Saudi Arabia opened its doors to global tourists recently and announced a new visa regime, which will be applicable for 49 countries. The sultanate is also encouraging foreign companies to come and invest in a sector which hopefully would contribute almost 10% of the gross domestic product by the year 2030.

The kingdom, which was comparatively closed for decades, has recently, relaxed some of its severe social codes such as differentiating men and women in various public places and necessitating women to dress in all-covering black robes called abayas.

The tourism chief, Ahmed al-Khateeb mentioned before the official announcement that abayas would now not be compulsory; however, modest dress should be worn, which covers shoulders and knees, especially in public places and also at public beaches.

He also said that alcohol would remain banned. Visas, however, are now easily available online, either on arrival or at various Saudi diplomatic missions for a cost of about $120 which includes a health insurance fee. Outbound countries comprise of the United States, China, Russia, Japan and many European states as of now. More countries are slated to be added later.

Visas permit multiple entries and one could stays up to 3 months. There are no constraints for unaccompanied women, as was in the past, and Muslims can also do pilgrimage other than the Haj season.

Till now, any foreigners who were travelling to Saudi Arabia were majorly restricted to resident workers and their dependents, Muslim pilgrims who are allotted special visas to visit the holy cities like Mecca and Medina, and other business travellers.

The plans to welcome considerable numbers of tourists who come for leisure have been discussed for long, but was not accepted due to conservative views and bureaucracy. An added benefit was the e-visa meant for sporting events and concerts, which was announced last December.

This move comes as a part of the de facto ruler Crown Prince Mohammed bin Salman’s impressive plans to cultivate new industries to deter the world’s top oil exporter off crude and open up the country’s society by introducing formerly banned entertainment.

In quest of investments

In addition, the tensions with arch-enemy Iran have also flared up. Riyadh accuses Tehran for an assault earlier this month on Saudi oil facilities, which is denied by Iran.

However Khateeb, the chairperson of the Saudi Commission for Tourism and National Heritage, mentioned that the country is quite safe and this attack would not influence the plans to attract more tourists.

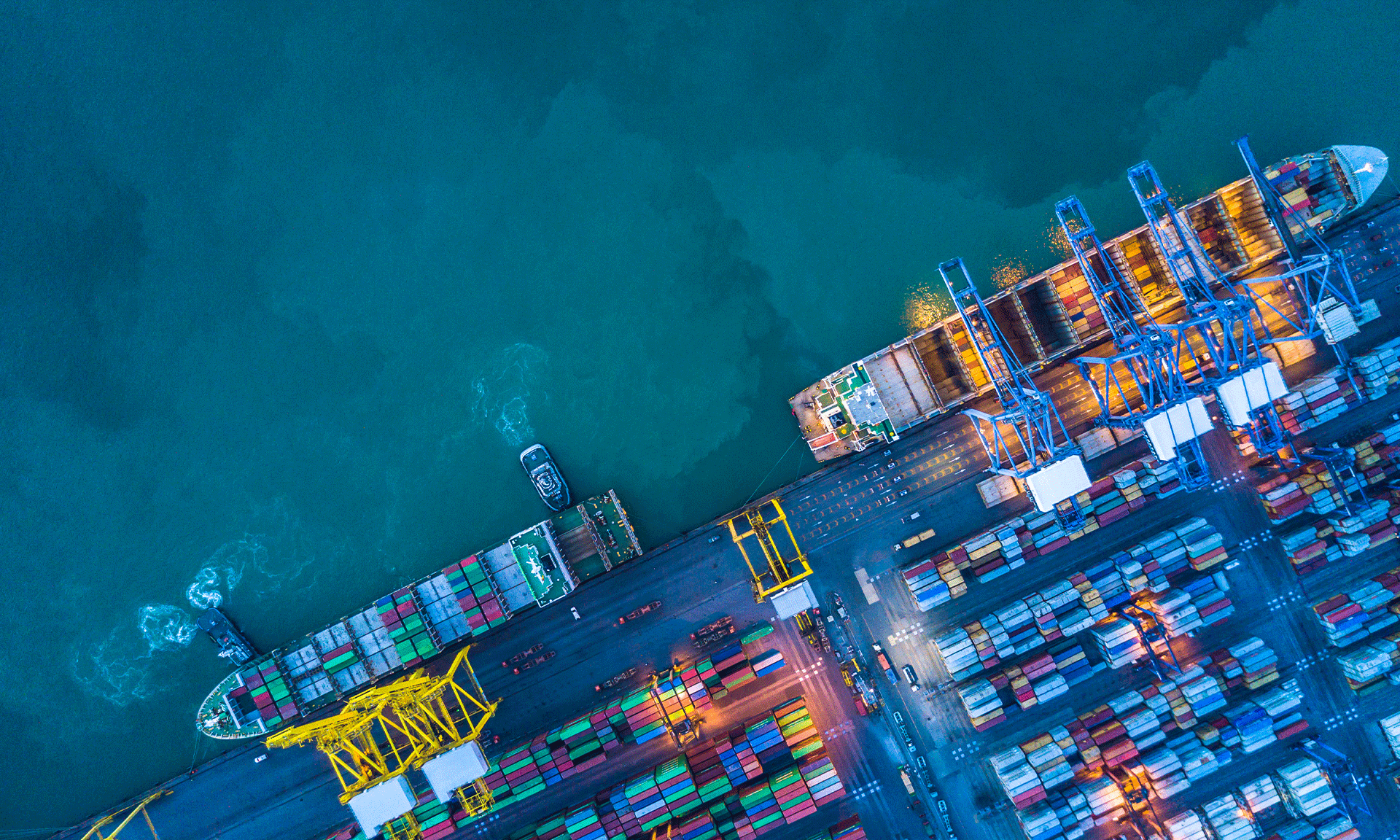

Tourism remains high on the crown prince’s memo or agenda, in spite of a shortage of infrastructure. To push further growth, Khateeb projected that almost 250 billion riyals ($67 billion) of investments are required, which includes 500,000 new hotel rooms by the year 2030 — half from government-supported mega projects and other half coming from private investors.

The government has also signed a memoranda of understanding which totalled to approximately 100 billion riyals with about regional and global investors like conglomerate Triple Five and UAE-based developer, Majid Al Futtaim. This of course signals that the next few years are going to be a perfect time for company formation in Saudi Arabia or foreign company registration in Saudi Arabia.

The government wishes to entice 100 million annual visits in the year 2030, which is up from about 40 million currently. The contribution to the country’s GDP is aimed to reach 10% from the current 3%.

This country, which shares its borders with Iraq in the north and Yemen in its south, claims of vast tracts of desert but also lush mountains, untouched beaches and heritage and historical sites that include five UNESCO World Heritage Sites.

This development drive has a purpose of adding almost 1 million tourism jobs. However, adding hundreds of thousands of Saudis into the workforce still remains as a key challenge for the crown prince, who has been able to manage making a dent in the official unemployment rate which is currently over 12%.