Singapore has recently doubled the additional buyer’s stamp duty (ABSD) for foreign buyers of residential property from 30% to 60% in a bid to dampen investment demand. However, experts believe that this measure will not significantly deter ultra-rich foreigners from investing in Singapore’s property market in the long term.

The latest round of property cooling measures has raised concerns among foreign buyers, with some questioning if the 60% ABSD rate is the final increase. Experts acknowledge that the higher ABSD rate may initially discourage foreign buyers looking to settle in Singapore. However, they believe that they will eventually “come to terms with it, bite the bullet and move on.”

According to the Urban Redevelopment Authority, foreign buyers accounted for 6.9% of property purchases in Singapore in the first quarter of 2023, up from 3.1% during the same period last year. Minister for National Development Desmond Lee has defended the ABSD increases as a “pre-emptive measure” to curb both local and foreign investment demand in the residential market.

Foreign buyers who are considering purchasing residential property in Singapore to establish roots and contribute to the economy may initially think twice about investing due to the increased ABSD rate. However, instead of looking towards other cities, some may even consider applying for permanent residency sooner than planned, primarily because Singapore is viewed as a safe and comfortable environment.

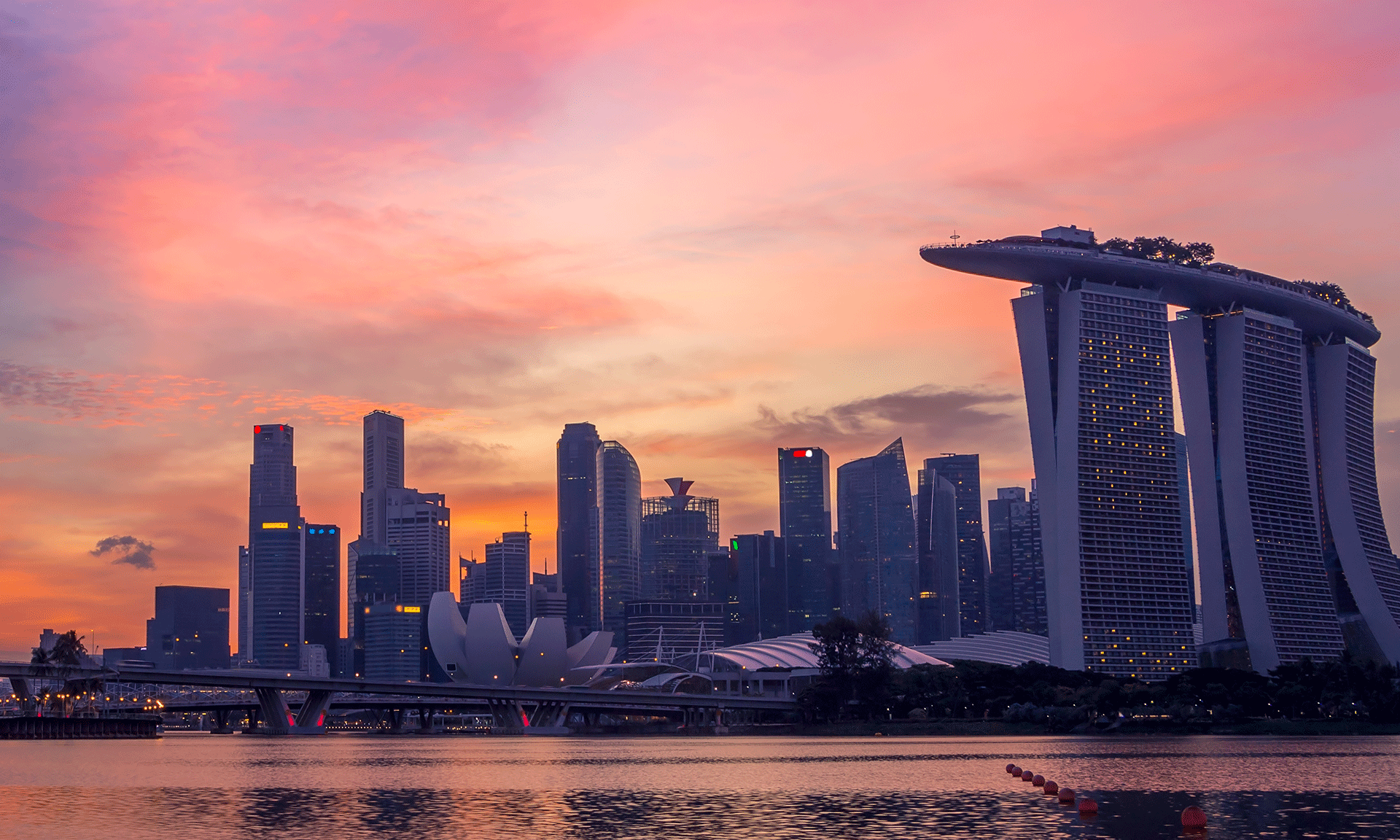

Singapore’s reputation as a safe haven is a major draw for foreign investors. The country’s excellent infrastructure, education system, and public services make it an attractive destination for ultra-rich individuals looking to relocate their families. Despite the 60% ABSD rate, experts predict that demand for Singaporean property will remain strong in the long term.

The initial reaction to the ABSD increase is expected to result in a temporary dip in demand over the next three months. However, ultra-high net-worth individuals will likely still invest in Singapore’s property market once they have adjusted to the new rates.

While foreign buyers currently represent a small proportion of property purchases in Singapore, their presence can have a significant impact on the market. Increased demand from foreign investors can lead to spillover effects on the surrounding market, and changes to the ABSD rate can trigger chain reactions.

However, there are concerns about the potential consequences of a major market correction, which could threaten the integrity of the financial system and have widespread implications for the economy. To mitigate these risks, the Singaporean government will need to carefully manage its property cooling measures and remain vigilant to market changes.

Conclusion

It’s crucial for investors to stay informed and make strategic decisions. If you’re considering investing in Singapore’s property market or looking into Singapore company incorporation, reach out to the experts at IMC Group for professional advice and guidance tailored to your specific needs. Let IMC Group’s experienced team help you navigate through the complexities of the market and maximise your investment potential in Singapore.