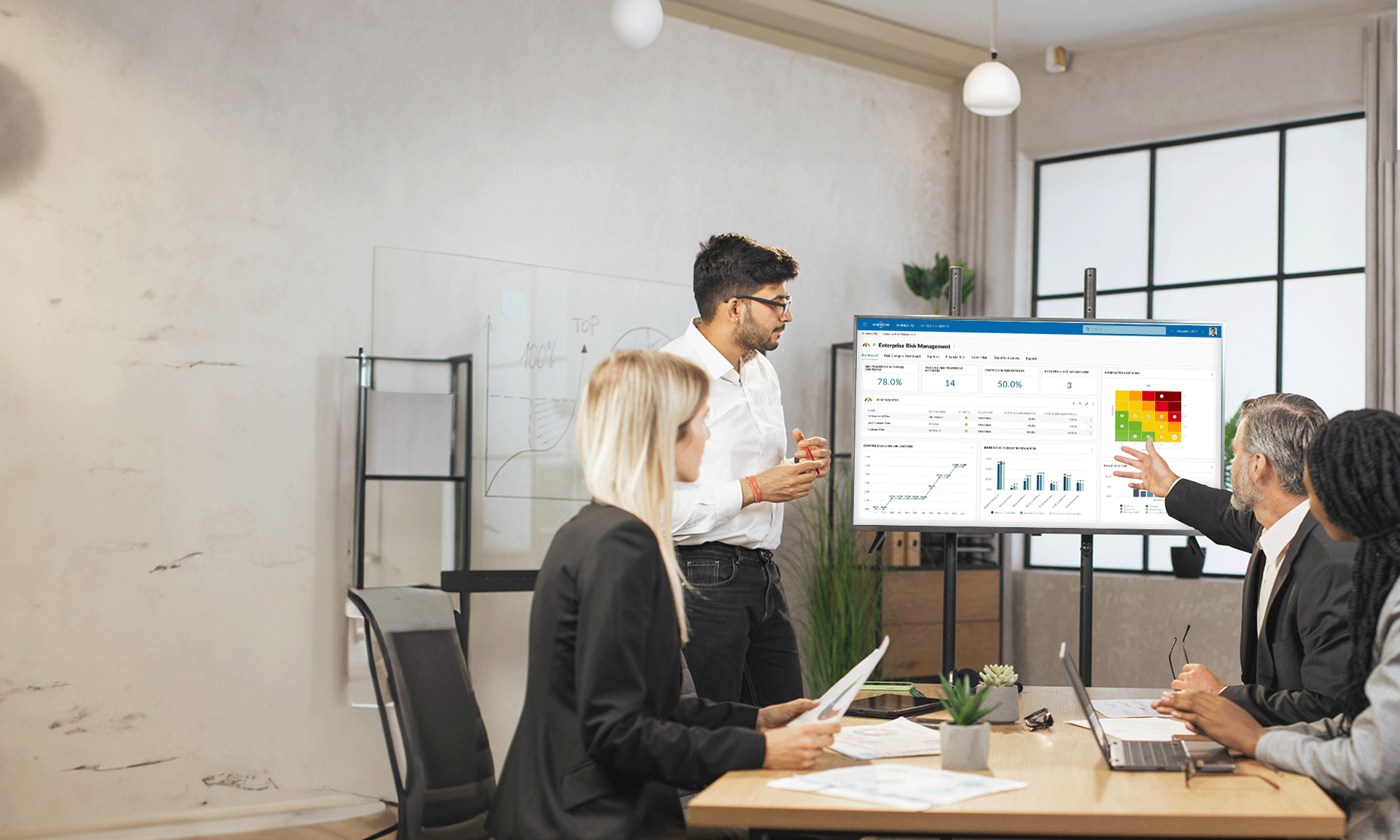

A recent survey sheds valuable light on the shifting risk appetite for family offices in Asia. The hunger for risks for these family offices used to be bigger compared to other global counterparts, but there has been a change of late. While a general trend was observed of family offices moving away from cash and towards risk assets, Asia stood out as a unique exception to this pattern.

A family office serves as a private client and family advisory firm that high-net-worth individuals often count on. They are different from traditional wealth managers as they offer exclusive services to affluent families or individuals.

The survey, encompassing family office clients with a collective net worth of $565 billion, revealed an interesting trend that merits our attention. Around two-thirds of the surveyed individuals were based outside North America.

According to experts, family offices in Asia chose risky assets to allocate more funds compared to low-risk assets in the initial part of the year. A notable 44% of their assets are allocated to private and public equity, a stark contrast to the 30-33% held in cash and fixed income. Compared to the family offices in Europe, the US, or Latin America, this difference looks much bigger.

Factors Fuelling the High Risk Appetite for Asian Family Offices

Different factors shaped this risk appetite for family offices in Asia. These include early bets on post-Covid recovery in China and historically low rates of interest. While these factors sparked the initial appetite for risk, the trend evolved with the potential slowdown in China and disruptions in global supply chains. This explains the motive of family offices re-evaluating portfolio allocations.

The contrasting performance of equity markets makes the trend more interesting. While Asian markets, led by Hong Kong’s Hang Seng index and mainland China’s CSI 300, experienced declines, the S&P 500 and Europe’s Stoxx 600 demonstrated robust growth.

Singapore emerged as the global hub for family offices, occupying a prominent place in the evolving market. According to reports, Asia houses 9% of the global family offices, with Singapore leading the list. This country has around 59% of Asia’s family offices, as of 2023. This serves as a testament to the city-state’s proactive regulatory stance and attractive tax environment. While Hong Kong has 14% of Asia’s family offices, around 13% are located in India. Thailand, Malaysia, and Pakistan host the remaining family offices.

Many experts consider Singapore to be a preferred destination for global family offices. This makes it a strategic place from where high-net individuals can access different investment opportunities across Asia.

Seeking Professional Financial Advice from Experts

The shifting dynamics of family offices in Asia demonstrate the resilience and adaptability of wealth management strategies. While global trends indicate a move towards risk assets, Asian family offices are re-evaluating their portfolios in response to regional and global economic shifts.

The IMC Group continues to be a trusted partner for family advisory services. With professionals to assist you in handling finances, you can invest in the right avenues to maximize your returns.

IMC Group

IMC Group