In the context of a global economy, it is crucial for companies to attract and retain the best talent to stay competitive on the international stage. An effective strategy for gaining a competitive advantage is to provide a flexible workspace that caters to the requirements of the current distributed workforce. This article explores how flexible workspace solutions can assist global employers in attracting and retaining top talent across geographical borders.

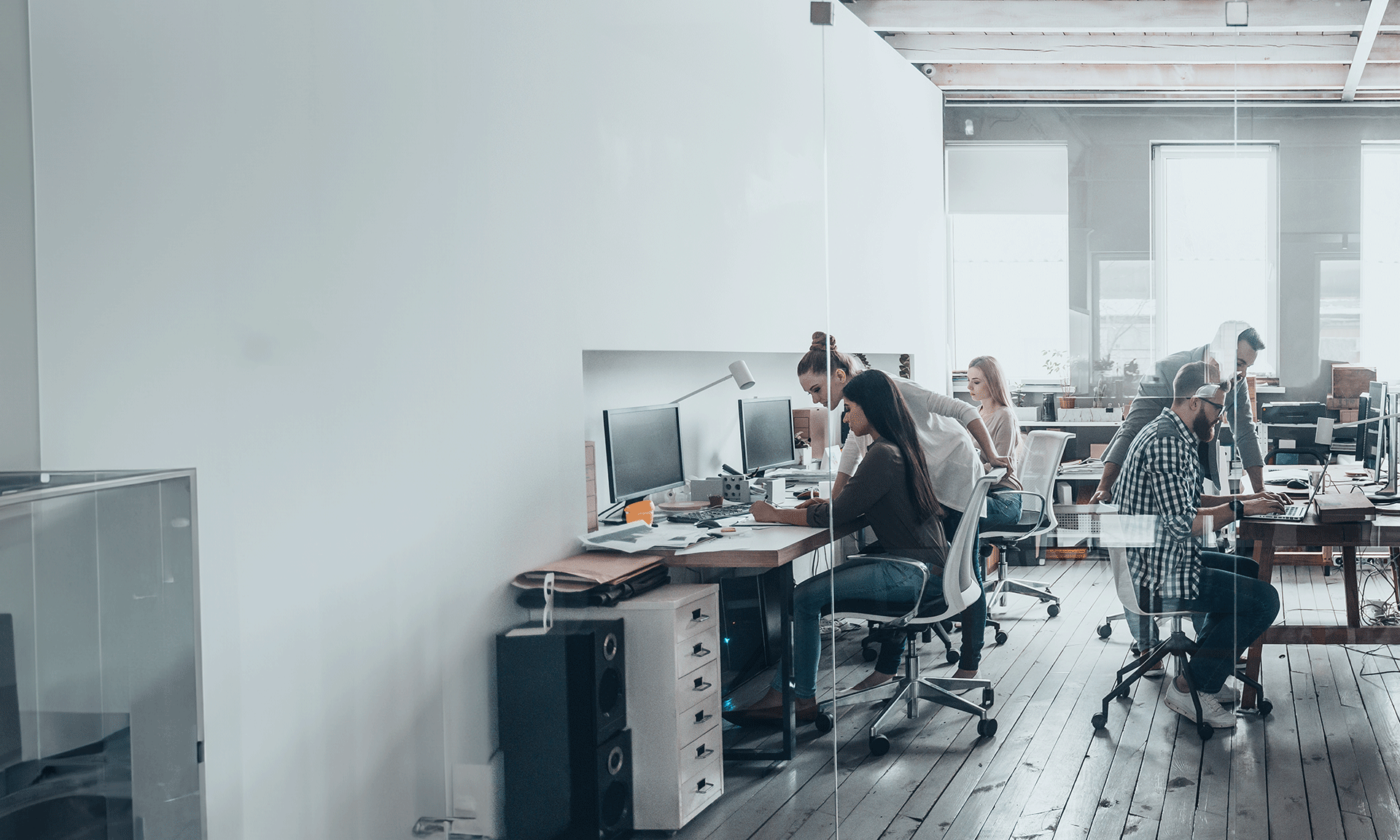

What defines a flexible workspace?

A flexible workspace refers to a comprehensive workspace solution that offers employees and teams a range of work options based on their individual needs. Such options include open offices, hot desks, and coworking spaces.

Advantages of Offering Flexible Workspace Solutions to International Staff

Enhanced Employee Satisfaction:

The increase in remote work has resulted in a growing demand among employees to work from locations that align with their preferences and lifestyle. By availing a global network of flexible work desks, employees can easily locate a workspace that is convenient for them, irrespective of their location. This allows employees to have greater autonomy over their work environment, leading to an improved performance in a workspace that suits them best.

Heightened Efficiency and Teamwork:

Flexible workspaces not only offer convenience to employees but also provide them with fresh and distinct work environments that can stimulate creativity and innovation. This advantage is particularly evident in coworking spaces, where employees and businesses from diverse backgrounds and industries come together. The resulting diversity of perspectives can lead to the generation of novel ideas and innovative work methodologies.

Improved Harmony Between Work and Personal Life:

Offering employees greater flexibility in terms of when and where they work can help them manage their personal and professional lives effectively. Work flexibility is particularly crucial for employees who have family commitments, lengthy commutes, or inadequate access to stable and secure WiFi connectivity at home. When employers empower their teams to choose their work schedule and location, it promotes a better work-life balance, leading to increased productivity and job satisfaction while reducing stress and burnout levels among employees.

Enhanced Relationships and Involvement:

Providing employees with access to a worldwide network of flexible workspaces enhances their sense of connection with the company. When employees can work from a location that is convenient for them, it improves their level of engagement with the work. This advantage is especially relevant for international employees who may experience feelings of isolation or disconnection from their colleagues and the organization’s central office.

Enhanced Trustworthiness:

Empowering employees to select their preferred work schedule and location is a clear demonstration of trust from employers. This trust reflects respect for employees, which has a positive impact on their job performance. Additionally, when employers exhibit trust and respect towards their employees, it creates a mutual feeling of trust and respect, leading to elevated morale, improved teamwork, and increased innovation within the workforce.

Expense Reduction:

Employers can significantly reduce lease costs, as well as the expenditure on office furniture and equipment, by providing flexible workspace solutions. Most flexible workspaces come pre-equipped with all the essential amenities, resulting in cost savings for the employer. Moreover, through discounted global workspace access, employers can enjoy significant savings. These cost savings, along with those attained from using online collaboration tools, can be reinvested in building a better team.

Global Appeal and Talent Retention Through Adaptable Workspace Solutions

Organizations worldwide are recognizing the significance of creating a comfortable and productive workspace for their employees. Including flexible workspaces as part of an employee benefits package can offer a competitive advantage in attracting and retaining top talent internationally. With flexible workspace solutions, employers can reduce lease costs and office equipment expenses, enhance employee productivity, collaboration, and job satisfaction, promote work-life balance, and foster better engagement with the company. By empowering employees with the freedom and flexibility to work in an environment that suits them best, employers demonstrate trust and respect, leading to the creation of a more robust and innovative team.

In summary, a flexible workspace is a win-win situation for both employers and employees in the global economy, promoting a mutually beneficial work culture.

IMC Group

IMC Group