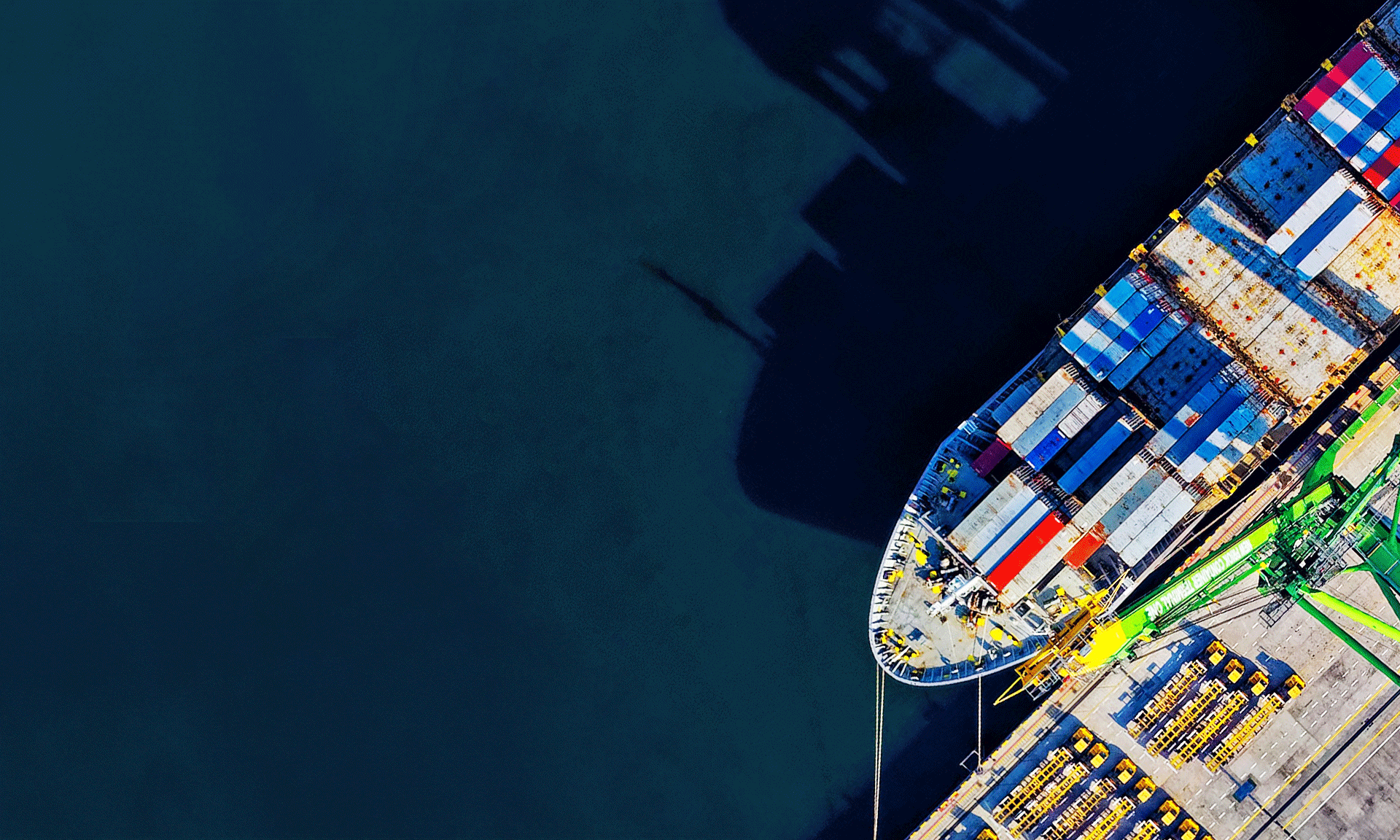

- It is the major port hub in the region, which offers convenient access to all the markets in the Middle East

- The tourism and entertainment industry in Bahrain has been flourishing and expanding year on year

- The standard and quality of life and variety of food in the country is quite tempting

Bahrain is now one of the major players in the financial and banking services throughout the world. Its strategic location and its sophisticated digital telecommunications systems facilitate communications with all business hubs and financial centres. Another big advantage is that the regulation, licensing, and supervision of advisors offering investment and any other financial advice in or from Bahrain is also quite regulated. This safeguards the investors from the probability of negligence or fraud.

What all should you know to start a business in Bahrain in the year 2020?

- Firstly, gain considerable knowledge about the region.

- As per the law, you must have a local partner who should be holding the majority of the shares of your company, and thus controls the business.

- After Bahrain company formation, the Ministry of Commerce should have ensured that you possess the minimum required capital for investment.

Also Read: Top 10 Business Opportunities in Bahrain

However, it is always recommended to consult a local business advisor right from the beginning. A reputed and experienced consultancy like IMC can help you sail through the formalities of company incorporation procedure in Bahrain, and help in attaining your business objectives, whether you are thinking of setting up a start-up or a larger firm.

What are the available legal structures in Bahrain?

When thinking of Bahrain company formation, you could opt from among the following legal entities:

1. Limited Liability Company

2. Branch Office

3. Partnership

When setting up a business in Bahrain, a partnership could fall in three categories:

- Partnership Limited by Shares

- Limited Partnership

- General Partnership

4. Sole Proprietorship

5. Bahrain Shareholding Company

- Public Shareholding Company

- Closed Shareholding Company

What are the steps to set up your small business in Bahrain?

Company incorporation procedure in Bahrain involves several requirements, which must be followed to run the business. The key steps are:

- Registering a company name: Then, you need to register your company name which would help identify your business forever. The Ministry of Industry and Commerce (MOIC) has outlined some guidelines to keep in mind when selecting a business name. You must ensure that you comply with those laws. An entrepreneur is allowed to propose up to four business names at a time.

- Doing the commercial registration of your company: The Commercial Registration papers are released by the Bahrain Investment Centre. They issue the papers after checking and ensuring that there is no fault in the application filled in the initial stage. The papers are given after paying the required fees.

- Licensing and approval process: Licensing and approval is required when a company or business does not get their Commercial Registration papers right away. Therefore, they need to follow this additional step for registering their company in Bahrain.

- Other Approvals: After registering your company successfully, the next steps is to open a company bank account, then lease an apt office space, and then hire Bahraini employees etc.

- Other Approvals: After registering your company successfully, the next steps is to open a company bank account, then lease an apt office space, and then hire Bahraini employees etc.

Company formation in Bahrain guarantees a huge earning potential, benefits of various tax exemptions, convenient facilities, state-of-the-art infrastructure, and liberalized public policies along with free trade barriers. We, at IMC, assist entrepreneurs, companies and corporates to set up their business in Bahrain, while taking advantage of all the benefits this economic and financial hub provides. Our professionals would take charge of all the visa, banking, licensing and legal formalities and help you to glide through the company incorporation procedure in Bahrain without any worry. If you are planning to start your own small business in Bahrain in 2020, please contact us and we would be glad to assist you.