In a move to encourage higher investment in social and environmental causes, the Monetary Authority of Singapore (MAS) has updated its guidelines for SFOs (Single Family Offices) looking for tax incentives under the Section 13O and Section 13U schemes. These changes are likely to benefit your single family office in Singapore, fetching you better tax incentives and shift the focus to develop sustainable investment practices.

Have a look at the key policy updates and their respective implications.

Minimum Assets Under Management (AUM)

- Currently, the minimum AUM for the 13O Scheme stands at S$20 million while applying. This has to be maintained throughout the incentive period, eliminating any grace period

- At S$50 million, the minimum AUM for the 13U Scheme remains unchanged while applying as well as the period throughout incentives

- The updated norms highlight the need for SFOs to have a financial buffer in their plans. This ensures that they can fulfill the criteria even when markets remain volatile

Investment Professionals (IPs)

- The 13O Scheme makes it mandatory for an SFO to use at least two IPs, where there should be at least one non-family member IP

- IPs in Singapore should hold relevant qualifications for fund management and maintain tax residency

- According to the 13U Scheme requires at least three IPs, including one non-family member IP

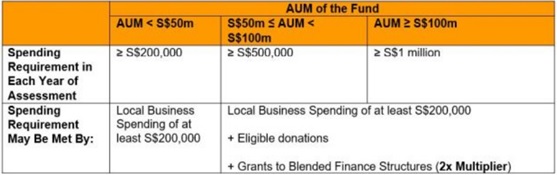

Minimum Spending Requirement

- According to the 13O Scheme, local business expenses should be at least S$200,000 per financial year. This is subject to the Tiered Spending Requirement Framework

- According to the 13U Scheme, at least S$500,000 has to be spent on local businesses in a financial year, also subject to the same framework

Tiered Spending Requirement Framework

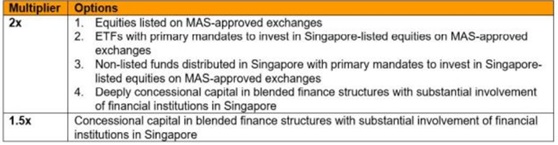

Capital Deployment Requirement (CDR)

- Under the updated guidelines, funds must allocate at least 10% of their AUM or S$10 million for particular local investments

- The list of eligible investments has been expanded to include climate-related projects and blended finance structures that involve substantial participation from Singapore-licensed/registered financial institutions

- Multipliers have been introduced to incentivize certain investments, helping SFOs meet the Capital Deployment Requirement and facilitating their contributions to the local economy.

These newly introduced guidelines aim to make the 13O and 13U Schemes more flexible for Single Family Offices. This will foster an environment conducive to sustainable investments and economic growth. Besides, they promote a higher degree of professionalism within the SFO sector. In the process, Singapore further solidifies its position as a dynamic hub for family officers, emerging as a leader in responsible wealth management.

With Singapore’s SFOs growing popularity, you may partner with one of the trusted companies like the IMC Group to make the most of the opportunities. Professionals can help you maximize your tax incentives as you grow your single family office in the country.